Features of the mortgage lending program for military personnel at Rosselkhozbank

Military mortgage is a special loan program for employees.

Lending to participants in the NIS (savings and mortgage housing system) is carried out in national currency.

Despite the fact that the property is registered as the property of the borrower (or in shared ownership for military personnel who have started a family), the property is pledged to the financial institution and the Federal State Institution Rosvoenipoteka until the loan is repaid in full.

Advantages

Mortgage lending is carried out according to the state program. This makes it possible to offer borrowers a low rate in comparison with other products of Rosselkhozbank and other financial institutions.

Other advantages of a military mortgage:

- small down payment - only 10% of the cost of housing;

- long repayment period, which is convenient for military personnel starting their career;

- the opportunity to purchase housing without waiting for the end of the service life;

- no fees for issuing loans;

- the opportunity to independently choose real estate (before the adoption of Federal Law No. 117-FZ of August 20, 2004 “On the savings and mortgage system of housing for military personnel,” the housing problems of military personnel were resolved in kind, i.e., by issuing keys to an apartment or house);

- a small package of papers provided by the client to formalize the contract;

- a long period of validity of a positively reviewed application (this allows you to avoid going through the procedure again during a lengthy real estate assessment and collection of documents);

- maximum amount increased in 2020 (it may change depending on client requests and the ability to provide additional documents).

Despite having several advantages, mortgage terms are not beneficial for all contract workers.

For example, age restrictions allow only young military personnel to benefit from government support.

Potential loan recipients

The banking product is intended for citizens of the Russian Federation serving under a contract and included in the NIS register. Military personnel who have been participating in the NIS for more than 3 years have the right to conclude a loan agreement.

Property types

You can take out a loan for housing under construction, an apartment on the secondary market, a cottage or a townhouse with a plot of land. The choice depends on personal preferences and needs.

There are features when applying for a loan for different objects:

- the interest rate for primary housing is often lower than for secondary housing, but you should make sure that the developer is accredited by Rosselkhozbank;

- a cottage with a plot of land must be connected to communications, have designated boundaries, and be suitable for year-round use;

- a secondary building should not be older than 1970 and be in disrepair;

- for secondary housing, a certificate from the registration chamber is additionally provided confirming that third parties are not applying for housing;

- the area of a townhouse (a residential building of 1-2 floors with a separate entrance) should be 70-125 sq.m, the area of the plot should be 400 sq.m;

You can choose housing both within the city limits and in the region (no further than 50 km from the city).

The developer of primary housing must be accredited by Rosselkhozbank.

Benefits of the program

Thanks to its large loan portfolio and conditions, Rosselkhozbank is very popular among clients. Compared to similar offers from other banks, the following advantages can be highlighted:

- technical innovations and modern programs that allow you to submit an application online and receive confirmation directly on the RSHB website;

- reduced down payment amount, which is only 10% of the cost of the purchased home;

- the maximum amount for a military mortgage from Rosselkhozbank was increased in 2020 and may vary based on the requests of the client;

- the long validity period of the application (90 days) allows you not to have to re-submit when collecting documents and assessing the property for a long time;

- When you take out insurance, you can count on a reduction in your monthly payment if certain circumstances occur.

Terms of military mortgage

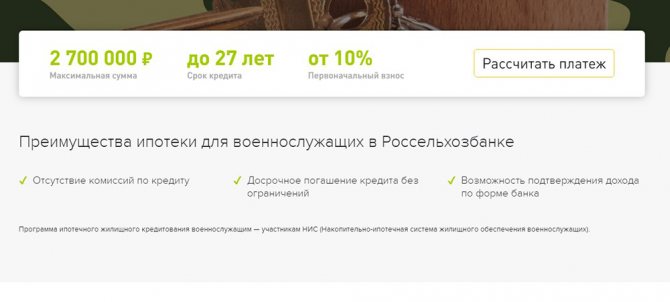

Mortgages for military personnel are issued in non-cash form for a period of 3 to 27 years. The amount depends on the rate, down payment (minimum 10%) and other parameters. The loan application is reviewed by the bank within 5 days.

Upon receipt of a preliminary positive decision, the borrower can begin collecting documents.

Maximum amount

A serviceman can receive a loan of up to 2.7 million rubles.

In each individual case, the loan size is determined individually, because depends on:

- interest rate;

- initial payment amount;

- loan term;

- dates of conclusion of the agreement with the bank;

- income of the borrower and co-borrowers (the spouse of a military personnel must be involved as a co-borrower).

