What is title insurance for a mortgage?

Title insurance when purchasing an apartment with a mortgage is an optional type of insurance. Its registration is voluntary; credit institutions rarely insist on purchasing such a policy. Taking out a policy protects the client and the credit institution from loss of ownership rights to the purchased object.

Rights may be lost for the following reasons:

- illegality of concluding a purchase agreement (apartment, cottage, mansion, garage);

- the presence of false documentation when selling an object on the part of the buyer and/or seller;

- participation in the concluded transaction of incapacitated, minors and other persons who do not have the right to sign such agreements;

- invalidity of privatization of real estate.

Important! Title insurance is a type of voluntary insurance. Unlike disability insurance, credit institutions rarely impose such insurance policies on their clients when taking out a mortgage.

Title insurance does not always save you from losing your apartment

They constantly talk about the need to carefully check the history of an apartment, but in reality, even professional realtors and lawyers cannot guarantee that no one will ever encroach on the buyer’s property rights. It is believed that you can protect against loss of property rights with the help of title insurance - the Russian Guild of Realtors even proposed making it mandatory. However, as the editors of IRN.RU found out, title insurance does not always work. At least in its current form.

How property rights are deprived

According to Boris Sharonov, director of the NSKA risk department, about 2% of transactions per year are terminated by court decisions as a result of various lawsuits. Ownership can be challenged in many cases. These could be errors made during the registration of past transactions, or, for example, cases when the rights of the owner are presented by a person whose rights were violated during the privatization or alienation of real estate: say, at that time the person had not reached the age of majority, or was in prison, or was sick and incapacitated.

Also, the basis for claims may be the presence of a forged or forged power of attorney when making any of the transactions in the past, transactions using forged or forged documents, transactions carried out by incapacitated persons or persons who were under the influence of delusion, deception, violence, a combination of difficult circumstances or persons unable to understand the meaning of their actions or manage them, transactions in violation of the rights of co-owners of real estate or heirs and other defects in property rights.

You can lose your apartment if the seller suffers from mental disorders and is duly declared incompetent; the acquired property is subject to judicial seizure due to the debts of the former owner, as well as as a result of fraudulent actions.

Title Insurance

A mechanism designed to solve the problem is title insurance, which protects the interests of the owner in the event of an unexpected loss of the apartment. The insured risk in this case is the loss of a property due to termination of ownership for reasons beyond the control of the insured. The insurance covers the agreed amount (usually the market value of the apartment at the time of the transaction), and the title insurance agreement may also provide for coverage of the costs of conducting cases in court.

The first title insurance policy in Russia was issued in 1994. However, according to Boris Sharonov, title insurance did not officially exist until 1998, when insurance companies, including, in particular, Standard-Reserve, Rosgosstrakh, Leader, ROSNO, Spasskie Vorota, etc. received the first licenses to provide title insurance.

The expert gives an example from insurance practice: in 1995, a businessman disappeared; many years later, his daughter, having received with the help of certain “professionals” a certificate of his death and a will in her favor, sold her father’s apartment. “Subsequently, the transaction was contested by the relatives of the wife of the missing owner. Fortunately, the new owner of the apartment had a title insurance policy and managed to defend the apartment with the help of an insurance company lawyer,” says Boris Sharonov.

Nagatino i-Land Moscow, Southern District, Danilovsky district, Technopark metro station, ZIL metro station

Title insurance only gained momentum with the advent of mortgage lending. Banks, aware of the existence of title risks, insisted that borrowers insure the risk of loss of title when taking out mortgage loans. Today, most insurers engage in title insurance only within the framework of cooperation with banks, and rely mainly on the results of the bank check of the borrower and the purity of the transaction, therefore they conclude such contracts almost automatically. However, you need to keep in mind that in this case the insurance compensation will be received by the bank, and not by the buyer of the apartment. That is, in any case, he will lose his property, the bank will receive insurance, and the maximum that a person can claim is the difference between the insurance payment and the balance of debt obligations to the bank.

When they can refuse

According to the managing partner of Miel-Network of Real Estate Offices Tatyana Saxontseva, insurance companies sometimes refuse to conclude a title insurance agreement due to the high-risk history of transferring rights to the property: recent inheritance under a will, incorrect determination of shares, double sales of apartments in new buildings, violations rights of minors during privatization.

