It's time to figure out what the pros and cons of electronic transaction registration with Sberbank are. What does the client get? Does it really save on costs? Can any transaction be registered in this way? The answers are in this article.

The purchase of real estate involves further registration of the transaction in Rosreestr. In this case, you need to come to the MFC (multifunctional center), get a coupon, stand in line, and provide documents. If any certificate is not enough, the procedure will have to start over.

In recent years, the Russian Government has been striving to transfer the provision of a significant part of government services to electronic format. The registration of ownership of apartments, cottages, land plots, etc. was no exception. It was decided to involve banking structures that issue mortgage loans, in particular, Sberbank, in cooperation.

What is electronic registration of transactions and property rights?

Electronic registration assumes that documents are submitted to Rosreestr not in person, but in a file format containing scans along with the application. But the buyer cannot send copies to any website on his own. The service is provided by banking institutions for a certain fee via secure communication channels.

The initiator of the introduction of the new service was Rosreestr itself. At a certain stage, it turned out that he did not have enough employees to accept and process applications. In order not to increase the staff, it was decided to switch to a fundamentally new form of document submission. Currently, Sberbank offers the most active use of electronic transaction registration services.

It is important to emphasize that the system is still operating in semi-test mode; the technology has not been fully developed. According to the assurances of official representatives of Rosreestr, the review and registration procedure takes no more than 1-5 days.

Attention, the client always has the right to refuse electronic registration of a transaction; this is not a mandatory procedure, and the documents can be submitted to the MFC. But often employees resort to coercion and intimidation in order to sell the service to Sberbank’s subsidiary, the Sberbank Real Estate Center (SRC). Clients also note that the manager puts psychological pressure in the conversation and plainly states that the final decision on the object has not yet been made, and the bank may refuse.

In what situations is electronic registration of transactions beneficial?

In the modern world, people are increasingly buying real estate far from their permanent place of residence. Thus, a resident of Petropavlovsk-Kamchatsky can purchase an apartment in the Krasnodar Territory, hoping to move into it after retirement.

Recommended article: Mortgages for large families in Sberbank - conditions and benefits

Even if the procedure for selecting and checking square meters is entrusted to a realtor, the actual procedure for obtaining a mortgage loan and drawing up a purchase and sale agreement takes more than a month. Flying planes across the country is quite expensive. The buyer will spend half the cost of the loan on transportation costs alone.

In such situations, electronic registration of transactions offered by Sberbank comes to the rescue. The latter, according to Rosstat, issues at least 50% of all mortgage loans in the country. At the same time, the country's largest bank is investing significant amounts of money in the development of Internet banking. Accordingly, the choice of Sberbank as a partner in the implementation of a new government service was obvious.

Important: you can submit documents for registration at any bank branch, provided that there is access to a mortgage center.

Sberbank takes a commission from the client for the operation:

- from 5550 rubles if you buy an apartment in a building under construction;

- up to 10,250 rubles, if the housing has already been put into operation.

The exact cost must be clarified with the Sberbank manager. The indicated amount includes the cost of the bank’s services directly and the state duty paid when applying to Rosreestr.

It's time to evaluate the pros and cons of the new system.

Pros and cons of electronic registration in Sberbank

Considering that the process of purchasing real estate with a mortgage is quite complex, clients who decided to use the transaction through electronic registration received a large number of advantages:

- The owner and the apartment are not always located in the same city. This used to be a big barrier to getting a mortgage. Now everything is much simpler. You can register a transaction electronically while in any city through Sberbank ;

- there is no need to travel to various organizations in order to draw up an agreement. You just need to contact a credit institution, submit all documents remotely and wait for registration. By and large, this is also convenient for the bank;

- after the registrar has completed all the necessary contracts, all completed documentation will be sent to the email address specified during registration;

- a similar registration data procedure is available not only to those who bought an apartment with a mortgage, but also to ordinary clients who spent cash to purchase real estate;

- everyone who decides to use the service will be provided with a manager who not only registers the necessary documents, but also provides consulting assistance on any issues that arise;

