Legislation

When buying an apartment with a mortgage, the person who receives the property often leaves the buyer an advance or a deposit. The Civil Code of the Russian Federation (Article 380) states that the deposit is an amount that is transferred from the buyer to the seller as payment for the goods and acts as evidence of the seriousness of intentions. The preliminary agreement for making a payment is drawn up in writing. The main difference is that if obligations are violated, the funds are not returned, but the advance payment goes back to the buyer without any consequences.

In addition, Article 454 of the Civil Code of the Russian Federation describes the procedure for transferring the subject of the transaction, and Article 381 discusses the consequences that a violation of the requirements of the preliminary agreement entails. There are also a number of legislative acts regulating the process of transferring money when purchasing real estate into a mortgage.

Important nuances

To purchase a sales contract with an advance payment and a deposit of legal significance, it is important to indicate a complete list of data:

- list all property owners and buyers;

- enter reliable passport information (full full name, registration addresses) of all participants in the transaction;

- indicate the amount of the deposit, the price of the property in figures and words, the period during which the payment is made, and the method of transferring funds. If this is not done, the seller can unilaterally extend the contract for an indefinite period and increase the price;

- enter the characteristics of the apartment/house: cadastral number, floor, area of the premises, etc.;

- obligations and rights of both parties in cases of unfair performance or failure of the transaction.

When planning to purchase an apartment with the conclusion of a deposit agreement for a mortgage, you must notify the lender of your intention in advance. If the credit institution approves such a transaction, the amount of the deposit paid will be deducted from the down payment figure.

Further procedures for obtaining a deposit when purchasing an apartment with a mortgage are exactly the same as without it. The parties to the transaction sign a bilateral agreement on the deposit. A copy of the contract and a receipt from the seller confirming receipt of cash or transfer to a bank card are sent to the bank.

Another important aspect is confirmation of ownership of the apartment. The deposit should not be transferred before the owner provides a recent extract from Rosreestr.

Before concluding a transaction, you need to study the payment receipts of the former owner. If there is a debt to utility services, it must be stated in the preliminary agreement. Otherwise, paying off the debts will fall on the shoulders of the future owner.

Recommended article: Nuances of obtaining a mortgage before marriage: division, maternal capital, judicial practice

Often buyers contact the seller through real estate agencies. This option is convenient because... saves the client's time. Part of the contribution can be transferred through an intermediary - an office employee. If a realtor asks for a deposit for an apartment under a mortgage, a notarized power of attorney must be drawn up for him in compliance with all aspects.

Main rules

The stages of transferring a deposit (advance payment) include drawing up an agreement between the parties (drawn up in writing), as well as filling out a receipt that confirms the fact of transfer of cash when purchasing a home. Main rules:

- The agreement specifies the amount of funds that are given to the seller, as well as the conditions and day of payment of all funds. The date for concluding the basic agreement is also specified here.

- The person who sells the property confirms ownership of it.

- All owners of the property being sold (if there are 2 or more of them) participate in the registration process.

The law allows the transfer of money when buying an apartment with the participation of two parties. But it is better if a third party is present - for example, an employee of a notary office, a lawyer or a representative of a real estate agency. When controversial issues arise, the mentioned persons act as witnesses.

Deposit agreement and sample agreement

The need to conclude an agreement on the transfer of the deposit provides guarantees for the completion of the main transaction for the purchase and sale of real estate. This agreement legally regulates the further actions of both parties.

Below is a detailed sample of a deposit agreement for the purchase of an apartment.

Agreement on deposit

Moscow 04/25/2020

Vladimir Ivanovich Petrov, hereinafter referred to as the seller, and Igor Anatolyevich Rostov, referred to as the buyer, entered into an agreement as follows:

- The buyer transfers to the seller a deposit in the amount (the amount is indicated in numbers and words) in accordance with the concluded purchase and sale agreement.

- The buyer may receive the deposit back if the contract is terminated before execution begins.

- The deposit is returned in double amount if the seller refuses to sell the property.

- The buyer does not receive the deposit back if I voluntarily refuse to purchase the property.

- The party that is responsible for failure to fulfill the terms of the contract is obliged to compensate for losses incurred after the transaction is unsuccessful.