They may also refuse to insure an apartment acquired under a rental agreement, especially if less than a year has passed since the death of the annuity recipient, in the case of inheritance by distant relatives, or sale by proxy.

It should also be taken into account that insurance only applies to cases where the circumstances for payment of compensation arose independently of the insured. If the acquired property is transferred to other persons under a paid or gratuitous contract (even if the person was misled), he will not receive an insurance payment. In addition, payment may be refused if the insured object is not used for its intended purpose (for example, if a residential apartment is used as an office), if there has been a change in the characteristics, properties, design parameters of the property, if the object is subject to seizure from the policyholder (for example, by fiscal authorities) .

Underwater rocks

There are also not so obvious nuances. The first problem is timing. Most often, an apartment is insured for three years - the statute of limitations for claims in relation to real estate transactions is three years. However, firstly, in some cases the period can be extended to 10 years, and secondly, the plaintiff may insist in court that this period should not be counted from the moment the transaction was concluded, but from the time when the plaintiff learned that his rights were violated. “And he can find out, appear on the doorstep and threaten to sue in 10 or 20 years,” says Boris Sharonov. It is very expensive to pay insurance for all these years. The cost is usually 0.2-1% per year, and in particularly difficult cases it can reach 5%. That is, it’s tens of thousands of rubles a year for a budget apartment in Moscow.

Another important point is that insurance will not always cover the risks that the buyer thinks about when concluding an agreement with Elvira Dadasheva. – This means that if the reason why the owner may lose title due to claims of third parties arose before title insurance (and this is basically what happens), and the insured event occurred during the period of ownership, then the insurance company will not reimburse anything." Previously, such cases were very common and, in fact, were an indicator of the dishonesty of insurers - after all, in this case, insurance practically loses its meaning. Nowadays, events in the past are most often insured, but you need to read the contract carefully.

Rasskazovka New Moscow, Novomoskovsky district, Rasskazovka settlement, 7 km from the Moscow Ring Road

“In addition, the insurance company can challenge the fact that the loss of the property occurred for reasons beyond the control of the insured, citing the fact that the buyer did not check the documents well enough, for example, did not request a certificate of the seller’s legal capacity,” says the lawyer, president "Guild of Lawyers of the Real Estate Market" Oleg Sukhov. Therefore, title insurance does not eliminate the need to check documents and the history of the apartment.

Since title insurance is designed to protect the buyer only from risks associated with loss of ownership of the purchased property, it does not apply in the event of an encumbrance. For example, you bought an apartment and lived in it for a certain time. Suddenly, a man released from prison appears on the doorstep. Even if he never owned your living space, but was once registered in the apartment, he has the right to live in it, according to Art. 40 of the Russian Constitution, provided that he has no other home. In this case, title insurance does not work because no one is claiming your title. And you will have to share housing with a stranger.

Abroad

Abroad, the practice of title insurance is more widespread and provides more guarantees. First of all, thanks to a clearer definition of the concept of “title”. In Russian legislation, it essentially does not exist; it is not the title as such that is insured, but the risk of loss of property.

In Europe and the USA, almost all real estate transactions require title insurance. According to Igor Indriksons, a real estate investment manager and founder of the Indriksons.ru portal, in the United States, an object is insured once for the entire life of its owner and the insurer pays the client the amount necessary to purchase the same home at the time of the insured event. Let us recall that in Russia the amount of insurance is fixed (that is, it does not take into account possible changes in prices on the market) and the contract is concluded for a certain period.

In Canada and Germany, it is not title insurance that operates, but deed insurance - that is, guarantees are provided not by the insurance company, but by the state. Something happened - the state pays, and then itself deals with the violators and collects money from them. The contribution is paid in a lump sum at the time of the transaction and usually does not exceed 1-2% of the cost of housing. And, for example, in Austria the fee for the state guarantee is completely symbolic - 0.15% of the cost of the object.

According to experts, the best way to increase the efficiency of title insurance is to make it lifetime, since the risks of deprivation of property can arise at any time. However, in Western countries, where the history of an apartment is more transparent and the mechanisms for protecting the rights of owners are better established, it is actually more difficult to lose rights to an apartment. Therefore, inexpensive options for life insurance are possible. In Russia, such insurance will be very expensive.

