What kind of document is this, what does it look like?

The loan agreement of Sberbank of the Russian Federation is a bilateral agreement under which the lender (bank) provides funds to the borrower, and he undertakes to return them within a certain period of time at a certain percentage. The agreement is drawn up on the basis of the General Conditions for the provision, servicing and repayment of loans prepared by the bank back in 2013.

The loan agreement regulates:

- property relations associated with the issuance and payment of a loan;

- liability of the parties in case of failure to fulfill an obligation (for example, late payments, non-repayment of a loan);

- procedure for securing an obligation (registration of a purchased apartment as collateral);

- procedure for removing the encumbrance after repaying the mortgage.

For each loan agreement, the general conditions in force on the date of its conclusion apply. However, loan rates, terms, repayment schemes and other nuances may be individual.

The agreement looks like a 3-4 page document, drawn up in two copies and signed by a representative of the bank and the borrower himself or his legal representative. A collateral agreement (mortgage agreement) is usually drawn up for it, which is signed within the same time frame as the loan agreement. Until the loan is repaid, an encumbrance is placed on the apartment, which is registered in Rosreestr.

Important! Sberbank of the Russian Federation has various loan programs (“Military Mortgage”, “Young Family”, “Mortgage with Maternity Capital”, etc.). In each specific case, an individual loan agreement is drawn up, prepared on the basis of the bank’s general lending conditions.

What to pay special attention to

As a rule, before signing a mortgage agreement, bank employees distribute copies of it to sellers and buyers of real estate and ask them to check their personal data for errors. This is a useful practice. But what should a borrower pay attention to besides the presence of typos in his last name?

- Conditions for termination of the contract. As a rule, the bank has the right to terminate the agreement unilaterally if the client fails to fulfill its obligations. This also includes the sale of debt, its assignment, etc.

- The possibility of the bank raising the loan rate unilaterally. It is one thing if the lender stipulates an increase in the rate as a result of the client refusing insurance - such a condition is usually specified in the general description of the loan program and is known in advance. And it’s quite another thing if the contract contains a vague wording “due to the changed economic situation.” It is worth asking for a clearer description of the reasons.

- Possibility of early repayment of the loan. As well as the conditions for this procedure and its cost.

- The possibility of the borrower refusing insurance (or at least part of it). Conditions for this procedure, bank sanctions for refusal.

Also a very important point is the procedure for the borrower’s disposal of the purchased property until the mortgage loan is repaid. As is known, while the apartment is pledged, its owner does not have the right to carry out redevelopment or repair work that leads to a change in living space without the approval of the bank. Reconstructions are also prohibited - removing or installing plumbing fixtures, moving kitchen stoves, demolishing built-in cabinets indicated on the legend, etc. You should definitely familiarize yourself with these restrictions in order to take them into account when carrying out repairs.

Important! Bank representatives may not make inspection visits to the apartment. But when the encumbrance is removed after repaying the debt, the borrower will have to issue a new registration certificate, which will indicate all the changes he has made. Based on this document, the bank can impose a fine on the client for non-compliance with the agreement.

It should also be clarified whether the borrower has the right to register in the mortgaged apartment one of the persons not specified in the agreement . Registration of temporary registration without the approval of the bank and registration of one’s own children born after the transaction must also be taken into account.

Compiled by whom?

The loan agreement is drawn up by the bank's lawyers without the participation of the borrower. If the client has his own proposals for adjusting the text, then let’s be honest, they are unlikely to be taken into account, since the terms are dictated by the lender. The basis is the General Conditions for Providing Loans of Sberbank of the Russian Federation, as well as standard agreements, legal norms (in particular the Civil Code of the Russian Federation, the Law “On State Registration of Real Estate”, etc.).

The conditions in the document are standard for all borrowers and do not change, unless we are talking about the amount of the rate, commission, penalties, which can be established based on the borrower’s credit history and the bank’s assessment of his solvency.

Parties

As in any other loan agreement, in the Sberbank agreement the bank itself appears as a creditor, and an individual, legal entity or individual entrepreneur appears as a borrower.

When drawing up the text of an agreement by an individual, the following should be indicated:

- personal data of the borrower;

- his TIN or SNILS;

- permanent registration address.

If the party is a company or individual entrepreneur, then the following must be included:

- Name;

- legal address;

- Full name of the director or legal representative.

The creditor bank also indicates:

- all your details;

- TIN;

- department number;

- personal data of the person on behalf of whom the loan is issued.

