Why debt is formed on a military mortgage - reasons

Many people wonder where military mortgage debt comes from, if paying off the debt is a function of the state. The serviceman is required to fulfill his duty to his homeland (serve for twenty years). After this period, the property becomes the property of the person. But in practice, there are two reasons why debt is generated on a military mortgage.

State's fault

The state did not index the savings, after which the payment schedule is updated and the military man becomes a debtor. Banking institutions often limit mortgage terms. The amount of interest and the repayment period of the debt are calculated in such a way that the country has time to repay the debt for the military. During the calculation process, a standard inflation target is taken and conditions are set based on it.

In the period from 2014 to 2020, a serious crisis occurred, as a result of which the indexing of savings did not occur. Panic arose, and the size of the military personnel’s debt reached 1,000,000 rubles.

In the winter of 2020, measures were taken by the state. According to the new instructions, savings cannot be reduced, and indexation is carried out every year. To pay off your military mortgage debt, you can use savings deposit money and raise it to 12 percent per year.

Serviceman's guilt

The second option is to dismiss a person at will, for example, due to unsatisfactory pay or low salary. This step refers to non-compliance with the terms of the contract, so the military man will have to pay for housing himself. It is required to return to the country the money that was paid earlier.

Early repayment of a military mortgage

The terms of the loan, which was received under the state military mortgage program, provide for the possibility of early repayment of loan obligations: both full and partial, without any sanctions. It can be carried out at the expense of maternal capital, personal savings or savings that remain on the INS.

Partially repaying a military mortgage ahead of schedule is really beneficial, since the loan term is shortened, as the amount of the principal debt is reduced, which means the amount of overpayments on interest is reduced.

Please note: the faster the loan is repaid, the sooner the state program participant will begin to accumulate savings in their personal account, which will subsequently generate additional income from investments.

After each write-off of funds that were used for partial early repayment of the mortgage, the payment schedule is recalculated.

Early partial “closure” of a military mortgage with the serviceman’s own savings

The serviceman should contact a banking institution and provide an application indicating his intentions to partially repay the debt ahead of schedule. Each organization has its own application form, and a sample can be found on the official websites of banks. Before submitting your application, you need to clarify:

- Are there requirements for a minimum repayment amount?

- When can you partially repay your debt early?

- To which account should funds be deposited, that is, to a special NIS account or to a current account).

- How to get an “updated” repayment schedule.

- How the bank notifies the Federal State Institution "Rosvoenipoteka" about the completed early repayment of a mortgage loan. This must be done ten working days from the date of repayment.

Early partial repayment of a military mortgage with funds from the INS

To transfer the balance of savings that are accounted for on the INS, you need to send an application to the Federal State Institution “Rosvoenipoteka” addressed to the head, and also attach a copy of the passport of the state program participant to it. The application must contain the following information:

- Loan agreement number.

- CZZ agreement number.

- Address of the place of residence.

- E-mail address.

- Military contact phone number.

You can submit documents to the Federal State Institution "Rosvoenipoteka" in a convenient way, that is:

- By sending a letter to the official email of the Federal State Institution “Rosvoenipoteka”. We recommend sending your application in PDF format (as one file); the size of the attached document should not be more than 3 MB. Sending the original is not required.

- Through the branch of the Federal State Institution "Rosvoenipoteka".

- By registered mail.

Please pay attention to the delivery time of the item.

An application received from a state program participant is considered within 30 days. You can track the “status” of application processing, as well as find out the date of transfer of funds for partial early repayment, on the official website of the Federal State Institution “Rosvoenipoteka”.

You can repay the debt using savings from the IRA only after making the first payment on the mortgage loan. When transferring the balance of savings, the Federal State Institution "Rosvoenipoteka" notifies the participant of the state program and the bank about the direction of the corresponding funds. The bank, in turn, makes early repayment without the written consent of the military man. However, we recommend that the NIS participant check with a bank employee whether it is necessary to write an additional application to write off funds for partial early repayment of the loan.

Is it possible to use maternal capital?

The possibility of using maternity capital for these purposes must be previously agreed with the Pension Fund of the Russian Federation and the bank. Consult with specialists, they will tell you whether it is possible to transfer funds to maternity capital to solve this problem. First, contact the Pension Fund of the Russian Federation with this question, and after that, contact the bank’s representatives. If you receive a positive answer, collect the necessary package of documents, including:

- Statement on the disposal of maternal capital funds.

- Certificate for maternal capital.

- Passport of the manager of maternal capital.

- Loan agreement.

- Certificate of state registration of ownership of housing purchased with a mortgage loan.

- An extract from the house register, as well as a financial and personal account.

- An obligation confirming the intention to register the purchased property as the common property of all family members, including minor children, after the complete removal of encumbrances from it. The obligation must be certified by a notary.

- A certificate from the bank indicating the exact amount of the balance of the principal debt and the debt to repay interest accrued for using the loan.

This package of documents must be submitted to the territorial branch of the Pension Fund of the Russian Federation. The application will be reviewed within thirty days from the date of submission. A “positive” or “negative” decision is sent to the applicant a maximum of five days from the date of its adoption.

