If the bank refuses

Sberbank offers Russians a variety of loan products, including mortgages. Citizens of our country very often turn to this organization. Some applicants receive a negative decision.

The reasons may be different:

- Unpaid fines, including for violation of traffic rules.

- Unclosed court cases transferred to bailiffs for execution.

- Debts to pay taxes and/or housing and utilities.

- Damaged credit history, including late payments.

- Errors in the mortgage loan application.

- Failure to satisfy the requirements of the bank of co-borrowers and guarantors.

Sberbank has set a period after which you can apply for a mortgage a second time, equal to 60 days. During this time, you can change the circumstances that became the basis for the refusal - pay off a debt of one type or another, correctly enter the necessary information, exclude third parties from the transaction or replace the co-borrower/guarantor, etc., and submit the application again.

What does it look like in reality?

Extending a mortgage is more of a special case than a practice that not all bank clients can take advantage of. As a rule, people can count on it when their family’s financial situation becomes difficult. The quality of the credit history and the absence of overdue payments are taken into account.

As a result, bankers may approve:

- Deferred payment of the loan principal for a period of 6 months. up to 2 years. The client will only have to pay interest.

- Extension of the loan from 3 to 10 years, if possible according to the standards of the mortgage program. Maximum – up to 35 years.

- Payment holidays, when a person does not repay anything for 3-6 months, until the financial situation stabilizes.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

In any case, an additional agreement to the current contract will be signed, which will indicate the new period and nature of payment. Naturally, they will also recalculate the repayment schedule.

Advantageous mortgage offers from Sberbank of Russia ⇒

The entire procedure will receive the status of a restructured loan. If financial problems arise, you should not wait, but should immediately notify the bank.

You might also be interested in these articles:

By the will of the borrower

Potential borrowers most often apply to several banks at once. They do this in order to be able to get the most advantageous offer for themselves. The client’s application in itself does not obligate anyone to anything.

If a person has already received approval from Sberbank and did not take advantage of the offer, his right to apply again at any time remains. Sometimes a mortgage application is posted as a loan issued. This circumstance has a negative impact on your credit history and can serve as a refusal when applying to the bank. To prevent such a decision, applications from other banks that were not used must be cancelled. A list of issued loans can be found at the credit history bureau.

It might be interesting!

Is it possible to take out 2 mortgages in parallel in 2020?

What do you need to renew your mortgage approval?

First of all, contact your bank. You will be asked to write an application, which will be considered for a certain number of days. This can be done in person at the branch, as well as through your personal account (the service is not available at all banks). Some financial institutions will ask you to update your information. To do this, you will need to bring again a copy of your work record book or employment contract, or a salary certificate. It takes less time to re-register because the main information is stored in the database.

If, while searching for an apartment, you receive a more suitable offer from another bank, then the application is submitted again with a full package of documents. You don’t have to notify the first bank; after the deadline, the offer is canceled automatically. Experts still recommend calling your specialist so that no negative marks are made on your credit history.

Read more: Power of attorney to obtain digital signature for individuals

In conclusion, we note that extending approval for a mortgage application is a popular practice. The least problems will arise if you document the reason why you did not use the approval on time. Financial organizations are more loyal to corporate or regular clients in a situation where the main direction of the bank’s work is mortgage lending.

When applying for a housing loan, you may encounter a refusal. Let's look at its main reasons, ways to correct the situation, and also after what time you can re-apply for a mortgage at Sberbank.

Bank requirements for the facility

Secondary market apartments are not always suitable for mortgage lending from Sberbank.

It places a number of requirements on the object, namely:

- No illegal redevelopment.

- The condition of the apartment building is satisfactory, that is, it should not be considered unsafe.

- An apartment building is not subject to occupancy.

- Housing and utilities paid in full.

Primary market apartments are not tested according to the specified parameters. The bank cooperates with a number of developers. By choosing housing as part of their facilities, approval of the facility is automatically obtained.

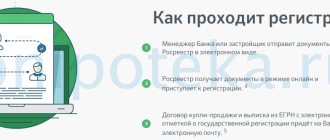

Algorithm for obtaining a mortgage loan

To obtain a mortgage loan, a person must follow the following algorithm:

- Calculate the total cost of the mortgage loan;

- Submit an application and other necessary documentation to the bank;

- Find a collateral apartment in a new building or on the secondary housing market;

- Conclude a preliminary agreement for the purchase and sale of an apartment;

- Collect a set of papers on the loaned object and take it to the bank;

- Assess the collateral property and conclude an insurance contract;

- Sign a loan agreement and receive funds;

- Transfer money to the apartment seller;

- Pay off the mortgage and register ownership of the living space with Rosreestr.

At each stage of the transaction, it is necessary to consult with lawyers, realtors and banking specialists. Some borrowers make the mistake of starting the mortgage loan process by looking for collateral. They enter into a preliminary agreement for the purchase and sale of housing and transfer the deposit to the seller of the property. They then apply for a mortgage, which is rejected by the bank. The potential borrower loses the deposit and is temporarily deprived of the opportunity to solve his housing problems.

