Conditions of the main mortgage programs

Promotion for new buildings

:

- Purpose of the loan: purchase of housing in a new building with varying degrees of readiness.

- Amount: min. 300,000; Max. 85% of housing cost

- Duration, up to: 30 years

- Rate,%: 10.4

- Down payment,%: 15

- Additional conditions: increase in rate upon refusal of insurance and electronic registration.

Ready housing

:

- Purpose of the loan: purchase of any premises on the secondary market.

- Amount: min. 300,000; Max. 80% of housing cost

- Duration, up to: 30 years

- Rate,%: 10.75

- Down payment,%: 20

- Additional conditions: additional security at the time of registration. Property insurance

Maternal capital

:

- Purpose of the loan: under the terms of the “Ready Housing – Flat Rate” and “Housing Under Construction” programs.

- Additional conditions: transfer of maternity capital within 6 months. after the transaction is completed.

Construction of a residential building

:

- Purpose of the loan: individual construction of a house.

- Amount: min. 300,000; Max. 75% of housing cost

- Duration, up to: 30 years

- Rate,%: 12.25

- Down payment,%: 25

- Additional conditions: additional security at the time of registration. Property insurance. Pledge of land.

country estate

:

- Purpose of the loan: construction or purchase of buildings for consumer purposes. Purchase of land.

- Amount: min. 300,000; Max. 75% of housing cost

- Duration, up to: 30 years

- Rate,%: 11.75

- Down payment,%: 25

- Additional conditions: guarantee of individuals. Real estate insurance.

Military mortgage

:

- Purpose of the loan: purchase of residential real estate on the secondary market.

- Amount: max. 80% of housing cost

- Duration, up to: 20 years

- Rate,%: 10.9

- Down payment,%: 20

- Additional conditions: participation of a military personnel in the funded mortgage system. Age up to 45 years.

There is a special program for young people, the condition of which is that the borrowers are under 35 years old.

Mortgage from Sberbank Online

Sberbank is the largest financial institution. Most Russian citizens and foreigners trust this bank due to the fact that it was established by the Central Bank of Russia. The Central Bank is the main shareholder, which implies a higher degree of reliability. The lender offers mortgage programs to its clients depending on the borrower’s status. The general conditions are:

- Loan amount in the amount of 300 thousand rubles to 9 million. The loan is given only in rubles.

- Minimum percentage of 13%. But this indicator is not critical, since preferential mortgage products are available.

- The loan term reaches 30 years.

- The down payment is on average a third.

To complete an online application at Sberbank for a mortgage, you will need proof that the person has official income. But in some cases, additional documents from the workplace will not be needed.

The person must have Russian citizenship at the time of application. And the property being purchased must be located in the Russian Federation and registered on its territory. If a person submits an application without documents confirming income, the bank classifies him as unreliable.

If a citizen cannot take responsibility for paying the loan, he takes on a co-borrower. An automatic co-borrower is a spouse who is responsible to the financial institution in the process of fulfilling obligations. The co-borrower's salary will also be taken into account at the time of calculating the loan amount.

Who can become a borrower

A person who has reached the age of 21 can apply for a mortgage. The maximum age at the time of fulfillment of obligations, depending on the program, can be from 55 to 75 years.

The potential borrower must have a stable income. When calculating solvency, the total income of co-borrowers will also be taken into account, while their expenses for mandatory payments should not exceed 60 - 70% of the amount of income. The percentage will depend on the number of dependents and other factors determining ability to pay. Work experience at a permanent place of 6 months or longer. Total labor – from 1 year (for the last 5 years). It is necessary to have Russian citizenship and registration (temporary or permanent) within the radius of a Sberbank branch. A positive credit history will be one of the criteria influencing the decision.

Service Benefits

Sberbank is a commercial institution founded in 1991. It is the largest bank in Russia in terms of volume of transactions with individuals.

Its advantages include:

- Convenient Internet banking, which allows clients to perform many different actions with funds in their current account (ordering statements of expenses, transfers in various currencies, paying loan debts and much more). An advantage to this should also be noted the presence of a clear interface, thanks to which you can navigate the personal account (PA) menu without any problems and make the necessary transactions in a matter of seconds.

- Remote connection of banking services by submitting an application on the bank’s official website. By choosing this variation, for example, to apply for a mortgage loan from Sberbank, you can find out the decision on the submitted application form without leaving home, and if it is approved, receive funds to any bank card or current account.

- The presence of several lending programs, thanks to which you can get a loan with or without collateral and guarantee.

- A call center operates 24 hours a day, whose specialists can be contacted via a single toll-free number 900 or by submitting a form on the website sberbank.ru in the “Feedback” section.