Unfortunately, like any other program that is still quite new, this service also has its disadvantages. It is impossible not to say about them:

- Only citizens of the Russian Federation can use the service. If there is no citizenship, then the transaction will be refused and entry into the Unified State Register will not be made;

- a mandatory condition is the age of majority of the participant in the transaction. In addition, an incapacitated citizen cannot use the service either;

- if the previous owner bought the apartment before 1998, then registration can only be carried out using generally accepted methods and in paper form;

- when selling not the entire apartment, but its share, the service is also not available;

- all documentation will be in electronic form, which may lead to difficulties in obtaining the necessary documents from government agencies;

- expensive cost of providing the service. Depending on the region, it can range from 7 to 10 thousand rubles.

The procedure is quite simple and if you read reviews from clients who have already used the service, you will find a huge number of extremely positive reviews. If you decide to use the real estate registration service, the easiest way is to contact the bank.

Advantages of registering transactions in electronic format

For the recipient of the service, comfort, convenience, and speed of execution are always important. If we talk specifically about electronic registration, it is necessary to emphasize the following:

- There is no need to queue, wait to receive a number, or spend hours waiting at the MFC office.

- It is enough to provide the necessary documents to the bank branch and receive the result by email in PDF or XML format. An electronic digital signature certifying the authenticity of the certificate comes in a separate file with the SIG extension.

- You can submit documents to register ownership of real estate located not only in another city, but also in another region, time zone or federal district.

- A discount of 0.1% on the mortgage rate when registering the transaction electronically.

Advantages of simplified online registration of mortgage transactions

Advantages of electronic registration of a mortgage transaction

Countless certificates, collecting documents, waiting for their consideration - all this accompanies a person who has decided to take out a mortgage on real estate. When it comes to obtaining a permit or other document from a government agency, everything becomes even more complicated. All of them have not undergone complete technical modernization, and there is also an element of bureaucracy. But now that mortgage transactions can be registered online, everything has become much easier and faster.

Fast electronic registration – in just a few days

Other benefits:

- The region doesn't matter. If a person who takes out a mortgage lives in one region and buys real estate in another, then he can go to the Rosreestr website from anywhere in the Russian Federation. He does not need to go to another region for registration and incur significant expenses because of this. Everything happens on the website, remotely.

- Applying for the mortgage itself is faster. Obtaining a loan and all the documents already takes several weeks. If you also register the transaction itself with Rosreestr for more than a month, then it will take up to six months to purchase a home. This is not beneficial for anyone. Therefore, transferring documents online to Rosreestr in one day has become a solution for thousands of Russians.

- Banks help with online registration and provide an agreement for this so that the client can quickly buy his apartment with a mortgage and register it in his name. More than 50% of loans for the purchase of real estate are issued by Sberbank. It actively introduces new technologies and electronic banking.

- After signing the loan agreement, the borrower does not need to wait time to register the transaction. Often it is carried out by the bank itself, using the Rosreestr website.

Very often, the bank itself will tell you what electronic registration of a mortgage transaction is and how to use it. Lenders also benefit from quick processing and increased customer loyalty.

But do not forget about the disadvantages:

- Not all types of transactions are currently registered via the Internet. If more than two sellers or two buyers are involved in the transaction (except for joint property of spouses), documents for registration will not be accepted.

- The owner does not receive paper documents. Only electronic copies with an electronic signature file are sent to him by e-mail. At the same time, the country has not yet developed the technology for working with documents that do not have a paper basis. An extract from the USRN is also sent by mail.

- It will not be possible to register a transaction via the Internet if a military mortgage is used as a contribution, if one of the participants is a minor, if we are talking about the purchase of not an entire apartment, but a room, a representative is involved under a notarized power of attorney. In the above situations, you will still have to meet with MFC employees in person.

- Registration via the Internet is also not provided if the buyer is a legal entity or a citizen of another state other than Russia. Also, documents will be refused if the previous owner of the apartment registered his ownership before 1998.

