Large families belong to a vulnerable category of Russians. Therefore, the state meets them in many issues - this concerns payment of housing and communal services, reimbursement of rent, provision of land plots, but in the field of mortgages everything is somewhat different. In 2016, the State Duma was unable to pass a targeted law that would regulate this issue. Therefore, parents with many children are forced to find a way out of the situation on their own, turning to various organizations, including Sberbank. Mortgages for large families in Sberbank, benefits and state support in 2020 will include several programs, including a mortgage at 6% for the second and third child.

Conditions for issuing mortgages to large families in Sberbank in 2020

At the moment, Sberbank offers a mortgage program for large families at an interest rate (with a discount from the developer) from 7.4% . At the same time, to receive a developer discount, the loan term must be up to 7 years.

General conditions of mortgages for large families with a loan term of 12 years (without discount)

- The minimum mortgage amount should not be lower than 300 thousand rubles;

- term - up to 30 years;

- rate from 9.5%;

- down payment - no less than 15%.

Additional benefits and more favorable conditions

The only significant additional benefit may be the payment of the down payment or part of it using maternity capital. It is important to know: the legislation allows you to pay mortgage interest with the specified money, but Sberbank’s requirements state that they can only be spent on the contribution. In addition, it is only possible to obtain a mortgage for housing under construction or new housing, that is, secondary housing cannot be the subject of a transaction.

Mortgage benefits for large families

There is no single mortgage program for large families in Russia. There are several options you can take advantage of to facilitate payments:

- Mortgage with state support for families with children (regulated by Government Decree No. 1711 of December 30, 2017). With financial assistance from the state, the rate is reduced to 6% per annum. Previously, it was valid for a limited time, but from 2020 it applies to the entire loan term. Families whose second or next child will be born from January 1, 2018 to December 31, 2022 can take part in the program. There are restrictions on the loan amount and type of property.

- Housing subsidies. The state allocates part of the funds for the purchase of real estate to those who need to improve their living conditions. There are different programs, and their rules depend on the region. Most often they give from 20 to 50% of the estimated cost of the necessary housing. The Young Family program operates throughout Russia (the age of the eldest spouse is limited to 35 years). You can find out about specific opportunities from your city or district administration.

- Maternity capital - federal and regional. The rules for managing capital are described in Art. 7 and 10 256-FZ. These include the possibility of investing in a mortgage.

- Payment of 450 thousand rubles. The opportunity to receive this money appeared in 2020 for families where the third or next child will be born since the beginning of this year. They can only be spent on a mortgage, both under a new agreement and under an already concluded one. To confirm your right to payment, it is enough to present the birth certificates of your children to the bank. As of May 2020, the law is being discussed in the State Duma. The likelihood that he will not be accepted is almost zero. Only details are discussed.

All of these features can be used individually or together. There is only one limitation - you receive a housing subsidy once in your life. The rest depends on whether the family fits the conditions of the program.

Regional cash subsidies are the most significant mortgage support for families with many children

You can use a tax deduction for your mortgage payments. In other words, get your income tax back. To do this, you need to submit an application to the tax office. The state will return 13% of the cost of the apartment, but not more than 260,000 rubles.

Help for young families under the “Young Family” program 2020

Nowadays, the “Young Family” program can provide assistance to large families, but it is only relevant if the parents are under 35 years old. This benefit allows Russians to receive compensation from the state in the amount of a third of the cost of housing (30%). To clarify the amount of compensation, you need to contact the local authorities, indicating individual conditions.

However, due to insufficient funding, those wishing to take advantage of such assistance wait for their turn for years. In view of the above, parents with many children are forced to buy housing using credit money on a general basis.

Getting social housing

Housing subsidies for large families are allocated at the regional level, but the procedure itself is regulated by Federal legislation.

