The housing issue is so acute for the vast majority of the country’s citizens that it is simply impossible to resolve it on their own without borrowing funds.

Mortgage lending, which has become so popular lately, is not only a chance to buy your own apartment, but also an opportunity to profitably invest free funds in real estate that consistently has high market indicators.

Today, almost every credit institution has special mortgage programs with the help of which it helps solvent citizens purchase their home.

Uralsib Bank has been successfully operating in the credit market for more than 30 years. Mortgage terms at Uralsib Bank are designed for the mass consumer who, with an average income, is able to make monthly obligatory payments without delays.

We will describe below what specific mortgage products the bank offers.

Mortgage at Uralsib Bank - documents for new buildings and secondary housing (secondary housing)

Purchase of housing under construction from Uralsib

Taking out a mortgage loan is attractive because there is no need to save money for a long time when you have to deny yourself everything. For many people, the advantage is that you don’t have to wait a long time. One of the main questions asked by those wishing to take out a mortgage is the time during which the bank considers the application.

Sometimes the review takes a short time, and in some cases it drags on for months. There are several reasons for this. Firstly, mortgage lending is one of the most popular types of loan services.

Due to high workload, employees physically do not have time to quickly consider the application, and the time increases.

When considering an application, the bank makes every effort to guarantee the reliability and solvency of the borrower. The submitted application goes through several stages.

During scoring, the application is automatically reviewed by a special program that analyzes it and assigns scores. When a certain amount of points is reached, the application is transferred for further consideration, and if it is not scored, the borrower receives a refusal.

The analytical department will check the submitted documentation and data, and based on the conclusions drawn, they will make a forecast about the client’s solvency and reliability.

One of the factors in how long a bank takes to process a mortgage application is the security check. Here documents and data are checked for authenticity, for which it is necessary to make requests to the appropriate services. In some cases, security officers may visit the borrower's place of business and verify the validity of the information provided during a personal visit.

The risk department calculates how safe it is to issue a mortgage loan to a client. Here the risks of non-repayment are calculated, depending on the stability of the borrower’s work and previous credit history. If you frequently change jobs, employer companies, or professions that are not permanent, the likelihood of failure increases significantly.

After going through all the stages, the bank makes a decision to issue a mortgage or refuse it. If you are in a hurry, take a few simple steps that can significantly reduce the processing time.

Banks consider applications received from clients for services in it much more quickly. If you receive a salary or have a credit card, the bank is already making conclusions about your solvency.

Providing all required documents at one time significantly increases the speed of review. You should collect everything right away and not waste time bringing missing data.

When attracting guarantors, on the one hand, it provides an additional chance that you will be provided with a mortgage loan, but it increases the review time. The bank needs to check not only you, but also the person taking on the obligations on this mortgage loan.

Russian banks began to massively increase mortgage rates

https://www.znak.com/2020-03-24/rossiyskie_banki_nachali_massovo_povyshat_stavki_po_ipoteke 2020.03.24

Russian banks began to massively increase mortgage rates amid the fall in the ruble exchange rate. Conditions are deteriorating even for already approved applications. This process continues despite the fact that the Central Bank on March 20 kept the key rate at the same level - 6%.

Znak.com

UniCredit Bank and Transcapitalbank were among the first to raise mortgage rates on March 13. They grew by 1.5%, in the first case - to 10.4-13.5% per annum, in the second - to 9.99-10.29%, the Vedomosti newspaper reported. Moreover, at UniCredit Bank the percentage increased not only for new clients, but also for those whose application had already been approved, Rossiyskaya Gazeta writes. Transcapitalbank said that the increase will affect clients who are just applying for loans, and those who have already been approved for a mortgage, if they do not manage to reach a deal before March 31.

