Interest rates and mortgage conditions for military personnel at Gazprombank

Military personnel who want to purchase their own real estate can use the lending service from Gazprombank. There is a standard military mortgage program with affordable terms and no hidden fees. The minimum interest rate is 8.1%.

The standard conditions for obtaining a military mortgage at Gazprombank are as follows:

- the lending period is limited to 25 years;

- the borrower is required to make a first payment of at least 20% of the total price of the apartment;

- funds are provided exclusively in national currency;

- the maximum mortgage amount is 3.05 million rubles.

The initial deposit must be paid from the borrower's funds accumulated in the individual account. The money is transferred by Rosvoenipoteka from the state budget. If desired, the applicant has the right to contribute personal savings if the transferred amount is not enough.

Conditions for Gazprombank military mortgage

The conditions for lending to military personnel to purchase their own housing are approximately similar in all partner banks implementing such a program. The differences are insignificant. Let's look at the details of the military mortgage lending program, general terms and conditions and current interest rates.

Loan programs

According to the law, an applicant for a preferential mortgage loan can be a Russian citizen who is serving in the ranks of the Russian Army and has been a participant in the savings-mortgage system for at least three years.

The purpose of lending is to purchase living space from the list of real estate properties accredited by the bank and Rosvoenipoteka. In accordance with this, the following lending programs are in effect:

- Purchasing an apartment with registered ownership (on the secondary market).

- Purchase of housing under construction under the DDU in compliance with the provisions of 214-FZ.

- Purchasing living space under the “Family Mortgage with State Support” program (for families in which a second and/or third child is born from the beginning of 2020 to the end of 2022).

The choice of a specific program depends on the type of real estate purchased and the family status of the serviceman. For example, if a family meets the requirements for the family mortgage program, then it would be more profitable and logical to submit a mortgage application for this particular product. The current rate of 6% per annum during the grace period is certainly lower than the rate approved for the standard military mortgage product.

General terms

The standard conditions for obtaining a loan for the military at Gazprombank are as follows:

- loan term – no more than 25 years;

- loan amount – up to 2 million 814 thousand rubles;

- down payment – from 20% of the market value of the purchased property.

The first installment is paid from the funds accumulated in the borrower’s individual account, transferred by Rosvoenipoteka from the state budget. Additionally, if desired, the serviceman is given the opportunity to deposit personal funds.

The loan is issued strictly in rubles. When signing a loan agreement and agreeing on loan parameters, three parties are involved: the creditor bank, Rosvoenipoteka and the borrower himself, a military serviceman.

Interest rate

A distinctive feature of a military mortgage is a fixed interest rate for the entire loan period. Gazprombank approves a rate of 8.8% per annum.

If the client, as part of obtaining a preferential loan for the military, decided to use the family mortgage program, then a fixed rate of 4.9 will be applied.

Minimum and maximum amount

There are no restrictions on the minimum loan amount for the military. The amount can be almost any.

As for the maximum loan amount, it is determined by the size of the annual savings contribution approved at the level of the Government of the Russian Federation, as well as the repayment period.

The longer the loan term and the larger this contribution, the greater the amount the serviceman will be able to claim.

In 2020, the maximum amount for a military mortgage at Gazprombank was established - no more than 2,814 thousand rubles.

Options for applying for a loan

Gazprombank provides two options for applying for a mortgage loan:

- Personal application to a nearby bank branch. A potential client needs to visit the bank, provide documents to an authorized employee, and find out the details of mortgage lending.

- Submit your application online. On the official page of Gazprombank there is a special form for applying for a mortgage. When filling it out, the user must indicate personal data, passport details and lending parameters (amount, purpose, loan term). After reviewing the application, a representative of the bank will contact the client and invite him for an interview.

In addition to the options listed, employees of real estate agencies can apply for a loan. They have the right, on behalf of the buyer, to send an application for consideration to a banking organization.

Military Mortgage Program

The mortgage loan program is designed for participants in the accumulative mortgage system (NIS) for housing provision for military personnel, for the purchase of:

- Apartment with registered ownership;

- Apartments in a new building, under an agreement for participation in shared construction, concluded in accordance with the requirements of Federal Law No. 214-FZ.

