Main features of NIS countries

Among the key features of the group of NIS countries are the following:

- high and rapid rates of economic growth;

- dynamic changes in macroeconomics;

- structural changes in the national economy;

- increased professionalism of the workforce;

- active participation in international trade;

- widespread attraction of foreign capital and investment;

- high share of the manufacturing industry in the structure of GDP (over 20%).

Scientists and economists classify a particular state as a member of the NIS group according to several basic parameters (indicators). This:

- GDP size (per capita);

- its growth rate (average annual);

- share of manufacturing industry in the structure of GDP;

- total volume of goods exports;

- volume of foreign direct investment.

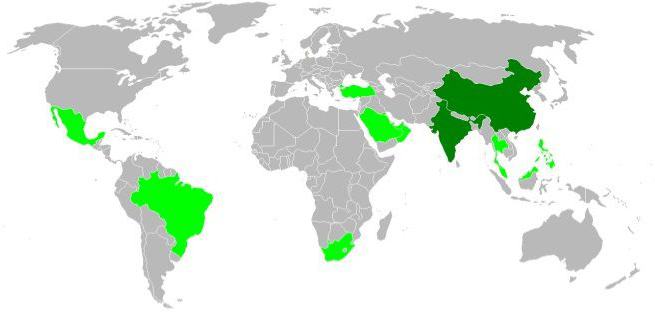

The NIS states became a separate group from developing countries. This process began around the mid-1960s. Today, the NIS includes the states of Asia, America and Africa. In the formation of this group of countries, four stages (or waves) can be distinguished.

So, all NIS countries (list):

- first wave: these are the so-called “East Asian tigers” (Taiwan, Singapore, Hong Kong and South Korea), as well as three American states - Brazil, Argentina and Mexico;

- second wave: India, Malaysia, Thailand;

- the third wave includes Cyprus, Indonesia, Turkey and Tunisia;

- fourth wave: China and the Philippines.

The map below shows the location of all these countries on the planet.

Thus, today 16 different states can be included in the NIS group. At the end of the twentieth century, geographers and economists could safely say that entire regions with sustainable and rapid economic growth had formed on Earth.

NIS: economic development models

In accordance with the instructions of the President of the Russian Federation, the Federal Law of August 20, 2004 No. 117-FZ “On the savings and mortgage system of housing provision for military personnel” was developed and adopted.

Ensuring the functioning of the savings and mortgage system is entrusted to the federal state institution “Federal Administration of the Savings and Mortgage System of Housing for Military Personnel” (hereinafter referred to as FGU NIS), created in pursuance of Decree of the Government of the Russian Federation of December 22, 2005 No. 800.

With the entry into force of Decree of the Government of the Russian Federation dated May 15, 2008 No. 370 “On the procedure for mortgage lending to participants in the accumulative mortgage system for housing provision for military personnel,” the accumulative mortgage system for housing provision for military personnel began to operate as normal.

The resolution defines the current main method of using a targeted loan - repaying the down payment when receiving a mortgage loan and repaying obligations on such a loan. In accordance with the resolution, credit institutions developed and agreed upon appropriate mortgage programs (see below).

In March 2009, FGU NIS and OJSC AHML agreed on the main parameters and conditions for the provision of mortgage loans (loans) by regional operators and service agents of OJSC AHML under the lending program for NIS participants - “Military Mortgage”:

- loan amount – no more than 2 million rubles;

- loan term – until the borrower reaches the age of 45 years;

- interest rate – the refinancing rate of the Central Bank of the Russian Federation is 2%.

On November 1, 2010, Gazprombank began issuing mortgage loans under the special “Military Mortgage” program, developed within the framework of a previously signed cooperation agreement with the Federal State Institution NIS. Parameters of the bank's mortgage program:

- loan amount – no more than 2 million rubles;

- loan term – up to 20 years (inclusive);

- interest rate – 10.5%;

- no fees for processing an application and issuing a loan.

As a result of the influence of certain factors in economically developed countries in the 60s of the twentieth century (such as the USA, Japan or Germany), the production of certain goods ceased to be profitable. We are talking about textiles, electronics, and chemical products. Ultimately, their production moved to developing countries, which could boast of cheap labor and low land prices.

Over time, many transnational corporations began to locate their production facilities here. And those states that were the first to create a favorable climate for foreign investment were able to achieve economic success. These were the NIS countries of the first wave of formation: South Korea, Singapore, Taiwan and others.

It is logical that over time, the newly industrialized countries of the first generation began to lose their obvious advantages compared to other developing countries. Now they have begun to move part of their production (primarily labor-intensive) to nearby countries. They were: Thailand, Indonesia, Malaysia. This happened already in the 80s. Even later, the Philippines, Vietnam, Sri Lanka and others were drawn into these processes.

