Terms of lending with payment of a contribution using maternity capital

Sberbank provides mortgage programs with maternity capital.

Sberbank has several mortgage programs for maternity capital, which can be used as a down payment. The main things to consider when choosing a program are the requirements and interest rates.

Sberbank provides reduced tariffs for those who choose an apartment at a discount through the DomClick service. It is also necessary to remember that the bank requires compulsory life and health insurance of the borrower.

When calculating the final interest rate, it is worth taking into account the surcharges that the bank imposes for failure to comply with the following conditions:

- +0.4% - if the down payment amount is less than 20% of the loan amount;

- +0.5% - if the borrower’s salary card is from another bank;

- +1% - if the borrower refuses life insurance.

Young Family Program

This solution allows a young family to obtain a mortgage at an annual rate ranging from 5% to 9.6%.

Amount - from 300,000 rubles, loan agreement term - up to 30 years.

“Young Family” is a special state support program.

Interest rates:

- 8.8% - basic value;

- 8.5% - if you purchase real estate marked with the “0.3% Discount” checkbox through DomClick;

- 8.7% is the rate for those buying an apartment under state programs to support real estate construction in cooperation with Sberbank.

There is an option for registration with a minimum set of documents. This is suitable for those who do not provide proof of income from their place of work and purchase housing built with money borrowed from a bank.

The down payment in this case will be at least 50%. The base rate is 9.6%, when purchasing a promotional apartment through DomClick - 9.3%.

Loan "Mortgage plus maternity capital"

The loan size is from 300,000 rubles, the term of the mortgage agreement is up to 30 years.

Interest rate - from 6.2%. It can be reduced by 0.5% if the borrower receives a salary on a Sberbank card.

Under this program, the borrower makes a down payment using maternal capital funds. The loan is issued for the purchase of both new buildings and secondary housing.

Sberbank has simplified the process of obtaining a mortgage using maternity capital.

There are a number of special conditions for approval of this type of mortgage:

- The purchased property is registered as the property of the borrower or as joint property with the spouse/children.

- If the borrower and co-borrower receive salaries on a card from another bank, it is necessary to provide proof of employment and financial solvency.

- It is necessary to provide additional documents: state certificate for maternity capital; confirmation from the Pension Fund about the availability of maternity capital funds (can be brought to the bank within 90 days from the date of approval of the mortgage, the document is valid for 30 days from the date of issue).

- It is mandatory to insure property against damage, loss or destruction in favor of the bank for the entire term of the mortgage.

Other preferential options

Characteristics of “Mortgages at 5% for families with children”:

- rate - from 5%;

- first deposit - 20%;

- term - from 1 year to 30 years.

- amount - up to 12,000,000 rubles. for Moscow, St. Petersburg and their regions, up to 6,000,000 for other regions of the Russian Federation.

The main condition for providing mortgage benefits is that from January 1, 2018 to December 31, 2022, a second or subsequent child must be born in the family. However, if he is born between July 1 and December 31, 2022, the loan period may be extended until March 3, 2023.

Features of the conditions:

- Mandatory insurance of property, life and health of the borrower.

- The purchase of real estate is possible only from a legal entity.

- Only the borrower/co-borrowers can pay for the property or obtain the right to budget funds for payment. Participation by other persons is not permitted.

“State support 2020” assumes the following conditions:

- rate - from 6.4%;

- down payment - from 20%;

- term - up to 20 years;

- amount - up to 8,000,000 rubles. for Moscow, St. Petersburg and regions, up to 3,000,000 for other regions.

Under this program, mortgages are issued until November 1, 2020. It is possible to purchase both under construction and secondary real estate.

The main condition is to conclude a transaction only with a legal entity. Before registering the purchased property, a pledge in the form of property rights to existing real estate or a guarantee from individuals is required as collateral.

How to pay off a mortgage with maternity capital?

You can use maternity capital to pay the down payment. To do this, you need to contact the Pension Fund and receive a statement of the balance of funds. It is valid for 1 month and must be submitted to Sberbank along with a certificate of maternity capital and an assessment report within 90 days from the date of approval of the application.

