Absolut Bank offers to obtain a mortgage for the purchase of your own home or other real estate. The organization has developed a wide variety of products, among which borrowers will be able to choose the best lending option for themselves. Mortgage "Absolut" bank is distinguished by favorable loan conditions and loyal interest rates.

About the bank

Absolut Bank was founded in 1993. The full name of the institution is Joint-Stock Commercial Bank "Absolut Bank", abbreviated as JSCB "Absolut Bank". The main directions of its activities are:

- Consumer and mortgage lending.

- Working with deposits of individuals.

- Servicing medium business accounts.

The head office of the organization is located in Moscow. It has 5 branches and 45 offices located in 22 regions of the Russian Federation. Representative offices of the organization are present in such cities as:

- Novosibirsk;

- Tyumen;

- Samara;

- Krasnodar;

- Chelyabinsk;

- Permian;

- Tolyatti;

- Ekaterinburg;

- Saint Petersburg;

- Krasnoyarsk;

- Kazan.

The main stake in the bank belongs to PJSC Credit United Systems. The priority activity of the organization is issuing mortgage loans.

Mortgage programs

Absolut Bank offers borrowers several mortgage lending programs. You can get a loan to purchase real estate both on standard terms and under programs with government support. As of 2020, the organization has 14 diverse products.

Ready housing

Under this program, you can get a mortgage for the purchase of secondary housing. The loan amount is 15%-80% of the property value. The maximum amount is set at 20 million rubles. The down payment must be at least 20% of the cost of housing. The maximum loan term is 30 years.

To increase the loan amount, it is allowed to attract up to 4 co-borrowers.

New building

The terms of this loan program imply the issuance of a loan for the purchase of housing on the primary real estate market. The bank allows you to buy an apartment both in a ready-made new building and in a house under construction. The minimum down payment for this program is 20% of the property value. The maximum amount is 25 million rubles. The loan term is up to 30 years.

State program for young families

A family mortgage allows you to obtain a loan for the purchase of primary or secondary housing, construction of a private house or participation in shared construction. Under this program, families with children receive a loan at 6% per annum for up to 30 years. The down payment must be at least 20% of the cost of living space. The maximum loan size for a family mortgage is 12 million rubles.

Important: the 6% rate is set for a period of 3-6 years. The length of the grace period depends on the number of children born since the beginning of 2020. After the specified period of time, interest increases according to the current Central Bank rate.

By passport or two documents

Absolute allows its clients to obtain a mortgage loan using 2 documents. This program is relevant for those who, for some reason, are not able to collect a complete package of documents. This program is characterized by the speed of loan processing due to the absence of the need to prepare a large package of papers. This product also has its drawbacks: higher interest rates and an increased down payment.

Loan secured by an apartment

This program is suitable for those who already have their own living space and want to expand it or buy an additional apartment. The maximum loan amount for residents of Moscow and St. Petersburg is 15 million rubles, for clients from other constituent entities of the Russian Federation - 9 million rubles. The amount cannot exceed 70% of the cost of the housing pledged. The loan term under this program is 3-15 years.

Military mortgage

The bank offers military personnel a loan to purchase their own home on preferential terms. This category of borrowers can receive a loan that will be paid from the budget of the RF Ministry of Defense. The maximum loan period is 20 years, and at the time of repayment of obligations the borrower must be no more than 45 years old. The maximum mortgage amount for military personnel is 2,485,000 rubles. The down payment amount is 20% of the property value. It can be contributed from the savings of the NIS participant.

Apartments

The product is designed for the purchase of apartments in commercial real estate. Housing can be purchased on the primary or secondary market. The loan amount cannot exceed 70% of the cost of the apartment. The maximum amount of such a mortgage is 15 million rubles. Down payment – 30%. The loan term is up to 30 years.

Maternal capital

Owners of maternity (family) capital can use funds from this program to pay the down payment on a mortgage loan in the amount of 20% or pay off current debt. You can purchase a primary apartment or secondary housing. The loan repayment period is up to 30 years.

Commercial real estate

Entrepreneurs can obtain a loan from Absolut Bank to purchase commercial premises. The loan term under the commercial mortgage program cannot exceed 10 years. The maximum loan amount is no more than 65% of the cost of the premises. This amount can be increased to 80% subject to the provision of additional collateral.

Parking space

You can apply for a mortgage agreement at the bank to purchase a place for a car. This could be a garage or a fenced parking area. The parking space must be properly registered with Rosreestr. The limit does not exceed 70% of the purchase price.

For Russian Railways employees

The bank has developed an individual lending program for railway workers who have worked for Russian Railways for at least six months. This category of borrowers can receive a mortgage on preferential terms.