- Resolution of possible disputes under the terms of the contract by mutual consent voluntarily (negotiations, sent letters, telegrams).

- Other issues that arose during the preparation of documentation must be resolved on the basis of the legal norms of the current legislation of the Russian Federation.

- The legal force of the agreement arises from the moment the document is signed by all parties to the transaction and is valid for the specified time. Upon expiration of the term, the obligations under the contract cease to apply, but the parties remain liable for violation of the conditions specified in the document.

This agreement was drawn up by the parties listed below in Moscow on April 25, 2020 in 2 copies for each of the parties.

Signatures of the parties:

Full name Buyer Full name Seller

agreement on deposit when purchasing an apartment here

Subtleties of drawing up a contract

Documentation that confirms the fact of issuing a deposit (advance payment) must be drawn up correctly, indicating the conditions, information about the participants and subject to compliance with legal requirements. It is worth considering that the nuances of paperwork in each agency or bank may differ, so it is important to obtain the information of interest directly in the office or on the organization’s website. As a rule, the mentioned structures post a sample receipt and agreement implying the transfer of an advance payment when purchasing a home.

If we are talking about purchasing an apartment or house with a mortgage, you must notify the banking institution of your desire to transfer the deposit. The latter subtracts the specified amount from the down payment amount. Funds can be transferred in cash or transferred to an account (card).

Drawing up documents when purchasing real estate with a mortgage is no different from a classic transaction:

- The agreement is drawn up in two versions - for one and the other party.

- A copy of the above-mentioned paper is made and sent to the creditor bank.

- The buyer issues finance in the agreed amount.

- The recipient of the funds (seller) draws up a receipt.

- A copy of the receipt is provided to the creditor bank.

The agreement is drawn up in accordance with the law, if the owners of the property are specified in it, the parties to the transaction are indicated, information about the cost of housing and the amount of the deposit (advance) is mentioned. In addition, the document must contain information about the real estate itself and liability for failure to comply with conditions.

Deposit size

The law does not establish the amount of money that is transferred to the seller as a deposit; the parties determine it independently.

There are two calculation options:

- A percentage of the total cost of the purchased property. Usually this is no more than 5% of the price, but by agreement, the amount of the deposit can be 10-15%. In the latter case, it may completely cover the initial payment, so it is important to notify the bank about the transferred amount and regulate the moment when the deposit is taken into account as a down payment.

- Fixed amount. In standard cases, it is 50-100 thousand rubles, but it can change up or down, provided that the parties agree to this amount of the deposit. In this situation, the amount of prepayment does not depend on the value of the property or other factors; only the agreement of the parties to the transaction is important.

The amount of the deposit is indicated in the purchase and sale agreement - preliminary and main.

Subtleties of transferring funds and drawing up an agreement

When drawing up a preliminary agreement during the purchase process, it is important to specify the definition (nature) of the amount transferred. If the document does not stipulate that the money is a deposit, the court will consider the payment an advance. As a result, if the buyer refuses to purchase, the seller will be obliged to return the money, because they do not have the function of securing a transaction between the parties. The obligations of the participants in the purchase and sale (under the terms of Article 359 of the Civil Code of the Russian Federation) are secured by the guarantee of third parties, a pledge or a bank guarantee.

Payment amount

The size of the deposit is not specified by law, and the issue is resolved through agreement between the parties to the transaction.

Today there are two ways to determine size:

- As a percentage of the property price. As a rule, the advance amount is up to 5%, but there are situations when payments reach 10-12% of the housing price.

- In a fixed form. In this case, the size of the payment does not depend on any factors. As a rule, this amount ranges from 50 to 100 thousand rubles (by agreement of the parties). The size can change up or down (the law does not prohibit this).

In this case, the amount of the deposit (advance payment) must be indicated in the agreement between the parties.

