Is it profitable for a non-resident to take out a mortgage in Spain?

Almost half of the country's housing stock goes to foreigners on loans of up to 70% of the cost of the property. The demand for purchases in this format is due to attractive real estate prices and low loan interest rates.

Mortgages can be beneficial when viewed from an investment perspective.

By renting out an apartment worth 100 thousand euros, you can earn up to 5% of its price per year, which is 600-700 euros per month. The income will cover debt and tax payments. In this case, you should choose housing in tourist or student areas.

Difficulty getting a mortgage

For non-residents, the procedure for obtaining a mortgage loan is not complicated, but it does take time.

To get a mortgage in Spain, a non-resident must have a stable and high salary.

The first task for future borrowers is to collect certificates and statements from the bank, tax office and place of work. In order to confirm the legality of income.

The second point is waiting. Review and approval of a loan takes 1-2 months.

Need for legal assistance

Applicants can submit an application to a Spanish bank independently or with the participation of lawyers.

Legal assistance is as follows:

- Drawing up an individually selected list of documents for a mortgage.

- Selection of favorable loan conditions.

- Notarized translation of all papers from Russian into Spanish.

- Transaction support with the participation of a translator.

Prices for services vary and depend on the conditions of the company. Both hourly payment and a percentage of the cost of the object (1-1.5%) are possible.

Non-resident rights

There are no restrictions on the purchase of housing for foreign citizens. Owners of real estate in Spain have the right to open a long-term Schengen visa. A residence permit (residence permit) is issued to those who have purchased residential space or a commercial property in the amount of 500 thousand euros or contributed 1 million euros to the country's economy.

You can become a full owner after paying off the loan in full.

You can become the full owner of the purchased property after full repayment of the loan; until this moment, the bank holds the property as collateral. But at the same time, the borrower can rent out and even sell the home during the loan repayment period.

A special feature of mortgages in Spain for foreigners is the absence of a guarantee. However, residents of Spain apply for a 100% loan, and foreign citizens count only on a partial amount of financing: 50-60% of the cost of the property, rarely 70%.

In case of late payments, the bank charges a penalty of 3% to the monthly payment. After 12 months of delay, prohibits the use of the property and terminates the contract.

The foreign borrower is also provided with the right to early repayment of the loan. In this case, a monetary penalty of 0.15% to 2% is provided, depending on the rate. But some banks approve full repayment of the loan after 5 years.

Features of mortgage lending in Spain

As an applicant for a loan, it is important to take into account the specifics of obtaining a mortgage in Spain. A loan for the purchase of housing in this country is issued for a period of 5 to 25 years, in some cases it can be increased to 30 years. Persons who are not residents can count on an amount not exceeding 70% of the final value of the property (estimated or indicated in the excursion). When calculating, the bank takes the lesser of the two values as a basis.

As soon as the loan application is submitted to the bank for consideration, the real estate assessment procedure is launched. Based on the results obtained, the final decision is made whether to approve the loan or not.

It is important to take into account the fact that a resident can qualify for a larger loan amount (up to 80%). For non-residents this percentage drops to 50-70.

Like banks in the Russian Federation, in Spain loan payments are made monthly. Moreover, their size is specified in a special contract. For persons who are not citizens of this country, there are loyal lending programs.

Requirements for a borrower from another country

A significant indicator for loan approval is the client’s solvency. Therefore, the applicant is considered according to the following parameters:

- Labor stability.

- Amount of income.

- Age.

- Client reliability.

Criteria by age and status

Both individuals and legal entities have the right to obtain a mortgage from a Spanish bank.

Mortgage loans from non-residents are more readily available when the borrower is between 25 and 60 years old.

The desired age of the applicant is 25-60 years.

Older people participate in similar programs, but the requirements are stricter and the likelihood of failure is higher. In addition to a certificate of permanent pension payments, you will need supporting documents about the presence of a deposit in the bank and about ownership.

Legality and amount of earnings

The borrower's salary must be at least 3 monthly loan payments, and his work experience in one place must be at least 6 months.

Expert opinion

Maksim

He has been actively traveling around Spain for the last 4 years.

Ask a Question

In this case, candidates whose continuous work experience is at least 2 years are considered.

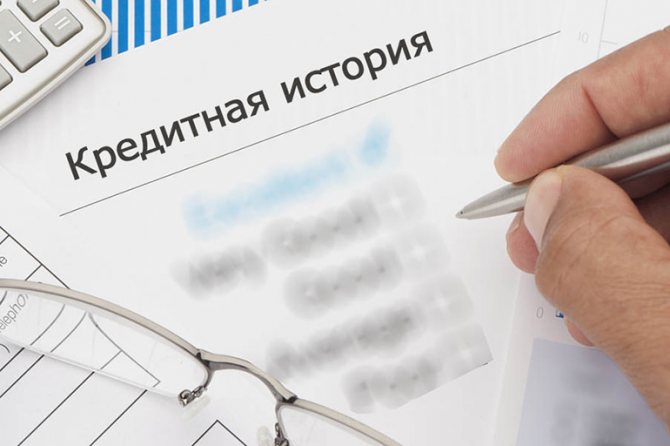

No debt obligations

A good credit history and absence of debt present the applicant as a reliable client.

