Many people want to take out a mortgage without a down payment from Sberbank. This is an opportunity to buy a home using loan funds provided at a minimum interest rate. After all, it is difficult to save 20%, 15%, and even 10% of the market value of an apartment or house. However, if you understand all the intricacies of mortgage lending and use the recommendations of experts, you can purchase your own home on credit without an initial investment. The main thing is to choose the right method in order to overpay as little as possible, because there are several paths you can take.

Why don't banks want to issue mortgages without a down payment?

By providing mortgages to citizens of the Russian Federation, financial institutions pursue the goal of receiving remuneration. The interest paid by borrowers is the bank's profit. And the down payment is the minimum guarantee of no losses in case of non-payment of the loan. Banking structures do not welcome issuing loans without an initial investment because:

- There is a risk of deterioration in the solvency of borrowers when they lose the ability to repay debts on time, and, taking into account penalties and fines, they refuse to repay the mortgage altogether.

- The down payment increases the client’s responsibility, since he is afraid of losing the capital that has already been contributed. This encourages clients to continue repaying the money according to the established schedule.

- It is generally accepted that if an applicant is not able to save at least 10% of the cost of an apartment, this indicates indiscipline and an inability to properly manage the available money.

- It is also believed that the absence of liquid 10-15% of the housing price indicates a lack of solvency. It can be said with a greater degree of certainty that there will be failures and delays during the mortgage repayment period.

- If the mortgage is in default and you have to sell the property to repay the funds spent, the bank bears the costs of registration. It is planned to compensate them with money from the down payment.

This shows that when applying for a mortgage, a contribution is taken in order to protect finances from possible risks and losses.

Is it possible to get a mortgage loan without a down payment?

The standard amount of the initial mortgage payment is 1/5 of the price of the purchased property. Special programs can reduce it to 15%. Preferential categories of citizens who enjoy social protection of the state and the Government contribute 10%. There are no offers that allow you to obtain a mortgage for an apartment without a down payment. But there are absolutely legal ways to make a transaction without using your own savings:

- Use a maternity capital certificate.

- Take advantage of the capital of the “military mortgage”.

- Become a participant in the borrower assistance program.

- Buy a home using funds from a non-targeted loan.

To receive government subsidies, you must meet a number of mandatory requirements. Beneficiary status is assigned on the basis of submitted documents confirming the need for social protection.

What is the total cost of a mortgage?

If it is not possible to bear the initial costs, the loan is formed through:

- The cost of the registered object.

- Discounts if you have an insurance policy.

- Providing bank letters of credit.

- Payments for the work of the evaluation commission.

- Account opening and maintenance fees.

- Costs of paying fees for government services.

Possible financial losses in the form of fines, penalties, penalties are not taken into account in the initial calculation. Only the actual costs that will have to be incurred are taken into account.

Basic moments

Purchasing real estate on the secondary or primary market with the help of credit from one bank or another is an excellent opportunity to become the owner of your own home if you cannot pay the entire cost of the property at once. But what to do if the borrower has absolutely no funds even for the down payment for a mortgage loan?

Not all banks welcome purchasing real estate with a mortgage loan without sufficient funds for a down payment. Why is this operation considered risky:

- There is a high risk of a possible price surge or a crisis situation. If the borrower purchases housing at a sufficiently high price and subsequently cannot pay the loan for the apartment, and at the same time a collapse in prices occurs, the bank will no longer be able to sell the property at the initially stated price.

- A mortgage loan with no down payment typically attracts borrowers with low income or ability to pay. Therefore, there is a high probability that the borrower will not cope with his obligations, and the bank, due to the lack of funds to ensure the fulfillment of debt obligations, which is the down payment on the loan, will suffer significant losses.

Mortgage programs without down payment

There are no special offers, and to avoid initial expenses, use programs for large families, young families, and military personnel. Take advantage of the opportunity to subsidize if you belong to preferential categories of citizens. An alternative is a loan for any purpose. The money received can be used to pay for housing. Then there is no need to save up funds to pay off the initial costs associated with the acquisition and registration.

Program “Non-targeted loan secured by real estate”

To receive the required amount, it is enough to meet the following requirements put forward by Sberbank:

- Citizenship – Russian Federation.

- Availability of permanent registration in the Russian Federation.

- Total work experience of 12 months.

- Availability of official salary.

- Work experience at last place of employment was six months.

- The minimum age of borrowers is 21 years.