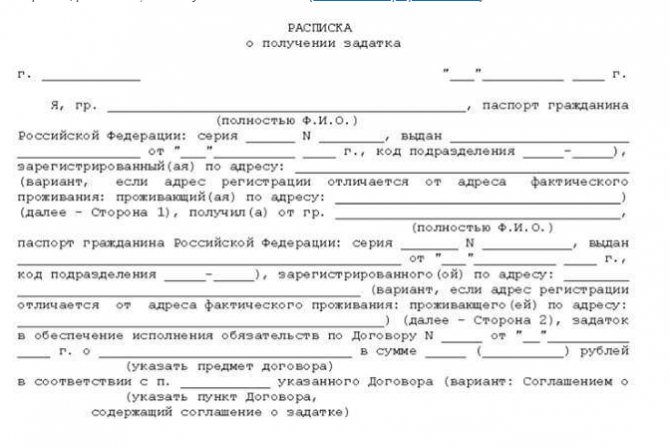

How to issue a receipt?

When purchasing an apartment with a mortgage or directly (if a decision is made to transfer the contribution), the seller must write a receipt confirming receipt of the money. The document is drawn up on white paper and without a specific form. The main thing is that it reflects the following points:

- Document's name.

- Personal information of participants.

- The cost of purchasing real estate (determined taking into account the cadastral or market price).

- Day of transfer, scope, goals and reasons.

- Date of execution of the basic contract.

- Brief description of the object (address, numbers of documentation that establishes rights to real estate).

- Conditions for refund (in case of delays in the execution of the basic contract).

- The nuances of counting the transferred amount into the total cost of the apartment (including when applying for a mortgage).

Both parties sign the receipt (after checking the information specified in the document). The best option is if two people are present during the transaction, who, if necessary, will confirm the fact of the transfer of funds. The money is given immediately after receipt of the receipt. It is the responsibility of the recipient to ensure that the agreed amount has been transferred to him. The recount is carried out in the presence of witnesses.

Advantages, disadvantages and possible risks

Let's consider what the use of a deposit gives. For both parties, this is a certain guarantee that the deal will not fall through at the last moment due to the fact that one of the parties simply changed its mind about concluding it. This is especially important in the case of a mortgage, since this is sometimes a long and labor-intensive process of collecting documents. In turn, for the seller, failure of the transaction may be fraught with the loss of another potential buyer and a delay in the sale.

For bona fide participants in the transaction, the risks are minimal. The main problem when buying an apartment with a mortgage is the bank’s refusal to issue a loan (more details: about popular reasons for refusal of a mortgage from Sberbank). Typically, housing is selected in parallel with the submission of an application, and you don’t want to miss out on a good property while the bank is considering it. The seller pays a deposit, and after that the bank refuses the loan. Refunds can be a problem if you don't plan for this situation in advance. Next, we will consider popular questions regarding the use of a deposit when purchasing a home with a mortgage.

If the bank refuses a mortgage

When purchasing a home with a mortgage, any actions must be taken taking into account the fact that the bank will refuse the application. This point is best discussed in advance with the seller and reflected in the agreement on the transfer of the deposit. There are two possible scenarios when a mortgage is rejected:

- The agreement was signed before the bank made a decision to issue a mortgage loan. In this case, the seller may refuse to return the deposit, citing lost time and loss of other buyers. If this situation is not specified in the deposit agreement, the buyer will have to try to claim the money through the court.

- The bank rejects the mortgage transaction if the seller has any problems with the documents for the apartment. In these circumstances, the buyer has the right to demand a double refund of the deposit. Read more: about which housing is suitable for a mortgage.

How to use a deposit as a down payment

The buyer can use the earnest money as a down payment. But in practice, the amount of the deposit is significantly less than the amount required by the bank. The credit institution must be notified of the settlements made and provide documents confirming the transfer of the deposit: a preliminary agreement and a receipt.

In this case, the purchase and sale agreement must specify in detail from what funds the buyer will pay the full cost of the apartment:

- own funds;

- deposit;

- mortgage loan.

Thus, the deposit can and should be taken into account when making payments to the bank.

Purchasing through a real estate agency

Registration of the transaction through a real estate agency does not fundamentally change the procedure for signing an agreement on the transfer of the deposit. The parties enter into an agreement in the presence of an agent, and the receipt is drawn up in the same way. By agreement of the parties, the deposit amount may remain for temporary storage at the real estate agency. In this case, the agency representative provides a receipt for accepting funds.

