Each mortgage transaction has its own characteristics. The personal circumstances of borrowers and their sources of income may vary. The parameters of the purchased property may not suit the credit institution.

To choose a mortgage bank for a client with the conditions that best meet his requirements and to help him obtain a loan is the task of the Tinkoff Mortgage service. This article will tell you how mortgage programs from Tinkoff Bank work, their advantages, features, and why you should use the service.

Advantages of the Tinkoff Mortgage service

Advantages of a mortgage from Tinkoff Bank:

- One online application for Tinkoff Mortgage. The client generates a package of documents, which is submitted simultaneously to several credit institutions for consideration.

- The interest rate on Tinkoff Mortgage is 0.25-1.5% lower compared to partner banks, due to the discount they provide on the cost of their loan products for Tinkoff clients.

- A personal manager will help you collect the necessary documents, select an insurance and appraisal company, coordinate actions, and organize the process.

- One visit to the bank to complete the transaction. All other communication with managers occurs remotely: through your Personal Account, email, telephone.

How to apply

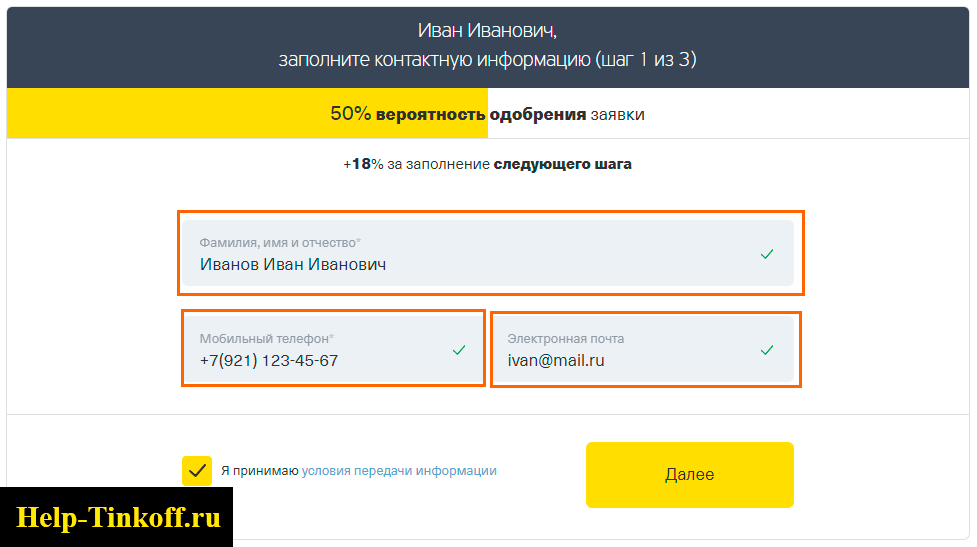

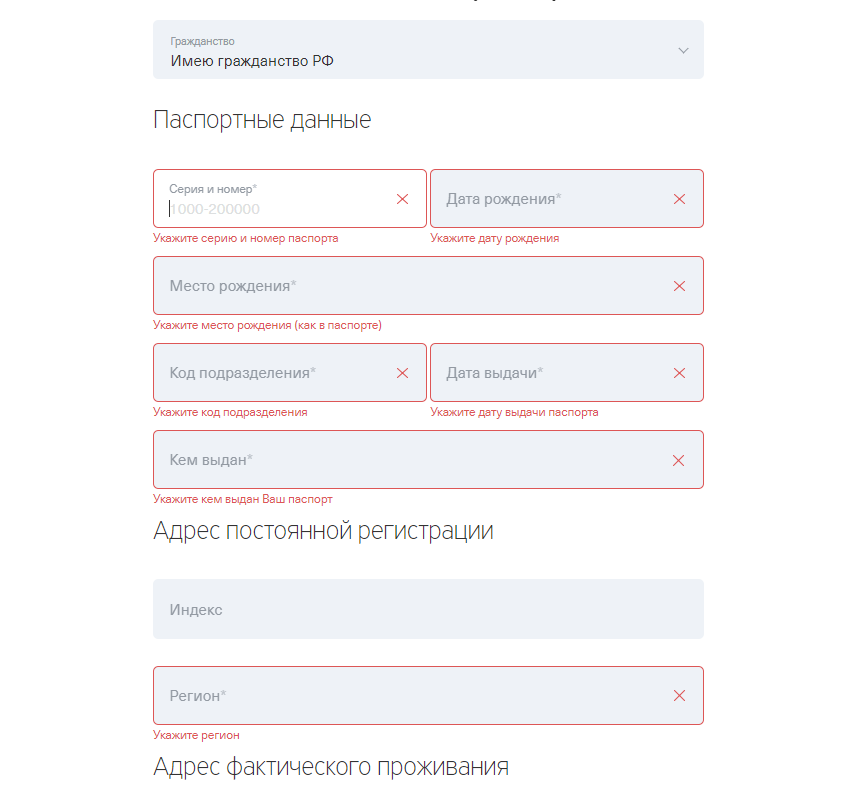

The specified package of documents is submitted to the financial institution. Within 3 months, the expert commission reviews the documents and gives a positive or negative answer. Previously, you could also fill out an online application on the website:

- Indicating your full name, phone number, e-mail;

