ABOUT

SOGAZ is the largest player in the domestic insurance market, appearing on it in 1993. The company insures clients under more than 100 programs it has developed. The insurer's services are used by both private clients (there are about 18 million of them) and organizations in various fields of activity (their total number exceeds 100 thousand).

Rating agencies appreciate the financial stability of the SOGAZ insurer. A high rating is achieved due to thoughtful reinsurance protection, as well as the presence of large insurance reserves and the company’s own capital.

The insurer SOGAZ has over 800 points of sale throughout Russia. The company's employees are about 12 thousand high-level specialists.

Registration procedure

To purchase mortgage insurance for structural elements, life and health, and title insurance, you will need to contact the SOGAZ office. It is necessary to prepare in advance a complete package of documents on the basis of which the mortgage insurance agreement is drawn up.

Package of documents:

- insurance application;

- passport;

- medical certificate when applying for life insurance;

- marriage certificate;

- consent of the spouse to conduct the transaction;

- documents of a legal entity;

- contract of sale of an apartment;

- certificate of registration of ownership.

Important! We offer you to download a complete package of documents and an application form, which should be filled out in your own hand.

Mortgage insurance procedure:

- Before applying for a loan, contact SOGAZ for mortgage insurance based on the calculation obtained through the calculator.

- Provide a complete package of original documents and a completed application form.

- Request a re-calculation of the insurance premium for the selected program.

- If the conditions are satisfactory, wait until the insurance policy is prepared by a specialist from the SOGAZ financial institution.

- Carefully study the policy and if you are satisfied with all sections, then sign and make payment according to the receipt.

- Receive your copy of the agreement and contact the bank to obtain a mortgage.

Important point! If you want to avoid this large amount of paperwork, we recommend that you apply for a policy online. To do this, you need to make a calculation on our calculator, and then pay for it. Your mortgage insurance policy will be sent to you by email. All you have to do is print out the form, sign it and submit it to the bank. Typically, such a policy will be 10-15% cheaper than a regular one.

Current Mortgage Insurance Offers from

provides its clients with an advantageous opportunity to conclude a mortgage insurance agreement. This type of insurance is mandatory, and it is impossible to obtain a mortgage on real estate without having the appropriate policy.

A mortgage insurance contract may include several types of insurance. These include:

- Apartment mortgage insurance. This insurance guarantees compensation in the event that the mortgaged property is damaged. Insured events include fires, explosions, accidents, as well as unlawful actions on the part of third parties. Apartment mortgage insurance can be considered one of the most popular insurance programs.

- Mortgage life insurance. Such an agreement insures the borrower against unforeseen accidents and illnesses. The mortgage life insurance contract provides that in the event of his death, as well as complete or partial (including temporary) disability, the insurer pays the bank the outstanding balance of the loan.

- Title insurance. The loss of mortgaged housing due to termination of ownership by decision of the judicial authorities is considered as an insured event.

- Insurance for non-repayment of a mortgage loan. Such an insurance program provides for the insurer to cover the loan in the event of the borrower's loss of solvency.

Types of mortgage insurance

It is necessary to distinguish between the concepts of compulsory and voluntary insurance. When applying for a mortgage, the borrower must insure the property that serves as collateral. But it is not necessary to conclude a life or health insurance contract.

See this same topic: How to get a mortgage with deferred payment during construction? Sample application

Property protection

The need to protect collateral when applying for a mortgage is a mandatory condition that is regulated at the legislative level. Without such a policy, not a single bank will issue a loan, and if a person refuses it, then even if he is lucky enough to take money from the bank, he will subsequently face serious penalties.

Protecting the life and health of the borrower

Despite the fact that the safety of life and health of the borrower is not a priority, many citizens still try to take out such insurance. This trend is due to the fact that many people take out mortgages for 20 and even 30 years. During this time, anything can happen to the borrower: he can get sick and become disabled, have an accident, or even die.

SOGAZ offers a special package, which includes various risks associated with the health and life of the borrower.