In the modern real estate market, both financial instruments appear - both an advance payment and a deposit. The choice of one or another prepayment method in most cases depends on the seller. At the same time, he does not always agree to accept the deposit - after all, the mortgage transaction is long-term, and a buyer with cash may appear at any moment. Therefore, in the case of a mortgage, the presence of a deposit is more beneficial to the party purchasing the apartment, especially if it is transferred after the bank has made a positive decision on the loan.

What does the seller risk?

During the sale process, the owner of the apartment bears the greatest risks. But each situation is individual and there are no uniform recommendations for protecting interests. To avoid problems, it is important to ensure that the contract is drawn up and a number of information are indicated in it (listed above). In addition, the seller must be sure that the buyer has funds to complete the transaction.

It is worth considering the following points:

- The method and date of transfer of money when purchasing an apartment with a mortgage or cash.

- Subtleties of mutual settlements (specified in the contract).

- Option for transferring money (the best option is using a safe deposit box).

It is worthwhile to carefully study the buyer, because the latter may assure that he is ready to make a transaction, but in fact he does not intend to make a purchase due to various circumstances. Depositing a certain amount and drawing up a preliminary agreement allows you to avoid risks and ensure the seriousness of the second participant.

In what cases can the advance be returned?

Deposit and advance have different definitions in law. The advance payment for the purchase of an apartment on a mortgage is not returned, even if the deal falls through. This point is extremely important to take into account so that there are no problems with refunds.

Nuance. If we are talking about an advance, we can get by with the definition of prepayment, since in the legislation any payment in addition to the deposit is considered an advance.

Based on this, it is necessary to indicate in the contract what payment is transferred to the seller - a deposit or an advance payment. Even if you go to court, the money will be considered an advance unless it is expressly stated that it is a deposit. In this case, the seller has no obligation to return the money, even if he decides to sell the apartment to another buyer.

The obligations of the parties are regulated by the third party to the transaction - the bank.

Thus, drawing up an advance agreement when purchasing a sale is quite risky; it is important to indicate that the transferred funds are precisely a deposit. In this case, they can be returned, in accordance with clause 2 of Art. 381 Civil Code of the Russian Federation.

How to return the deposit if a credit institution refuses a mortgage?

There may be situations when, when applying for a mortgage, the bank refuses to issue funds. Here the question arises of how to return the money previously transferred. To avoid difficulties, it is important to carefully approach the preparation of the preliminary agreement. It is important to indicate in it the amount that is paid for the purchase of real estate, as well as the amount of funds that the banking institution issues within the mortgage. It is necessary that the document describes the guarantees, as well as the consequences for failure to fulfill obligations. It is important to indicate that the deposit is returned to the buyer if the credit institution refuses to formalize the agreement.

What if the bank refused?

This circumstance is often not taken into account when drawing up preliminary agreements.

The seller, in case of refusal of a mortgage to the buyer, can always refer to the fact that he has lost clients and time. And the buyer will have to try to return the deposit through the court.

Important : if the contract does not stipulate the conditions for the return of money, the buyer may lose his funds.

Therefore, even at the stage of drawing up the preliminary contract, it is necessary to take into account and specify the terms of return. In particular, it should be a mandatory clause that if the credit institution refuses to carry out the transaction, the advance will be returned in full.

How to apply for a refund?

Situations end well when the parties fulfill their obligations. But this doesn't always happen. Several situations can be distinguished here:

- The buyer changed his mind and demands a return of the previously transferred funds. The seller has the right to expect compensation for costs (in full or in part, depending on the terms of the agreement).

- The owner of the apartment kept silent about the problems with the property and delayed the sale. In this case, the buyer has the right to demand a double refund.

- The buyer received a refusal from the bank, and the other party does not want to give the funds. The consideration of the case is transferred to the judicial authority, which in most cases is on the buyer’s side.

Advance, deposit, pledge - similarities and differences

The difference between a pledge and a deposit and an advance lies in the functions performed and their purpose in mortgage lending. The security role is inherent in all three concepts; the penalty is not specified only in the contract for an advance payment. Without collateral and deposit and advance payment, it is impossible to carry out any transaction for the sale of real estate and its purchase.

