Annuity and differentiated payment

The difference between these payment methods lies in the amount of payments. With the annuity order, they are equal throughout the entire lending period, and the differentiated one is characterized by their monthly decrease. The possibility of reducing payments is explained by constant recalculation based on the amount of the debt balance.

Often, those applying for a mortgage do not have the right to choose how to repay the debt. In terms of lending, banks, as a rule, offer the annuity route. It has its advantages. When making a payment early, you have a choice: reduce monthly payments or shorten the loan term.

Mortgage programs from Absolut Bank

Absolut Bank operates 12 mortgage programs, with the help of which you can purchase secondary housing, apartments in new buildings and even commercial real estate.

To use the loan, funds from maternity capital, the savings-mortgage system and other government payments can be used.

So, the full list of lending programs is as follows:

- Military mortgage;

- Mortgages for new buildings;

- Mortgage for finished housing;

- Mortgage under the state program;

- Mortgage secured by real estate;

- Pledge program;

- Commercial real estate;

- Car space;

- Apartments;

- Mortgage for maternity capital;

- Refinancing;

- Mortgage for employees of the Russian Railways corporation.

Let's look at the conditions of each mortgage program in detail. Who can use them, and what benefits can be expected from this?

Military mortgage

Military mortgages are designed for citizens in military service. At the same time, they must be participants in the savings-mortgage system. At the same time, at the time of future repayment of the mortgage, they must be no more than 45 years old.

Not only the military themselves, but also their proxies can act in a military mortgage transaction. In order to become a participant in the program, the borrower must make an initial payment of 20%.

The mortgage is issued on the following conditions:

- The rate is determined individually;

- The maximum loan term is 20 years;

- The maximum loan amount is about 2.9 million rubles.

Mortgage for secondary housing and new buildings

Absolut Bank has similar lending conditions for resale and new buildings.

In these cases, up to 4 co-borrowers can be involved, also receiving income . With their help, you can get an increase in the mortgage amount and lower interest rates.

These programs also require a down payment of at least 20% of the cost of the home. In this case, the maximum contribution amount should be 85% of its price.

Borrowers can receive loans for 30 years in the amount of up to 20 million rubles.

Mortgage with state support

State support applies only to those families where a second or third child was recently born.

The preferential lending rate has a limited period of validity. When the second baby appears, it is valid for 3 years, and when the third child appears, it lasts for 5 years.

The birth of the second or third child should occur between the beginning of 2020 and the end of 2022.

The following lending parameters apply for this program:

- Loan term up to 30 years;

- The maximum loan size is 12 million for the two capitals and 6 million for other regions and cities.

The rate for mortgage lending at a preferential rate will be only 6%. After the grace period of the loan expires, it will be increased.

It is better to find out in advance from the bank managers how its further increase will occur, so that its growth does not become an unpleasant surprise.

Mortgage secured by real estate

This is a lending in which housing already owned by the borrower is transferred to the bank as collateral.

This is a mortgage with no down payment . Real estate is the main guarantee of the return of funds issued under the mortgage lending program.

Mortgages secured by real estate are issued by Absolut Bank for a maximum of 15 years. The loan amount is limited to 15 million rubles.

Pledge program

A secured mortgage is a loan to a borrower for the purchase of a residential property that is already pledged to Absolut Bank. This greatly simplifies all the paperwork associated with registering collateral on the bank’s balance sheet.

Secured mortgages are subject to the general conditions of mortgage lending . The term of cooperation with the client is limited to 30 years, and the maximum amount of payments is 20 million.

Commercial real estate

Absolut Bank gives its clients the opportunity to purchase not only residential, but also non-residential premises for personal purposes.

They can do this in two ways:

- By making a 40% down payment;

- By making a 20% down payment and providing the collateral.

Under this program you can receive up to 15 million rubles for 15 years of life.

Car space and apartments

The bank also provides the opportunity to purchase a parking space for its clients. But for this they will need to make 30% of its cost as a down payment. The loan size in this case is limited to 2 million rubles.

