In Russia, more and more citizens are receiving mortgage loans. In 2018, a new record was set: 1.5 million loans worth 3 trillion were issued. rubles Compared to 2020, their number increased by 50%. Those who already have a mortgage have passed the stage of collecting documents. And yet, the number of people wishing to take out a loan to buy an apartment is growing, so we continue to publish publications for those who are still planning to draw up documents. This will help to conclude a deal according to all the rules. Today’s material talks about how an apartment should be assessed for a mortgage.

Why do you need an apartment appraisal for a mortgage?

An important component when concluding a mortgage agreement is assessing the value of the property. This requirement is put forward by the Federal Law “On Mortgage”. Since the bank is issuing a loan for a large amount, it wants to receive collateral equal in value to the loan amount or higher. If a loan is issued for the purchase of housing, then it is the object of collateral. This is precisely why real estate valuation is carried out.

The amount a financial institution will issue as a loan depends on the market and liquid value of the apartment. The minimum price is taken into account. This is how the bank insures itself in case the borrower flagrantly violates the loan agreement. In such a situation, the financial institution will be able to sell the mortgaged property at a price that will cover losses.

It is also important for the borrower to evaluate the apartment for a mortgage. In this way, he will be able to understand whether the price for the property requested by the seller is acceptable. Also, thanks to this procedure, the borrower can be sure that if he is unable to repay the mortgage debt on time, the contract will be terminated through the sale of the apartment at the current market price.

[offerIp]

It is beneficial for the bank that the price of the property is not artificially inflated, since the sale of real estate will not compensate for all losses on the loan. But if you look from the other side, it becomes clear that the borrower, like the realtor, is interested in getting the maximum possible loan and conducting a transaction with the largest amount. Thus, in order for the contract to be beneficial to all parties, it is necessary to order an examination.

Let's list why the bank and the client need an apartment appraisal for a mortgage:

- For the bank, this is insurance in case the borrower is unable to fulfill the terms of the contract. Since the property being purchased is an object of collateral, the credit institution must understand at what price it will be able to sell it if the client does not pay the debt. In addition, to determine the maximum mortgage amount, the financial institution focuses on the liquidation value, that is, the price in the event of an urgent sale of real estate.

- The borrower will be confident that if due to unexpected circumstances, for example, serious illness or divorce, he is forced to sell the apartment, then its price will allow him to repay the debt to the bank in full. Otherwise, he will lose his home and will have to pay the missing amount on the loan.

- The client will know how much the apartment costs on the market, and in the future can bargain with the seller if the latter quotes an inflated price.

- This is another check of the deal’s “purity”. Both the lending institution and the borrower will be confident that the property is not encumbered, there have been no illegal redevelopments, and it is not a dilapidated property. In addition, such an inspection will reveal shortcomings of the apartment that were not reported by its owner.

Why do you need to do a real estate appraisal and what is it?

When a bank issues a large loan, it bears certain risks of non-repayment. Firstly, mortgage loans are often issued for a long period of tens of years. Secondly, the borrower’s financial situation may deteriorate at any time, which will make it impossible to make the monthly payment.

In order to obtain a guarantee of return of money on a mortgage, the bank is forced to require the provision of collateral, which is the property being purchased with a mortgage.

If the borrower stops paying the loan, the collateral property is forcibly sold, and the proceeds from the sale go towards repaying the debt to the bank.

In mortgage practice, a mortgage is used - a security that acts as a guarantee for the bank. It is this document that will allow the lender to transfer ownership of the collateral property if the borrower is unable or unwilling to fulfill financial obligations.

Mortgage appraisal – activities aimed at establishing the liquid and market value of the property. This is necessary so that the parties to the agreement can understand what amount can be received from the sale of the collateral property in the event of an inability to fulfill financial obligations to the bank. Also, this indicator sometimes affects the size of the maximum loan that a borrower can receive.

The assessment is carried out by accredited organizations, and the borrower has the right to apply to any of them. At the same time, the bank offers a list of companies that meet the requirements of Sberbank.

The cost of the appraisal is paid by the borrower, and without a report from the appraisal company, it will not be possible to obtain a mortgage from Sberbank.

Documents for appraising an apartment for a mortgage

Only after you have chosen an apartment and agreed with the seller on the purchase, you can evaluate the apartment for a mortgage. What documents are needed to formalize an agreement with an appraiser?

Companies that provide this service do not require many documents. Some companies may request photos of the apartment from different angles. But it would be correct if the appraiser himself comes to the site and takes the necessary photographs. However, this may increase the cost of services. Keep in mind that a personal visit will have little effect on the assessment result, since the algorithm for analyzing the value of real estate is the same in both cases.

