A prenuptial agreement for a mortgage plays a decisive role in maintaining the inviolability of the rights of each spouse. In addition, it allows you to save a little money for the family, as it eliminates the need to insure a co-borrower.

In order to retain the right of ownership of real estate under any life circumstances, it is necessary to correctly formalize and consolidate your property relations with your spouse. This is usually done by signing a prenuptial agreement.

Quite often, the only way to purchase an apartment is a bank loan.

Basic Concepts

Before we begin to consider the rules for drawing up a marriage contract to resolve issues of credit housing during the division of property, we must first become familiar with the basic concepts.

- A mortgage is a lending agreement on the basis of which real estate is purchased. This is a document that has legal force for the borrower’s debt obligations to a credit institution, most often a bank. Housing purchased using borrowed funds from the bank automatically acts as collateral for the loan until the debt is fully repaid along with interest for the provision of this banking service.

- A marriage contract is a legal document that is concluded on a voluntary basis and establishes the property rights of each spouse, as well as their children. It may also designate rights to individual property that will not be subject to division after a divorce. When signing a marriage contract, the regulation of Article 34 of the Family Code, which stipulates that property acquired during marriage must be divided in half between the spouses, is annulled.

After concluding a marriage contract, Article 42 of the Family Code takes effect, which establishes the rules for the contractual nature of the division of property.

The distribution of shares and other relations between spouses in a marriage contract must be verified and confirmed by a notary. Despite the contractual basis of such a document, it should not have clauses that will limit the rights and freedom of the second spouse in an illegal manner. The convenience of a marriage contract is that it can be signed at any stage of family life and solve many issues, including the division of mortgage housing, which according to the law is not always divided in a fair manner.

Pros and cons of a prenuptial agreement for a mortgage loan

A prenuptial agreement for a mortgage has its pros and cons .

advantages can be mentioned :

- delineates the rights of husbands and wives to housing;

- determines the scope of the spouses’ obligations under the mortgage loan;

- insures the financial risks of the parties in case of unequal financial situation;

- makes it possible to get a loan even in case of objections from the second spouse.

Many citizens believe that love and mercantile calculation are incompatible concepts. Therefore, they are in no hurry to conclude a marriage contract. Most often, the agreement is signed at the insistence of the bank.

The procedure has some disadvantages :

- high cost of notary services;

- if new legal requirements are introduced, changes must be made to the agreement, otherwise it will be invalid;

- it is difficult to foresee all controversial situations;

- the contract comes into force only after the marriage is registered.

If, under the terms of the marriage contract, the apartment goes to one owner, the bank may provide a loan on less favorable terms. If there is no co-borrower, only the income of one spouse is taken into account, so the loan is issued in a smaller amount.

Why do you need a prenuptial agreement for a mortgage?

In most cases, lenders require spouses to enter into a prenuptial agreement before taking out a mortgage. This is done to protect the property interests of the creditor, since there is a risk that if a divorce occurs, the couple will stop making payments due to loss of solvency. If the agreement has already been drawn up, then resolving the issue will be much easier.

The couple provides the bank with the original signed agreement, which specifies the procedure for dividing property rights for all types of property. The bank may accept the contract or, if the terms are not suitable for the lender, may require a change in the agreement. Such a requirement is legal.

Important! If a couple has drawn up a prenuptial agreement after opening a mortgage, but has not agreed on this issue with the lender, then the financial institution can cancel the agreement in court.

Before applying for a mortgage

Drawing up a contract is advisable under the following circumstances:

- Unequal distribution of income in the family. Example – one spouse is employed, provides for the family and pays the mortgage. Having a contract will protect against claims to property from the second spouse.

- The borrower was only one spouse, whom the bank refused to apply for a loan. The reason is unreliable solvency. Having a contract ensures that together the couple can pay off the debt.

- Lack of consent of the second spouse to apply for a loan. According to the law, all property transactions after the official registration of marriage can only be concluded with the notarial consent of the official husband/wife. A prenuptial agreement makes it possible to obtain a mortgage without the consent of the other partner.

- Receiving unofficial income. If the profit cannot be documented, the bank will not agree to issue a loan.