Contents of a standard mortgage agreement

The loan agreement of Sberbank of the Russian Federation fully complies with the requirements of the Civil Code of the Russian Federation (Articles 819, 820) . The agreement is drawn up in writing with the obligatory indication of all essential conditions (loan amount, purpose of financing, loan terms).

Main sections of the agreement:

- details of the parties;

- procedure for granting a loan;

- procedure for using the loan and repaying it;

- rights and obligations of the parties;

- procedure for terminating the contract.

The loan agreement must clearly indicate what kind of real estate is being purchased on credit, where it is located, what its area is and on what basis it belongs to the seller.

The loan amount and the procedure for issuing it (in parts or in a single amount) are also recorded. A prerequisite is also to indicate the loan rate and loan currency, and the loan repayment scheme (annuity or classic). The agreement specifies the rights and obligations of the parties, in particular the borrower’s obligation to pay the loan, adhering to the payment schedule and annual property insurance.

The bank, in turn, undertakes to transfer money to the borrower for the purchase of an apartment within the agreed time frame. The lender has the right to actually verify the intended use of the loan and control the payment of insurance.

The borrower does not have the right to rent out, sell or give an apartment without his consent, since this will first require repaying the loan and removing the encumbrance.

When receiving a loan, the borrower undertakes to repay it within the terms specified in the contract, along with accrued interest. The agreement must also indicate the amount of the penalty that may be assessed in case of late payment of monthly payments.

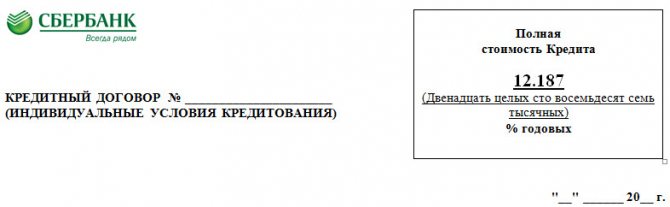

Below is an example of a Sberbank mortgage agreement.

Marriage contract

A mortgage is usually issued for a long time, and there is no guarantee that the family will not break up during this time. For people who are officially married, it may be relevant to conclude a prenuptial agreement, which will help resolve issues of fulfillment of obligations and division of property rights in the event of a divorce, when marital relations are complicated by the presence of an existing mortgage loan.

A marriage contract for a mortgage at Sberbank is concluded and executed exclusively voluntarily at the request of the borrower and his spouse. Such an agreement is drawn up in writing, signed by both spouses and certified by a notary.

The main reason why a prenuptial agreement is needed for a mortgage transaction is that one of the spouses does not meet Sberbank’s requirements for a borrower (bad credit history, problems with the security service, foreign citizenship, insufficient solvency, etc.)

A prenuptial agreement at Sberbank must be drawn up before submitting an application for a mortgage, which differs negatively from the conditions of other banks. After all, you may receive a refusal on your application, and the costs of drawing up this agreement will not be returned to you.

Sberbank does not set any special requirements for a marriage contract. It is important to observe only one essential point. It lies in the fact that the spouse excluded from the transaction is not responsible to the bank for the mortgage and does not have the right to apply for mortgage housing.

Read more: Who receives funeral benefits after death

A mortgage loan agreement with Sberbank is a very important document when applying for a loan to purchase real estate. Its conclusion and signing must be preceded by a comprehensive study of each clause and section, checking the key conditions and features of a particular transaction. This will avoid many misunderstandings and unpleasant moments in the future.

If you need professional help in drawing up such an agreement for Sberbank, our lawyer will definitely help you draw it up. Sign up for a free consultation with him using a special form.

The next stage of obtaining a mortgage at Sberbank is registering the transaction. Pay attention to our next post “Electronic registration of a Sberbank transaction.” He will tell you about a very useful bank service that will allow you to save not only time, but also money. A bank employee is required to request an agreement from you to conduct a transaction through this service because it's paid.

We look forward to your questions in the comments below. We would be grateful for rating the post, liking and subscribing.

Hello! I plan to take out a loan for an apartment from Sberbank. I would like to familiarize myself with all the documents and conditions in advance. I am especially interested in the mortgage agreement (completed sample) and the sample preliminary agreement for the purchase and sale of an apartment under a mortgage. Thanks in advance. Vyacheslav Yurievich.

Good afternoon, Vyacheslav Yurievich!

Your desire to study the clauses of the agreement in advance is very commendable; it is rare that a person even pays attention to the Sberbank loan agreement - an example of a situation in which the absence of important information provokes unpleasant consequences.