You can get a loan to purchase housing on the primary or secondary real estate market. The maximum mortgage size depends on the category of living space. If you buy a new apartment, you can get a loan equal to the full cost of housing, but not more than 9 million rubles. When purchasing secondary housing, you can get a loan of up to 15 million rubles, but not more than 90% of the cost of the apartment.

Collateral property

Absolut Bank offers to obtain a mortgage on favorable terms for the purchase of living space pledged by the organization. When receiving such a loan, the maximum amount, repayment period, as well as the size of the down payment are determined according to the selected lending program. Borrowers purchasing collateral housing will receive a 1 point reduction in the interest rate.

Mortgage without down payment

In 2020, the bank does not offer products for which you can get a loan without a down payment. If you do not have the funds to make a down payment, you can pledge your existing property. The encumbrance will remain in effect until the debt is paid in full.

Proposed program

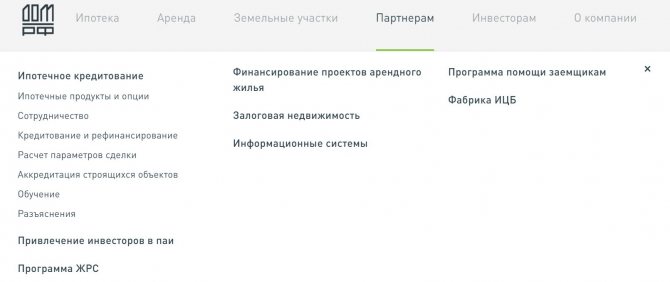

AIJK lending standards have long been recognized by borrowers. Thanks to the availability of special social programs, it is easy to choose the appropriate options.

The rate depends on the loan term, amount and price of the collateral. An important role is played by whether the user has an insurance policy.

All regions have their own maximum loan amounts issued according to the standard scheme.

The interest depends on the amount taken in a particular region.

The basic requirements for those who want to take out a mortgage are as follows:

- The loan can be obtained for a maximum period of thirty years.

- Loans are issued only to capable citizens of Russia between the ages of eighteen and sixty-five.

- The subject of collateral is the property being purchased.

Clients are also offered a social loan. It can be obtained by hired workers with at least six months of work experience.

The recipient must be at least eighteen years old. In addition, one of the pledgors must belong to the following categories of citizens:

- Persons living in a house where each person has at least eighteen square meters of space.

- People who need housing provided under a loan agreement.

- War veterans.

Important! The offer is also relevant for managers of maternity capital and large families with more than three children.

To view the terms and conditions, click “partners”

If you have any questions, call

Terms of mortgage loans

Below is a summary table with the conditions for each mortgage product offered by Absolut Bank.

| Mortgage program | Minimum interest rate, % | An initial fee | Loan term, years | Maximum amount, million rubles |

| New building | 9,74 | 20% | 30 | 25 |

| State program for young families | 6 | 20% | 30 | 12 |

| Apartments | 9,74 | 30% | 30 | 15 |

| Ready housing | 9,74 | 20% | 30 | 20 |

| Military mortgage | 9,5 | 20% | 20 | 2,4 |

| Loan secured by real estate | 10,24 | – | 15 | 15 |

| Maternal capital | 9,74 | 10% | 30 | 20 |

| Parking space | 10,74 | 30% | 15 | 2 |

| Commercial real estate | 11,74 | 20% | 10 | 15 |

| For Russian Railways employees | 8,95 | – | 15 | Primary market – 9, secondary – 15 |

| Refinancing | 9,74 | – | 30 | 20 |

What risks are included in the insurance?

Mandatory insurance of the collateral provides for the risk of loss or damage to property. In this case, accidental unintentional damage to the property is assumed, including such damage as a result of which the premises become unsuitable for use. For example, if there is a fire in the apartment. The beneficiary of this type of insurance is the mortgagee, who is also the creditor.

Svetlana

Real estate expert

Title insurance applied to collateral property provides for the risk of loss of real estate due to termination or restriction of ownership rights. In this case, it is assumed that it is possible to challenge the transaction as a result of which the object was acquired. This type of insurance is not mandatory and is issued for the most part as part of lending programs that provide for the purchase of housing on the secondary real estate market. At Alfa-Bank, issuing such a policy is an integral condition of the “Loan secured by existing housing” program.

Borrower health and life insurance is used more often than title insurance and provides for the risk of disability or death. By agreeing to take out a personal insurance policy, the client provides himself and his relatives with a safety net in case of illness, job loss, disability or sudden death.