- Payments must stop before your 75th birthday.

It is allowed to attract up to four co-borrowers - employed family members, relatives, and close ones. Guarantors will not be required to provide collateral.

Conditions

Mortgage loans are more profitable, but if there is no other way out and there are no funds to pay the initial 15-20%, a non-targeted loan is a way out of the situation. The interest rate is fixed at 13% per annum. Sberbank is ready to issue at least half a million, maximum 10 million rubles. the borrower is expected to repay the money with interest over a period of twenty years. Before submitting an application, make a preliminary calculation of the costs of the mortgage and non-targeted loan. Choose the best option. It might make sense to wait and save up for a down payment.

What restrictions apply?

Mortgage lending without a down payment is issued by Sberbank under strict conditions:

- To receive a housing loan under the Military Mortgage program, a person must be a member of the NIS for at least three years. The maximum age of the borrower should not exceed 45 years. Restrictions also apply to the size of the loan: military personnel can take out a housing loan for a maximum of 2,220,000 million rubles.

- Certain restrictions also apply under the Mortgage and Maternity Capital program.

The minimum down payment must be at least 15% of the cost of housing. If the amount of maternity capital is 453 thousand rubles, then a young family will be able to afford housing costing a maximum of 3 million rubles.

To whom is a mortgage available from Sberbank without a down payment?:

- persons who want to refinance their mortgage;

- property owners.

With the payment of a down payment at the expense of the state, a loan can be issued:

- military personnel participating in the NIS;

- families with a maternity capital certificate.

What requirements does the bank put forward?:

- age from 21 to 75 years (for the military - up to 45 years);

- solvency;

- good credit history;

- Russian citizenship;

- experience – from 6 months at the current place of work, total – from 12 months over the last five years.

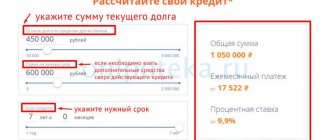

How to calculate a mortgage loan?

An initial cost calculation allows you to determine the possibility of timely repayment of credit debt. It becomes possible to determine optimal conditions under which the family budget will not suffer from the need to repay the loan. There is a special service for this. Using an online calculator, the credit schedule, the amount of overpayment, and the amount of the monthly payment become clear. All that remains is to submit an application indicating the most acceptable loan terms.

Mortgage calculator

The service is available not only to Sberbank clients using the Internet Bank Online system. Anyone can get the initial data right now. Just follow the step-by-step instructions:

- Indicate the value of the collateral property (apartment, house, cottage, etc.).

- Select the type of loan: annuity with equal payments; differentiated.

- Enter the desired amount not exceeding the price of the property.

- The amount of the down payment if you decide to take out a mortgage.

- Determine the period during which you plan to return the money to the bank.

Information about the interest rate, total overpayment, and the amount of monthly payments is immediately displayed on the monitor. This is enough to compare your own capabilities with the real costs that you will have to bear throughout the entire period.

Change the initial data to choose the optimal loan terms. Compare the data obtained with the amount of officially confirmed family income. Keep in mind that you will need money to pay off mandatory payments (utilities, children’s education, etc.), as well as for food, clothing, treatment, etc.

"DomClick" from Sberbank - Mortgage, real estate selection

HOW TO APPLY FOR A MORTGAGE IN SBERBANK ONLINE

- Calculate your mortgage, use the mortgage calculator

- Fill out an application in your DomClick personal account from Sberbank*

- Choose an apartment on the official DomClick website from Sberbank*

- Complete the transaction online, electronic registration of property rights is possible

* In order to apply for a mortgage with Sberbank online, you must register on the official website DomClick.ru or log into your DomClick personal account from Sberbank. Official website of DomClick https://domclick.ru. "DomClick" mortgage Personal account.

Credit offers from Sberbank of Russia

- Consumer loans

- Credit cards

- Business offers

- Offers for pensioners

Applying for a mortgage loan without a down payment with the help of the state

For the state, mortgages are a way to support the domestic market and the production sector. In addition to these goals, the Government takes care of citizens who need their own housing. There are a number of categories of people who do not have the physical ability to save up for an initial payment, and the country’s task is to support them, which is successfully done with the help of special programs. They can be used by military personnel, families with children, as well as employees of budgetary organizations and government agencies.

Unable to pay the mortgage payment from the developer, contact your local government. Some programs involve determining benefits at the regional level, and the terms of subsidies are always different depending on the future location.