Thus, in the history of the formation of the NIS, “stepped industrialization” is observed. Developing technologically, each of the NIS countries over time yielded the lower stage in its development to the states of the next generation of industrialization.

Among all the newly industrialized countries, several basic models of economic development can be distinguished. This:

- Asian model;

- Latin American model.

The first is characterized by a small share of state ownership in the national economy. However, the influence of government institutions on the economies of these countries remains high. In the countries of the Asian NIS sector, there is a certain “cult of loyalty” to “their” companies. The national economies of these countries are developing, focusing primarily on the foreign market.

The second model, Latin American, is typical for the countries of South America, as well as Mexico. Here, on the contrary, there is a clear trend towards the development of national economies with a focus on import substitution.

Rosvoenipoteka: official website and document tracking

For military personnel, the issue of housing always remains relevant. A military mortgage comes to the rescue, allowing you to have your own home, eliminating the need to rent a dormitory. To have the right to purchase an apartment, you must register on Rosvoenipoteka, the official website, and draw up a report for the allocation of funds.

Who is Rosvoenipoteka intended for?

In the fall of 2005, a savings and mortgage system (NIS) was created to resolve issues of housing for military personnel.

For the functioning of the NIS, the Federal State Institution “Rosvoenipoteka” and the official website were created.

The system has advantages:

- Any citizen serving has the right to use the program. People with family burdens and single soldiers and officers can get a targeted housing loan.

- The mortgage lending rate compares favorably with similar ones offered by the mortgage lending system.

- The right to choose housing does not depend on service or registration.

- If a soldier or officer chooses to buy housing in a region other than his current location, he has the right to receive official living space for the duration of his work.

The program is not without its drawbacks:

- When taking out a mortgage loan, the home will be held as collateral by the lending institution until final payment.

- The down payment for housing is a fixed amount, depends on the type of living space, and is not subject to change under the influence of circumstances (presence or absence of family, length of service, officer rank).

- If you are dismissed for a reason other than service benefits, the remaining amount is paid in full.

Conditions for participation in the NIS program, documents for registration

The following categories of citizens have the right to apply for entry:

- Warrant officers, officers, citizens with a contract since 2005

- Those in reserve and those who returned to work after 2005.

- Employees on long-term contracts with a validity period of more than 5 years.

- Long-term employees with a contract concluded again after the adoption of Federal Law No. 117.

- FSB employees (personnel), whose status was equal to military personnel.

- Employees of the Ministry of Emergency Situations (while serving in paramilitary units).

- Military personnel transferred to the reserve due to disability or health conditions that occurred during military service.

- Employees of the Ministry of Defense, dismissed from the ranks of the Armed Forces due to the disbandment of the HF. Their service life must be more than 3 years.

To become a participant, you need to submit a report or application.

Category of citizens already included in the program:

- Officers who have completed their military education, nominated for rank after 2005 inclusive.

- Those serving under a contract whose validity period began after 2005.

- Those who served as warrant officers and midshipmen with a period of work after 2005 of at least three years.

Everyone else must submit a report requesting to join the program.

After submitting the report, an accumulating account is opened where funds are credited. The data is then entered into the register and assigned a registration number.

Required documents

The serviceman writes an application for participation, indicating the following information:

- Your initials in full.

- Document (passport).

- Assigned rank, position in accordance with the registration order.

- Military unit number.

Other data will be required when applying for a housing loan.

The application signed by the unit commander is transferred to the Local Administration, which deals with the provision of living space for employees of the junior, middle and senior command levels. Included in the register of NIS FGKU Rosvoenipoteka.

After 12 days, a decision will be made, which will also be notified to the submitter. To track the progress of the paper, you can go to the official website of Rosvoenipoteka, where the status of the document is indicated:

- Received, currently under review.

- Passes the necessary legal examination.

- Awaiting signature from the head of the organization.

- Sent by courier (the name of the courier service and the item number are indicated).

After a positive decision is made, the military person is assigned a registration number and an accumulating account.

NIS participant registration number

The registration number includes 20 digits, the participant’s account is linked to it, where the transfer and movement of money takes place.

They can be disposed of:

- Save money to buy an apartment, then buy living space.

- After 3 years, apply for a mortgage loan under the preferential lending system of Rosvoenipoteka.

Receipts of money occur quarterly, starting from the moment a person becomes a participant in the system.

If the officer has savings, they can be taken into account in the initial payment - this is an opportunity to buy a more expensive apartment. The amount of savings is regulated by the FB Law and is reviewed every year.

On the official website of Rosvoenipoteka you can track money in your personal account.