Requirements for the borrower

To obtain a mortgage, the client must meet the following requirements:

- Age 21-65 years.

- The duration of work in the last place is at least 6 months.

- Cumulative work experience of 1 year.

- Citizenship of the Russian Federation.

- Possibility to confirm income.

- Full legal capacity.

- The borrower is not registered with a drug treatment or psychoneurological dispensary.

- Mandatory involvement of a spouse as a co-borrower.

Mortgage insurance at Alfa Bank

Buying a home using mortgage funds is almost the only option for a young family or people who do not earn a lot of money. Due to large amounts, this loan is distinguished by a complex registration process - collecting papers proving the client’s ability to repay the loan, providing documents for the purchased home, thoroughly checking the possible borrower, and much more. And last but not least is the issue of insurance.

For the average person who does not understand the essence, insurance when taking out a mortgage is nothing more than an additional burden on the family budget and a headache with the execution of the contract. However, if you understand all the nuances of mortgage insurance, you can see that this process, with a competent approach, is beneficial not only to the lender, but also to the borrower himself.

Why do you need collateral housing insurance?

Every person who took out a mortgage loan paid attention to how carefully the bank treats the availability of an insurance policy. This is explained quite simply: by issuing a large sum of money for the purchase of an apartment or other property, it simultaneously acts as collateral for the issued funds for the lender. And the bank treats its capital very carefully, and if something happens to the mortgaged apartment, it promises losses for the lender. Since the deposit is the bank’s guarantee to return its finances if the client for some reason cannot pay the mortgage.

It is necessary to note that when taking out an insurance policy for the purchased apartment, the beneficiary of the insurance money, according to the agreement, is the credit institution.

A clear example proving the need for mortgage insurance for housing is the following situation: the borrower and the bank signed a mortgage agreement, during the preparation of which the client purchased an insurance policy at the request of the bank. Over the next few months, the borrower regularly makes monthly payments on the debt. In the area where the mortgaged housing is located, a natural disaster occurs (or another event specified in the agreement), as a result of which the apartment (or house) receives severe damage. The insurance organization, according to the agreement, will pay the bank part of the outstanding debt of its client (an agreed amount, the amount of which depends on the degree of damage to the object, but cannot be more than the balance of the debt).

This situation shows that mortgage home insurance is primarily beneficial to the borrower. In the absence of a policy, a person will be left not only with damaged property, but also with a large debt to his creditor.

Mandatory insurance at Alfa Bank

The federal law regulating credit relations obliges the borrower to take out an insurance policy for the collateral property (which is an apartment purchased on credit). Alfa Bank operates in accordance with this legislation and obliges each client with a mortgage to have a home insurance policy. Moreover, the insurance contract is concluded in parallel with the mortgage agreement. The borrower has no right to refuse it. The insurance must be in place for the entire duration of the mortgage loan until it is paid off.

This insurance covers the following risks:

- fire (a fire can occur both inside and outside the property);

- gas explosion;

- natural impact (hurricane, earthquake, etc.);

- flooding that occurred as a result of a breakdown in the water supply, sewerage system or heating system. Water can even come from other rooms;

- criminal actions of other people (vandalism, hooliganism, etc.);

- damage to real estate as a result of falling aircraft parts;

- damage resulting from design defects (they should not be known until the contract is signed).

A typical insurance policy includes a minimum of property (load-bearing and non-load-bearing structures, partitions, windows and entrance doors). There are policies with an extended list of property - insurance for repairs, furniture, equipment, etc. — it all depends on the desire of the borrower, because the more risks the policy covers, the more expensive it is.

Since it is impossible to refuse this insurance, the future borrower should study in advance all the information that interests him. In particular, before concluding an insurance agreement, the borrower must carefully study the document itself and become familiar with the cases in which the insurer has the right to refuse to pay funds.

Optional insurance at Alfa Bank

In addition to mandatory insurance, Alfa Bank offers its future borrowers additional risk insurance. According to the law, no financial institution has the right to require a client to have optional policies.

Alfa-Bank offers to clarify at the time of filling out the application for a mortgage whether the borrower intends to take out additional insurance.

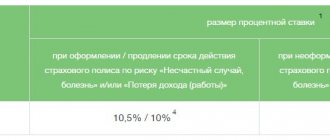

The organization does this in order to obtain additional guarantees of repayment of borrowed funds. Optional policies further reduce the lender's risk of incurring losses, which allows Alfa-Bank to further reduce the interest rate for the borrower.

The list of optional but recommended insurance includes:

- Policy on the life and health of the borrower. If the borrower dies or receives the first/second group of disability due to illness or an accident, the insurance organization undertakes to pay the balance of his debt to the lender (the specific amount depends on the concluded agreement).

