Read more about mortgages for a young family

Among the mortgage products presented on the VTB24 website you will not find a special program for a young family, however, you can take advantage of government support under the housing certificate program or use a maternity certificate for payments.

The state support program for young families has been extended for 2020, while regional authorities are assigning additional subsidies for young families, which can also be used to improve housing conditions. In addition, you can take advantage of a mortgage with government support at a favorable interest rate.

To whom is it provided?

Spouses over 18 and under 35 can become participants in the Young Family program. They must have citizenship of the Russian Federation and need improved living conditions.

This means that per family member there is less than 15 square meters of apartment space. Spouses must live together. Families who own their own housing are not allowed to participate in the program. The state's goal is to help those who are unable to buy a separate apartment.

State assistance is provided free of charge, that is, you will not have to return the subsidy received.

Once you become a member of the program, you will receive a certificate that can be used for mortgage payments or as a down payment. In this case, you contact the bank with a request to provide a regular mortgage loan, but the amount on the certificate is taken into account in the calculations.

The second option is to take out a mortgage taking into account maternity capital. It is available to women who have citizenship of the Russian Federation and who have given birth to a second or subsequent child. Fathers are also eligible to receive a certificate if the mother has lost her right to participate in the program, or if the young father is the sole adoptive parent of a minor.

In 2020, the payment is 453,026 rubles. These funds can be spent on improving living conditions. VTB accepts the certificate as a down payment on a mortgage or allows you to use funds to pay off debt.

Requirements

Requirements for the borrower. Since VTB does not provide a special product for young families, all families with a second child can take advantage of a mortgage taking into account maternal capital. The standard requirements for obtaining a mortgage loan apply:

- age from 18 years;

- official employment in Russia;

- total work experience of at least one year;

- The place of registration does not have to be in the same city where the housing is purchased.

Required documents. First of all, fill out an application, which can be downloaded on the bank’s website. It must be filled out by hand in block letters or sent online. In addition to the application, provide the following documents:

- Russian passport;

- SNILS (pension insurance certificate);

- TIN;

- certificate confirming income;

- photocopy of work record book or extract;

- military ID (men under 27 years old);

If you plan to use maternity capital, provide the bank with a certificate and a document from the Pension Fund, which will confirm information about the balance of funds. After approval, do not forget to contact the Pension Fund so that the funds from the certificate can be used to pay off the mortgage.

To use a housing certificate under any current government support program, attach it to the package of documents for the bank. Once your application is approved, you can begin searching for suitable real estate.

To confirm income, you can provide a certificate in form 2-NDFL or in the form of a bank. A tax return for the most recent year may also be provided. You can take into account wages from two places of work: main and part-time.

Certificates on the bank form can be found on the official VTB website. Persons participating in the VTB salary project do not need to confirm income. If you attract guarantors to increase the available amount, they also need to provide a full package of the documents listed above.

The bank may ask you to provide additional certificates and documents (about marital status, education, work activity, credit history).

Sample certificate of income according to the bank form.

Program conditions

Parents who had a second child and subsequent children between January 1, 2020 and the end of December 2022 can apply for a primary loan or refinancing.

Look at the same topic: How to get a mortgage from Zapsibkombank in [y] year? Loan terms and mortgage interest rates

Coverage areas: the entire country with the exception of the Far Eastern Federal District. Here the upper limit is the same - December 2022, the lower - January 1, 2020. In the first case, the rate is 6%, in the second - 5%, subject to the conclusion of insurance contracts: illness, accident, property, etc.

Approved amounts:

- Residential premises in the country with the exception of Moscow, St. Petersburg and their regions - no more than 6 million rubles;

- Real estate objects for living in the territories of the above cities and regions - 12 million rubles.

If the borrower refuses to enter into insurance contracts or violates the conditions specified in them, the loan rate may be increased.

Conditions

Available amounts . You can use any currently available mortgage program and receive from 600 thousand to 60 million rubles for the purchase of an apartment . The maximum mortgage amount depends on the client’s solvency, the price of the apartment, the desired term and other factors.