The calculation of the maximum loan amount is based on the amount of the savings contribution, which is established by the federal law on the federal budget for the corresponding year, transferred to the Federal State Institution "Rosvoenipoteka" to repay the loan debt, and the loan term.

As a down payment, you can use funds from a targeted housing loan provided to the borrower by the Federal State Institution "Rosvoenipoteka", including the borrower's own funds.

| Loan currency | Russian rubles |

| Maximum loan amount | 2.33 million ₽ |

| Interest rate | 9.5% per annum |

| Minimum down payment | from 20% |

| Credit term | from 1 year to 25 years |

| Loan issue fee | won't take it |

| Application review period | 1-10 working days (from the moment all documents are submitted to the bank) |

| Loan form | one-time loan (credit line with a disbursement limit – when purchasing an apartment) |

| Insurance | compulsory (insurance of a real estate property, title insurance in cases provided for by bank requirements, insurance of a real estate property after state registration of ownership of a purchased apartment), voluntary (personal insurance) |

| Redemption | carried out in monthly payments, using funds from a targeted housing loan provided to the Borrower by the Federal State Institution "Rosvoenipoteka" |

| Conditions for early repayment | It is possible to repay the debt early, using funds from a targeted housing loan, as well as with your own funds |

Requirements for the borrower:

- Military personnel - a citizen of Russia who is undergoing military service, is included in the Register of NIS Participants, and has the appropriate certificate;

- Permanent registration in the region of presence of Gazprombank;

- With a good credit history;

- The borrower's age is from 20 to 45 years (at the time of full payment of the mortgage debt);

- Participation in NIS – at least three years.

The package of documents includes:

- Application – application form for obtaining a mortgage loan;

- A copy of the Russian Federation Passport, or another document that can verify your identity;

- SNILS (it is enough to indicate the insurance number of the individual personal account in the application form);

- A copy of the work book, certified by the employer’s seal;

- Certificate of the right of a participant in the accumulative mortgage system of housing provision for military personnel to receive a targeted housing loan.

No proof of income is required.

Requirements for a potential borrower

Gazprombank puts forward a number of requirements for the borrower, which he must meet in order to apply for participation in a military mortgage:

- serving in the Armed Forces and including the applicant in the register of NIS participants;

- presence of Russian citizenship, foreigners are not allowed to participate in the lending program;

- permanent registration or residence in the region where there are territorial branches of Gazprombank;

- no problems with credit history; if the assessment is negative, the borrower will not be provided with funds;

- compliance with the age limit of 21-45 years.

Important! Gazprombank reserves the right to make individual decisions on each application submitted. This means that some clients may be subject to additional requirements in accordance with the current internal regulations of the banking structure.

General lending conditions

The conditions for obtaining a mortgage loan for the military at Gazprombank established by the institution are as follows:

- The currency in which the loan is issued is Russian rubles;

- The minimum amount is not limited, the maximum loan amount is 2,401,000 rubles;

- The minimum and maximum loan term is from 1 to 20 years;

- The minimum down payment amount is 20% of the cost of the purchased housing (paid with Rosvoenipoteka funds from the state budget transferred to the borrower’s account) with the possibility of making personal savings.

The submitted application is reviewed within 1 to 10 working days, starting from the day following submission of the full package of documents.

Mortgage interest rate

The advantageous advantage of a military mortgage is the fixed interest rate established for the entire loan period. Approved by Gazprombank is 9% per annum.

Under the family mortgage program, in the presence or birth of children, the loan rate is reduced to 6%

In 2020, Gazprombank set the maximum amount for a military mortgage to no more than 2,486,000 rubles.

Requirements for the borrower

Each military member who applies for a preferential mortgage loan must meet the following requirements:

- Have Russian citizenship;

- Serve in the ranks of the Russian Army and be included in the register of NIS participants;

- Age from 21 to 45 years;

- There must be a positive credit history or no negative one;

- Have permanent registration in any region where Gazprombank branches and offices are located.

Accredited properties

A military mortgage can only be obtained for the purchase of finished or under construction housing accredited by Gazprombank. You can find out the availability of such facilities at any branch of a credit institution or a representative office of Rosvoenipoteka in your region.

