Law on rural credit and mortgage up to 3%

The development of a document on special conditions for mortgage loans for rural housing was initiated by the state and was carried out throughout almost the entire 2020. As a result, government decree No. 1567 was signed, which came into force on January 1, 2020. The code name of the program is “rural mortgage,” although it should be noted that measures to return people to villages are not limited to providing affordable housing.

In the next 5 years, it is planned to spend approximately 2.3 trillion rubles on the implementation of the program, 1 trillion will be provided by the Federal budget, and the remaining funds will be allocated by regional budgets.

The initiators of the program do not exclude the possibility of attracting developers to create new villages in which housing can be purchased with a rural mortgage.

General conditions and purpose of rural mortgages

Representatives of the Ministry of Agriculture talk about the need to attract people to the village and other settlements. Everything is explained by the “extinction” of residential villages, as a result of which the agricultural economy suffers. City shopping complexes are forced to turn to imported products, and this increases the cost and prices of goods. By attracting citizens to the village, it is planned to improve purchasing activity, because the harvest of Russian farmers will be cheaper.

The general conditions for lending under the Rural Mortgage program, in accordance with Government Decree No. 696, include:

- You can only buy housing in rural areas;

- loan terms are up to 15 years, but Sberbank provides the opportunity to obtain a loan with repayment up to 25 years;

- minimum rate – 0.1%, maximum 3%;

- down payment – 10% of the cost of the selected object;

- the maximum loan amount is 3 million rubles, but for some regions larger values are provided (for example, in the Leningrad region loans up to 5 million rubles have been approved);

- It is possible to use maternity capital as a down payment.

You can apply for a mortgage under the Rural Mortgage program in 2020 at a bank. Since the credit institution does not receive proper profit, losses are compensated at the expense of the state, which is also confirmed by Passport of Government Decree No. 696.

For your information

At the moment, the situation is acute in the Far East, so preferential loans have been available here for many years. You can purchase housing in rural areas at a rate of 6%, but with the adoption of the law on the start of rural mortgages, the overpayment values have also been reduced.

Terms and requirements

The rural mortgage program involves a number of requirements for both the buyer and the home. In addition, the borrower must meet the conditions of the lending bank.

Requirements from the state:

- Targeted spending of borrowed funds.

- Down payment of at least 10% of the value of the purchased property.

- The loan term is up to 15 years (the possibility of increasing the loan term to 25 years is being considered).

- Repeated participation in the program is not provided (you can apply for a loan within the program only once).

- Refinancing of existing loans at the current program rate is not provided.

Terms from the bank:

- Citizenship of the Russian Federation.

- Registration in the region where the creditor bank operates.

- Confirmed solvency sufficient to cover the loan.

- Positive credit history.

- Banks have the right to put forward additional requirements for borrowers. In some cases, a guarantor may be required.

Requirements for the purchased property:

- Suitability for living (in case of purchasing ready-made housing).

- Functioning communications.

- The area is in accordance with the accounting norm for each family member (set at the regional level).

- The condition of the premises is satisfactory (not considered dilapidated or unsafe).

- Possibility of year-round living.

The program does not provide for any restrictions on the age or social status of borrowers; therefore, representatives of any category of the population can apply for a loan at a reduced rate.

The program participant must confirm his intentions to live in a rural area. Rural registration can serve as an argument, although it is not a prerequisite.

The program provides for the impossibility of selling the purchased premises within 5 years from the date of purchase, even if the mortgage obligations expire.

General requirements for the borrower

In different financial institutions, the requirements for the borrower vary slightly. The main ones are the presence of official employment, solvency and a positive credit history.

Age

From the point of view of banks, the most favorable category of clients for concluding long-term loan agreements are people between 30 and 40 years old. Younger people rarely have a stable income sufficient to service the loan.

But formally, a borrower aged 18-21 can receive approval. It is more difficult to obtain a loan for clients who will be 60-65 years old at the time of the last payment - this is the upper age limit.

Young people over 30 years of age are the most favorable candidates for obtaining a mortgage.

Citizenship

To get a housing loan, you must be a citizen of the Russian Federation. A foreign citizen who has a residence permit (residence permit) can become the owner of real estate in Russia.

But this category of clients is rarely given credit. VTB, AlfaBank, Rosbank are ready to consider applications from foreigners. At Sberbank, foreign citizens can only apply for a consumer non-targeted loan.

Permanent registration

The requirements of most banks include a clause on mandatory permanent registration in the region where the financial institution operates.

AlfaBank, Rosselkhozbank, Uralsib, Sberbank, Otkritie are ready to issue a mortgage to a client with temporary registration. Tinkoff Bank pays attention to registration only to verify the borrower; VTB has completely excluded registration from the list of requirements.

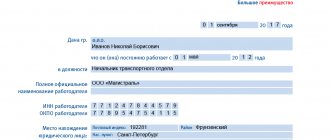

Employment

Having official employment is almost always one of the mandatory requirements for a potential borrower.

But instead of a work book or contract, you can submit a certificate in the form of a bank or choose a mortgage program using two documents.

Such proposals imply increased requirements for the size of the loan (at least 30% of the cost of real estate) and an unfavorable interest rate for the borrower.