The reason for the confusion in the interpretation of terms can be attributed to the difference between an advance and a deposit. The easiest way to understand the difference between a deposit and an advance when purchasing real estate is to look at the example of unfulfilled agreements.

If the advance is cancelled, the money goes back to the buyer in full. No one loses anything financially. The degree of culpability of the counterparties is not taken into account when the event is disrupted. This is the ideal outcome of events when one person returns money to another without trials or litigation. If one of the parties refuses to return the funds to the other, then the opponent begins collecting evidence to resolve the conflict. The outcome depends on how well the documentation was drawn up.

If the contractual terms of the deposit are violated within the prescribed time frame, one party is obliged to pay monetary compensation to the injured person. If the initiative to terminate the agreement comes from the buyer, then the amount given to the seller is not withdrawn. If the owner of the property fails to fulfill the obligations endorsed in writing, the amount is returned to the buyer in double amount.

Recommended article: Rural mortgage at 1 percent

Exceptions include only the sudden death of the seller or force majeure events that lead to damage to the property beyond the possibility of its restoration. Then the penalties are canceled. Cancellation of a contract is not beneficial to anyone. If the transaction takes place, the deposit becomes part of the payment.

The Civil Code of the Russian Federation describes deposit and advance payment as unequal terms. Their essence is spelled out in and. Only the deposit is subject to legislation. The law of the Russian Federation interprets the payment as an advance payment if the contract did not indicate that the payment was a deposit. In an advance payment agreement and a deposit agreement, the difference is determined by the semantic content .

The pledge, unlike the above methods of depositing a share of the total amount, does not operate with money. It is expressed not in money, but in property units. A pledge agreement is concluded when real estate is the subject of obligations under a loan (mortgage) agreement. Simply put, the object itself (house, apartment), taken on a mortgage, is the subject of collateral ().

Borrowers often ask whether it is possible to get a mortgage loan without making a down payment. This is possible, but it happens quite rarely. The state has clearly defined the list of persons who can qualify for preferential conditions with a zero rate: military personnel, families of teachers, doctors, participants in various programs, for example, Young Family or using maternity capital, etc.

It turns out that getting a mortgage at a zero rate is quite difficult and not always convenient. Credit institutions put forward a number of additional requirements: purchase only from a specific developer, an expanded list of documents. A down payment for a bank is a way to protect itself from insolvent and unscrupulous citizens.

In the event of failure by the mortgage debtor to fulfill its obligations, the creditor bank has the right to receive back the issued loan. To do this, the property is put up for auction to recover losses.

There is another term - prepayment. The Civil Code of the Russian Federation considers it equivalent to an advance payment (ground). However, there is a small nuance: an advance is a part of the funds, and prepayment is a selective concept and can be paid either partially or in full. In common parlance, an advance payment is called an advance payment; business style, of course, uses the term advance payment. A deposit has a completely different purpose, different from an advance payment.

The procedure for returning money in case of dishonest fulfillment of obligations of the prepaid payment system is exactly the same as for an advance payment. Is the advance or deposit or prepayment refunded? The clear answer is all three methods of calculation, but depending on the conditions.

Useful cheat sheets: Stages of buying an apartment on the secondary market with a mortgage with maternity capital

Buying a new building with a mortgage: instructions

Buying a secondary apartment with a mortgage: step-by-step instructions

Subtleties of drawing up an agreement for a mortgage at Sberbank

The principle of buying an apartment in Sberbank with a mortgage has a number of differences. In particular, after receiving approval, the credit institution allocates 120 days to find suitable housing and resolve legal issues.

During this period, it is necessary to prepare papers and draw up an agreement. At the same time, Sberbank does not put forward strict requirements for the house, but sets them for the living space. The latter must be legalized. In addition, execution of a preliminary purchase and sale agreement is mandatory. It should contain a description of the size of the deposit (advance) and the specifics of their return. In addition, the buyer transfers the advance payment to the account of a banking institution, which is an additional guarantee for the seller.

We draw up a receipt

If one party transfers funds towards a future purchase, the one who receives them must write a receipt confirming their receipt. The document does not have a legally established form, but there are requirements for content.