Following this, Rosbank Dom raised rates on all mortgage loans by 1% (to 9.89–10.14% for home purchases and to 9.69–9.94% for refinancing); Raiffeisenbank’s loan rates for the purchase of new buildings, secondary housing, as well as loans secured by existing real estate, increased by 0.2% (to 8.99%) for loan amounts of 3–7 million rubles, and by 0.5% for amounts up to 3 million rubles. (up to 9.49–9.79%). On Friday, March 20, Otkritie Bank joined them, increasing mortgage rates by 1.5%, RIA Novosti reports today. For home buyers on the secondary market and when refinancing, the base rate increased to 10.2%, on the primary market - to 9.9%.

Absolut Bank, VTB, Alfa Bank, Uralsib, and Promsvyazbank also reported a possible adjustment to mortgage rates. Bankers note that they will “monitor changes in the economic situation and adjust lending conditions accordingly.”

Representatives of financial organizations explain the increase in mortgage rates due to the unstable situation in global stock markets. The ruble exchange rate against the dollar has fallen by almost 20% over the past two weeks amid the coronavirus pandemic and the failure of the OPEC+ deal to extend the agreement to limit oil production. Oil prices have fallen to multi-year lows; since the beginning of the year, quotes have fallen by more than half.

According to the forecast of the International Monetary Fund, the global economy in 2020 is expected to experience a recession no less deep than during the financial crisis of 2008–2009.

Do you want independent media in the country? Support Znak.com

Share

Author

News Service

On this topic:

mortgagebankcrisis-2020Analysts: by the end of the year, rising housing prices will “eat up” the effect of the low state mortgage rateAnalysts explained what will happen to the real estate market due to the extension of preferential state mortgagesNews about Trump’s COVID-19 infection caused a fall in stock indices and oil pricesEvery working resident of Khanty-Mansi Autonomous Okrug owes banks almost half a million rubles How the government will save the economy Yugra has overtaken Moscow and has become the leader in Russia in the growth of mortgage loansACRA predicts the closure of about 100 banks in the next three yearsShares of banks mentioned in money laundering investigations have fallen in priceIn Yugra, housing prices have risen by 2.3%Course the euro exceeded 90 rubles for the first time since 2016. Yamal, Yugra and the Tyumen region are leading in the demand for mortgages among the regions of the Russian Federation. Research: every second Russian has a loan from a bank For the first time in 16 years. The profits of Russian businesses collapsed by 67%. Urals again took money to banks, despite the reduction in deposit rates. VTB Deputy Chairman warned that a situation could arise with deposits, as in the mid-90s Sberbank reduced rates on the main line of ruble deposits. Evgeniy Kuyvashev proposed to the Deputy Prime Minister of the Russian Federation to reduce mortgage rate up to 2% per annum UPN: mortgage rates on the secondary housing market may drop to 7-7.5% per annum After the key rate is lowered, Ural developers are hoping for a mortgage at 1% Survey: 75% of Russians surveyed said they would look for part-time work after withdrawal quarantineThe founder of the Superjob service estimated real unemployment in Russia at 10 million peopleMishustin told how much it would cost to restore the Russian economyRussians' loan debts reached a historical maximum during the pandemicThe Ministry of Finance transferred ₽100 billion to regions with fallen incomesThe head of the Ministry of Economic Development: the Russian economy “has a chance” to recover by the end of 2021 of the year Senator proposed introducing criminal penalties for “gray” salaries The Ministry of Economic Development told what inflation would be at the end of the year Minister of Labor: the Cabinet “did not expect” that one-time payments would be so “in demand” Russian regions are exempt from paying budget loans in 2020 Head of VSMPO-Avisma "said that he could not come from Moscow due to measures against COVID-19. The government allowed dentists and cinemas to temporarily not pay rent. "Ural Airlines offers food delivery "from the plane." The price of an economy lunch is ₽900. The head of the Ministry of Internal Affairs proposed to simplify the access of security forces to bank secrets. In the Central Bank against the Duma of Yekaterinburg asked Mayor Vysokinsky to reduce taxes for business by 10 times AvtoVAZ will suspend car production until May 18 In the Kurgan region - the highest inflation in the Urals Federal District due to tariffs and expenses of traders Sverdlovsk authorities have prepared new measures to support business due to COVID-19 for ₽7 billionMishustin signed a decree on a preferential mortgage programRussian banks issued 25% more mortgage loans compared to last yearIn the Sverdlovsk region, wage debts amounted to ₽33 millionSverdlovsk entrepreneurs will have interest on loans for May–July written off due to the crisisThe self-employed of the Sverdlovsk region were told that do to receive a payment of ₽5 thousand. Banks in Yekaterinburg are again selling dollars for 85 rubles, euros for 90 rubles. Gref reassured: the state will not confiscate citizens’ deposits. It became known how the affected self-employed in the Sverdlovsk region will be paid. At Ural factories, reserve shifts have been created to replace employees with Coronavirus values, Ural factories will be given more than ₽2 billion for the production of ventilators and medicines. A system-forming enterprise from the Kurgan region will receive a state loan of ₽500 million. Migrants were offered to be temporarily equated with citizens of the Russian Federation in order to pay them benefits. Which apartment can you buy in Yekaterinburg with the 6.5% mortgage promised by Putin? Putin announced on the launch of a mortgage rate of 6.5% for those who buy comfort-class housing Mishustin proposed abandoning a single list of systemically important enterprises RBC: companies are denied government support for formal reasons Evgeniy Roizman published a list of companies that need help due to the crisis seeds and equipment due to the depreciation of the ruble In the Sverdlovsk region, 320 thousand people work in the most vulnerable industries in this crisis Zyuganov called for nationalization to preserve independence after the pandemic Survey: 54% of Russians suffered financial losses due to restrictive measures on coronavirus RBC: banks want to know about transactions on deposits and accounts of those who ask for credit holidaysRussian banks en masse refuse clients to restructure loansCourier services are leading among offers from Russians looking for part-time workABC: US intelligence warned about the crisis due to the coronavirus back in NovemberThe government will consider increasing the mortgage threshold for credit holidaysAlfa Bank has stopped issue loans to Russians working in the most affected sectorsIMF: the situation in the global economy is worse than during the crisis of 2008–2009Putin said that due to the epidemic in the country it is not worth introducing restrictions “one size fits all” included in the list of systemically important ones that will be helped by the State Duma In the third reading, it adopted a law on providing credit holidays. In Russia, up to 50% of car dealerships may go bankrupt due to the crisis. Chelyabinsk bankers said that they do not plan to raise loan rates. The Central Bank explained how loan payments are postponed due to a week off. Due to the dollar exchange rate and coronavirus in The Yamal-Nenets Autonomous Okrug predicts a 15-20% increase in housing prices. Trans-Ural authorities will limit inspections of shopping centers and catering establishments suffering losses due to the pandemic: VTB Leasing introduces leasing holidays for Aeroflot due to coronavirus Tenants of the Kurgan shopping center record a decrease in demand and a drop in revenue up to 70% VTB called the situation in the Russian economy a “perfect storm” The Central Bank kept the key rate at 6% per annumRBC: suppliers predicted a shortage of laptops due to the mass transition to remote workUral banker announced a competition for ₽10 million for “creative business” amid the pandemicAnalysts : if the Central Bank raises the rate to 7–7.5%, the GDP rate will slow down to zeroVedomosti learned about the government plan to support the economy due to coronavirusIn Russia, banks began to raise mortgage rates due to the ruble exchange rateThe American stock exchange closed with the maximum decline in recent years 30 years Kudrin called the losses of the Russian Federation budget in 2020 due to the low cost of oil and the ruble The dollar exchange rate exceeded 74 rubles after the announcement of the coronavirus pandemic In the USA, new trading began with an increase in stock indices Retailers of household appliances spoke about the rise in prices of goods due to the collapse of the ruble In Russia, banks began to sell euros 95 rubles each Deripaska called the “real price” of mortgages in Russia In Russia, until March 16, measures will be developed to reduce mortgage payments The head of the agency of the authorities of the Khanty-Mansi Autonomous Okrug, whose clients went on a hunger strike, extended their powers Deceived by the authorities, mortgage holders of the Khanty-Mansi Autonomous Okrug announced a new indefinite hunger strike Yamal and Yugra entered the top 5 regions RF with the most affordable mortgagesMothers of many children in Surgut, who went on a hunger strike in the fall, were summoned to the prosecutor's office

How long does it take for a bank to consider a mortgage application?