Since getting an apartment as a large family is not easy, you should familiarize yourself with the conditions:

- there is no own housing, or its area does not meet the standards for each tenant;

- the family has low-income status;

- over the past five years, living conditions have not been deliberately worsened (otherwise this will be regarded as deception);

- availability of permanent registration in the region for a specified period;

- citizenship of the Russian Federation.

Housing is issued on a first-come, first-served basis, so to get an apartment you must be on the waiting list.

Where to apply for status registration

To queue, you need to do the following:

- contact the Department of Social Protection with the appropriate application and other documents;

- send papers to the self-government body at the place of residence to obtain the status of a low-income family;

- Parents of children are required to have a social tenancy agreement.

You can track the queue movement at your local municipality. Housing for large families is provided in the form of a certificate, and on its basis citizens receive money to purchase an apartment. You can spend them on housing on the primary or secondary market or build your own home.

List of documents for queuing

Let's look at how a large family can get an apartment from the state. To do this, you should collect a certain package of documents:

- a certificate of the standard housing space per person;

- ID cards of all family members (for adults - passports, for children under 14 years old - birth certificates);

- extract from the real estate register;

- Marriage certificate;

- certificates of obtaining the status of a large and low-income family;

- certificate of family composition;

- Confirmation of registration;

- a certificate from the house register for each parent and child.

A specially created commission reviews the submitted documents and makes a decision. If the verdict is positive, the family gets on the waiting list. The decision is made within a month.

Getting housing

All documents must be submitted to the local administration. After submitting, the institution’s employees review them and give consent or refusal to be placed in the queue. Today this subsidy is given in the form of certificates.

The money transferred to the family’s account can only be spent on improving living conditions. Spending funds on other needs is strictly prohibited. The state does not limit citizens in choosing suitable housing. The only condition is that it must comply with legal standards.

New law on mortgages for second and third children from 2020

At the end of 2020, Russian President Vladimir Putin signed a decree on the launch of a program to support mortgage lending for the second and third child, you can read about this in detail in the article “Mortgage for 2 and 3 children at 6% in 2020.” That is, according to the specified program, benefits in the form of compensation for part of the cost, a reduced interest rate can now be counted not only by families with many children, but also by parents with two children.

Conditions for receiving 450 thousand to pay off the mortgage

From the conditions provided for in the law for obtaining state support for large families can be identified as follows:

- Families in which a third or subsequent child was born between January 1, 2020 and December 31, 2022 (including adopted children) can participate in the program.

- Parents and children must be citizens of the Russian Federation .

- You can receive a payment even if the eldest child is already 18 years old - this does not affect participation in the program in any way. There is no obligatory condition that a family must be recognized as having many children - only the condition specified in paragraph 1 is important.

- The right to participate in government program is available to the mother or father of a third or subsequent child. The mother or father must be a borrower or a joint borrower (co-borrower).

- The mortgage loan must be issued by a Russian bank or JSC DOM.RF. The purpose of the loan should be the acquisition of residential premises (including a land plot) from an individual or legal entity under a purchase and sale agreement or an agreement for participation in shared construction. That is, you can buy:

- apartment in a new building;

- apartment on the secondary market;

- individual housing construction object;

- land plot for individual housing construction.

- The payment amount is 450,000 rubles, but not more than the balance of the credit debt and the amount of accrued interest.

The law contains only one restriction on the date of receipt of a mortgage loan - it must be issued no later than July 1, 2023 . That is, these can also be mortgages issued before this law came into force (before January 1, 2019).

It will be possible to jointly use funds from maternity capital (which in 2020 amounts to 466,617 rubles) and 450 thousand, which will be allocated to repay the mortgage.

Registration of a mortgage

Even if there are any benefits in Sberbank, as in any other bank, the solvency of parents with many children is checked on a general basis.

Required documents and certificates for obtaining a mortgage

To apply for a mortgage, large (young) families should prepare the following documents in advance:

- Passports.

- Certificate of family composition.

- Certificates confirming that the parents have many children. Such documents are issued by municipal authorities.