Spanish banks may request a credit history report from the borrower's country of origin.

The buyer cannot be listed as a debtor in Spain. Even small late payments affect the outcome of the transaction, as do taxes not paid on time in the country.

Availability of half the amount

The larger the contribution amount, the higher the chances of loan approval. Accordingly, there are fewer risks for future owners.

If you have the opportunity to cover 70% of the cost yourself, then it is better to consider a consumer loan rather than a mortgage loan. This will save you on mortgage application costs.

Correct bank account

When purchasing real estate in Spain, you must open a bank account from which payment for the purchase will be made, and in the future tax and utility payments will be made. The necessary write-offs will take place automatically; the owner will have to monitor the positive balance.

In order to purchase real estate, you must open a bank account.

To open, you will need a Foreigner Identification Number (NIE). You can get it from the migration service at your place of residence or on the territory of Russia at the Spanish consulate.

The down payment amount, at least 30% of the purchase price, is transferred to an open account. As part of the mortgage agreement, it is allowed to transfer money only from the Russian account specified in the documents, otherwise payments may be blocked.

Citizens of the Russian Federation are required to notify the tax office (Federal Tax Service) of the presence of foreign accounts and money transfers through them. Otherwise, penalties will be imposed.

Mortgage conditions for Russians

For Russians and other foreigners in Spain, quite favorable conditions are provided in terms of interest rates and the amount of the mortgage, if the client confirms his high solvency.

They do not differ significantly depending on different programs, but different banks can set their own increases to the standard interest.

Useful video:

Property options

In Spain, you can get a mortgage for any type of real estate, it is understood that it can be an apartment, a house or similar housing.

The borrower is limited only by the cost of housing, since not all banks will be able to provide a sufficiently large amount without investing a large amount of their own funds.

However, Spanish banks willingly issue loans for commercial real estate only to those clients whose income significantly exceeds the amount of mandatory monthly repayments.

When choosing housing of a certain cost, it is also worth considering payment for bank services and related payments.

For example, you chose housing in Benidorm for 200,000 euros, the cost of taxes and registration of ownership will be about 13%, that is, 26,000 euros, and the cost of obtaining a mortgage will be another 3% (6,000 euros).

Interest rates

In Spain, there are two types of interest rates for obtaining a mortgage:

1. Effective interest or so-called TAE is an interest rate that includes the amount of the mortgage and all additional costs that the client must incur during registration, except for notary services, that is, the actual cost of the mortgage. If the prime interest rate is fixed, then the amount of effective interest is calculated for the entire period of the mortgage. If the client has chosen a Spanish bank with a floating interest rate, then the mortgage amount will be calculated based on the interest for the current year.

2. Nominal interest or TIN , as they are called in Spain, is the standard interest rate for the current year, which does not take into account inflation or additional payments.

There are also official rate indices according to the established standards Euribor, Libor, which are calculated by summing the coefficients of these indicators and the addition fixed by the bank.

Maximum loan amount

Only some Spanish banks set a specific maximum loan amount, while in others it is determined only by the cost of housing and ranges from 60% to 80% (this figure is already set by the bank).

Then the borrower will need to deposit the remaining amount into his personal bank account, taking into account all taxes and payment for the mortgage procedure for the further purchase of real estate.

Video on the topic:

List of documents

To take out a mortgage in Spain, a Russian must provide documents proving the legality of his income: bank statements, tax statements, certificates from his place of work, etc.

All papers are translated into Spanish and submitted at the time of account opening. Sometimes certificates of no criminal record and additional income, if any, are required. The Bank has the right to request this or that document at its discretion.

For an individual

The loan is issued for both one person and a married couple. When opening a mortgage for several participants, conditions are set for each of the applicants.

An individual must present a valid passport.

List of required documents:

- Valid passport.

- Foreigner identification number.

- Declaration of income for 2 years (form 2-NDFL).

- Bank statements about account status and credit history.

- Certificate from work indicating position and length of service.

- Confirmation of the availability of property.

Expert opinion

Maksim

He has been actively traveling around Spain for the last 4 years.

Ask a Question

All documents must be translated by a sworn translator in Spain.

For individual entrepreneurs

Entrepreneurs also buy real estate using a mortgage loan. To do this, they attach documents from the list for individuals, as well as:

- Extract from the Unified State Register of Individual Entrepreneurs.

- Declaration of income for six months (form 3-NDFL).

Is it profitable to buy a home with a mortgage?

The economic benefits of buying a home on credit from a Spanish bank are visible to the naked eye. According to statistics, the average lending rate in the Kingdom is 3%, while the rate of increase in real estate prices fluctuates around five to eight percent. Among the additional bonuses of such an acquisition, it is also worth highlighting the excellent opportunity to earn money based on the delivery of resort facilities that are always in demand among tourists, and the stability of interest in them among foreign investors.