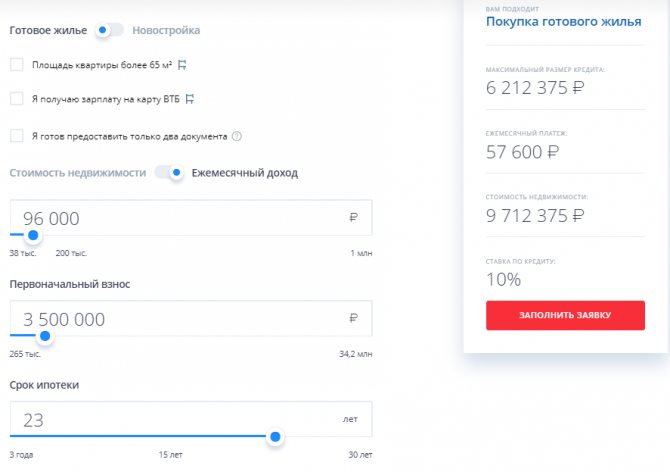

In regions, the mortgage amount may differ. You can make an approximate calculation on the VTB Bank website using a mortgage calculator. For an accurate calculation, we recommend that you contact the department and personally consult with an employee.

The calculator will help you calculate your mortgage and assess your capabilities.

The down payment on a mortgage at VTB is from 10% . The larger the amount you are willing to deposit at once, the more comfortable the terms of the contract will be. Maternity capital can be no more than 15% of the down payment.

In this case, you must deposit your own funds, at least 5% of the cost of the apartment . If a housing certificate is used as a down payment, the bank issues borrowed funds only after paying part of the price of the apartment with subsidies.

Loan terms. You can get a loan for a period from 1 to 30 years. The borrower must be under 75 years of age at the time of loan repayment. You can indicate the desired loan in the application form.

Interest rates. rate is fixed, that is, it does not change throughout the duration of the contract. The minimum rate is 9.5% per annum. You can get a favorable rate if:

- you receive your salary on a VTB card;

- work in the public service, as a teacher or as a doctor;

- you are an employee of a VTB corporate partner;

- apartment area is more than 65 sq. meters;

- agree to take out comprehensive insurance.

Conditions for obtaining a mortgage

We can formulate general criteria for borrowers to obtain a mortgage loan from a bank:

- available to anyone over 18 years of age;

- the down payment when purchasing real estate is not lower than 10%, taking into account the mandatory insurance of you against unreliability in the amount of the difference between your down payment and the basic (20%) requirement of the bank;

- loan term from 5 to 50 years;

- the need for compulsory insurance of purchased real estate and the life of borrowers;

- the opportunity to obtain a loan with a low interest rate (11%), without commissions and additional guarantee - “Mortgage program with state support”;

- participation of maternity capital in the amount of the down payment when purchasing real estate under the “Mortgage + Maternity Capital” program.

Insurance

Insurance against the risk of loss and damage to the purchased apartment is mandatory. Thanks to this, the bank protects itself from possible losses. You can additionally take out insurance in case of death or disability of the borrower, limitation or termination of ownership in the first three years after purchase (only for the secondary housing market).

If you take out only mandatory insurance, the loan rate will increase by 1% . On this page you can familiarize yourself with the list of insurance companies where you can obtain comprehensive insurance. Their policies will be guaranteed to be accepted by the bank when applying for a mortgage.

How to apply?