Shome Moscow, Western District, Fili-Davydkovo district, Kuntsevskaya metro station, Slavyansky Boulevard metro station, Pionerskaya metro station

Pros and cons of title insurance

The main advantage of title insurance is the security of property rights of the bank client. Additionally, before concluding a transaction , employees of the insurance company conduct a preliminary examination, studying the legal purity of the real estate. This significantly reduces the likelihood of encountering scammers and signing an unfavorable contract.

Many real estate and mortgage lawyers urge borrowers to forgo personal title insurance. The reasons are as follows:

- If the property, in the opinion of the insurer, looks suspicious, then he will never insure it with a mortgage. Therefore, only fully checked and 99.99% clean objects are insured. The occurrence of insured events when using such policies is reduced to zero.

- If an insured event occurs, the insurer will necessarily prove in court and other authorities that not only the seller, but also the buyer (mortgage borrower) was dishonest. Insurance employees will be convinced that the buyer knew in advance about the impurity of the transaction. The insurance company will try in every possible way to terminate the agreement unilaterally without making the required payments.

Related article: Features of commercial real estate insurance, tariffs and registration procedures

Therefore, if we talk about what title insurance is for a regular mortgage, it is worth noting that for many potential policyholders it is not profitable.

Objects and risks of title insurance of real estate

A feature of title security is protection not from future events, but from those that have already occurred but are unknown to the owner. Title insurance of real estate provides protection against the following:

- The document was drawn up incorrectly from a legal point of view.

- Fraud.

- When making the transaction, the wishes of the second spouse were not taken into account.

- The rights of minor owners are not taken into account.

- The court decided that the person made the transaction while under delusion, violence or threats.

- The court declared the citizen who made the transaction incompetent or unable to answer for his actions.

- Other cases.

This policy allows you to protect your right to newly acquired housing. When insuring risks when taking out a loan secured by real estate or a mortgage, it is also recommended to take out this type of insurance in order to be able to receive compensation for the loan payment in the event of loss of the right to own the collateral.

Apart from rare exceptions, this procedure is carried out only with secondary market objects, which can be:

- apartment;

- house;

- non-residential premises, building;

- land plot.

Who can insure the title?

Only the buyer, whose name appears on the sales contract, can apply for title insurance. The buyer, if he decides to purchase such an insurance policy, is strongly recommended to contact the insurer before registering ownership of the property - this will ensure that his interests are truly protected. If, after studying the transaction and the object, the insurance company refuses to sell the policy to the buyer, then this is a serious reason to think about purchasing the object.

Important! New construction properties are not eligible for traditional title insurance. During the construction of the building, the apartments do not belong to anyone. After delivery of the house, the development company automatically issues the first rights to the buyer.

In what cases can the insurance company refuse to pay?

The insurance company may refuse to pay funds in the event of cases not covered by insurance, including exception cases.

Such cases include the following circumstances:

- The fault of the insured person for the loss of title, i.e. actual deprivation of the debtor's real estate and its transfer to the bank for non-payment of the loan;

- The insured person’s appeal took place after the expiration of the established period;

- The policyholder provided false information and did not contribute to the preservation of the property;

- The occurrence of the insured event was not confirmed;

- Compensation has been received from the person at fault;

- An exceptional case has occurred, which includes: flood, terrorist attack, earthquake, explosion, etc.

How to apply correctly?

Before executing a contract for title insurance for a mortgage, you must immediately clarify what the cost of the policy will be with the desired risks, the type of payment of the insured amount and other important points. The final cost is indicated in the contract.

It is recommended to obtain all mortgage insurance from one company. This approach makes the client more important to the insurance company, so he will be provided with additional consulting services when applying.

An agreement for title insurance must be completed before registering ownership of the property. Otherwise, there will be little point in obtaining such a policy.

For how long is the title insurance contract concluded?

You can take out an insurance policy that protects the ownership of real estate for a period of 1 to 10 years. In practice, such agreements are most often concluded for 3 years, since during this period a real estate transaction can be challenged.

Note: when concluding a contract for several years, the policyholder can save on paying the insurance premium. This is due to the fact that the first year of title insurance is the most expensive, since it is during this period that the risk of challenging the transaction is highest. Each subsequent year brings the expiration of the limitation period for the concluded transaction closer and reduces the risk of an insured event.