SOGAZ rules for registration of voluntary insurance:

- Citizens over the age of 18 can apply for this package of services. As of the expiration date of the contract, they must be no more than 75 years old;

- The company will refuse to conclude an insurance contract as a result of illness if, on the date of execution of the agreement, the person was already a disabled person of the first or second disability group.

Information you need before purchasing insurance from

Before applying for insurance, each applicant wants to know the cost of such a service, as well as the amount of insurance payment that he can count on if necessary.

The insurance amount is calculated based on:

- amount of mortgage debt;

- the amount of mortgage debt increased by the percentage set by the bank.

It is important to understand that the insured amount cannot be higher than the actual cost of the home purchased with a mortgage.

The price of insurance is determined only after checking all the necessary documents, which contain the following information:

- gender, age, health status of the applicant, etc.;

- technical condition of the immovable object;

- the presence of other transactions with real estate.

It is these factors that largely influence the final cost of insurance, which is also determined in accordance with the established initial rates.

Insurance cost

The mortgage insurance rate in SOGAZ is fixed. As of February 2020, the company offers rates:

- apartment – 0.12%;

- life and health – 0.17%;

- title – 0.08%;

- lack of debt repayment – 1.17%;

- civil liability – 0.12%.

Important! To obtain up-to-date information on the day of registration, we recommend using a calculator to calculate the cost of mortgage insurance in SOGAZ. We will consider what data you will need to provide later in the article.

How to get mortgage insurance from

It was once believed that mortgage insurance was beneficial exclusively for banks, but now the opinion of borrowers has changed. Recently, many of them have independently declared their desire to take out insurance and receive reliable protection for themselves and their financial interests. To do this, they need to go through several stages, which we will talk about below.

To get insurance from, you need:

- Fill out the application online. This is done directly on the official website of the insurance company. The required option is located in the “Real Estate” section. By going to it, you need to find the “Mortgage” subsection. It will be even easier to follow the link https://www.sogaz.ru/private/mortgage/ and click on the “Order” button. The applicant will see an empty form in which he will need to enter personal data. First of all, the federal district in which the nearest office is located is selected from the list. Next, you need to find the insurer's division. This is followed by entering the personal data of the policyholder: full name, desired insurance product, notes. Next, the SOGAZ client needs to enter his contact information. It is for these reasons that a company specialist will contact the applicant and provide detailed advice on further actions. At the end, you need to enter the characters indicated in the picture and click on the “Submit” button. Before doing this, it is advisable to double-check that all entered information is correct.

- Wait for a response from the representative. After receiving the application, the insurance company promptly contacts the client and provides him with a complete list of documents required to obtain insurance. It depends on the selected program. For example, for mortgage life insurance, you must provide the results of a medical examination. To insure an apartment with a mortgage, the insurer is instead provided with documentation on the property (a document confirming ownership, an extract from the house register, etc.).

- Collect the necessary documents. provides clients with enough time to collect all documents. This is exactly what takes several months.

- Get insurance. After collecting the required documents, you must visit the office of the insurance company to conclude an agreement. The borrower independently chooses the duration of its validity. This can be either one year or the entire term of the mortgage (in which case payments will be made annually).

Tariffs – calculation calculator

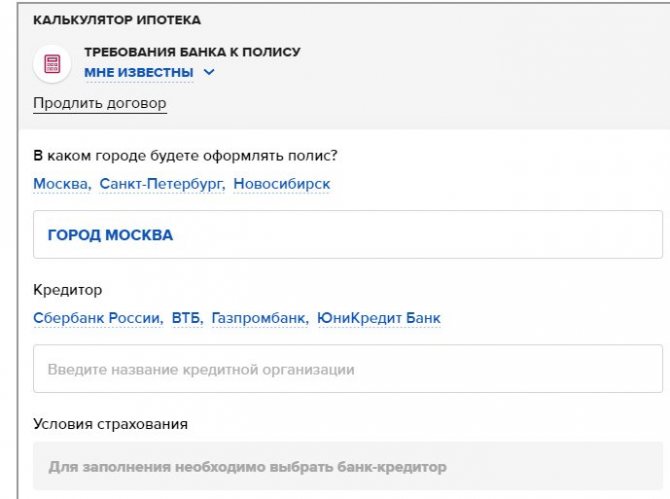

On the official website of SOGAZ you can make a calculation of the mortgage tariff. To do this you need:

- On the insurance group’s website, go to the “Real Estate” – “Mortgage Insurance” section.

