Hello, dear readers!

A roof over your head is a necessity, your own home is better than a rented one, but there is often not enough money of your own for real estate, and buyers take out a mortgage. But it’s easy to say “they take it”: choose a bank, get the application approved, fill out the package of documents correctly, and so on - there are a lot of subtleties.

But the borrower does not have to take on all the worries, because there is a mortgage broker - a professional who is ready to help for a similar fee.

What kind of broker is this and what does he do?

I will tell you about this profession:

- for those who want to buy a home with a mortgage – what services do mortgage brokerage specialists provide, do they guarantee obtaining a home loan, what are the pros and cons of using an intermediary;

- for those who want to start a new profitable business - how a mortgage broker works, how much they earn, what career prospects this specialty opens up, how to become a mortgage brokerage professional.

A mortgage brokerage specialist provides a wide range of assistance to the client in obtaining credit funds for the purchase of real estate secured by the real estate being purchased or (less often) owned by the borrower.

The intermediary's work begins with assessing the client's solvency. A professional consultant evaluates an applicant for a home loan from the point of view of bank employees, in which knowledge of underwriting principles greatly helps.

For those who do not know: in the banking industry, underwriting is a check of the creditworthiness of a person who has applied for a loan, according to the methodology used in a credit institution.

Having received information about the client’s financial capabilities, the broker:

- compares them with his requests for the amount of the mortgage loan, loan term, size of the down payment;

- selects a mortgage program for the client;

- helps prepare a complete package of necessary documents;

- transfers papers to the bank;

- accompanies the mortgagee's transaction with the lender until the conclusion of the loan agreement;

- receives the agreed remuneration.

The intermediary knows the mortgage lending market, and business connections with banks allow him to obtain a loan much faster and on more favorable terms than if the client did it himself.

Brief history of the emergence of the profession

Demand creates supply. The development of the mortgage lending market has led to a significant increase in the number of citizens applying for a housing loan.

At the same time, the procedure for obtaining a mortgage remains quite complicated, and the risk of receiving a refusal instead of money is high.

Thus, a demand arose for the services of specialists who know the process of issuing mortgage loans, monitor the market in search of relevant banking products, and act as an intermediary - a bridge between the borrower and the bank.

Rights and obligations

A mortgage brokerage specialist has the right to:

- on confidentiality terms, make inquiries about the financial situation of a potential bank borrower: the amount of average monthly income, its sources, the amount of funds available for the down payment on a mortgage;

- accept from the borrower documents required for transmission to the bank;

- enter into service agreements with clients;

- enter into partnership agreements with banks issuing mortgages.

His responsibilities:

- selection of a credit program that best meets the client’s request;

- transferring to the financial institution the documentation necessary to draw up a mortgage agreement;

- fulfillment of obligations to the client stipulated in the agreement on the provision of brokerage services.

Anyone wishing to take out a home loan must carefully read this agreement and understand what they are paying money for.

Important: providing a person with borrowed money, whatever his financial condition, is not within the powers of the broker. No intermediary can guarantee that a person who is uncreditworthy from the point of view of banks will receive a loan. If you are given a 100% guarantee of successful approval of your application, you are faced with a black broker, or, more simply put, a scammer.

When do you need a mortgage broker?

As you already understand, a mortgage broker is simply a qualified intermediary between you, the person who wants to take out a mortgage loan, and the bank. He is well versed in the banking services market in your region and knows all the pitfalls of the real estate market. From him you will always be able to receive comprehensive information in a timely manner about the size of the loan, the timing of its repayments, basic conditions and penalties if you violate the terms of the mortgage.

Advice and consultations

In principle, the help of such a specialist will not be superfluous even if you are a regular client of a bank and have already decided on a mortgage program. A consultation with a broker will help you understand what really awaits you. A professional will analyze the selected program, talk about additional costs, and select alternative options, if this makes sense.

Unstable financial situation

In addition, a mortgage broker is needed when the bank in words can treat you in the best possible way, but in reality you fall into the category of clients with whom the lender is very reluctant to cooperate. At the same time, it is not at all necessary to be a malicious defaulter on loans or to somehow “fine” the banks.

These categories often fall into:

- freelancers and self-employed;

- individual entrepreneurs (small business owners);

- people who work on one-time contacts or frequently change jobs.

In many cases, a broker will be able to convince a bank to give you a mortgage, even if you do not meet the requirements of an ideal client and cannot 100% prove your solvency or official income.

Presence of debts and obligations

Often, a borrower, trying to make a more favorable impression on the lender, does not disclose his real situation:

- current liabilities;

- late payments;

- criminal records;

- alimony debts;

- fines, etc.