If the property you are interested in is not on the list, you can submit an application for accreditation to Gazprombank. It is submitted simultaneously with the package of documents required to obtain a mortgage.

Conditions for issuing a mortgage

To participate in the military mortgage program from Gazprombank, you must meet all the criteria approved at the legislative level. The conditions for a military mortgage at Gazprombank are standard. The loan is secured by collateral of the purchased real estate. The bank puts forward special requirements for it:

- year of construction, the building must be no older than 40 years;

- wall and ceiling material - concrete or brick;

- availability of communications;

- normal infrastructure support, the presence of important facilities nearby, including schools, kindergartens, shopping facilities and medical institutions;

- additional requirements, which include the absence of illegal redevelopment.

Military mortgage funds can be used exclusively for the purchase of housing that has been accredited by Gazprombank. You can clarify the list of objects that meet all the requirements directly from the employees of the banking organization. If the selected house has not been inspected by Gazprombank, an application for accreditation of the facility is allowed.

Requirements for the property

Gazprombank issues a loan secured by the purchased apartment, so it wants to see housing as collateral that it can sell in the event of the borrower’s default.

Gazprombank has increased requirements for the year of construction. For buildings with stone floors it should not exceed 25 years, for brick ones - 10 years. Capital foundation made of concrete and metal structures. All redevelopment must be legal.

The apartment should not be located in a dilapidated, unsafe or subject to demolition building. The living space must have a kitchen, a bathroom and be connected to the water supply system.

Calculation of mortgage costs from the bank

Gazprombank's military mortgage is a federal program that guarantees benefits to military personnel. However, the presence of state support does not relieve the applicant from additional expenses.

A mandatory condition for providing borrowed funds is insurance of the property against damage or loss. If desired, the user has the right to insure his life and health. This type of insurance is optional.

Important! Insurance is carried out at the applicant's personal expense, which is not subject to reimbursement from the state budget.

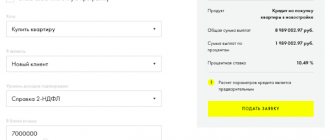

Mortgage calculator

For convenience in calculating monthly loan repayment amounts, users can use a mortgage calculator. This is a kind of tool that allows you to determine the size of monthly payments during the entire loan period.

To make calculations through a mortgage calculator, you must fill out a standard form consisting of the required fields:

- amount of borrowed funds;

- mortgage interest;

- date of issue;

- type of payment (annuity or differential);

- loan terms.

Using the calculator, the user will not only determine the cost of repaying the loan, but also calculate the minimum income to fulfill the obligations.

Calculate monthly payment and loan overpayment

Payment schedule

Mortgage calculators presented on specialized portals allow you to create and determine a loan repayment schedule. Users have access to information regarding monthly expenses for fulfilling loan obligations.

A detailed breakdown will be given for each payment. With its help, the applicant can find out how the monthly payment amount is formed and what parts it consists of. Initially, most of the payment consists of paying mortgage interest. Over time, this component decreases, after which the debt itself becomes the basis.

Military mortgage calculator at Gazprombank

Knowing the rates and lending volumes, all that remains is to calculate the amount of monthly payments. To do this, use a special calculator:

- enter the property value;

- indicate the rate;

- choose the optimal repayment period;

- start the calculation process;

- wait for the results.

But it is important to emphasize that the results obtained are preliminary. They are approximate only and should be used as a guide only. The exact figures will be known at the time of concluding the loan agreement, when the bank provides the client with a detailed payment schedule.

Required documents

To participate in Gazprombank’s military mortgage program in 2020, the client will need to provide employees of the banking structure with a package of accompanying documentation, including:

- a completed application form for receiving borrowed funds;

- original and copies of passport;

- insurance certificate of pension insurance, you will need to provide SNILS to the bank, indicate the personal account number in the application;

- a certificate confirming participation in the savings-mortgage system (NIS) for military personnel for obtaining a housing loan.

A military mortgage is supported by the state, therefore the applicant is not required to provide documentation confirming the presence of a permanent source of income. If necessary, the bank has the right to request additional information.