- Select the lender with whom the borrower enters into a mortgage agreement. Let's look at the example of Sberbank.

- Enter the mortgage amount. Let it be 5 million rubles with an interest rate of 12% per annum.

- Select an insurance program. Let's look at the example of property insurance (apartment, type of building - mixed).

- By setting the required values, the insurance amount will be determined. In our example, it is equal to 5 thousand rubles.

Look at the same topic: How to get a mortgage from Zapsibkombank in [y] year? Loan terms and mortgage interest rates

Tariffs for other types of mortgage insurance are automatically calculated using the same principle. If we take the same values - a mortgage in the amount of 5 million rubles. at 12% per annum, then the cost of a title insurance policy will be 11,500 rubles, and life and health insurance will cost 8,800 rubles.

The calculation calculator can also be found on third-party Internet resources, but many factors need to be taken into account: the size of the mortgage, the age and gender of the borrower, the type of insurance, the risks taken into account and much more.

Advantages and disadvantages

SOGAZ offers affordable rates for mortgage insurance, which, of course, is the main criterion for choosing this company. It is also possible to pay the insurance premium in installments.

Pros of insurance:

- Availability of an online store on the company website;

- 24/7 hotline;

- a large number of branches and representative offices;

- transparent terms of cooperation.

Disadvantages of insurance:

- many exceptions to payments;

- in case of early termination of the contract, payment of the insurance premium is possible only in some cases;

- If payment is delayed, the policy may be denied payment.

If the loan is closed ahead of schedule, SOGAZ returns part of the premium for the unexpired period. There are few disadvantages when it comes to insurance with this company. If you carefully study the terms of insurance and the text of the contract, the insured’s risks can be reduced to zero.

Mortgage insurance in Sogaz

One of the most complex and expensive types of lending is a mortgage. It implies a large volume of funds raised, a long payment period and a high risk of non-repayment of funds.

Therefore, insurance is necessary, which ensures the possibility of repaying the loan if the borrower for some reason cannot repay the money.

JSC SOGAZ is one of the largest insurance companies on the Russian market, ranking second in terms of the amount of insurance payments received from clients. The company offers many insurance options, including mortgage insurance.

“SOGAZ” in the mortgage insurance market

IC SOGAZ began its activities in 1993 as part of the group. Today the company has about 18 million private clients and more than 100 thousand organizations using insurance services. The company has 12 thousand specialists on staff, and in total more than 1000 sales points are open in the country.

SOGAZ invariably occupies a leading position in financial stability ratings compiled by analytical companies. This is facilitated by a competent policy of risk transfer to reinsurance. In addition, the company has high insurance reserves, ensuring its stable operations, and large equity capital.

Today, SOGAZ works with many large Russian banks. Among them:

- VTB 24;

- Sberbank;

- Binbank;

- Gazprombank;

- Rosselkhozbank;

- Alfa Bank;

- ICD;

- Raiffeisenbank;

- Bank "Russia", etc.

You can see the full list of insurance company partners on our website.

Pros and cons of working with the company

Before purchasing an insurance policy from SOGAZ, it is important to understand all the advantages and disadvantages of the services provided by the company.

Among the advantages we highlight the following:

- flexible tariffs;

- developed system of branches;

- a large selection of insurance programs, thanks to which the borrower can choose a policy based on his preferences;

- information about SK products is available on the Internet or by calling the organization’s hotline;

- the policy can be purchased in installments, which is paid in 2-3 installments;

- The company's support service works around the clock, so you can get help in filling out a form or registering a loss at any time convenient for you;

- registration of the policy is carried out quickly and without complications - it will take no more than two hours;

- if the insured event does occur, the payment corresponds to the actual amount of damage received;

- Regular customers of SOGAZ can count on discounts under new contracts.

