Banks are cautious about giving mortgage loans to individual entrepreneurs. An entrepreneur’s income is unstable, even if it is high; individual entrepreneurs often cannot officially confirm income - banks do not like this. Let's figure out whether an individual entrepreneur can take out a mortgage and how to increase the chances of getting one, for what reasons they refuse, and which 5 banks are most willing to issue mortgages to entrepreneurs.

Do they give mortgages to individual entrepreneurs?

They do. But let us immediately note that in comparison with other borrowers, individual entrepreneurs are in a more difficult situation. As a rule, the main difficulty is that it is difficult for banks to determine their level of solvency.

Expert opinion

Alexander Nikolaevich Grigoriev

Mortgage expert with 10 years of experience. He is the head of the mortgage department in a large bank, with more than 500 successfully approved mortgage loans.

Individual entrepreneurs and self-employed citizens are those categories of borrowers whom banks can refuse without a specific reason. Many individual entrepreneurs who have gone through the procedure of obtaining a mortgage call this process nothing more than a quest, which does not always end successfully.

Many banks separate these two types of borrowers: an ordinary citizen and an individual entrepreneur, and create separate loan offers for the latter. If the bank has a mortgage product that applies to all individuals, then the situation for individual entrepreneurs will still be worse - the interest rate is at least 1-5% higher.

Expert opinion on the Yandex.Connoisseurs service

What documents do individual entrepreneurs need to obtain a mortgage?

The list of documents for an individual entrepreneur’s mortgage with proof of income is significant:

- entrepreneur's passport;

- extract from the Unified State Register of Individual Entrepreneurs;

- TIN;

- An individual entrepreneur’s tax return is official information about your income, expenses and profits.

- bank account statement - using it, the bank will analyze your income and expenses that you made;

- statements of deposit accounts - for the bank this is confirmation that you have a cash reserve;

- agreements with suppliers - according to them the bank predicts your future expenses;

- contracts with buyers - the bank predicts income based on them.

This is an open list of documents. If necessary, the bank can expand it.

Terms of mortgage lending for entrepreneurs

Each bank sets its own mortgage conditions for individual entrepreneurs.

But they all boil down to roughly the same thing:

- The individual entrepreneur has been working for at least 1 year and has no arrears in taxes and contributions. Some banks will ask for a longer period.

- An entrepreneur’s income is constant and does not fluctuate from hundreds to tens of thousands. Banks love stable income and do not favor seasonal individual entrepreneurs.

- The entrepreneur has a current account where you can track the turnover of funds - at least 50 thousand rubles per month. Some banks consider only those individual entrepreneurs who are ready to show a turnover of at least 1 million over the past year as candidates for a mortgage.

An ordinary hired employee, when taking out a mortgage, pledges the purchased home as collateral to the bank. Many banks require additional collateral from an individual entrepreneur. For example, existing commercial real estate, an apartment, a car or any expensive equipment.

User reviews on the forum

What kind of real estate can you buy?

Not every bank is ready to issue an individual entrepreneur a loan for residential real estate. Even if an entrepreneur finds an institution that finances the purchase of housing, it will require additional guarantees of loan repayment and tighten the conditions.

Banks prefer to give mortgages to entrepreneurs for commercial real estate:

- Offices.

- Warehouses.

- The shops.

- Garages.

- Industrial premises.

They are more profitable for the client and increase his solvency. This, in turn, guarantees the repayment of the debt to the bank.

For what reasons are entrepreneurs denied a mortgage?

There can be a huge number of reasons for refusing a mortgage.

Let's look at the main ones:

- Errors in documents. Remember that every document submitted to the bank will be checked by a loan specialist. Therefore, try to avoid even the slightest mistakes and inconsistencies.

- Debts, unpaid fines. Another common reason for mortgage refusals for individual entrepreneurs. Even the smallest underpayments can play a cruel joke, and fines are almost guaranteed to lead to refusal. Therefore, before submitting documents to the bank, an individual entrepreneur should request a tax statement confirming the absence of debt.

- Forgery of documents. An entrepreneur’s desire to meet the bank’s strict requirements by any means can lead to a refusal to issue a loan and blacklisting of the client. The individual entrepreneur will not be able to obtain a loan from any credit institution in the future. Moreover, for providing knowingly false information you can also incur criminal liability.