Recommended article: Mortgage for families with a disabled child from Uralsib Bank

If your situation does not correspond to the cases described, electronic registration of a transaction with Sberbank will help you save free time for more important matters.

Possibilities of online services

Using electronic registration makes it possible to quickly and conveniently register ownership of an apartment. The online service allows you to:

- Issue a secure qualified signature for all participants in the DCP (regardless of their number).

- Send the package of documents (electronically) to Rosreestr.

- Pay the fee for re-registration of property rights.

- Receive comprehensive assistance on various issues from a personal manager.

Procedure steps:

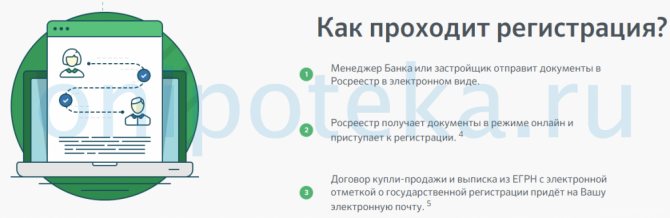

- An employee of a financial institution or a developer sends the collected documents (electronically) to Rosreestr.

- After receiving the package of papers, Rosreestr employees begin the registration procedure.

- Information about the state registration of the transfer of ownership is sent to the client’s e-mail - an extract from the unified register, a written document with a mark on state registration.

The procedure for state registration of property rights is paid; the exact cost depends on a number of factors: from the region of location to the characteristics of the object. For example, DomClick services will cost 5,550 – 12,250 rubles.

Some problems associated with imperfect electronic document management

As mentioned earlier, when registering a transaction electronically with Sberbank, the buyer receives title documents for real estate in file format; there are no paper copies. In this regard, owners may encounter the following situations:

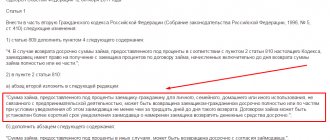

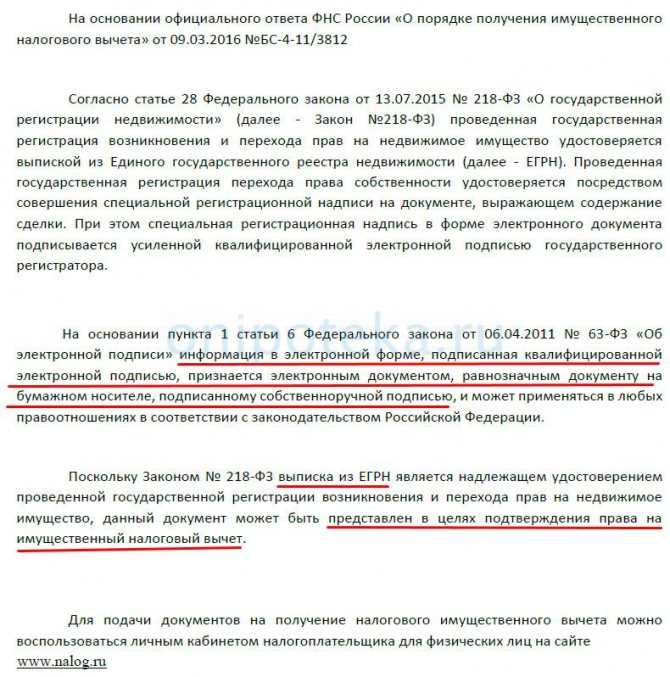

- When applying for a tax deduction, the Federal Tax Service requires a printed certificate of ownership. Especially for this case, the Federal Tax Service issued Letter No. BS-4-11/3812 dated March 9, 2016, ordering the acceptance of electronic documents on an equal basis with paper ones.

Additionally: in order not to waste time on explanations with employees of the regional tax office, documents for obtaining a tax deduction can be sent through your personal account on the department’s website.

- The Pension Fund refuses to issue maternity capital to repay part of the mortgage loan. The most difficult thing in such a situation is receiving an official refusal in writing. If Pension Fund employees have issued such a paper, it must be sent in scanned form to an email address. As practice shows, the problem very quickly ceases to be relevant.