The term of the loan to purchase a place for a car will depend on two factors:

- If a client has a mortgage loan for real estate at Absolut Bank, it will be equal to 30 years;

- If a client does not have a mortgage loan for real estate at Absolut Bank, it will be equal to 10 years.

For the purchase of apartments, standard lending rates and terms apply. However, the bank will only be able to pay 70% of the cost of the apartment.

Other mortgage programs of Absolut Bank

Clients can also use the contribution of maternity capital to pay the down payment on a mortgage . For such borrowers, the bank has established a minimum contribution rate of 10% of the cost of housing.

Russian Railways employees have preferential lending conditions. They are subject to a minimum interest rate. If they purchase a newly built home, they may not even make a down payment on the loan.

Absolut Bank has an attractive program for refinancing mortgages received from other banks . You can use this service for 30 years.

A mortgage based on two documents is also available at this bank, but the terms of such lending will not be particularly favorable for ordinary citizens.

Interest rates and mortgage terms at Absolut Bank

Like other credit and financial institutions, Absolut Bank offers the lowest possible interest rate for programs for young families: from 4.99% to 8.74%. At the same time, part of the debt can be covered with budgetary funds from the state fund (for example, as part of a mortgage with maternal capital).

The purchase of finished housing (secondary market), new buildings (primary market) and apartments (in the primary and secondary markets) is carried out with a standard rate index of 8.74%. The down payment is also the same and ranges from 20.01%. The loan amount is also identical - 79.99% of the price of the purchased home.

The same conditions for mortgages are found in refinancing, that is, refinancing old debts from other banks. A mortgage secured by existing real estate is characterized by an increased rate of 12.74%. The maximum loan amount is reduced compared to previous options and amounts to a maximum of 70% of the cost of housing.

Military mortgages are issued at 10.6% and cover a maximum of 80% of the cost of housing with a primary payment of 20.01%. Russian Railways employees take out a mortgage of up to 20 million rubles at 8.95% and without a down payment. The purchase of commercial properties and parking spaces is carried out at 11.49% per annum. The remaining parameters are identical to the average characteristics.

Mortgage at Absolut Bank 2020

A mortgage from Absolut Bank has become a popular solution to the problem of buying your own home. Borrowers are offered various programs aimed at different types of real estate. If the client has a sufficiently high official income and a good credit history, he can easily take out a large amount to purchase real estate. The size of the loan for the purchase of secondary market housing reaches 20 million rubles.

Users have a choice of the following financing programs:

- "Ready housing." The program allows you to purchase an apartment on the secondary market at a rate of 9.74%. Borrowed funds are issued for a period of up to 30 years, the amount of the down payment must be at least 20%. It is allowed to attract up to 4 co-borrowers for payment.

- "New buildings". On similar terms, a mortgage is provided at Absolut-Bank for the purchase of primary market housing. The rate starts from 9.74%, it will depend on the category of the recipient and some other factors. The first payment must be no less than a fifth of the cost of the purchased object.

- "Apartments". The program allows you to purchase not a standard apartment in an apartment building, but high-class apartments on the secondary market or in a new building. The minimum rate is the same, the repayment period is up to 30 years.

- "Secured by real estate." This is an opportunity to borrow up to 15 million rubles, the minimum rate starts from 12.74%. The total amount depends on the object that is transferred to the bank as collateral.

The organization is also a participant in a number of government programs. It is possible for military personnel to obtain a mortgage from Absolut Bank; cash loans are provided for the purchase of a parking space or commercial building. There is also a special refinancing program: it allows you to take out a new loan to close a previously issued, more expensive mortgage loan. This allows you to get rid of unfavorable conditions, but you can use this service only if there are no overdue debts.

Conditions for issuing a mortgage loan at Absolut-Bank

Citizens of the Russian Federation who have permanent registration in the region where the bank operates can become a borrower under the listed offers. The minimum age for obtaining a mortgage under Absolut Bank programs is 21 years, the maximum is 65 years. The length of work experience in the last place must be at least 1 year, taking into account the probationary period.

The purchased property must comply with banking requirements - the organization is interested in its liquidity. This will allow you to sell the collateral if necessary and return the invested amount. A detailed list of requirements can be found on the official website.