- Illiquid real estate. Sometimes clients choose illiquid apartments because of their low cost. Such a choice may lead to a refusal to issue a mortgage. Remember that the purchased home will be pledged to the bank until the loan is paid in full. It is important for the bank to know that if the client stops repaying the loan, he will be able to sell this property and recover losses.

- The bank has no confidence in the client's solvency. This is especially true for those individual entrepreneurs who have chosen a simplified taxation system (STS). It is difficult to track solvency based on the documents submitted by the entrepreneur, because they do not always objectively reflect reality. Many individual entrepreneurs use every opportunity to optimize and even evade taxes. This distorts income, expenses and profits earned.

- Bad credit history. This is one of the frequent and compelling reasons for refusals. If the client is overdue on other loans for more than 3 months, the bank will refuse to issue a mortgage.

How to prepare to receive

Obtaining a mortgage for entrepreneurs is difficult; not all banks are ready to cooperate. Therefore, it is worth preparing for the application to minimize the likelihood of loan refusal.

The recommendations are as follows:

- Make profits transparent. Individual entrepreneurs are allowed not to keep accounting records. This creates problems when obtaining a mortgage loan. Therefore, it is important that all reporting is on hand, even if it is not necessary when doing business.

- Collect evidence of good solvency. Banks require you to provide a tax return, but in fact it does not reflect the real state of affairs. If there is an additional source of profit, you need to confirm it.

- Provide additional collateral. If an entrepreneur has his own real estate or transport, you can pledge them to the bank. For the lender, this will be a guarantee of debt repayment, so the risk of refusal to issue a loan will be reduced to a minimum.

- Improve your credit history. If your reputation is damaged, you should first try to improve it. Otherwise, contacting the bank will be a waste of time.

Banking organizations provide loans to individual entrepreneurs who have been working for over a year. Therefore, there is a real opportunity during this time to put your activities in order, increase profitability, and draw up all the documents reflecting the position in the company.

Requirements for borrowers

Individual entrepreneurs are subject to the same conditions as other individuals:

- Age from 20 to 65 years. Banks consider clients under 20 years of age as unreliable payers. Elderly people rarely get approved, since a mortgage is a long process and the average life expectancy in our country is low.

- Availability of regular and confirmed income.

- No debts: taxes, fines, alimony, utility bills, etc.

What to look for when choosing an individual entrepreneur bank for a mortgage

To apply for a real estate loan, you need to thoroughly prepare. First, it is important to choose a bank. Mortgages for individual entrepreneurs include loan programs for various real estate properties. Therefore, it makes sense to focus on your needs and look for a financial institution that will issue a loan for the purchase of the property you are interested in. For example, Sberbank provides loans for the purchase of residential real estate, land, and also for the construction of a house. Some financial institutions do not work with small businesses.

After choosing a bank, all the conditions for obtaining a mortgage for an individual entrepreneur are clarified. Mortgage agreements with different lending companies may vary:

- a package of documents, reporting and comments thereon;

- the amount of the initial contribution, the requirement for additional collateral.

After analyzing several credit institutions and their programs, it is advisable to first consider the bank with which the entrepreneur has already worked.

A mortgage for individual entrepreneurs is issued with certain conditions.

- A real estate loan is not always approved for individual entrepreneurs, since this involves certain risks for the bank . Therefore, many requirements are put forward to obtain it. This is how credit institutions try to mitigate risks and protect themselves. In this sense, the situation with employees is simpler - banks trust them more, and accordingly, it is easier to get a loan.

- Special loan programs for small businesses are offered by many financial companies . However, if a real estate loan is issued to all categories of individuals (it does not matter whether it is an entrepreneur or an employee), then banks increase the rate for individual entrepreneurs by 1 - 3 points.

- Loans for private entrepreneurs for residential real estate are not interesting to all banks . Some people prefer to issue only commercial real estate mortgages for individual entrepreneurs. This type of space brings profit to the borrower and ensures his solvency. This is important for the lender because they are attracted to stable payments.

- Banks often require additional collateral for individual entrepreneur mortgages . It could be a car, apartment or commercial property, equipment, etc.