- Certificate 2-NDFL, indicating the presence of a stable income and its amount. If you have additional income, you should also provide certificates or other documents (for example, lease agreements) confirming this fact.

- Copies of work records, which show that the parents are employed and have at least six months of work experience at their last place of work.

- A certificate confirming that a large family has its own funds for a down payment.

Each parent is required to provide these documents, since one of them will be the borrower (who has more income), the second will be the co-borrower. If the salary does not allow the parents to buy housing with a mortgage, then the parents can introduce additional co-borrowers to Sberbank, which may be immediate relatives. But it should be remembered that each co-borrower has the right to claim a share in the purchased property.

Documents for housing

When interested parties decide on their future housing, they need to collect the necessary documents and submit them to Sberbank, or rather to the same branch where the mortgage was issued.

The bank requires the following documents:

- Contract of sale. In addition to it, any paper confirming the transfer or alienation of property rights can be accepted.

- Certificate confirming the seller's ownership.

- Extract from Rosreestr.

- Written consent of the seller's spouse to sell the property.

After making a purchase, parents with many children must insure their home; a copy of the policy is also handed over to Sberbank representatives.

What to do after receiving approval for a mortgage

When the collected portfolio of documents is handed over to Sberbank representatives, you will just have to wait for the bank’s decision. If it is positive, a bank employee will call you back and review it. After this, parents can begin looking for housing, which should be found within three months - this is the time the Sberbank offer will be valid. If citizens with many children do not invest within the specified period, then they will have to start the registration all over again, which is costly and inconvenient.

An initial fee

Related costs for mortgage lending at Sberbank:

- A down payment paid by the borrower. In addition, you will have to provide a document confirming the availability of such money or place it in Sberbank.

- Real estate appraisal is mandatory and must be carried out by an accredited appraiser.

If you plan to use maternity capital to pay the down payment, you should provide the lender’s specialists with a certificate confirming your right to such a benefit. Also, it is necessary to provide the bank managers with a certificate or any other document indicating the presence of money in the account. Every citizen who has the right to manage maternity capital can receive such a document; it must be submitted within three months from the date the mortgage is approved by the bank. Typically, submission is carried out along with documents for housing.

Loan application procedure

The procedure for obtaining a mortgage for a large family is no different from the sequence of actions performed by other categories of citizens.

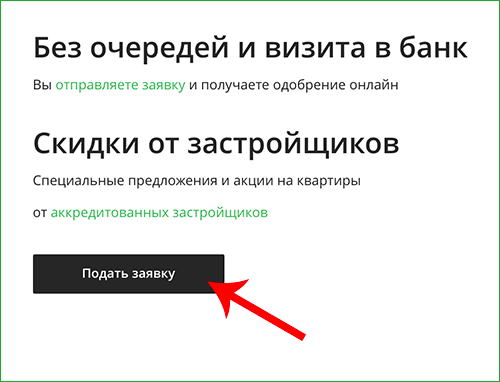

First, the borrower must personally visit a bank branch to write an application for a housing loan and provide documents. Submitting an application online will save time.

When choosing this method, physical. the person should:

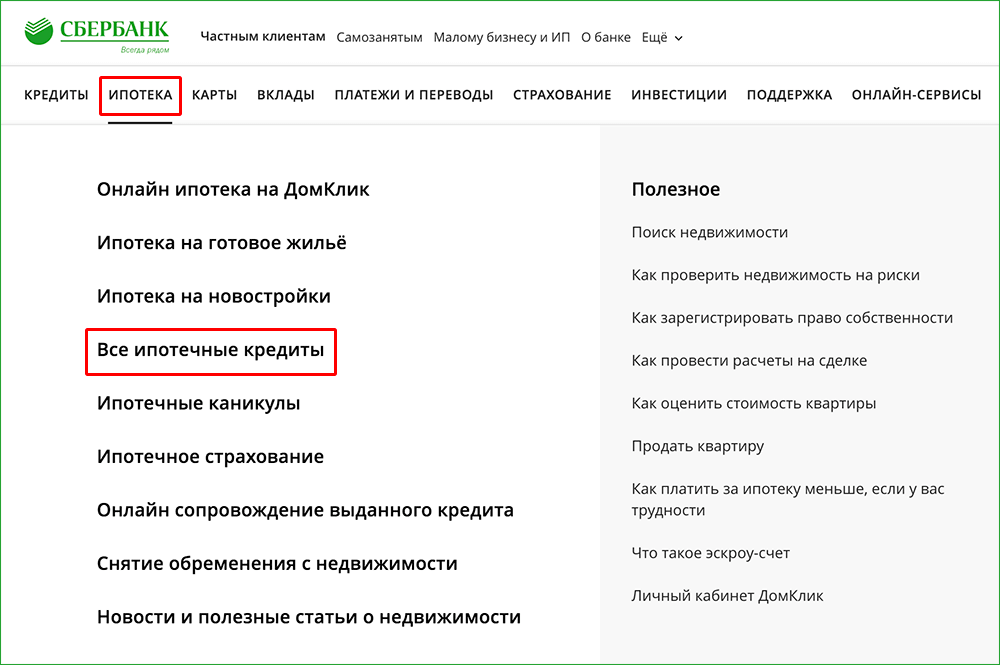

- Open the official website of Sberbank, expand the “Mortgage” section and select “All mortgage loans”.

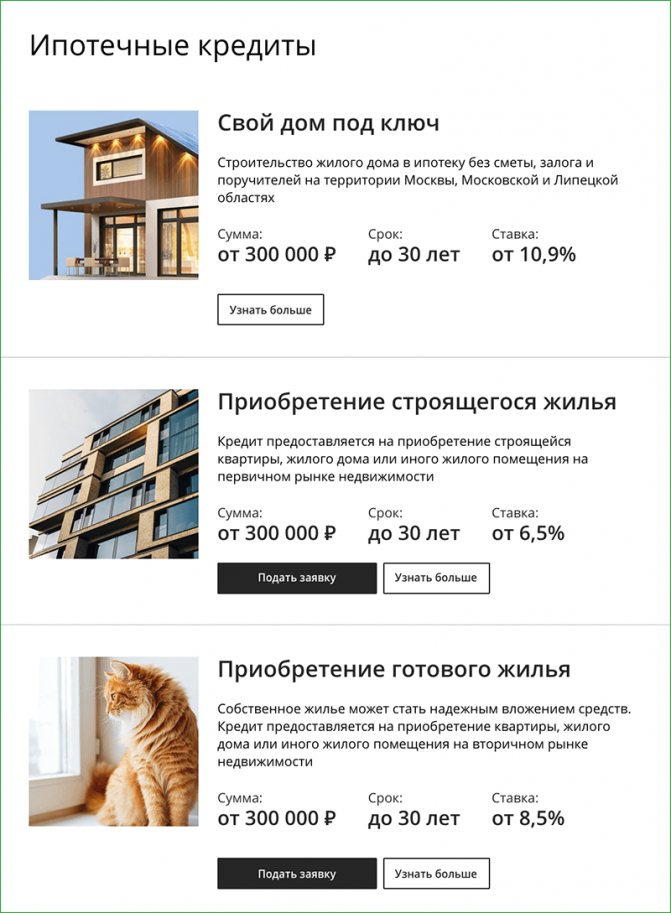

- Check out the list of available products and choose the one you need.