NIS participant’s personal account, its capabilities

Any military personnel can register on Rosvoenipotek, the official website and carry out the following actions:

- Regularly check the amount in your account.

- Track the amount of accruals and the amount of available funds.

- Record information about accrued funds and deductions.

- Request a certificate of accruals and deductions from the official website of Rosvoenipoteka.

- There is feedback from the organization, you can ask questions, make additions and suggestions.

The only inconvenient point, according to employees, is the too long response time to sent requests, which is one month.

The response period is regulated by regulatory documents.

How to register on the official website of the Federal State Institution Rosvoenipoteka, enter your Personal Account

The registration procedure is simple and will not take much time. Necessary:

- Go to the “Personal Account” tab, which is located on the right on the main page of the official website, click “Registration”.

- In the window that opens, enter all the requested data and click the active “Register” button.

- Once everything is entered, the registration process will take a few seconds.

- The system will request confirmation by sending a link to the user's mailbox. If the person registering does not have an email address, you must create one. After registration, the options are available to the user on the official website of Rosvoenipoteka.

- Pay attention to the password, it must be unique and contain the required number of characters.

After completing all stages, registration is completed.

How to start using the NIS Member's Personal Account

After completing registration on the official website of Rosvoenipoteka, the user will see four main tabs of the Personal Account:

- User profile. Here you can correct or supplement information about a person, change a previously entered password (confirmation via email will be required).

- Section “Your questions” - anyone can inquire about the lending program, the rules for accrual, withholding funds, and issuing a housing loan. You can open the “Standard Questions and Answers on NIS” form, where the user will find the information of interest.

- Section "Requests". In the tab, you can submit a request about the status of your account and request a duplicate (electronic) Certificate. If a serviceman has a debt, he will be able to obtain data on it.

- “Additional services” - the official website of Rosvoenipoteka informs about programs for members of the system.

If your profile is completely filled out correctly, all tabs in your Personal Account will be available.

How to find out the amount in your account

The size of the contribution and the transfer of money are strictly regulated by the Government of the Russian Federation and amount to a fixed amount.

After appearing on the lists, cash receipts begin to flow into the participant’s account.

- To check the status, you must submit an application in the “requests” tab of the official website.

- Every year, before 15.04, the Personal Account of Rosvoenipoteka receives mandatory information about the current status of the account.

- You can send a similar request to the command of the unit where the RA serviceman is serving.

How to track a submitted package of documents

After registration, a person must remain in the system for at least 3 years. After the expiration of the period, he can apply for a housing loan and write an application to the unit commander with a request to issue an NIS Certificate.

Then he submits an application for a housing loan, which indicates:

- The applicant's initials (last name, first name, patronymic in full).

- Officer's ID, passport details (copies).

- Copy of NIS Certificate.

- If there is a marriage - Certificate.

- Consent of the spouse to enter into a mortgage or take out a housing loan. A marriage contract is allowed.

The participant can track the package of documents on the official website of Rosvoenipoteka by indicating his data on the left side of the page: “Information about the stages of consideration and execution of documents.”

How to find out the amount of savings

You can check the amount of available funds in three ways:

- According to the order of the Government of the Russian Federation No. 665, 07/07/2005, each regional housing authority has indicators on the state of the account. The commander of the military unit sends a request annually before April 15 and receives all the data on the personal savings accounts of employees. It is enough to write a report to the unit commander and get an answer.

- On the official website of Rosvoenipoteka, average savings values are published as of January 1 of each year, depending on the timing of the grounds for payments. The monthly contribution must be added to the amount received, the final result will be the required amount.

- In your Personal Account you can send a request and receive all the information after a set time.

In addition to the Personal Account and fixed tabs, the “Hotline” telephone numbers are listed on the official website of Rosvoenipoteka.

What you can find out by calling the “Hotline” from the official website of Rosvoenipoteka:

- Submission, preparation of documents.

- General issues regarding the functioning of NIS:

- General provisions.

- Conditions for providing housing loans.

- Opening and maintaining a savings account.

- Procedure for receiving funds.

- Sample documents for purchasing residential premises.

- Other functions that are prescribed by the legislation of the Russian Federation.

How to find out savings on a military mortgage

On the basis of this law, in order to ensure the functioning of the NIS, the federal state government institution “Federal Administration of the Savings and Mortgage System of Housing for Military Personnel” - FGKU “Rosvoenipoteka” - was created. It is the agency that deals with all issues related to military mortgages.

His functional responsibilities also include popularizing this program among the population. So, military personnel can become home owners:

- by obtaining a targeted housing loan from banks participating in this project.

- having accumulated the required amount of money in a special account and waiting for the right to use it;

Banks offer:

- take advantage of a consumer loan;

- purchase of primary or secondary housing on credit;

- become a participant in the Military Relocation program.