- First of all, you need to decide what kind of real estate you want to purchase (a new apartment, an apartment in an old housing stock or country property). The Uralsib Bank mortgage program that you can use depends on your choice.

- The next step is choosing the conditions for a mortgage loan - this can be done at any bank branch, by calling 8-800-200-5520 or on the Uralsib Bank website, having familiarized yourself with the mortgage lending programs offered for the purchase of this or that type of real estate. In addition, here on the bank’s website, you can use an online mortgage calculator to calculate the specific terms of the proposed loan.

- After choosing a loan program, terms and loan amount, you must submit a preliminary application for consideration by credit managers. For this purpose, you can use the 24-hour telephone support line or online services on the bank’s website (directly from the mortgage calculator page). The review period for submitted mortgage applications from Uralsib Bank ranges from 3 (for loans for housing under construction) to 5 days. After a decision has been made on your application, the bank manager will call you on the phone and inform you of the decision made, which will be valid for the next 3 months.

- Next comes the stage of collecting documents for obtaining a loan. In total, you will need to prepare about a dozen different documents. The full list is available for download at the bottom of this article.

- After collecting all the documents and submitting them to the bank manager, the stage of making a final decision on your application for a Uralsib Bank mortgage begins. The validity period of the final decision is 1 month. During this time, you need to complete the procedure for purchasing real estate.

- A mandatory condition for providing a mortgage from Uralsib Bank is the conclusion of an insurance agreement. To do this, you do not have to choose any insurance companies, including the insurance company of the same name. The insured amount will be equal to the mortgage amount plus 10%, and the term of the insurance contract will be equal to the term of the mortgage agreement.

- After completing all the above procedures, all that remains is to visit the Uralsib Bank branch and sign, in fact, the mortgage loan agreement. It is this stage that gives you access to funds and provides the opportunity to make settlements with the real estate seller.

- The last nuance is the registration of ownership of your property. As soon as you receive a certificate of registration of ownership from the registration chamber, take it to the bank. At this point, the process of purchasing real estate is completed and you can safely move to a new home, all that remains is to pay the required amount monthly for using the loan.

To pay for a mortgage loan from Uralsib Bank, a special current account is opened for you, from which the monthly payment amount is debited. You yourself must ensure that on the date of the next debit the required amount is already in the account. There are several ways to top up your account.

- depositing cash through the cash desk

of any Uralsib Bank branch - through a bank ATM

with cash acceptance function - through a bank payment terminal

if you have an Uralsib Bank card - using Uralsib Internet Bank

(money can be transferred from any account opened with Uralsib Bank) - transfer of funds from an account

opened in another bank (in this case, you can issue a long-term order for regular transfer of funds). This procedure is usually not free; either a fixed amount or a percentage of the transfer amount is debited (depending on the tariffs of the bank in which the current account is opened) - deduction of the payment amount from your salary

(you must write an application to the accounting department at your place of work and provide them with the details of your account at Uralsib Bank) - through terminals of the Eleksnet system

(with a commission of 1.2% of the transfer amount)

If you choose one or another method of paying for a Uralsib Bank mortgage, you should take into account the payment processing time: 3 banking (working) days for third-party organizations and several hours in case of payment within Uralsib Bank (the required amount must be paid no later than 14:00 of the last day of payment) . Also, if you decide to repay your mortgage loan early, you need to remember that this can only be done on the basis of a previously written application (30 days in advance).

How to get a mortgage

Applying for a mortgage loan at Uralsib Bank consists of several important stages, each of which we will consider below.

Requirements for the borrower

Before submitting an application to the bank, it is important to check yourself against the established requirements of the lender. These include:

- Having Russian citizenship.

- Age limit – from 18 to 70 years.

- Registration on the territory of Russia.

- Full legal capacity.

- Sufficient solvency.

- Work experience at the current place of work for at least 3 months (the organization itself must be founded at least 1 year ago).

