In situations where a potential borrower has a stable and good income, but there is no proper registration of this very profit, the bank has to maneuver with unofficial sources of funds to retain the client. To do this, all banking organizations in Russia have developed their own alternative to the 2-NDFL certificate - the so-called “certificate in the form of a bank.” With 2-personal income tax, everything is generally simple - you came to the employer’s accounting department, asked for paper, and took the finished document to the bank. How to work with an “informal” document? This article is devoted to the questions of how to fill out a certificate correctly, why it is needed, how long it is valid and where it can be obtained.

More information about the Sberbank certificate

The bank's management has approved for consideration a certain set of papers that are needed when applying for a loan. Separately, documents are prescribed that confirm the client’s income and experience. A bank form certificate is one such official document.

What is a certificate from Sberbank in 2020:

- a unified form that cannot be changed;

- in terms of volume, this is a certificate in one sheet of A4 format;

- information is presented in blocks of information: the first - general information about the employer, the second - information about the employee, the third - an indication of the average monthly income for six months (or for the time that the employee works at the company), the fourth - establishing the authenticity of the paper with the signatures of the manager and chief accountant .

The date of issue is indicated in the header.

Reference! A certificate from Sberbank will be needed not only for a loan, but also when applying for a guarantee. Therefore, we recommend downloading it.

Why do you need a 2-NDFL certificate?

The abbreviation “NDFL” is defined as a tax on personal income. The “2-NDFL” certificate is an official document that is issued to a citizen who has the status of an individual. It contains information about the place of employment, the amount of wages and tax deductions for the year.

According to Russian legislation, all employed Russians pay income taxes to the state. If you are officially employed, then Form 2-NDFL will be issued by the accounting department without unnecessary red tape. It is this paper that confirms that a citizen has an official income and its size.

Why is the document needed?

The sample is needed so that the client can officially confirm with Sberbank his average monthly earnings and work experience in order to receive a loan. Often the main confirmation document is a certificate on the tax form. This is a report already submitted to the territorial body. The Federal Tax Service is responsible for the accuracy of the information. This is 2-NDFL, which reflects both income and the calculated tax on it.

A bank form certificate is required for several reasons:

- real earnings exceed the income that is reflected by the employer in the tax office. This is the well-known salary in envelopes. Many individual entrepreneurs work according to this scheme;

- the income received is not official. The client is not legally employed: no employment agreement or contract has been concluded with him;

- the client is engaged in legal activities, but works on the basis of a contract;

- the employer refuses to issue a 2-NDFL certificate;

- The law limits the issuance of form 2-NDFL.

It doesn’t matter for what reasons the client cannot bring a tax return using the above form, he will most likely have to confirm income in 2020 in some other way. It is for such purposes that Sberbank has developed a unified form for reference, which can be filled out free of charge.

What to do if the bank calls about someone else's loan? Read here. Sovcombank hotline numbers. You will learn what issues are resolved by phone support, as well as other types of communication with bank support by reading the article at the link.

Read all about insurance for loans that are subject to repayment at the link: https://samsebefinansist.com/banki/kak-vernut-strahovku-po-kreditu.html

What is it and why is it needed?

Obtaining a loan - both a regular consumer loan and a mortgage or a large loan - is impossible without the solvency corresponding to the amount taken. The bank never practices charity: it gives loans only to those persons who can not only repay the debt in full, but also pay in excess of the amount issued (overpayment - interest, penalties, etc.).

But anyone can say that they earn well and get a loan through deception. Therefore, as of 2020, banks always require documents from the future borrower confirming his income. As a rule, a standard certificate in such cases is accepted in form 2-NDFL on the amount of a citizen’s salary and his other registered income. But what to do if the client has a good unofficial income? That’s when you need a salary certificate in the bank’s form.

At its core, this is a document of a reference nature, drawn up bypassing the tax and other regulatory authorities. In terms of the nature of the information displayed, there is no difference between 2-NDFL and a certificate in the bank form. But there is a difference in content: 2-NDFL indicates only those incomes that are registered and on which taxes have been paid (or will be paid); a certificate in the form of a bank, on the contrary, does not obligate anyone and indicates only the real income of the citizen.

This document is very necessary if:

- If the employer cannot order a standard certificate from an accountant due to bureaucratic reasons;

- If the client receives a “gray” (minimum salary according to the Labor Code of the Russian Federation and real salary in an envelope) or “black” (everything in an envelope) salary;

- If the client has income on the side. For example, renting out an apartment without registering an agreement;

- Lack of registration according to the Labor Code of the Russian Federation in the workplace.