Documents required for electronic submission

Important: the service is intended not only for those who bought an apartment using a mortgage loan. Anyone who doesn't want to spend hours in queues can use it.

The following documents are submitted to the bank manager:

- Agreement for the sale and purchase of real estate or equity participation, if the apartment was purchased at the foundation pit stage.

- Consent of the spouse, if required by law.

- Application for registration. The new owner fills it out directly at the bank.

Recommended article: How to repay a mortgage at Sberbank early through Sberbank online

If one of the submitted documents is in doubt, the registrar has the right to refuse acceptance.

Deadlines for processing documents

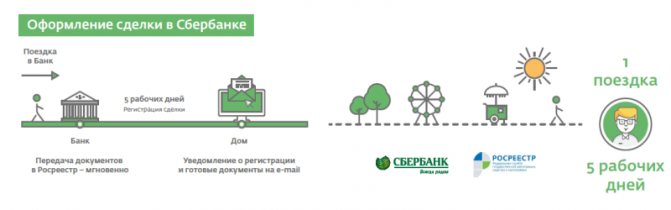

The maximum period set by the bank is 5 working days. This is the time during which a Sberbank employee receives all the necessary documents from the client, processes them and transfers them to Rosreestr employees for further processing. Once the documents are ready, the employee sends them via email to the client.

Please note: a bank employee has the right to refuse registration due to the lack of any necessary documents. Therefore, in case of refusal, you must be informed of the need to provide the bank with the missing documents.

Agreement templates for electronic registration

Etc. 1 DKP_mortgage ER_1 Seller+1 Buyer

Etc. 2 DKP_mortgage ER_1 Seller +2 Buyers (jointly owned)

Etc. 3 DKP_mortgage ER_2 Seller +1 Buyer

Etc. 4 DKP_mortgage ER_2 Seller +2 Buyer (jointly owned)

Etc. 5 DKP_mortgage ER_nedofin_1 Seller+1 Buyer UMO amendments

Etc. 6 DKP_mortgage ER_nedofin_1 Seller +2 Buyers (in joint ownership) UMO amendments