The down payment is at least 10% of the cost of the house or apartment. The larger the payment, the more expensive real estate a serviceman can obtain on credit.

Interest rates

NIS participants can count on a fixed rate of 7.5% per annum. The full loan amount is calculated individually. The interest rate may be higher if the borrower waives life and disability insurance or makes a minimum down payment.

Requirements for the borrower

The potential borrower must be a citizen of the Russian Federation living in the region where the bank operates (confirmation is the fact of permanent registration). The minimum age of a military personnel when applying for a loan is 22 years, and the maximum on the date of the last payment is 50 years. A prerequisite is participation in the NIS program for at least 3 years.

Contract military personnel are not automatically included in the list of NIS participants.

There must be a reason for this:

- officers - receiving the military rank of officer, concluding a contract or a report on inclusion in the register;

- warrant officers, midshipmen - service experience of 3 years;

- sergeants, foremen, soldiers, sailors - report on inclusion in the register.

There is no need to confirm solvency.

There are no income requirements to receive a targeted loan under the military mortgage program at Rosselkhozbank.

To the property

The property must be connected to water supply, heating, and electrical systems and be in a condition suitable for habitation.

The property must have a kitchen and toilet.

Other housing requirements:

- there is a separate kitchen, bathroom and toilet (the borrower is allowed to buy out the last room in a communal apartment if all the others are already his property);

- the foundation is stone, cement or brick;

- there are no wooden floors (reinforced concrete, metal, mixed are allowed);

- housing complies with the BTI plan (redevelopment, reconstruction must be registered);

- the house is not classified as unsafe, is not subject to demolition, reconstruction, and is not registered for major repairs.

The main requirement for housing on the secondary market is freedom from restrictions and encumbrances:

- it should not be under arrest;

- among the persons previously registered at the address, there should not be citizens deregistered due to departure to places of imprisonment or to the RF Armed Forces for military service.

If minors live or are registered in the apartment, then the sale and transfer of the object as collateral to the bank is allowed only with the consent of the guardianship and trusteeship authority.

Registration of a mortgage at Rosselkhozbank

In order to apply for a mortgage at Rosselkhozbank, you must obtain from government agencies a Certificate of Participation in the Savings Mortgage System, which will indicate the amount that is in the military man’s personal account.

Afterwards, with all the required documents and a completed application, the military man applies to the branch of Rosselkhozbank, which provides services in the territory where the purchased property will be located.

Bank specialists review the borrower's candidacy for compliance with the requirements, and also check the property he has chosen.

After a positive decision is made, a mortgage agreement is prepared and personally signed by the borrower.

The money is transferred to the client’s personal account, specially opened at the bank for the purchase and sale transaction. A notification of this is sent to the military unit at the borrower’s place of service.

Useful video:

Required documents

To draw up a loan agreement, the borrower must provide a basic package of documents (to verify information about the borrower) and real estate papers.

The main package includes:

- application form (the form can be downloaded on the Rosselkhozbank website);

- passport of a citizen of the Russian Federation and copies of all pages;

- military personnel identification card;

- a valid NIS participant certificate;

- notarized consent of the spouse to conclude a transaction for the purchase and sale of housing (if the serviceman is in a registered marriage);

- SNILS of the borrower.

The list of documents can be changed unilaterally by decision of the bank.

Purchasing on the secondary market

The list of documents for the loaned property depends on the type of property.

If the borrower buys a secondary property, the following papers are required:

- title documents of the seller (registration certificate, basis for the emergence of ownership rights);

- extract from the Unified State Register for the right to carry out transactions with property (valid for 1 month);

- real estate appraisal conducted by an independent appraiser (valid for 6 months);

- an extract from the house register, an address card, a certificate of absence of persons registered at the address or a document replacing it;

- cadastral, technical passport of an apartment, house or an extract from the technical passport of a building;

- certificate of absence of debt for utility services.

If the borrower buys a resale property, a real estate appraisal is required.

In a new building

To obtain a loan to purchase an apartment in a new building under an agreement for participation in shared construction, you must:

- title documents of the developer;

- confirmation of ownership or lease of the site;

- basis of ownership or lease of the site;

- extract from the Unified State Register;

- building permit;

- real estate project;

- agreement for participation in shared construction.

Documents are provided in copies certified by the developer.

