According to the law of the Russian Federation No. 284-FZ of October 19, 2011, any client can make early repayment of a mortgage at Rosselkhozbank without paying any additional interest or penalties. You can pay for a loan at a bank branch, through self-service terminals or using your personal account. But for early repayment, you must contact a branch of Rosselkhozbank.

Federal Law of October 19, 2011 No. 284-FZ “On Amendments to Articles 809 and 810 of Part Two of the Civil Code of the Russian Federation”

The bank gives borrowers the opportunity to repay in full or in part. In case of full repayment, you need to write a statement before this, and in case of partial repayment, after that you need to write a statement and recalculate the interest.

You can take out a mortgage from Rosselkhozbank for a maximum of 30 years. Along with the mortgage agreement, you are given a schedule according to which this debt must be repaid. It is better to pay a little in advance to avoid unpleasant circumstances, since transactions going through the bank may be a little delayed.

Is this procedure possible?

You can immediately answer with confidence - yes. Rosselkhozbank does everything for the convenience of clients and the terms of the mortgage agreement provide for its early closure by the borrower.

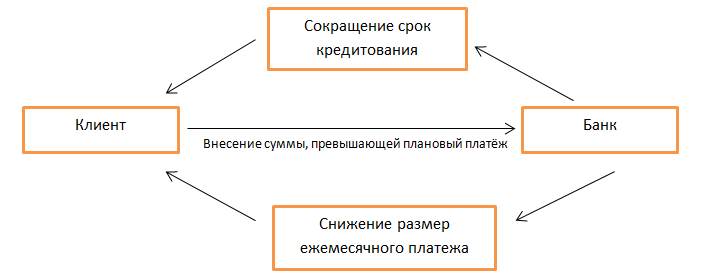

The bank allows customers to choose a more convenient option for them and offers two methods to choose from:

- Mortgage with interest of 12.5 per annum.

- Take out a mortgage loan with two documents.

Article on the topic: How to reduce interest rates on an existing mortgage at Rosselkhozbank?

Depending on the type of agreement concluded, you can read in it how to carry out the procedure for repaying a mortgage loan.

Now this procedure can be done according to Russian Federal Law No. 284-FZ of October 19, 2011. Therefore, no bank can deny you your right. Previously, when the state had no control over this, banks could impose fines or interest on the borrower for early repayment. Now the state takes care of the population and regulates this process.

The only thing you must do before repayment is to inform the bank of your decision in writing. To do this, you can use and write an application for early repayment of the loan.

You can also view applications for early repayment by following the link.

Not all banks are loyal to such clients, because they lose their profits. Rosselkhozbank has a positive attitude towards all its borrowers and without any problems gives the opportunity to repay the mortgage at any time when the financial capabilities allow the borrower to do this.

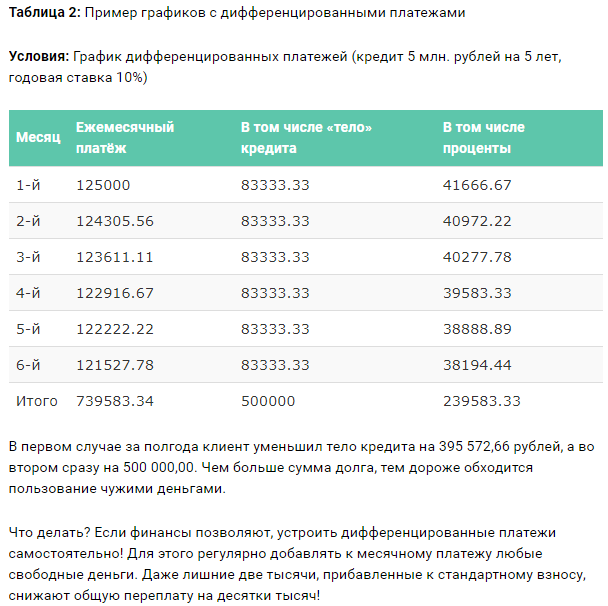

Early repayment of a loan from Rosselkhozbank with differentiated payments.

Some loans from the Russian Agricultural Bank are issued with differentiated payments. This method is quite economical in terms of saving on interest. Early repayment with any type will be more profitable here compared to the same loan, but with annuity payments. You can repay your debt early with a differentiated payment scheme:

- By reducing the number of payments with a final reduction in the payment period. In this case, the client will no longer have the right to apply for refinancing or restructuring with an increase in the term at the same bank.

