Last update: 02-07-2020

0

0

Coronavirus, lower oil prices, stock market collapse, ruble collapse. Well, we have another crisis.

In this article, we will figure out whether it is worth taking out a mortgage in 2020 or is it better to wait until the situation normalizes?

It is important to understand! A mortgage is a working tool that really helps you get your own home, but only if you use it wisely.

Do not believe those who are against mortgages; as a rule, for this category of people the housing issue has already been resolved.

Banks are now offering very attractive mortgage rates.

Let's figure out why a mortgage loan isn't so scary? Is it worth taking out a mortgage during a crisis?

Is it profitable to take out a mortgage in 2020?

If we compare it with 2014-2015, when the interest rate started at 13% and above, now in 2020 it is more profitable to take out a mortgage. The rate ranges from 2 to 10 percent (depending on which category of borrowers you fall into).

A mortgage at 2% per annum is unlikely to be easy to obtain. Most likely there will be restrictions and not very favorable conditions.

Two examples:

First example. I looked at new buildings in my city. As soon as such a program appeared, to compensate the bank for interest, the developer raised the price. Apartments immediately became uninteresting for purchase.

Second example. A low interest rate is good, but when I started to understand the conditions, it turned out that the interest rate was not fixed. I think everyone understands that due to political instability in the world, tomorrow some event may happen and everything will fly up. And instead of 2% you will have to pay 8-10-15, etc. Has anyone forgotten the foreign currency mortgage in 2013-2014?

The rate is unlikely to go lower, but its growth is quite possible.

With a mortgage of several million rubles, a difference of 2-3% will have a significant impact on payments and the final overpayment.

- If you are planning to buy an apartment with a mortgage, then there is no point in waiting for better times.

- In addition, not so long ago, news appeared in the media that the Central Bank of the Russian Federation wants to tighten the requirements for mortgage borrowers and increase the size of the down payment.

- While loan rates are being lowered all over the world, our country is going its own way – rates are rising.

We also do not forget that from 2020 new rules for the work of construction companies and settlements with shareholders began to apply. We're talking about escrow accounts. The name is of course incomprehensible, but in the video below everything is explained in accessible language. Relevant in

However, many banks, together with developers, offer various programs where you can save money.

The process of obtaining a mortgage at Sberbank

A mortgage from Sberbank is issued on a special portal “DomClick”. All stages of the mortgage transaction are carried out via the Internet, with the exception of signing a loan agreement for real estate.

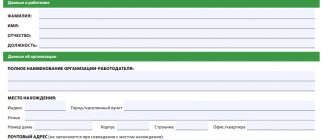

Applying for a mortgage at Sberbank consists of the following steps:

- We calculate the loan using a mortgage calculator (select a loan program, mortgage term and indicate the amount of the apartment, after which we get a preliminary result)

- After reviewing the amount of payments and the total loan amount, we send the application to Sberbank for consideration

- We choose an apartment within the amount of the approved mortgage application (new building, secondary housing, country house, etc.)

- We formalize the deal (first we make a visit to the bank to sign the loan agreement and other documents)

- We make monthly payments within the period specified in the contract

- We pay off the mortgage to the bank

- The bank removes the encumbrance from the apartment and it becomes completely your property (it is best to order an extract from Rosreestr 30 days after paying the mortgage)

If you seriously intend to take out an apartment or house on a mortgage, then it is better to start doing this in advance, since each stage takes a certain time. The longest stage is the consideration of the application by the bank.

In addition to the principal amount of the loan, the borrower is required to take out home insurance , since for the entire period of repayment of the mortgage the purchased property will be pledged to the bank and the insurance will serve as a guarantee of the safety of the collateral from unforeseen events (fire, property damage, real estate emergencies). Also note that you are not required to purchase liability insurance from the bank , since this service is optional.

You can calculate the approximate cost of housing with a mortgage using the Sberbank mortgage calculator below.

Should you take out a mortgage in 2020?

To make it easier to assess how the situation is specifically for you, look at the rules below. If something is not being done, then this is a reason to think about it, since there is a risk.