Cost of title insurance for a mortgage

The cost of an insurance policy for title insurance varies widely. The calculation of the premium to be paid to the insurer is carried out taking into account the total sum insured (usually the value of real estate is taken as a basis) and the tariff used by the insurance company. The rate for title insurance varies from 0.25 to 0.5%.

Important! After carrying out expert work to study the property, insurer specialists can apply increasing coefficients for title insurance (for example, if they suspect any risks of impropriety in the transaction). For example, suspicious points are: a large number of transactions for the purchase of apartments and houses from the seller or buyer, a short period of time since the last transactions were completed, etc.

Title insurance is an unpopular insurance product, which many experts recommend immediately abandoning. But if there are certain suspicions about the impurity of the transaction, then it is recommended to buy title insurance (especially if the insurer offers it at a low cost or in combination with life insurance or disability).

Video on the topic of the article

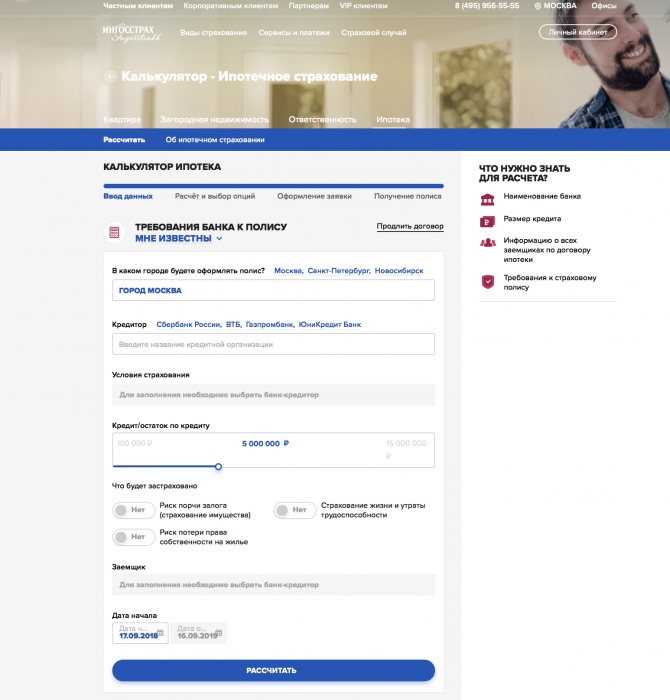

Insurance Process

For its clients, the company offers interesting and convenient working conditions, which include the possibility of long-term insurance for several years with the necessary payments made through a personal account on the Ingosstrakh website . As for the cost of insurance, it can reach 10-15% of the total amount of borrowed funds. To determine the most attractive price option, it is advisable to use online calculators. When you contact Ingosstrakh, you can receive the necessary approval within one day by taking out insurance not only for the property, but also for the life of the borrower.

Required portfolio of documents

To obtain mortgage insurance, the client needs to create a package of documents. It includes:

- Documents of ownership of real estate purchased under a mortgage;

- Application and medical certificates if the borrower’s life is insured;

- A set of title documents for title insurance.

Procedure for purchasing insurance

To apply for mortgage insurance on the official website, the user needs to complete a simple set of steps.

- Initially, you need to go to the company’s website, where you go to the appropriate section.

- Using the built-in calculator, a preliminary calculation of the cost of insurance is made.

- The city where the insurance was issued and the credit institution where the loan agreement was concluded are indicated.

- Information on the purchased housing, ready-made or in a house under construction, is indicated. Information on the mortgage loan rate is displayed.

- Using the scale slider, the amount of the loan balance is set when applying for a loan.

- Insurance items are selected that provide protection, for example, against loss of property rights or disability by the borrower.

- Information about the policyholder is entered, in particular his age, gender and other parameters offered on the site.

- The start date of the insurance policy is indicated.

- After this, all you have to do is click the “Calculate” button to determine the cost of the insurance document. The system will also show the amount of insurance coverage, but it is possible that the bank will require an increase in it, that is, the cost of the policy itself will increase.

- If the conditions proposed by the insurer suit the client, you can proceed to paying for mortgage insurance.

- After this, contact information is entered indicating the telephone number and E-mail address. They are needed to communicate with the employee's client.

- When the application is approved, the user will receive confirmation of insurance coverage indicating the application number.

- After this, an offer to receive a gift will appear on the screen, allowing you to receive discounts on other services of the domestic insurer.

