When applying for a mortgage at Sberbank, the question arises: is it necessary to take out insurance and, if so, what kind? The answer is simple: property must be insured, the rest is optional. But due to the fact that the mortgage is provided for a long term, it is wiser to buy other policies, for example, life and health . Hence the next question: what is their validity period and how to renew them correctly?

Mandatory and voluntary insurance for mortgages at Sberbank

It is imperative to obtain mortgage insurance for the collateral. Without this, such a loan simply will not be provided. After all, the purchased apartment or house is given to the bank as collateral, so the borrower must insure it by law.

At his discretion, a bank client can insure his health and life. Of course, these are additional costs, but they are fully justified. After all, during the period that you need to make regular payments to repay the loan, anything can happen. For example, the borrower may become ill or have an accident. As a consequence, loss of ability to work, and with it, loss of solvency. But in this case, the loan will still remain with the client. There is a risk of losing the collateral, i.e. housing. By insuring yourself against such events, you can be sure that the loan will be repaid and no one will take away the property.

Protected borrower at Sberbank

We remind you that personal life insurance (and this is precisely the aspect the insurance program concerns) when lending, including when applying for a mortgage, is carried out exclusively voluntarily. Insurance Protected Borrower policy specifically for those who have entered into a mortgage lending agreement, although when concluding such transactions, only insurance of the property (not life) is required, which will be the subject of collateral for the loan.

Types of mortgage protection

A mortgage is the longest loan, its term can reach 30 years, so borrowers are also offered various insurance protection options:

- civil liability: protection applies in case of damage to property of neighbors;

- health: the policy can include a variety of items (illnesses, injuries, accidents, disability, etc.) This is exactly what the Protected Borrower program ;

- personal from job loss and other cases leading to a deterioration in financial situation.

All of the listed options are not a prerequisite for the bank to conclude an agreement.

Protected Borrower insurance program is a policy that will allow you to insure the borrower personally, namely his life and health.

Let's find out in more detail what risks are included in it, i.e. In what cases will it be possible to receive compensation to fulfill one’s own obligations to the bank.

Who needs life insurance

The policy of the insurance company Sberbank Insurance The protected borrower is not mandatory for concluding a mortgage lending agreement.

Why do banks recommend drawing up such contracts that protect the client’s life with insurance companies? Having a policy is beneficial:

- for the borrower himself: upon the occurrence of an event specified in the risks, the insurance company assumes obligations to repay the loan. That is, it compensates for the cost of paying the mortgage through the insurance premium. In this case, the borrower is partially or completely exempt from paying contributions;

- for banks: in the event of force majeure (serious illness, injury, loss of job, etc.), payments on the issued loan continue to be received, i.e. their risks of non-payment of the loan are reduced.

Taking out insurance under the Protected Borrower program at Sberbank can be recommended as additional protection for a potential or current client

When is insurance valid?

Life insurance The protected borrower involves receiving compensation for the following risks:

- disability due to any reason (groups 1 and 2);

- death of the borrower (any reason).

That is, this program allows you to fulfill your obligations to the bank in full in any of the above cases.

Disability of 1 or 2 groups – significant harm to health with loss of ability to work. Consequently, it will be quite difficult to fulfill your obligations to the bank. The result may be termination of the contract with the sale of collateral, that is, real estate purchased with a mortgage.

In the event of the death of the main borrower, the obligation to repay the loan falls on co-borrowers (who are often close relatives) or heirs.

Insurance A protected borrower in any tragic event will help to fully fulfill obligations to the bank through compensation from the insurance company

After this, the contract will be completed, and the property will become the full property of the client (or his co-borrowers, heirs in the event of the death of the main borrower).

Which companies can you get insurance from?