The application can be resubmitted by agreement with the personal manager. The counterparty may refer to force majeure circumstances that prevented the collection of all documents on time (the contract contains a provision allowing the extension of the application period).

Documents required for re-application

After the application expires or before this point, it may be necessary to re-apply.

In both cases, the following package of documents is provided:

- Applicant's application form with a new date.

- Passport of a citizen of the Russian Federation. A mandatory requirement is to have a permanent or temporary residence permit. In the latter case, a separate document is provided.

- SNILS, driver's license, foreign passport. Attached in case of an application for a mortgage product without proof of income.

- Document confirming income. This can be a certificate in form 2-NDFL or in the form of a bank; an individual entrepreneur sends an income declaration.

- Employment history. It is certified by the employer (manager or employee responsible for the order) on each page or stitched and signed and sealed. On the last sheet there should be a record of the continuation of work in the last place at the present time.

The application contains data about the property planned for purchase - type of housing (individual residential building or apartment), type of apartment building (new building or secondary housing), and so on.

When submitting documents, applicants are interested in how long it takes to update data from the employer - employment and income certificate. They are considered to be valid for one month.

It might be interesting!

How Sberbank checks borrowers and approves loans in 2019

After what time can I reapply?

The general period valid for all clients is 60 days. But sometimes it is allowed to do this earlier.

If the approval period has expired

It happens that the client does not take advantage of the opportunity to apply for a mortgage on the approved terms and the application is canceled (changed his mind, is not satisfied with the conditions, did not have time to select a property). Its validity period is 90 days. In this case, you can resubmit the documents and application form for consideration at any time.

Re-application after refusal

If the refusal is due to incorrect completion or insufficient data, the manager will offer to rewrite it and resend it for approval. The exception is identified cases of deception and attempts to mislead. Sberbank may refuse to deal with such a citizen and will put him on the stop list.

At the same time, if the client’s situation has not changed in any way, then it is more likely to receive a negative answer again.

If the borrower does not meet the bank’s requirements, then there is no point in submitting a second application until the situation changes. This applies to lack of employment or low income.

If you receive a refusal, you should ask the credit manager about the probable reasons. He will tell you what parameters of the applicant, in his opinion, could lead to a negative decision.

If you do not receive a clear answer, review all the requirements, check your documents for a Sberbank mortgage, assess your solvency and compare it with the financial burden associated with paying off the debt. The fact that you did not have time to select a property (apartment, apartment, etc.) does not affect approval.

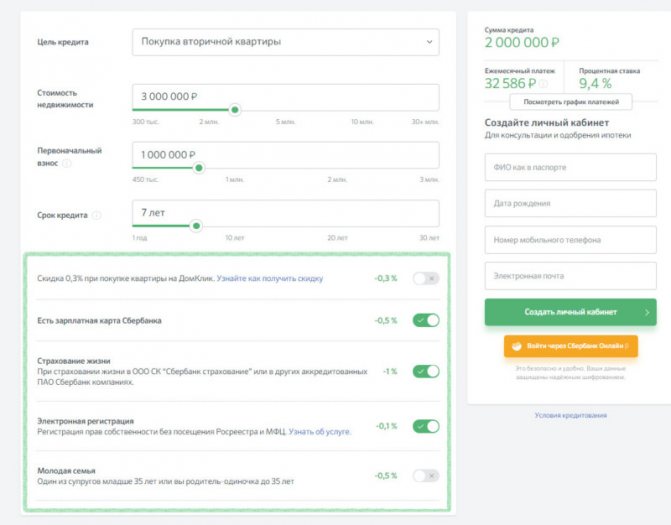

Before you re-apply for a mortgage at Sberbank, you need to try to improve your situation. If there are existing loans, i.e. If the salary level is insufficient to pay two obligations, it is worth paying them off first. You can calculate the ratio of wages to monthly payments using the calculator on the official website.

A preliminary calculation using the DomClick calculator will help you avoid rejection of your mortgage application.

If the calculator shows that the profit is not enough for monthly payments, you can consider different options:

- Increase the period;

- Request a smaller amount;

- Find another property;

- Raise money for a larger down payment;

- Find a co-borrower with a good salary;

- Find additional sources of profit.

If you have a negative credit history, you should try to improve it. To do this, it is recommended to take out a loan from any bank for the shortest possible time and make payments on time. The process is lengthy, but it will allow you to count on mortgage approval in the future.