Mortgage for families with children

If the applicant has the status of a mother or father of many children, Sberbank is ready to provide a mortgage without initial investment. It would be more accurate to say that the state is ready to pay a down payment so that the family can live in their own apartment. This benefit is available to people who:

- During the period 2018-22. the second, third, subsequent child was born.

- Each resident has less than 18 square meters.

- The current housing is considered unfit for habitation and in disrepair.

- The age of the spouses is no more than 35 years (for the Young Family program).

- A dependent living in the same area is supported.

You can only buy apartments in new buildings. Preferential mortgage programs do not apply to secondary housing, nor to unfinished buildings. The loan amount limit is set according to the region. For Moscow and St. Petersburg this is 12 million rubles, while for other cities and regions the limit is 8 million. Up to 30% of this amount is paid from the state budget.

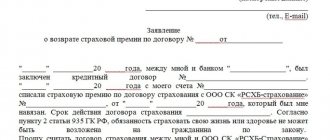

Mortgage plus maternity capital

This mortgage is available for families with children. Matkapital is used to repay initial costs, the loan itself and interest. It will not be possible to pay fines and penalties for late payments using the certificate. Subsidization assumes that the applying family has two or more children. According to Federal Law No. 256-FZ of December 29, 2006, the received maternity capital is allowed to repay up to 20 percent of the mortgage, which corresponds to the standard (maximum) down payment.

You won't have to wait. Unlike other legal ways to use money received upon the birth of children, a mortgage is issued immediately after the birth of the baby and receipt of the certificate. However, the approval of the Pension Fund will have to take up to two months from the date of application.

The step-by-step algorithm of actions is as follows:

- Search for a developer offering a suitable apartment at a favorable price.

- Applying to the Pension Fund for permission to use maternal capital.

- Calculate initial mortgage costs using an online calculator.

- Submitting an application in person at a branch or applying for an online mortgage at DomClick.

- Signing an agreement involving the use of maternity capital.

- Re-registration of real estate into the ownership of the borrower, still with an encumbrance.

If, after deducting the initial expenses, a certain amount remains on the certificate, it can subsequently, if necessary, be used to pay off mandatory payments.

Military mortgage

If a citizen is in military service, but does not have the opportunity to obtain a mortgage with a down payment, the Government provides the right to purchase housing on preferential terms. Laws regulating the legality of the provision of funds - Federal Laws No. 117-FZ of August 20, 2004. and No. 76-FZ dated May 27, 1998. For the military, the step-by-step instructions are as follows:

- Applying to Rosipotek with an application.

- Selection of an apartment from a developer in a new building.

- Submitting an application to Sberbank, providing documents.

- Obtaining approval, signing the contract.

- Re-registration of ownership in Rosreestr.

In this case, the initial costs are borne by the Ministry of Defense of the Russian Federation. The described procedure is available to applicants who have been participants in the savings mortgage program for three years. The processing time for an application at Sberbank is from two to five days.

Loan amounts

Sberbank provides citizens with a different range of mortgage amounts issued. It all depends on the loan category.

| Borrower category | Loan amount in rubles |

| Mortgage with state support | 45000–8000000 |

| Military personnel | 15000–2400000 |

| Young families with maternal capital | 15000–8000000 |

| Refinancing | From 15,000 to 80% of the value of the property or debt balance |

The size of the approved mortgage, which does not require a down payment, also depends on the citizen’s solvency. With a significant salary level and long work experience in one organization, a person can count on a more “weighty” loan.

Also, the bank certainly takes into account the income of the spouse, who acts as a co-borrower. The higher the total family income (even unofficial), the greater the amount citizens can count on when applying for a mortgage at Sberbank.

Interest rates and maximum amounts issued

After the latest changes, the following mortgage conditions apply to persons who do not have initial capital:

- The interest rate has been reduced to 6% for applicants participating in the Young Family program. The limit has been increased to RUB 12,000,000. for Moscow and St. Petersburg.

- From 8.5% is paid by borrowers using maternity capital as a down payment. Then the upper limit of the amount is 70 million.

- Military personnel who took advantage of the preferential savings mortgage program pay a loan of up to 2.502 million rubles at 9.5%.

When using a non-targeted loan, the rate is fixed at 13.0%. However, it can be lowered. There is a 1% discount for salary card holders. The same amount is removed in case of insurance of the applicant in case of temporary and/or permanent disability.