- Calculate your financial capabilities (article about how to manage a family budget). You should not take on a mortgage with payments exceeding 30% of the family budget. Incomes may decline, people get sick, etc.

- Leave a reserve of money in case of unforeseen situations (there should be a reserve for at least 3-6 months, and preferably for a longer period).

- The loan must be taken in rubles or the currency in which you receive income.

- The interest rate on the loan must be fixed.

- Life + health + property insurance must be taken out.

- Assess your sources of income. The situation with coronavirus is very revealing. There will now be colossal losses in many areas (tourism, transportation, event organization, etc.). Some will go bankrupt, some will be laid off, and somewhere operations will be suspended. For this kind of case, a stash will come in handy (see point 2 above).

A mortgage is an important step and the decision is up to you! The responsibility will also be yours alone! Remember that not only any action entails consequences, but also inaction.

To make a more thoughtful and balanced decision, you need to imagine what you will have to face.

To complete the picture, I recommend reading the articles from the list below:

- Mortgage Step by Step - the procedure for buying an apartment with a mortgage, what needs to be done and in what order.

- How to save money in the family - here are 4 rules and 35 examples that will help you save money and ease the mortgage burden.

- Documents for a mortgage - here is a general list of documents that the bank may request, you can make sure that there is nothing supernatural there.

- Another important question will be which apartment to buy - with a rough finish or not, and you can also find out how much it costs to renovate an apartment with a rough finish. How long does it take to renovate an apartment?

- After an apartment has been found, a preliminary agreement should be drawn up, read here, you can also find it there.

- After purchasing an apartment, we proceed directly to renovation and an apartment renovation plan will be very helpful.

To take out or not to take out a mortgage during a crisis?

By the way, my wife and I have already paid off our second mortgage. Read the detailed review at the link

As for crises , in the picture below you can see the change in the dollar exchange rate between 1998 and the beginning of 2020.

I think there is no need to write about 1998 and 2014 (August 2008 – military conflict with Georgia). True, in 1998 the population had practically no money, but in the face of new shocks they accumulated some fat and endured everything much easier.

This means that crises happen with enviable regularity. About once every 7 years, difficult times come. Putting your life on hold because of this is simply stupid. You need to be prepared for this.

For example, a simple rule is not to keep all your savings in one currency.

Do many people do this? Do many people have a reserve of money for half a year?

As much as I look at my friends, basically everyone runs to buy dollars just before a vacation, and they only have a reserve of money for a maximum of 1 month.

But let’s return to the main question: is it worth taking out a mortgage during a crisis or waiting for better times?

- If the rates are high, no one is rushing you to buy, and your income is subject to fluctuations, then why take the risk.

- If the crisis, on the contrary, opens up good opportunities for you and you are confident in your abilities, then why not.

Mortgage fear and how to deal with it

What scares you the most about a mortgage?

First of all, these are long loan terms: 5, 10, 15, 20 years .

Is this really scary? Will you really have to pay all these years and won’t be able to pay it off sooner?

No no and one more time no!

Keep in mind that no matter what type of payment you choose, if you start paying off early, you can reduce the overpayment and the mortgage term (comparison of annuity and differentiated payments).

Example . Calculate how much your salary has increased over the past 5 years. Now imagine if you took out a mortgage 5 years ago, you could now start paying it off ahead of schedule, because... payments remained the same.

Calculation of the period for which it is more profitable to take out a mortgage

Don't be intimidated by a 20-year mortgage if you have a fixed interest rate. In just 4-5 years you will begin to pay off your debt ahead of schedule and payments will not be so burdensome for you.

Requirements for a borrower for a Sberbank mortgage

Any loan implies the presence of certain requirements for the applicant for a loan, and a mortgage from Sberbank is no exception. The list of mandatory requirements for a borrower wishing to take out a mortgage is as follows:

- Age : from 21 years (age at the time of return - up to 75 years)

- Work experience : at least 6 months at the current place of work and at least 1 year of total work experience over the last 5 years. Overall length of service is not important if you receive your salary into your Sberbank account

- Attracting co-borrowers : no more than 3 individuals can act as co-borrowers on a loan, whose income is taken into account when calculating the maximum loan amount. The requirements for the Co-borrower(s) are similar to the requirements for the Borrower.