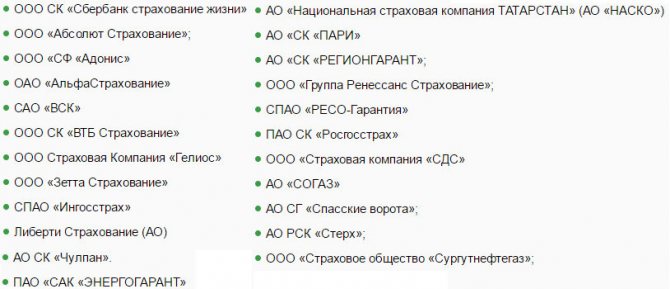

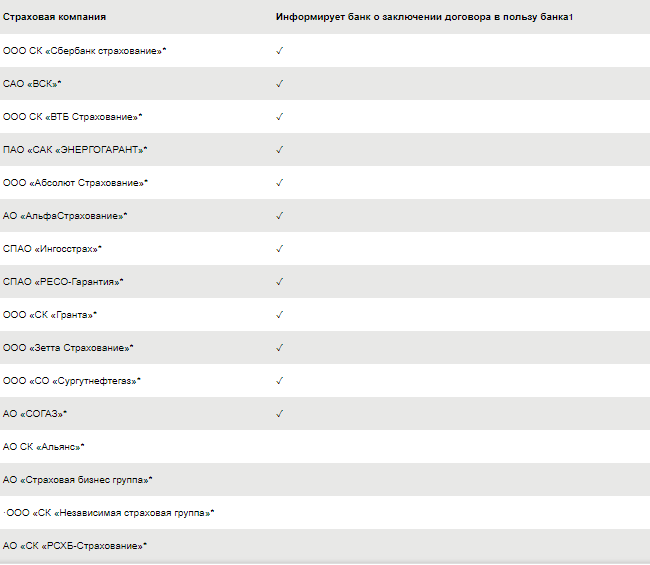

Any policy can be issued only with an insurance company that is accredited by Sberbank or a subsidiary of a credit institution. Sberbank has two of them: “ Sberbank Insurance ” and “ Sberbank – Life Insurance”. The list of accredited insurers includes more than two dozen companies. Therefore, choosing the one whose services you can use is quite simple. In addition, all of them have already been thoroughly checked by Sberbank, so there is no need to doubt their reliability and solvency.

"Sberbank" - Features of Life and Health Insurance

This division of Sberbank was founded in 2012. During the short time of its existence, it was able to become one of the leaders in the field of life insurance for Russian citizens.

Now the organization’s activities are highly assessed by rating agencies (in 2014, “Expert RA” assigned it with a stable forecast, now it is “RuAAA”). More than 9 million people use the insurer's services.

A notable feature of Sberbank Life Insurance is the large number of offices where you can issue a policy. Since the purchase procedure takes place through Sberbank branches, the life insurance option is available anywhere in the country. You can also highlight the following features of life and health insurance in this company:

- Wide variety of insurance programs. You can choose the optimal product for both adults and children.

- Some programs allow remote registration.

- It is possible to issue an individual policy or order insurance for the whole family.

- Availability of flexible configuration of the terms of the insurance contract. This applies not only to the list of insured persons, but also to the amount of protection.

- 24/7 free customer support (hotline).

- The sums insured significantly exceed the cost of the policy.

- Possibility of receiving payments even if an emergency occurred in another country.

The duration of the insurance depends on the program (in most cases - 1 year), the amount of payments depends on the selected product and selected parameters. A large number of offices and methods of communication with the insurer simplify the process of applying for a policy and receiving payments under it.

How and where can you renew your insurance?

The mortgage loan is issued for a long term. As a rule, it is 15-25 years. In this case, the policy has a shorter validity period. Accordingly, it will have to be extended from time to time. This can be done in different ways.

The first option is to contact the company where the contract was concluded. The insurer's employee will explain in detail what documents are required for this, issue the necessary forms to fill out, and check their correctness.

The same can be done at a Sberbank branch. Since insurance companies are accredited by this credit institution, the bank can provide insurance services on their behalf, including policy renewal.

