Mortgage calculator

When deciding to purchase real estate on credit, a potential borrower must first calculate the monthly mortgage payment in order to understand the level of long-term credit load. The amount of payments should not exceed a certain proportion of the potential borrower’s monthly income, most often no more than 50%. Knowing the possible level of payments, a potential borrower can independently calculate the maximum mortgage size, loan term and overpayment. To calculate mortgage parameters, a special calculator is used, available to everyone.

A mortgage loan calculator is a program that contains a set of mathematical formulas and is used to determine the essential parameters of a loan. Calculating mortgage payments is the most important function of a mortgage calculator. In addition to the payment, the program allows you to calculate the mortgage amount, term, overpayment and other key conditions.

The cost of the mortgage, also calculated on the calculator, is affected by the interest rate on the loan, possible commissions and fees, and the amount of the down payment available to the borrower. For a more accurate calculation of the mortgage calculator, it is advisable to find out the interest rate and information about the presence of commissions for a suitable loan program.

A mortgage calculator is easy to find online.

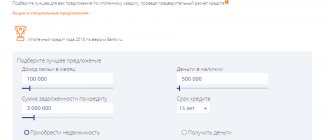

It is convenient to use a mortgage calculator located on the websites of many banks. Often, such services take into account the category of the borrower, the desire to connect to an insurance program or refuse it, the type of housing being purchased, and a suitable loan program. Thus, mortgage loan calculators on bank websites allow you to find out the individual interest rate, calculate mortgage payments and other loan terms that are relevant for a particular borrower.

However, online calculators located on specialized Internet portals will help you calculate your mortgage. Such mortgage calculators calculate loan parameters based on user-specified conditions. An online mortgage calculator is an excellent opportunity to pre-calculate the size of the mortgage and the amount of overpayment without visiting the bank.

It must be remembered that the mortgage calculation obtained from a loan calculator located on third-party sites is not final.

You can also calculate your mortgage directly at the bank. The manager will give professional advice and calculate the mortgage for the desired apartment or other real estate.

Thus, those wishing to purchase a home can first assess their strengths and capabilities using a mortgage calculator.

Before taking out a mortgage for an apartment, potential borrowers should know the amount of monthly expenses. Professional employees of banks or real estate agencies calculate the loan amount based on the client’s monthly income, which is usually divided by 2. Thus, the maximum amount of monthly annuity payments is obtained. When calculating a differentiated payment, the scheme is slightly different: when divided by 2, the amount to be repaid in the initial lending period is obtained. The size of the payment under a differentiated schedule gradually decreases and becomes less than half of the monthly income, thus, free funds can be sent for early repayment. Now, according to the law, all loans are issued with early repayment without restrictions and commissions.

Calculating payments on a military mortgage does not make sense, since all payments are made by the state.

Potential borrowers can use the Banki.ru universal calculator to understand how much money they will be given for a mortgage. The service allows you to calculate the amount of your salary payment using the calculation method described above. Also, using the Banki.ru search, you can choose a loan for the required amount, with a specific down payment. In 2014, there were enough offers on the mortgage market without a down payment.

Terms and conditions of the Family Mortgage

- Amount – from 1OO LLC rub. (not less than 15% of the value of the property) up to 12 LLC LLC rub. (for Moscow, St. Petersburg and corresponding regions, for other regions up to 6,000,000 rubles).

- Lending period – from 1 year to 30 years.

- The interest rate is 4.5% or more for the Far Eastern District, 5.5% or more for other regions of the country. Half a percent is added if the borrower refuses life and health insurance.

- The amount of the down payment is 20% or more.

- No commissions.

- Possibility of using maternity capital as a down payment.

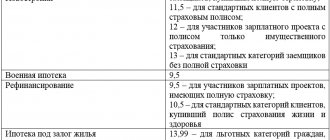

Interest rate and loan terms.

Standard conditions for granting a loan provide for certain requirements that are put forward in relation to the potential borrower and to the characteristics of the purchased housing.