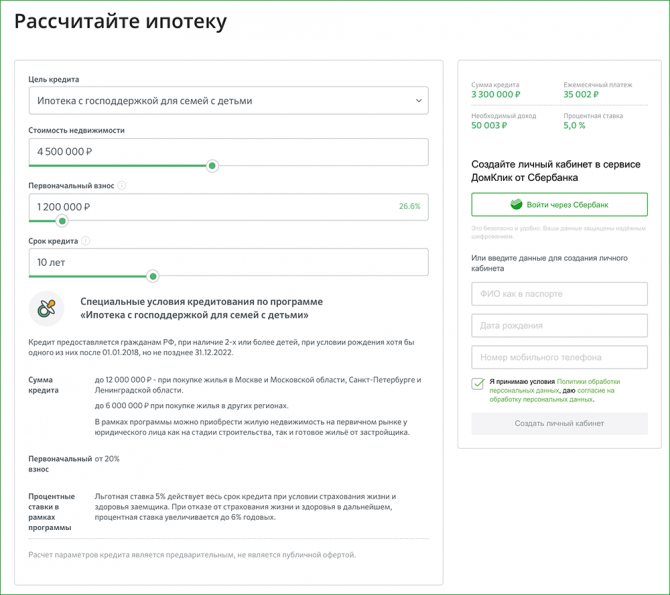

- Once on the page with the selected loan, using an online calculator, you can make preliminary calculations of the main parameters of the mortgage: term, size of monthly payments and total amount of overpayment.

- You can start submitting your application immediately on the loan description page by clicking the appropriate button.

Next, the financial institution reviews the application, checks the credit history, assesses the risks and analyzes the compliance of the citizen and his family members with the requirements set for borrowers. At this stage, calls are made to the employer to confirm the fact of employment of the individual. persons, if any inaccuracies are discovered, additional certificates or extracts may be required. If everything is in order, the client will be informed of the results of the consideration of the application within 5 working days.

Within 90 days, the borrower should come to the bank office; at the time of the visit, it is necessary to decide on the property and collect the missing documents. An employee of the credit institution will send information about the property for verification to eliminate possible risks. One working week is enough to approve the selected apartment/house. When everything is ready, the client is invited to sign a contract. This step is the most important: you need to carefully read all the provisions of the offer, the payment schedule and the size of the monthly debt load. Particular attention should be paid to the procedure for calculating fines, fees and penalties.

Note: When applying for a mortgage, the borrower is advised to refrain from changing jobs, obtaining loans or credit cards. These actions affect his solvency and may negatively affect the final decision of Sberbank.

One of the mandatory conditions for issuing a mortgage loan is insurance of the collateral. You can purchase a policy at a branch of a financial institution, on the insurance company’s website, or using the DomClick . Life and health insurance of the borrower is not mandatory, but provides a discount on the interest rate of 1%.

When all paperwork with the lender has been settled, the seller gives the buyer the keys to his new home, and the transaction is registered in Rosreestr or the MFC. After the borrower takes ownership, the bank will need to provide an extract from the Unified State Register of Real Estate. If the property was purchased using maternity capital, you will additionally need to visit the Pension Fund to write an application for the transfer of social assistance to pay off the mortgage.

The advantages of lending to large families at Sberbank are:

- Affordable interest rates and the opportunity to get a discount subject to special conditions;

- Providing the borrower with a credit card with a large limit as a bonus;

- No commission for issuing a mortgage and early repayment of debt;

- Availability of preferential mortgage programs for young families;

- The ability to attract co-borrowers to increase the chances of receiving a large loan;

- Convenient RBS (remote banking) services for making monthly payments;

- Possibility to submit an application for loans online.

The terms and conditions for banking products given in this publication are for informational purposes only. You can get the most up-to-date information on the bank's official website.

Loan write-off

In fact, there are many projects from the government. The most popular is “Affordable Housing” for young couples. Subsidies are provided to pay off part of the debt and repay the down payment. There is no question of writing off the mortgage upon the birth of a third child.

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

Funds to support parents with 3 or more children come from the federal and regional treasuries. In those regions where the demographic situation is more deplorable, it is possible to achieve significant preferences, including complete 100% debt repayment, no matter how much people have left to pay.

4 banks that are happy to issue mortgage loans

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

The calculation takes into account the average cost of housing, as well as the amount of benefits and family size. The standard cost per m2 of housing comes from local government regulations, which usually begin as “Development of construction of economic class housing in (such and such) region.”