- By reducing the number of payments without changing the payment term. In this case, payments according to the schedule are considered repaid in quantity and amount not exceeding the amount for the NPV. If the amount of such full payments is less than the deposited amount, but the balance is not enough to repay another payment, then the next scheduled payment is considered to be repaid for this difference. For example, the next payment is 15,500 rubles. (RUR 12,000 is the principal debt, and RUR 3,500 is accrued interest). The balance after the emergency period is 2500 rubles. The client can receive the payment minus this amount.

- With a reduction in the amount of payments. In this case, all payments remaining after early repayment will be changed proportionally downwards from the date following the NPV date.

Thus, early repayment of a loan from Rosselkhozbank with a differentiated payment scheme will be more profitable, since interest is charged on the balance of the debt. With an annuity payment scheme, early repayment is also beneficial at any stage. Many people mistakenly believe that the bulk of the interest is repaid in the first half of the term.

In the last months the client also pays interest. By repaying the loan even six months before the expiration date, you can save on interest. You can calculate the economic benefit using a loan calculator or independently in your repayment schedule.

We refinanced the loan (mortgage) agreement of Rosselkhozbank with another bank. Everything is very fast and successful, the rate is lower than in the Russian Agricultural Bank by as much as 2.6% (thanks to the Russian Agricultural Bank for the refusal to refinance, which they delayed for two months...

Mortgage repayment terms

Rosselkhozbank gives its clients the opportunity to repay the loan in two ways :

- Annuity – paying off the loan amount in equal payments.

- Differentiated – always pay in different payments. This payment method results in a smaller repayment amount at the end of the mortgage.

Article on the topic: Restructuring of a mortgage loan at Rosselkhozbank

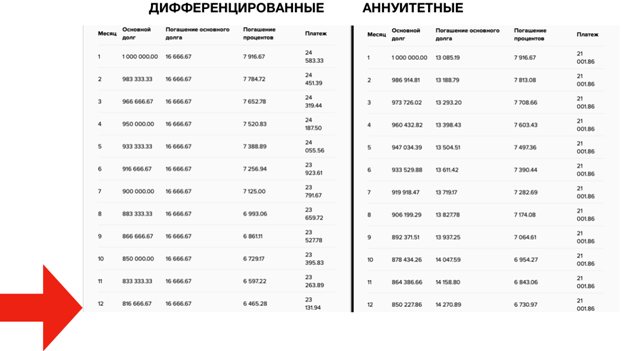

Comparison of annuity and differentiated payments

Depending on how you repay the debt to the bank, the conditions for early repayment will depend. Repayment can also be partial or full.

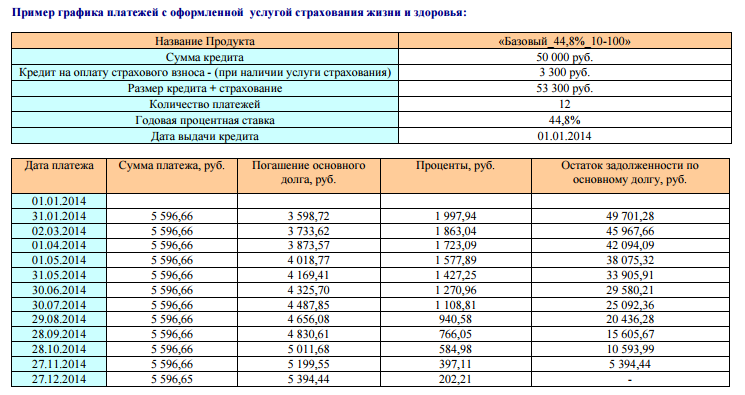

Examples of payment schedules:

To repay the debt early, a number of conditions must be met:

- Before repayment, it is mandatory to notify Rosselkhozbank of your intention to close the contract early.

- Fill out an application for early closure following the example given by the bank.

- Indicate the exact amount that you will contribute to the payment account.

- The amount indicated in the application must be without taking into account interest accrued on the loan.

- The bank manager himself will calculate the entire amount that needs to be paid, taking into account interest under the terms of repayment before the end of the term.

- The mortgage will need to be repaid either on the same day or before the date stated in the loan agreement as the last day of the monthly payment.