If an apartment in a new building is being assessed for a mortgage, then the list of required documents is as follows:

- An act of acceptance of the object, which states the postal address of the living space, and not the location of the building.

- Participation agreement.

- Borrower's passport.

As a rule, no other papers are needed; all information for the report is in the contract and in the act. But each company has its own requirements. Find out from the company's employees what they need in order to make a report.

When a resale property is pledged, it is considered that the housing has already been the property of the borrower for some time, and accordingly, he has all the necessary papers. In this case, to order an apartment appraisal for a mortgage, you will need the following documents:

- Technical passport of BTI.

- Certificate of state registration of housing.

- A purchase agreement, gift agreement, or other similar document that confirms that you are the owner of the property.

- Client's passport.

In some cases, you may be asked for other documents:

- A copy of the cadastral passport, which the owner of the living space receives from the BTI.

- A certificate confirming that the house is not being demolished. If the apartment is in a new building, then such a certificate is not necessary.

- When buying a home with a mortgage in a house built before 1960, a certificate of flooring is required. The reason is that in old houses there are often wooden floors, which are a fire hazard. Insurance companies understand that in this case the likelihood of an insured event occurring is high. They do not want to take risks and therefore refuse to cooperate with the bank. And if there is no agreement with the insurer, then you will not be able to take out a mortgage.

After the borrower has collected a package of documents, he needs to agree on an independent assessment of the apartment for a mortgage. An employee of the appraisal company comes to the property and performs the necessary actions, after which he draws up a report with all the necessary information about the property.

Validity period for real estate assessment

The assessment of real estate objects is carried out if it is necessary to find out their objective average market value.

All factors that influence the final price are considered. Among them are not only the parameters of the object itself, but also the economic, general market, and political situation.

What is the validity period for a real estate appraisal provided by law? This is a popular question among individuals, lawyers, and company accountants.

The problem is that there is no clear answer to it in the law. The validity period for assessing the market value of real estate may vary depending on the specifics of the procedure and the property itself.

This is important to know: Responsibility of the management company for filling the apartment

If assessments are regular, the results of each expert report will be relevant until the next one is drawn up. At the same time, the federal standard establishes the maximum validity period of the assessment - it cannot be more than 6 months.

After its expiration, the found value can be used, but this is not recommended. All controversial issues are resolved in court.

Who pays for the mortgage appraisal of the apartment, and who carries it out?

Who pays for the appraisal of an apartment with a mortgage? The client himself must decide the issue of appraising the apartment. He also pays all expenses associated with this procedure out of his own pocket. There will be no compensation from the bank, even if the mortgage is denied. For this reason, a credit institution often does an analysis of the object itself. If the cost of housing is acceptable and there is no reason to refuse the client, then the latter is obliged to pay the costs to the appraiser. In most cases, banks work with specific companies that are accredited. They accept reports from them without any complaints. Of course, according to the law, the client has the right to contact any other company. But then you should expect the bank to make comments about every letter and number in the report.

There are situations when the appraiser’s services are paid for by a credit institution. For example, if she sues a borrower who does not fulfill his obligations. In this case, you need to know exactly how much it costs to appraise an apartment for a mortgage. Since an unscrupulous client does not repay the loan debt, then you should not expect him to pay for the services of the appraiser.

An object can be assessed by persons who have a special certificate confirming their qualifications. Such a specialist can be found in a company that evaluates real estate, or you can enter into a separate employment contract with him. If we are talking about appraising an apartment for a mortgage, then you need to understand that there are independent and accredited appraisers.

Independent specialists. Such appraisal companies either did not want to receive bank accreditation or do not meet the requirements of the credit institution. Lack of accreditation is not a reason to assume that an independent appraiser is doing a poor job. However, the bank may reject the reports of such specialists for a variety of reasons. Therefore, it is better to order an apartment appraisal for a mortgage from a company that is accredited.

Specialists accredited by the bank. These are companies that are accredited by the bank because they meet its requirements. The credit institution recommends a list of accredited specialists to its clients. Such cooperation is beneficial to both parties. First, accredited appraisers become bank clients. And secondly, they provide reports in the form approved by the financial organization. Thanks to this interaction, appraisers receive a constant flow of customers. Sometimes, by agreement, the appraiser pays the bank an agency commission.

It is preferable to evaluate an apartment for a mortgage from companies that are accredited. Their list can be found on the website of any bank. Please note that a particular appraiser may not be accredited by all banks. This means that his report may not be accepted somewhere. This should be taken into account by those who do not yet know which bank will apply for a mortgage.