The third method is the DomClick service. If directly when signing a loan agreement (and when initially taking out mortgage insurance ) you need to provide a large package of documents, then when renewing everything becomes much simpler. Moreover, when carrying out the procedure through this service, you will not need to go to the bank and provide documents there. They will all be loaded into the system at the stage of their registration.

In order to use this service, you must first register. After this, all you need to do is go to your personal account and select the “Policy renewal” option. A form will be displayed on the screen that you need to fill out. It should include information about the current policy, as well as the remaining balance on the loan. The same operation can be done through the Sberbank Online .

Rules for participation in the program

You can take out insurance with one of the insurance companies that are partners of the Protected Borrower program if you know the mandatory conditions and requirements for the client. You can familiarize yourself with the Standard Insurance Policy Form.pdf in advance.

Policy conditions

The Sberbank Protected Borrower insurance program is issued under the following conditions:

- validity period: 1 year (hence, the client can decide on its renewal every year);

- the amount of compensation paid upon the occurrence of an insured event: equal to the amount of the loan balance at the time of conclusion of the contract. That is, it completely covers the debt to the bank;

- premium amount: 1% of the amount of insurance protection (recalculated annually if the borrower decides to renew the policy and decreases as the mortgage loan is repaid);

- entry into force of the agreement: 5 days after conclusion. Therefore, if the client wants to make the protection continuous, he will need to conclude an agreement with the insurance company 5 days before the end of the current one;

Please note what requirements Sberbank Insurance imposes on a client who wants to take out insurance under the Protected Borrower program: age restrictions for men - no older than 60 years, for women - up to 55 years old, the contract can be concluded with persons over 18 years old.

Any mortgage loan payer can become a client of Sberbank Insurance under a protected program, since the age criteria coincide with the standard ones for mortgage lending

These are the basic rules developed for the Protected Borrower policy. The conditions are simple and clear. The included risks do not require the listing of all diseases, injuries and life circumstances under which compensation will be paid, since the reason is indicated as any.

How to conclude an agreement

An agreement with an insurance company can be concluded:

- remotely;

- personally.

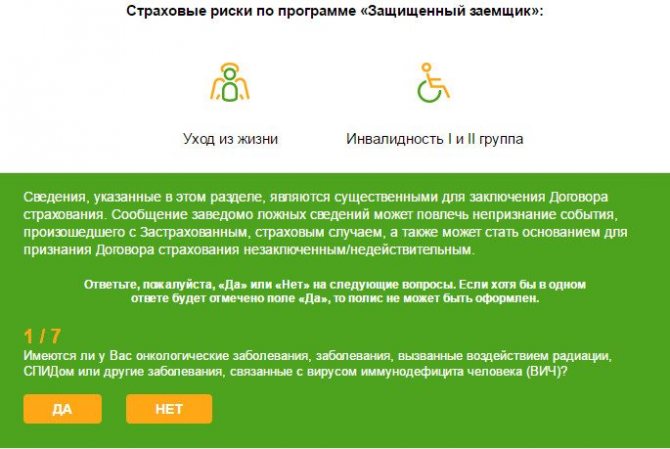

When registering life insurance remotely, it is enough to fill out a special form on the official website https://sberbank-insurance.ru/ipoteka/sales-mini/?step=1, which was developed for the Sberbank Protected Borrower policy. Insurance companies will issue a policy remotely and send the contract to the email address specified when filling out. Payment is made using a bank card.