Also, in case of serious illness, the insurer may pay a monthly premium. Until the client is able to go to work. More exact conditions depend on the chosen policy and company.

- A policy that protects the borrower’s right to own the collateral property. If the contract for the purchase and sale of collateralized housing is declared invalid, as well as the borrower’s requirement to provide the property (in whole or in part) to the persons who retained ownership of the apartment. This policy protects the rights of an honest buyer. The insured event will be the decision of the judicial authority. Insurance payments cover both the client's costs and the amount of funds issued by the lender.

These policies in Alfa Bank are called risk insurance. If the borrower refuses to take out additional policies, the bank will increase the annual mortgage rate by 1%. This is due to the fact that the mortgage is issued for an extremely long period (up to 30 years) and no one can predict the occurrence of unforeseen circumstances.

Another type of optional policy is client liability insurance. It protects against losses that may arise from bank claims. If the client does not fulfill his obligations, and the amount available after the sale of the mortgaged home is not enough to repay the mortgage, the insurance company will pay the remainder. This insurance is used for mortgages where the down payment is extremely small - about 10%.

Conditions and cost of insurance contracts

The cost of processing mortgage agreements is calculated as a percentage of the loan debt. In addition, it will never be static - it all depends on the specific client and his characteristics. The average cost of an individual policy in different companies ranges from 0.1% to 0.6% of the balance of the mortgage debt. In a number of insurance organizations, prices can vary extremely greatly - for insurance of a mortgaged apartment from 0.07% to 0.77%. And risk ratios can significantly increase these numbers.

Real estate policy

The price depends primarily on the size of the mortgage, the chosen program and the characteristics of the housing itself (date of commissioning, condition, etc.). In addition, the likelihood of an insured event may affect the tariff (for example, if the communications in the house are old, an increasing factor will be used, and vice versa).

Regardless of the insurer chosen, the contract will not provide for insurance payment if the property was damaged due to the fault of the client.

Life and health policy

The price of this type of insurance is also influenced by many factors: the client’s age and gender, his state of health, and occupation. Risk factors will be the presence of chronic pathologies, passion for a dangerous sport, and a profession with high trauma rates. Before executing the agreement, the client is required to undergo a medical examination.

Payment under the insurance contract will be denied if the client committed suicide, if a fatal accident occurred through the fault of the client, if traces of alcohol or drugs were found in the borrower’s blood. If the borrower concealed the presence of a serious illness (at the time of signing the contract), he will also be denied payment.

Title policy

To assess risks and calculate the cost of this insurance, the organization will be interested in disputes between heirs over collateral property. The presence of lawsuits will also affect your insurance risk. Registered children and persons serving sentences in special institutions will increase the cost factor.

In addition, each insurance organization has special offers - comprehensive insurance packages (banking institutions prefer that the borrower apply for them). Such packages, depending on the company, offer property and health insurance or property and title insurance, etc. Some insurance companies insure risks in all areas of interest to the client at once.

Duration of the contract and payment

Regardless of the chosen policy, the contract is usually concluded for one year, after which the client has the right to extend the agreement, refuse it or choose another insurance organization. There are insurers who prefer to issue a policy for the entire term of the mortgage payment; AlfaStrakhovanie would be a prime example. If the client needs it, the insurer can meet halfway and issue a policy for a non-standard period.

Payment for the policy is usually a one-time payment for the entire year, although many borrowers choose to negotiate and pay the premium along with their mortgage payments. There are options when the amount of insurance premiums is paid into the body of the mortgage (the money for the policy is issued by the bank), this option must be clarified with the manager. If an agreement was concluded for the entire term of the loan, the borrower will receive a receipt for payment of the installment once a year.

Since the amount of payment for the policy directly depends on the balance of the debt, the borrower must provide the insurance company with a bank certificate every year with the exact amount of the debt. Thus, paying for the policy will require less and less money every year. If a client chooses to pay their mortgage up front, this will also reduce insurance premiums, as long as they notify their insurer promptly.

It is worth noting that the cost of a comprehensive package will certainly be lower than purchasing policies separately. However, the final choice always remains with the borrower.

Accredited insurers of Alfa Bank

By law, the borrower is free to choose the insurance company to enter into an agreement. However, Alfa Bank prefers to cooperate exclusively with those companies that have been accredited. And, given the leading position of this financial institution, it is reasonable to assume that accredited insurers have the highest ratings and experience in the insurance market.

