One of the largest banks in Russia, VTB 24, offers a mortgage lending service for the purchase of land plots, both for the construction of individual residential buildings on them, and with unfinished real estate properties. What conditions the institution offers, the requirements for the borrower and the facilities and the application process will be discussed in this article.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Conditions

The banking product is presented by the Bank of Moscow, merged with the VTB24 group.

Due to the fact that when registering a mortgage, land becomes the subject of collateral, certain features are associated with the conclusion of the agreement:

- the site should be located no more than 100 meters from the city border, preferably no more than 30 km to increase the chances of receiving a positive decision on the loan application;

- the purpose of the land must be for the purpose of constructing an individual construction project; when registering an allotment for farming, it is not allowed; it is possible to sign an agreement for land for running a personal subsidiary plot during the construction of a structure suitable for living on it;

- documentation for land must be in accordance with the requirements of current legislation, if there is a lease agreement, permission for the right of perpetual or hereditary ownership, then such real estate will not pass the control of any bank, including VTB24, you must first undergo privatization, obtain a certificate for property to the seller, only after this is it possible to conclude a mortgage agreement;

- documents confirming the boundaries of the land must be drawn up for the plot, such as a cadastral plan and, in the event of disputes between the owners of neighboring plots, a land survey with an act of approval of boundaries;

- provision of water is mandatory, it is desirable that communication systems be connected to the site so that after the construction of a residential building they are transferred to premises for normal living in comfortable conditions;

- the land must be located in an accessible area, to which a road has been built and access is possible.

Since this type of transaction is due to a certain status of the property, and the mortgaged property is considered illiquid - the purchasing power is very low, such loan programs provide for increased interest rates of up to 20% annually. This tariff, in accordance with the bank’s credit policy, allows us to guarantee coverage of the risks of non-payment of debt.

In addition, this product requires a down payment ranging from 20 to 50% of the value of the property based on the assessment of independent experts.

VTB24 is ready to issue a loan for the purchase of land in a fairly large amount compared to other institutions - up to 50 million rubles. Such plots are suitable not only for individual construction purposes, but also for commercial purposes to generate profit for enterprises.

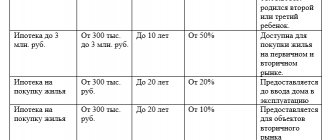

Conditions for granting a mortgage for the purchase of land

Typically, the initial payment under the program is 20% of the market value of the land. The loan period varies from 10 to 30 years . The longer the loan period, the higher the interest rate will be.

The interest rate on a mortgage for the purchase of land ranges from 15 to 26% per annum . It is determined based on individual conditions.

Bank employees can offer you various options that help reduce your interest rate.

Requirements for borrowers

The following requirements are imposed on potential debtors:

- reaching the age of 21 at the time of signing the loan agreement and no more than 65 years at the date of full repayment of the debt;

- Russian citizen status;

- employment on an official basis with confirmed regular income;

- registration of a person at the location of the bank branch;

- good credit history, no arrears or debts on other banking products in relation to other financial institutions.

Not only a citizen, but also a person with the status of an individual entrepreneur or a manager or founder of an organization can receive a loan for the purchase of a land plot.

The company will need a package of constituent documents, including an order for the appointment of the general director of the enterprise and a power of attorney to represent the interests of the company in the bank, Rosreestr authorities and other bodies related to the registration of mortgage relations.

Obtaining a loan is possible both for permanent residence and for holidays at the dacha, as well as for farming.

Object requirements

Before accepting an application and drawing up an agreement, employees of a credit institution must go to the site to check the characteristics of the property, its condition, distance from the city and the actual condition and absence of illegal buildings on the territory, that is, squatting of the territory.

The status of real estate is also checked, the absence of prohibitions on its disposal in the form of restrictions and encumbrances due to the effect of a mortgage, collateral for other loan obligations.

A property is not suitable for a mortgage if:

- land is allocated for state or municipal needs, or is intended for confiscation;

- the plot is located on the territory of a reserve, park, strategic territory;

- plot area is less than 6 hectares or more than 50 hectares;

- buildings were erected on it without permits;

- The category of land use has been changed from individual construction to other purposes not related to recreation and permanent residence of citizens.

It is possible to purchase land on the territory of a horticultural cooperative if ownership documents are drawn up for it in the prescribed manner, and the seller’s right is registered in the unified state register.

The procedure for refinancing a mortgage at Khanty-Mansiysk Bank is described in the article: mortgage at Khanty-Mansiysk Bank. Read about mortgages for the construction of a private house here.

List of required documentation

A loan for purchasing your own home or building it is issued upon presentation of the following documents:

- A document confirming the identity of the applicant.

- Certificate of income for the last six months in form 2NDFL.