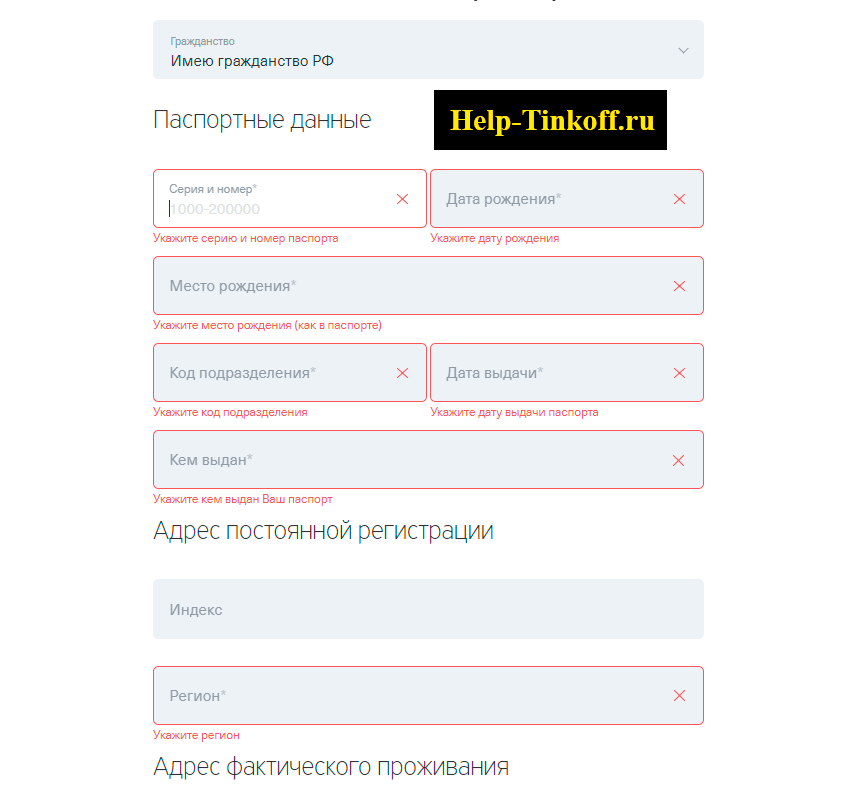

- Filling in your passport details and residential address;

- Agree to the terms and conditions and submit the application for consideration;

- Within 3 days the manager will report the status.

Tinkoff Mortgage - how does it work?

Procedure for obtaining a Tinkoff mortgage:

- The client submits an application with a package of necessary documents electronically through the official Tinkoff website.

- The manager conducts an initial analysis of documents and transfers them to several partner banks at once. Banks consider the application within 2-4 days and report a preliminary decision.

- From the banks that approved the application, the client chooses one with the most favorable conditions for him.

- The client collects a complete package of documents for the property.

- The partner bank signs a loan agreement with the borrower.

Tinkoff acts as a mortgage broker - an intermediary between the borrower and the lending bank. When working with an application, from the moment of receiving the questionnaire until the conclusion of the loan agreement, the client is accompanied by a personal manager.

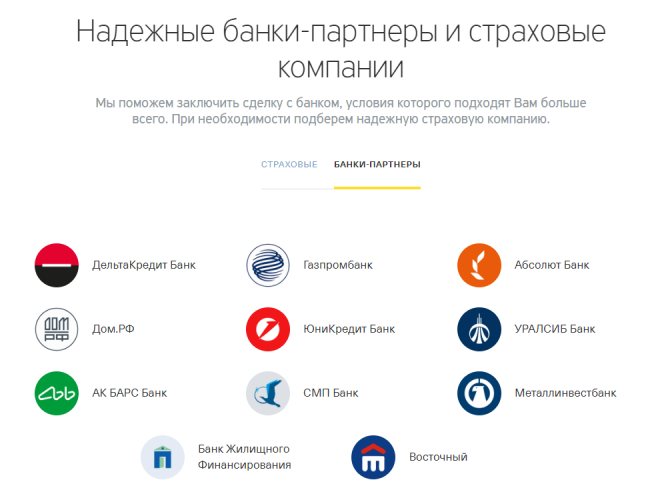

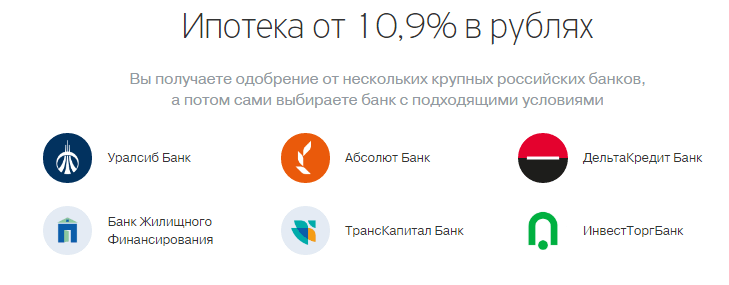

Tinkoff Mortgage partner banks:

- Absolut Bank;

- AK BARS;

- Housing Finance Bank;

- Oriental;

- Gazprombank;

- DeltaCredit Bank;

- Dom.RF;

- Metallinvestbank;

- SMP Bank;

- Bank URALSIB;

- UniCredit Bank.

Tinkoff mortgage insurance is provided by counterparties of partner banks:

- VTB Insurance;

- Alpha Insurance;

- VSK Insurance House;

- RESO-Garantiya.

Depending on the requirements of the credit institution, you can insure the mortgaged object, the life and health of the borrower. Other insurance companies can also become a partner of Tinkoff Bank.

