The conditions of state support for the purchase of a wooden house are specified in Government Decree No. 259 of March 15, 2018. Any family wishing to acquire their own housing has the right to try to take part in the program. Its goal is to reduce the financial burden by subsidizing the mortgage rate.

Mortgage subsidy rate for a wooden house

Houses built of wood are classified as illiquid real estate. Banks are reluctant to agree to issue mortgage agreements for the purchase of such a building. Therefore, future owners will have to face an inflated rate. It can be several times higher than the standard one, drawn up in the process of purchasing an apartment.

The government makes it possible to reduce the mortgage rate by only 5%. In total, this is a small help. However, its presence still allows you to slightly reduce the financial costs of the family as a whole.

As is the case with the program to subsidize mortgages for large families, citizens will be able to count on a rate reduction of 5% for a certain period of time, according to the terms of the program. The subsidy has no monetary value in kind. It only provides an opportunity to reduce the rate in general. The family will not be able to count on the provision of “real” money.

Conditions for subsidizing the purchase of a wooden house

The terms of the subsidy include a number of requirements for the developer and the facility being built. Let us immediately make a reservation that it will not be possible to buy a house that has already been built and put into operation under the preferential program.

General list of requirements:

- The mortgage is issued in the national currency of the Russian Federation - rubles.

- The total loan amount does not exceed 3.5 million rubles.

- An encumbrance is placed on the purchased property until the mortgage is paid in full.

- It is recommended to attract co-borrowers with good financial standing.

- The down payment amount is at least 10% of the total loan amount.

- The house must be handed over within four months.

The benefit is relevant for the purchase of prefabricated buildings. These include houses built using frame technology. Since such a structure is not capital, banks are reluctant to provide a mortgage loan.

As for the conditions for establishing a new interest rate, the standard rate is reduced by 5% in general. The borrower will pay the difference between them. The remaining amount will be compensated to the bank from the state budget.

The subject of mortgage lending can only be a house suitable for permanent residence. At the same time, the borrower should carefully choose a developer. According to the terms of the program, its turnover per year of operation should not be lower than 200 million rubles.

Which banks issue loans for wooden housing?

Taking into account statistical data, when purchasing wooden houses with a mortgage, the average annual rate can be from 15%. Registration of state subsidies allows you to save up to 5% of the cost of construction. This option is beneficial for people who do not have other opportunities to purchase housing at a discount.

In 2020, only one bank offered preferential mortgages for the purchase of wooden houses - Credit Europe Bank. In 2020, the list of lenders expanded significantly and included other banks.

The following banks provide loans to citizens for the purchase of a wooden house:

- Opening;

- Alfa Bank;

- Rosselkhozbank;

- Sberbank;

- Raiffeisenbank;

- UniCredit Bank;

- DeltaCredit;

- VTB;

- ATB.

It is worth adding that most of the listed banks do not have a special program for receiving benefits. A mortgage is issued as part of a standard offer for the purchase of a private home or country property. As an example, let's compare the conditions in two banks offering such a mortgage.

| Lending terms | Sberbank | ATB |

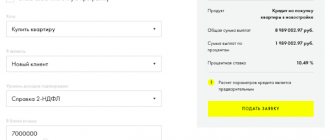

| Percentage, % | 10 -12,5 | 12,25-12,5 |

| Loan term, years | 30 | 3-25 |

| Loan amount, thousand rubles | from 300, but not higher than 75% of the collateral assessment. | from 600 – for the capital and from 350 – for the regions, but not more than 70% of the value of the collateral. |

| An initial fee, % | 25 | 30 |

| Insurance | Collateral property is insured, except for a plot of land. | Life, health and collateral insurance is required. If you refuse insurance, the interest on the loan will increase by 1-1.5%. |

From the presented conditions it is clear that a mortgage with state support from Sberbank is more profitable. For comparison, it is better to study the offers of other lenders and choose the best option.

Nuances to consider when applying for a loan

The subsidy is provided exclusively for wooden houses. The method of their construction is not specified in the law, but it is worth remembering that the construction period should not exceed 4 months. Therefore, borrowers often choose frame buildings.

The house can be built from:

- Glued or solid timber.

- MDF boards.

- Lamels.

- OSB panels.

- Natural wood.

The benefit does not apply to houses built from brick, aerated concrete, foam blocks, or metal structures.

At the same time, attention should also be paid to the status of the land plot on which the building is planned to be erected. The land must belong to the future owner of the house. The site must be designated for individual housing construction. It is worth preparing the necessary list of documents and permits in advance, in order to avoid problems with obtaining a mortgage.

Requirements for the developer

A wooden house must be built from scratch as quickly as possible. Its purchase is possible only from an official developer, who offers for sale not only a ready-made house kit, but also its high-quality assembly.

Requirement for the developer:

- The organization operates transparently, has official legal status and permitting documentation.

- The company cooperates with the bank that issues the loan. Management agrees to pay with borrowed funds.

- The organization agrees to enter into a contract for the construction of a house and its commissioning within four months.

- The company receives at least 200 million rubles a year in the form of profit.

At first glance, the requirements for the customer are considered small. In fact, they are quite harsh. Only a small portion of developers comply with them.

Only a few developers can boast of a profit of 200 million rubles a year. Most resort to tax fraud by dividing assets into several different companies. This directly affects the profit margin, which is actually reduced.