- Reliable protection against unauthorized access to your Internet profile. If you need to improve security, you can either set up a login to your account using a one-time password, which will be sent to your phone number in the form of SMS, or specify an additional email in the settings.

Pre-application procedure

If you qualify for all of the above, then let's look at how to apply for a mortgage at Sberbank. To get started, go to the official website in the “Loans” section, find the “Mortgage loans” item and open the mortgage calculator. Make a preliminary calculation to get an idea of the terms and amount of the loan. Pay attention to the discounts that you can receive when using additional services, such as life and health insurance and electronic registration of a transaction, processing a transaction with individual developers. On the same website (menu “Application for a loan”), an online application for a mortgage with Sberbank is completed. You need to enter your full name, the selected loan product, the desired amount, registration information and feedback information.

You can get preliminary advice on a mortgage from Sberbank at the branch itself.

Online mortgage application process

The whole procedure is considered quite simple, and is divided into successive stages:

- banks and programs are selected, and it is recommended to submit applications to several institutions at once in order to increase the likelihood of receiving approval in at least one area;

- fill out the appropriate forms, where only correct and accurate data must be entered;

- you need to wait for the decision, and the notification will be sent in the way that the potential borrower chooses when filling out the application.

Is it possible to get a mortgage at Sberbank online? Watch the video:

Important! The advantages of using an online application include the speed of completion of the action, as well as the absence of the need to personally visit a bank branch.

Features of sending an application and agreeing on conditions

As soon as the application is completely filled out, it is sent to the bank, and it usually does not take much time to complete it.

The bank will respond within two days, and if the application is sent on a working day, this period may be reduced by several hours. A bank employee contacts the applicant and invites him to come to the bank to agree on conditions.

It is at this stage that the main nuances of future cooperation are selected.

How can you get a loan next?

Approval of the application is preliminary, so in any case you will have to visit the bank branch and agree on all the conditions related to obtaining a mortgage.

These include the loan amount, loan term and other nuances.

It is discussed which apartment can be purchased, as well as when it should be pledged. All these rules and requirements may vary significantly from region to region and bank to bank.

Important nuances of fulfilling the terms of the contract

After agreeing on the terms and receiving approval, you need to look for an apartment, and it must meet the bank’s requirements.

The following steps are performed:

- the selected property is assessed;

- the seller’s documents are studied;

- a purchase and sale agreement is drawn up;

- insurance is issued for the home and for the borrower himself;

- a mortgage agreement is formed and funds are transferred to the seller;

- The apartment is registered in the name of the buyer.

Next, he must make monthly payments to the bank to pay off the mortgage.

Sberbank website with a list of online services.

Terms of consideration

How many days Sberbank will consider your mortgage application will depend on the completeness and reliability of the data provided. The online application for a mortgage with Sberbank is completed instantly. Feedback is provided on the same day , in some cases it may take longer. Next, wait for the employee to call to invite you for an interview. Already there you will be selected a suitable program, given a sample of filling out the application and questionnaire, as well as a list of necessary documents. When using the “Home Click” service, you can upload the necessary documents in electronic form. There you can also take advantage of an online consultation with a specialist in an open chat. The submitted application is considered for about five days, subject to the submission of a complete package of documents. Many people have difficulties with deadlines if the desired apartment is not fully decorated. You can use the help of special agencies, a list of which is on the website.

Features and documentary support for obtaining a mortgage via the Internet

Modern and large banks provide the opportunity for their customers to apply for mortgage loans through their official websites.

Important! When filling out such an application, only reliable information must be entered, and no lines must be omitted, since if there are errors or false data, approval of this application will be refused.

If any questions or inconsistencies arise while filling out the form, it is advisable to call the manager of the selected bank to ask the necessary questions.

Sometimes it is necessary to attach electronic versions of documents to the application, and these include a passport and a certificate from the place of work, which indicates the citizen’s income.

If a person is a salary client at a bank, then confirmation of his income is usually not required.

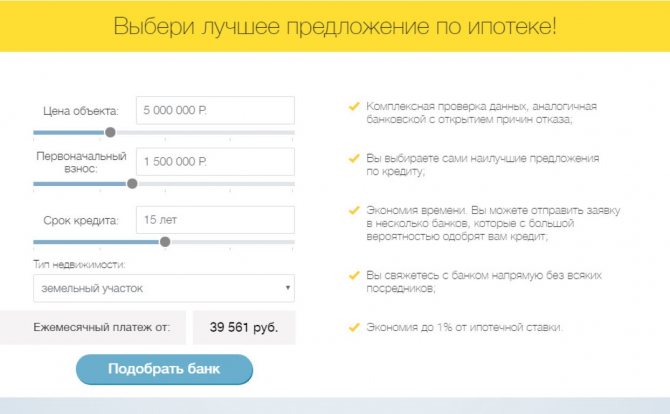

How to find a mortgage with the right terms online.