When applying for a mortgage for the construction of a residential building, the following is required:

- certificate of registration of ownership of the site;

- documentary basis for the emergence of property rights;

- extract from the Unified State Register;

- cadastral passport;

- estimate for individual construction drawn up and certified by the borrower or the company building the house;

- permission from local approval authorities for construction (if the process has not yet begun, the borrower provides the document within 12 months after the loan is issued);

- contract (if the construction is carried out by a contracting company).

List of documents

It is best to prepare the necessary documentation in advance to expedite the consideration of the application and the transfer of money for the mortgage loan to the specified bank account. Sometimes it will be necessary to submit additional papers in the form of statements and certificates.

Among the main documents are:

- a completed application issued at the bank’s office or downloaded from the official website of the Russian Agricultural Bank;

- Russian Federation passport confirming identity;

- registration in the service area of a bank branch;

- certificate of registration in the NIS program (minimum 3 years);

- a notarized application from a spouse with consent to obtain a mortgage loan;

- documents on the selected property - assessment and other certificates.

Stages of registration

After receiving a pre-approved mortgage application, the borrower faces a long process of preparation and collection of documents.

Choosing an apartment, assessing the property, concluding a deal are the main stages of obtaining a mortgage.

Stages of obtaining a loan:

- Choosing an apartment. An accepted application shows the bank’s readiness to lend and determines the amount of money it is willing to provide. Therefore, you should start looking for housing only when the mortgage amount has been approved.

- Property valuation. The buyer must independently order an assessment of the value of the home from an independent company.

- Approval of the apartment by the bank. If the apartment is liquid and meets the requirements of Rosselkhozbank, then getting approval is not difficult.

- Conclusion of a preliminary mortgage agreement. It is signed between the bank and the home seller. The document indicates the obligations of the parties, describes the object of the transaction, the amount and conditions.

- Drawing up an insurance contract. Purchasing a property insurance policy with a mortgage is a prerequisite. Borrower life insurance is voluntary, but refusal of the service may result in an increase in the interest rate.

- Concluding a deal, making the first payment and registering the property. The papers are signed at the bank, after which the buyer and seller visit the registration chamber and pay fees to rewrite the rights to the apartment. After a few days, the new owner needs to visit the registration authority again to receive an extract.

From the moment the loan agreement is concluded, rights and obligations are assigned between the bank and the borrower.

The buyer becomes the owner of the home and must fulfill loan obligations (make payments on time, avoid delays and violations of the agreement).

Application submission algorithm

You can submit a preliminary application for a military mortgage through the Rosselkhozbank website or third-party online aggregators of loan products. Also, a potential borrower can independently print out the application form (the form is available on the bank’s website), fill it out and bring it to the branch along with a package of documents that are necessary to make a preliminary decision.

Main reasons for failure and ways to solve them

There can be many reasons for refusal to issue a mortgage loan. They may relate to the documents provided, insufficient income, detection of errors, falsifications, etc. At the same time, the bank reserves the legal right not to voice the reason for such a refusal, but to indicate only the fact of the decision made.

Let's take a closer look at why they don't give a mortgage.

Credit history

The credit history of a particular borrower is one of the most important parameters assessed by banks during the application review process and one of the common reasons for denial of a mortgage. All data on issued loans, as well as applications submitted over the last 5-7 years are taken into account.

In the available BKI databases, you can obtain up-to-date information on the presence or absence of delays on previously issued obligations, violations of other terms of loan agreements and the process of debt repayment.

If the client has proven his unreliability, then it is unlikely that the new lender will want to contact him. An exception may be situations where, for example, the violations took place quite a long time ago, and the client now has a stable job and a high income. In this case, the bank, after a detailed study of his financial situation and the availability of liquid property, can meet halfway and issue the required loan.

You will learn more about how to get a mortgage with a bad credit history and improve it from a special post on our website.

Debt to bailiffs

Persons who have debts to the Tax Service, the State Traffic Safety Inspectorate, unpaid fines, debts for alimony and other obligatory payments are unlikely to be able to count on bank approval. The very fact that a person is in the debtor database indicates the client’s lack of performance and irresponsibility. There is a high probability that after concluding a loan agreement, he will similarly violate his obligations.

Before you go for a mortgage, be sure to check yourself and your co-borrowers on the bailiffs website. You can learn a lot of interesting things, and also protect yourself from being rejected for such a stupid reason as an unpaid car fine.