- loan for the purchase of a house with land;

Registration number of a participant in the savings and mortgage system

The following indicates which codes belong to which federal executive authorities: 10 - Ministry of Defense of the Russian Federation, 11 - Federal Service for Military-Technical Cooperation, 12 - Federal Service for Defense Orders, 13 - Federal Service for Technical and Export Control, 14 - Federal special construction agency, 20 - Ministry of Internal Affairs of the Russian Federation, 30 - Ministry of the Russian Federation for Civil Defense, Emergencies and Disaster Relief, 40 - FSB of the Russian Federation, 50 - FSO of the Russian Federation, 60 - Foreign Intelligence Service of the Russian Federation, 70 - State Courier Service of the Russian Federation, 80 — Main Directorate of Special Programs of the President of the Russian Federation.

Flaws

- This can cause shoulder and hip pain if you have a very old mattress or if you have muscle or joint injuries.

- Wrinkles may appear and the result may be a swollen face upon waking. If a person presses their face into a pillow, fluid accumulates in the area, causing swelling and thus wrinkles in the skin, making it more susceptible to wrinkles.

- This can accelerate breast sagging as the ligaments stretch without support over time.

- A fixed amount of a targeted housing loan, which does not depend on family composition, length of service and benefits.

The following circumstances are recognized as the undeniable advantages of military savings for apartments and houses:

- the amount of earthly funds allows you to purchase good housing (credit is provided to defenders of the Fatherland in a larger volume than to civilians);

- You can buy a house in any corner of the country;

- the military man is freed from the need to worry about where his family will live after discharge;

- In addition, he does not spend money from his salary on the purchase of real estate.

Advice: if you wish, you can pay off your mortgage early using your own funds.

The disadvantages include the registration process. It requires collecting a large amount of paperwork. You have to conclude contracts and attract specialists, which is quite difficult without legal support.

In addition, the system participant is required to pay money from his own pocket for:

- conducting an independent real estate assessment;

- insurance;

- real estate and legal services.

Hint: married military personnel must provide the consent of their spouse if they register an apartment as shared ownership.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

What is Rosvoenipoteka?

Rosvoenipoteka is the abbreviated name of the Federal State Institution (FGKU), created in 2006. Its responsibilities include monitoring the implementation of the mortgage program (NIS) for the supply of military personnel with housing, launched in 2005. Today, the easiest and most accessible way to obtain information on it is the official portal of Rosvoenipoteka.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

System regulations:

- upon entering service, a military man becomes a member of the NIS;

- every month a certain amount of money is transferred to his account from the state budget;

- funds accumulated over 3 years can be used to make a down payment on a home mortgage;

- further contributions from the government are used to pay off payments on the principal mortgage debt, subject to the borrower's continued military service.

The amount of the savings contribution for a military mortgage is systematically increasing.

Amount of annual savings contribution

The amount of the annual savings contribution is established in the Federal Budget for the corresponding year.

| Year | Annual savings contribution, t.r. | Regulatory document | Increase by, % |

| 2005 | 37 | Art. 85 of the Federal Law of December 23, 2004 N 173-FZ, Consultant | — |

| 2006 | 40.6 | Art. 82 of the Federal Law of December 26, 2005 N 189-FZ, Consultant | 9.72 |

| 2007 | 82.8 | Art. 93 of the Federal Law of December 19, 2006 N 238-FZ, Consultant | 103.94 |

| 2008 | 89.9 | Clause 2 Art. 11 Federal Law of July 24, 2007 N 198-FZ, Consultant | 8.57 |

| 2009 | 168.0 | Clause 3 Art. 11 Federal Law of November 24, 2008 N 204-FZ, Consultant | 86.87 |

| 2010 | 175.6 | Clause 3 Art. 10 Federal Law dated December 2, 2009 N 308-FZ, Consultant | 4.52 |

| 2011 | 189.8 | Clause 3 Art. 10 of the Federal Law of December 13, 2010 N 357-FZ Consultant | 8.09 |

| 2012 | 205.2 | Clause 3 Art. 10 of Draft Federal Law N 607158-5 “On the Federal Budget for 2012” | 8.11 |

"East Asian Tigers" - the first among NIS

They are called differently: “East Asian tigers”, “small Asian dragons”, “four Asian tigers”. All of these are unofficial names for a group of the same countries. We are talking about South Korea, Singapore, Taiwan and Hong Kong. All of them showed very high rates of economic development in the last third of the twentieth century.

In the mid-1950s, South Korea was, by all indicators, one of the most backward countries in the world. In a short 30-year period, she was able to make a tremendous leap from poverty to high development. The country's GDP per capita during this time increased 385 times! Modern South Korea is the most important center of shipbuilding and the automotive industry in Asia.