- The couple decided to purchase real estate before getting married. All material goods purchased before marriage are considered personal property and cannot be divided. The presence of a contract will confirm that the purchase was made jointly and the loan was repaid from the very beginning through joint efforts.

During the mortgage

You can draw up a contract, but only with the written consent of the bank.

The lender's property rights directly depend on who will pay the loan and whether the borrower can guarantee his continued solvency.

After paying off your home loan

A marriage agreement can be drawn up at any time before the divorce (Article 43 of the Family Code).

The contract may mention all benefits that have already been purchased or will be purchased in the future. If the couple does not draw up a contract, the mortgaged apartment will be conditionally divided in half.

What is a marriage contract

The procedure and conditions for signing a marriage agreement between a man and a woman are regulated by the rules of the Family Code. In particular, Article 40 of the mentioned law states that a marriage contract is a bilateral document signed by a man and a woman, containing the procedure for the distribution of property rights to all existing objects of movable and immovable property, as well as the formation of such in the future when making large, general purchases.

Attention! An agreement can be drawn up between the bride and groom before marriage (including before filing an application for registration of legal relations with the registry office), as well as at any stage after marriage. It is possible to sign such a contract on the eve of the planned divorce, which avoids litigation with the division of property.

Moreover, a prenuptial agreement for a mortgage is a prerequisite. On the one hand, spouses receive guarantees that after paying off the debt, each of them will receive a fair share in the rights to own the home. On the other hand, there is a bank that can be sure that in the event of termination of the marriage relationship, the spouses will continue to repay the loan for the apartment.

How does a prenuptial agreement for an apartment purchased with a mortgage differ from a standard one?

To analyze the differences, just look at the comparison table:

| Peculiarities | Mortgage | Standard |

| What issues does it cover? | Applies only to obligations to the bank and property purchased on credit | Covers all issues of property and financial nature |

| Bank value | Increases the guarantee of timely mortgage payments. Increases the chances of getting a home loan approved | Has virtually no effect on the decision of a financial institution to approve a loan if the document does not contain a chapter on mortgages and its details are not indicated |

| Division of property and debt obligations after divorce | Either spouse can pay off the debt | There may be no clause on repayment of debts to the bank regarding a specific apartment |

Sample marriage contract for a mortgage in Sberbank and Rosselkhozbank

No bank can oblige borrowers to enter into a marriage contract when applying for a mortgage, but the presence of this document in some cases increases the likelihood of loan approval.

Sberbank does not have a unified form, so spouses can draw up an agreement on their own or seek help from lawyers. If the document is concluded at the time of registration of the loan, the lender must be warned about this.

Rosselkhozbank has a standard form, but it is not necessary to adhere to it. If borrowers decide to enter into a contract after the mortgage has been issued, they can do so on official letterhead from the financial institution.

Mortgage and prenuptial agreement on separate property

When applying for a mortgage, a marriage contract allows you to delineate the property rights of spouses upon divorce. Such an agreement between the parties can be concluded before the formalization of the marriage relationship, or during the marriage. The prenuptial agreement sets out the property and financial rights of the spouses during the marriage.

When spouses enter into a contract, it can indicate that the property after a divorce goes to the spouse who financed the purchase. Also, under the contract, it is possible to divide property in unequal quantities if the parties mutually agree on such an agreement.