Of course, there are also disadvantages that can become significant when choosing an insurance company.

So, to terminate the contract with SOGAZ upon repayment, you will need to contact the office, present insurance and wait for approval within 30 days. Review of the application does not eliminate the need to make an insurance premium.

In addition, the insurance company makes many exceptions to the rules, due to which even if an insured event occurs, you may not receive payment.

Programs for mortgage borrowers

Among the hundreds of insurance programs offered by SOGAZ, you can also find several types of mortgage insurance. Let's consider all its types in more detail.

Real estate protection . Since housing is purchased on credit - an apartment or a private house - it becomes the main object of insurance. The policy protects it from natural disasters, damage due to hooligan actions of third parties or vandalism, as well as from the consequences of emergency situations.

This type of insurance is mandatory, and if you refuse it when applying for a mortgage, you will most likely be refused by the bank.

This includes risks such as:

- flood, earthquake, fire, lightning and other natural disasters;

- domestic gas explosions;

- a break in the water supply or sewer system;

- illegal actions of third parties;

- vandalism.

Personal insurance (life and health).

Unfortunately, even in relatively calm times, we are constantly exposed to risks - accidents, serious illnesses that undermine health and performance for a long time, sudden death is far from uncommon.

The insurance company assumes these risks and, if the borrower is temporarily unable to work or is unable to work due to disability, compensates the bank for the damage. The policyholder, in turn, is fully or partially exempt from payments.

In addition, in the event of the death of the insured borrower, his debts do not become the obligations of his relatives and close people - they are dealt with by the insurance company.

However, there are exceptions to insurance risks. Thus, payments will not be made if the borrower became disabled or died due to suicide or other intentional actions.

In addition, payments may be denied if injuries were sustained while under the influence of alcohol or drugs.

Important! SOGAZ guarantees compensation for losses to the bank if the client is unable to pay money due to a serious illness or injury, group 1-2 disability or partial loss of ability to work.

This is a voluntary type of insurance and is concluded individually at the request of the client, since many factors are taken into account when drawing up the contract - from the client’s health status and chronic diseases to favorite hobbies and sports.

This policy may include the following risks:

- death of the borrower;

- disability of the first or second group;

- loss of ability to work due to serious injury, illness or accident.

Loss of title . Those who purchase an apartment in a new building will not need this type of insurance. It’s another matter if you prefer ready-made and lived-in apartments on the secondary market and purchase housing second-hand.

Unfortunately, in this case, it cannot be guaranteed that some time after the transaction is completed, its rightful owner will not appear on the threshold of your new home, who lost his property due to fraudsters or was illegally bypassed during privatization.

There are many cases when a third party challenges the right to property in court. If the claim is satisfied by the court, then the housing is transferred to another owner on completely legal grounds. Therefore, if you prefer a mortgage in a new building to an option on a secondary building, take out a policy to protect your property rights.

Thus, title protection allows the insured to prove the illegality of the purchase and sale transaction or the loss of title when the rightful owner of the property appears.

Insurance cost

Naturally, first of all, before taking out insurance, clients are interested in its cost, as well as the amount of compensation paid. However, there is no simple answer to this question. The fact is that the cost of any insurance is influenced by several factors:

- mortgage loan amount;

- the amount of debt multiplied by the established mortgage interest rate.

In this case, the insured amount cannot exceed the actual value of the property.

The price of the insurance policy will be announced after evaluating the following data:

- technical condition of the insured property,

- age, gender, presence of chronic diseases, bad habits of the policyholder, his professional activity;

- presence of other real estate transactions in the past.

On the website in the “Mortgage Insurance” section you can find estimated rates for each type of coverage. If there are no factors that increase the risk (for example, the presence of complex chronic diseases), then the insurance premium will be the same.