Etc. 7 DKP_mortgage ER_nedofin_2 Seller +1 Buyer UMO amendments

Etc. 8 DKP_mortgage ER_nedofin_2 Seller +2 Buyer (jointly owned) UMO amendments

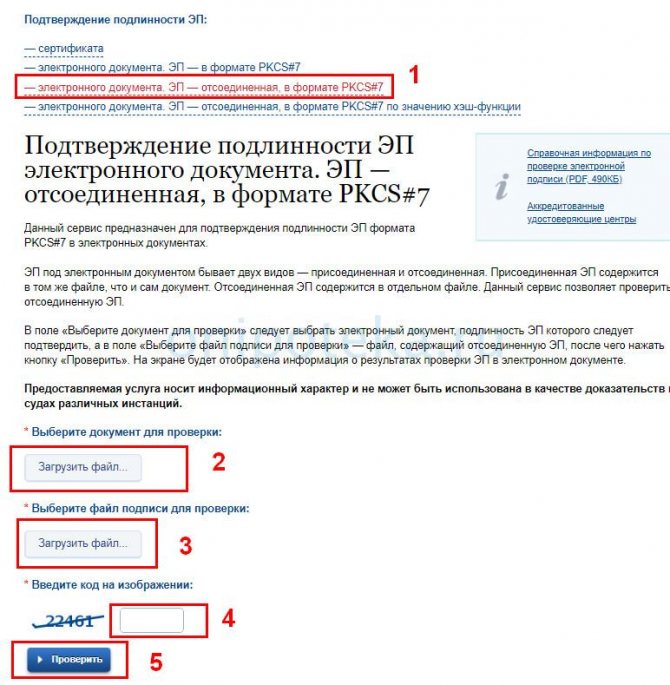

How to check documents after registration

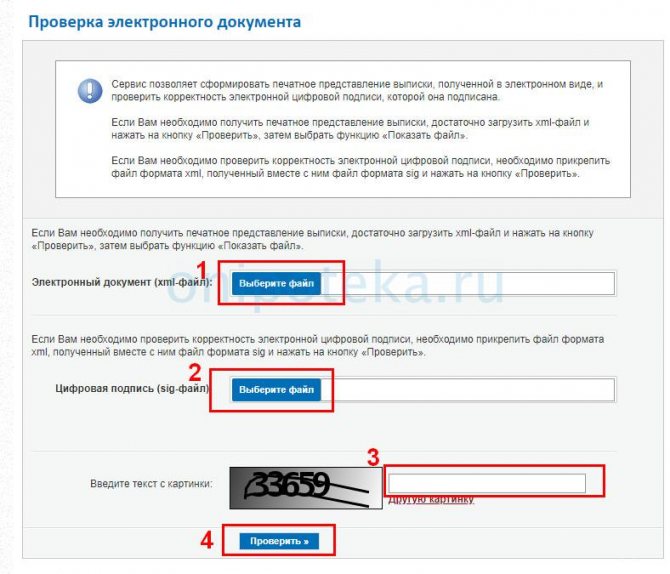

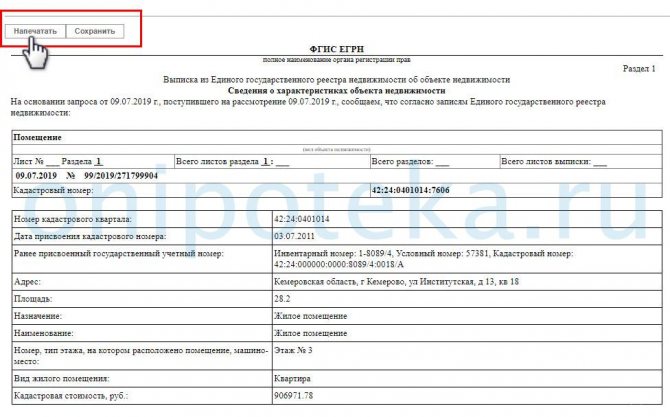

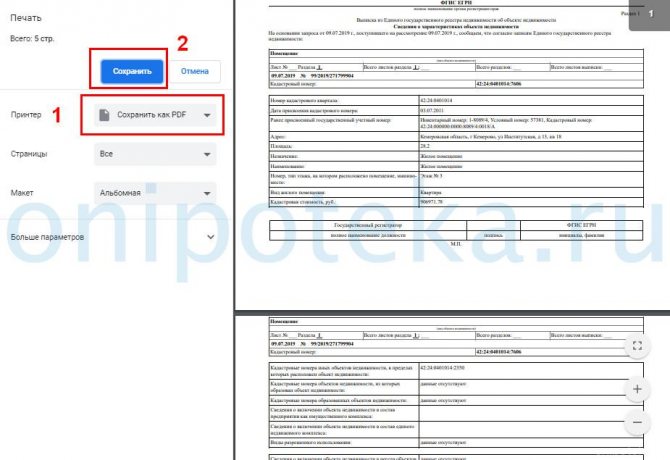

An extract from the Unified State Register is generated through the Rosreestr website. The submitted XML and SIG files are added to the site and then you can see the readable format of the statement. After electronic registration of the transaction in Sberbank, two documents will be sent to the mail of the seller and buyer. One with the extension .xml, the second - .sig.

To check and read these documents, you can go to the Rosreestr website using the link - https://rosreestr.ru/wps/portal/cc_vizualisation

After adding files to the fields and text from the image, you need to click Check. An additional link will appear - Show in human-readable format. When you click on it, an electronic extract from the Unified State Register will appear.

You can then print the statement or save it in pdf format. To do this, click on “Print” at the top.

You can see more details on how this is done in the video below.

You can check the electronic signature on the government services website using the link - https://www.gosuslugi.ru/pgu/eds.