Banks quickly identify discrepancies, and this becomes the reason for refusing a mortgage. The broker’s task in such cases is to close all possible questions in advance and turn you into a desired client in the “eyes of the bank.”

"Unliquid" housing

Another problem is the choice of real estate. In the case of new buildings, banks are willing to accommodate buyers. But purchasing an apartment on the secondary market can cause problems. For example, if you want to buy an apartment with a complex redevelopment, the bank will be reluctant to look at such a deal. A good specialist will be able to help you obtain a mortgage loan even in such difficult cases.

Saving money and time

With the help of a mortgage broker who work, including in Krasnodar , you, first of all, save time and money. The broker will be able to get you not just a mortgage, but also choose the most profitable program, and often also achieve a preferential rate.

The specialist you hire will also tell you what bankers are silent about in such cases:

- how to reduce mortgage overpayments;

- where the mortgage is kept;

- how to reduce the rate on an existing mortgage;

- how to transfer a mortgage to another bank or change a program within the bank;

- how to get benefits on an existing mortgage;

- how to sell or rent out housing that is under mortgage, etc.

In addition, you will learn from your broker how the bank deals with borrowers who are late in payment for one reason or another. He will tell you how you can avoid problems and even in the event of force majeure, agree with the bank on a deferment or restructuring.

If an application for a mortgage is received by the bank from an agency, the consideration of the application is reduced significantly. Many real estate agencies and brokers cooperate with large banks on an ongoing basis, and as a result, they can offer you more favorable conditions than if you contact the bank directly. If your mortgage broker can lower your interest rate by even 1%, it could save you hundreds of thousands of dollars.

How does it work

White mortgage brokers are good at refusing people who ask for help in obtaining borrowed bank money. If, based on the results of a survey of the applicant (in the office or by phone), the specialist comes to the conclusion that no bank will give this person a housing loan, then he immediately reports this.

Many conscientious companies refuse to apply to persons who do not have a large official salary, confirmed by Form 2-NDFL. Borrowers with a bad credit history should not count on a mortgage loan.

I do not give a list of cases when banks absolutely refuse, but brokerage professionals know them (the cases), and decent intermediaries do not mislead clients with impossible promises.

If it is possible to help a potential mortgagee, the specialist invites him to sign an agreement.

The intermediary can take over filling out the application for a mortgage loan, but the borrower has to collect the remaining documents; the broker only advises on what papers are needed and how they should be completed.

When the entire package of papers is collected, it is transferred to the bank. An intermediary can significantly speed up the process of reviewing documents and making a decision on an application for a large loan.

Having learned that the lender has resolved the client’s issue positively, the broker invites him to call a bank employee, agree on the date and time of his visit to the branch, come and sign the agreement. The satisfied borrower then pays the intermediary a fee upon successful transaction.

Further worries - settlement with the seller of the real estate, registration of ownership of the property, transferring it as collateral to the bank - fall on the mortgager.

Types of services

Mortgage Broker:

- selects a loan program;

- helps the borrower collect and fill out the documentation required to obtain borrowed funds;

- selects a suitable real estate object, against which the bank will agree to issue a loan;

- makes every effort to obtain lender approval of the mortgage application;

- accompanies the process of concluding a mortgage agreement between the bank and the mortgagee.

The intermediary is also able to help the borrower obtain a non-targeted cash loan (consumer loan), which will be used as a down payment on a mortgage.

What knowledge should you have?

A mortgage brokerage specialist knows:

- specifics of servicing borrowers by banks;

- properties of credit banking products;

- legal subtleties of drawing up mortgage agreements;

- characteristics of residential real estate;

- the nature of the mediator's work.

What does he earn from?

The income is equal to the agreed percentage of the loan amount issued to the client by the bank. The intermediary also charges a fixed fee for services related to choosing a credit program, preparing documentation, and supporting the transaction.

Working conditions and income

A credit broker, as a rule, has standardized working days and weeks that coincide with the banking companies’ service schedule for individual clients.

An entrepreneur’s income depends entirely on the number of new clients, the amount of each service agreement, and other business results.

A hired broker's remuneration consists of a salary and a percentage of each successful transaction.

Career

The opportunity to grow from an ordinary specialist to a manager of one or another level in the credit broker profession is the same as in any segment of the legal or financial sphere.

It is possible to move to a higher position in a financial or legal company.

How much can a bank representative earn?

It is difficult to name a specific amount; it all depends on the effort and time expended, that is, on the activity and diligence of the partner.

The following points affect the salary:

- The amount of commission for a specific action.