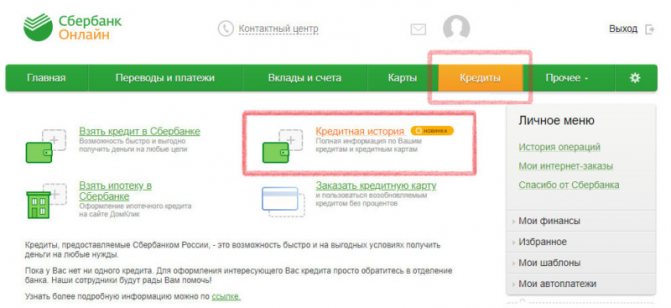

Check your credit history before reapplying - financial score is critical for approval

If you didn't manage to find an apartment

In this case, a repeated application for a mortgage at Sberbank is submitted immediately. It is usually approved through an expedited procedure. The exception is when the documents have expired.

You will find it useful: Sample of filling out a mortgage application form.pdf

Remember that the information on the income certificate (NDFL-2 or according to the bank form) is relevant for the bank only for 30 days.

If you managed to find an apartment in a new building, a good area, etc., re-application is also possible without waiting.

If circumstances have changed

If a person’s situation has changed dramatically compared to the previous one, they can submit a second application earlier than the generally accepted deadline. Among these circumstances:

- An additional source of income has appeared;

- Wages increased significantly;

- It was decided to attract a co-borrower with high solvency;

- There is money available to pay a larger down payment;

- It was decided to use maternity capital;

- Dr.

Submitting a re-application for a mortgage at Sberbank is allowed an unlimited number of times.

Documents provided after approval

After the borrower has selected a property for purchase, he must provide information about it to the bank, namely:

- The title document for the object is a certificate of registration of ownership rights or an extract from the Unified State Register of Real Estate.

- A title document is a purchase and sale agreement, a gift agreement, an equity participation agreement, a court decision, etc.

- Real estate valuation report. Manufactured by a specialized organization that has been accredited by the bank. You can request a list of them from your credit manager. It is ordered and paid, as a rule, by the buyer. Valid for six months.

- Cadastral or technical passport of the object. Contains object parameters, including total area, cadastral number, and so on. Must correspond to the actual state of the object.

- Seller's marriage documents. If the seller has not entered into official relations, then this fact is confirmed by a corresponding statement with a notary certificate. If the apartment was purchased during marriage, then a notarized consent of the spouse to the transaction and a marriage certificate will be required.

- Extract from the house register or certificate of registered persons. Allows you to understand who lives in the residential premises or is registered there. If there are minors among them, one rule applies. They must be discharged to another apartment with their parents or one of them.

- Seller's passport and SNILS. If the owners of the property being sold are several people, then all of them are required to provide the specified documents.

- Marriage contract. It is necessary when purchasing an apartment by a married person, when the property will be registered in the name of one of them or distributed between the spouses in shares, but not equally. In the absence of this document, the common property is distributed in accordance with current legislation.

Buying a home through a mortgage is a complex and lengthy process. It is especially delayed when you re-apply to the bank for approval. The information provided will help not only save time, but also get the desired result by improving your living conditions.

Reasons for refusal of a mortgage application

Each institution has its own risk assessment criteria for issuing loans. To protect the privacy of our system, the reason for the negative response is not disclosed. But the credit manager can tell you what led to the refusal. Sometimes you can guess this yourself if you know the basic parameters that every lender pays attention to:

- Compliance with minimum requirements for borrowers. In Sberbank this is registration, citizenship, age in the range of 21-75 years, permanent employment - from 6 months, total experience - over a year.

- Authenticity of documents and submitted information. Providing inaccurate or false information is not permitted. The applicant's information is checked and, if fraud is detected, the mortgage is denied.

Please pay attention to Sberbank requirements when uploading documents

- Trustworthiness. There is a check for violations of the law, participation in litigation, etc.

- Level of financial condition. This is the main criterion that is compared with the requested amount in order to determine the possibility of repaying the debt. Perhaps, in the bank’s opinion, you were unable to save enough for a down payment on your mortgage or your income is too low.

- Credit history . Previous loan relationships, timely repayment, arrears, and whether there are any current outstanding debts are checked. The latter may prevent a person from repaying his mortgage on time if his salary is insufficient.

- Employer . It is determined whether the company is operating, its reliability, whether there are arrests on accounts, etc.

A refusal may be issued if you managed to find an apartment or other property, but it did not pass a bank audit.

Please note the official comment from Sberbank on re-application

There are certain requirements for real estate, the main one of which is liquidity.

The apartment must be located in a building that does not require major repairs, is not registered for demolition, or in a dilapidated and old building. If the selected apartment does not suit Sberbank, you will need to find another one.

Read more: 290 Criminal Code for failure to serve mandatory work sentence

What to do after a mortgage application is rejected

If a person is denied a mortgage loan, he can re-apply to the banking organization within the prescribed period. If the refusal was received at Sberbank, you can contact another bank. There is a possibility that the documents will be approved there. However, it is worth remembering that after abandoning Sberbank, the conditions will be less favorable: the interest rate is higher, the amount of the down payment will be larger.

There is no limit on the number of applications. You can try contacting several organizations at once. Don’t forget about small banks: they have fewer clients and checks are not as thorough.