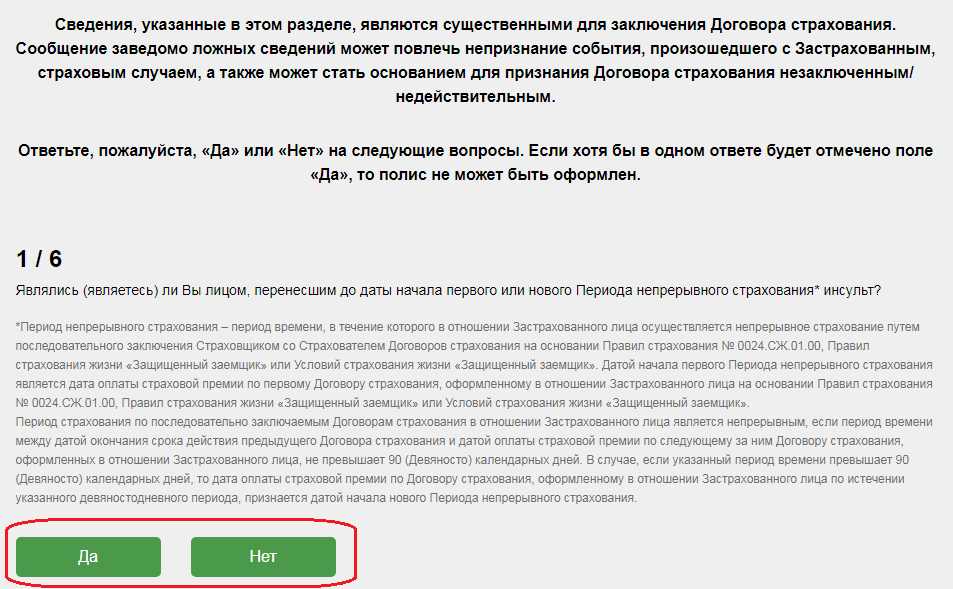

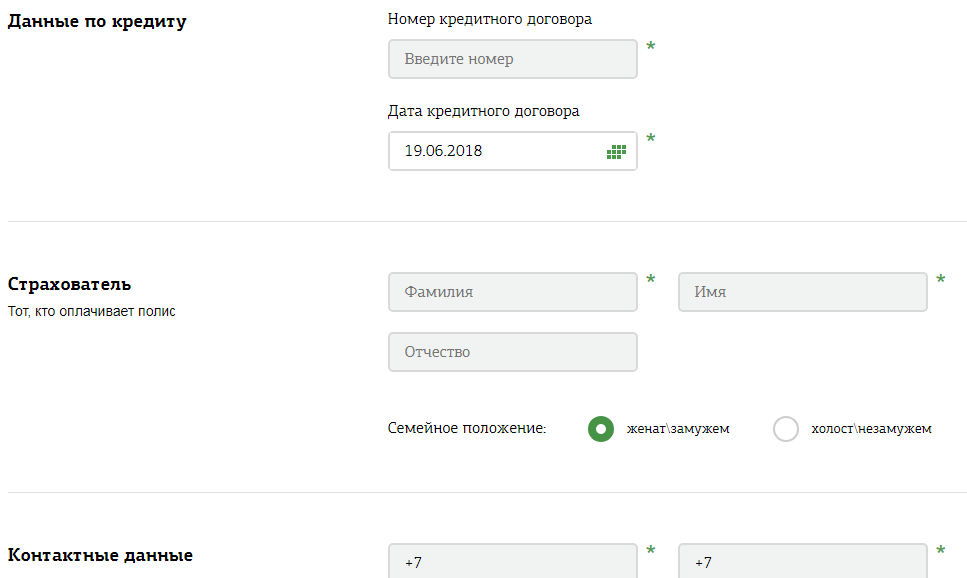

Read the questions in the electronic form that you will need to fill out to receive insurance under the Protected Borrower program at Sberbank

If you apply in person, you will need to visit the insurance company office; if the balance of debt on the current loan exceeds the amount of 1.5 million rubles, then you can conclude an agreement at any stationary branch of Sberbank.

Note: before applying, check the current amount of debt, since this is the amount that will be indicated in the contract and is subject to compensation. The size of the contribution also depends on the amount (1% of the current debt).