Uralsib is not too strict about the quality of credit history and is ready to consider clients with minor violations of previously issued obligations.

Documentation

To submit an application, the client prepares the following package of documents in advance:

- application form;

- Russian passport;

- employment documents (copy of work book or contract);

- documents on income (in addition to the 2-NDFL certificate, the bank accepts a certificate in its own form, account statements);

- SNILS;

- TIN;

- a copy of marriage/divorce certificates and birth certificates of children.

If the loan is issued using benefits, the package of papers will be expanded.

You should also prepare a set of documentation for the purchased property:

- a copy of the home seller’s passport;

- documents confirming ownership of the object (certificate of ownership, purchase and sale agreement, exchange, donation, etc.);

- cadastral passport;

- certificate of absence of debts for housing and communal services;

- certificate of absence of persons registered in the living space;

- assessment report.

How to apply

A mortgage application is submitted in two ways: through the website in real time and at any authorized Uralsib branch. The first method involves receiving only a preliminary answer. The final decision will be made only after submitting a complete package of papers and personal appearance at the service office. For such an application, you need to fill out basic information about yourself and the required loan.

The second method is to visit the selected branch with a package of documents and fill out a form. The period for consideration of each application does not exceed 3 working days.

What to do after approval of a mortgage at Uralsib Bank

If the application has been approved by the bank, then the subsequent algorithm of actions on the part of the borrower includes the following steps:

- Search for a specific property to purchase.

- Conclusion of a preliminary purchase and sale agreement with the seller.

- Valuation of real estate in an appraisal company (when purchasing a secondary property).

- Conclusion of an insurance contract.

- Conclusion of a loan agreement and a mortgage agreement.

- Payment of the first installment to the seller's account.

- Registration of the transaction and encumbrance of property.

- Transfer of the remaining amount by the bank to the seller.

This list implies a standard mortgage loan.

Loan review period at URALSIB Bank

For loan applications submitted to URALSIB Bank, the terms of consideration and approval depend on the method of submission. The time it takes to make a decision will differ between applying in person at a branch and online.

The advantage of an online application is the speed of consideration and the ability to provide a reduction in the interest rate for some loans issued remotely.

At URALSIB Bank, regardless of which lending program you choose, the first stage of obtaining a loan is submitting an application form with the necessary data. URALSIB provides the following loan offers: When applying for a loan at URALSIB Bank, use the online application - this will shorten the approval time and allow you to get more favorable conditions on interest rates

Mortgage for the purchase of finished housing and refinancing program

Both mortgage programs are provided to customers at an interest rate of 9.90%.

Refinancing is provided to clients if they previously took out a mortgage with another bank, and now want to transfer to Uralsib.

The loan repayment terms in both mortgages are unchanged (from 3 to 30), but the maximum loan amount that the bank can issue will differ.

So for refinancing, this amount will be 50 million without additional collateral and guarantors.

For a mortgage for the purchase of finished housing, the mortgage size will be from 300 thousand and also up to 50 million, but such an amount is issued only to clients with high incomes

Therefore, you should realistically count on a mortgage of no more than 5 million.

Attention! In addition to the net rate, which is 9.90%, clients can

Deadlines for considering a mortgage application: approval procedure and reviews

When applying for a mortgage, you should understand that this type of loan is the riskiest for the bank. That is why employees carefully check you and calculate their risks several years in advance. Because of this, we have to wait a long time for a decision.

- A call from the bank manager.

- SMS notification from the bank.

- Electronic notification in your personal account on the website.

- Find out for yourself by visiting the branch.

After receiving a positive decision from the bank, the actual registration of the mortgage begins, which takes quite a lot of time. In this article we will look at how long it will take to get approved for a mortgage application. Let's find out how banks check application forms and how long each stage of applying for a mortgage takes.

We have prepared ways for you to speed up this process and collected reviews about banks.

Mortgage from UralSib

The interest rate on a mortgage at UralSib depends not only on the type of program. The value of this parameter is also influenced by the following factors:

- whether the client plans to insure his life and title;

- at what rate does he service the mortgage?