However, Singapore had the highest rates of economic growth of these four at the end of the last century (about 14% per year). This tiny state is one of the world's largest oil refining centers. In addition, knowledge-intensive industries are actively developing in Singapore. There are quite a lot of foreign tourists here (over 8 million annually).

Other NIS countries - Hong Kong and Taiwan - are more or less dependent on the PRC government. Tourism is significant to the economies of both of these countries. Taiwan is also a major center for advanced technology and nuclear power throughout Asia. And the country also holds the world championship in the production of sea yachts!

How to purchase a home

Stages of completing a transaction:

- Apartment search

- Bank selection

- Collection of documents for the apartment

- Conducting an assessment

- Signing of the Targeted Housing Loan Agreement (DHLO) and the loan agreement

- Signing the Sales and Purchase Agreement (SPA)

- Registration of the agreement with the Federal Registration Service of the Russian Federation

- Providing copies of documents to the bank

Let's start from the very beginning. First of all, you need to decide whether to use the services of agents or not. Let's look at the pros and cons. Pros: saving time and... everything, cons: cost, opacity of the transaction. If you have difficulty negotiating and do not have free time, then you need an agent or developer who sells an apartment as a property.

The investment algorithm is similar to applying for a mortgage. So, the program participant will have to do the following:

- Study the offers of partner financial organizations (the list is on the program website).

- Choose a suitable bank.

- Order a settlement for the maximum amount, taking into account the lender’s conditions.

Hint: The mortgage is calculated so that the last payment is made by the service member before his 45th birthday.

- Choose housing at your own discretion within the amount specified by the lender.

- Conclude a preliminary agreement with the seller and conduct an independent assessment of the value of the property.

- Sign a loan agreement based on the documents provided (specified in the previous paragraph).

- Insure the purchased property.

- Conclude a purchase and sale agreement.

- Send a package of documents to the Federal State Institution “Rosvoenipoteka” to organize the transfer of funds to the bank.

Attention: housing is immediately registered as military property. However, until the terms of the transaction are completed, it is jointly pledged by:

- states;

- credit organization.

Due to the various subtleties of the conditions for using funds, the following must be taken into account:

- If you enter into a mortgage agreement after three years of military service, you will have to:

- remain in the military until at least ten years of service;

- pay off the loan balance from your own funds in case of early dismissal;

- If you wait until 20 years of experience, then:

- savings are enough for a large apartment;

- The loan balance will be paid by the budget.

Information: if a serviceman dies in the line of duty (or is declared missing), then relatives receive the right:

- to receive money from a personal account;

- to continue loan repayments within the framework of signed agreements.

Registration in the mortgage register

If a serviceman uses the system for the first time, he must register.

- You need to go to the state program website, and then follow the instructions given by the registration wizard.

- By clicking the “Registration” link, you must enter your last name and initials, as well as specify a password. A soldier must carefully choose a password; it must be quite complex.

- To activate the account, the serviceman will be required to enter information about his postal address, which must be indicated in the registration form.

The generated account will allow the participant of the state program to find out the following:

- how much money have you been able to accumulate over the entire period of participation in NIS;

- what amount comes to the account;

- what funds are currently available;

- deductions in allowances in cash.

You can enter your personal account from the main page of the site, the entrance is located at the top right.

Personal Area

It was created so that a participant in the system could find out about savings without contacting the institution (how to check savings on a military mortgage by registration number?).

On the main page of the site you can get information about the application and get acquainted with offers for military mortgages.

Without authorization, you can also find out information about the certificates that were issued to the military personnel. In addition, information can be obtained about what stage of registration the documents are at.

The site is convenient to use; you can find up-to-date data in your personal account.

The opportunity to use the funds comes after the serviceman has been in the system for three years. After a specified time, the soldier or officer can begin to manage the funds.

Of course, money from the account is used only for the purchase of housing. For example, they can be used to pay a down payment on a military mortgage. Other loan payments are also made through your personal account.

Dismissal from military service

The section is not completed.

The regulatory framework is regulated in detail in [3], [5]. In particular, the procedure and forms of reports and reports on payments are defined in [5].

In addition to the funds accumulated in the personal account of a participant in the savings-mortgage system, the participant can also receive additional funds. The basis for receiving them is, for example, dismissal from military service in connection with organizational and staffing measures.

The regulatory framework is regulated in detail in [6]-[7]. In particular, the procedure and forms of reports and reports on payments are defined in [7].