In addition to the listed documentation, the user will have to collect separate documents on the selected property. Based on the provisions of Federal Law-214, when purchasing housing in a house under construction, the following data will be required:

- current project of preschool education;

- a copy of the permit to carry out construction procedures;

- project declaration and investment agreement;

- constituent documentation of the developer;

- land documents;

- a certificate confirming the degree of readiness of the residential property.

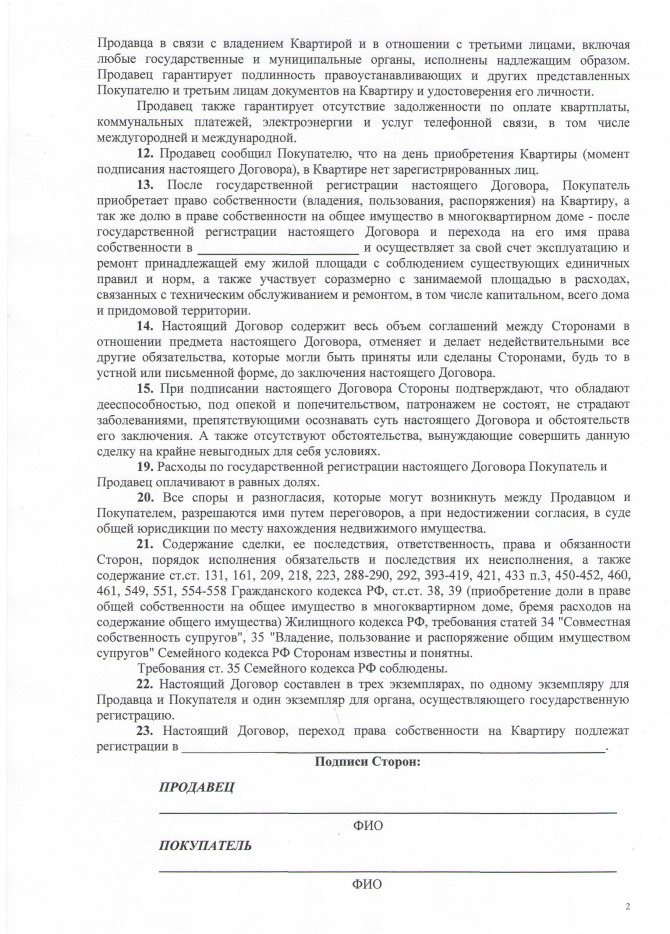

When purchasing an apartment on the secondary market, the list of additional documentation consists of:

- title documents of the seller confirming his right to dispose of the property;

- cadastral passport;

- estimated housing costs;

- certificates confirming the absence of utility debts and the absence of persons registered in the apartment.

Real estate documents are provided by the developer and the secondary market seller, respectively. The applicant is not involved in the collection of this documentation package.

Documents for mortgage

The client must prepare 2 sets of papers in advance: personal and for the purchased property. Let's look at the list of each in more detail.

For application

The borrower prepares:

- Russian passport;

- application form;

- certificate of participation in NIS;

- SNILS.

No documentation of the military member's income or employment is required.

For real estate

For finished housing projects, the list will be standard:

- title documents;

- cadastral passport;

- assessment report;

- certificate of absence of debts on utility bills;

- certificate confirming the absence of persons registered in the apartment.

For an apartment under construction:

- DDU project;

- building permit;

- project declaration;

- land documents (certificate of ownership or lease agreement);

- investment agreement;

- a certificate from the developer about the stage of readiness of the property;

- constituent documents for the home seller.

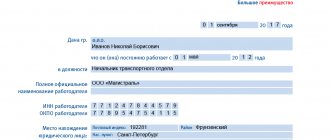

Application Form

Filling out an application for a Gazprombank mortgage is carried out in strict accordance with current legislation. In 2020, the procedure includes a number of fundamental stages:

- Collection and preparation of required documentation.

- Filling out the application. You can obtain a current sample application form from bank employees or download it on the official website of the banking structure. The application has a standard form.

- Submitting the application with a package of documentation for consideration to Gazprombank. Employees of the banking structure will provide a response within 1-10 business days from the date of acceptance of the documents.

- Preparation of a report on the assessment of the property (if the purchase takes place on the secondary market). The conclusion is provided by an appraisal company accredited by Gazprombank.