Filling out an application on the insurer’s website is possible without organizing a preliminary determination of the cost of the policy. In this case, the client is required to enter contact information and data on the property being purchased. Data on the issued mortgage is also entered. After the application is completed, all that remains is to wait for the manager’s call.

The process of obtaining title insurance for real estate transactions

Title insurance of real estate transactions, as a developing area, does not have a clear mechanism of action. Therefore, you should carefully study the contract before signing. It may specify some nuances that affect the recognition of a case as insurable. Such as, for example, obtaining legal advice from organizations that do not cooperate with a particular company.

Registration of title insurance for real estate transactions

To conclude a contract, the following documents will be required:

- registration of property rights;

- copies of the passport of the client and the seller of the object;

- land plan;

- technical passport for housing;

- extract from the house register;

- documents on the alienation of the housing being sold over the past 5 years;

- a certificate confirming the right to inheritance, a copy of the will, a death certificate of the testator (when inheriting housing);

- permission of guardians, in the presence of minor owners;

- consent of the second spouse to a transaction with common property;

In individual cases, additional documents may be needed, such as a certificate from a psychoneurological dispensary, to confirm the buyer’s legal capacity.

Price

The price of title insurance typically depends on the appraised value, which is conducted by the title bureau. Title insurance most often costs 0.5-1% of the appraised value. The policy is purchased every year.

If an apartment costs, for example, 5 million rubles, then every year you will have to pay 25-50 thousand until the mortgage loan is fully repaid. It is possible to issue a policy for several years at once - from 1 to 10. Such terms were chosen for a reason, but were calculated by insurers. This option is more expensive, and the option of early repayment of the mortgage cannot be ruled out. So the best solution is to buy a new title insurance policy every year.

The price of this service depends on:

- The insured amount, which is equal to the estimated value of the purchased property.

- The insurance rate, which is set as a percentage by each specific insurance company.

- The period for which the contract is intended.

- Insurance scheme (meaning a list of covered risks).

- Other points that are established by each insurance company at its own discretion.

Insurance cost calculation

The contract price is calculated based on the tariffs approved by the internal regulations of Rosgosstrakh. Let's look at base rates for major products.

Life and health:

- For men: 0.1-0.8%.

- For women: 0.07-5.6%.

Property insurance:

- Residential and non-residential premises: 0.12-0.15%.

- Residential and non-residential buildings: 0.25-0.65%.

- Land plots: 0.08-0.1%.

Title insurance:

- Residential and non-residential premises: 0.15-0.2%.

- Residential and non-residential buildings: 0.2-0.35%.

- Land plots: 0.2-0.35%.

To calculate mortgage insurance, our portal offers a calculator. Let's look at how to use it correctly and what information is requested.

Calculator

To calculate the cost of life insurance for a mortgage at Rosgosstrakh, we suggest using a loan calculator. To receive information please indicate:

- Region of obtaining a mortgage.

- Property value.

- Insurance conditions.

- Start date of the validity period.

Afterwards, all that remains is to request a calculation, select an offer and arrange protection.

Advantages and disadvantages of this service

Main advantages:

- It is possible to conclude a title insurance agreement even before the purchase and sale is completed.

- Before concluding such an insurance contract, a pre-insurance examination is carried out, that is, the property is carefully studied from the legal side.

- Minimal paperwork is required to obtain title insurance.

- The insurance company that issued the title insurance may act in court as a third party.

- If the property is transferred to the previous owner (the purchase and sale transaction is declared invalid), then the buyer receives monetary compensation from his insurance company.

- The mortgage interest rate is automatically reduced.

Flaws:

- In order to conclude a title insurance agreement, you need to carefully select an insurance company. It is important to be sure that employees will thoroughly inspect the property before concluding a contract.

- Unscrupulous insurance companies try to pay out less money for compensation than the buyer spent on purchasing the property.

- High cost of the policy. In fact, it seems so only at first glance: it will not be more expensive than the bank increasing the interest rate due to the lack of an insurance policy. And even more so, the policy will not be more expensive than the losses that can be incurred if any problems arise with the apartment.

- If the new owner finds out that the apartment has been rented out for a long period of time, the title insurance agreement will not help. In fact, the owner has not lost his ownership rights, although he cannot fully use the housing (until the lease term expires).