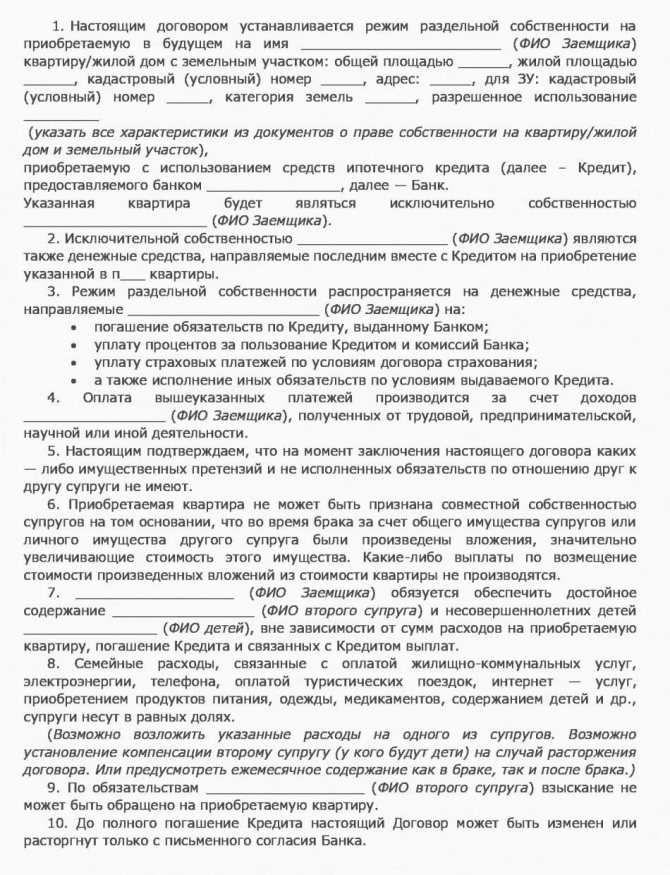

Marriage agreement for a mortgage (sample)

The legislation does not define the strict form of the marriage contract, but the following blocks of information must be included in the content of the document:

- passport details of the spouses;

- name of the document (nuptial agreement);

- conditions of a contract;

- the day on which the document comes into force;

- signatures of participants;

- date of registration.

Only property issues can be included in the content, otherwise the agreement may be considered void.

In order to determine the procedure for repaying the loan, the following questions must be included in the content:

- method of repaying the mortgage (jointly, one by one);

- from what income the loan will be repaid;

- the procedure for dividing property after full payment of the mortgage;

- debt repayment algorithm in case of divorce;

- children's property claims;

- liability of the parties for violation of the terms of the contract.

Sample of a separate part of the mortgage agreement (can be included in the current marriage contract):

What issues need to be approved

Before you come to a lawyer or notary to conclude a marriage contract, think in advance what questions need to be raised. Here is a rough list of questions:

- who is the main borrower and owner after the mortgage is paid off;

- the amount of the monthly contribution for each spouse;

- conditions of the down payment;

- Who bears the costs associated with applying for a mortgage - insurance, appraisal, bank commission;

- how the mortgage will be paid off after divorce;

- what happens if one party refuses to pay the mortgage;

- Will it be possible for the debt of one spouse to be covered by the other;

- how the division of real estate will take place;

- is it possible to redistribute property;

- Who is responsible for distributing the debt?

- whether children claim shares in the mortgaged apartment;

- reflection of the shares of each spouse.

A prenuptial agreement can only regulate the material side of the divorce process. There should be no clauses about personal relationships.

This is an approximate list that you can adjust at your own discretion, if this does not contradict the Law. When drawing up a contract before or during the registration of a mortgage, the following data must be indicated: the total amount of debt, the amount of monthly payments and down payment, data of the credit institution, complete information about the loan property.

The procedure for drawing up a marriage contract to obtain a mortgage

The algorithm of actions of participants includes the following steps:

- clarification of lending conditions in various banks in the country;

- preliminary drafting of a contract;

- contacting a lawyer to check and correct the contract (the lawyer will eliminate legal, semantic and stylistic errors);

- signing the original agreement;

- contacting a notary for approval of the contract and registration in the register;

- transfer of the agreement to the bank for further registration of the mortgage.

Be sure to read it! Forgery of a work record book: what is the penalty?

If the couple is officially married, the contract becomes legally binding after notarial approval.

Where to contact?

Banks offer families wishing to obtain a mortgage ready-made sample agreements . But as a rule, they are built on the separate property of the spouses. It is more convenient and profitable for the bank for one of the couple to become the borrower, and therefore it can insist on registering separate property. After all, it is easier to collect the debt from one borrower and there is no need to recalculate the repayment. And the second spouse will not be able to claim anything during a divorce.

It is important to remember that the bank can only offer such an option, and it does not have the right to demand the mandatory fulfillment of this condition. The spouses themselves must determine who is the owner and payer.

If they wish to specify other conditions, borrowers may not use a bank form and draw up a contract themselves . To do this, it is advisable to obtain advice from a family law specialist who will provide qualified support, help take into account all wishes and correctly reflect them in the contract. Further, the contract must be certified by a notary.

How to compose?