Buying real estate in the Sunny Kingdom is a fairly simple matter with significant chances of success. Unlike other European countries, local banks show greater loyalty to foreign citizens, offering favorable conditions and not putting obstacles in the way of obtaining a loan. The only condition is to demonstrate the financial solvency of the buyer, without the need to attract guarantors or pledge property as a guarantee. It is not surprising, therefore, that about fifty percent of all resort home lots in the country are purchased using installment payments.

We hope that we were able to dispel all doubts and you no longer have questions about whether it is possible for a citizen of Russia or Ukraine to take out a mortgage in Spain without a down payment and at what percentage it is given to foreigners. If you have any additional questions, please contact our specialists by phone (WhatsApp) or write

Approximate list of expenses

In addition to the down payment for the purchase of the property, you will need an additional amount to pay the costs associated with borrowing funds.

The main ones are:

- The loan processing fee is 1-2% of the loan amount.

- The fee for assessing the property is 500 euros.

- Real estate insurance – up to 300 euros per year.

- Notary services and entering the purchase into the register - 2% of the price of the object.

- Translation of certificates and declarations into Spanish and their certification – 500 euros.

- Property transfer tax – 10% of the value of the property.

When summing up additional payments (taxes, commissions, contributions), the total costs amount to 13-15% of the cost.

In the future, in addition to the mortgage, you will have to pay the monthly maintenance of the purchased property.

Mandatory payments for property owners:

- Property tax (0.5-2% per year).

- Municipal tax (set regionally).

- Tax on renting out space (24% per year).

- Utility payments.

IngDirect Bank

| Mortgage based on a floating interest rate: Euribor + 0.99% | Mortgage based on a combined interest rate, floating + fixed:

| |

| Monthly quota in 1st year | €321,61 | €353,79 |

| Monthly quota starting from year 11 | €321,61 | €338,43 |

| Total amount of interest in euros paid over 20 years | €7187,41 | €13 250,99 |

Interest rates

Mortgage financing is offered for a long term and at a low interest rate.

There are 3 types of interest rates:

- Fixed - 3-3.4% per year, unchanged throughout the entire debt repayment period and guarantees a constant monthly payment.

- Floating – changes value throughout the entire mortgage term. The percentage is recalculated annually or twice a year based on market indicators.

- Mixed - includes both types. One part of the loan is paid at a fixed rate of interest, and the second - taking into account the floating rate. It is risky, but often the loan is repaid before the rate changes.

The average mortgage rate in Spain is from 2.8 to 3.2%.

You are allowed to modify your mortgage by converting it from variable to fixed. The cost of the service is 0.15% of the amount paid.

Property options

You can purchase any kind of housing on credit in Spain - an apartment, townhouse, villa, house, apartment. The only limitation can be the unaffordable price of real estate, since not all banks have an unlimited credit limit, and the solvency of the borrower plays a role.

Housing priced up to 100 thousand euros is in particular demand among foreigners; there are many such offers on the market, including in beach areas. In more prestigious places, the price of an apartment reaches 300 thousand euros.

For such a mortgage, banks require proof of income that significantly exceeds the size of the regular payment. For commercial properties, mortgages are approved less often; more documents will be required.

Look at the same topic: Customer reviews of mortgages from Tinkoff Bank: is it worth taking out a mortgage from Tinkoff in [y] year?

Algorithm for obtaining a Spanish mortgage

The process of obtaining a mortgage takes 2-3 months.

The entire procedure can be divided into several stages:

- Selecting a suitable object.

- Real estate valuation. The process takes up to 10 working days.

- Contacting a bank to obtain a loan and open an account.

- Waiting for a decision. Takes 4-6 weeks.

- Transfer of the required amount to the buyers account (if the answer is positive).

- Signing the contract and entering the transaction into the state. Spanish registry.

According to the new rules, the bank is required to send a copy of the contract at least 10 days before signing the contract. Without a studied duplicate, the transaction cannot take place.

Which banks work with this?

Mortgages in Spain for Russians are available in many banks. These are La Caixa, BBVA, Sabadell, Bankinter, Abanca, Bankia, etc. They have similar lending conditions, but there are differences that are worth paying attention to when choosing.

Bankia offers the lowest interest rate, which makes it attractive to foreign borrowers. However, it strictly applies to money transfers from the Russian Federation, requiring confirmation of the source of money.

Fast service is noted at Sabadell Bank. Within a few days after submitting the documents, the decision on mortgage payments will be known. Sabadell also has its own residential complex for sale.

Bank La Caixa is interesting because it allows opening an account without a NIE (foreigner number) and has been considered the best in personal customer service for 4 years in a row.

And there is little chance of getting a mortgage from Santander. But a credit-free purchase is possible, since Santander has a large real estate asset on its balance sheet.

Bank BBVA

Mortgage based on a combined interest rate, floating + fixed:

| Mortgage based on a combined interest rate, floating + fixed:

| |

| Monthly quota in 1st semester | €329,79 | €354,12 |

| Monthly quota starting from 2nd semester | €329,79 | €354,12 |

| Monthly quota starting from year 11 | €329,79 | €342,55 |

| Total amount of interest in euros paid over 20 years | €9150,61 | €13 739,62 |