SOGAZ mortgage insurance calculator

To estimate the cost of your policy and your mortgage insurance premium, use an online calculator. This is available on the official SOGAZ website in the appropriate section, as well as on many other sites.

In the calculator, you just need to indicate the parameters you are interested in and select your preferred insurance risks, if the program has such a function. Then the preliminary cost of the policy will appear on the page.

Important! Any electronic resource shows only an approximate result, so you should not rely only on information obtained on the Internet.

Consult with an insurance company specialist in the office or call their hotline.

Procedure for drawing up an insurance contract

You can apply for a policy with SOGAZ in two ways - at the company’s office (or at the bank branch where you take out a mortgage loan) or on the website. To obtain insurance, follow the following instructions.

- Complete the application online.

On the SOGAZ website, go to the “Real Estate” section and select the “Mortgage” sub-item. A page will open on which you need to fill in the empty fields, select your region and the IC office closest to you. Submit your application and enter the CAPTCHA verification code that appears in the image. - Wait for a call from the insurance company operator.

An employee will advise you on all issues of interest and tell you what documents you need to prepare to apply for a policy - they depend on your preferred insurance program. So, if you need life and health insurance, you need the results of medical examinations. And for real estate insurance - proof of ownership and extracts from the house register. - Before signing the contract, prepare the necessary papers. Then visit the company branch, check the agreement and sign. You can set the validity period of the policy yourself.

What documents may be needed? First of all, an application (you will write it at the bank or at a branch of the insurance company), a passport of a citizen of the Russian Federation, documents about the property being purchased and a medical report if you are taking out life insurance. Important! The health and life insurance policy is valid for only one year. Therefore, if you wish, you can extend the contract after its expiration. However, it is possible to conclude an agreement for the entire term of repayment of the mortgage loan.

Payment procedure

There are several options for paying for the contract at SOGAZ. So, you can make contributions immediately for the entire year of use - according to the dates indicated in the contract, or immediately pay the entire cost for the entire period of protection.

Periodic payments are also available, which the client makes during the entire period of the contract. They also come in two types.

A one-time payment means that you are assigned a period during which you need to make the payment, for example, 2 weeks after signing the papers. The second option is subsequent payments.

The amount is divided into several parts, and the payment of each part extends the validity of the agreement.

SOGAZ offers many options for making contributions for your insurance. Among them:

- personal accounts of the organization’s partner banks - Rossiya Bank, Gazprombank, VTB Online;

- ATMs of Gazprombank and VTB;

- branches of banking organizations;

- branches of the Russian Post.

The first option is suitable for those who have taken out a loan from one of these banks and actively use their personal account - an online service that allows you to manage your finances online using a computer or laptop.

Just log in to your account using your username and password, find the payment menu for services and enter the name of the insurance company in the search box. Then you will need to fill in the necessary information (contract number, contribution amount, etc.)

d) the fields that appear and proceed to payment.

The second and third methods are suitable for those who prefer to pay in cash. Find on the map the nearest SOGAZ branch or one of the organization’s partner banks.

Contact the operator and provide him with the necessary information - the name of the insurance company, your agreement number and the contribution amount. Then pay for the service. If you use an ATM, enter the contract number yourself and double-check it to avoid mistakes.

It is worth considering that some organizations may charge a commission for transferring funds to the insurance company.

Finally, funds transfer is also available at Russian Post branches. The scheme is similar to the previous one - tell the employee your contract number and contribution amount, then transfer the money. Advice: try to make insurance contributions a few days before the deadline indicated in the contract. This way you will be sure that the money will arrive in the insurance company’s account on time. Delays may result in termination of the contract.

Customer Reviews

IC "SOGAZ" has been offering its services for more than 25 years; today the number of its clients exceeds millions.

Many of them are satisfied with the quality of service and note the clear and fast execution of services, reasonable rates and good amounts of insurance coverage.

The work of the company’s managers is also noted, who explain in detail the terms of the contract and do not impose additional services.