How to find the optimal program with transparent conditions

Before submitting an application online, you should decide directly with the bank, as well as with the lending program.

What are the risks when buying an apartment with encumbrances? See here.

To do this, the offers of various banks are studied, and the use of special services on the Internet is considered effective, with the help of which it is possible to select the most optimal option with transparent conditions that will be suitable for the immediate potential borrower.

When choosing a program, the following conditions are taken into account:

- interest rate;

- the maximum and minimum amount that can be received by the borrower to purchase a home;

- loan terms.

When using the selection service, you only need to set the necessary filters, after which all suitable offers will be displayed.

What is included in the complete list

Information about borrowers and guarantor

When you undergo consultation for a mortgage, Sberbank will provide a manager who will determine the number of co-borrowers and guarantors. Legally married spouses must be co-borrowers. In other cases, there may be a need for a third co-borrower (if the spouses have insufficient solvency). A guarantee from individuals is required until the encumbrance is registered in favor of the bank. Each participant fills out and leaves a personal questionnaire, which is submitted along with an identity document. Co-borrowers additionally submit second identification documents. A certificate from a psychoneurological clinic is provided if you do not have a driver’s license.

Employment and solvency information

A work record book certified by the employer, or an extract from it (your choice). Salary project participants do not provide information about income. Other citizens confirm their income for the last six months with a certificate drawn up according to the employer’s form or 2NDFL.

Information about the property

- documents confirming the seller’s ownership of real estate (a certificate issued by Rosreestr, or an extract from it, a purchase and sale or gift agreement);

- certificates of absence of encumbrances on residential premises and arrears in payment of utilities;

- independent assessment of the apartment;

- other documents.

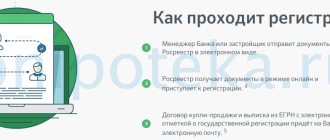

How long does the registration procedure take?

After submitting an application to a bank branch, completing the entire procedure until the receipt of documents for real estate takes 4-6 weeks.

When the application is approved, the borrower has 3 months to search for real estate and evaluate the premises. The duration of the procedure will depend on the number of documents provided. Employees of a financial institution will tell you how to find out about a Sberbank mortgage. Rate the author

A single online application for loan selection to all banks

Required data and documents

To make the procedure for obtaining a loan faster after completing the application, the following data is collected in advance:

- Personal information about the applicant in the form of initials with a transcript, passport details and contact details.

- Data regarding the presence of other family members, education.

- Contact information: work number, mobile, email.

- Can a person be considered creditworthy? To determine this indication, you should write down the name of the company where the applicant works, average earnings and answer questions about the distribution of your budget.

- Information about available loans and credit cards from other banks.

Information about a person must be entered without errors so that the bank does not refuse.

It will not be possible to deceive the system, since the fields have an automatic check of possible entries. If those filling out make mistakes in the number of numbers or words entered, the system will underline these fields in red.

Look at the same topic: Mortgage in MTS Bank in [y] year - review of mortgage programs

How to find out the decision on your application

After checking the data, a mortgage specialist will call the client. The bank employee will discuss all the nuances of the program, ask questions and clarify his own. Together with the potential borrower, the specialist will agree on the time and date of the visit to the Sberbank office.

To find out your status at the time of viewing the application, you can use alternative methods offered by the financial institution: hotline number, email, feedback, interactive chat. It is also possible to contact a specialist through social networks. During the conversation with the bank employee, the application number is indicated, which can be viewed in your personal account.

Step-by-step description of the process

To apply for a mortgage loan online, you need to go through the following steps:

- Log in to the official website of Sberbank, where there is a tab with the name of the product “mortgage”.

- Among the offered credit products, the one needed by the client is selected. If the client knows the conditions, he immediately starts filling out the application; if not, he opens the tab with additional information.

- The system moves the user to Domklik from Sberbank. A system opens with the ability to calculate using a calculator, which will clearly display information regarding the payment and loan term, the percentage of the down payment, possible benefits and additional conditions. People participating in affiliate programs check a box and enter information to receive a bonus.

- The client has access to filling out personal data on the right side of the screen. You should enter the information and click on the offer to create a personal account.

- In order to register in the system, a username and password are created, which must be confirmed after verification via SMS.

- After logging into his personal account, the client can see the loan application awaiting him. Electronic copies of personal documents are attached, after which the application is sent to the bank.

- The user can, through geolocation, choose the place where the transaction will be made: the address of the nearest Sberbank office.

- After the data is sent to the bank, the applicant must wait for a response and prepare the documents necessary for the transaction.

The personal account will then operate for the client on an ongoing basis: you can check the status of your loan, make payments, open cards, etc.