- The number of applications processed (some banks set a fee, but you can also take overtime tasks, for which bonuses are provided).

- Quality of work.

- Having positive reviews of the agent’s work from clients is also encouraged for this.

- Difficulty in completing the task.

Who is this type of income suitable for? Those who:

- Loves communication.

- Doesn't like to sit in one place and prefers movement.

- Able and willing to work in a cohesive team.

- Has minimal knowledge in the financial sector.

- Able to work towards results, completely joining the process.

- Can manage his time.

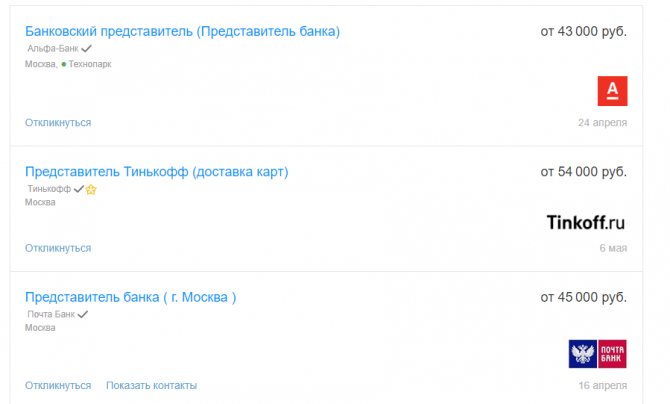

In the image you can see the commissions of Tinkoff Bank.

Lazy and pessimistic individuals should not consider this type of employment. It's a job like any other. To earn good money, you have to work hard.

Successful banking agents receive up to 10 thousand per month. The highest rewards are set for mortgage transactions.

What should it be

A self-employed mortgage broker must be a good white collar worker who performs the duties of an office manager.

A self-employed private broker must have the qualities of a successful entrepreneur.

Qualities as a person

A mortgage brokerage specialist must have:

- punctuality, attention to detail;

- perseverance;

- communication skills, communication skills with clients and business partners;

- business acumen.

What is included in the scope of activity

The essence of a mortgage broker's activity is to provide services to the client. I have already described them in detail.

A conscientious intermediary will only help those borrowers who have a real chance of getting the loan approved. He also makes no attempt to mislead banks, so as not to lose his reputation as a reliable partner.

Does a mortgage broker influence a bank's decision to issue a mortgage?

A broker cannot guarantee that anyone will receive a mortgage loan.

The intermediary only recommends that the bank approve the application. But the creditor organization, when making a decision, is guided not by the recommendations of a third party, but by the results of underwriting.

The last word always remains with the bank, because it lends money, lends its money and takes on all the risks.

Choosing a broker

When choosing an intermediary, rely on the advice of friends or relatives. Do not trust reviews on dubious forums - more often than not, these are custom posts that have nothing to do with reality. A profitable option would be to engage a mortgage broker from a lending bank or subsidiary. A wise choice is a representative of the developer company who is a member of a professional organization of brokers.

Important! An experienced broker will not withhold information about the borrower, late payments and poor CI. Otherwise, falsification of documents and forgery are possible (criminal actions).

Who regulates the activities of mortgage brokers in Russia

Today in Russia there is no supervisory body regulating this activity. Even the powers of the financial mega-regulator - the Central Bank of the Russian Federation - do not extend to intermediaries between lenders and borrowers.

There is also no federal law on the concept of credit brokerage, the rights and responsibilities of market participants. A corresponding bill was developed, but subsequently remained unadopted.

Therefore, both white and black brokers work freely in Russia, whose activities do not violate the Civil, Criminal and other codes. Whites respect the laws, blacks skillfully circumvent them, taking advantage of legal illiteracy or simply the naivety of those who believe their promises, give an advance payment, and are left with nothing.

It is better for borrowers to choose a reputable service provider from the list of members of ACBR - the Association of Credit Brokers of Russia. ACBR, to the best of its ability, promotes the development of a civilized market in the country.

Pros and cons of cooperation

I'll start with the disadvantages of receiving mortgage money through a broker, of which there are only three:

- high cost of services of such an intermediary (see below);

- the risk of ineffective service delivery;

- a huge number of unscrupulous firms and black lone brokers.

To prevent the third minus from deleting a certain amount from the client’s wallet for nothing, you should politely refuse to order services from intermediaries:

- providing a 100% guarantee of loan approval;

- those offering to concoct forged documents for a banking company, supposedly guaranteeing good luck;

- requiring 100% advance payment for their mediation.