Payment of additional funds is made by the interested federal executive body within 3 months from the date of receipt of the corresponding application (report) of a participant in the savings-mortgage system or a member of his family, to which the following documents are attached:

- extract from the Unified State Register of Rights to Real Estate and Transactions with It;

- an extract from the house register and a copy of the financial personal account at the place of residence;

- copies of the passport of a citizen of the Russian Federation of all family members (with marks of registration at the place of residence or stay)

- birth certificates of children under 14 years of age;

- certificate of family composition of a participant in the savings-mortgage system;

- certificate of total duration of military service;

- an extract from the order of dismissal from military service (indicating the grounds for dismissal);

- written consent of the participant to repay the debt to the authorized federal executive body or a receipt for the transfer of these funds to the account of the authorized federal executive body (if there is a debt to the authorized federal executive body).

The application (report) of a participant in the savings-mortgage system or a member of his family for the payment of additional funds shall indicate: information that the participant in the savings-mortgage system or members of his family are not tenants of residential premises under social tenancy agreements or members of the family of a tenant of residential premises under a social rental agreement or by the owners of residential premises or family members of the owner of the residential premises, with the exception of residential premises acquired using targeted housing loans in accordance with the Federal Law “On the savings and mortgage system of housing provision for military personnel”;

information about the non-acceptance by family members of a participant in the savings-mortgage system of his obligations under the mortgage credit (loan) (in case of exclusion of a participant in the savings-mortgage system from the lists of personnel of a military unit in connection with his death or death, recognition of him as missing in the prescribed manner or declaration his deceased);

recipient of funds and his payment details; obligations to use additional funds for their intended purpose, vacate occupied office premises or other residential premises of a specialized housing stock. The specified application is submitted by a participant in the savings-mortgage system before he is removed from the lists of personnel of the military unit, and a family member of the participant in the savings-mortgage system submits an application after the participant in the savings-mortgage system is excluded from the lists of personnel of the military unit in connection with his death or death, recognition in accordance with the established procedure, missing or declared dead.

In the event of early dismissal from military service, if a participant in the savings-mortgage system has not purchased housing, the question arises of a bank account to which it is necessary to transfer the savings accounted for in the personal savings contribution, as well as funds that supplement savings for housing.

The sender pays for the transfer of funds to the recipient's account. Transfer of sent funds to the recipient's account, as a rule, occurs without commission. The most important aspect when choosing a bank, which is often not taken into account, is the conditions for withdrawing funds from the bank account (cash out). Banks may charge a significant commission for this operation.

Commission for withdrawing funds from the account: up to RUB 600,000. — 0.5% (minimum 100 rub.), 600,000 — 3,000,000 rub. — 1%, over RUB 3,000,000. — 7%. But there is a way to withdraw funds from an account without a commission, which bank employees are prohibited from disclosing. To do this, you need to open any deposit in the bank, transfer funds to the deposit account, and then withdraw funds from the deposit.

The most suitable deposit for this purpose is the “Target - Telebank” deposit. The deposit should be opened for the maximum period - in this case the interest rate will be maximum up to 6.7%, with interest capitalization. Interest accrues at the end of each month. The account details at VTB24 Telebank should be indicated as details.

Commission for withdrawing funds from an account up to RUB 5,000,000. — 1% (if the funds were on the account for less than one month), 0% (if the funds were on the account for more than one month)

How to find out your nis member number

First you will need to go through a simple registration on the site. To do this, you will need to enter your email and create a password.

To track the status of your account, you will need to fill in your personal information (registration number, registration date) and send the corresponding request to Rosvoenipoteka (). The review period is 1 calendar month.

In addition, the capabilities of your personal account allow you to find out the balance of the debt to Rosvoenipoteka and even receive a duplicate of the NIS participant certificate.

How to obtain (withdraw) the savings portion of a military mortgage

The law provides for the possibility of withdrawing funds accumulated on a military serviceman’s personal account.

This can be done subject to the following conditions:

- upon reaching twenty years of service, including preferential calculation;

- upon preferential dismissal if the service period is 10 years or more.

Preferential reasons include:

- The maximum age for military service has reached.

- Organizational and staffing measures.

- Declaration of unfit health.

- For family reasons:

- when a military man is declared dead or missing for many years;

- the presence of diseases that do not allow further continuation of service.

At the same time, savings can be used for any purpose, and the fact of owning housing is not an obstacle to receiving them.

To cash out savings, an NIS participant should submit a petition (report) to management about his intention to withdraw funds from his personal account.

The report indicates the grounds giving the military the right to withdraw savings, the date and bank details for transferring funds.

Next, the request is sent to the Federal State Public Institution Rosvoenipoteka, an institution vested with the authority to manage NIS funds. Consideration of the request takes a month. If all conditions are met, funds from the personal account are transferred to the account specified in the report. From this moment, the savings are considered cashed out.