Conditions for obtaining a mortgage loan without a down payment

With any mortgage lending option, insurance of the object of purchase and all possible risks for the borrower is required. This procedure involves financial coverage for situations of property damage, death or loss of health of the borrower, or disability.

Sberbank always provides for a separate, “thirteenth payment”. He demands payment of funds calculated by insurance policies for the past year. Since the amount is often related to the amount of the regular contribution, it is allocated as a separate payment made at the end of the year.

Money is provided by the bank only in Russian rubles. There are age restrictions for borrowers: 21–75 years. For military personnel, such a program is designed only until the recipient reaches the age of 45 years. All mortgages with no down payment have a limited term of 30 years.

Interest rates

For different mortgage programs, Sberbank sets its own interest rate, which has the following parameters:

- The refinancing program provides for a rate of 10.9%.

- If a young family uses maternity capital as a down payment, this rate is calculated at a minimum rate of 10.2%.

- For borrowers participating in the federal program, the rate is from 6%.

- For military personnel, it starts at 9.5%.

Sberbank works with floating rates, so they are subject to change. Also, the percentage may increase in a situation with the acquisition of housing under construction.

Volume of borrowed capital

A young family that receives a loan under the state program can receive a mortgage in the amount of 45,000–8,000,000 rubles. When you contribute maternity capital, the loan limit increases - 15,000–8,000,000 rubles. Below is the maximum lending volume for military personnel - 15,000–2,400,000.

When refinancing an old mortgage, citizens are provided with an amount starting from 15,000 rubles, although it cannot exceed 80% of the housing already purchased or the balance of the outstanding mortgage.

Redemption

In addition to military personnel, for whom the repayment period is limited to 45 years of age, other categories of citizens can use a Sberbank mortgage for 30 years. An annuity scheme for repayment is certainly used, which involves uniform payment of the debt. The entire loan amount, together with accrued interest, is clearly distributed over the loan period and involves monthly payment of equal amounts.

Lending terms

There are a number of conditions that must be met in order to obtain a mortgage, but not incur the initial costs associated with paying for part of the apartment. You will have to meet the basic requirements of Sberbank. To receive subsidies there are additional conditions that are also mandatory. The main thing is that the applicant has Russian citizenship and is fully capable at the time of signing the mortgage agreement. Otherwise, the agreement is considered invalid (void) and the transaction is considered imperfect.

Requirements for borrowers

In order not to invest initial funds and get a mortgage, it is necessary that the borrower:

- He had Russian citizenship and was registered on the territory of the Russian Federation.

- Celebrated my 21st birthday and could pay off my mortgage before my 75th birthday.

- Worked in one place for at least six months, and had a total length of service of more than 12 months.

- Confirmed a sufficient level of official income with a certificate in form 2NDFL.

- Attracted co-borrowers and guarantors, which increases the chances of receiving bank approval.

Military personnel do not incur upfront costs if they participate in the savings mortgage program for at least 36 months. If a decision is made to issue a non-targeted loan, collateral is provided. This is the property owned by the applicant. Maternity capital is issued after receiving the child's birth certificate. For young families the following requirements apply:

- The total area of a two-room apartment purchased with a mortgage is greater than or equal to 42 square meters. If there is a third tenant - 18 square meters for each.

- The current living conditions are recognized as inconsistent with the sanitary and technical standards in force in Russia. The housing is in disrepair, there are no amenities, etc.

- One or more family members are dependent due to a serious illness or injury where recovery and rehabilitation are impossible.

A family applying for a mortgage without an initial investment is considered “Young” if the marriage is officially registered and the husband and wife are under 35 years old.

Preparation of documents

Before signing the contract, in order to avoid incurring initial costs, you need to prepare. A mortgage is issued upon presentation:

- Passports citizen of the Russian Federation. Bringing borrowers, guarantors and co-borrowers.

- Driver's license, SNILS or international passports of all participants in the transaction.

- Military ID if the applicant is under 27 years old.

- Borrower questionnaires. The form is issued at a Sberbank branch. Can be downloaded on the website.

- Certificates of marriage and birth of all minor children.

- Pension certificate, copy of the work book, certified by the employer.

- Documents confirming the availability of additional sources of income.

- Certificates about the level of official, confirmed income of co-borrowers, guarantors.

Additional income accepted for consideration is the receipt of funds under a lease agreement, interest on a deposit, dividends from investments in securities.

When applying for a mortgage without an initial investment, data on official earnings is provided in form 2-NDFL. An alternative is to obtain a form from Sberbank employees or download it from the website.