Step-by-step scheme for obtaining a mortgage

If the client understands that he meets all the bank’s requirements and is ready to collect a package of documents confirming this, it is important for him to know what the process of obtaining a mortgage for an individual entrepreneur looks like.

Stages of registration:

- Selecting a bank. Remember that you are taking out a loan not for several years, but for at least 15-20. That’s why it’s so important not to make a mistake with the bank. Be sure to check its rating, terms of loan programs and reviews from other customers.

- Choosing a mortgage program. Pay attention to the size of the down payment, additional fees, insurance, etc. Of course, it is better to choose a product with minimal interest rates.

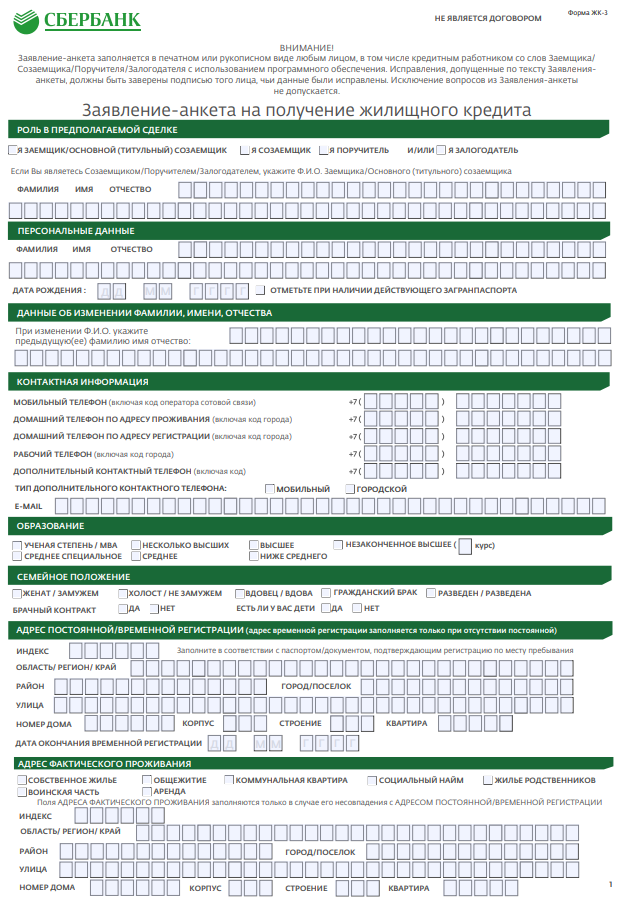

- Submission of papers. In addition to the listed documents, you must fill out a special application for a mortgage for an individual entrepreneur.

- Checking papers and making a decision. At this stage, employees of the financial institution carefully study the submitted documents and make their decision. The verification lasts from several days to a month. During this period, the credit manager may call the client repeatedly and ask different questions.

- After approval. Selection of real estate, collection of necessary documents and conclusion of a purchase and sale agreement.

- Signing a loan agreement. It is at this stage that the down payment is made. The client needs to be prepared to draw up an insurance contract.

- Registration of property rights. After signing the loan agreement, the individual entrepreneur can go to Rosreestr and register his ownership of the apartment. Only after registration of ownership will the bank transfer funds to the seller of the property.

Required documents and registration procedure

The procedure for obtaining a mortgage loan is quite simple and is no different for individual entrepreneurs:

- Submitting an application - a questionnaire, a package of documents for the borrower, as well as for the property being purchased.

- After approval of the loan, conclusion of a preliminary agreement with the seller , making a down payment.

- The bank draws up a loan agreement and transfers the loan to the seller’s account.

- Registration of ownership rights to the acquired property by the new owner.

- Registration of real estate as collateral.

Along with the application, you must submit documents for a mortgage for an individual entrepreneur:

- Passport of a citizen of the Russian Federation.

- Certificate of state registration as an individual entrepreneur.

- A license and a copy thereof to conduct a particular activity of the entrepreneur.

- Tax return for one year, subject to working under the simplified taxation system.

- Tax return for two years, subject to working under the single tax system on imputed income.

- Documents for the last tax period, if the entrepreneur maintains tax reporting on personal income.

- Documents confirming the presence of additional property and savings.

Note! Documents for the mortgaged property are collected and presented in the same order as for lending to individuals.