- For late payment, you will be charged additional interest.

- If you also took out insurance when applying for a loan, be sure to notify the insurance company of your intention to repay it ahead of schedule . In this case, there is a chance that you will be able to get part of the insurance back.

- You can repay your housing loan ahead of schedule at any time before its expiration . You will not be charged any fees or fines for this.

Before you repay the loan early, get a new payment schedule from the bank, in which they will indicate the exact amount you still have to pay along with interest.

Possibility of early repayment through the application.

Modern technologies strive to make people's lives easier and give them the opportunity to satisfy their needs remotely. Therefore, most credit institutions provide for submitting an application online. Rosselkhozbank also offers this through its personal account. However, customers have publicly reported difficulties associated with such an operation through the application.

Most borrowers want to get rid of debt as quickly as possible. Bank specialists assure mortgage loan applicants that they can make early repayments easily and painlessly, without penalties or fees. It is not uncommon to encounter difficulties when performing these actions.

It is necessary to rely on the terms of the loan agreement and the bank’s service rules. An application for early payment should be submitted in advance - at least five days in advance, so that the employees of the credit institution have time to carry out all the necessary actions. Early repayment allows you to save a significant amount of money.

Early repayment of a mortgage loan

As mentioned above, Rosselkhozbank gives clients the opportunity to close their mortgage before the end of the term. You can do this ahead of schedule by paying it off in full or in part. Let's consider both options.

Full repayment

Of course, being completely free of debt is already very good.

To do this, you need to write an application to the bank stating:

- The number of the credit account where the money will be deposited.

- The number of the mortgage agreement issued to you when you took out the loan.

- The amount of funds deposited into the account.

After early repayment, you can contact the insurance company. Perhaps you will get back part of the unspent insurance by reducing its validity period.

To finally get rid of your mortgage, you must fulfill the following conditions:

- Make a one-time and full deposit of the entire amount into the debt account, along with the charges that the manager will calculate.

- Notify Rosselkhozbank of your decision to repay everything at once.

- Consider the deadline within which you must deposit money into your account.

According to Russian law No. 284-FZ dated October 19, 2011. banks should give the population the opportunity to easily pay off their mortgages, without any additional commissions or payments.

It will be useful to view:

Partial repayment

By repaying in part, you will not close the contract, but you will reduce the total amount of debt and the interest that will accrue on it.

You need to write an application for partial repayment. Since without this statement the manager will not recalculate the remaining interest on the debt. Consequently, the meaning of such repayment is lost.

Also take a document from the bank with the amount of the debt balance indicated on it.

Online early repayment calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

To make recalculation with monthly data changes without errors and difficulties, automated software is used. The online early mortgage repayment calculator presented in this section was created taking into account the current rules of Rosselkhozbank. Having established certain initial data, they study the change in regular payments and the total amount of debt. This tool will help you choose the optimal loan repayment algorithm.

List of required documents

Having decided to repay your mortgage early, in full or in part, you need to go to the bank, first taking with you the following documents:

- Application, handwritten according to the example that will be issued at the department.