The highest priority companies for Alfa Bank are AlfaStrakhovanie and RESO-Garantiya (ruAA+ according to RAEX rating) - the bank is most loyal to these institutions. List of other insurance institutions cooperating with this bank:

- SOGAZ - ruAAA according to RAEX (Expert RA - the largest rating company in the Russian Federation);

- Ingosstrakh-ruAAA according to RAEX;

- Energy guarantor - ruAA-;

- Consent – ruBBB;

- VSK – ruAA;

- Alliance – ruAA;

- ROSGOSSTRAKH – ruBBB+

According to the rating, the level of reliability of companies ranges from satisfactory to maximum.

Nuances

If the borrower agrees to take out comprehensive insurance, the manager will most likely offer to do this directly at the bank. And here lies a small catch - the insurance company will be selected in such a way as not only to cover the risks, but also to bring financial benefits to the bank (the prices of the proposed companies are extremely high). The borrower does not have to take out a policy with the bank; he has the right to choose any company from the list.

Before concluding an agreement with the insurer, it would be wisest for the client to study the offers of all accredited organizations, compare their prices and services and then choose the best option for themselves. There will be no sanctions from the bank - the borrower, one way or another, fulfills all the terms of the agreement.

How unprofitable is insurance?

Since mortgage home insurance is mandatory, it is not discussed. The client can save on this policy by choosing the cheapest company and the minimum package. But with optional insurance at Alfa Bank, a rather interesting picture emerges. By refusing it, the borrower will pay higher interest on the mortgage.

But it's worth doing a little math here. For example, a comprehensive insurance policy at AlfaStrakhovanie costs on average 1% of the loan. And it is by this figure that the bank reduces the annual rate for the insured client. Considering that the comprehensive policy also includes real estate insurance, the client wins - he saves an amount equal to apartment insurance. In addition, the cost of the policy will fall every year. In other banking organizations, the picture may be different, and by choosing to refuse optional insurance, the client will spend less money, even with increased interest.

Every year the bank will require you to provide a copy of the new insurance policy. And in case of refusal, it has the right to impose penalties that are prescribed in the mortgage agreement (Alfa-Bank will increase the interest rate).

A mortgage is a risky venture not only for the bank, but also for the client. And insurance organizations allow you to minimize the risks of unforeseen situations. Many experts suggest that the borrower think twice, because, despite the additional costs, the borrower gains confidence that the mortgage will not hang as a dead weight in the event of major problems.

How to apply

You can apply for a mortgage at Absolut Bank in one of 2 ways:

- In a branch of the organization.

- On the official website of the company.

When contacting the bank, you will need to immediately provide a complete set of documents. If the application is submitted online, the client receives only a preliminary decision. After which you will need to collect all the necessary papers and transfer them to the organization’s branch. After studying the submitted documents, the lender will make a final decision.

Where can I get a policy?

Most credit institutions offer their borrowers accredited insurance companies. And this is a generally accepted practice, because the bank first of all thinks about the future. Insurance, especially comprehensive insurance, allows lenders to significantly reduce the risks associated with possible losses.

It might be interesting!

What are the conditions and advantages of a mortgage with state support at Alfa Bank?

Alfa-Bank also has partner companies, a list of which is posted on the official website in the “links and documents” tab under the title “list of recommended insurance companies.”

The list of these includes:

- SPAO "RESO-garantiya";

- Absolut Insurance LLC;

- JSC "VSK";

- JSC Alfastrakhovanie.

It is worth noting that the companies recommended by Alfa-Bank are included in the rating of the most popular insurers, however, the tariffs they apply differ. The amount of the tariff is determined as a percentage of the amount of funds that the borrower must repay. Accordingly, as the amount of debt decreases, insurance becomes cheaper each subsequent year.

Svetlana

Real estate expert

In most companies, the tariff applied when applying for a mandatory policy starts at 0.1%, but some insurers apply a higher percentage. So, for example, in VSK, when insuring property, a tariff of 0.43 is applied, while in Alfastrakhovaniye its value is 0.15, and in RESO – 0.1.

In addition, not all insurers are able to offer a complete list of insurance policies. Therefore, if a borrower requires comprehensive insurance, you need to choose a company that insures the property, title, as well as the life and health of the borrower. At the same time, the rate applied for different types of policies will differ.

Reviews

Most of the mortgage reviews found online are positive. Clients note a high percentage of application approvals, loyal rates, and a variety of mortgage programs. Borrowers also highlight the absence of long queues and working with a personal mortgage manager throughout the loan period.

Absolut Bank is an actively developing organization that provides mortgage lending to the population. Offers several products with attractive terms and conditions. The institution works with state support programs, which allows more citizens to receive a loan from this organization.