It is necessary to spell out the conditions in the contract in as much detail as possible, taking into account all the nuances. This will help avoid difficulties and controversial situations.

Basic rules for drawing up a contract:

- it must be certified by a notary;

- a contract can be concluded both before and after marriage registration;

- The contract gains legal force only after marriage;

- clauses limiting the personal rights of the parties, their legal capacity, and legal capacity are prohibited;

- the contract regulates only the property sphere;

- a marriage contract can be terminated if one or more provisions are violated, as well as if a mutual agreement is concluded.

Attention! If a prenuptial agreement has already been concluded before the mortgage is issued, it is necessary to draw up an additional agreement to it, in which all the conditions regarding the specifics of the mortgage program and the requirements of a particular lender must be specified.

Mandatory terms and conditions

Questions that a marriage contract should contain and describe:

- borrower (which spouse is it);

- property (who will become the owner of the property and in what shares);

- down payment (who pays);

- payer (who will repay the loan amounts);

- other payments (which spouse pays for insurance, interest, utility bills);

- division of property (conditions for implementation);

- grounds for revision (which may entail a change in mortgage payment obligations);

- list of sources of official income (cash that will ensure loan repayment);

- responsibility for failure to fulfill (what consequences will arise from evasion of obligations by one of the parties);

- information about real estate (details: address, cadastral number, etc.);

- loan amount and repayment procedure;

- name of the credit institution (the bank where the mortgage is issued).

Required documents

At all stages of registration/approval of a marriage contract, the following documents will be required:

- participants' passports;

- marriage registration certificate;

- receipt of payment of state duty;

- personal documents of children, if their interests are taken into account.

Cost of registration with a notary

Article 333.24 of the Tax Code of the Russian Federation provides that the cost of notary services for approving a marriage contract in 2020 will be 500 rubles. The amount is considered for one copy of the agreement.

If we take into account the involvement of a lawyer in drawing up the text of the contract, the average cost of the agreement will be 5 thousand rubles. The price depends on the region.

Duration of the procedure

On average, it takes up to 1 month to complete a marriage contract.

There is no need to make an appointment with a notary in advance; all you need to do is draw up an agreement and come to the nearest notary office.

Registration of the contract

In 2020, Sberbank presented the following requirements for candidates to receive a mortgage loan:

- the minimum age of spouses must be 21 years;

- at the end of loan repayment, the age limit of the husband and wife cannot exceed 75 years;

- availability of a permanent place of employment (except for wives who are on maternity leave);

- the minimum length of service at the last place of duty must be six months;

- making a down payment equal to 15% of the total cost of housing.

The marriage contract used to obtain a mortgage is a special agreement that contains only issues related to the procedure for repaying the loan, as well as the distribution of ownership rights to the purchased object. It is forbidden to introduce any other issues into the articles of the agreement.

In general, drawing up such a contract yourself will not be difficult, but be sure to use a sample of a special marriage contract for a mortgage. The finished document must comply with the following rules and requirements:

- it is not allowed to describe the conditions and rules of behavior of spouses, as well as personal relationships that could cause a divorce;

- it is prohibited to use restrictions that violate the constitutional rights of citizens (for example, a ban on changing place of residence or remarriage);

- be sure to clarify from what sources the family budget is filled, as well as the procedure for distributing general funds;

- a list of real estate and movable property owned by family members;

- conditions for division of property in case of divorce.

Such a contract is subject to mandatory approval by a notary, after which it acquires legal force. After notarization, the contract can be amended. But if it was used to obtain a loan, then in terms of disposing of the loan property, the agreements remain the same.

The marriage contract for a mortgage in Sberbank can be downloaded here

Drawing up a prenuptial agreement for a mortgage under special circumstances

A marriage contract can be drawn up only with the mutual desire of the spouses, therefore, the couple can include any conditions regarding the division of joint and personal property into the content of the contract.