IMPORTANT! The bank takes into account only large debts for which enforcement proceedings have been opened for collection. The generally accepted amount that is taken into account is 10 thousand rubles.

Negative about the employer

Proven negative information about the client’s employer can also become an objective reason for denial of a mortgage. For example, the employing company has tax arrears, losses on official accounting reports, or is in litigation with its counterparties.

The difficult economic situation of the employer is a direct threat to the client’s loss of work and, accordingly, the possibility of full fulfillment of the terms of the contract. Therefore, in addition to the borrower himself, many lenders analyze the situation of the company in which the client is employed.

You can independently check this reason for a mortgage refusal through open sources on the Internet.

The employer refuses to confirm the borrower's employment

During the process of reviewing a loan application, bank employees contact the employer to confirm that the client is employed. If for some reason it was not possible to get through or the company employee who answered did not confirm that the potential borrower is listed in the position specified in the application form, then the application will most likely be rejected.

Therefore, the client is recommended to notify the accounting department, his management and other responsible employees in advance about a possible call.

Especially often, for this reason, people from closed security forces are refused. In this case, you need to write a report on providing information to a specific bank.

A large number of refusals

The BKI contains information not only about repaid and existing loan obligations, but also about all requests to credit institutions with applications for a loan.

If a person has a large number of refusals, then there is a high probability that the next bank will make a similar negative decision. This fact may indicate that the client is on interbank blacklists and has an unreliable financial reputation.

To avoid numerous application rejections, it is recommended to obtain a preliminary positive decision from the bank. Only after this should you collect a set of papers and submit the application for consideration.

We recommend scheduling a free consultation with our specialist to understand your options and potential reasons for mortgage refusal. Sign up in the special form below.

Low income

The main indicator of sufficient solvency of a potential client is sufficient income to service the loan. If its size does not meet the minimum requirements of the lender, then refusal will be guaranteed.

Most credit institutions require official confirmation of the salary received using a 2-NDFL certificate. However, if this is not possible, a number of lenders are ready to take into account bank certificates, bank statements, etc. Any of these documents must show that the income is sufficient for the application to be approved.

You can learn more about what salary is needed for a mortgage in order not to be rejected from the previous post.

Forgery of documents

If earlier it was quite simple to falsify 2-NDFL certificates, work books or other documents, today it is almost impossible to do this unnoticed and with impunity. Accessibility to many databases and the ability to fully verify almost any information about the client and employer will allow you to quickly identify inconsistencies or forgery.

The consequences of identifying forgeries of the documents provided can be very sad. The most harmless outcome is a refusal to issue a loan, and the worst is the borrower being blacklisted and filing a statement with the police about attempted fraudulent activity.

Very important! You should not make a personal income tax certificate 2 for your entire income if your income is “gray”. It is better to fill out a certificate using the bank form. Forgery of personal income tax can not only cause a mortgage refusal, but also lead to serious consequences for the borrower and the employer.

Problems with the borrower

A fairly common reason for a mortgage application to be rejected is problems related to the borrower himself. What is meant here is:

- serious health problems (for example, the presence of serious illnesses recorded in the medical record, disability);

- pregnancy (as a rule, mortgages are denied to clients in later stages, when this becomes noticeable to others);

- having a criminal record (most Russian banks have an unspoken rule not to contact people who have an expunged and active criminal record);

- the client is on parental leave (this type of borrower is also classified as high-risk).

You can learn more about how to bypass these reasons for refusal from the posts on our website.

Error in documents and inaccurate information in the application form

Errors can be made both by the client himself and by an employee of his company authorized to issue certificates and certify copies of documents. Most of these errors relate to ordinary typos, which, however, distort the reliability of the information provided.

If the bank is loyal to the client and understands that the client is not involved in the facts of erroneous data, then at the stage of consideration of the application, the borrower will be asked to correct the identified errors and prepare the correct papers.

Collateral does not comply with bank requirements

The bank's requirements and restrictions apply not only to the borrower, but also to the real estate being purchased or pledged as collateral. In most banks, these requirements relate to:

- construction period of the house;

- prestige of the area;

- availability of necessary communications;

- type of real estate (apartment, separate house, apartments, etc.);

- availability of infrastructure around the facility;

- materials of walls and ceilings.

Lenders have an extremely negative attitude towards the purchase of rooms in dormitories, communal apartments, dilapidated, emergency living space, as well as shares in real estate. They may also be denied a mortgage when purchasing housing located in poor, remote areas.