If Sberbank approves the property, you can submit an application to the Pension Fund for the use of mat. capital. The money will be transferred within 1 month and 10 days.

Due to the mat. capital is also allowed to pay off the existing mortgage if the housing was purchased as common (shared) ownership.

The procedure for early repayment of a mortgage with family capital is as follows:

- We receive a certificate from Sberbank about the balance of the mortgage debt.

- We submit to the Pension Fund a certificate about the amount of the remaining debt, a mortgage agreement and an application for the use of mat. capital.

- We are waiting for the transfer of money from the Pension Fund.

- We submit an application for full or partial early repayment of the mortgage at the branch or through Sberbank Online.

Advantages of mortgage lending at Sberbank

Loans from a leading bank in the Russian Federation have the following advantages:

- Mortgage programs that allow you to obtain a housing loan using only 2 documents.

- Compared to mortgages from other banks, interest rates are relatively low.

- The ability to confirm income that consists of more than just your official salary.

- Cooperation of Sberbank with state programs to support young families.

- Possibility of mortgage for pensioners (up to 75 years).

- Registration of a mortgage for an apartment by bank employees.

- No commissions.

- Simplicity and accessibility of online resources and bank applications.

- Prevalence of bank offices across the country.

Sberbank cooperates with government programs for young families.

Mortgage programs with maternal capital in Sberbank

Sberbank allows you to get a home loan with the investment of maternity capital funds under two mortgage programs:

- purchase of finished housing - flat rate;

- purchase of housing under construction.

You can use maternity capital for a mortgage before 3 years have passed since birth (adoption).

Sberbank imposes the following requirements :

- Must be at least 21 years old .

- At the end of the loan - no more than 75 years , if employment and income have not been confirmed - no more than 65 years .

- Availability of Russian citizenship .

- The length of service in the current workplace is at least six months , and the total length of service over the previous 5 years is more than a year (this requirement does not apply to Sberbank’s salary clients).

When applying for a loan with maternity capital, you can attract co-borrowers (up to 3 individuals) - their income will be taken into account when calculating the maximum loan amount. One of the co-borrowers must be a spouse, except in the following cases:

- a marriage contract was concluded between the spouses containing a clause on separate property;

- the spouse does not have Russian citizenship.

Loans under the two specified programs are provided on the following conditions :

- minimum amount - 300 thousand rubles;

- maximum amount - no more than 85% of the contract price of the purchased housing, or the estimated value of the residential premises as collateral;

- down payment - from 15%; if income and employment are not confirmed - at least 50%;

- when participating in the developer subsidy program - up to 12 years.

For the spring of 2020, under the “ Purchase of finished housing - flat rate ” program, the interest rates presented in the table apply.

| Bid | % on the “Showcase” promotion* | % |

| Upon confirmation of employment and income | ||

| Base rate | 10,70 | 11 |

| "Promotion for young families" | 10,20 | 10,50 |

| Without proof of income and employment | ||

| Base rate | 11,30 | 11,60 |

| "Promotion for young families" | 10,80 | 11,10 |

* promotion for apartments purchased through the DomClick portal.

The indicated interest rates are based on the electronic registration service.

Under the “ Purchase of housing under construction ” program in the spring of 2020, the following interest rates apply.

| Bid | % |

| Base rate | 10,50 |

| Under the subsidy program from 7 to 12 years | 9 |

| Under the subsidy program for up to 7 years | 8,50 |

The indicated rates apply to Sberbank payroll clients who have used the electronic registration service.

A rate of 10.60% when purchasing housing under construction applies to participants in state federal (regional) programs as part of Sberbank’s cooperation with constituent entities of the Russian Federation.

The possibility of using maternity capital under other mortgage programs must be clarified in each specific case, as well as the interest rate at which the certificate holder can take out a loan.