- Citizenship : citizen of the Russian Federation

First of all, it should be said that those potential borrowers who do not have official employment and cannot therefore provide a certificate of income will not be able to obtain a mortgage loan from Sberbank.

In this case, it would be useful to have an additional source of income, which should also have official confirmation. For example, social benefits or a pension could play this role.

However, the requirements for the financial situation of the applicant will not be the only ones. Sberbank will necessarily require a potential borrower to involve a co-borrower in the credit transaction, which is usually a spouse.

Sberbank also puts forward restrictions in relation to the age of a potential borrower wishing to obtain a mortgage loan. It seems possible for citizens who have reached the age of majority to obtain a housing loan from this bank, although, in fairness, it should be said that in practice, most often a positive decision on issuing a mortgage can be achieved by applicants who have reached the age of 21.

A distinctive feature of mortgage lending at Sberbank is that this lender does not impose strict age restrictions on applicants of retirement age. The main thing is that by the time the loan is fully repaid, the borrower’s age does not exceed 75 years.

By the way, it should also be noted that applicants who have negative entries in their credit history will definitely not be able to get a mortgage from Sberbank, while the lender will be completely uninterested in the financial condition of the potential borrower and his compliance with other requirements.

Advantages of a mortgage loan that should not be forgotten

Now let’s get acquainted with the advantages of a mortgage in order to ultimately decide whether to take out a mortgage.

- Buying an apartment with the help of a mortgage is much safer than just through a real estate agency, because... the bank at least somehow checks the documents and is interested in ensuring that no problems arise in the future (not a 100% guarantee, but something). This way you can even arrange everything without realtors and save on commissions. The only thing is that you need to correctly draw up a preliminary agreement, but this is not that difficult, some banks even provide their own form.

- A mortgage loan typically has a lower interest rate than a consumer loan.

- Registration of documents on mortgage transactions takes place in just 7 days.

- A mortgage allows you to buy a home much earlier than if you save money for it. This is especially true for those who live in a rented apartment. It’s one thing to pay for your own house and another when you have to pay for someone else’s apartment (possibly purchased with a mortgage). about what is more profitable , a mortgage or a lease, in this article.

- Another plus is that if you save money, then inflation will “eat it up,” while the purchased apartment, on the contrary, becomes more expensive. Again, due to inflation, payments will become less and less burdensome from year to year.

- You can get a deduction (popular questions about deductions) from the interest paid on the mortgage and thereby get back 13% of the amount spent (instructions on how to fill out the 3-NDFL declaration), and then make it as an early payment on the mortgage (overpayment and term will be reduced).

- If problems with money still arise, no one will kick you out of the apartment so easily. You can take a credit holiday.

I’ll tell you in what cases you shouldn’t take out a mortgage.

We are publishing a response to our reader’s “personal experience”: “We’ll figure out what’s more profitable – renting or buying”

. - ed.

Having your own apartment is, of course, good, there are many advantages. And if there is an opportunity to buy with minimal or at least reasonable borrowing, or even with your own funds, then why not, especially if you don’t have your own apartment, but the need for it is felt.

But to fit into a mortgage to the maximum extent possible is, in my opinion, not very reasonable.

Although everyone decides for themselves. Well, before making a decision, you need to think, assess the risks, your capabilities, and escape routes. I’ll try to formulate a number of questions to which it would be nice to have answers when making a decision, and points that need to be clearly understood.

1. We must clearly understand that the decision to buy an apartment, especially on a long-term loan, is one of the most important decisions in a person’s life, on approximately the same order as the decision to have a child.

A mortgage is not a loan for an iron, a mobile phone, a vacuum cleaner, a saucepan (underline as appropriate); buying an apartment is not like going out for beer.

A debt of a million rubles, two, three, is not enough to borrow teal until payday. The bank is not the neighbor from whom you borrowed this teal, and it has many more opportunities to collect the debt. This is the first thing to realize.

2. It is necessary to keep in mind that anything can happen in life, for example, you can lose your job and look for a new one and still not find it.

