Is it possible to get a mortgage in another city?

Content

It is certainly possible to purchase an apartment in another city using borrowed funds. However, for credit institutions, such a decision carries additional risks (borrower’s solvency, control over payments), so not every bank will approve a mortgage for purchasing an apartment in another region.

Main problems

When deciding to purchase housing with a mortgage in another city, you need to study all the possible difficulties that you may have to face:

- longer term for completing a transaction;

- additional expenses for trips to another city to inspect the apartment, conclude an agreement, register a transaction;

- expenses for intermediary services;

- limited choice of credit institutions willing to provide loans;

- More stringent conditions for the borrower are possible (increased interest rate, shortened loan term, life and health insurance).

For the bank, such a transaction also brings additional difficulties, because in addition to checking the legal cleanliness of the apartment and the solvency of the borrower, it needs to coordinate the work of branches in different cities.

Many of the listed problems can be avoided if you contact a bank that has a large network of branches and sufficient experience in conducting this type of transaction.

Terms of purchase

Some credit organizations consider the borrower's lack of registration in the city where he plans to apply for a loan as grounds for refusing to issue a loan. Therefore, you will have to spend some time searching for a bank that can issue a loan based on your current conditions.

The options may be the following:

- If the property is located in a city where the borrower is not registered, is not employed and does not actually live, then it is more advisable to contact the bank at his place of residence.

- If you have a permanent job and a high income in the city where you plan to purchase housing, but are not registered, your chances of getting a loan are quite high.

- If the borrower wants to purchase real estate in a city where he only has registration, but does not actually live or work there, then such an application can be approved by a credit institution;

- If it is impossible to travel to another city to conclude a transaction and register it, it is possible to issue a power of attorney for a representative.

In any of these cases, we recommend that you first contact the banks to find out the possibility of loan approval, and only then start searching for suitable real estate.

"To Moscow! To Moscow!"

A significant portion of Moscow real estate buyers are Muscovites themselves, but residents of other regions also occupy a significant segment of the market. All visitors are clearly divided into two groups. The first group includes wealthy citizens who prefer apartments in historic buildings. They are often ready to put up with the inconveniences that living in a noisy center brings, just to be in the whirlpool of metropolitan life.

The second group includes those who have a limited budget and are ready for any housing just to gain a foothold in Moscow. Basically, such provincials buy living space to work in the capital, so they opt for economy and comfort class options. Only a small part of buyers purchase apartments for children studying at Moscow universities or for rent.

General Director of Moscow Sofya Lebedeva believes that in the primary market the share of nonresident home buyers within the Moscow Ring Road is 8%, and in New Moscow – 23%. The general director of Metrium Group, Maria Litinetskaya, does not agree with her, who believes that residents of other regions account for about 37% of buyers of expensive real estate, and more than half (55%) of those who purchase affordable housing. Well, the truth, as always, is somewhere in the middle.

This is interesting: Mortgages for young professionals

On average, nonresidents buy housing of a smaller area than Muscovites. Representatives of the regions most often opt for one- or two-room apartments with a total area of up to 100 square meters.

Which credit institutions can I get a mortgage from?

To decide on the choice of a credit institution, first of all you need to find out the availability of its branches in your city and where the purchase will be made. As a rule, large banks have branches in many cities. The leader among mortgage lending is Sberbank, as it has branches in every city.

You can also apply for a mortgage loan to purchase real estate in another region by contacting the following credit organizations:

- Sberbank;

- Gazprombank;

- Alfa Bank;

- VTB;

- Raiffeisenbank.

Before completing the documents, please check:

- how well is the interaction between bank branches established;

- what stages of the transaction can be carried out remotely;

- In what cases will you have to come to another city in person?

This will help you accurately calculate all possible costs of completing a transaction.

Applying for a mortgage in another city

When applying for a mortgage to buy a home in another city, you need to be prepared for the fact that you will need to take more steps and it will take a longer time. However, it is possible to obtain such a loan; you just need to get the bank’s approval and go through all the stages of registration.

Requirements for the borrower

To obtain a mortgage loan, a potential borrower must meet some standard requirements:

- age must be at least 21 years and not more than 75 years at the time of full repayment of the loan;

- mandatory presence of Russian citizenship;

- total work experience of 1 year and at least 6 months at the last place of work;

- proven solvency.

A positive credit history, a permanent job with a high salary, and a significant down payment will help increase the chances of your application being approved.