From the list of appraisers, choose the one whose services cost the least and who can complete the work on time. Price in this case is a more important indicator. The deadline most often does not matter; besides, appraisers usually prepare a report for no more than a week. In general, all such companies operate under the same conditions and provide the same services.

What requirements do credit institutions place on an appraiser?

- He must be a member of an organization that is engaged in valuation activities. The organization must be registered in the Unified State Register of Legal Entities.

- The appraiser must have a civil liability insurance policy in the amount of at least 300,000 rubles. Such security eliminates the risks associated with an error as a result of the apartment appraisal examination.

- The appraiser must be a member of an SRO (self-regulatory organization) that deals with the activities of appraisers.

Keep in mind that in such cases, the lending institution is very scrupulous about checking the apartment appraisal report. Often documents are asked to be revised. Banks place greater trust in those companies with which they cooperate on an ongoing basis, and the results of their assessment are approved faster.

It is also convenient to choose an accredited organization because then the client does not need to check the papers confirming the appraiser’s qualifications. It is imperative to check the relevant qualifications if you contact a company that is not accredited by the bank. The financial institution will return the report if it was compiled by a person who is not authorized to engage in appraisal activities.

How is an apartment appraised when purchasing with a mortgage?

There is a list of recommendations for assessing residential and non-residential real estate for collateral. They were compiled by the Association of Russian Banks. They are consistent with the Federal Law “On Valuation Activities” and federal standards. The recommendations describe in detail how an apartment is assessed for a mortgage.

The assessment procedure looks like this:

1. The client submits an application to the appraiser or appraisal company . For this you need the following documents:

- establishing property rights;

- cadastral passport or extract from it;

- BTI registration certificate or extract from it;

- Explanation of the apartment diagram and floor plans.

2. The appraiser checks whether the specified documents contain enough information to make an analysis . Perhaps he will require other papers. This may be a certificate about the presence of encumbrances and redevelopment.

3. The appraiser visits the property to inspect the apartment and the house in which it is located . During the visit, he checks whether the structures and area correspond to those indicated in the passports. It also takes photos of damage found inside and outside, such as leaks or cracks. Analyzes the state of communications.

4. The appraiser then prepares a report, taking into account the requirements of the financial institution and the law . If the contract does not specify the type of value being assessed, the specialist calculates the price of housing on the market.

Legislation allows the appraiser to determine value in three ways: comparative, cost, and income. But in fact, the comparative method is used. How does this happen:

- The appraiser determines the state of the real estate market in general and in a separate segment, for example, housing in Moscow.

- Then he selects analogues - apartments for comparison. They are almost identical to the object of evaluation, differing only in some characteristics.

- For similar apartments, the specialist finds parameters on which the sale price depends. This could be the condition of the apartment, its area, floor, year the house was built, infrastructure, transport links, etc.

- Based on the results of comparison of the appraised apartment and similar ones, the prices of analogues are adjusted. Thus, the price of the apartment on the market is determined.

What is the term for appraising an apartment for a mortgage? The procedure takes from one to five days. The cost of services is influenced by many factors. In particular, the region, the luxury of the property, the bank for which the report is being compiled. On average, the cost varies from 2500 to 6000 rubles.

When performing calculations, the appraiser takes into account parameters that affect the assessment result:

- Location and area of the property.

- Availability of transport.

- Condition of the apartment, availability of repairs.

- The year the house was built and the degree of wear and tear of the property.

- Floor, condition of the entrance and landing.

Due to what factors can the cost of an apartment be higher?

- The presence of isolated rooms, especially if the windows face different sides of the house.

- Separate bathroom and toilet.

- Balcony or loggia with glazing.

Many people believe that good, expensive renovations increase the cost of an apartment. This is true only in the case of market price. This does not affect the liquidation price.

What factors can reduce the value of real estate?

- The apartment is located on the first or last floor.

- There are signs of fire or other serious damage in the entrance.

- Bad view from the windows.

- The redevelopment was not legalized. In this case, the owner of the apartment will be asked to register it.

- Unfavorable environmental situation in the area.

The figure indicated in the report will be relevant for approximately 6 months. The reason is that the appraiser cannot predict with absolute accuracy what the situation on the real estate market will be in the long term.

Even if you ask an expert to name the cost of the property before the assessment is carried out, he will not be able to do this, since he does not have all the data on the apartment you are interested in.

The credit institution takes into account the liquidation price of housing, which is 10-30% below the market price. There are situations when the market value of an apartment suits the client, but since the liquidation price is always lower, he may be denied a mortgage. Or the bank will ask you to reduce the requested loan amount.