Advantages of cooperation with Tinkoff

Mortgage lending through an intermediary bank, in our case Tinkoff, looks quite profitable. Why:

- Tinkoff provides a discount on annual interest. Its size is up to 1.1%.

- By leaving one profile at Tinkoff, you receive offers from partner banks. You can choose the most favorable conditions for you.

- There is no need to visit bank branches to apply. Online mode is available 24 hours a day.

- Insurance and real estate valuation are carried out through Tinkoff.

- There is no commission for mediation and provision of services.

Loyal conditions of Tinkoff partner banks help you get the most profitable loan for real estate. Save time by submitting an application online and visiting the bank office only once.

Fill out the application in the form below and find out the bank’s decision immediately after filling it out online. ↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓↓

![Tinkoff mortgage[status_lead]](https://ipotekasos.ru/wp-content/uploads/tinkoff-ipoteka-status_lead.jpg)

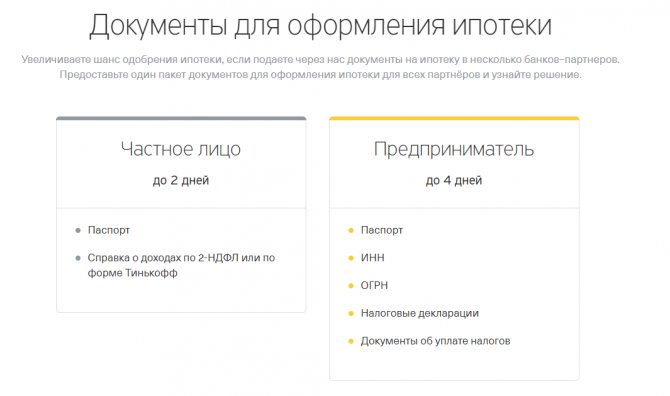

Documents for a mortgage at Tinkoff Bank and requirements for the borrower

To begin working with a loan application and obtain a preliminary result, the client must fill out the Tinkoff Mortgage application form and also submit a minimum package of documents.

Private individuals working for hire represent:

- a copy of the passport of a citizen of the Russian Federation;

- salary certificate 2-NDFL or certificate in the Tinkoff Bank form.

Individual entrepreneurs must submit:

- copy of civil passport;

- a copy of the TIN certificate;

- OGRN;

- copies of tax returns;

- tax payment documents.

After receiving preliminary approval, selecting a lending program and a partner bank, a package of documents is compiled according to the list of the selected bank. Partner banks have different requirements for the borrower, but there are some common ones:

- citizenship of the Russian Federation;

- the borrower does not have a negative credit history.

Other parameters: age restrictions, work experience, permanent registration at the place of residence, etc., may differ. These factors are also taken into account by Tinkoff employees when choosing a credit institution and mortgage lending program.

Requirements and documents

In 2020, it is not possible to get a mortgage through Tinkoff. However, the partners to whom this bank previously redirected are still functioning. You can contact Absolut, Gazprombank, Delta, Uralsib and others. Among the requirements:

- positive credit history;

- no existing debts;

- absence of trials or positive results in your favor;

- official employment or own business;

- use of the Tinkoff card and funds turnover;

- availability of subsidies from the state (maternity capital).

To apply for a mortgage you will need the following package of documents:

- passport;

- questionnaire;

- work book and its copy with a wet stamp;

- personal income tax form certificate (2).

Mortgage with maternity capital

With a certificate for maternity capital, you can pay the down payment on a Tinkoff mortgage or use it to pay off payments on principal and interest.

- minimum rate – 6%;

- minimum down payment - from 10 to 20% depending on the purchased object;

- term – up to 25 years.

Among the loan products offered by the Tinkoff Mortgage service, there are no offers without a down payment. Conventionally, this can be called a mortgage with maternity capital, since it is possible to repay the advance payment with a certificate for maternity capital, and not with cash.