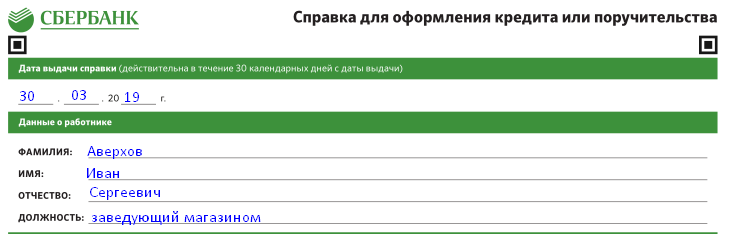

What does the sample look like?

The sample consists of four informative blocks, which we have already discussed, located on one A4 page spread. The certificate is issued in the corporate color. A sample form for Sberbank looks like this:

Where can

The form can be downloaded:

- on the bank’s official website online;

- on our website via the link.

Before submitting a loan application, check which set of documents should be collected. If Sberbank is ready to review a certificate using its form, it’s free and read the information. You can also be given such a template at the lender’s branch where the loan was issued.

Bring the printed sample to your place of work and give it to the contractor who will fill it out. This is often done by the company's payroll accountant. If you work for an individual entrepreneur, the document is filled out and endorsed by an employee who performs the duties of an accountant. If this is not the case, an individual entrepreneur is responsible for issuing the certificate.

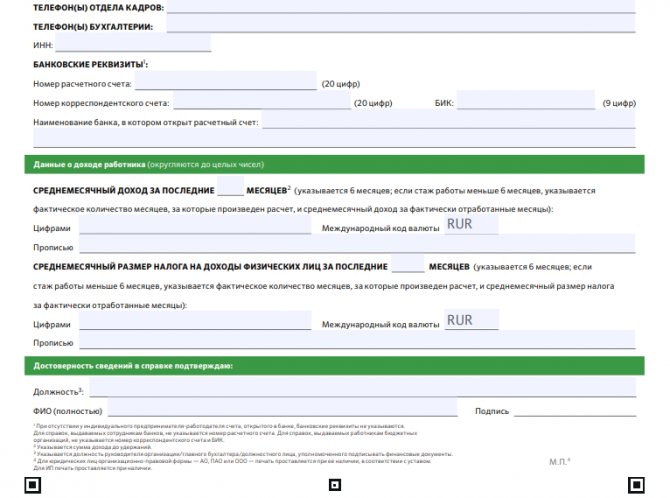

Instructions and example for filling

We suggest looking at an example of filling out a certificate using the Sberbank bank form in detailed pictures.

- We start by indicating the date of issue; do not forget to indicate it, because the certificate is valid for only thirty days.

- Fill in information about the employee: name and position.

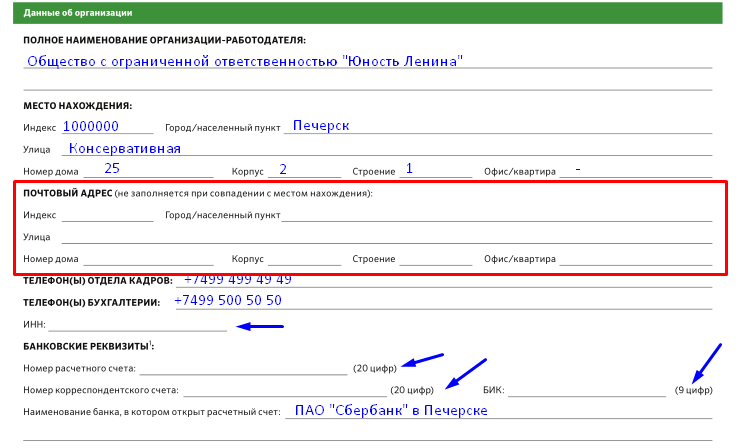

- The third block is about the employer. This includes the full name, legal and postal address. Blue arrows indicate that it is mandatory to fill out the TIN and the organization’s accounts.

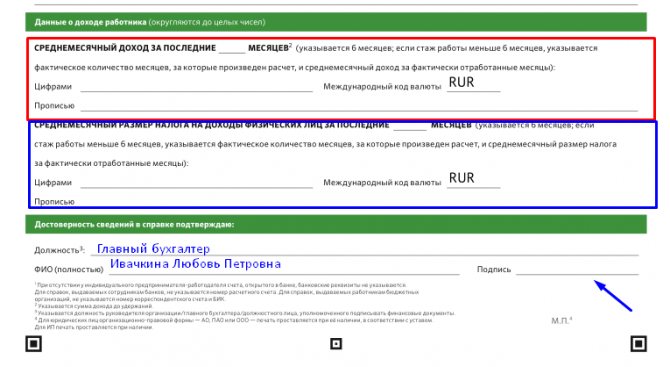

- The fourth block is devoted to filling out information about the average monthly income and the amount of personal income tax. The international currency code is also indicated. After the word “Position” it is indicated specifically who signs the certificate. This could be the manager, his deputy, the chief accountant or any person who officially has the right to sign. It is best to sign the certificate by the chief accountant or director. The same person signs. If available, the organization's stamp is placed at the location where it is printed.