Mortgage at 6 percent in 2020

A mortgage loan at a preferential rate of 6% from Sberbank is eligible for those families in which a second or subsequent child was born from January 1, 2020 to December 31, 2022. In addition, the following requirements must be met:

- Housing is purchased on the primary real estate market.

- The loan was concluded no earlier than January 1, 2018 .

- at least 20% from his own funds (maternity capital funds are allowed).

- Amount of credit should not exceed:

- 12 million - for Moscow, St. Petersburg and the regions;

- 6 million - for other regions of the country.

- The borrower's life must be insured by Sberbank Life Insurance LLC or another company accredited by the bank (for the entire term of the mortgage). It is also necessary to insure the residential premises being financed.

- The mortgage must be repaid in equal monthly payments .

If within the specified period the parents have a second, third or subsequent child, then they have the right to refinance a previously taken loan at a preferential rate.

To apply for a preferential mortgage, along with the documents from the main list, you must provide the bank with:

- children's birth certificates;

- confirmation of Russian citizenship, if there is no mark on it in the certificates.

On April 13, 2020, the changes established by Government Resolution No. 339 of March 28, 2019 came into force. Now the preferential interest rate is valid for the entire loan term . It has also become possible to obtain a 6% mortgage when purchasing secondary housing (including land) in rural settlements of the Far Eastern District.

Briefly about the requirements for borrowers and co-borrowers

The requirements for the borrower and co-borrowers are the same:

- Citizenship of the Russian Federation.

- Age - from 21 to 75 years at the end of the mortgage agreement.

- Work experience: at least 1 year over the last 5 years and at least 6 months at the current job (if the client receives a salary on a card from another bank).

The number of co-borrowers is no more than 3 people. Most often they become close relatives. The borrower's spouse is counted as a co-borrower; length of service, employment or income is not important.

However, there are exceptions: if the spouse is not a citizen of the Russian Federation, and also if a marriage contract was concluded, according to which the property of the spouses is divided.

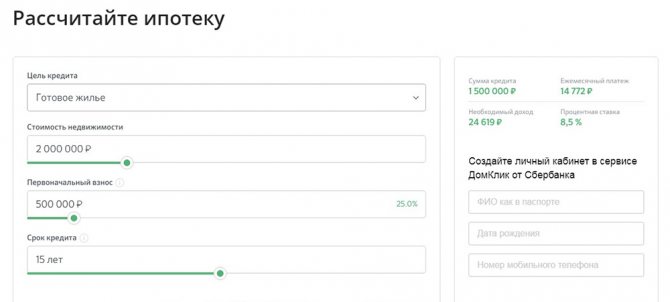

Credit calculator

When choosing a mortgage program, you should use the official online calculator (will appear when you go to the page with the required type of loan), which will calculate the monthly payment and overpayment.

You can also use our:

You should not completely rely on the results obtained, since only bank employees can provide accurate information. However, such calculations are necessary for a preliminary assessment of one’s financial capabilities and the burden on the family budget.

The most important parameter that you should pay attention to when choosing a mortgage is the interest rate. This value shows how much interest the debt will accrue per year. The volume of monthly payments and the amount of overpayment depend on it.

The rate is:

- fixed - not changing over time;

- floating - calculated according to the formula written in the contract.

The latter is divided into two parts: fixed - the one that the bank is guaranteed to take every month, and depending on market indicators. It is recalculated at some frequency (once a month, once a quarter, once every six months).

When making calculations, it is worth taking into account the type of payment, which can be:

- annuity - a fixed payment amount for the entire period of validity of the mortgage agreement (the most common option);

- differentiated - gradually decreasing payment amount.

How to use the calculator

The program can calculate the mortgage based on the value of the property and the loan amount. You must select the desired option and enter the available data.

When calculating the value of real estate, the amount of the down payment, the mortgage term and the interest rate are entered in the appropriate fields. In addition, the type of payment is selected - annuity or differentiated. After this, you need to click on the “Calculate” button. At the stage of entering data, the calculator will determine the required loan amount.