In this case, do not ask the appraiser to inflate the value. It is unlikely that a specialist will put his reputation at risk. If the bank, which always checks the report, becomes aware of the fraud, this could have a bad effect on the borrower.

If a specialist appraises the apartment at an amount less than what you planned to take out on credit, then try to appraise the apartment for a mortgage from another company. There are cases when appraisers do not take into account some parameters. If the second specialist approved the same or approximately the same price, then we advise you to bargain with the seller. Otherwise, you will have to look for another apartment or make a larger down payment than planned in order to thus reduce the mortgage amount.

Stages of compiling an assessment album

The procedure for assessing real estate for obtaining a mortgage is divided into three stages. First, the client and the appraiser agree on the cost and time of the procedure and draw up an application.

To analyze the condition of an apartment with a mortgage, you will need the following documents:

- Extract from the Rosreestr of Real Estate (USRN). The document must contain current data.

- Explanation of the architectural design of the building, floor plan or technical passport of the BTI.

- A copy of the borrower's passport.

At the second stage, the appraiser comes to the site for a visual inspection. The expert takes photographs of the apartment, compares the information provided with the actual technical characteristics, and confirms the absence of illegal redevelopment.

At the third stage, a specialist from the appraiser company directly compiles an appraisal album for the mortgage.

Valuation of real estate for lending involves the use of three approaches simultaneously: cost-based, profitable and comparative. The complexity of the procedure allows us to take into account the following important details:

- Location of the property - district, microdistrict, nearby buildings, distance from the industrial zone and infrastructure.

- The general condition of the building in which the apartment to be assessed is located. The specialist takes into account the number of floors, type, and year of construction.

- The condition of the apartment - living and total area, number of floors, as well as the presence of balconies or loggias and layout.

All this information allows you to determine the cost of liquidating the collateral.

The evaluation album corresponds to:

- ARB standards;

- established requirements of AHML;

- personal standards of the financial structure itself.

How an apartment is appraised for a mortgage from Sberbank and VTB

How is an apartment appraised with a Sberbank mortgage? According to the algorithm described above. The list of appraisers who are accredited by this bank can be found on the website. Independent assessment services include:

- Inspection of the apartment.

- Preparation of a report with photographs and copies of documents.

- Justification of the assessment performed.

- Submitting the report to the bank.

The assessment is carried out in accordance with the requirements of the financial institution, so Sberbank accepts such reports without any problems and issues a positive response to obtaining a mortgage.

The procedure for appraising an apartment for VTB 24 is carried out according to the same scheme as for Sberbank, so there is no point in talking about it in detail.

What should be reflected in the apartment appraisal report for a mortgage?

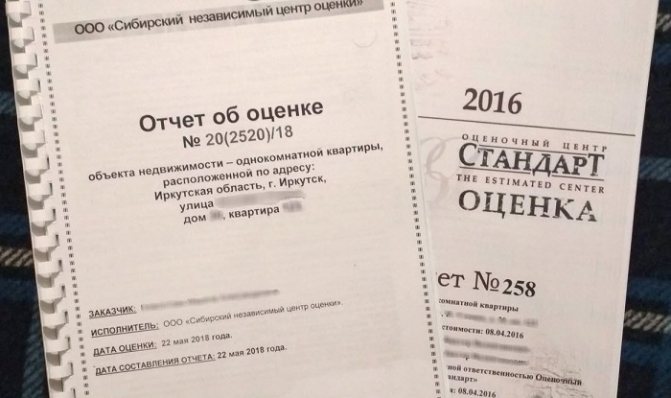

Based on the above information, the appraisal company prepares a report. It contains the following data:

- Information about the appraiser and the customer.

- Assessment method.

- Detailed description of the assessed living space.

- Statistical data from the analysis of the situation in the real estate market.

- Market and liquidation value of the property.

- Attachment with photographs and other documents.

All data mentioned in the report must be confirmed by calculations, expert opinion, documents and other resources that are considered serious enough to be taken into account when evaluating an apartment for a mortgage.

Financial institutions advise adhering to the following requirements:

- The characteristics of the apartment should be based on documents that contain the qualitative and quantitative parameters of the object.

- When analyzing the real estate market, the appraiser is obliged to provide evidence that the housing is liquid. Therefore, if the object is located in the Tver region, there is no need to provide a description of the Moscow market.

- Liquidity is how quickly a property can be sold. The bank offers the following levels of liquidity.

- The report should always be accompanied by high-quality and meaningful photographs of the house and the area around it, the entrance, and all rooms of the property.

- The report must explain why other methods of determining value were not used.

- The report on the analysis of similar apartments should contain their location so that their proximity to the property being assessed can be compared on a map.