Now I will name six advantages of interacting with a white broker:

- high chances of saving. A mortgage brokerage specialist provides the client with such favorable lending conditions that purchasing a home will be cheaper, even taking into account the intermediary’s commission;

- excellent chances to get a mortgage on the most favorable terms;

- the ability to get a loan even with a damaged credit history, since banks are loyal to proven, bona fide brokers;

- saving time that you don’t have to spend searching for a mortgage with the best conditions, visiting bank branches, endlessly collecting documents;

- saving effort and nerves: handed over all the requested papers to the broker, waited for the application to be approved, came to the bank only to sign the mortgage agreement;

- guarantee of purchasing a good home, a legally clean purchase and sale transaction.

Pitfalls when working with a mortgage broker

Interaction with mortgage brokers is complicated by the above-mentioned lack of government oversight of their activities. Hence the high risk of ineffective work of the intermediary and his inability to obtain a mortgage loan to the client.

How much do their services cost?

The client is offered to pay at least 10 thousand rubles for the work done by the broker. If the lender approves the mortgage and the borrower enters into an agreement with him, the intermediary will demand a percentage of the mortgage loan amount - on average 2%.

Minimum amount for work

Consultation with a bona fide broker can be obtained free of charge.

The standard prepayment is 50% of the fee for the work (if it is 10 thousand rubles, you need to pay 5 thousand right away).

The minimum percentage of the mortgage loan amount is 1%.

Trading conditions and account types

The Sberbank broker does not indulge in an abundance of opportunities and tariff plans, but this is not always a plus. Traders are offered only 2 tariffs to choose from, which differ in the size of the commission:

- “Independent” tariff : from 0.018% to 0.060% in the stock sector; from 0.02% to 0.2% on foreign exchange and 0.5 rubles per contract on futures and options.

- Tariff “Investment” : 0.3% stock market, 0.2% foreign exchange and 0.5 rubles per contract on futures and options.

There is also a slight difference in that the second tariff provides analytical support and trading ideas. Among the general parameters, there is a depository fee in the amount of 149 rubles, exchange fees from 0.00154 to 0.01% and free use of the terminal. Withdrawal of funds without commission to accounts in Sberbank. In principle, these trading conditions can also be called fairly standard; they are not outstanding, but not bad either.

How to choose the right broker

You need to choose an intermediary to provide yourself with a profitable mortgage loan based on the following criteria:

- agency reputation;

- experience in the brokerage services market;

- reviews from real clients.

Ordinary common sense will help you distinguish reviews from real people from cheap advertising.

Rating of the best

Top 10 Russian credit brokers:

- MBK Credit,

- Credit Consulting Brokerage,

- TsFK-Finance,

- Royal Finance,

- Finance Credit,

- MSK Credit,

- SCC (Capital Credit Center),

- ProfFinance,

- Premium finance,

- SSK (Credit Assistance Service).

How to choose and apply for a loan through a broker

It is better to use the following criteria:

- determine who is best able to satisfy your needs;

- read reviews from clients who were helped;

- carefully study the business license;

- make a visit to the office and talk with the staff;

- proceed according to the scheme indicated above in the text.

Sources

- https://kreditkavbanke.ru/kak-stat-kreditnym-brokerom.html

- https://www.kredibank.ru/kreditnye-brokery/kak-rabotajut-kreditnye-brokery/

- https://ipotekaved.ru/v-rossii/ipotechnyj-broker.html

- https://www.Sravni.ru/enciklopediya/info/kak-stat-brokerom/

- https://greedisgood.one/ipotechniy-broker

- https://creditzzz.ru/kreditnyj-broker/kak-stat-kreditnym-brokerom.html

- https://kakbiz.ru/kredit/kak-stat-kreditnyim-brokerom.html

- https://xn—-8sbebdgd0blkrk1oe.xn--p1ai/biznes-plan/yslygi/kak-stat-kreditnym-brokerom.html

- https://credits-pl.ru/bankg/kak-stat-kreditnym-brokerom-otkrytie-brokerskoj-kompanii/

- https://exbico.ru/kak-stat-kreditnym-brokerom/

- https://greedisgood.one/kreditnyy-broker

[collapse]

How to conclude a service agreement

Before signing the contract, it is recommended to check:

- list of services that the contractor undertakes to provide. It should contain everything that the specialist promised to do;

- “Payment for services” item. The costs of executing the contract must be borne by the broker. He does not have the right to charge any money from the customer other than remuneration;

- place of service provision;

- validity period of the document.

I advise you to provide in the agreement the right of the customer to terminate it early.

What documents will the representative request?

The mortgage brokerage specialist should request from the client only the documents required by the bank.

He undertakes to keep the personal data of the customer of services secret, without transferring documents to third parties.