Work experience

To apply for a mortgage in Gazprombank, you must confirm that you have at least 3 months of continuous work experience at your last place of work, in AlfaBank - 4 months, in Sberbank - 6. Most financial institutions have additional requirements for total work experience - at least 1 year.

Income amount

Monthly income must be sufficient to service the requested mortgage amount. There are no clear salary requirements. Any person who has a stable source of income and is able to confirm it can apply for a loan.

When calculating the maximum mortgage amount, banks take into account the main source of income - official employment (for employees), profit from doing business (for individual entrepreneurs). Additional income may be taken into account, such as rental property or investment.

Debt load

The client’s level of solvency is affected by the presence of existing loans and other types of financial obligations (cards with a credit limit, microloans, fines, alimony).

The debt burden indicator is calculated as the ratio of monthly payments on all obligations to the average monthly income. If a potential borrower's debt level is above 50%, most banks will refuse to issue a mortgage. The optimal debt burden is 30-40%.

Credit history

Credit history (CI) shows the borrower’s level of responsibility and willingness to accurately fulfill financial obligations. The presence of a problem-free CI and solvency are the most important criteria for approval of a mortgage transaction.

If there are current delays or a damaged CI, the housing loan will be refused. Therefore, you first need to restore your reputation as a borrower.

To do this, you should pay off your current debts, take out a small loan and pay it off carefully, and start using your credit card responsibly.

A positive CI is one of the main factors for loan approval.

What is considered rural?

In the program, rural areas are understood as:

- Village;

- village, incl. urban type;

- workers' village;

- village;

- farm;

- village;

- aul and village.

In addition, the program covers inter-settlement territories that do not have additional status, as well as small towns with a population of up to 30,000 people that have a common infrastructure with the nearest rural settlements (at the discretion of local authorities).

It is better to clarify whether an area belongs to a rural area with the creditor bank at the stage of selecting real estate.

What will the preferential rate be?

The main advantage of a rural mortgage is a reduced interest rate. The state has set boundaries: 0.1 – 3.0%. The exact rate is set in the regions, but cannot exceed 3%. Compared to other loans offered, this is the most affordable option.

In this case, the lending bank does not incur losses, since the difference between existing loans and those issued under the terms of a rural mortgage will be reimbursed by the state.

The rate does not change for the entire period of validity of the mortgage agreement, i.e. loan repayment terms will not change.

How to get a rural mortgage from Rosselkhozbank?

To obtain a mortgage at a reduced rate, you will need to contact the bank branch where you are registered with the following documents:

- Russian Federation passport;

- Certificate of income;

- A certified copy of the work record;

- Military ID;

- Pension certificate and certificate of the amount of pension received (for pensioner borrowers);

- Certificate of State Register of Individual Entrepreneurs or self-employed (for relevant categories of citizens);

- Declaration of income (for categories requiring its availability).

If the borrower has already decided on the property, it is necessary to provide an assessment report, a technical and cadastral passport and a certificate of ownership.

Next, you need to register the purchase and sale agreement with Rosreestr, after which the bank transfers the money to the seller’s account.

After completing the transaction, the creditor bank turns to the state for reimbursement of part of the interest rate. The borrower is not involved in this.

The obligation to pay monthly installments arises from the moment the loan agreement is signed. Due to the fact that obtaining a mortgage with state participation is not a quick procedure, a situation may arise when the borrower is obliged to make payments even before actually receiving the property. Be sure to read the loan repayment procedure!

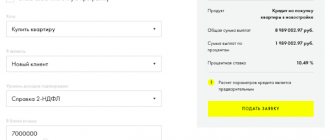

Basic mortgage terms

Most financial institutions offer similar conditions. Only preferential programs that are implemented with government support have special features.

Loan terms

The mortgage is issued for a period from 3 to 30 years. Avito Real Estate experts have calculated that the average Russian family needs 10 years to pay off a housing loan for a one-room apartment on the secondary market. In Moscow, this period averages 24 years.

To calculate the optimal loan period, you need to determine the amount that the borrower can pay monthly towards the mortgage.

The maximum financial burden is 40% of income. The monthly payment must be divided by the loan amount. This will give you the number of months in which the borrower will be able to repay the debt.

Mortgage loan amount

The amount varies from 300 thousand to 20 million rubles. The average mortgage size in Russia is 2.64 million rubles. The loan size depends on the value of the property, location (in Moscow and St. Petersburg the limits have been increased) and the solvency of the borrower.

Currency

Housing lending is carried out primarily in rubles. There is no direct ban on transactions in dollars or euros, but it is not profitable for either banks or borrowers to deal with mortgages in foreign currencies.

An initial fee

Down payment (DP) is part of the cost of the property that the borrower must pay from his own savings at the time of execution of the mortgage loan agreement.

The greater the PV, the higher the likelihood of approval of the loan application and the better the conditions (reduced interest rate, reduced loan term).

The minimum PV is determined by the programs of financial institutions. Most often this is 10-20% of the value of the property. For a mortgage with state support, a PI of only 5% is allowed. If maternity capital or NIS funds are used, then often some part of the PV still needs to be paid from personal savings.