You can obtain the necessary information in the following ways:

- look at your own copy of the agreement concluded with the bank (there is a repayment schedule indicating the current debt for the entire loan period);

- contact the bank: in person or by telephone (call the Hotline);

- find out the balance through your personal online banking account.

List of insurance companies

If desired, the borrower can choose one of the insurance companies that participates in the Protected Borrower program in order to obtain insurance from it

Is insurance renewal necessary?

Yes, this definitely needs to be done in case of compulsory insurance. The property must be insured throughout the entire loan term. These conditions are specified in the contract and cannot be violated.

If we are talking about voluntary insurance, then the policy does not have to be renewed. But some risks will no longer be insured. And if an insured event occurs, you won’t have to rely on the policy. From now on, the borrower will solve his problems independently. Therefore, if it has already been decided that these types of insurance are needed, then it is better to renew the contract and obtain new policies.

Requirements for clients

One of the significant drawbacks of the program is the fact that not all citizens can afford to take out a policy. There are certain requirements for those who want to receive a policy under the “Protected Borrower” program from Sberbank Insurance:

- client age: for women – 18–55 years, for men – 60 years;

- Citizens with a certain list of diseases are not subject to insurance.

All insured citizens are entitled to receive funds in the event of disability or death. Only a limited number of people can expect to receive compensation when an accident occurs. The beneficiary under the terms of the agreement is the client or his heir.

How to apply for a “Protected Borrower” life insurance policy from Sberbank Insurance?

What to do if the renewal deadline is missed?

If we are talking about compulsory property insurance, then for the period until the property was insured, the bank will charge penalties and fines. Therefore, you need to monitor deadlines. If the borrower has temporary financial difficulties and cannot pay on time, the most reasonable solution would be to immediately contact the bank. You need to describe the situation in detail and ask to find a possible solution. Credit institutions willingly meet borrowers halfway if they do not try to hide from the bank or otherwise violate the terms of the agreement.

Is it possible to change insurance company?

It can be done. Firstly, such a replacement can happen for objective reasons. For example, the insurer will cease to operate or its license will be revoked. Then the client, in any case, will have to choose a new company from among those accredited by Sberbank.

Another situation is that another insurance organization may offer more favorable conditions. In this situation, the client has every right to terminate one contract and enter into a new one with another company. In fact, this can also be called a policy renewal. After all, only the insurer will change, but the very fact that property (or life and health) are protected will remain.

What Sberbank offers mortgage insurance

Sberbank insurance specialists are interested in arranging the maximum package of services for their client. As a result, when signing the contract, the borrower is offered not only apartment insurance, but also life insurance.

Life

When purchasing a life insurance policy, the lender reduces the rate by 1%. In the event of the death of the insured person or disability, the insurance company will pay off the debt. In this case, the property remains with the client or passes to the heirs by law in the event of death.

Approximate cost:

| Debt amount | Man | Woman |

| 1,000,000 rub. | RUB 5,180 | RUR 3,440 |

| 3,000,000 rub. | RUB 25,900 | RUB 10,320 |

| 7,000,000 rub. | RUR 36,240 | RUB 24,080 |

An approximate calculation is made on the condition that the insured persons are 35 years old. Having studied it, it becomes clear that the cost of the policy for men is higher.

The exact calculation can be downloaded through the calculator on the company’s official portal.

Insurance of collateral property

The contract insures the structural elements of the purchased property. The structural elements in the apartment are:

- walls;

- window;

- floors;

- doors.

When insuring a private house (building), this also includes the roof and foundation.

A policy is issued for 12 months and is renewed provided that the mortgage debt is not repaid.

Approximate policy price:

| Price | Apartment | House |

| 1,000,000 rub. | RUR 2,250 | RUR 3,150 |

| 3,000,000 rub. | RUB 6,750 | RUB 9,450 |

| 7,000,000 rub. | RUB 15,570 | RUR 22,050 |

Title Insurance

Title insurance is issued when purchasing real estate on the secondary market. Insurance risk – protection against loss of ownership rights to a purchased object.