Video: Mortgage for entrepreneurs

TOP 5 banks providing mortgages to individual entrepreneurs and their conditions

| Name | Bid, % | Max. amount, million | Duration, years | An initial fee, % | Note |

| Sberbank | From 11 | 200 | 15 | From 20 | This is not a separate mortgage product for individual entrepreneurs. This is a business loan for any purpose |

| Alfa Bank | From 10.2 | 60 | 5 | — | Suitable for purchasing any type of real estate |

| Tinkoff | From 9 | 15 | 10 | — | Only secured by real estate |

| Rosselkhozbank | Depends on loan terms | 200 | 8 | From 20 | Only for the purchase of commercial real estate |

| VTB | From 9.4 | 30 | 20 | From 30 | The program is for all individuals without the need to confirm income. |

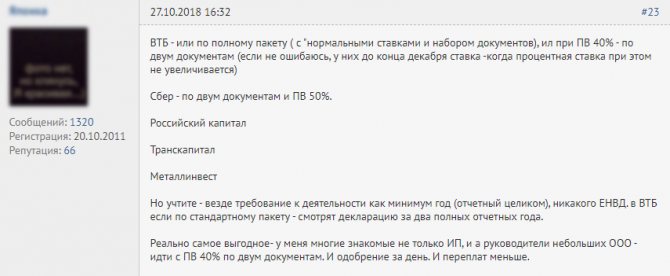

User advice on a forum with a list of banks that have a better chance of getting a mortgage

Types of mortgages for entrepreneurs

A mortgage is a loan secured by real estate. You take money from the bank, and leave an apartment, house or land as collateral. Most often, a mortgage is taken out to purchase a new home, which becomes the object of collateral - it can be taken away if debts are not paid.

Banks believe that an individual entrepreneur is less reliable than an individual with an employment contract. The problem for an entrepreneur is income instability. With employed citizens, everything is simple - they have a salary, which can be confirmed with a 2-NDFL certificate or a certificate in the form of a bank.

Individual entrepreneurs do not have a salary, but they have income, which is more difficult to confirm. Banks treat the income of individual entrepreneurs as a temporary phenomenon - today it is, but tomorrow it is not. Therefore, mortgage conditions for individual entrepreneurs are much less attractive: the rate is higher, the loan term is shorter, and the down payment is increased.

An individual entrepreneur can take out a mortgage in two ways.

Mortgage without proof of individual income

Some banks give a mortgage without proof of income - it is also called “Mortgage on two documents”. You don’t have to collect certificates, bring tax returns, etc. A passport and SNILS are enough. Then you and the bank manager will fill out an application for a mortgage.

A mortgage without income verification has a big disadvantage - a high down payment. For example, at Sberbank the down payment without proof of income is 50% of the cost of housing, and at Rosselkhozbank it is 40%. At the same time, the interest rate sometimes increases.

Mortgage with proof of income for individual entrepreneurs

Everything is more complicated here; an entrepreneur needs to confirm not only his income, but also its regularity. To confirm the registration date, you will need an extract from the Unified State Register of Individual Entrepreneurs and a certificate. To confirm income, they can request statements from current accounts, agreements with counterparties, tax returns, etc. On average, entrepreneurs collect a package of 15 documents.

The bank where you have a current account will request fewer documents, since it has enough information about you and your turnover. This bank also increases your chances of getting a loan.

Newly created individual entrepreneurs should not count on a mortgage - banks may consider them to be ephemeral and not issue a loan. But if you have been working for more than 12 months, there are chances.

Find your bank to maintain your account

Select bank

Find your bank to maintain your account

Select bank

How to increase your chances of approval?

It's always unpleasant when you are denied a loan. This is especially true for such an important point as a mortgage.

To increase your chances of approval, follow our recommendations:

- Apply a more transparent tax system. Banks are more active in approving loans to individual entrepreneurs who pay taxes not on potential income, but on actual income.

- Improve or start your credit history. For banks, the absence of a CI, as well as the presence of a negative one, is a reason for refusal. It is much more likely that a financial institution will approve a loan to those individual entrepreneurs who have already had loans and closed them on time without delays. If an entrepreneur does not have a credit history, then before applying for a mortgage, he should take out a small loan and pay it off. Timely payment will show the individual entrepreneur as a reliable client.