- Opening two accounts with Gazprombank - “military mortgage TsZhZ” and “credit”.

- Conclusion and signing of a loan agreement between the borrower and the banking structure. Drawing up a targeted housing loan agreement.

- Transfer of agreements drawn up between the bank and the applicant for consideration to Rosvoenipoteka. This organization acts as an intermediary and guarantor of state support for preferential lending. After the contracts are certified by Rosvoenipoteka, the user will have to transfer the original documents back to the bank.

- Based on the current conditions of housing lending, Rosvoenipoteka transfers the savings contribution to the “Military Mortgage Central Housing Loan” account. The funds provided will be used as a down payment. If the transferred amount is not enough, the borrower has the right to use his own savings in full or in part.

- After paying the first installment, a DDU or purchase and sale agreement is concluded between the real estate seller and the borrower. The first agreement is used when purchasing housing in a building under construction in accordance with the requirements of Federal Law-214, the second - when purchasing secondary real estate.

- The next step is purchasing an insurance policy. One of the key requirements of the bank when issuing a mortgage is insurance of the collateral property against damage and loss. The borrower is obliged to purchase the policy at his own expense.

- Submitting an application to Companies House. After completing all registration procedures and receiving certification from a government agency, Gazprombank transfers the remaining funds to the seller.

How to apply step by step

- Choose an apartment to buy.

- Fill out an application online on the Gazprombank website or at any branch. Up to ten working days are allotted for review.

- If you are purchasing a secondary home, you must order an appraisal.

- Bring documents for the property to a convenient bank branch.

- Sign the loan agreement and loan documentation.

- Agree with the bank on the opening time and open two accounts: “CZZ” and “Credit”.

- Sign the agreement at Rosvoenipoteka and wait for the first installment to be transferred to the Central Housing Plant.

- If you have your own funds, deposit them into the “Credit” account.

- Sign the purchase and sale documents and register the transaction at the Companies House.

- Insure mortgage housing.

- Present to the bank the purchase and sale agreement from Rosreestr and the insurance certificate.

- The bank will transfer funds from both accounts to pay for the property.

Deadlines

Approval of a military mortgage takes from 1 to 10 business days after acceptance of the application. It takes longer to confirm the transaction. The housing lending program is accompanied by government support and the need to have the agreement certified by Rosvoenipoteka. This process can take up to 3 months.

The time frame for obtaining borrowed funds may be extended if the selected facility is not accredited by Gazprombank. In this situation, you will need to write an application to include real estate in the list of accredited objects, which also takes quite a lot of time.

What documents are needed

Before contacting Gazprombank for a military mortgage, you must obtain a certificate for the issuance of a central mortgage loan. This document is provided by FKU Rosvoenipoteka.

It is allowed to sell a home mortgage within 6 months. If the certificate is not used during this time, its validity will be canceled.

When you next contact the bank, you will first need to obtain a certificate with new validity periods.

The package of documents submitted by an NIS participant to Gazprombank to obtain a military mortgage includes:

- application form for a mortgage;

- copies of the borrower’s passport (all pages);

- NIS participant certificate.

Confirmation of regular income is not required, but the bank has the right to request additional documents if necessary. Once your application is approved, you can begin searching for housing within the approved amount.