The receipt must indicate:

- Name;

- personal data of the parties to the transaction;

- the price at which living space is purchased (taking into account cadastral and market value);

- date of transfer of funds, purpose and reasons for receiving them;

- the fact of their receipt;

- date of signing of the main purchase and sale agreement;

- characteristics of the subject of the transaction - exact address, details of documents confirming the rights to the property;

- conditions for the return of funds (if the transaction does not take place due to the fault of the seller);

- the fact that the transferred amount is included in the total purchase price (or the down payment for a mortgage).

The receipt is approved by the signatures of the parties. To obtain legal force, the presence of the parties to the transaction is sufficient, but it is advisable to invite two witnesses who, if necessary, will confirm the fact of the transfer of funds.

Finance is transferred immediately after signing the receipt, the seller must make sure that he receives the full amount immediately on the spot. Witnesses are present during the recount.

How to draw up an advance agreement - sample

In order to correctly draw up a document on the transfer of an advance payment when purchasing real estate (on a mortgage or directly), it is advisable to have a sample agreement before your eyes. The contract states:

- Place and time of registration (at the top), that is, the name of the locality and the day of conclusion.

- Information of the parties - full names, addresses, information from the passport and telephone numbers.

- Information about the apartment - the object of the transaction, the price of housing and the date of execution of the basic contract.

- The amount of the deposit or advance (in numbers and text).

- Features of money transfer.

- Rights and obligations of participants (when filling out, the Civil Code of the Russian Federation, Article 381 is taken as a basis).

- Indication of the validity of the contract from the date of signing.

- Force majeure and its effect on the document.

- Details of the buyer and seller, as well as their signatures.

How to draw up a deposit agreement when buying a home with a mortgage

The deposit agreement should be drawn up taking into account the fact that the housing is purchased with a mortgage. For the buyer, this nuance is of fundamental importance, since the bank counts the deposit as a down payment, and if the mortgage is refused, the possibility of its return remains possible on the basis of clause 1 of Art. 381 Civil Code of the Russian Federation. It states that if the obligation is terminated due to the impossibility of its fulfillment, then the deposit must be returned. At the same time, there is no clear definition of what constitutes a loan refusal falling under this formulation. Therefore, in the deposit agreement it is necessary to indicate the conditions for return in the event of a negative credit decision of the bank .

In addition, when signing the contract, it is necessary to check the following information in the text:

- Full names of all property owners;

- passport data of all participants, residential addresses;

- cost of the apartment;

- deposit amount;

- descriptions of the technical characteristics of the apartment (address, area, floor, etc.).

If necessary, the agreement should be supplemented with a clause indicating any details that are significant for the participants. The document is drawn up in 2 copies. It is not necessary to have it certified by a notary. A sample deposit agreement can be downloaded from this link.

Important! After transferring the deposit, on both copies the seller must write in his own hand that he received a certain amount (in numbers and in words, name of currency), full name, date and signature.

The difference between an advance and a deposit

Deposit and advance are two different concepts from a legal point of view, which, in no case, should be confused or generalized.

The main difference is that the deposit is a payment confirming contractual obligations under the contract being concluded.

The deposit, in case of non-compliance with the terms of the contract, or its termination by the buyer, is not refundable until the purchase and sale transaction is completed.

An advance payment is an advance payment made by a person interested in purchasing, as part of a concluded agreement for a house or land, guaranteeing the proper fulfillment of obligations. A transaction that fails for various reasons is a reason for returning the advance payment in full.

Entities who have agreed to transfer the advance amount as an initial repayment of the cost of real estate must necessarily enter into an additional agreement, which can be notarized or notarized. A prerequisite is his written conclusion.

Sample of a receipt

Vladivostok 04/25/2018

Receipt for receipt of funds

I, citizen of the Russian Federation Antonina Vladislavovna Mironova 04/25. 2020 (indication of passport data with registered place of residence) received from a citizen of the Russian Federation, Maxim Vladimirovich Ivanov (passport data, registered place of residence) an amount of 50,000 (fifty thousand rubles) under a previously concluded agreement on the purchase and sale of an apartment.

The calculation was made in full, so I have no complaints.

Seller's signature (full name)

Buyer's signature (full name)