Calculation results

| Monthly payment | RUB 12,940 |

| Overpayment on loan | RUR 552,771 |

| Total payout | RUB 1,552,771 |

| INTEREST RATES | link to calculation |

| date | Loan balance | Interest payment | Loan payment | Payment |

| October 2020 | 1 000 000,00 | 7 916,67 | 5 023,09 | 12 939,76 |

| November 2020 | 994 976,91 | 7 916,67 | 5 023,09 | 12 939,76 |

| December 2020 | 989 914,06 | 7 876,90 | 5 062,86 | 12 939,76 |

| January 2021 | 984 811,12 | 7 836,82 | 5 102,94 | 12 939,76 |

| February 2021 | 979 667,79 | 7 796,42 | 5 143,33 | 12 939,76 |

| March 2021 | 974 483,73 | 7 755,70 | 5 184,05 | 12 939,76 |

| April 2021 | 969 258,64 | 7 714,66 | 5 225,09 | 12 939,76 |

| May 2021 | 963 992,18 | 7 673,30 | 5 266,46 | 12 939,76 |

| June 2021 | 958 684,03 | 7 631,60 | 5 308,15 | 12 939,76 |

| July 2021 | 953 333,86 | 7 589,58 | 5 350,17 | 12 939,76 |

| August 2021 | 947 941,33 | 7 547,23 | 5 392,53 | 12 939,76 |

| September 2021 | 942 506,11 | 7 504,54 | 5 435,22 | 12 939,76 |

| October 2021 | 937 027,86 | 7 461,51 | 5 478,25 | 12 939,76 |

| November 2021 | 931 506,24 | 7 418,14 | 5 521,62 | 12 939,76 |

| December 2021 | 925 940,91 | 7 374,42 | 5 565,33 | 12 939,76 |

| January 2022 | 920 331,52 | 7 330,37 | 5 609,39 | 12 939,76 |

| February 2022 | 914 677,72 | 7 285,96 | 5 653,80 | 12 939,76 |

| March 2022 | 908 979,16 | 7 241,20 | 5 698,56 | 12 939,76 |

| April 2022 | 903 235,49 | 7 196,09 | 5 743,67 | 12 939,76 |

| May 2022 | 897 446,35 | 7 150,61 | 5 789,14 | 12 939,76 |

| June 2022 | 891 611,38 | 7 104,78 | 5 834,97 | 12 939,76 |

| July 2022 | 885 730,21 | 7 058,59 | 5 881,17 | 12 939,76 |

| August 2022 | 879 802,49 | 7 012,03 | 5 927,72 | 12 939,76 |

| September 2022 | 873 827,84 | 6 965,10 | 5 974,65 | 12 939,76 |

| October 2022 | 867 805,88 | 6 917,80 | 6 021,95 | 12 939,76 |

| November 2022 | 861 736,26 | 6 870,13 | 6 069,63 | 12 939,76 |

| December 2022 | 855 618,58 | 6 822,08 | 6 117,68 | 12 939,76 |

| January 2023 | 849 452,47 | 6 773,65 | 6 166,11 | 12 939,76 |

| February 2023 | 843 237,55 | 6 724,83 | 6 214,92 | 12 939,76 |

| March 2023 | 836 973,42 | 6 675,63 | 6 264,13 | 12 939,76 |

| April 2023 | 830 659,71 | 6 626,04 | 6 313,72 | 12 939,76 |

| May 2023 | 824 296,01 | 6 576,06 | 6 363,70 | 12 939,76 |

| June 2023 | 817 881,93 | 6 525,68 | 6 414,08 | 12 939,76 |

| July 2023 | 811 417,07 | 6 474,90 | 6 464,86 | 12 939,76 |

| August 2023 | 804 901,03 | 6 423,72 | 6 516,04 | 12 939,76 |

| September 2023 | 798 333,41 | 6 372,13 | 6 567,62 | 12 939,76 |

| October 2023 | 791 713,79 | 6 320,14 | 6 619,62 | 12 939,76 |

| November 2023 | 785 041,77 | 6 267,73 | 6 672,02 | 12 939,76 |

| December 2023 | 778 316,93 | 6 214,91 | 6 724,84 | 12 939,76 |

| January 2024 | 771 538,85 | 6 161,68 | 6 778,08 | 12 939,76 |

| February 2024 | 764 707,11 | 6 108,02 | 6 831,74 | 12 939,76 |

| March 2024 | 757 821,29 | 6 053,93 | 6 885,82 | 12 939,76 |

| April 2024 | 750 880,95 | 5 999,42 | 6 940,34 | 12 939,76 |

| May 2024 | 743 885,67 | 5 944,47 | 6 995,28 | 12 939,76 |

| June 2024 | 736 835,01 | 5 889,09 | 7 050,66 | 12 939,76 |

| July 2024 | 729 728,53 | 5 833,28 | 7 106,48 | 12 939,76 |

| August 2024 | 722 565,79 | 5 777,02 | 7 162,74 | 12 939,76 |

| September 2024 | 715 346,35 | 5 720,31 | 7 219,44 | 12 939,76 |

| October 2024 | 708 069,75 | 5 663,16 | 7 276,60 | 12 939,76 |

| November 2024 | 700 735,55 | 5 605,55 | 7 334,20 | 12 939,76 |

| December 2024 | 693 343,28 | 5 547,49 | 7 392,27 | 12 939,76 |

| January 2025 | 685 892,49 | 5 488,97 | 7 450,79 | 12 939,76 |

| February 2025 | 678 382,72 | 5 429,98 | 7 509,77 | 12 939,76 |

| March 2025 | 670 813,49 | 5 370,53 | 7 569,23 | 12 939,76 |

| April 2025 | 663 184,34 | 5 310,61 | 7 629,15 | 12 939,76 |

| May 2025 | 655 494,80 | 5 250,21 | 7 689,55 | 12 939,76 |

| June 2025 | 647 744,38 | 5 189,33 | 7 750,42 | 12 939,76 |

| July 2025 | 639 932,60 | 5 127,98 | 7 811,78 | 12 939,76 |

| August 2025 | 632 058,97 | 5 066,13 | 7 873,62 | 12 939,76 |

| September 2025 | 624 123,02 | 5 003,80 | 7 935,96 | 12 939,76 |

| October 2025 | 616 124,24 | 4 940,97 | 7 998,78 | 12 939,76 |