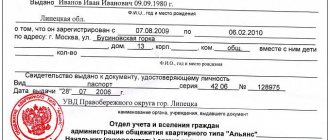

List of documents

To apply for a mortgage loan to purchase a home in another city, a standard list of documents is required:

- passport of the borrower (co-borrowers), guarantors (if any);

- second document (for example, SNILS, military ID);

- marriage certificate and notarized consent of the spouse (if the borrower is married);

- documents for the purchased apartment;

- a copy of the work record book certified by the employer;

- income certificate in form 2-NDFL or in the form of the creditor bank.

Depending on the bank's conditions, additional documents may be required.

Registration procedure

If the borrower is located in one city, and the purchased property is in another, then the application and assessment of solvency is carried out by the bank branch at the place of his residence, and the transaction is documented by the branch at the location of the housing.

The main stages of the procedure for obtaining a mortgage are similar for different credit institutions.

To do this, the borrower must:

- send applications to banks that provide loans for the purchase of real estate in other regions (through websites or by visiting offices in person), and obtain approval of the application;

- find an apartment option that meets the wishes of the borrower and the requirements of the lending bank;

- independently or through a representative, prepare documents in relation to the acquired property for the bank to assess the legal cleanliness of the apartment and its condition (submitted to the branch at the location of the property);

- insure the purchased housing;

- conclude a mortgage agreement (at the borrower’s place of residence or at the location of the property);

- carry out state registration of the transfer of rights.

In essence, the registration procedure is no different from a regular mortgage, the only difference is that two bank branches are involved in this process.

Terms and procedure of payments

Final payments for a mortgage are made cashless, so a few days after registering ownership, the bank transfers funds to the seller’s account. Maternity capital funds or other government programs used during the purchase will be received by the seller later (in accordance with the terms of transfer under these programs).

Note! Some banks may charge a commission for transferring funds between regional branches. Inquire about the availability of this condition in advance to avoid getting into an unpleasant situation.

We tell you how a nonresident can get a mortgage loan in Moscow

Very often, citizens of our country are faced with a situation where they are forced to live in another city, not in their place of registration (study, work and other circumstances). This is especially true for such a huge city as Moscow, where visitors from the provinces live and work. And, naturally, many living in the capital without registration and forced to rent an apartment have a desire to buy their own living space. Until recently, financial institutions were reluctant to provide mortgages to non-residents in Moscow without registration. And it turned out that the borrower could not obtain permanent registration in the capital in order to buy an apartment, and the bank refused a mortgage due to the lack of registration in Moscow. Currently, many capital banks are accommodating to visitors, and the borrower is only required to register in any Russian city. These banks include: Sberbank of Russia, VTB-24, Russian Mortgage Bank, Alfa Bank, National Mortgage Company, Moskommertsbank, MDM Bank, City Mortgage Bank. This list is expanding every day and more and more credit institutions in Moscow are meeting halfway needs of borrowers from other cities of Russia. A mortgage loan can be issued both for secondary housing and for the purchase of an apartment in a building under construction.

This is interesting: The apartment was purchased with a mortgage using maternity capital

Mortgages for non-residents in Moscow. Conditions

Mortgage lending in the capital for visitors is available subject to certain conditions: down payment, the amount of which must be significant; a good loan history and a document confirming the income of the future borrower.

Attention is also paid to how many people live in Moscow; usually, to receive a positive decision from the bank, the period of residence in Moscow must be at least six months. Some credit organizations, in order to verify the client’s solvency, ask to provide documents that confirm the costs of renting living space. For this reason, it is better to formalize a rental agreement.

Often, a mortgage loan for nonresident residents of the capital is more expensive than a loan for Muscovites. It's not about interest rates; they don't depend on where the borrower is registered. Immigrants are more likely to have additional costs for obtaining a loan to purchase a home.

When considering a mortgage application by nonresident citizens in Moscow, a banking institution may ask for guarantors. The consideration of the application itself can take quite a long time due to the fact that the bank will have to make inquiries about the borrower in another city where he is registered.

A bank can refuse mortgage lending for several reasons: the main thing is that if there is no branch of the bank he applied to in the city where the borrower is registered, then this will be a problem for checking his data and real income. The client’s place of work also plays a big role; ideally, if he works in a well-known company and receives a flat salary. The borrower's chances of getting a mortgage in a city where he is not registered are very low if he works in a small private company and receives a salary in an envelope. In these cases, the bank's security service will consider the borrower to be an unreliable client and the mortgage will be denied.

Basic documents for obtaining a mortgage in Moscow

- passport of a citizen of the Russian Federation;

- certificate 2-NDFL;

- employment history;

- marriage certificate (if you are married);

- military ID;

- accounting reports (for entrepreneurs);

- documents that confirm the borrower has other property;

- educational documents (if available);

- documents confirming other income.