The responsible employee of the employer must fill out a certificate in the form of Sberbank.

How to fill

To bring a certificate to a Sberbank specialist in the form accepted at this institution, you can ask to print it out when visiting any branch or download it yourself on the website. A sample of filling out the fields is posted on information stands in all Sber representative offices. Once the certificate is issued, it is valid for 30 days. When filling out the “Date” field; It is important to take this parameter into account so as not to redo the new form.

When entering data in the “Seniority” field, the entire period from the date of the order to enroll the employee to the present is indicated. To indicate the average monthly income, a six-month period is most often used, but if the employee’s length of service is less than this period, then this is done. Enter the total number of months worked and the amount that comes out on average during this time.

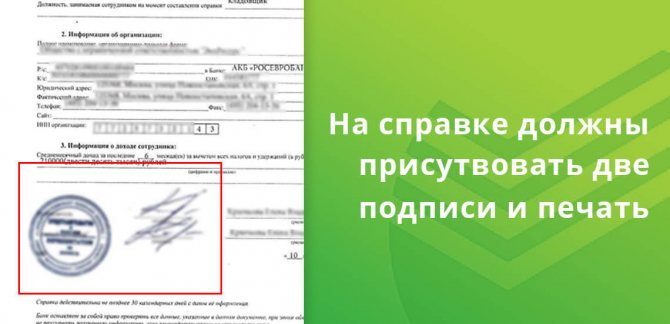

The bank specialist will definitely check the signature of the head of the organization and the seal of the institution where the client works. The form also requires the signature of the chief accountant. If there is no such position in the staffing table, then the director signs with an additional indication that there is no such employee. In any case, the certificate requires 2 signatures and a seal. If according to the documents of the enterprise there is no seal, then in place of m.p. affix the badge and hand over the form with only two signatures.

The form for confirming income when receiving a mortgage loan or guarantee from Sberbank is the same as for loans for consumer needs.

How to get help step by step

The obtaining algorithm consists of several simple steps:

- First step: pick up a form at a Sberbank branch or download a sample certificate in the bank form on the institution’s website.

- Second step: give the finished template to the accounting department, directly to the manager or to the immediate head of the department.

- Third step: the accountant will independently fill out the template, sign the chief accountant and the director, and affix a stamp (if there is one).

- Fourth step: the completed certificate is sent to you. It should take the employer no more than three days to prepare it.

- Fifth step: bring the paper in the Sberbank form to the office where you are going to issue a loan offer.

The bank will review all documents, analyze the potential borrower, and make a final decision on the loan. To receive a loan using a Sberbank certificate, download the certificate in advance and print it out - this will speed up the application process.

Download the certificate using the Sberbank bank form

You can visit the bank’s official website (sberbank.ru) or from our website. There is no difference between the forms. 14 lenders found

| Maximum amount 3 000 000 ₽ Minimum amount 50 000 ₽ Take a loan |

| Take a loan |

Favorable tariff

| Maximum amount 400 000 ₽ Minimum amount 5 000 ₽ Take a loan |

| Take a loan |

Quick Receipt

| Maximum amount 30 000 000 ₽ Minimum amount 150 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 700 000 ₽ Minimum amount 30 000 ₽ Take a loan |

| Take a loan |

Favorable tariff

| Maximum amount 3 000 000 ₽ Minimum amount 25 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 2 000 000 ₽ Minimum amount 90 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 5 000 000 ₽ Minimum amount 50 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 3 000 000 ₽ Minimum amount 50 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 1 000 000 ₽ Minimum amount 10 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 3 000 000 ₽ Minimum amount 50 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 1 500 000 ₽ Minimum amount 50 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 4 000 000 ₽ Minimum amount 15 000 ₽ Take a loan |

| Take a loan |

| Maximum amount 2 000 000 ₽ Minimum amount 50 000 ₽ Take a loan |

| Take a loan |

Quick Receipt

| Maximum amount 1 300 000 ₽ Minimum amount 15 000 ₽ Take a loan |

| Take a loan |

How to download a Sberbank certificate:

- You must click on the link "" . A PDF file will open in front of you;

- In the upper right corner there is a “Download” (usually represented as an arrow);

- By clicking on it, a certificate form in the form of Sberbank will be downloaded to your computer, which you just need to print and fill out correctly.

The bank makes a preliminary decision without submitting any documents - only on an online loan application. However, after preliminary review of the application, Sberbank will ask you to provide documents.

Validity

Sberbank, like other lenders, consider the certificate valid only for one month. The countdown starts from the date of issue. For this purpose, such a date is indicated in the header. A certificate form for obtaining a loan or guarantee can be downloaded at any time.