| November 2025 | 608 062,13 | 4 877,65 | 8 062,11 | 12 939,76 |

| December 2025 | 599 936,20 | 4 813,83 | 8 125,93 | 12 939,76 |

| January 2026 | 591 745,94 | 4 749,49 | 8 190,26 | 12 939,76 |

| February 2026 | 583 490,84 | 4 684,66 | 8 255,10 | 12 939,76 |

| March 2026 | 575 170,39 | 4 619,30 | 8 320,45 | 12 939,76 |

| April 2026 | 566 784,06 | 4 553,43 | 8 386,32 | 12 939,76 |

| May 2026 | 558 331,35 | 4 487,04 | 8 452,72 | 12 939,76 |

| June 2026 | 549 811,71 | 4 420,12 | 8 519,63 | 12 939,76 |

| July 2026 | 541 224,63 | 4 352,68 | 8 587,08 | 12 939,76 |

| August 2026 | 532 569,57 | 4 284,70 | 8 655,06 | 12 939,76 |

| September 2026 | 523 845,99 | 4 216,18 | 8 723,58 | 12 939,76 |

| October 2026 | 515 053,35 | 4 147,11 | 8 792,64 | 12 939,76 |

| November 2026 | 506 191,10 | 4 077,51 | 8 862,25 | 12 939,76 |

| December 2026 | 497 258,69 | 4 007,35 | 8 932,41 | 12 939,76 |

| January 2027 | 488 255,57 | 3 936,63 | 9 003,12 | 12 939,76 |

| February 2027 | 479 181,17 | 3 865,36 | 9 074,40 | 12 939,76 |

| March 2027 | 470 034,93 | 3 793,52 | 9 146,24 | 12 939,76 |

| April 2027 | 460 816,28 | 3 721,11 | 9 218,65 | 12 939,76 |

| May 2027 | 451 524,66 | 3 648,13 | 9 291,63 | 12 939,76 |

| June 2027 | 442 159,47 | 3 574,57 | 9 365,19 | 12 939,76 |

| July 2027 | 432 720,15 | 3 500,43 | 9 439,33 | 12 939,76 |

| August 2027 | 423 206,09 | 3 425,70 | 9 514,05 | 12 939,76 |

| September 2027 | 413 616,72 | 3 350,38 | 9 589,37 | 12 939,76 |

| October 2027 | 403 951,43 | 3 274,47 | 9 665,29 | 12 939,76 |

| November 2027 | 394 209,62 | 3 197,95 | 9 741,81 | 12 939,76 |

| December 2027 | 384 390,69 | 3 120,83 | 9 818,93 | 12 939,76 |

| January 2028 | 374 494,03 | 3 043,09 | 9 896,66 | 12 939,76 |

| February 2028 | 364 519,02 | 2 964,74 | 9 975,01 | 12 939,76 |

| March 2028 | 354 465,04 | 2 885,78 | 10 053,98 | 12 939,76 |

| April 2028 | 344 331,46 | 2 806,18 | 10 133,57 | 12 939,76 |

| May 2028 | 334 117,66 | 2 725,96 | 10 213,80 | 12 939,76 |

| June 2028 | 323 823,01 | 2 645,10 | 10 294,66 | 12 939,76 |

| July 2028 | 313 446,85 | 2 563,60 | 10 376,16 | 12 939,76 |

| August 2028 | 302 988,55 | 2 481,45 | 10 458,30 | 12 939,76 |

| September 2028 | 292 447,45 | 2 398,66 | 10 541,10 | 12 939,76 |

| October 2028 | 281 822,90 | 2 315,21 | 10 624,55 | 12 939,76 |

| November 2028 | 271 114,25 | 2 231,10 | 10 708,66 | 12 939,76 |

| December 2028 | 260 320,81 | 2 146,32 | 10 793,43 | 12 939,76 |

| January 2029 | 249 441,93 | 2 060,87 | 10 878,88 | 12 939,76 |

| February 2029 | 238 476,92 | 1 974,75 | 10 965,01 | 12 939,76 |

| March 2029 | 227 425,11 | 1 887,94 | 11 051,81 | 12 939,76 |

| April 2029 | 216 285,80 | 1 800,45 | 11 139,31 | 12 939,76 |

| May 2029 | 205 058,31 | 1 712,26 | 11 227,49 | 12 939,76 |

| June 2029 | 193 741,93 | 1 623,38 | 11 316,38 | 12 939,76 |

| July 2029 | 182 335,97 | 1 533,79 | 11 405,97 | 12 939,76 |

| August 2029 | 170 839,70 | 1 443,49 | 11 496,26 | 12 939,76 |

| September 2029 | 159 252,43 | 1 352,48 | 11 587,27 | 12 939,76 |

| October 2029 | 147 573,42 | 1 260,75 | 11 679,01 | 12 939,76 |

| November 2029 | 135 801,95 | 1 168,29 | 11 771,47 | 12 939,76 |

| December 2029 | 123 937,30 | 1 075,10 | 11 864,66 | 12 939,76 |

| January 2030 | 111 978,71 | 981,17 | 11 958,59 | 12 939,76 |

| February 2030 | 99 925,45 | 886,50 | 12 053,26 | 12 939,76 |

| March 2030 | 87 776,78 | 791,08 | 12 148,68 | 12 939,76 |

| April 2030 | 75 531,92 | 694,90 | 12 244,86 | 12 939,76 |

| May 2030 | 63 190,12 | 597,96 | 12 341,79 | 12 939,76 |

| June 2030 | 50 750,62 | 500,26 | 12 439,50 | 12 939,76 |

| July 2030 | 38 212,64 | 401,78 | 12 537,98 | 12 939,76 |

| August 2030 | 25 575,40 | 302,52 | 12 637,24 | 12 939,76 |

| September 2030 | 12 838,12 | 202,47 | 12 737,28 | 12 939,76 |

Tinkoff Bank's mortgage calculator is a financial tool for calculating the monthly mortgage payment schedule for 2020 and obtaining the overpayment amount. Since the mortgage is taken out for more than one year, you should approach its choice very seriously. It is necessary to calculate everything in advance, preferably very accurately. Our Tinkoff Bank mortgage calculator will help you with just this.