- Collect a large down payment. Bank specialists note that the chances of a positive decision on a loan are directly proportional to the size of the down payment.

- Collect evidence of the individual entrepreneur's solvency. These are not only financial documents, but also papers on the ownership of housing, cars, shares and other assets with high liquidity. If there is nothing like this available, involve a guarantor or co-borrower.

- Do not take out a mortgage in the first year after registering an individual entrepreneur. The minimum time to wait is 1 year. The longer a business exists, the greater the chances of getting a loan.

Submission rules

A number of factors influencing a positive response when requesting a mortgage loan for a person running a small or medium-sized business as an individual entrepreneur:

- Stable income – permanent, not seasonal.

- Transparency of income and the ability to present it to the bank.

- Good credit history

- The use of the general taxation system (GTS) is a priority ; the simplified system (STS) evokes significantly less confidence among bank representatives.

It is easier to get a positive response from the bank if you contact the bank leading the program for lending to small and medium-sized businesses, 1 year or more after opening the business, and provide maximum evidence of financial security.

Note! Individual entrepreneurs using a simplified taxation system have a chance to take out a housing loan, but if the entrepreneur pays taxes not on turnover, but on profit. In this case, bank representatives will be able to estimate the real income of the person running the business.

List of documents

Usually this is a standard package, as well as additional papers related to the specifics of the activity.

There are two options:

- full package - passport, tax identification number, tax returns, activity reports, etc.;

- simplified package - in addition to the standard set, you will only need a certificate of business activity and tax returns.

The possibility of presenting a simplified package of documents depends on the type of bank and the taxation system of the entrepreneur.

Choosing a mortgage program

Depending on the purposes of lending, Sberbank offers 7 programs in which purchased or existing real estate serves as collateral. The loan can be issued not only for the acquisition of commercial properties, but also for the direct activities of the enterprise, such as:

- purchase of working capital;

- modernization or replacement of non-current assets;

- investing in new activities;

- payment for government and export contracts;

- repayment of loans from other banks.

| Loan program | Purpose of using the loan |

| Secured by purchased commercial real estate | |

| Business Real Estate Express Mortgage | Purchase of finished and under construction commercial real estate, incl. land plots |

| Secured by existing real estate and other types of security | |

| Business Contract |

|

| Business-Invest |

|

| Business project |

|

| Business Turnover |

|

| Express bail | Any goals |

How to confirm income as an individual entrepreneur

This have not happened before! Read Mortgage 6 percent for the birth of 2 children in 2020

In this case, the taxation system plays an important role. If he works for the simplified tax system, then his position is more advantageous than in the case of UTII or Unified Agricultural Tax. Using the simplified version, it is easier to track income according to the tax return submitted every quarter to the Federal Tax Service. As a rule, when applying for a mortgage, the bank requests all declarations for the last year. Therefore, an entrepreneur who works longer than this period has a better chance of getting a loan than a new businessman.

But this is in theory. But in practice, in addition to the tax return, banks force you to present other documents related to finance:

- certificate of expenses and income;

- confirmation of remaining funds in loan accounts;

- certificate of property status, as well as current obligations.

Note! an individual not associated with entrepreneurial activity will not need such documents. They are covered by the 2-NDFL certificate.

If a businessman applies for a mortgage where he already has an account, he will be treated more loyally and may require a minimum of documents.

What should entrepreneurs do on PSN? When working on a patent, there are no tax returns to submit to the Federal Tax Service. Therefore, it is extremely difficult for a bank to assess the level of income of a businessman. In this case, an income book is used, which is kept during work. Typically, data for the last six months is considered. Additionally, they will require a certificate from the Federal Tax Service stating that there are no tax arrears.

On a note! Entrepreneurs have the right to choose a simplified mortgage lending program, the essence of which is to present only two documents to obtain a mortgage (passport and SNILS). But the interest rate in this case will be high, and the down payment will be 40-50% of the cost of the purchased property.

Features of a commercial mortgage

A commercial mortgage is typically the purchase of real estate for use as an office, retail or industrial premises. Such real estate can be purchased by both a company (legal entity) and a simple person (individual).