However, there are also disadvantages. So, many people say that the hotline is too slow. In addition, they note the impossibility of terminating the contract with the insurance company without losing funds. Some clients complain about delays in carrying out examinations, while others single out individual employees who are dismissive of clients and not interested in helping them.

You can also read reviews about the company’s work on Vybera.ru. Only real users of banking and insurance services leave their opinions on our portal. Rate their comments and form your own opinion about the work of SOGAZ JSC or write your review if you already have experience working with it.

Sogaz – mortgage insurance

When a client takes out a loan from a bank to purchase real estate, the lending institution faces the risk of non-repayment of funds. In this regard, according to the law, real estate purchased with a mortgage must be insured. This can be done in any company, but it is best to trust one of the largest insurers in Russia - SOGAZ.

in the insurance market

is the largest insurance company in Russia as of 2020. The insurer began its activities in 1993 as part of the group.

Currently, approximately 18 million clients and more than 100 thousand organizations use it.

The company's staff includes almost 12 thousand highly qualified specialists who serve customers at more than 800 points of sale throughout the country.

In analytical ratings, SOGAZ invariably takes leading positions in terms of financial stability.

First of all, this is due to a competent policy for transferring risks to reinsurance.

In addition, the insurer has large equity capital, as well as large insurance reserves, which ensure the stable activities of SOGAZ.

Risks accepted for insurance

If a client needs to insure his property to obtain a mortgage, I am ready to provide the widest possible range of services in this area. Let's look at the main types of coatings offered by SOGAZ:

- Insurance of the property itself. This is the only type of coverage that a client is legally required to have when taking out a mortgage. An insured event here refers to a situation where damage to property is caused, including damage leading to its loss. This may be a consequence of various natural disasters, fire, flooding, etc.

- Life and health insurance for the person who will repay the loan. Situations are quite possible when only one person in a family earns money, but if something happens to him, the bank will demand a refund from the entire family. This coverage can financially protect your family from the consequences of the death or injury of the breadwinner.

- Title Insurance. Title refers to the ownership of the property being purchased. If previous real estate transactions were executed incorrectly or distant relatives of the seller claim the apartment, then by court decision the client may lose his rights to the mortgaged property. To compensate for expenses, you can purchase appropriate coverage from SOGAZ.

- Insurance in case of mortgage default. This coverage is similar to life and health insurance, only in this case the reason for non-repayment of the loan will not be the injury or death of the borrower, but his dismissal and subsequent search for work.

- Civil liability insurance. This is the least common type of coverage associated with liability to third parties, for example, when the client accidentally floods the neighbors below.

Factors influencing the cost of the policy

Of course, any client is interested in the cost of a mortgage insurance policy, as well as the amount of possible compensation in the event of an insured event. In this type of insurance, the insured amount depends on the following factors:

- The amount owed on a mortgage loan.

- The amount of debt multiplied by the mortgage interest rate established by the bank.

In general, the insured amount cannot exceed the actual value of the property at the time of its acceptance for insurance.

Clients will be able to tell the price of an insurance policy after providing the following data:

- The technical condition of the property accepted for insurance (for property insurance).

- Age, gender, presence of chronic diseases, bad habits, etc. from the one who will pay the mortgage (for life and health insurance).

- Have there been any previous real estate transactions (for title insurance).

On the website in the “Mortgage Insurance” section (https://www.sogaz.ru/private/mortgage/) the estimated rates for each type of coverage are indicated; if there are no factors that increase risks, then this is exactly what the insurance premium will be. As of September 2020:

- Property – 0.12% of the insured amount.

- Life and health – 0.17% of the insured amount.

- Title – 0.08% of the sum insured.

- Non-repayment of mortgage – 1.17% of the insured amount.

- Civil liability – 0.12% of the insured amount.