Important: Official coefficients when calculating a mortgage at Tinkoff Bank will not give reason to doubt the correctness of the calculation.

We update mortgage interest rates every day, taking them directly from Tinkoff Bank. Without visiting the bank, using only our mortgage calculator, you will receive comprehensive data on the loan: monthly payment, overpayment amount. You will be able to predict your payment costs and make the right decision.

How to make a calculation

It is necessary to take the input data very seriously, because the reliability of the received mortgage calculations will depend on them.

First, you need to decide on the cost of the home you are purchasing. Keep in mind that you will need to have cash available for the down payment on your mortgage. Typically it is between 10 and 15%. By the way, a small life hack - you can take out a consumer loan for the down payment, the Tinkoff Bank loan calculator 2020 will help you with this.

Will I afford the mortgage?

The Tinkoff Bank mortgage calculator 2020 is just what you need so that you can weigh your chances of whether you can allocate money from your family budget for monthly mortgage payments. You can also change the amount of monthly payments by changing the loan term. Thus, achieving the amount that you can pull. Do not forget that a mortgage also has an unpleasant side; by increasing the term of the mortgage, you increase the amount of overpayment. Sometimes it can even exceed the amount of the mortgage itself. Let's do the calculation using Tinkoff Bank's mortgage calculator. Input data: property value 1 million rubles, interest rate 9.5%. Changing the period until full repayment of the mortgage we get the table:

| Sum | Term | Overpayment, % | Overpayment, RUB. |

| 1 million RUB. | 10 YEARS | 55% | RUR 552,771 |

| 1 million RUB. | 15 YEARS | 88% | RUB 879,604 |

| 1 million RUB. | 20 YEARS | 123% | RUB 1,237,115 |

| 1 million RUB. | 25 YEARS | 162% | RUB 1,621,090 |

From the table we can clearly see that if you take out a mortgage from Tinkoff Bank for 25 years, the overpayment will be 162%. The Tinkoff Bank mortgage calculator clearly showed this.

Tinkoff Mortgage with state support

The program is intended for families who had a second or third child between 2020 and 2022.

- rate – from 6%;

- down payment - from 20%;

- the goal is to purchase housing on the primary market;

- term – up to 25 years.

Maximum amount:

- 3 million rubles – for regions of Russia;

- 8 million rub. – for Moscow and St. Petersburg.

Mortgage programs at Tinkoff Bank

Tinkoff offers several loan programs with a down payment, the conditions for which may vary significantly. The ability to participate in a particular program is determined by the borrower’s status.

Refinancing an existing mortgage loan

Under this offer of refinancing, you can try to achieve more favorable conditions than in an existing debt obligation. The bank fully repays borrowed funds from another institution under the following conditions:

- The rate starts at 8.5%. It is considered individually and depends on the level of confidence in the borrower.

- Refinancing a mortgage in an unfinished building, with financial capital, and so on.

- If the borrower needs a larger amount, the size of the loan agreement can be increased in comparison with a debt obligatory in a third-party institution.

- There is no fee for closing a mortgage at another bank.

- You can refinance not only mortgage debts at once, but also other loans.

Tatiana Shevtsova

Author of the article

Ask a Question

The main advantage of refinancing is that partners do not name additional services, that is, you only have to pay for the loan itself and insurance.

Tinkoff Mortgage with a reduced rate

To obtain a mortgage at a reduced rate, you will have to meet a number of requirements:

- Availability of certificates to confirm income in the form of personal income tax-2.

- The secondary market is not suitable. Buy a residential property only in a new building.

A mortgage is issued from Tinkoff on the following conditions:

- In 2020, mortgage rates are from 6%.

- Down payment of at least 10-40%. It all depends on the type of living space.

- The loan is issued for a period of up to 25 years.

It is worth considering one more nuance - the bank must obtain legal confirmation of the legal activities of the development company. If the borrower has chosen housing himself, the relevant documents about the developer must be attached to the application.

In order to avoid such problems, it is first better to look at the Tinkoff showcase, which already has partner offers for purchasing housing in new buildings. If one of them is suitable, you do not need to provide any documents.

At Tinkoff, mortgages without a down payment are not issued under any of the offers.

Mortgage with maternity capital

A young family can get a mortgage under the following conditions:

- Low interest - 6 per annum.

- As a down payment, you can provide a certificate for maternity capital if you do not have the required amount of 10% of the value of the property. This solves another problem - you don’t have to wait until the second child reaches the age of 3 years.

- Young families are given loans for up to 25 years.

Applications for mortgages using maternity capital are reviewed within 4 days.

Mortgage with government support

State program to support families who have had or will have a second or third child between 2018 and 2022. You can take out a mortgage with state support under the following conditions:

- Housing is purchased on the primary real estate market.

- The rate starts at 6 percent.

- Down payment of at least 20% of the property value.

- The loan term is up to 25 years. Early repayment is often provided.

- The mortgage size depends on the region. In Moscow and St. Petersburg - 8,000,000 rubles, in other regions you can count on the amount of 3,000,000 rubles.

Mortgages under government programs have a very high approval rate.

Secured by real estate

You can take out a mortgage to purchase a new home using your existing property as collateral. Such a loan will be approved for both a pensioner and a student under the following conditions:

- Mortgage rates range from 11.25 to 22%. Depends on what kind of property you take and leave as collateral.