The first feature of a commercial mortgage is the subject of the purchase. If classic mortgage lending involves the purchase and simultaneous pledge of residential real estate, in other words, an apartment or house, then a commercial mortgage is issued for the purchase of warehouses, offices or industrial premises.

The economic meaning of a mortgage on commercial real estate is to acquire a stable place of work, not to depend on the landlord, who can terminate the contract at any time (in accordance with the procedures provided for in the contract).

When deciding to purchase non-residential premises, it is recommended to consider the following factors:

- Rental amount. If rental payments are comparable to mortgage payments, then purchasing a property with a mortgage makes economic sense. Otherwise, it is more profitable to rent a workshop, office or retail outlet.

- Risks of contract termination. If such risks are minimal, then perhaps it is not worth increasing the loan burden. If the landlord insists on vacating the premises as soon as possible, then it is more profitable to take out a mortgage and gain stability.

The second feature of a commercial mortgage is the terms of the loan. They are significantly less compared to a home mortgage. If for mortgages for individuals the loan term reaches 30 years, then for the purchase of commercial real estate banks offer loan products for up to 10 years.

The lending rate also differs. For mortgages for individuals, it currently does not exceed 10-11% per annum, and for legal entities, the cost of money can reach 18-19% per annum (the most common rates are 13-15% per annum).

Such differences are associated with higher risks in commercial mortgages. The law stipulates that in case of receiving a standard mortgage loan, it is used only for the purchase of residential premises, which are pledged immediately. There is no such law in relation to loans for the purchase of commercial properties.

First, the transfer of ownership of the non-residential premises must take place, and only then it can be pledged. Consequently, the bank faces a period when the loan is not secured by anything. This is a period of increased risk, for which the borrower is forced to pay.

It should also be noted that assessing a commercial mortgage property is difficult. There are significantly fewer transactions on the non-residential market than on the residential market, therefore, in order to determine the adequate price of the property, it is necessary to invite an appraiser, which also requires additional costs.

Conditions for issuing a mortgage

You need to know about this! Read Inheritance under a will for an apartment

Usually they are as follows:

- down payment - 15-40% of the property value;

- the minimum amount for issue is 100 thousand rubles;

- interest rate - from 9.4% and above.

Both secondary housing and apartments in new buildings are available for purchase.

Sberbank, Akbars and Rosselkhozbank offer mortgage lending for this category using maternity capital. It goes towards making a down payment.

In addition, there are other requirements:

- Russian citizenship;

- age from 21 to 75 years (age restrictions vary in each bank);

- conducting business activity for at least 6 months.

Check the conditions for obtaining a mortgage with your bank.

Bank conditions

Taking into account the greater risk of issuing loans to entrepreneurs, the bank provides loans on more stringent terms than to individuals. This is explained by the possibility of bankruptcy of the entrepreneur and the instability of the modern market. Therefore, the conditions for individual entrepreneurs differ from private lending in the following points:

- Increased remuneration rate. Starts at 15% and is set individually for each client.

- The repayment period has been reduced to 10 years.

- Increased down payment – from 25%.

- Penalties for late payment – 0.1% per day.

There are also some restrictions for individual entrepreneurs:

- Conducting activities on the territory of the Russian Federation.

- Age at the end of contractual obligations is 70 years.

- The period of activity is from one year.

- Annual income is no more than 400 million rubles.

By setting such strict limits, the bank is trying to protect against losing a large amount of money. It is assumed that the income of a private entrepreneur is higher than that of an ordinary employee, so the loan can be repaid in a short time.

Which banks issue mortgages?

Mortgage lending conditions vary from bank to bank. In particular, differences in interest rates are visible. Note that a 1% difference in mortgage size is quite significant. After all, this is hundreds of thousands of rubles, depending on the total amount.

Large banks are willing to offer borrowers lower interest rates than smaller financial institutions.

Let's consider what conditions apply when applying for a mortgage for individual entrepreneurs using the example of the largest banks in the country.

Sberbank

As practice shows, it is more profitable for entrepreneurs to apply for a mortgage at Sberbank, which offers interesting programs. For example, “Your turnkey home.” The offer is relevant for borrowers living in the Moscow and Lipetsk regions.