And here you can download the preliminary purchase and sale agreement.

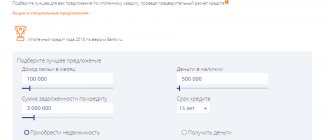

Mortgages from Sberbank in 2020 are provided on very favorable terms from 10.75%. You should hurry to get a loan at such a low rate.

This is what a Sberbank mortgage loan agreement looks like (sample):

It is prohibited to publish agreements filled with customer data, so you are unlikely to find such a document in the public domain.

The loan agreement reflects the essential terms of the upcoming transaction. This document specifies the general rights and obligations of the parties, as well as the individual parameters of a specific transaction. The Sberbank mortgage agreement is drawn up by qualified lawyers who are well aware of the specifics of the banking business.

How does the signing take place?

The loan agreement is signed on the day the purchase and sale agreement for the apartment is executed (immediately after signing or within the time period agreed upon by the parties). The date of actual provision of the loan is the date the money is credited to the client’s account.

The document is signed personally by the borrower or co-borrowers or their legal representative. Sometimes, for convenience, the purchase and sale transaction and the execution of other documents takes place at the branch of the creditor bank.

Would you like to learn more about the procedure for obtaining a mortgage at Sberbank? We present to you a selection of articles on this topic:

- List of required documents and rules for writing and submitting the application form.

- Requirements for the borrower and real estate.

- Do you need a guarantor and why?

- Features of the down payment.

- How to get a mortgage secured by existing real estate?

Pitfalls of mortgage lending in the SB of the Russian Federation

When applying for a mortgage at Sberbank of the Russian Federation, you must first of all pay attention to the sanctions in case of delay and failure to repay the loan on time. If the loan is not repaid, the bank will have to go to court and forcefully collect the debt through bailiffs. In this case, the borrower will have to compensate all legal and other expenses.

It is worth paying attention to the following points:

- the amount of the penalty for late payments;

- conditions for early repayment of the loan;

- actions of the bank in case of long overdue (for example, 3-4 months);

- conditions for repayment of the loan if the purchase and sale transaction falls through;

- the borrower’s right to rent out the purchased apartment and register children in it;

- the possibility of transferring the credit file to collection companies (in case of late payments).

A mortgage can turn into an enslaving obligation if you take it out for a long period of time without thinking through how it will be repaid if your income or family composition changes. The borrower should be able to “close” the loan at any time without any fees, as well as sell the apartment on his own (with the consent of the bank) if he is unable to pay the payments.

Important! Any mortgage agreement results in a large overpayment. To minimize financial losses, try to pay off payments ahead of schedule and take out a loan for a short period (for example, up to 3-5 years).

What should you pay special attention to?

One of the most important dangers for a borrower is an unexpected demand from the bank to repay the loan in full ahead of schedule.

All points related to this topic should be carefully studied. They are also in the documents of the Savings Bank of the Russian Federation - after all, this is the main guarantee for the lender in the event that an insolvent borrower comes across.

Sberbank of the Russian Federation may require repayment of the loan in the following cases:

- overdue loan (even one-time);

- refusal to check the condition of the collateral (apartment);

- lack of home insurance;

- termination of the apartment purchase and sale agreement;

- failure to fulfill other obligations under the contract.

When signing a loan agreement, you should also pay attention to points regarding the timing of transferring the loan to the account, the possibility of reducing or increasing the interest rate and the use of maternity capital amounts.

Also pay attention to the amount of the penalty for late payments on the loan and calculate how much the fine could be if you delay payment by at least a month. Please note that a bank can easily get rid of a problem loan by selling it to another bank or collectors (this is noted in the agreement). This can result in big problems for the client.

A bank representative can come to the borrower at any time to check the condition of the apartment, which is pledged until the debt is fully repaid. Every year you will also have to pay for property insurance against major risks (fire, flooding, etc.) to ensure the safety of the collateral.

Basic terms of a standard contract

The standard mortgage agreement is a template for the main agreement that will be concluded later. Its form includes all the main points and sections of the mortgage agreement, but without specifying specific data regarding the property (cost of the property, location, data from title documents) and the borrower (passport, contact information).

Its main goal is to familiarize each party with the terms of obtaining a mortgage loan in advance and to save time allocated for signing the main document. Simply put, this is the preparation of participants directly for the transaction.