Table “Features of contract execution”

| Circumstances | Peculiarities |

| When your spouse doesn't work | If one of the spouses is not officially employed, the borrower will be the working spouse. When drawing up an agreement, the couple can clarify that the non-working spouse will not take part in repaying the mortgage and will not be able to claim part of the apartment during a divorce. |

| With maternal capital | Matkapital is targeted assistance to families with two or more children. The law establishes that when purchasing real estate using maternity capital, the housing must be registered as the shared ownership of all family members (children and parents). And husband and wife can repay the loan in any convenient shares. |

| With bad credit history | If there is a marriage contract, the bank looks at the overall solvency, so the borrower will be a spouse with a good credit history, and the second will be insurance in case something happens to the borrower. |

| Something happens to the borrower | Only property issues can be included in the content of the agreement. This concerns the ability to provide for a condition on how the mortgage will be repaid if something happens to the debt payer. The second spouse can act as a co-borrower. It is allowed to involve other relatives in the loan agreement. |

| If you have minor children | As a general rule, in a divorce, children cannot claim the property of the spouses, and vice versa. But the couple can include in the contract a mention of how housing will be divided, taking into account the interests of their common children. |

Features of the contract if the mortgage was taken out before marriage

In such a situation, the owner of the property is one of the spouses who took out a mortgage for himself before marriage. He made a down payment and also paid part of the mortgage himself.

After marriage, the couple will pay the mortgage from the family budget. This means that the second spouse will also participate in the loan repayment, but he does not appear in the agreement. Therefore, it is important for him to have a marriage contract that will spell out his rights.

If a divorce occurs, there are 2 possible scenarios:

- The husband or wife takes a share in the apartment equal to the share of the payments made during the marriage.

- One spouse must return to the other half of the payments made during the marriage.

Expert opinion

Alexander Nikolaevich Grigoriev

Mortgage expert with 10 years of experience. He is the head of the mortgage department in a large bank, with more than 500 successfully approved mortgage loans.

Resolving these issues through the courts is time-consuming and expensive. The solution is a prenuptial agreement. It reflects who receives what share in real estate upon dissolution of marriage. Or a condition is prescribed that one of the spouses pays the other an amount of money equal to his mortgage payments.

Prenuptial agreement for a mortgage taken out during marriage

Spouses have the right to fix in the agreement the option of dividing the mortgage debt and the apartment in any proportion. The shares will not necessarily be equal. The financial and social status of each spouse and other factors affecting solvency are taken into account. In addition, you can choose joint or separate ownership.

Banks are more profitable when the marriage contract specifies separate property. In this case, it is easier for the bank to collect the remaining balance of the mortgage debt if a divorce occurs.

Expert opinion

Alexander Nikolaevich Grigoriev

Mortgage expert with 10 years of experience. He is the head of the mortgage department in a large bank, with more than 500 successfully approved mortgage loans.

Lenders insist on separate ownership and may even require that one spouse relinquish the property before taking out a mortgage. The bank may not give a mortgage if you do not agree to its terms. We have already discussed above why the bank may demand that one of the spouses be removed from the mortgage agreement.

If the prenuptial agreement was drawn up before the mortgage, the bank must be notified of this. An additional agreement will be required. It indicates the rights and obligations of spouses regarding the mortgage in the event of a possible divorce.

Features of database for maternity capital

Any real estate that was purchased through a mortgage using maternity capital must be registered as shared ownership of the spouses and their children. The mortgage loan can be taken on by one person, but it is necessary to indicate the shares of the owners.

Expert opinion

Alexander Nikolaevich Grigoriev

Mortgage expert with 10 years of experience. He is the head of the mortgage department in a large bank, with more than 500 successfully approved mortgage loans.

The marriage contract stipulates that children have their own part of the living space. The size of the share for each child is determined by the spouses. A minor cannot give up his living space. An adult child has the right to register his refusal after his share in the mortgaged property is determined in the marriage contract.

Another nuance is the following. The marriage contract may stipulate that one of the spouses will not qualify for a mortgage. However, this will only apply to the property that the first spouse bought with personal or borrowed funds. And the loan was not repaid with maternity capital.

Children receive their share of the living space. This point must be specified in the contract.

Bank consent to a marriage contract for a mortgage

Clause 1 Art. 46 of the RF IC indicates that the spouse is obliged to notify the creditor of the conclusion, amendment or termination of the marriage contract. If this requirement is not met, the debtor is obliged to answer for his obligations, regardless of the content of the contract.

Be sure to read it! Corruption of minors: Articles 134, 135 of the Criminal Code of the Russian Federation in 2020, how many years do they give?