The government is preparing a document for each region separately.

Partial closure of the mortgage upon the birth of the third child

Thanks to innovations in social legislation, mortgages for the birth of 3 children in 2020 have been significantly simplified.

From July 3, 2020, parents with many children who have signed a mortgage agreement can repay a debt in the amount of 450 thousand rubles. The amount will be written off at the expense of the state, which provides targeted subsidies to the joint-stock company DOM.RF.

This organization distributes government subsidies among banking organizations to cover their expenses in connection with the provision of preferences.

Issues of providing subsidies are reflected in Federal Law No. 157-FZ of July 3, 2019 and in Resolution No. 1170 of September 11, 2019.

Conditions for obtaining a mortgage discount

Parents will be able to apply for a reduction in the loan amount under the following conditions:

- A mortgage agreement for residential premises (a house or apartment, a plot of land for a house) has been drawn up for one of the parents until July 1, 2023.

- The third child (fourth, fifth, etc.) appeared from the beginning of 2019 to the end of 2022. A child whose birth gives birth to the right to preference must be a citizen of Russia (just like his parents).

Important! You can reduce the loan amount for both primary and secondary real estate.

The subsidy is provided once per loan. If the loan balance is below the amount of 450 thousand rubles, the balance is not paid and is not transferred to other loan obligations. The child factor is also taken into account once. If three more children are subsequently born into the family, the family will not be able to qualify for a mortgage reduction.

Where to apply for a subsidy and what documents are required

A family falling under the terms of the program sends an application to the banking organization with which the mortgage agreement was concluded, or to the joint-stock company "DOM.RF" (if the company is a lender).

A parent-borrower with many children attaches a set of documents to the application:

- Children's birth certificates (adoption), court decision to establish maternity or paternity, passports for children over 14 years of age.

- Credit agreement.

- Title documents for the housing property being financed.

Note! Documents for children must be notarized.

The bank verifies the accuracy of the beneficiary's information within 7 days. Upon completion of the verification, the application will be rejected or approved. If the decision is positive, the creditor sends the documents for re-verification to the joint-stock company "DOM.RF".

The DOM.RF company conducts its own mortgage history check within a week and makes a final decision on the possibility of repaying a loan for a large family in the amount of 450 thousand rubles (or a lesser amount equal to the balance of the mortgage debt).

If the result of consideration of the application is positive, DOM.RF transfers the funds to the bank account (5 days are allotted for this).

The credit institution is obliged to properly notify the joint-stock company about writing off the debt from a citizen with many children no later than three days after the loan is repaid.

What does the new law say?

At the annual meeting in February 2020, the president delivered another message. It was noted that a small number of citizens applied for a family mortgage, so a preferential interest rate should be established for the entire period of validity of the loan agreement. In April, a decree was signed legalizing a single interest rate throughout the entire loan repayment period. Previously, it was limited to 3 years for the birth of a second child and 5 years for the birth of a third.

Other significant changes were made to mortgage programs aimed at popularizing credit instruments and increasing their accessibility to the population.

The following innovations became important:

- In rural areas of the Far Eastern regions, residents are allowed to use a family mortgage to purchase secondary housing from individuals, subject to the birth of a child in 2020;

- Citizens received the opportunity to refinance loans received under other programs at a preferential rate;

- Subsidizing has become possible for families in which the number of children has reached 4 or more;

- The validity period of the preferential lending program for Russian large families, which involves subsidies from the state, has been extended.

Such changes became possible thanks to the allocation of additional funds from the budget, the total volume of which is estimated at 9 billion rubles. Previously, at the birth of the 4th child, the family could not count on preferential lending conditions, which was eliminated after the introduction of changes. A big plus for existing borrowers was the opportunity to refinance previously issued loans at a rate of 6%.

It might be interesting!

What are the conditions in banks for a primary mortgage, pros and cons