At Sberbank, individual entrepreneurs can count on the following types of real estate:

- housing from the developer (at the construction stage);

- apartment on the secondary market;

- commercial real estate.

Note! Sber takes part in state programs designed for preferential categories of the population. This is the main advantage of cooperation with this bank.

Sberbank sets the amount of the down payment for individual entrepreneurs in the region of 15-20% of the value of the collateral real estate. It is worth noting that today this is the lowest percentage for individual entrepreneurs among all banks.

To apply for a mortgage, you will need a standard package of documents and general requirements have been established for borrowers of all categories. Depending on the chosen mortgage program, conditions may vary slightly.

Read, it’s interesting Preliminary agreement for the purchase and sale of an apartment with a Sberbank mortgage

VTB 24

In this bank, a suitable program would be “Victory over formalities”. According to it, the following requirements are established:

- the average interest rate is 10-11%;

- a mortgage is issued using two documents (a passport is required and a second one of your choice, more often they show SNILS);

- life insurance of the borrower and real estate.

To apply for a loan to purchase real estate, registration in the region where the bank is located is not required. No proof of income is required, which is an even greater advantage. However, the down payment amount is 40% of the value of the property on the secondary market and 30% when purchasing housing in a new building. Thus, only those who have initial capital will be able to take advantage of this mortgage lending program.

Gazprombank

They are also ready to accommodate entrepreneurs halfway and issue a mortgage based on two documents. However, the requirements are stricter than in VTB 24.

The borrower must be a citizen of the Russian Federation, age did not exceed 65 years on the date of full repayment of the mortgage. The following package of documents will be required:

- certificate of registration in the Unified State Register of Individual Entrepreneurs (form P67001);

- tax return;

- account statement (issued by the servicing bank);

- information about existing property that is used for commercial purposes;

- license or patent, if available.

In addition, you will need to make a down payment of 40%.

Promsvyazbank

The offer “Getting a mortgage is easy!” is valid here. According to this program, you will not have to confirm your solvency.

The minimum interest rate is 11.5%. It is available to those who make a down payment of 40% of the cost of the property, as well as if they own another home. The smaller the down payment, the higher the interest.

Another requirement established by Promsvyazbank is registration as an entrepreneur for at least two years.

What is Express mortgage

Such a banking product really exists. It is offered to individual entrepreneurs by Sberbank of Russia and has a number of advantages, including:

- quick consideration of the application;

- loan amount up to ten million rubles;

- mortgage repayment period - up to ten years;

- attractive annual rate (from 15.5%);

- The collateral is only the purchased property;

- no hidden fees;

- simplified requirements for the package of documents;

- the possibility of obtaining both residential and commercial mortgages;

- a separate pledge agreement is not concluded.

The conditions are extremely attractive, however, the Sberbank Express Mortgage program provides for the client to pay a down payment in the amount of 20–25% of the cost of the property. Other standard terms and conditions also apply. Among them:

- presence of a bank account in Sberbank;

- surety;

- at least a one-year period of successful commercial activity.

In addition, the commercial rate is indicated as a minimum, and the less the client corresponds to the ideal image, the higher it will be. To roughly calculate monthly payments, you can use a loan calculator available on the official website of Sberbank and other banks.

To the Sberbank website

Mortgage alternatives

If the business brings in large and constant income, it is worth considering the option of buying an apartment in installments. The contract is concluded directly with the developer, bypassing the bank. A minimum package of documents is required, there is no need to confirm income, and processing is much faster than with a mortgage loan. The only significant disadvantage of installment plans is the short term and, as a result, large payments.

All large, reliable developers in St. Petersburg offer various installment plans, including interest-free. For example, in the residential complex “House on Kosmonavtov” we offer this one-room apartment. The installment plan is valid until June 2022, the first payment is 20%:

Required documents

The requirements for the package for individual entrepreneurs should be clarified with a specific organization: some banks will offer their own forms to fill out, some will ask for an expanded list of papers. You will need to provide:

- personal passport and copies of documents of all family members (birth certificates for minors);

- marriage/divorce certificate;

- Certificate of State Registration of Individual Entrepreneurs;

- individual entrepreneur license (if required by the area of activity);

- tax return for at least one year.

Based on these documents and additional information, the bank will decide to approve a mortgage loan for individual entrepreneurs.