At the same time, Art. 37 of the Federal Law “On Mortgage (Pledge of Real Estate)” regulates that property pledged under a mortgage agreement may in any way be alienated to third parties only with the consent of the mortgagee.

For your information

In relation to housing, the mortgagee is the bank that provided the loan to the spouses. Practice shows that the lack of approval from the credit institution subsequently serves as a basis for challenging the provisions of the marriage contract in the case of a mortgage.

Thus , citizens must obtain consent from the bank under the following conditions:

- A marriage contract is drawn up after signing a mortgage agreement with a credit institution.

- A prenuptial agreement affects property pledged to the lender.

Please note

: Russian legislation does not establish requirements for the consent form, so banks independently develop their own forms. To obtain approval, you must contact a branch of a banking institution with a passport, where employees will independently check the details of the mortgage agreement and draw up an application for consent from the credit institution.

Marriage contract for a mortgage in Sberbank

When spouses apply to banking institutions for a mortgage loan, bank employees often insist on concluding a marriage contract between them. The conclusion of a prenuptial agreement for a mortgage is an important point in the debt obligations of the borrower. Since the lender retains the property as collateral, there is a risk that in the event of a divorce the loan may remain unpaid.

When the contract states that the borrower is one of the couple, this circumstance greatly facilitates the task of establishing a separate regime for mortgaged real estate. When the contract clearly states who is the borrower from the bank, ownership of the property and mortgage debts will transfer to that person after the divorce.

It is not advisable to conclude a marriage contract in all cases. But there are situations when concluding a marriage contract will protect spouses from possible misunderstandings and conflicts.

- In the case where spouses have radically different income levels;

- One of the spouses has an overdue debt;

- Refusal of a loan by the bank due to the bank’s doubts about the credit-paying ability of one of the couple;

- One of the spouses is against the mortgage loan;

- One of the couple does not work or is not officially employed and cannot document his income;

- The mortgage was issued to one of the couple before entering into an official marriage;

- One of the couple is a non-resident;

- One of the spouses has a criminal record;

- The purchase of real estate occurs with the money of the parents of one of the couple;

- After a divorce, the spouses want to divide the mortgage debt;

- One of the couple does not want to participate in the loan repayment.

When applying for a mortgage loan from Sberbank, spouses will most often be offered a specific sample prenuptial agreement that suits the bank. This way the bank can protect itself from non-payment of the mortgage.

Thus, a prenuptial agreement for a mortgage allows you to financially protect one of the couple, who is less financially protected, and also allows the credit institution to receive certain guarantees in repaying the loan debt.

The prenuptial agreement for a mortgage can be found here.

Is it possible to enter into an agreement after a divorce?

No, you can enter into a prenuptial agreement either before marriage or during marriage. After a divorce, it is possible to draw up an amicable agreement on the division of property.

A situation is possible when the divorce process has already begun and the spouses have a prenuptial agreement. However, it does not contain a clause on the division of property. Then, before the official dissolution of the marital relationship, the husband and wife must supplement the document with relevant information. If, of course, they reached an agreement on the issue of dividing the mortgage.

Re-registration of an apartment after a mortgage with maternity capital

According to the rules for disposing of family (maternity) capital, housing purchased with these funds is divided between spouses and children. Depending on the terms of the marriage contract, the right to property may be distributed as follows:

- When jointly owned. Each spouse's share will correspond to ½ mortgage + ¼ maternity capital funds. The amount of children's shares must be at least ½ of the family capital. Shares in real estate are determined by the ratio of borrowed funds and capital capital.

- With shared ownership. Family capital is distributed between spouses by ¼, and mortgage payments - in accordance with the proportion specified in the marriage agreement.

- With sole ownership. The share, which corresponds to the percentage of maternal capital from the cost of housing, is distributed among all family members. The remaining share belongs to the spouse, who is the sole owner under the agreement.

During the mortgage repayment period, only the borrower is the owner. The distribution of shares in the capital must take place within six months after the collateral is removed.

Real estate purchased using maternity capital is divided between spouses and children.

Adult family members can refuse the shares provided, which will allow the purchased apartment or house to be registered only in the name of minor children. Such property will not be subject to division.