Example! Alekhmanov received an endorsed certificate from the accounting department on February 10, 2020, but together with the loan application he submitted the paper to the nearest Sberbank branch only on March 15, 2020. The loan officer did not accept the document for consideration and returned the application because the certificate was already overdue on the date of submission. The Sberbank 2020 filling out form emphasizes the obligation to indicate the date.

Checking the certificate by bank employees

Certificates in the bank form are treated with suspicion; such a document is riskier because it can be forged. There are services on the Internet where they sell certificates for a nominal fee. In addition, the employer, at the request of the employee, can provide false information, for example, increase the amount of average monthly income.

To begin, a bank employee will visually check the certificate:

- are all lines filled in?

- Are the names and surnames indicated correctly?

- Are all signatures and stamps affixed?

Next, the bank can call the employer’s contact number to make sure that the client is actually employed by the company.

If a large loan obligation is taken on, a more thorough check is carried out:

- Additional information may be requested directly from the employer;

- a request is made to internal databases;

- Information is taken from partners if the client has already received credit somewhere.

As a rule, clients who take out mortgage loans and bring a certificate in the Sberbank form filled out by the employer as a supporting document are subject to more thorough verification.

What is the best salary to indicate?

A client receiving a gray salary with a small official part is recommended to indicate in the income certificate in the Sberbank form a figure that is as close as possible to reality. A significant overstatement will be unacceptable, since the bank will definitely check the information in all available ways, including calls without warning to various employees of the employing company.

The ratio of the family's current income to the potential monthly mortgage payment will also be taken into account. Loan payments should not spend more than 40% of the family budget. It is optimal if the certificate indicates a figure that exceeds such payment by 50%.

NOTE! If Sberbank detects falsification of data on income received, the application will be rejected and the borrower will be included in the database of unreliable clients.

When can you do without a certificate?

There are cases when, even when applying for a mortgage, Sberbank will not request its form.

Without consequences (this is in cases where due to failure to provide documents to clients, inflated rates are set or amounts are reduced), you can do without a certificate only in two cases:

- If your salary card belongs to Sberbank. The bank will check the accruals on the account; no additional documents will be needed. Exception: if no money has been received on the card for a long time.

- If you have a bank deposit for a decent amount. It’s difficult to say which one specifically; everything also depends on the amount the borrower takes out on credit.

Important! You can also do without a certificate if a loan is issued without confirmation. But in this case, a consumer loan is implied; you should not count on a large amount.

For citizens operating as individual entrepreneurs, the supporting document will be a tax return. You can also draw up a certificate of income, which will be signed by an accountant, but you have a better chance of approval if you present an official document from the tax office.

In what cases can you do without it?

When an individual wants to get a loan from Sberbank, he may not need a certificate of income (both 2-NDFL and in the bank form). Almost always, such preferential conditions are provided in the following situations:

- If the client joined the salary project more than three months ago before applying to the bank for a loan. The bank already has all the information about the receipt of funds and the client’s solvency, and therefore does not need additional paperwork;

- If the client regularly and in an impressive amount deposits funds or repays an existing loan/credit card. In this case, the bank, knowing the integrity and solvency of the borrower, can approve a new loan without paperwork.

As for individual entrepreneurs, they can confirm their income using a tax return in form 3-NDFL. If simplified taxation is included, then according to the simplified taxation system.

Legal entities cannot receive privileges in the format of individuals and individual entrepreneurs - a separate procedure for checking solvency with the participation of auditors is provided for them.

Alternative ways to verify income

An individual employed is also allowed to bring a certificate in the form of the employer. Sberbank does not have specific requirements, but basic information must be provided:

- employee identification information (full name);

- his position in the company;

- length of service, date of employment;

- information about his income. This may be an indication of the average monthly earnings or the full amount of income for each month for six months.

You can also prove your financial situation by having securities, open deposits (and best of all - in Sberbank), additional certificates if the client works part-time in another company.

Alternatives to Verify Income

An obvious alternative is the standard 2-NDFL . It is drawn up in the accounting department of the enterprise without the participation of the bank. The disadvantage of paper is obvious - it requires registration and transfer of salary in strict accordance with the law, and in Russian realities this does not happen in every company.

Individuals can provide all kinds of agreements showing the real level of income : for example, an apartment rental agreement, a civil law agreement, a loan agreement (where the applicant acts as a creditor), securities with dividend payments, etc.

Even a statement from a deposit account - if there are enough funds on it and monthly interest payments are relatively acceptable (more than 3 thousand rubles), there is a chance of loan approval even without certificates.

Individual entrepreneurs can provide the same 3-NDFL declarations and certificates from the Federal Tax Service.