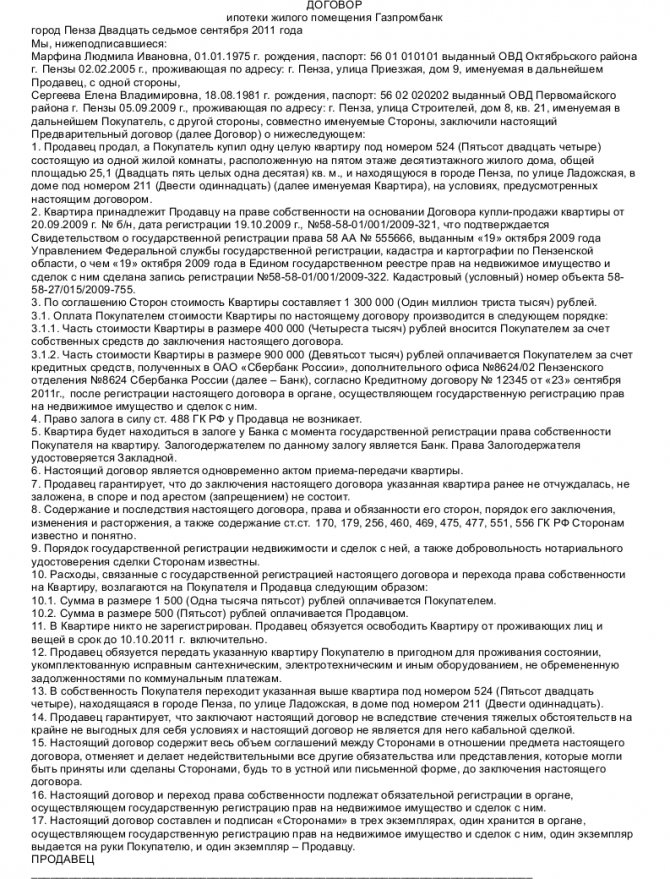

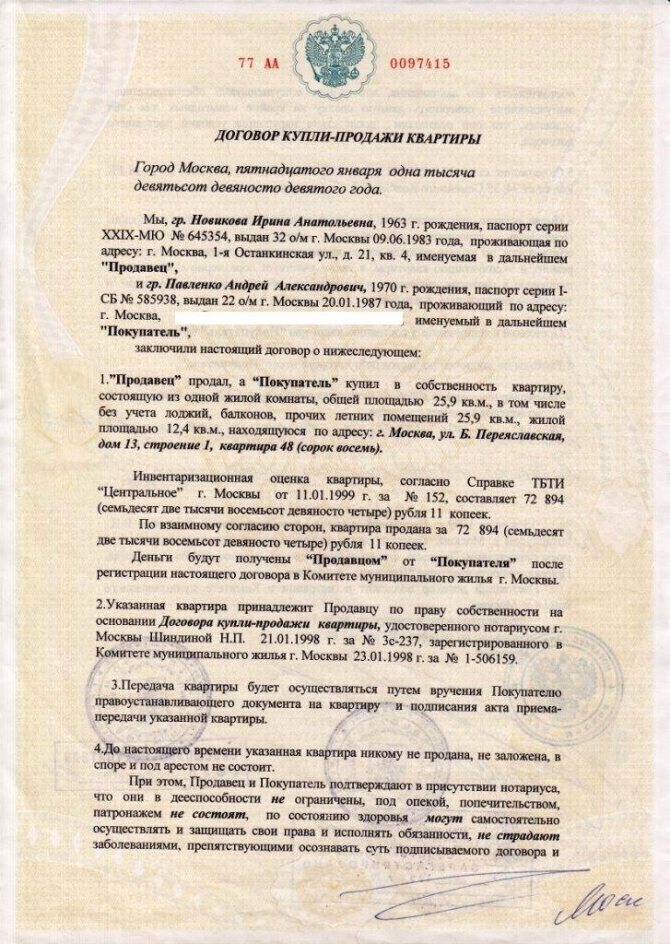

- The bank agreement under which you took out a loan.

- The payment schedule issued at the conclusion of the mortgage agreement.

- Identification document – passport.

- Documents for housing purchased with a mortgage.

Photo gallery:

Payment schedule

Mortgage agreement Passport

Sales and purchase agreements

Attention! After full repayment, do not forget to take a document confirming that you no longer have any mortgage debt. It is necessary to close the mortgage line.

At the place where the mortgaged housing is registered, you must contact the territorial body of Rosreestr and close the entry in the Unified State Register that the housing is on credit. Also find out what documents are needed to close the mortgage line.

Only after fulfilling all these requirements, you will be able to obtain a document from Rosselkhozbank that will remove the encumbrance from your home. Then you will be able to take ownership of the property purchased with a mortgage.

This procedure is used not only in Rosselkhozbank; according to the state standard, it is carried out in all banks.

Application for early repayment of a loan at Rosselkhozbank: complete

- partial payment. A paper is written in advance indicating the intention to close the debt. The client deposits funds, and they are debited in full on the next scheduled date. RSHB will make new recalculations and change the schedule. Partial early payment helps to make monthly payments smaller for the same loan term or reduce the repayment time, leaving the same amount to be deposited.

- Full payment. The remaining debt is paid in one payment. Here it is also necessary to notify the RSHB in advance about the closure of the debt and write a corresponding statement. Employees of the institution are required to recalculate how much needs to be paid at the time of the upcoming payment date.

There is not always all the money available to cover the debt, so free money can ideally cover part of it. Partial deposit of funds followed by recalculation helps either pay off the debt faster or reduce the financial burden on the family. In both cases, the method helps to save on interest payments.