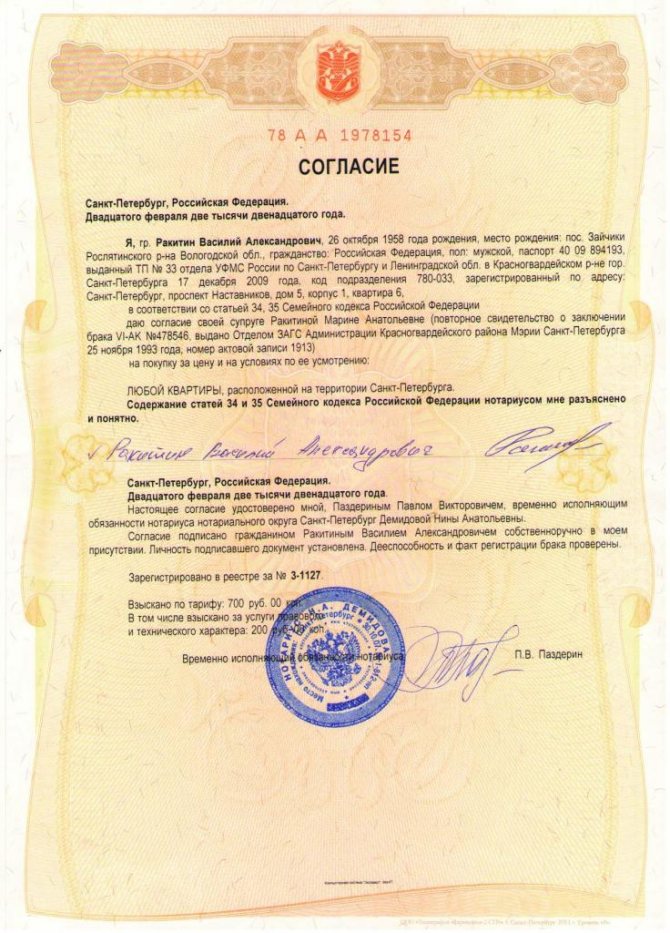

As soon as a suitable property is found, you should submit to the bank:

- title documents of the home owner;

- contract of sale;

- notarized consent of the owner’s spouse;

- permission from the guardianship and trusteeship authorities (if there are dependents).

If you purchase real estate under construction, then the bank is provided with an agreement with the developer on the intent to purchase and sell and the seller’s documents granting the right to carry out the transaction.

Review and approval of the housing chosen by the borrower takes from 3 to 30 days.

It is worth noting this aspect when the borrower wants to register with the collateral object. To do this, he must submit to the bank:

- application for written consent from the bank for registration;

- copies of all pages of the passport;

- written refusal by the borrower and family members of the right to use the borrowed housing and consent to its release upon the first bank request;

- copies of documents on housing ownership;

- copies of documents on marital status;

- copies of documents of all family members.

Reviews

Elena, 32 years old, Perm. My husband and I took out a military mortgage from Gazprombank, since they have the most normal conditions and minimal waiting time. I would like to thank the bank employees for their sensitivity and polite service. It turned out that mortgages for combat veterans (CVD) are issued with additional guarantees from the state, which was very pleasing. In general, the purchase of the apartment went without any negative aspects, everything was extremely fast and neat.

Ivan, 38 years old, Yaroslavl. I took out a mortgage to buy an apartment in a military camp under construction. Since the facility was accredited by Gazprombank, I was immediately advised to apply here for a loan. The bank employees processed everything very quickly, there were no delays on their part, everything was done as quickly as possible. I would like to thank you for the quality work and very good service. The only problem I encountered when applying for a mortgage was the long wait for Rosvoeinpoteka to register the agreement.

Ekaterina, 42 years old, Irkutsk. My husband and I chose Gazprombank for a military mortgage because we heard a lot of good things about this bank. Almost all of my husband’s colleagues applied for a mortgage through Gazprombank and always praised him for his efficiency and good level of service. For us, the process of buying an apartment took about 3 months due to the wait for the registration of the contract with Rosvoenipoteka. The whole procedure went very well, the bank employees gave quick answers to all our questions. I am very glad that there is such a program for military personnel, because it was thanks to it that we were able to buy a long-awaited apartment.

Military mortgages from Gazprombank are very popular among military personnel. This is due to favorable conditions, attentive attitude towards each potential client and ease of registration. Getting a loan from Gazprombank is easy. It is enough to find out the specifics of applying for a mortgage loan, prepare documents and choose suitable housing.

Lending programs at Gazprombank in 2020:

- Primary market (partial payment of the down payment with financial capital is possible, discounts for home buyers from developers, special conditions for salary clients);

- Secondary market (it is possible to purchase the last share, a room, as well as a garage, a townhouse from the owner - a legal entity);

- Mortgage refinancing from 9.5% per annum with re-registration of collateral to Gazprombank;

- Military mortgage (conditions correspond to the state program of NIS participants for housing provision for military personnel);

- Special programs from partners (mortgage with a grace period, purchase of apartments and townhouses from KP UGS, Gazprom Invest Group of Companies, garages from KP UGS and State Unitary Enterprise DGS).