Policy registration procedure

Mortgage insurance on the official website of SOGAZ https://www.sogaz.ru/private/mortgage/

Previously, it was believed that this type of insurance could only be beneficial for banks, but now borrowers have become more financially literate. In addition, it became possible to independently send requests for a policy. To obtain insurance from SOGAZ, you need to complete the following steps:

- Fill out an application online on the company’s official website (link was provided earlier). There is a special “Order” button, after clicking on which a form appears for filling out personal data. Here you need to select the region and the nearest SOGAZ office. To send this application to a consultant, you need to enter the numbers in the picture and click “Submit”.

- The consultant contacts the client at the phone number specified in the application and explains what list of documents will be required from him to issue the policy. This depends on the chosen insurance product: if the client is only interested in property insurance, then he will need documents for the apartment, and if he wants to purchase coverage in case of death or injury, he will also need a medical certificate.

- The client collects all necessary documents. Usually enough time is given for this, so the borrower has several months left to provide SOGAZ with documentation.

- The last stage is to issue a policy at the nearest office. The borrower has the right to choose an insurance period equal to either a year or the entire mortgage repayment period - in the latter case, insurance premiums will be charged annually.

Do not forget that under a mortgage insurance agreement, the beneficiary is always the creditor bank, and not the borrower himself. In this regard, the client will only be required to report the insured event that has occurred - all other interaction will take place between the insurer and the bank without the participation of the borrower.

Conclusion

is one of the recognized leaders in the market, however, when insuring a mortgage, you must also remember that banks prefer policies from partner insurers. Due to its size, the company has agreements with the largest banks in Russia, so clients do not have to worry that their mortgage will cost them more if they contact SOGAZ.

It is also possible to compare mortgage insurance conditions in online calculators: there are many sites on the Internet where you can check the cost of a future policy based on specified criteria.

Calculators work online 24 hours a day, so thanks to them you can choose the optimal insurance company at any time.

However, you cannot purchase mortgage insurance itself through calculators.

Source: https://ipotechnoe-strahovanie.ru/sogaz/

What to do in case of an insured event

Every client should know what to do in the event of an insured event. For convenience, SOGAZ specialists are ready to advise the client via a toll-free customer support line. For your convenience, we have prepared small instructions, after studying which you will understand how to record an insurance event.

What to do:

- Register an insured event through a special service. For example, if you have a fire, you need to take a supporting document from the fire department.

- Contact the SOGAZ office with a complete package of documents and an application. As a rule, a policy, the borrower's passport, a loan agreement and a document confirming the occurrence of an insured event are requested.

- If necessary, agree on a date when an authorized specialist from a financial institution will inspect the damaged property in order to record the damage. If a mortgage life insurance agreement was included in the price and you were injured, an inspection may be scheduled at a clinic with which SOGAZ has a contractual relationship.

- Receive payment.

SOGAZ. Mortgage

A mortgage insurance agreement is to ensure that the borrower fulfills his obligations to repay the loan and may include one or more types of insurance:

- property insurance - insurance of real estate pledged to the bank in case of damage or loss (an insured event is the death or damage of real estate as a result of: fire, explosion, lightning strike, liquid flooding as a result of an accident in water supply systems, natural disasters and other events stipulated by the insurance contract);

- personal insurance – insurance of the borrower against accidents and illnesses (the insured event is the death of the borrower (co-borrower/guarantor), loss of ability to work (establishment of disability group I or II), or temporary loss of ability to work);

- title insurance – insurance in case of loss of real estate as a result of termination of ownership by a court decision.

What is the amount of insurance protection (sum insured)?

The insured amount for property insurance, personal and title insurance is established in accordance with the requirements of the bank’s loan program and can be calculated based on:

- the amount of debt on the loan, but not more than the actual value of the real estate;

- the amount of debt on the loan, increased by the percentage established by the bank, but not more than the actual value of the real estate.

For insurance of the borrower's liability to the bank for non-repayment of the loan, the insurance amount is also established in accordance with the requirements of the bank's loan program. In this case, the insurance amount must be no less than 10% and no more than 50% of the loan amount.

How much does insurance protection cost?