Housing loans will be most profitable for certain categories of clients. These are employees of Russian Railways, employees who receive salaries on cards of this bank, holders of deposits and cards. For them, rates can be reduced to 8-10.5%; there are other privileges that make lending more accessible.

Documentation

To provide a mortgage under any Absolut Bank program, you will need to prepare the following set of documents:

- Application form drawn up in the form of a financial institution.

- Passport of the borrower and each person who acts as a co-borrower.

- Certificate 2-NDFL or a document in any form to confirm the level of official income of the recipient.

- A copy of the work record to confirm official employment.

Individual entrepreneurs must provide financial statements of the enterprise to assess solvency.

Advantages of mortgage lending at Absolut-Bank

The loan products of this financial institution are in demand due to relatively low interest rates and loyal attitude towards borrowers. The percentage decreases if the client receives a salary from this institution or uses other services, for example, keeps deposits in accounts. This allows you to check your financial viability at any time and reduces the risk of non-repayment.

pros

A mortgage with Absolut Bank has the following advantages:

- Fast decision making. Review of applications takes relatively little time.

- Personal manager services for clients. He will accompany the borrower from the moment of application until the final repayment of the debt.

- Flexible terms of service and personal approach. For example, if the recipient cannot provide a 2-NDFL certificate, he can draw up a document in the employer’s accounting department about the amount of earnings in free form.

- Reduced minimum age limit. Most financial institutions are ready to issue mortgage loans to clients at least 23 years old, but here access is open from 21 years of age.

Minuses

- However, contacting this institution also has a number of significant disadvantages:

- A small number of offices and ATMs - this can cause difficulties in promptly resolving emerging issues.

- The down payment is quite high - it should be at least 20%.

- There is no possibility of purchasing a country house or a plot for residential development.

- High overpayment with a long repayment period.

As in other banking organizations, the rule applies here: the longer the term, the higher the overpayment in the end. Full or partial early repayment will allow you to avoid unnecessary costs, and the purchased housing will ultimately cost less.

The housing issue sooner or later faces every person. Some people want to leave their parents’ house and live independently, others dream of replacing their old apartment with a larger one. A mortgage from Absolut Bank will help you quickly solve the problem of purchasing a home. When evaluating a mortgage lending program, there are several important points to keep in mind.

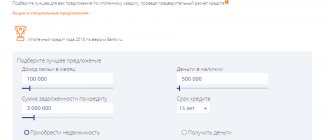

A large down payment will help you get more favorable terms for a mortgage loan to buy an apartment. The more of your own funds you deposit, the lower the loan rate set by the bank will be. Young parents can use maternity capital funds as a down payment, unless prohibited by the contract. Taking into account the amount of your own funds and knowing the cost of the apartment, you can first determine the amount of interest on the loan and calculate the approximate amount of the monthly payment using a mortgage calculator.

In order to take out a mortgage loan to buy an apartment or house now, it is not necessary to visit a bank branch multiple times. A preliminary decision on issuing a loan can be obtained without leaving your home or office by submitting an application on the credit institution’s website online.

Parking space

When applying to Absolut Bank for funds to purchase a parking space, the client receives a non-targeted loan without a mandatory report on the spending of the amount issued. The annual interest is 11.49%, the repayment period of loan obligations is up to 10 years.

Attention: the applicant will need official confirmation of income (2-NDFL) if the salary is credited to the current account of another banking institution. There is also an age restriction - the client must be 21 years old at the time of submitting the application.

Refinancing

Favorable refinancing conditions allow you to get a new loan to repay the primary mortgage at 9.99% per annum. The Absolut Bank rate is available to citizens who have not previously applied for refinancing. The client receives a revision of the primary contract, withdrawal of property from collateral (with re-registration in Absolute), and a reduction in monthly installments.

The advantages of the procedure are obtaining a convenient payment schedule, developed taking into account the family’s income. Availability of a 2-NDFL certificate remains a mandatory requirement.

Important! Refinancing at Absolut Bank is beneficial for mortgage holders from 2012-2015. The procedure is not possible if less than 6 months have passed since the receipt of the initial loan.