Some developers offering services for the construction of frame houses do not have permits on hand. Their activities are illegal. It will not be possible to conclude an agreement with such an organization and receive a subsidy.

Requirements for the home

There is a separate list of requirements for the house being built:

- The building is located on a site for individual housing construction, owned by the owner.

- The cost of construction does not exceed 3.5 million rubles.

- The building is built on a permanent foundation.

- The construction material is durable and safe.

- The house is suitable for year-round use.

- The facility is being built on the territory of the locality in which the bank that issued the loan is located.

The suitability of the building for year-round use implies the location of vital communications inside. These include : sewerage, water supply and heating systems, connection to electrical networks. It is not necessary to have a gas supply inside the building.

Both a cesspool or a central collector, and a modern septic tank are suitable as a sewer system. Heating can be different (gas boiler, electric boiler, etc.).

There are no specific requirements for the building area. The building can be absolutely anything. The main thing is that its cost does not exceed 3.5 million rubles.

Is it possible to get benefits for the construction of a wooden house?

Mortgage rate subsidies can be obtained not only for the purchase of residential real estate, but also for its construction.

Individual construction (IHC) can be more profitable and convenient than buying ready-made housing, so the state program allows the construction of a wooden private house with some nuances:

- a house kit (a package of wood or wooden parts for construction) can only be manufactured by a certified manufacturer who meets the program requirements;

- the purchase of a plot for individual housing construction is not subsidized, but the land for construction must be owned by the borrower or under long-term lease;

- the period for transferring a set of wood from the developer (manufacturer) to the borrower (customer) can be no more than 4 months from the date of signing the contract.

Features of obtaining benefits for the construction of a private house.

The period for manufacturing a house kit may be longer than established by the program rules, but this circumstance should be separately noted in the clauses of the contract.

Requirements for a potential borrower

The subsidy program does not impose requirements for the candidacy of participants. However, there are a number of criteria imposed on the borrower by the bank itself:

- Having Russian citizenship.

- Working age.

- Availability of official employment.

- Getting a stable income.

- Possibility of providing a certificate of income for each adult family member.

- Availability of guarantors with a stable financial position.

- No outstanding loans.

- Good credit history.

Mortgage lending terms may vary. First of all, they relate to the amount of income per family member, the presence of official employment for a minimum period (6 months), and the size of the down payment (10-20%).

Differences from the previous edition

The new Resolution has a number of significant differences from the expired Resolution No. 259 of March 15, 2018:

- restrictions on revenue volumes and other requirements for contractors (suppliers) have been lifted;

- a one-time subsidy in the amount of 10% of the cost of the house is guaranteed (previously it was supposed to extend the period of preferential lending annually, but there was no guarantee of an extension from the state).

It is planned that the individual does not receive the money in hand, but the bank sends the loan funds to the contractor (supplier). The bank sets the minimum down payment amount independently.

Vadim Fidarov

working group GR Association of Wooden House Construction

The program prepared by the Ministry of Industry and Trade is aimed at industrial wooden housing construction using sets of prefabricated houses, said Vadim Fidarov.

List of banks issuing preferential mortgages

There are no special requirements for a potential lender. As a standard, it must be registered in the Russian legal framework, operate officially, without violating current legislation. There is no specific list of financial institutions. The borrower has the right to contact any organization with favorable mortgage lending conditions.

As mentioned above, banks are reluctant to provide mortgages for the construction of frame houses. Therefore, finding a suitable organization will be quite difficult. A potential participant in the program will have to visit more than one financial institution, studying the offers of each and the possibility of obtaining a loan.

Having an official list, similar to the program for subsidizing mortgages for large families, would greatly facilitate the task. However, its development is not planned in the near future.

How to extend a wooden mortgage

The first experience of introducing this mortgage program was unsuccessful, since very few people across the country were able to take advantage of it. Some people did not know about its launch, others thought it was not very safe to build housing from wood, and still others were not ready to exchange the bustle of the city for living in the countryside. For these and many other reasons, only one hundred citizens of the country managed to take advantage of the program at the end of 2020.

But even despite the fact that this type of mortgage lending remained undervalued, it was decided to extend it. And in order for citizens to be able to evaluate this program, Sberbank is taking measures to inform the population about its features and conditions. Today, clients of a financial institution can take out a loan to build their own home made of wood until 2022. It was for this period that it was extended this year. Its conditions are available on the website of the banking institution.

List of documents for obtaining a mortgage at a subsidized rate

The program participant will have to enter into a standard agreement with the bank for the provision of a mortgage. After this, additional development of an agreement to reduce the rate in accordance with the subsidy program will be required. Documents are signed at the bank.

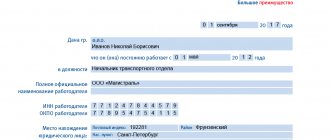

Applying for a mortgage with a subsidized rate will require the provision of:

- Passports of the borrower, co-borrowers, guarantors.

- Certificates of family income in form 2-NDFL.

- A certified copy of the work book.

- Documentation for the future home.

- Copies of the agreement with the developer.

- Estimates for building a house.

- Documentation for the site being built.

The documents for the house can be a ready-made technical plan for future development, permitting documentation, a purchase and sale agreement, an extract from the Unified State Register of Real Estate.