Early repayment of a loan to Rosselkhozbank is one of the most common procedures, the possibility of which is stipulated in the mortgage or consumer lending agreement. Any borrower wants to repay debts to the bank faster in order to save on interest. In this case, the loan is repaid in full or in part.

RSHB does not impose any fees or fines on the client.

Advantages and disadvantages of early repayment of a mortgage at Rosselkhozbank

By repaying the loan in full or in part, you will clearly be in the black, if only because in this way you will significantly save on interest charges and on insurance. When you pay more money on a loan than the monthly payment, the bank must recalculate the interest accrual and reduce the minimum payment.

For some reason, most borrowers don’t even think about how profitable it is to repay the mortgage, even if not in full. And few financial institutions tell their clients about such benefits.

If you still decide to completely close your mortgage, then do not immediately run to the cashier. First, you need to write an application to the manager of Rosselkhozbank.

To get the most benefit, it is better to pay off your mortgage in the first half. After all, first you pay interest, and then the debt itself.

The downside of such a repayment will be inflation. After all, you are taking out a mortgage not for one or two years, but for ten, twenty or more. Over this period of time, money will become cheaper.

And the bank has no right to increase your loan interest due to inflation . Therefore, over time, the loan amount will not seem so large.

No one can predict what will happen in the future. Still, it’s better to pay off your mortgage early if possible.

We recommend viewing:

In addition, you can always agree on the amount of the minimum payment so that it does not turn out that you pay the entire salary and are left without money. You shouldn’t do this; the bank will always try to accommodate you and help you resolve this issue.

Rosselkhozbank mortgage repayment: full and partial, calculate

A mortgage involves a long-term relationship with a lender. The average duration of payments is about 15 years. The overpayment for such a long period will be quite significant. To enable borrowers to repay their debt faster, the law establishes the right to partial and full early repayment. In today's post we will look at repaying a Rosselkhozbank mortgage.

General rules for mortgage repayment at RSHB

At Rosselkhozbank, mortgage repayment is possible using one of two types of monthly contributions - differentiated or annuity. The lender gives the borrower the right to choose. To understand which payment option is most convenient, let’s take a closer look at each type of contribution and look at a simple example.

- Annuity. When choosing this method, payments are made in equal amounts monthly. The payment consists of the principal debt and interest accrued for the use of borrowed funds. With an annuity, interest is paid first for the entire period of use of the loan, and only then the body of the loan.

- Differentiated. In this case, at the initial stages of repaying the Rosselkhozbank mortgage, the payment will be higher. It will decrease as payments are made. With differentiated payments, the amount used to reduce the loan amount remains unchanged, and the amount of interest decreases with each payment.

A simple example will help you understand the difference between these types of repayments. Let's say the mortgage amount is 1,000,000 for 60 months at a rate of 9.5. Every month you will need to pay 21,002 for annuity payments and 24,584 for differentiated payments. It seems that the first option is more profitable.

However, it is not. The differentiated payment scheme will allow by the end of the first year to reduce the loan amount by 34 thousand more than with an annuity. The difference can be seen in the table. The choice of the type of monthly contributions is a distinctive feature of Rosselkhozbank.

Important! Regardless of the chosen type of monthly payments, partial early repayment of a Rosselkhozbank mortgage will occur in the same way. This is due to the fact that interest is charged on the balance of the debt.

It should also be taken into account that with an annuity scheme, interest is paid in advance. Excess amounts paid may be returned if repaid in full early. Read how to do this here. Differentiated payments do not provide this opportunity.

Is it possible to pay off a mortgage early?

The rights of borrowers to repay the debt before the end of the mortgage agreement are secured by law. However, the regulatory act does not regulate the conditions for the operation. The law only stipulates that payments should be made without charging additional fees.