The insurance company will compensate for losses incurred if the client loses property as a result of:

- an illegal transaction (for example, the seller will be an incapacitated person);

- documents were falsified;

- the seller sold the apartment under pressure;

- illegally carried out privatization by the previous owner;

- lack of consent to the transaction on the part of the spouse.

The cost is calculated personally. On average, the company takes from 0.10 to 1% of the debt amount. You need to take out a policy for at least 3 years.

Is it possible to refuse insurance?

You can only refuse voluntary types of insurance. If you take out a mortgage from Sberbank , these are any types except property. The borrower has the right to immediately refuse to sign the contract. Of course, usually the bank insists that without a policy it will be denied financing or the loan rate will be higher. But this is illegal because it violates the provisions of the Consumer Protection Act. Therefore, if the client is completely convinced that he does not need a voluntary insurance policy , he must insist on observing his rights. But we need to think about whether it’s worth losing this option of financial protection. It is unknown what may happen in the future, but you still have to pay the loan. So purchasing a policy is a more than reasonable decision.

How to get a life insurance policy

One of the advantages of this program is that the policy can be purchased online through the insurer’s website. This will take no more than 15 minutes.

Important! If the coverage amount is more than 1.5 million, the contract is drawn up only at the branch during a personal visit.

How to apply for a policy online

The simplicity and convenience of issuing a policy online captivates many Sberbank clients (reviews show that most people draw up the document remotely). In just a few steps and in 15 minutes, you can get life insurance without leaving your home. And you don’t need to take the documents to the bank, since the insurer will do it for you. You will receive an electronic version of the document to the specified email address.

The procedure takes place in 4 steps:

- Go to the Sberbank Life Insurance website.

- Fill in the details.

- Get an electronic policy.

- Pay for the policy in a convenient way.

Before you start making a purchase, you need to prepare for a certain list of questions regarding your health and lifestyle. The cost of the policy will depend on your answers, as it is influenced by various risk factors. In some cases, registration may be refused.

Important! Answers must be reliable. If important information relating to your health and other areas of life is concealed, the insurer has the right to invalidate the contract and terminate it unilaterally or refuse to fulfill financial obligations upon the occurrence of an insured event.

The insurer is interested in the following information about you:

- Having a stroke.

- The presence or absence of diagnoses such as cardiac ischemia, angina pectoris, liver cirrhosis, as well as oncology diagnoses.

- Having any type of disability.

- Cases of referral for compulsory medical or social examination.

- Is there any insurance under other programs in this company, the total coverage for which is more than 10 million rubles?

- Do you have a valid life insurance contract under this program and did you submit an application for consideration a little earlier?

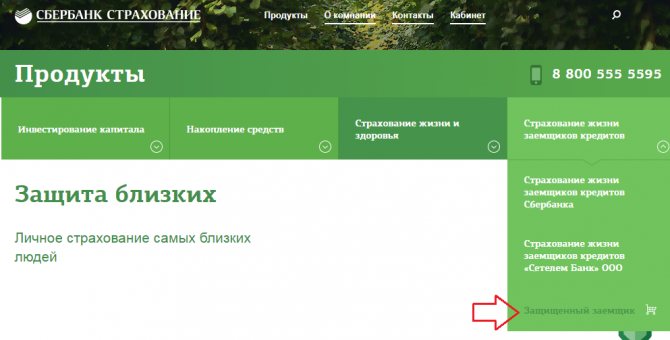

Step-by-step steps on how to apply for a policy online:

- Please visit the official website of Sberbank Life Insurance.

- On the main page, select the “Products” tab in the horizontal menu.

- Expand the list on the last tab regarding insurance of borrowers of loans, and select the last item “Protected borrower”.

- Find the "Buy" button.

- To get started, answer 6 questions.