The calculation for the loan amount is similar, but the amount of the down payment is not required.

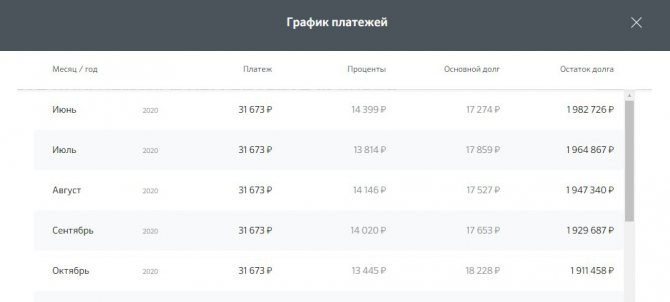

The calculator will also generate:

- A repayment schedule in which each column is a monthly payment. The color indicates how much of the payment is interest and how much is principal.

- A table with the same information, but in numbers.

- A diagram showing what percentage of payments will be taken up by accrued interest.

The loan calculator creates a payment schedule.

The calculation and schedule do not take into account possible early repayment of the mortgage.

Calculation of payments

To understand how the calculator works, calculations were made for the “Mortgage plus maternity capital” program.

Program input data:

- amount - from 300,000 rubles;

- mortgage term - up to 30 years;

- rate - from 6.2%

The calculation data will be as follows:

- The cost of a conditional apartment is 2,100,000 rubles.

- The mortgage term is 5 years.

- The rate is minimal, 6.2%.

- Initial payment - 460,000 rubles. (the amount of maternity capital after changes in the law of March 1, 2020 is 466,617 rubles).

- Loan amount (automatically calculated by the calculator) - RUB 1,640,000.

An example of the resulting calculations

To calculate the cost of housing and the amount of the mortgage, different types of payment were used, since the same type of payment would produce the same results.

Table 1.

| Parameter | By property value | By loan amount | |

| Initial data | Price | RUB 2,100,000 | — |

| Sum | RUB 1,640,000 | RUB 1,640,000 | |

| Down payment | 460,000 rub. | — | |

| Term | 5 years | 5 years | |

| Interest rate | 6,2% | 6,2% | |

| Payment type | Annuity | Differentiated | |

| Calculation | Monthly payment | RUB 31,858.53 | 35,806.67 ... 27,474.56 rub. |

| Interest charges | RUB 271,511.80 | RUB 258,436.67 | |

| Debt + interest | RUB 1,911,511.80 | RUB 1,898,436.67 |

Sberbank mortgage with maternity capital on an online calculator: calculation example

Unfortunately, the official website does not have a calculator that automatically enters the maternity capital (453,026 rubles). You can put this amount down yourself as a down payment.

Recommended article: Why do an apartment appraisal for a mortgage?

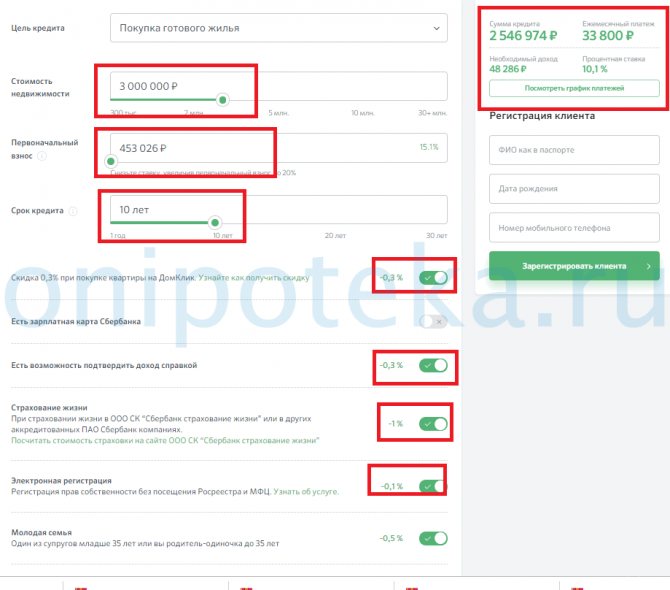

Let's make a simple calculation of a mortgage with maternity capital in Sberbank using an online calculator. At Sberbank, the down payment is at least 15%. If you expect to use maternity capital in full, then the maximum loan amount will be 3,000,000 rubles.