A serviceman who has received a “positive” decision from the Pension Fund of the Russian Federation must contact a banking organization and submit an application for partial repayment of the mortgage loan using maternity capital. The transfer of the corresponding funds is carried out by the Pension Fund of the Russian Federation a maximum of two months from the date of making a “positive” decision.

Please note: modern banks offer their clients the use of “personal accounts”, “Internet banks”, etc. With their help, borrowers can receive up-to-date information in real time about the status of accounts, loan arrears, ongoing transactions, etc. That is, these services can be used to clarify information about the “movement” of financial resources, including partial early repayment of a mortgage.

For example, VTB24 Bank provides its clients with a convenient service: mortgage repayment using the personal savings of a state program participant can be done by calling a hotline, and this does not require filling out an application. The use of various online services allows you to significantly save time.

Division of military mortgage debts during divorce

A difficult situation arises in a married couple who have decided to dissolve family ties. In such circumstances, two documents are valid:

- Civil Code of the Russian Federation (Article 256).

- RF IC (Article 34, Part 1).

These rules stipulate that property acquired during marriage is considered joint property. But in the RF IC (Article 34) there is a clarification that targeted payments in relation to one of the spouses are not common property. This means that the division of debt for a military apartment in the event of a divorce does not occur. The state remains the owner of the property until the serviceman ends his contractual obligations.

The law protects the rights of minor children, therefore the ex-wife and a child under 18 years of age have the right to live in an apartment until the joint child reaches adulthood.

The exception is cases when spouses used common savings when applying for a loan. In this case, the husband (wife) has the right to expect a return of 50% of the funds spent.

Payment terms

The repayment period for military mortgages and other provisions were first fixed at the legislative level in the Russian Federation by Law No. 117 of August 20, 2004 (On the savings-mortgage housing system for military personnel).

Military personnel have the opportunity to purchase their own housing before the end of their service.

The difference between a regular mortgage and a military mortgage is that the Department of Defense pays the loan for the military member.

Questions about including a serviceman in the lists of participants in the savings-mortgage system (NIS), about the amount of the amount of monetary remuneration payments are considered on an individual basis. Throughout the life of the law, many shortcomings have been identified and corrected. Until now, not all military personnel know about their rights, the amounts of payments and the procedure for obtaining a mortgage.

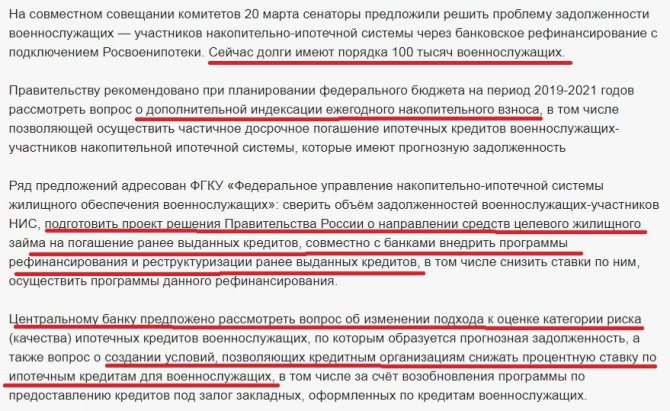

How does the state solve the problem of mortgage debts?

In 2020, more than 100,000 military personnel are in debt on a targeted mortgage loan. To find a solution, on March 20, a meeting of committees of the Federation Council of the Russian Federation met and the pressing issue of debt was discussed. The reason for the debt, according to the government, is incomplete indexation in 2015, when creditors collected the difference from military personnel.

Active complaints led to the creation of three groups to solve the problem - on the budget, on social policy and on defense (security).

The issue of additional indexation was proposed, which would make it possible to pay off part of the accumulated debt. Rosvoenipoteka has been instructed to consider the possibility of buying out the debts of military personnel on loans, the percentage of which is higher than the planned return on invested money in 2018 and 2020.

If nothing is done, military mortgage debt will continue to grow. In addition, by 2029 the difference between the planned and actual contribution parameters will reach 1.16 million rubles. To solve the problem, it is planned to launch a refinancing program and reduce the rate by 2-3 percent.

Pros and cons of bankruptcy

Seeking professional legal assistance guarantees:

- stopping systematic calls from collection companies;

- protection of interests in court;

- stopping the growth of debt obligations;

- writing off debt and arrears on military mortgages.

After a competently carried out bankruptcy procedure, the former borrower is released from obligations not only to the bank, but also from enforcement proceedings by bailiffs.

The main disadvantage of carrying out a bankruptcy procedure with a military mortgage can be considered the deprivation of housing, or rather, mortgaged housing, which will ultimately be sold at auction. But in a situation where systematic threats arise from collectors and banking services, and there is no opportunity to repay the contribution, the bankruptcy procedure can be considered the only correct one.

Before carrying out the procedure, the family of a former military man must take care in advance of renting or purchasing alternative housing.