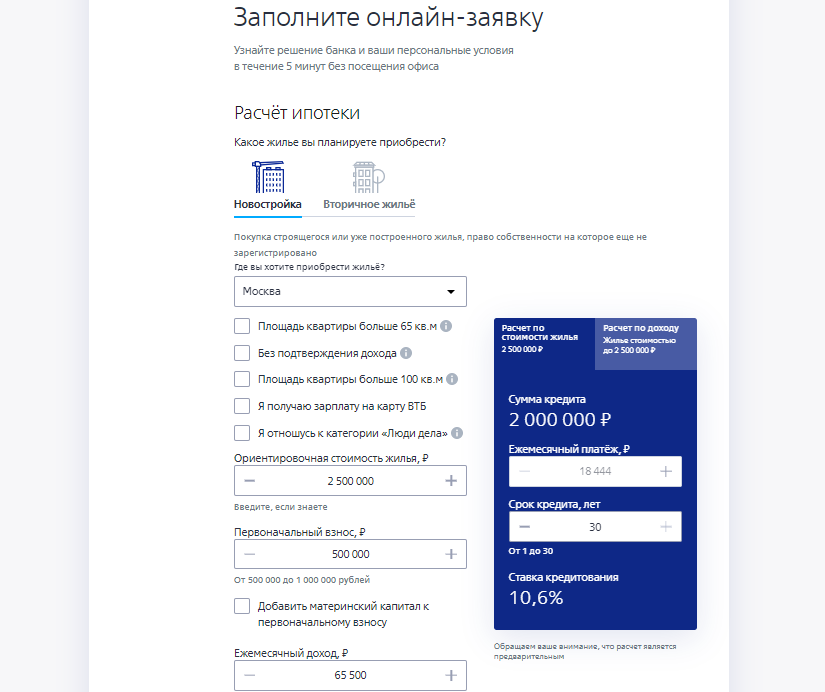

Do this through the website or branch. Use the calculator on the website to make a preliminary calculation of the VTB Mortgage Young Family program.

The order of forming a request:

- Go to the official website, follow the sections “Mortgage” - “With state support”. Check out the conditions, features, repayment methods and bonus from the bank. Scroll down the page and click "Submit Application".

- Wait for a call from a bank representative. He will perform calculations, give advice, and offer to visit the mortgage center at a convenient time;

- Bring the documents to the bank and wait for approval. It is valid for 120 days.

Look at the same topic: How to apply for a mortgage at UniCredit Bank using 2 documents without a down payment?

Then start searching for real estate on your own or use offers from accredited developers. Conduct an assessment of the property you are interested in (can be ordered on the website, sometimes not required for new buildings), take out insurance.

At the final stage, complete the deal - sign 3 agreements: purchase and sale (with the developer), mortgage (with the bank), insurance (with the insurance company). After this, VTB will send the borrowed funds to the account of the company that built the facility.

Congratulations! All that remains is to register ownership (in the case of unfinished construction - after its completion) and enjoy the results of the work done.

How to get a mortgage for a young VTB family?

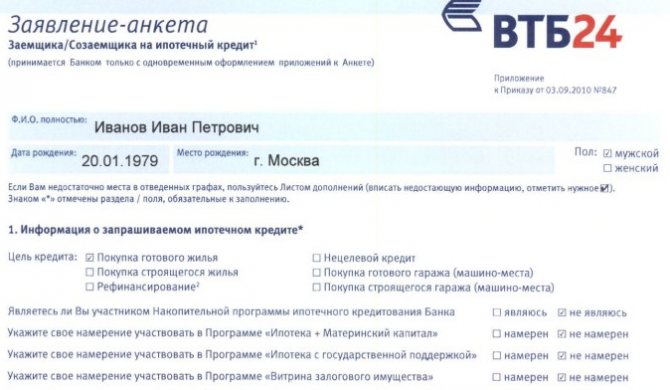

Filling out an application. The first step is to fill out an application. All fields in the main part of the form are required. It contains full passport data, SNILS numbers, TIN, registration and actual residence address, contact information.

Tell us your marital status and whether a marriage contract has been concluded between you and your spouse. This is followed by information about employment, employment contract, position held and length of service. You should indicate the assets you have (savings, real estate, car) and their characteristics. In appendices you can provide additional information that does not have a place in the main part of the document.

Sample application for a mortgage at VTB.

There are two ways to apply for a mortgage. You can submit the application online and submit it online or fill out the form in the office. After reviewing the application, the bank manager will contact you and schedule a meeting. You will be able to provide all the necessary documents, wait for approval, then start choosing a property.

How does approval happen? After all documents have been submitted, the bank begins to review and verify them. The procedure usually takes 1 - 5 business days. For those who receive wages on a VTB card, the decision will be made out of turn during the working day.