IMPORTANT! The bank takes into account all factors that determine the liquidity of housing, that is, the possibility of its quick sale.

Features of insurance

Real estate insurance is a mandatory condition for obtaining a mortgage. For military personnel participating in NIS, the loan is issued on preferential terms and is subsidized by the state, so the bank does not receive guarantees typical for loans under other programs. Life insurance is not mandatory, but it can change the terms of the loan agreement towards a higher interest rate.

Property insurance is mandatory.

The borrower pays for the policy from his own funds. After registration, a fixed insurance payment must be made every year: this is about 0.1-0.3% of the value of the property. The entire amount can be paid in one lump sum rather than every year. There is still an opportunity to get a discount by contacting a partner company of Rosselkhozbank.

The essence of the program

For those who have little idea what a military mortgage is, we will give a brief overview. So, a mortgage for military personnel is an alternative way of providing housing through government subsidies for participants in the NIS program.

The savings-mortgage system works as follows: the state once a year transfers an amount determined by federal legislation to a special account of a program participant, as a result of which a military service member can accumulate funds to purchase his own home over the course of several years. In this case, the NIS participant has the right to spend money on the initial payment, and later on repaying the loan.

Among the mandatory conditions for participating in the program, the legislator identifies the following:

- entry into service in the armed forces no earlier than 2005, that is, after the adoption of the relevant federal law (No. 117-FZ of 08/05/2004);

- participation in NIS for at least 3 years.

Thus, in order to purchase housing under a military mortgage, a potential borrower must enlist in the armed forces, submit documents for participation in the program, and serve at least three years before using state support funds.

Early repayment rules

Early repayment is available without restrictions. The borrower can repay the loan amount before the period specified in the agreement without additional fees or penalties. If you repay in full, you need to notify the bank in advance (one month in advance), and then take a document confirming the absence of mortgage debt. In case of partial repayment, you should write a statement after depositing the money into the cash register so that the credit managers of Rosselkhozbank will recalculate the interest. As a result, your monthly payment will decrease.

The borrower can repay the loan amount early.

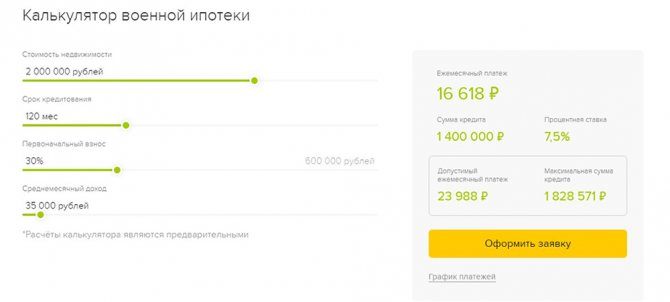

Mortgage calculator

In order to calculate the various options and evaluate which one is right for you, use a mortgage calculator.

The online calculator will help you determine the amount of the monthly payment , choose the optimal repayment scheme and calculate the acceptable period so that the serviceman can complete his service and not worry about the purchased home.

The data you will need for calculations is the cost of housing, the amount of the down payment, the loan term and the interest rate.

Article on the topic: Mortgage loan for the construction of a private residential building

Alternative programs

If the borrower does not meet the requirements of Rosselkhozbank or the terms of a military mortgage are not suitable for him, he can use other loan products to purchase housing.

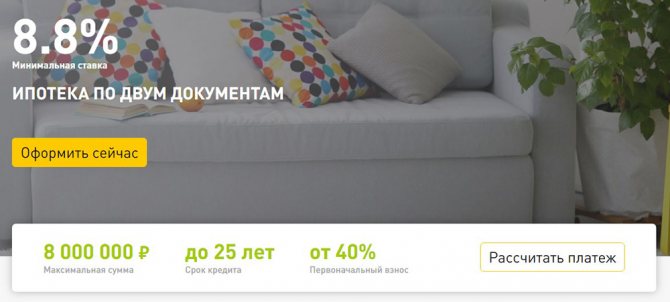

Mortgage under two documents

A targeted loan based on 2 documents is issued quickly and with minimal requirements.

The borrower can purchase real estate in both the primary and secondary markets under the following conditions:

- maximum amount - 8 million rubles;

- first payment - from 40%;

- loan term - up to 25 years;

- the minimum rate is 8.8%.