If the savings are used to purchase housing, they are not subject to taxation.

Military Mortgage Calculator

You can use any calculator, for example this one: #37891.

When filling out the conditions from our example, we get the following mortgage loan parameters:

The calculation was made based on the assumption that each year the amount of the monthly savings contribution will be indexed.

Example of calculation for military mortgage

Let's consider the calculation of a military mortgage at Sberbank, based on the data in our example.

- The total amount of savings taking into account investment income is RUB 2,529,568.

- The amount of cost of the purchased housing is 4,500,000 rubles.

- The size of the down payment depends on the bank - at least 10%. In Sberbank - 15%. For our example, it will be 675,000 rubles. Since there are more NIS savings, additional personal funds will not be needed. But if necessary it is possible.

- Calculation of the loan amount: RUB 4,500,000. – 2,529,569 rub. = 1,970,432 rub.

- The interest rate on Sberbank’s military mortgage is 9.5%.

- The loan period is determined by the bank based on the age of the borrower and should not exceed 45 years at the time of full repayment. Let's assume our military man is 31 years old. Accordingly, the maximum loan term is 14 years.

Next, for the calculation you will need a loan calculator for a military mortgage.

How to track the status of your military mortgage account

The list of military personnel participating in the NIS is formed and maintained by government agencies that provide for military service.

Upon registration, all participants are given a number (consists of 20 characters). The serviceman must be informed of this by means of a notification indicating his personal registration number. Information about the number is also entered into the individual system participant card.

The registration number will be needed in the future to view current information about accruals on a military mortgage or to check information about the exact debt on a military mortgage. This can be done in your personal account on the Rosvoenipoteka website ().

How to find out the queue in the savings mortgage system (NIS) for military personnel

The Savings Mortgage System (NMS) is a government program for providing residential real estate to military personnel who serve under a contract.

It replaced the old housing scheme for military personnel, when an apartment was provided only after twenty years of service or after leaving the reserve early due to unfitness for health.

Moreover, the military could only receive ready-made housing only in houses built specifically for these purposes. The pace of construction did not meet the needs of the military departments, as a result of which there were queues for military personnel to receive housing.

NIS solved this problem. Now you don’t have to wait for many years to become the owner of your own home. Implemented by NIS through partner banks through military mortgages. The down payment and monthly payments for the borrower are paid by the state.

There is also no such thing as a “queue at the NIS”.

Any serviceman who has entered into the first or second contract since 2005 can submit a report to participate in the system.

After the three-year period, the military man can apply to the head of the unit with a request for the issuance of an NIS certificate.

Over these three years, the state will transfer monthly contributions to a special account of the system participant, which will subsequently be used to cover the down payment on a military mortgage.

How much money is given for a military mortgage loan per month?

The annual state contribution for military mortgages in 2020 is 260,241 rubles. or 21,678 rub. per month. In 2020, this amount was RUB 20,490. The federal law on the federal budget provides for a monthly contribution (payment) for a military mortgage in 2019 at the rate of 22,372 rubles. or 268,465.6 rubles. in year. Initially, with the introduction of the NIS, the amount of annual contributions was much lower.

Let us consider, as an example, the volume of savings of a military member participating in the NIS as of , if he joined the system in January 2010.

Table of the amount of savings of an NIS participant on a military mortgage.

In addition, the amount of savings of each military personnel is subject to increase due to investment income.

According to official data from Rosvoenipoteka, the return on investing funds of NIS participants averages about 8-9%.

The numbers are quite logical, given that 90% of all amounts are invested in bank deposits, and only 10% are invested in higher-yielding securities. This was done to avoid losses from investing at the end of the year.

Stocks and bonds do not guarantee returns and carry many risks. For example, 2009 turned out to be unprofitable from an investment point of view due to risky transactions.

If we take an average return of 9%, then the approximate amount (size) of income from investing savings before using a military mortgage from our example would be:

So, from the point of view of purchasing housing, the amount turned out to be quite a decent amount of 2.5 million rubles.

Questions and answers

Sources of information used.

- https://ipoteka.finance/voennaya-ipoteka/kak-uznat-sostojanie-scheta-po-voennoj-ipoteke.html

Using the property tax deduction

Property tax deduction for the purchase of residential premises is a measure of support for citizens, which allows you to additionally receive up to 260,000 rubles. when purchasing housing with your own funds and even over 260,000 rubles. when purchasing housing using borrowed funds, on which interest is charged. Read more in the article Tax deduction.