- Resales are accepted as collateral: houses, apartments, non-residential properties.

- It is worth taking if the intended purpose of the loan is not related to the acquisition of new living space. The Bank does not require a report on this issue.

- The maximum amount of credit funds is 99,000,000 rubles.

- Issued for a period of up to 20 years.

Another advantage of this package is that the bank does not take into account the state of repairs and unauthorized redevelopment.

Tinkoff Mortgage with a reduced rate

Suitable for borrowers who can confirm their income with a 2-NDFL certificate or a bank form, purchase an apartment in a new building, and also have the opportunity to pay a down payment of at least 20% of the cost of housing.

- minimum rate – 6%;

- down payment - from 10 to 40% depending on the type of property;

- term – up to 25 years.

The documents required to obtain a mortgage at a reduced rate are the same as for other programs. These are documents confirming the borrower’s identity and income. The property requires a draft equity participation agreement or other agreement with the developer. If you purchase an apartment through the Tinkoff Mortgage real estate storefront, then you do not need to submit documents from the developer. If you choose an apartment yourself, you must submit legal documents from the developer.

Mortgage calculator

Before you decide to purchase real estate with a mortgage, you need to assess your financial capabilities so that the collateral is not subsequently seized by the bank.

Ordinary citizens rarely understand all these percentages, the need to multiply the interest rate by the loan amount, and so on.

What to do if you don’t have time to go to the bank?

Below you will find a simple and understandable calculator for calculating mortgage payments.

You need to fill in the required fields and the calculator will show the result with a detailed payment schedule.

Practice shows that the minimum mortgage payment amount is from 12,000 rubles .

It all depends on the purchase price and the down payment, since interest rates in the banks with which Tinkoff works are not significantly different for mortgages.

Loan secured by real estate

Among the products offered by the service is Tinkoff Mortgage without proof of income.

- the minimum rate is 11.25-22% depending on the type of property;

- collateral – houses, apartments, non-residential real estate;

- purpose - any, including those not related to the acquisition of real estate;

- maximum amount – up to 99 million rubles;

- term – up to 20 years.

Lending is possible both with proof of income and with two documents: a passport and a second document of the borrower’s choice from the list offered by the partner bank. The Tinkoff Mortgage calculator will help you find out the approximate interest rate and the maximum amount a borrower can expect when filling out a loan application through your Personal Account on the website.

What types of real estate can you take out a loan for?

The type of real estate that a borrower can buy depends on the choice of loan program . For example, if he chooses a mortgage with state support, in which he uses maternity capital (at 6% per annum), he can only buy housing on the primary market.

And if a mortgage is issued on an existing property, and the property being purchased is free of encumbrances, then the client’s choice is virtually unlimited. He can spend the funds received on an apartment on the secondary or primary market, a finished private house, or buy a plot for individual housing construction.

When applying for a loan under the separate “Mortgage without a down payment” program, you will need to choose a liquid property, preferably in a new house in a good area. If you choose a mortgage with just maternal capital, you can safely spend the money on building a house (the law allows this).

When is this possible and when is it not?

When choosing a program, you should always check with the credit manager what kind of real estate the bank is willing to finance. This is due to a lot of restrictions regarding collateral that any lender has. For example, it is unlikely that the Pension Fund will allow borrowers to spend maternity capital on a room in a communal apartment in which it is impossible to allocate shares to children or on a wooden building that is not suitable for permanent residence and registration.

Banks do not provide loans for the purchase of dilapidated, emergency funds, apartments in houses undergoing demolition, or renovation. The lender always pays attention to the condition of the repairs, as well as the presence of all communications.

Some advice for the borrower

To get a Tinkoff mortgage at the minimum rate, the borrower must have an officially confirmed income and have the amount to pay the down payment. The rate also depends on the type of property: the interest rate on a loan for the purchase of a new apartment or apartment is lower. Under an existing agreement, the rate can be reduced by writing an application to the bank, or it can be refinanced on more favorable terms.

Important! Before applying for a loan, you need to carefully calculate your financial capabilities. You should only take out a mortgage if you are confident in your income stability.

If the borrower encounters financial difficulties, the monthly mortgage payment can be reduced. There are three ways:

- Contact your credit institution for debt restructuring. With the help of restructuring, you can extend the term of the loan agreement or reduce the interest rate. Or, if financial problems are temporary, you can ask to revise the schedule: reduce or postpone upcoming payments to future periods. Each of these restructuring options must be justified in the application. Changing the terms of the mortgage agreement will require amendments to the mortgage note.

- Refinance. You can get a loan on more favorable terms to repay your existing loan either from a creditor bank or from another credit institution. Payments will become smaller due to a decrease in the interest rate and an increase in the contract term.

- Repay part of the principal debt early.

Important! This method of reducing the monthly payment may not work if the loan repayment scheme is annuity (equal payments). In addition, in case of partial early repayment under the terms of the contract, the term may be shortened, rather than the monthly payment reduced.

A Tinkoff Bank mortgage is not a specific product of a credit institution, but an entire service. Its goal is to take upon itself the solution of some of the client’s problems associated with obtaining a loan.

Borrower's procedure

The procedure for obtaining a loan is quite simple. The borrower needs to fill out a loan application form on the bank’s website. After this, the credit manager of Tinkoff Bank will call you back on the numbers left, ask clarifying questions and invite you to a meeting. The second option is also possible - the borrower will fill out all the necessary documents and send scans via the Internet.