If the purchase of real estate using maternal capital occurred after a divorce, then only the children and the certificate holder (the person with whom the children live) are given shares.

Is it possible to cancel a contract with a mortgage?

By mutual decision of the spouses or if one of them does not fulfill their obligations, the couple can terminate the marriage contract.

According to Article 46 of the Family Code of the Russian Federation, the borrower is obliged to notify the lender about this, regardless of the content of the agreement itself. Otherwise, the bank may require changes to the loan agreement or early repayment of the mortgage. This scenario is likely if the termination of the marriage contract worsens the position of the creditor.

Conclusion: before planning to terminate a marriage contract, it is better to consult your bank.

Where to go to apply?

To draw up a marriage contract, it is best to contact a lawyer; not many people can draw up a legally competent document on their own. When registering, you should take into account the Family Code of the Russian Federation (Articles 40-44). By contacting a specialist, you can be sure that the prenuptial agreement before purchasing an apartment will take into account all the necessary aspects and wishes of the parties.

Requirements for different banks

The requirements for a marriage contract in different banks are approximately the same, since they are regulated by civil and family law.

But for banks, it is more profitable for one of the spouses to be the borrower, and they often diligently insist on obtaining a mortgage for the husband or wife. The important point here is to comply with the provisions on non-infringement of the rights of one of the spouses and the norms of the law in general.

Many banks in Russia, for example, when signing a contract, enroll the spouse as a co-borrower, thereby determining his right to housing and responsibility for timely repayment. Such conditions are practiced by Sberbank, Rosselkhozbank and many others. The contract forms are also approximately the same. If you take the form offered by Sberbank, then you can freely use it for lending at another bank, just change the name and details of the parties.

Is it possible to formalize and draw up a prenuptial agreement for the purchase of an apartment with a mortgage during marriage?

When registering a relationship, few couples draw up a marriage contract. But what to do if you are already married, and the bank is ready to agree to issue a mortgage only if there is a prenuptial agreement? Don’t be discouraged, such a document can be drawn up not only by couples before the wedding ceremony, but also by partners who have already sealed the Hymen bond.

To draw up a prenuptial agreement for obtaining a mortgage, it is recommended to contact lawyers who will competently draw up the document. It is not recommended to download a template or a completed sample marriage contract from the Internet. It is better to simply familiarize yourself with these standard samples to understand the essence of the paper, and contact a notary for preparation and certification.

Information! An agreement that is not certified by a notary, or an oral agreement, has no legal force and will not be accepted by the bank or in court.

Termination of a marriage contract and invalidation

The validity of the marriage contract depends on the decision of the spouses themselves, therefore, at any time after the conclusion of the agreement, the couple can:

- make changes to the contract;

- draw up a new contract;

- completely cancel the agreement.

This can be done only after the mortgage loan has been fully repaid, when the interests of the bank will not be affected. Otherwise, you will have to obtain written permission from the creditor to terminate the agreement.

If the spouses independently terminate the marriage contract, and the bank becomes aware of this, the creditor can legally restore the agreement or a separate part of it.

A document may be declared invalid under the following circumstances:

- no notarized approval;

- the contract was signed by the incapacitated spouse;

- forced execution of the agreement;

- the presence of unfair conditions for the division of property rights;

- the content of the contract is contrary to the law.

Invalidation of a document occurs only in court, and a representative of the bank must be present at the process. His opinion is important.

Procedure and grounds for termination

Is it possible to terminate if the apartment is under mortgage? According to the Civil Code, all citizens are free both to enter into contracts and to terminate them. But it is not worth terminating the marriage contract if it is one of the conditions of the mortgage.

This is usually stated in the loan agreement with the bank and is highlighted as a separate paragraph. In case of violation of this obligation, he has the right to terminate all existing agreements with borrowers and demand early repayment.

The grounds for termination of the contract are:

- recognition of one of the spouses as incompetent;

- lack of notarized registration;

- if the fact of pressure on one of the parties (intimidation, threats) when concluding a contract is revealed;

- infringement of the rights of one of the parties;

- death of one of the parties to the contract;

- declaration of one of the participants as missing, confirmed by a court order.