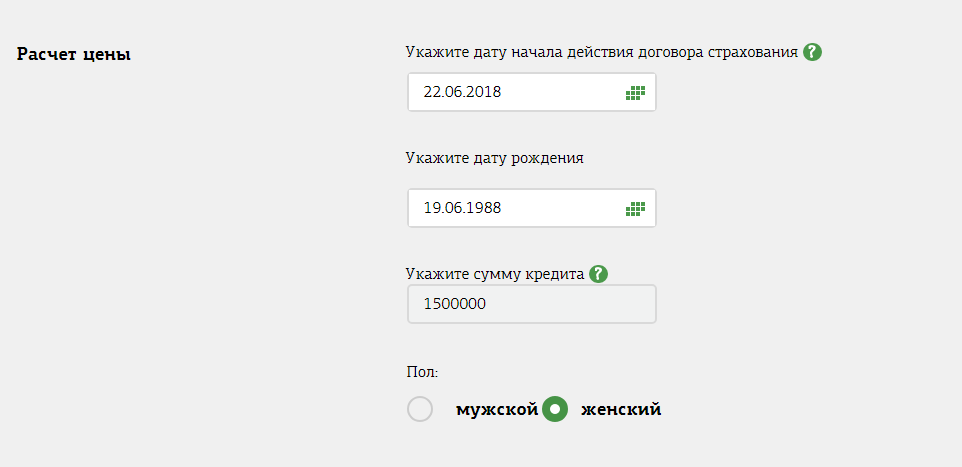

- Next, the system will redirect you to the policy price calculation page. Here fill in the required information: gender, date of birth, loan amount.

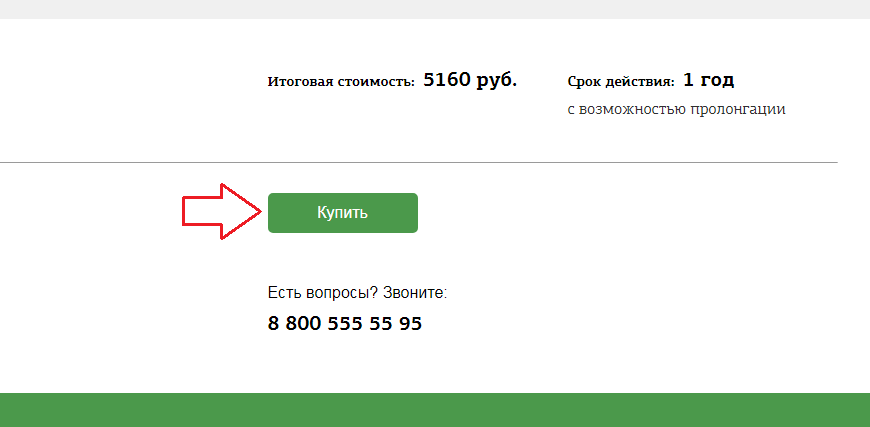

- If you are satisfied with the price, click the “Buy” button.

- On the new page, fill in the required fields (you must provide information regarding the loan agreement and the applicant’s personal data).

- After checking that the information provided is correct, click “Continue” and confirm the operation.

- Pay for the policy from the card in any convenient way.

Poll: are you satisfied with the quality of services provided by Sberbank in general?

Not really

Important! The contract begins to be valid no later than the third day after payment of the policy.

Is it possible to return the insurance?

The easiest way to get your insurance money back is during the “cooling off period.” It is 14 days from the date of signing the mortgage agreement. The borrower only needs to voice his decision in the application. The bank and insurance company are obliged to accept this document and return the money to the client within the period established by law. Of course, a certain amount will be deducted from the previously paid amount for the days that the policy was in force.

If the borrower repays his obligations to the bank ahead of schedule, he also has the right to a return of unspent money. After all, according to the agreement, the insurance policy applies only for the period during which the loan agreement was in force. In this case, the insurance company must recalculate only for this period, and the remaining funds must be returned to the borrower.