Step by step procedure:

- Approval of the application by the bank.

- Coordination with the lender of the collateral - purchased or existing real estate.

- Coordination of the issue with the Pension Fund or other government agencies if maternity capital or other state subsidies are taken.

- Signing a loan agreement.

- Loan repayment within the specified time frame.

Before signing the loan documentation, the bank will require an assessment of the collateral. This will need to be done at your own expense. Then, after the loan has been issued and the purchase and sale transaction has been completed, you will have to place an encumbrance on the purchased apartment or house and insure it with an insurer.

Tinkoff Bank mortgage – customer reviews in 2020

If you are not ready to rely only on a calculator, you should pay attention to an alternative way of obtaining information about lending. It consists of actively studying reviews and comments about the services received. This approach has one extremely important advantage for debtors. It is associated with the opportunity to obtain information about some incredibly important nuances of obtaining a loan that are impossible to notice on your own.

But when reading recent (2019 or 2020) reviews, you should promptly separate those comments that contain truly useful and relevant information from messages written on emotions. The latter cannot be objective and can mislead, preventing you from making the right decision and drawing a reasonable conclusion.

Advantages and disadvantages

The table shows the pros and cons of a mortgage at Tinkoff Bank:

| pros | Minuses |

| An online manager who helps and advises users on all issues that arise. | Unavailability of some government programs, as banks do not provide some services. |

| The application is considered by several banks at once, which gives the advantage of choosing the most favorable conditions. | The inability to use Tinkoff services for older people, as they often do not understand modern technologies. |

| Interest rate savings of up to 0.8% compared to a direct mortgage. | The system may fail and the customer's credit history will be misinterpreted. |

| The main thing is that the client does not need to be present at the bank at every stage of applying for a loan, but only come once for the final conclusion of the agreement | — |

| Possibility of choosing any type of real estate from the primary or secondary sales market. | — |

| Simplified package of documents. | — |

As you can see, the advantages of online registration are quite significant, and the disadvantages are mostly related to the technical side or to the disadvantages of applying for a mortgage mainly.

Is it profitable to get a mortgage from Tinkoff without a down payment?

For potential borrowers, taking out a mortgage without a down payment is beneficial for several reasons:

- Remote loan processing, no need to stand in queues and waste time traveling to bank branches.

- The opportunity to get a mortgage loan at reduced rates, because many banks give discounts to potential borrowers who take out a loan through their intermediary Tinkoff.

- No additional commission for the services of Tinkoff Bank as an intermediary.

- 24-hour support, you can contact the managers of a banking organization at any time of the day and get answers to questions about mortgages and other bank loan programs.

Disadvantages of mortgage programs without a down payment:

- there is no online calculator on the site, you have to use third-party resources, and if the total loan amount changes even slightly, you have to recalculate it each time or seek the help of an employee;

- may impose additional services from realtors, insurers, lawyers, for which additional funds must be paid;

- For each client, a personal manager is assigned, but if he is not at his workplace, it is difficult to see the status of the application, minus the relative one, because the application and status can be seen in the personal account on Tinkov’s official website.

Clients who have collaborated with Tinkoff Bank leave various reviews. Some are satisfied with the quality of service, while others have changed managers several times, and because of this, the processing time for the application has increased. In this situation, it is much easier to operate your personal account and monitor the information yourself remotely.

Mortgage loan insurance

When applying for a mortgage through this bank, the borrower will be offered to obtain insurance for both the mortgaged property and the client’s life.

Accredited Tinkoff mortgage insurance companies.

Tinkoff cooperates with many banks, namely :

- Alpha Insurance.

- VSK Insurance House.

- RESO-Garantiya.

- VTB Insurance.

Each company offers its own insurance conditions, and therefore it is worth familiarizing yourself with them in advance.

Important ! In this situation, only property insurance is mandatory, but personal insurance is required at the request of the borrower.

Mortgage Tinkoff without down payment

Tinkoff, as a modern financial organization, is engaged in the selection of numerous clients and the subsequent processing of their submitted data. Funds are issued by other financial institutions with whom partnerships have been established. Ordinary borrowers receive the following benefits:

- No down payment;

- Simplicity and efficiency in preparation, just fill out a form and provide copies of a couple of documents, Tinkoff takes care of the rest;

- The transaction provides an opportunity to save up to 0.25% of the total loan rate, which is much more profitable than most conditions from competitors;

- Possibility to choose between several financial institutions at once.

If the client has been given preliminary approval, he is given the opportunity to choose the most suitable bank, visit it to finalize all documents and sign the official loan agreement. This is the only time you need to visit the bank; all other issues can be resolved remotely.

Required documents

To apply for a mortgage with the help of Tinkoff Bank, the client requires a minimum package of documents.

At the initial stage of filling out the online application, you need to provide a copy of your passport and work record book, as well as a certificate of income in the prescribed form (later it will still be required).

A copy of all pages of the passport is required, and a copy of the work record book must be certified by a notary or employer.

Further, depending on the bank with which you will cooperate, you may need additional documents.

Useful video:

A certificate of marriage registration and birth of a child is required when using maternity capital funds.

Banks also require the appraised value of the apartment, since it will be the subject of collateral.

In any situation, the manager of Tinkoff Bank will help you not to get confused in the difficulties with documents in this area and will tell you what papers you should take with you to sign a mortgage agreement.