Thus, the property tax deduction provided for by this subparagraph does not apply in cases where payment of expenses for the construction or acquisition of a residential house, apartment, room or share(s) in them for the taxpayer is made at the expense of employers or other persons, maternal (family) funds ) capital allocated to ensure the implementation of additional measures of state support for families with children, through payments provided from the federal budget, budgets of constituent entities of the Russian Federation and local budgets, as well as in cases where the purchase and sale transaction of a residential building, apartment, room or share(s) in them is made between individuals who are interdependent in accordance with Article 20 of the Tax Code of the Russian Federation.

Since the purchase of housing by an NIS participant within the framework of the savings-mortgage system is carried out at the expense of funds from a targeted housing loan (federal budget funds), the property tax deduction in this case does not apply to military personnel - NIS participants. Source - Website of the Federal State Institution "Rosvoenipoteka". Section "Typical questions and answers". Question No. 38.

At the moment, the maximum size of the CLP is about 600 thousand rubles, the rest are credit and own funds. Receiving a deduction from loan funds is not prohibited by the Tax Code, but still contradicts the principles of legality in this case.

The exception is the case of purchasing housing using your own funds. In this case, the serviceman has the right to receive a tax deduction based on the amount of his own funds contributed (but not more than 2 million rubles).

For example, a serviceman purchased an apartment worth 4.7 million rubles, of which 2.5 million were a mortgage loan and personal savings, and 2.2 million rubles were his own funds. In this case, the serviceman has the right to receive a tax deduction on the amount of 2 million rubles (2.2 {amp}gt; 2). In addition, the serviceman has the right to receive a tax deduction on the amount of interest paid on the loan, provided that he again repays the loan using his own funds (in essence, this is early repayment).

What is a military personnel's personal account?

First of all, it is worth identifying the legal basis for military participation in the NIS. The rules for enrolling military personnel in the federal NIS program are prescribed in Order No. 245 of the Ministry of Defense of the Russian Federation. And the functions of compiling the register and further monitoring their implementation are assigned to the Department of Civil Defense of the Ministry of Defense of the Russian Federation. The basis for including military personnel in the number of participants in the NIS and the list of their categories are indicated in Federal Law 117 of August 20, 2004, Federal Law “On the NIS ZhO of military personnel.” This is what allows you to access your personal account on the Rosvoenipoteka website.

And the rights and obligations of participants in the mortgage-savings system can be found in the Federal Law “On the NIS of housing provision for military personnel”, in Government Decree No. 1028 of December 16, 2010 and No. 370 of May 15, 2008.

Attention

After submitting the application, the military man is assigned the status of NIS participant and the corresponding certificate is issued. On this basis, a serviceman can annually find out about the status of his savings account at the place of service or in his personal account.

In addition, the site has an online calculator that allows you to independently calculate the approximate amount of your savings. According to the law, money begins to be transferred to your personal account from the second month after joining the program. And the opportunity to use the funds to obtain a mortgage loan comes after 3 years of membership in NIS.

The service and specifically the military mortgage personal account allows the NIS participant to obtain all the necessary legal and organizational information. If you have any questions, there are hotline numbers. On the website in the official personal account of the NIS participant in Rosvoenipoteka there is a completely clear interface through which the following information is available to the user:

- scheme for joining the NIS;

- the process of obtaining a certificate;

- regulations for exclusion from the system register;

- current mortgage offers with detailed conditions;

- information about accredited real estate;

- promotions and preferential offers from partner developers;

- insurance details;

- regulatory documentation.

Additional information

The Rosvoenipoteka portal periodically conducts surveys that make it possible to assess the quality of work on the implementation of the military program.

What can you do to improve your sleep quality?

1. Your pillow should be firm enough to keep your spine straight.

2. You should fill the space between your neck and mattress to keep your head and neck in a neutral position.

3. If you have shoulder pain, try placing a pillow in front of your body and resting your arm on it. This will help relieve the pain.

4. To avoid or get rid of hip pain, try placing a pillow between your knees to keep your hips level.

5. To avoid sagging breasts, try placing a small pillow under them to prevent the ligaments from being stretched. Or just sleep on your back.

6. If you wake up in the morning with a puffy face, puffy eyes and deeper wrinkles than last night, you should change your sleeping position. Sleeping on your back can prevent unwanted contact between your face and your pillow.

7. A good mattress is the most important thing when it comes to healthy and restful sleep. If you're a side sleeper, you'll want to choose a mattress with good shoulder and hip support and a medium to firm firmness. Foam mattresses and mattresses that can “remember” your body position (viscoelastic) are the best options as they are very effective at relieving pressure points.

Of course, other reasons can cause pain and swelling. Therefore, do not immediately think about your sleeping position; maybe the problem is completely different, and the wrong position simply aggravates the situation.

Swelling, for example, can be caused by drinking large amounts of water before bed and/or consuming salty and spicy foods.

In any case, sleep in a way that suits your body to avoid any consequences.