You will be notified of the decision made via SMS to the contact number specified in the application form, or a bank employee will call you. If a positive decision is made, you need to contact the bank in person and receive a notification, then provide a complete package of documents and their photocopies. A positive decision is valid for 4 months (122 days), during which time you need to find a suitable apartment.

Online application and required documents.

How to use this program?

You must complete an online application for a mortgage on the VTB Bank website. A bank employee will call you, make a calculation and give some advice. With further coordination of actions, he will make an appointment for you at the VTB Bank office.

Then you will need to bring documents:

- application form according to the bank form. To fill out the application, the borrower must know the address of the organization where he works and the phone number. All fields in the form must be filled out correctly, passport data must be entered correctly;

- Russian passport;

- TIN;

- birth certificates of all children with Russian citizenship;

- SNILS;

- certificate 2-NDFL in standard form or certificate in bank form. In 2-NDFL, all lines must be filled out, passport data must be entered correctly. If 2-NDFL is filled out with errors, it will need to be replaced on the day the loan is issued. If you receive your salary on a VTB card, then you do not need a certificate to confirm your income;

- a copy of the work book. Each spread is certified by the seal of the organization, there must be a date of certification and the signature of the person who certifies (director, human resources department). On the last page there should be an entry “Currently working”. It is also necessary to attach the following blank page of the work book, also certified by a seal and signature. This is necessary to ensure that there are no further entries. The borrower must have worked at his last job for more than 3 months. If you have worked for only a few months, you must also provide an employment contract along with a copy of your work record book. It must indicate whether there is a probationary period or not. If there is a probationary period, the borrower can receive a mortgage only after passing it. If he works without a probationary period, he can apply for a mortgage after 3 months of work;

- military ID (if the man is under 27 years old).

VTB Bank is considering the application and may ask you to provide additional documents to obtain a mortgage at a rate of 5 percent. Before you start collecting documents, it is better to get advice from a mortgage manager.

The bank's decision will be made in 1-5 days. A positively approved decision is valid for 4 months. You can look for housing either yourself or with the help of bank partners. Housing should be purchased only from a legal entity: a house under construction or a finished house. It is impossible to buy an apartment from an individual under this program.

Repaying a VTB mortgage loan

The loan must be repaid in equal installments, once a month. The payment can be made without commission on the VTB Online service website, at an ATM, terminal, or set up automatic debiting from the card. If you want to make a payment at a bank office, remember that amounts up to 30,000 rubles are subject to a commission .

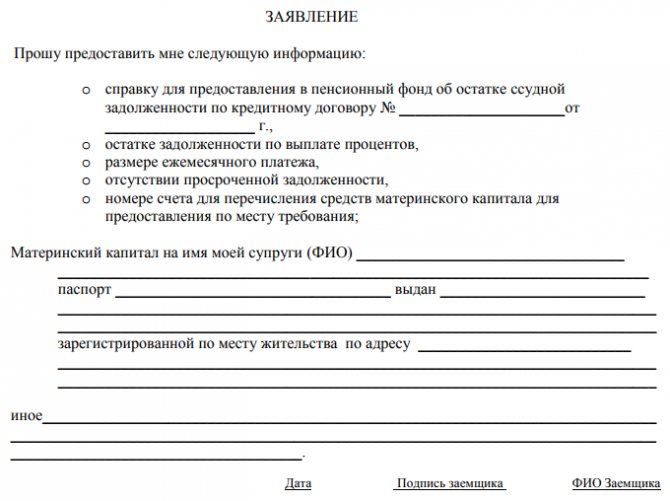

Early repayment. You can pay off your debt early without commission at any time. To partially repay the debt, you can use maternity capital. To do this, contact your nearest branch.

Russian Pension Fund at the place of registration. Submit a request for a certificate from the Pension Fund of the Russian Federation and an application for early repayment. You can download application forms on the VTB Bank website. Please note that if during registration you chose the option of two documents (“Victory over formalities”), maternity capital cannot be used.

Sample certificate for the Pension Fund.