Maternal capital

Social housing with a mortgage using maternal (family) capital from Absolut Bank is available at a rate of 9.99% with a payment period of up to 30 years. The amount of federal assistance to young families is used to contribute to the pension contribution (20%) or as a partial early repayment of the loan.

If the borrower wishes to contribute his or her own savings as a down payment, the financial institution requires a 10% PV. To receive it you need:

- availability of a maternity capital certificate;

- permission from the Pension Fund to allocate funds to improve housing conditions;

- extract from the pension fund on the capital balance.

A housing loan can be issued with the involvement of up to 4 co-borrowers, but the mandatory requirements include at least 1 year of work experience.

Commercial real estate

Absolut offers private entrepreneurs, legal entities and ordinary citizens favorable conditions for the purchase of commercial real estate at an annual rate of 11.49%. Features of the banking product:

- PV size – 20%;

- there is no requirement for mandatory registration at the place of application;

- positive decision in non-standard situations;

- up to 30 years to repay the loan;

- up to 80% of the total cost of the commercial property.

The privilege will be the transfer of company current accounts or salary payments to Absolut Bank.

Requirements for borrowers and documentation

For preferential lending programs, there are special requirements for candidates, which we will not discuss here. Let us note only those standards that have been created by the bank for ordinary potential borrowers.

There is no point in applying for a loan if you do not meet the following requirements:

- Availability of Russian citizenship and registration;

- Ages from 21 to 65 years;

- Work experience of at least 12 months in general and at the last place of work for six months.

To obtain a mortgage from Absolut Bank, you must fill out a special application form. In addition to the application form, which can be taken on the bank’s website or at any of its offices, you will need to submit a number of documents confirming your solvency.

In particular, the bank will ask you to provide the following information:

- Passport;

- A copy of the work book and income certificate;

- Certificates of ownership of the collateral;

- Certificate of maternity capital;

- Birth certificates of children;

- Evaluation report, etc.

Each specific lending program has its own rules for collecting and submitting documentation.

Advantages and disadvantages of Absolut Bank products

Thus, obtaining a military mortgage from Absolut Bank is carried out in several stages:

- A visit by a potential borrower to the bank and submission of documents required for initial consideration.

- The financial institution is reviewing the application. If a few years ago at Absolut Bank this took from 1 to 5 working days, now everything has become even faster - a maximum of 3 banking days.

- Providing documents on mortgaged real estate.

- Transferring property as collateral, signing loan and insurance documents, registering property rights.

To summarize, the Absolut Bank military mortgage has a number of advantages and disadvantages:

- The size of the down payment and the loan rate (20% and 9.95% per annum, respectively) are not the most advantageous offer. You can find organizations where these values will be lower.

- The main advantage is the ability to sign loan documentation with an authorized representative of the borrower.

Do you want to learn more about Absolut Bank’s programs or choose a bank with the most favorable conditions for you? Then contact the specialists of the Military Mortgage Company for help. You can get advice by phone: 8 (800) 700-24-96.

Mortgage lending PJSC JSCB "Absolut Bank"

| Loan currency | Russian rubles. |

| Purpose of the loan | Purchasing an apartment, concluding an agreement for participation in shared construction. |

| Loan size | No more than 80% of the acquired rights to the property (apartment). |

| Minimum loan amount | 300,000 Russian rubles. |

| Maximum loan amount | The maximum loan amount is calculated based on the interest rate and loan term. |

| Credit term | Until a military member of the NIS reaches the age limit for military service. |

| An initial fee | From 20% |

| Interest rate (% per annum) | 9,95% |

| Payment type | Annuity. |

| Insurance | Insurance against the risk of loss and damage to a property (after registration of ownership of the property). |

| Loan application review period | Up to 3 working days. |

| Program regions | All regions of the Bank's presence. |

| Early loan repayment | Full or partial early repayment of the loan is carried out without restrictions. |

| Requirement for the Borrower | A military personnel is a participant in the savings mortgage system (NIS). |

| Documents for submitting an application to the bank |

|