The cost of insurance is determined after checking the documents provided and depends on:

- gender, age, health status of the borrower, etc.;

- technical condition of the property;

- number and type of transactions with real estate.

The cost of insuring the borrower's liability to the bank for loan failure depends on:

- the ratio of the principal amount of debt to the value of the mortgaged item;

- ratio of the insured amount to the principal amount of debt;

- the duration of the obligation secured by the mortgage.

How is insurance payment made?

If an insured event occurs under a property, personal or title insurance contract, SOGAZ will make an insurance payment:

- to the bank in the amount of the borrower's unfulfilled obligations under the loan agreement;

- to the borrower or his heirs in the amount remaining after payment to the bank.

To insure the borrower's liability to the bank for non-repayment of the loan, SOGAZ makes an insurance payment to the bank within the insured amount in the event that the borrower has lost solvency and after the sale of real estate, the proceeds are not enough to fully repay the loan debt.

What is necessary to conclude an insurance contract?

- fill out an application for insurance;

- provide a set of documents on the property (for property insurance, title insurance);

- provide a set of documents for the borrower, co-borrower, confirming employment and income level (with borrower liability insurance);

- provide the results of a medical examination of the borrower (co-borrower/guarantor) (if a medical examination is necessary for personal insurance).

The insurance contract is concluded for one year or for the term of the loan. When concluding an agreement for the loan term, the insurance premium is paid annually.

To insure the borrower's liability to the bank, the insurance contract can end simultaneously with the loan agreement or when the loan balance reaches a certain value. The insurance premium is paid at a time for the entire validity period of the insurance contract.

Advantages

- wide network of partner banks

- Individual approach to each client

- flexible tariff policy

- efficiency of review and preparation of insurance documentation – from 2 hours

- the opportunity to undergo a free medical examination, if it is required to draw up a personal insurance contract

- in case of full early repayment of the loan or loan, SOGAZ returns part of the paid insurance premium for the unexpired insurance period

- payment of insurance premium in installments (for property insurance, personal and title insurance).

Documentation

Required package of documents (pdf, 185.63 Kb)

MORTGAGE INSURANCE RULES(pdf, 394.20 Kb)

Rules for mortgage lending(pdf, 369.99 Kb)

Rules for comprehensive mortgage insurance(pdf, 5007.90 Kb)

Rules for Comprehensive Mortgage Insurance (Uniform Insurance Rules)(pdf, 330.29 Kb)

Application for insurance(xlsm, 4747.62 Kb)

Contacts(xlsx, 20.12 Kb)

Source: https://shop.sogaz.ru/realty/mortgage/

Cost and tariffs: calculation

The average price of collateral insurance is from 0.12-0.3% of the insured amount . The cost of the policy is affected by the adjustment factors that the insurer may use. The tariff will definitely be higher if the building where the apartment is located has wooden floors, and the policyholder has a fireplace, sauna and other sources of fire.

The price of the policy depends on the loan amount and the level of insured risk. The insurance limit is usually equal to the loan debt, but sometimes borrowers prefer to insure for the full cost of the home. The insurer determines the insurance risk based on the age of the property and its technical condition, the presence of an alarm system.

How to calculate?

The easiest way to calculate the cost of a policy is on the website of the insurance company’s online store (https://shop.sogaz.ru/), where there is an online calculator. To do this, go to the “Mortgage Insurance” section and begin filling out an application for insurance (https://shop.sogaz.ru/realty/mortgage/). Already on the third page, taking into account the specified loan amount, the insurance payment will be calculated.

But even without an online calculator, determining the cost is quite simple. The insurance premium is determined in accordance with the company's current tariffs using coefficients that take into account factors affecting the degree of risk, as well as other conditions.

In other words, if the loan amount is 300 thousand rubles, then the preliminary cost of insurance at a rate of 0.1% will be only 300 rubles. In addition, correction factors must be added to this amount, but they must be clarified in advance from the manager of the insurance company or immediately asked him to calculate the full cost of the insurance premium.