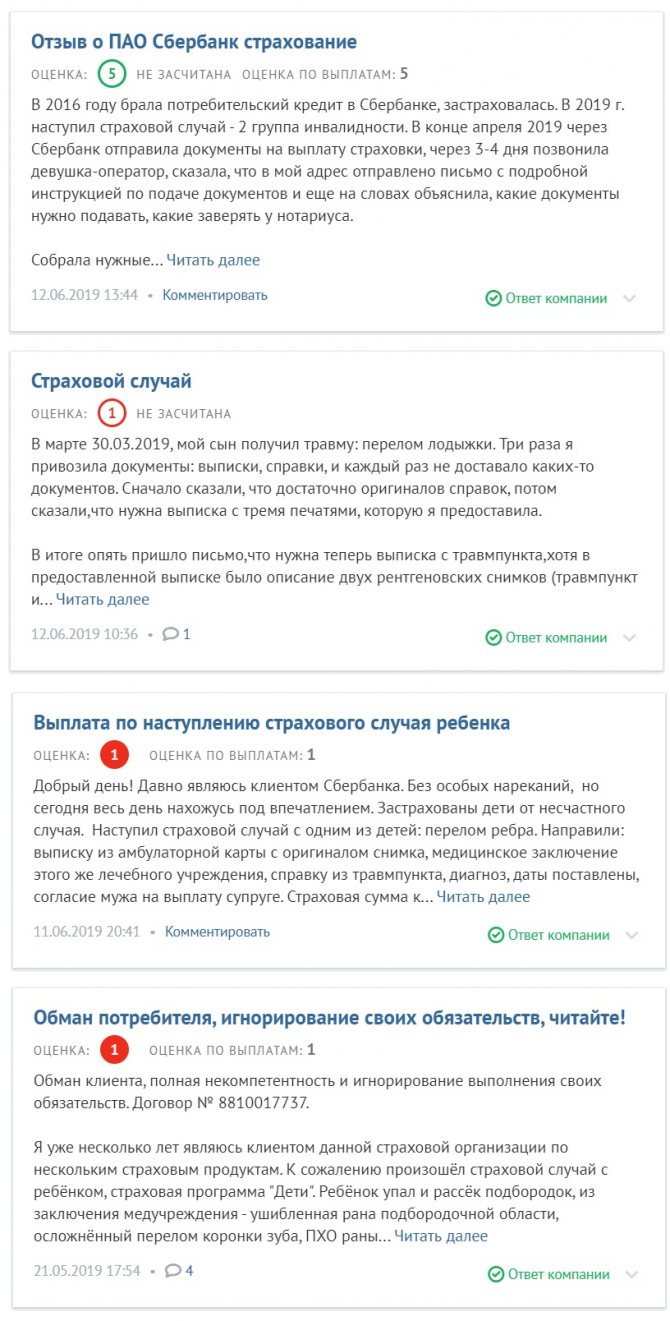

Reviews of Programs at Sberbank - Accident, Life and Health

The network contains a large number of reviews from Sberbank clients about the work of its insurance division. Although some users speak positively about the company's products, most commentators point out the following problems:

- Difficulties in returning clients' money in case of termination of the insurance contract during the cooling-off period.

- Delays associated with sending the insurance contract after payment.

- Incompetence of individual employees of the insurance company.

- Imposing insurance products when applying for a loan at Sberbank.

- Refusal to pay funds upon the occurrence of an insured event (with reference to missing the deadline for filing an application or the non-compliance of the incident with the terms of the contract).

- Ignoring customer requests.

- Problems associated with the receipt of funds by the heirs of the insured person (many citizens have difficulties in selecting documents and submitting them).

Listed above are the main reasons for dissatisfaction among insurance clients. Although some of them relate only to certain areas of the organization’s activities, IC employees have something to work on to improve the service.