We put 3 million rubles in the appropriate fields and the contribution is 450 thousand rubles. The loan term is 10 years. In this case, the monthly payment will be 33.8 thousand rubles at an interest rate of 10.1%. The required income for a family is 48.3 thousand rubles. clean.

For salary clients, the percentage will drop to 9.8%, and the payment to 33.4 thousand rubles. If you want to cancel your insurance, the interest rate will increase by 1 point. If the apartment is from its own developer, the percentage will increase by another 1-2 points. If you cannot confirm your income, then you will also not be able to use maternity capital as an initial contribution - the bank will require at least 50% prepayment.

It is planned to repay the mortgage with maternal capital from Sberbank and the online calculator may also be useful.

If you enter the remaining debt in the Loan Amount column and put the MK as a down payment, you can calculate how much the monthly payment will decrease.

Important! Use the online calculator on the DomClick website. A more complete version of the calculation is presented here. You can see not only the real amounts, but also the payment schedule. I would also like to draw your attention to whether you have enough income (column - Required income) to receive the required amount; set the loan amount equal to the price of the property. This is because Sberbank will issue (transfer) the amount of the mortgage plus maternity capital immediately, that is, following the example above - 2 million rubles for settlement with the seller. And then the pension fund will transfer and repay your debt to Sberbank ahead of schedule.

Briefly about the design

The process is performed according to approximately the following algorithm:

- You need to get a certificate from the Pension Fund indicating the amount remaining in the maternity capital account.

- It is necessary to collect additional documents and send an application to the bank.

- After approval of the mortgage, you should obtain a loan certificate from the bank.

- After selecting real estate and concluding a deal with the developer, you need to draw up an application for the transfer of funds available on the certificate as a contribution for the real estate.

- The completed application, along with a certificate of receipt of the loan, must be provided to employees of the Pension Fund.

How to cash out maternity capital illegally in 2020

When considering the question of how to obtain maternity capital in 2020 for a second child, many people are trying to withdraw cash. Since this cannot be done using legal methods, certificate owners are trying to carry out the procedure illegally.

In addition to the fact that such actions are suppressed at the legislative level, there is an even greater likelihood of being left without money if it falls into the hands of criminals. Over time, the appearance of certificates offered many ways to withdraw cash; in addition, the intermediary demanded a large commission for performing the operation. As soon as the activity of such performers decreased on thematic forums, reviews began to appear about how many families had lost funds, but could not go to law enforcement agencies for help because they had violated the law by their actions.

The main ways to illegally obtain cash from capital are as follows:

- Formal purchase of housing using maternity capital finance.

- The next method of illegal action is the purchase of real estate unsuitable for habitation.

- Registration of a mortgage loan for the purchase of housing that does not exist in reality.

- Sale of a certificate giving the right to use state support funds.

All methods presented are subject to criminal prosecution by both the persons who performed the action and the certificate holders. Regardless of the penalty, holders will be deprived of the opportunity to use the certificate in the future.

Before attempting to withdraw cash illegally, you must carefully study all the pros and cons. The optimal solution would be to refuse such operations. A favorable set of circumstances for such actions is unlikely.

As a rule, citizens lose money either under the influence of criminals or when a criminal case is initiated.

It is preferable to use finances for their intended purpose and use the certificate to improve living conditions. If the presented methods are not suitable, you can expect a solution to the situation by increasing the possibilities of using capital. However, it should be taken into account that since 2015, funds from capital are not indexed and will depreciate over time, and therefore there is no need to delay using the funds provided. Go to the Sberbank representative office and use maternity capital based on the possibilities determined by law. This will help you save your nerves and not lose money.