An online loan calculator is posted on all pages of the mortgage programs of this bank’s website (with the exception of “Military Mortgage”). Let's look at how to calculate a UralSib Bank mortgage using the example of the loan “Purchase of housing under construction.” You can repay your mortgage any day after signing the loan agreement.

You will find more information on this issue in modern Russian realities in our article “About mortgages in 2020”.

Features of the “Ready Housing” program

The bank is ready to lend you from 300,000 to 50,000,000 rubles for a period of up to 30 years. The size of the loan depends on the level of solvency of the applicant, the cost of the purchased housing and other factors.

What mortgage percentage does URALSIB Bank set for clients? The minimum rate is 8.99% per annum.

With borrowed money you can buy:

- apartment in a townhouse or apartment building;

- apartments;

- private residential building.

The amount of the down payment is 15% of the value of the purchased property. If you submit an application using only two documents, the amount of the down payment increases to 30% (if the property is purchased from the bank’s partners) or to 40% (in other cases).

Adult citizens of the Russian Federation with permanent registration and a current work experience of at least three months can apply to a lender for a mortgage.

To count on optimal lending conditions, you should take out personal insurance and provide the office with documents confirming your income level.

How long do banks consider a mortgage application?

Today we will talk about how long banks usually take to consider a mortgage application and how to complete it correctly so that the apartment you like does not go to another buyer during this time.

Therefore, if you like a particular apartment and don’t want to miss it, it makes sense to apply for a housing loan to several banks at once. And also pay attention to the list presented below.

Therefore, the average time to complete a deal for mortgage lending is about 1 month, sometimes a little more. Whether you want it or not, you need to be prepared for this and be patient.

What confuses borrowers most about mortgage lending?

Most people, without hesitation, will answer – the time frame for consideration. It also happens that an application only for a loan, without checking the property, takes up to 30 days in some banks.

Features of URALSIB mortgage

The features of a mortgage at URALSIB Bank include the following facts:

- The borrower can use maternity capital in some programs - for housing under construction or finished housing, as well as for state employees.

- Special payment schedule: provided for the purchase of housing under construction. At the time of construction, the amount of the monthly mandatory contribution may be reduced, which allows the borrower to rent a rented apartment during this time and combine this with partial repayment of the mortgage.

- Insurance of a property purchased with a mortgage in 2106 is mandatory, personal insurance of the borrower and a special title insurance program are also provided - loss of title. Not taking out personal insurance will result in higher interest rates.

Study the features of providing a mortgage at URALSIB Bank in 2020, which may allow you to receive on more favorable terms

Uralsib Bank mortgage calculator

We have added the ability to select Uralsib Bank's mortgage lending program so that you can immediately start calculating and not have to think about what percentage to set.

- For individual entrepreneurs

- For pensioners

- For individuals

- For legal entities

- Of course, Uralsib Bank provides the most favorable conditions for salary card holders

Uralsib Bank's online mortgage calculator will calculate all the data. You only need to indicate the amount you want to borrow and select the mortgage term. By changing this data, you can select online the necessary parameters of a mortgage loan, which you will be comfortable paying monthly.

Mortgage loans Uralsib Bank in 2020

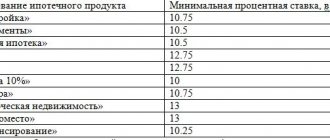

URALSIB Bank's line of business, based on issuing mortgage loans, applies to any type of real estate - new buildings, shared construction, secondary housing, individual private houses. The loan program should be selected depending on the type of property being purchased. The company offers the following types of mortgages:

- Loan for finished housing – from 9.9%;

- Loan for the purchase of housing under construction – from 9.9%;

- Mortgage refinancing – from 10.5%;

- Loan for any purpose secured by property – from 13.5%;

- Housing loan secured by existing property – from 12.5%;

- Mortgage lending for military personnel – from 10.9%;

- “Mortgage holiday” program - from 10.9%;

- Secured loan for partner clients (developers, agencies) – from 9.9%.