Individual entrepreneurs confirm their solvency using a declaration for the last reporting period. When applying for a mortgage with a subsidy, you will need birth certificates of children, family registration, as well as a certificate of assignment of the status of a large family. What document is required depends on the specific situation. For example, the military brings a paper stating that the applicant participated in the savings program. And if maternity capital is used as a down payment, they provide a certificate and a certificate from the Pension Fund about the balance of the amount received.

Submitting an application

There are two ways to apply to Sberbank for a mortgage. You can appear in person at the branch operating in the city, county or area where the property you are purchasing is located. When applying, you need to have a passport and an initial set of documents. An alternative is to apply online. For this:

- Launch your browser and go to the DomClick website.

- Log in to the system using your own login.

- Use the "Submit Application" function.

- Fill out the fields and columns of the online form.

- Check for accuracy and upload scanned copies of documents.

- Submit your request and wait for a decision.

Approval will be sent to your phone via SMS or email via letter. If a Sberbank employee requires additional information to relieve the applicant from having to make a down payment, an incoming call will be received. Follow the instructions provided.

Mortgage approval is received within 5 days after application. If this does not happen, contact support. The bank is not obliged to provide information about the reason for the refusal. If this happens, consider taking out a mortgage, but with a down payment, or find an alternative way out of the situation. After submitting the completed application, the borrower has 90 days to complete the transaction.

Sample

follow the link below, even if you decide to personally take the application to the bank. To get a mortgage from Sberbank, you must indicate:

- Full name, personal and contact information.

- Income level for the last six months.

- The cost of the apartment being purchased (type of housing).

- The amount of the down payment and the method of payment.

- Additional conditions (insurance, salary card).

- Belonging to the category of beneficiaries.

- Use of government subsidies, etc.

Application form for a housing loan

Size: 510.67 KB

If a non-targeted loan is issued against real estate, all necessary documents, including the appraised value, are scanned and sent along with the application. Use the tips provided in the electronic form. If you encounter any difficulties, please contact us for a free consultation by phone, email or online.

When purchasing an apartment or house with a mortgage, life and health insurance is not required. But having a policy will allow you to reduce the interest rate and will inspire confidence in Sberbank employees considering the application. Please put the appropriate mark in the form and send a scan of the watering to the bank along with the application.

Collection of documents and submission methods

What papers will you need to provide to Sberbank?:

- passport;

- employment history;

- income certificate;

- for the Military Mortgage program - certificate of participation in the NIS;

- for families - a certificate for maternal capital and an extract from the Pension Fund on the availability of funds in the account;

- for the mortgage refinancing program - loan agreement, documents on the collateral provided;

- for the “Loan secured by real estate” program - papers for housing issued as collateral.

After approval of the application, the client provides documents on the loaned property:

- certificate of ownership;

- extract from the Registration Chamber;

- technical and cadastral passport;

- a document confirming the right of ownership of property (sale and purchase agreement, exchange, deed of gift, etc.);

- extract from the house register;

- expert opinion on the cost of housing.

REFERENCE: To submit an application, you need to contact a bank branch. You can also fill out the form on the Sberbank website online.

Alternative options for purchasing an apartment without a down payment

From the above it is clear that it will not be possible to waive the initial costs when applying for a mortgage. We have to look for sources of funds that can help solve the problem. In fact, you will have to take out a mortgage with a standard or preferential down payment. Only your own funds will remain inviolable. And we are not talking about borrowing money from friends and relatives. It’s better to take out a consumer loan and use the money received to repay the initial tranche.

Inflating the cost of housing in front of Sberbank

The essence of the method comes down to the following. The seller provides a notarized receipt indicating that the buyer pays, say, a fifth of the amount directly. The bank can only provide a mortgage without taking into account the down payment. This may cause the following problems:

- When applying for a mortgage for apartments in new buildings, Sberbank will not accept any receipts, especially if the option was selected on the DomKlik website.

- The bank will double-check the data, and if the discrepancy is too great, it will most likely result in a refusal and an entry into the credit history, which will have a negative impact in the future.

- Sellers are reluctant to do this, since the buyer has the right to demand that they cancel the transaction and return the “virtual” payment, since the receipt is a legal document.

Remember that by resorting to such actions, you risk ending up on the “black list” of Sberbank, which has the right, in principle, to refuse to serve a client if it considers the actions illegal, bordering on fraud.