- All analogues must have direct links, for example, leading to Avito or CIAN. The seller's contact information must be included. Copies of advertisements must also be attached to the report. This is necessary so that the expert can verify the information provided.

As a result of appraising an apartment for a mortgage, you will know how much the property is worth on the market. The bank will focus on this price when determining the loan amount. It will not be higher than that determined during the assessment. It happens that a potential home is priced lower than the seller's price. What can be done in this case?

- show the seller the real market value of the apartment, try to bargain with him;

- re-evaluate in another organization, you will also have to pay for the services a second time;

- add your own funds, so you can increase the amount of the down payment;

- look for another place to live, make and pay for a new report. Perhaps this time the market value will match the desired loan amount;

Mainly, bank employees get acquainted with the appendix - the final part of the report, which contains a photo of the object, documents, and a description of the market and liquidation value.

As a result, the apartment appraisal report for a mortgage consists of 25-30 numbered and laced A4 sheets, certified by the signature of a specialist and the seal of the appraisal company.

The bank determines the period during which the report is considered valid. Therefore, it makes sense to order an assessment shortly before you go to the lending institution.

For example, Sberbank accepts appraisers’ reports that were made no earlier than six months before applying for a mortgage. Other financial organizations have similar requirements; they may differ only slightly in terms of terms. Information about this can be obtained from specialists at bank offices or by calling the hotline.

What needs to be done after appraising an apartment for a mortgage? Having received the report, the borrower brings it to the bank. Employees check that all documents are available, that they are authentic and that they do not contain errors. If the verification was successful, the bank informs the client of a positive decision on issuing a mortgage and offers to complete the transaction.

When evaluating an apartment for a mortgage, what factors positively influence the bank’s decision?

There are some points that influence the positive decision of a financial institution to issue a mortgage and determine the final loan amount:

- The liquid price of the property must be equal to or greater than the loan amount. In this case, the bank will issue a loan.

- A written agreement must be concluded with the appraisal company. These are the legal requirements. In addition, in this case the client will be able to request correction of the appraiser’s errors, if any.

- Photos of the living space, landing and entrance must be of high quality. It is recommended to do them during the daytime.

- The purpose of the real estate examination – evaluation of the apartment as a collateral – must be indicated in the report.

The estimated value may be reduced due to information contained in the Limitations and Assumptions section. It clarifies some details and also indicates the appraiser's personal assumptions. Thus, it may be stated that for certain reasons the specialist was unable to photograph certain areas of the apartment. Therefore, he only describes them based on his own guesses. Controversial issues and inaccuracies make the value of real estate lower.

What is the cost of appraising an apartment for a mortgage?

How much does it cost to appraise an apartment for a mortgage? There is no single price for these services. All firms or practicing appraisers have the right to offer their own rates.

The cost of the real estate valuation procedure is influenced by several factors:

- The region in which the client lives and the appraiser company is registered. Doing an examination in the capital is more expensive than in a small town.

- The degree of complexity of the assessment procedure.

- The base value of the property being assessed. The more expensive the property, the greater the amount of work associated with the examination, which increases the cost of the service.

- Location of the property being assessed. If it is located far from the appraiser's office, then the specialist will have to spend time and money to get to the site, so the customer must pay travel expenses.

If you give specific figures, then appraising an apartment for a mortgage can cost from 3,000 to 6,000 rubles in large cities and the capital. In the regions, prices for examination range from 2,000 to 3,000 rubles. Exact rates can be obtained from the appraisers themselves, who can calculate the full cost of services in each specific case.

Contents of the evaluation album

The evaluation album contains:

- Summary general information about the property, the assessment result obtained using the income, cost and comparative approaches, as well as the final value of the property.

- Assessment task: the name of the subject of analysis, property rights to it, as well as the purpose of the report, the intended application of its results and the restrictions associated with it. Be sure to indicate the date of the procedure.

- Assessment standards.

- Brief information about the customer and appraiser.

- Assumptions and limitations that the expert used when performing the procedure.

- Description of the object with links to documents.

- Color photographs of the apartment.

- Market analysis with a separate section about the segment to which the object of evaluation belongs.

- Detailed description of the assessment process.

- Directly estimate the price of the apartment.

- Detailed justification of the methods and coefficients used.

- Coordination of the results of a comprehensive property assessment.

- Attachments – copies of documents provided by the client to complete the procedure (extracts from the register, passport and floor plan).

The price of a mortgage appraisal book depends on the urgency of preparation, the object and additional difficulties in the process of providing the service. A reputable appraiser company discusses all financial issues with the client before concluding an agreement to perform the procedure.