To obtain a loan, there is no need to confirm income and employment.

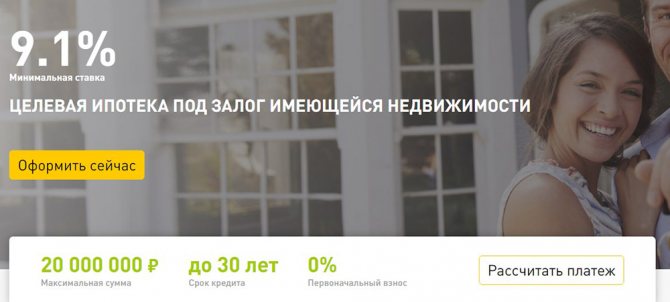

Targeted mortgage secured by existing housing

A special feature of the program is the transfer of existing real estate as collateral.

Basic conditions of a target mortgage:

- maximum amount - 20 million rubles;

- loan term - up to 30 years;

- the minimum rate is 9.1%.

There are no loan fees, and early repayment is possible without restrictions. The borrower can confirm income using the bank form (without employment certificates and 2-personal income tax) and choose a repayment scheme (annuity or differentiated).

Non-targeted loan secured by real estate

The borrower can receive a large loan secured by real estate. The program allows money to be spent for any purpose, incl. to buy an apartment or house.

Terms of consumer lending:

- maximum amount - 10 million rubles;

- loan term - up to 10 years;

- the minimum rate is 9.7%.

You need to confirm that you have an official and permanent income. If you have an extract from the Pension Fund of the Russian Federation and a confirmed entry on the State Services, it is possible to apply for a loan at the bank office only using a passport.

Affiliate lending programs

The Military Mortgage program involves the purchase of real estate on the secondary market, but if the client wishes to buy housing exclusively in a newly built new house, Rosselkhozbank can take advantage of special conditions when purchasing real estate built by the bank’s partner, the developer under the Eco Vidnoye project.

The residential complex "Eco Vidnoe" is being built in the Leninsky district of the Moscow region, the distance to the Moscow Ring Road along the M4 Don highway is 4 km.

It will be useful to view:

Negative sides

Lending under a preferential program is an opportunity to obtain housing with government support.

But a military mortgage, like any other loan product, has a number of weaknesses:

- the right to purchase your own apartment appears only 3 years after inclusion in the register of NIS participants, i.e. 6 years after the start of service;

- the number of family members of a serviceman, length of service and rank are not taken into account;

- housing falls into double collateral until the debt is paid in full;

- there is no flexible system for removing the encumbrance and selling the mortgaged apartment until the loan is fully repaid;

- If, upon dismissal before the end of the loan repayment, the right to savings was not preserved (short length of service, lack of preferential grounds), then the debt will have to be repaid independently.

It is impossible to refuse to participate in the state program (a military serviceman is excluded from the register only upon dismissal from the RF Armed Forces). Military personnel who signed the first contract before 2005 cannot choose the form of housing support - a housing certificate or purchasing housing using NIS funds.

Borrower reviews

Dmitry, 40 years old : “Since my youth I have been serving in the troops, which are now called the National Guard. When I first started serving, the conditions for obtaining housing for military personnel differed significantly. I registered, but I didn’t really believe that I would ever be able to get an apartment from the state, and I would have to move out after leaving the reserve. After accepting the new program, I immediately registered in the system and after 3 years I was able to get a mortgage. I chose Rosselkhozbank because our family has always trusted it. For almost 9 years now, payments have been regularly received and no problems have arisen.”

Veronica, 36 years old : “After the birth of our second child, the issue of expanding our living space and purchasing our own apartment became acute in our family, since we lived with our parents. My husband is in the military, so under the military mortgage program we were able to successfully obtain a mortgage from Rosselkhozbank, since we were attracted by the conditions, and we still wanted to buy an apartment from a friend, so the lack of lending for new buildings did not bother us at all. The down payment on the mortgage benefited from maternity capital, so we even combined two programs.”

Service Features

Military mortgages at Rosselkhozbank are repaid through monthly payments . Their value is fixed and is defined as 1/12 of the absolute volume of the savings contribution of a participant in the NIS for military housing, which is established by the law of the Russian Federation for a specific year.

The final payment may be more than the established minimum. Early repayment of the loan can be made on the scheduled monthly payment date. There are no fines or additional fees for this.