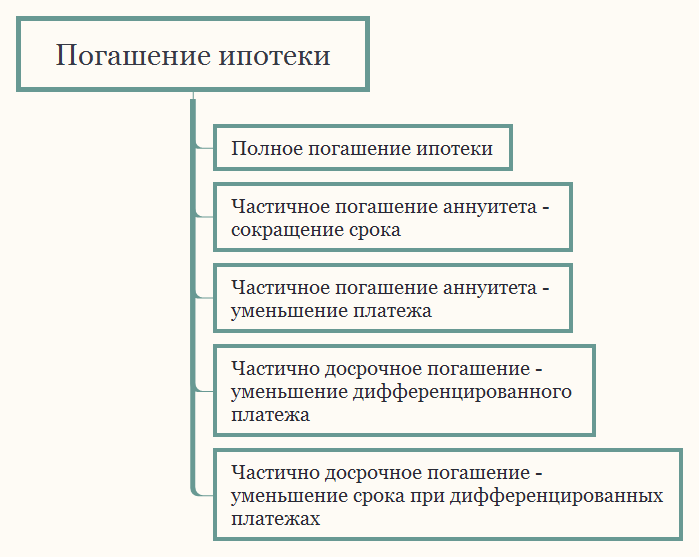

Rosselkhozbank allows borrowers to make two types of repayments:

- Complete.

- Partial repayment – both with a decrease in the loan period and with a change in the payment amount.

Partial repayment of the debt ahead of schedule allows you to reduce the final amount of overpayment. The most effective, from an economic point of view, is repayment with a reduction in the loan period.

However, if mortgage payments greatly burden the borrower’s budget, it makes sense to reduce the amount of monthly payments when making additional funds.

Rosselkhozbank allows the borrower to choose the type of write-off independently.

Important! If the loan was issued under the “Military Mortgage”, partial repayment is available only with a change in the amount of monthly payments.

An important nuance is the condition for the write-off - it is possible only on the date of the next payment according to the schedule. This rule applies to all types of additional payments - both full and partial.

The borrower must submit an application to the bank's additional office a few days before the payment date. You can submit multiple applications. On the day of payment, the total amount will be written off for early repayment based on the processing of all documents submitted to the department. The main thing is that there is enough in the account to write off.

The use of various government subsidies and payments will help you pay off your debt in full or reduce your credit burden. We'll talk about them later.

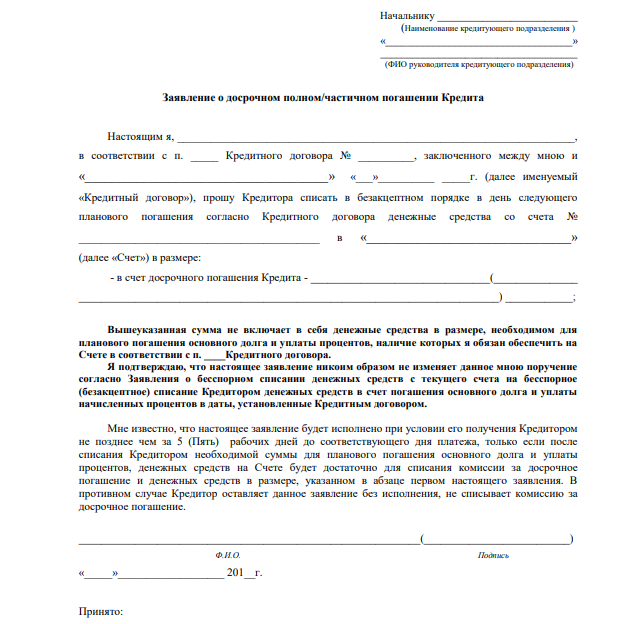

and applications for repayment

To repay the mortgage, you must submit a completed and personally signed application to Rosselkhozbank. Download forms:

- application for full repayment;

- application for partial repayment.

Important! For each type of mortgage repayment, Rosselkhozbank has its own form. The bank's acceptance mark is placed at the bottom of the application. When submitting an appeal, you should ask the employee to make a copy. This will help in case of a controversial situation.

To prepare your application, you will need the following information:

- The number of the current account in Rosselkhozbank, from where the debit will be made.

- Number of the mortgage agreement, date of its conclusion.

In paragraph 1, you should check the box “on the next payment date.” Point 2 is completed based on the type of early repayment chosen and the applicable monthly payment scheme. Next, the application is certified by a personal signature with a transcript, and the date of preparation is indicated.

The form for full repayment is easier to fill out. The same information will be required; a checkbox must be placed in the “on the next payment date” column. A mortgage received before March 2013 can be repaid at any time without being tied to a payment schedule.

Procedure

Next, we will consider the sequence of actions for carrying out the operation. The algorithm is applicable for each type of mortgage repayment.

- Transfer to the account the amount that you plan to use for early debiting. There must be enough money for the monthly payment and the amount specified in the application.