You can argue for a long time that real estate will only become more expensive, but it is necessary to take into account that it may become cheaper when making a decision that will determine your life for the next 10-20-30 years.

The fact that wages do not always rise, but sometimes fall, must also be taken into account. The fact that inflation may decrease to 2% and will not eat up your debt must also be taken into account. The fact that the need for specialists in your profile may decrease, or perhaps the need for your profession will disappear altogether.

3. If you are a young specialist with little experience, a good salary, and your salary has only grown so far, this does not give grounds to predict salary growth at the same rate for 30 years in the future.

I’ll repeat again: anything can happen, maybe you’ll have to retrain from an office clerk to become a road worker (pah-pah-pah).

4. Saying that I still don’t want to pay more for the mortgage won’t work; in Russia you can’t get rid of the mortgage. This is all very serious and will last for a very long time.

5. You also need to clearly understand what you are paying for. How well does the quality of the product correspond to its price?

Now the questions.

1. If you take out a mortgage with a small down payment, then if the price of an apartment falls, the bank may require additional collateral. What can you contribute as additional collateral?

2. If you lose your job, is there anyone to cover for you? Will your parents be able to help you with your mortgage payments for at least six months? Or do your parents have a salary that is 4 times less than yours and half the monthly payments?

Have you ever wondered why your father, with 30 years of experience, the highest possible rank, class, PhD (underline as appropriate), has a salary that is half as much as his mortgage payments? And why is your salary 4 times more than his? Maybe you are overrated about 8 times, and how long will it stay that way?

3. Again, many young people have a share in their parents’ apartment. If you lose your job, apartment prices fall, or for some other reason you can’t pay your mortgage, can the bank demand this share to pay off the loan, an additional mortgage, or something else?

Will your parents end up on the street thanks to you?

If mortgage payments are at the limit of your current capabilities (1/2-2/3 of income), if the down payment is small, if apartment prices are sky-high, and your salary has only grown and you have little life experience, then the risks described above increase many times over.

What to do? Think, weigh, decide. Think with your own head, don’t be fooled by extreme opinions (apartments will only become more expensive; salaries will only rise; grab it now, later it will be too late), decide based primarily on your current capabilities, and not on possibly inflated expectations for the future.

Having calculated and assessed, I concluded that the mortgage payments would be at the limit of my capabilities, and with such a payment amount in the event of losing my job, no one could help me, despite the fact that my salary is several times higher than the average, and I was looking at apartments the lowest price range and, accordingly, the minimum size.

Now I sleep peacefully, and the cries of “AAA! Grab it today, tomorrow it’ll be too late!” I also take it calmly, well, even if tomorrow it will be more expensive, I can’t do it today.

Does all of the above mean that you should never, absolutely, absolutely not get involved with a mortgage? No. Not at all. You just need to approach this wisely. If I can’t afford a mortgage now, then fine, I’ll wait, maybe later I’ll get involved in this business; it’s unlikely that I’ll be able to buy an apartment without borrowed funds.

Good luck.

Mortgage risks and dangers to consider

Let's consider the most likely risks associated with a long loan term and a large amount.

- You can lose your source of income (for example, you were fired from your job), BUT in this case, you can ask the bank for a deferment in the payment of the principal debt (credit holiday). And it’s hard to believe that someone will sit idly by; for the first time, you can always find a job not in your specialty or one that pays less - several proven options for how to make money on the Internet (without cheating).

- To be more relaxed in this regard, it is better to set aside a reserve for a rainy day in the form of 3 monthly payments.

- Health problems may arise. In this case, a nest egg + health insurance will save you. Not a 100% guarantee, but still much calmer.

- Recognition of the transaction as invalid. To do this, you can get title insurance. What is it, read the link.

These are the main problems that may arise.

For example, if in one family a decrease in income by 50% will not particularly affect the ability to pay the loan, then in another it will lead to late payments on the mortgage loan. I don’t think there is any need to explain what will happen if one of the family members loses income.

Assess all risks correctly and leave a reserve amount for at least several months of payments.

I also recommend watching the video below. A lot of useful information in 15 minutes. Set the playback speed to 1.5-1.75 in the settings to save time.