Registration of property rights in Rosreestr

Purchasing a home in another city is not uncommon these days. At the same time, the buyer is often forced to travel to another city several times, including to complete registration actions with Rosreestr.

In order to save time, Rosreestr has introduced a new service - electronic registration of a transaction. This service involves the transfer of documents for registration electronically through credit organizations. The period for reviewing documents and registering them is 1-5 days.

Mortgages in Moscow for non-residents in Sberbank

The reason for the reluctance to issue a mortgage in Moscow for nonresidents is the higher risk; in case of delay or non-payment, it is more difficult to find the debtor. From all of the above, it turns out that if a person works in Moscow and at the same time earns enough for a mortgage, but without registration in Moscow, he will most likely not be able to get a mortgage from Sberbank. This can only be called discrimination, because it infringes on the rights of Russian citizens. Most mortgage loan refusals occur precisely because of registration in another city, and despite the silence about this problem, the fact remains a fact.

Based on this, even a person with an ideal credit history, without registration in Moscow, will find it very problematic to take out a mortgage to purchase housing in Moscow.

The reason for the reluctance to issue a mortgage in Moscow for nonresidents is the higher risk; in case of delay or non-payment, it is more difficult to find the debtor. From all of the above, it turns out that if a person works in Moscow, and at the same time earns enough for a mortgage, but without registration in Moscow, he will most likely not be able to get a mortgage. This can only be called discrimination, because it infringes on the rights of Russian citizens. Most mortgage loan refusals occur precisely because of registration in another city, and despite the silence about this problem, the fact remains a fact.

Based on this, even a person with an ideal credit history, without registration in Moscow, will find it very problematic to take out a mortgage to purchase housing in Moscow.

There is a way out of this situation, leave a request and we will select mortgage lending programs in Moscow for non-residents, but the property you purchased will be the collateral.

Lawyer's answers to frequently asked questions

My husband and I are planning to buy an apartment in another city in our own name, but our children will live in it. Traveling alone with your spouse is very costly financially. Can one of us go there to complete the transaction or do we both have to be present?

It is not necessary to travel together. One of the spouses can go to complete the transaction, but it will be necessary to obtain a notarized consent of the second spouse to purchase the apartment.

Hello! My husband and I own a 3-room apartment; our children only have registration in it. Can we buy another apartment in another city with a mortgage and invest maternal capital in it? Or will the pension fund refuse us? The second child is now 1.2 years old.

The purchase of an apartment using maternity capital funds is not limited to the city in which the certificate was issued. The only restriction is that the apartment must be purchased on the territory of the Russian Federation. If you buy an apartment with a mortgage, then the age of the child does not matter.

I want to buy an apartment with a mortgage in another city, but due to work I don’t have the opportunity to travel often, at most I can go once. Is it possible to give such powers to a relative who lives there and will he be able to not only choose an apartment, but also sign a purchase and sale agreement on my behalf?

Yes, you can issue a notarized power of attorney for your relative. He will be able to perform all actions that will be specified in the power of attorney. Be careful when compiling it. You will have to perform actions not specified in the power of attorney personally.

Please tell me, if I buy an apartment in another city with a mortgage, then which city should I apply to the Registry of which city to register ownership, at the place where I bought the apartment or at my place of residence?

The transaction is registered in the Rosreestr of the city where you will purchase the apartment. To do this, you will need to be there in person or issue a power of attorney for your representative. You can also check with your creditor bank about the possibility of using the electronic transaction registration service. This will give you the opportunity not to waste time traveling to another city and send documents for registration through the bank electronically.

I am planning to buy an apartment for my daughter in the city where she is studying. But there are not enough own funds and therefore you will have to use a mortgage. I have an unpaid consumer loan. I pay regularly and without delays. Can the bank refuse me a mortgage given that I have an outstanding loan?

When considering your application, the bank will definitely check your credit history. If your credit discipline and income allow you to make mortgage payments and pay off an existing loan, then the likelihood of getting a mortgage approval is high.

Lending in the capital.

Mortgages in Moscow for non-residents are available subject to a significant down payment, confirmed high income of the borrower and his positive credit history. The length of residence in Moscow is also important (it must be at least 6 months). Sometimes the bank offers the client to prove his solvency by confirming expenses for renting an apartment, household purchases and other payments. So it makes sense to formally sign a lease and also keep receipts for large purchases.

At the same time, mortgages in Moscow for nonresidents are often more expensive, although the terms of housing loans for Muscovites and visitors are identical. Interest rates do not depend on the place of registration of the borrower, but visitors, as a rule, have more additional costs for obtaining a loan. The bank's requirements for non-residents can be stricter (for example, a guarantee from third parties may be required). The processing time for a loan application may be delayed, since the bank will have to request information in another city.