Termination of the contract occurs in court. But first you need to notify the bank of your intentions. And then go to court, where all the nuances of the case will be considered and a decision will be made on the legality of termination.

What is the procedure for terminating a marriage contract with a mortgage and/or declaring it invalid?

The rules for changing, terminating and invalidating a marriage contract under a mortgage are enshrined in the articles of the RF IC. The contract can be canceled by mutual agreement. In this situation, the division of property will occur according to the law. It is possible to terminate the agreement at the initiative of only one of the parties if the other party to the legal relationship ignores its obligations. In this case, you will need to inform the lender about the cancellation of the agreement. The corresponding rules are enshrined in Article 46 of the RF IC. The financial institution reserves the right to adjust the terms of repayment of obligations or put forward demands for early payment of debt. Such a measure is applied if the current situation leads to an increase in risks. Additionally, a marriage contract may be declared invalid in court.

Marriage and mortgage: subtleties and details

As a rule, a change in marital status encourages people to increase the space they occupy or purchase a new one. In eighty percent of cases, purchasing new space means turning to a mortgage. Recently, when entering into marriages, prenuptial agreements are concluded that regulate the division of property after divorce. This is the only document that changes the property status of the spouses. According to the Family Code, all property acquired after marriage is considered jointly acquired and is divided in half in the event of divorce. An online mortgage calculator will help you calculate the amount of payments, and this article will help you take into account all the subtleties between drawing up a marriage contract and the terms of the mortgage. When applying for a mortgage loan, you need to take into account its features. So, for example, the terms and conditions of Sberbank indicate that the spouse automatically becomes a co-borrower. Regardless of age and solvency. A co-borrower, according to the definition, automatically becomes a borrower if he cannot fully fulfill his obligations regarding the terms and amounts of the loan. That is, in the absence of a marriage contract, in the event of divorce, the spouse will be entitled to half of the apartment. If the agreement stipulates otherwise, the apartment will be divided in accordance with it, regardless of the contribution of each spouse to repaying the loan.

Unfortunately, in practice there are cases when one of the spouses, when concluding a marriage contract, refuses the apartment, citing this. That the other spouse is entirely responsible for paying off the mortgage.

Even when going to court, the deprived spouse will most likely be left with nothing. The decision about who will become the owner of the apartment and who will bear the actual costs of repaying the loan is made between the spouses independently. If, for one reason or another, a decision is made to conclude a marriage contract, then the bank must be notified of this fact. Because in a number of cases, the spouse will still become a co-borrower (as in the conditions of Sberbank), but will not receive anything in return. For the bank, presenting the agreement is simply confirmation of the spouses’ decision, and an additional parameter for assessing the risk of non-repayment.

In order to evenly distribute the burden of responsibility, you can turn to bank specialists for help - they can give advice on drawing up an agreement or offer a ready-made sample. Notarization of the contract is mandatory in any case.

The bank's requirement for mandatory notification when the terms of the contract are changed or terminated is quite reasonable. Since the apartment that is pledged (since mortgage lending is used) is at the same time the subject of joint ownership, the bank’s interest in the subject of pledge is obvious. All those circumstances that change the degree of risk of non-repayment of borrowed funds directly concern the lender.

The bank is also interested in concluding a prenuptial agreement when providing a mortgage loan. In his absence, half of the apartment will belong to the second spouse, and the bank will receive a low-liquid asset in the form of a share of real estate. It is almost impossible to sell or present half of the apartment to the next borrower. In addition, there may be long disputes in court about which spouse owns the majority of the borrowed housing, and in what shares. This will disrupt the payment terms and increase the risk of non-repayment, which is disadvantageous for the lender. In addition, if a co-borrower loses, the amount of the deposit will fall, and the ability of the remaining spouse to repay the loan will decrease.

Is it possible to challenge the transaction?

If an agreement violates the rights of one of the parties, it can be challenged in court. A positive decision is possible only if there are compelling reasons established by the Civil Code of the Russian Federation.

A contract is considered invalid in the following cases:

- lack of notarization:

- signing by an incapacitated person;

- concluding an agreement under the influence of violence, threats, deception, misconception;

- the provisions of the contract infringe on the rights of the husband or wife.

If a party decides to appeal the contract in court, the credit institution must be notified about this.