Consumer loan

Another option is to take out a loan and use the money for the initial mortgage payment. The terms of a consumer loan are as follows:

- Young people and pensioners return the money within five years.

- The interest rate varies between 11.9-13.0% per annum.

- The maximum amount for a down payment is 3 million rubles.

When following this path, remember that too much consumer loan debt may result in your mortgage being rejected. Carefully make calculations using a loan calculator, weighing the income and costs that you will have to bear on the mortgage and loan after repaying the down payment.

Promotions from a real estate agency or developer

It is necessary to clarify here. If we are talking about shares as securities, the holder has the right to sell them and pay the down payment, or provide them as collateral. But in most cases, borrowers are interested in ongoing promotions as events. If you monitor the real estate market over time, it is not difficult to find a developer who offers to purchase an apartment with a mortgage without a down payment within a certain period. The main thing is that at this moment all the necessary documents are prepared.

Loan from a real estate agency or developer

Often, the provision of borrowed funds is accompanied by an inflated price of real estate. The agency attracts clients in this way, and the procedure is absolutely legal. Conditions are negotiated individually. Perhaps the agent will actually lend the amount necessary to pay off the initial costs associated with obtaining a mortgage for an apartment or house, which he is resell. The main thing to do in case of overvaluation is to destroy the receipts and the loan agreement.

Mortgage Calculator

Our website provides the opportunity to independently calculate the main mortgage indicators. To be aware of the loan rate and the amount of payments for each month, you need to use a mortgage calculator. A very convenient service, since you do not need to visit the bank office, you just need to use the Internet resource.

It is worth indicating the following information: apartment price, down payment amount, loan period, interest rate, payment option, etc. After filling in the fields, you need to click the “Calculate” button, and the program will automatically display your result.

Mortgage

How to pay off your mortgage?

There are two types of mortgages. In one, the loan is repaid in equal payments. Naturally, the original one is larger and is not taken into account now. In the first quarter of the allotted period, most of the amount is interest, the rest is the body of the loan. In the last quarter it's the other way around. Therefore, if it is possible to repay the debt ahead of schedule, it is better to do it as early as possible. This type of scheme is called an annuity scheme. Differentiated, on the contrary, assumes that the loan body is divided by the number of months. But interest on the remaining debt is added to the payment. Therefore, you will have to spend a lot in the first months.

And you can deposit money into your account in different ways. Even the down payment is paid in cash, from a card, savings account, or deposit. Subsidies are not given. Government agencies transfer them directly to Sberbank, which is communicated to the mortgage applicant without initial investment. Next, the borrower can pay for the mortgage:

- In person at the cash desk of any Sberbank branch.

- From any offices of banks in the Russian Federation.

- Via an ATM, terminal with a debit card.

- In your personal account Sberbank Online cards or accounts.

In some cases, a commission is charged if the payment is interbank, or when the ATM does not belong to Sberbank. When the initial deposit and subsequent payments are made through a terminal or cash register, keep receipts and receipts. This is documentary evidence of the fact that funds have been credited. In your personal account, you can always view your payment history and set up automatic payment so that money is debited automatically every month in the specified amount.

If financial difficulties arise, when it is difficult to pay the mortgage, apply for a “credit holiday”. This is 6 months when you don’t need to contribute anything. The down payment on a mortgage cannot be deferred. Three months are allotted for everything after the application is submitted and approved.

How to get a mortgage at Sberbank?

If a person wants to take out a mortgage for the first time or refinance an existing mortgage, then he must:

- Collect the above package of documents.

- Come to a bank branch and write an application.

- Submit documents.

- Wait for the bank's preliminary decision.

- If the result is positive, you must come to the bank on the appointed day and agree on the details of the mortgage.

- Carefully read and sign the agreement if all conditions satisfy the borrower.

There is an option to submit an application online on the bank's website. But let’s be honest - in a preliminary application, the bank agrees to a mortgage for 90% of clients, but upon arrival at the bank, after checking the documents, they may be denied a mortgage.

Therefore, it is best to immediately contact a Sberbank loan specialist so that he can determine the chances of a positive decision on issuing a loan to purchase a home without making a down payment.

People participating in government programs most often receive approval from the bank and obtain a mortgage on fairly favorable terms. Therefore, there is no need to worry in vain, but it is better to contact Sberbank and resolve all the issues, especially since specialists, even at the time of submitting the application, tell the client what needs to be done to increase the chances of the application being accepted.