The legality of the mortgage agreement is established by the relevant regulatory legal acts of the Russian Federation:

- housing code of the Russian Federation;

- Federal Law “On Mortgage”;

- Civil Code of the Russian Federation;

- Federal Law “On state registration of real estate and transactions with it.”

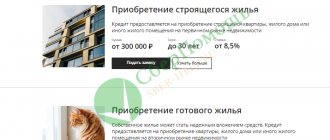

The fundamental or essential terms of a mortgage agreement determine its validity. Without their instructions, the document will lose its force. These conditions include:

- Loan amount

- Term

- Currency

- Interest rate

- The procedure for determining the foreign currency exchange rate if money is transferred by the lender to a third person specified by the borrower

- Number, size and frequency (timing) of payments

- The procedure for changing the borrower’s mortgage parameters in case of partial early repayment of the loan

- Methods for the borrower to fulfill obligations under the agreement at the borrower’s location

- Obligation of the borrower to enter into other agreements

- Loan collateral and requirements for it

- Purpose of lending

- Fine, penalty, penalty for delay or the procedure for determining them

- Condition for the assignment of rights of claim under an agreement from Sberbank to other persons or organizations

- Borrower's consent to the general terms of the agreement

- Additional services

- How information is exchanged between the borrower and the bank

- Procedure for granting a loan

- Title co-borrower

- Availability of a mortgage

- Intended use of funds and how to confirm it to Sberbank

- The borrower's consent to the lender providing information to third parties

- Representations and Warranties

- Consent to request information from a credit bureau

- Addresses and details of the parties (for Sberbank - these are all valid and current details, including postal and legal address, TIN, branch number, BIC, full name of the authorized person with signatures and seal).

Read more: Replacing SNILS when changing your last name; production time;

The date, place of conclusion and its number are indicated in the top header of the contract form. The agreement is printed and signed in 3 copies.

Reasons and grounds for termination and termination

The loan agreement is terminated early by the bank itself from the date of sending the relevant notice to the borrower (by registered mail with acknowledgment of delivery). Grounds for termination are failure to comply with the terms of the loan (for example, a large delay - more than three months).

The borrower himself does not have the right to terminate the agreement with the bank ahead of schedule. But he can repay the debt ahead of schedule and thereby “close” his loan. After fulfilling the obligation, the bank is obliged to remove the encumbrance and issue the former borrower a certificate stating that the loan has been repaid and he has no claims. The contract also terminates after the expiration of the term, that is, after making the last payment on the loan.

Rights and obligations of the parties to the contract

According to the terms of the mortgage agreement with Sberbank, the lender is obliged to:

- Transfer the loan amount to the client’s account;

- Consider an application for debt restructuring (if any);

- Issue a certificate of no debt to Sberbank (the document is drawn up at the request of the counterparty);

- Notify the borrower about the transactions performed with the mortgage (if it was issued);

- Direct maternity capital funds and other subsidies to repay the loan amount and accrued interest (relevant for borrowers eligible to receive budget funds).

Read more: Loan to buy a house without a down payment

The lender has the right:

- Unilaterally reduce the interest rate on the loan (the borrower is notified of this action in advance);

- Change the amount of the penalty if the client violates the deadlines for making annuity payments;

- Check the technical condition of the collateral object;

- Refuse to provide a loan to an unreliable applicant;

- Provide a deferment for making mortgage payments (we are talking about borrowers who find themselves in a difficult financial situation);

- Sell or assign the balance of the loan to third parties if the borrower violates the payment schedule.

Sberbank may require an early return of funds in the following situations:

- Systematic violation by the borrower of deadlines for depositing funds;

- Loss or partial destruction of the collateral;

- Unreasonable refusal of the counterparty to verify the collateral real estate;

- Concealing information about encumbrances placed on collateral;

- Lack of an agreement insuring the risk of loss or damage to the property being financed;

- Inappropriate use of borrowed funds.

- Insure the collateral;

- Make annuity payments on time;

- Maintain the property in proper technical condition;

- Notify the lender about changes in personal data (last name, place of permanent registration, etc.);

- Do not carry out transactions with real estate without the consent of Sberbank;

- Do not transfer obligations under the contract to third parties;

- Pay the bank a penalty for late repayment of the loan.

- Contact the creditor with an application for debt restructuring;

- Claim the mortgage after the mortgage loan has been repaid in full.

All contradictions arising during the repayment of the mortgage are resolved by the parties through negotiations. If it is impossible to reach a compromise solution, the lender and the borrower have the right to file a claim in court.