To receive approval, the applicant must meet the following criteria:

- Reaching the age limit of 20 years at the time of application;

- Age less than 70 years when repaying the last payment according to the schedule, with the exception of programs for military personnel;

- Requirement for work experience depending on the status of a salary client;

- Sufficiency of income received to repay the loan.

All bank programs can be divided into two categories according to the criterion of lending direction. The first allow you to obtain funds for the purchase of objects on the primary market, including with the participation of the shared construction mechanism. Banking products of the second group provide the opportunity to become the owner of finished housing.

It might be interesting!

Mortgage from Gazprombank in 2020: programs, conditions, rates.

The following mortgage conditions currently apply:

- Preferential – from 6.5%;

- New residents – from 7.5%;

- Family – from 6.5%;

- Military – from 8.1%;

- Far Eastern – from 2%.

Svetlana

Real estate expert

The allowable amount is determined within the framework of a specific program, and the maximum amount is determined for the New Residents program. The amount of the down payment is also regulated by the rules of the offer, and salary clients can count on making an advance payment equal to 10%.

How to get a mortgage from Gazprombank: step-by-step process

Any person who is faced with the question for the first time: “How to properly apply for a mortgage to purchase real estate?” does not know exactly what the procedure is for obtaining credit funds.

So, in order for the bank to approve the borrower and issue him a loan to purchase real estate, he must:

- Assess your financial capabilities. If he is an average Russian working in a low-level position, then he must understand that no one will approve a mortgage for him to buy a townhouse. He must also calculate how much he can pay the bank monthly, for what period to take out a loan, etc.

- Choose accommodation. Here it is at the discretion of the potential borrower: a new or secondary apartment, a private house, a cottage. If the borrower wants to buy a secondary home, then he must agree in advance with the owner of the apartment about the cost of living space, the size and features of the loan.

- Go to Gazprombank Bank and select the mortgage program you are interested in.

- Collect a package of documents and send an application to the bank for participation in the mortgage program (bring it in person or send it through a special form on the bank’s official website). Attach the required list of documents to the application form.

- Wait for the bank's decision (waiting period - from several days to 1-2 weeks).

- Contact an appraisal company that will evaluate the property.

- Sign the loan agreement.

- Deposit the required down payment amount into your current bank account.

- Sign a purchase and sale agreement with the real estate seller, and then submit it to Rosreestr to register ownership of the property purchased with a mortgage.

- Contact an insurance company to obtain insurance for the property that the borrower plans to take out on a mortgage.

When the purchase and sale agreement is signed, the borrower will have to provide the agreement and an extract from the Unified State Register (he receives it from Rosreestr) to Gazprombank. Based on these documents, the bank employee will transfer funds to the borrower to pay for the apartment/house.

Conditions for obtaining a loan

These programs are positioned by the bank as created specifically for young people. Each mortgage loan from Gazprombank can be characterized as follows:

| Purchasing an apartment on the secondary market 1 | |

| Lending terms |

|

| Advantages | The advantages of this product include the ability to borrow significant amounts from the bank for a significant period without the need to involve co-borrowers and guarantors. |

| Flaws | The disadvantages of this proposal include high interest rates. |

| Documentation | Mandatory documents are:

Required documents are:

|

| EXAMPLE: | For example, you take out a loan of 2,000,000 rubles. The down payment is 30%, and the loan is taken out for 15 years. When applying for a loan, you will be able to indicate the desired amount of payments per month to determine the interest rate. If, for example, you indicate that you want to pay 24,000 rubles per month on the loan, then the interest rate will be 12%. |

| Purchasing an apartment on the secondary market 2 | |

| Lending terms |

|

| Advantages | The advantages of this product include the ability to borrow significant amounts from the bank for a significant period without the need to involve co-borrowers and guarantors. |

| Flaws | The disadvantages of this proposal include high interest rates. |

| Documentation | Mandatory documents are:

Required documents are:

|

| EXAMPLE: | For example, you borrow 2,000,000 rubles from a bank for 10 years. The initial payment is 1,000,000 rubles. The rate for you will be 12.95%, and the cost of the loan (overpayment on it) will be equal to 1,576,463 rubles. |