- Decide on the type of repayment and fill out the application. You must put the appropriate checkmarks or crosses in the right places on the form.

- Submit the completed form to an additional office of Rosselkhozbank, receive a copy with an acceptance mark.

- Wait for the scheduled write-off date according to the schedule.

- Contact the branch to receive a new payment schedule.

New borrower support programs

Many borrowers would like to reduce their loan burden. This is especially true for families with small children. The government's social policy is aimed at providing all possible assistance to those with a mortgage.

Rosselkhozbank is fully owned by the state. This allows the lender to participate in all preferential programs joint with the government.

450 thousand for large families

This summer, a law was passed to allocate additional funds to repay mortgages for borrowers whose families have three or more children. At the same time, the family became large in the period from the beginning of 2020 to the end of 2022. Currently the subsidy works as follows:

- The borrower, the mother or father of the children, applies to Rosselkhozbank with an application for compensation in the amount of 450,000 to repay the mortgage. A set of documents confirming the family status must be attached to the written application.

- Bank representatives hand over papers to the House. Russian Federation, where a decision is made on the possibility of allocating funds.

- The money is credited to the borrower’s account at Rosselkhozbank and written off to pay off the debt. Depending on the balance of the mortgage, partial or full repayment occurs.

and applications for repayment

To repay the mortgage, you must submit a completed and personally signed application to Rosselkhozbank. Download forms:

- application for full repayment;

- application for partial repayment.

Important! For each type of mortgage repayment, Rosselkhozbank has its own form. The bank's acceptance mark is placed at the bottom of the application. When submitting an appeal, you should ask the employee to make a copy. This will help in case of a controversial situation.

To prepare your application, you will need the following information:

- The number of the current account in Rosselkhozbank, from where the debit will be made.

- Number of the mortgage agreement, date of its conclusion.

In paragraph 1, you should check the box “on the next payment date.” Point 2 is completed based on the type of early repayment chosen and the applicable monthly payment scheme. Next, the application is certified by a personal signature with a transcript, and the date of preparation is indicated. The form for full repayment is easier to fill out. The same information will be required; a checkbox must be placed in the “on the next payment date” column. A mortgage received before March 2013 can be repaid at any time without being tied to a payment schedule. In this case, you should first contact the bank to clarify the amount required to close the loan and the amount of interest.

How to repay: algorithm of actions

According to Federal Law 284, if you decide to repay your mortgage early, you must notify the bank of your intention 30 days in advance. Rosselkhozbank has a standard application form that is suitable for both partial and full repayment of loan obligations.

When filling out the application, the borrower enters the following information:

- number of the current account where the money will be deposited;

- number of the loan agreement and the date of its conclusion;

- the amount of funds allocated for early repayment.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

+7 (499) 938-90-71Moscow

As a rule, all this information can be obtained from a specialist in the credit department.

In case of full payment of the entire loan amount, the borrower's procedure is as follows:

- Get information from a credit department specialist about how much you need to deposit for full early repayment.

- Write to Rosselkhozbank a statement of intention to fully repay the mortgage loan.

- Deposit money no later than specified in the application. As a rule, this is the date of the next payment according to the current payment schedule.

- Obtain a certificate of no debt from the bank branch.

If payment is not made within the specified period, the bank will charge additional interest.

In case of full early repayment of the mortgage, the borrower must provide the following documents to the bank branch:

- Application for early repayment according to the bank's sample.

- Original bank agreement for a mortgage loan.

- Payment schedule issued upon conclusion of the contract.

- Borrower's passport.

- Contract of purchase and sale of housing.

- Original certificate of registration of ownership.

If there were two or more borrowers, then their presence is required when submitting the application along with original identification documents.

If partial early repayment of a mortgage loan is made, the borrower must proceed as follows:

- Write an application for partial early repayment of the mortgage.

- Obtain information from a bank specialist about accrued interest payable.

- Decide whether the early repayment amount includes the payment of this interest or whether he will pay additional interest for using the loan.

- It is necessary to decide what will be the result of partial early repayment of the mortgage: a reduced monthly payment or a shortened loan term.

- This decision must be communicated to the specialist who is preparing the change in the payment schedule.

- Deposit money into the current account according to the agreement.

- Get a new payment schedule.

In case of partial early repayment, the borrower will only need an identification document from the documents.