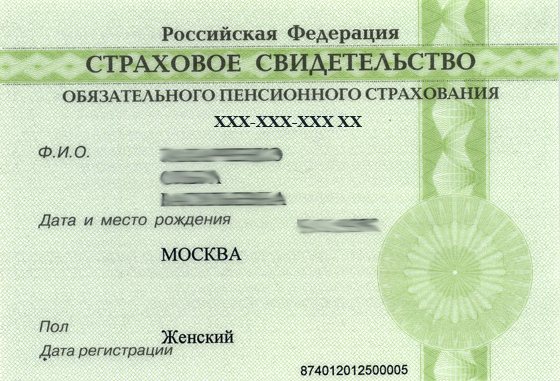

- SNILS.

In the case when the loan amount is more than 500 thousand rubles, the bank client must provide a certified copy of the work book and a copy of it.

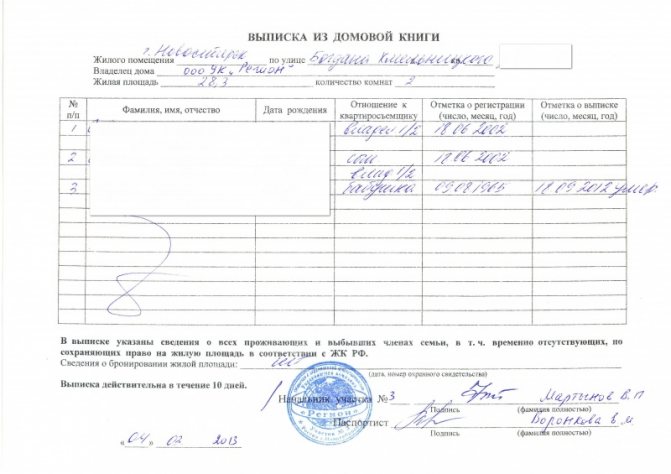

A simplified package of documents is provided only for those persons who are holders of a salary card from VTB24. In this case, you only need a passport and SNILS. If we are talking about providing a loan secured by real estate, then a certificate confirming the registration of property rights and a purchase and sale agreement is required. Installation documentation is also required to confirm ownership rights; an extract from their Unified State Register will do. It is important to present an extract from the house register.

Please note that the conditions for registration may vary, depending on the status of the applicant. In some cases, it becomes necessary to provide additional documents. That is why, before collecting a package of documents, you need to consult with a bank specialist.

What documents will be needed

VTB24 establishes its own package of official papers required to consider an application and conclude a transaction.

It includes:

- application form with completed personal data and information about the property being purchased;

- land cadastral plan;

- boundary work with the act of agreeing on boundaries in the event of disputes about their establishment;

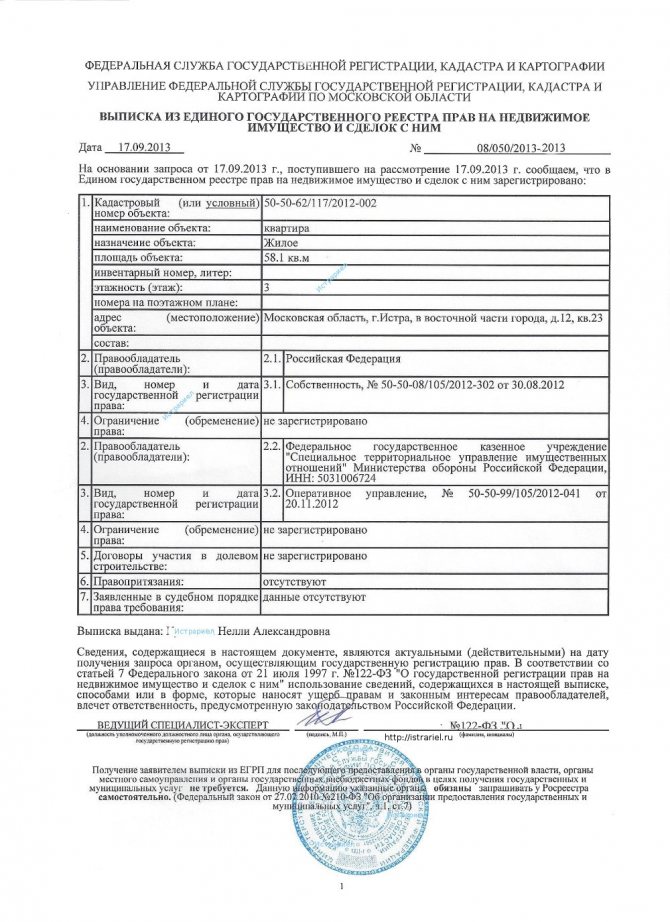

- an extract from the Unified State Register of Real Estate about the absence of restrictions and encumbrances, with full information about the owner and the basis for the transfer of rights;

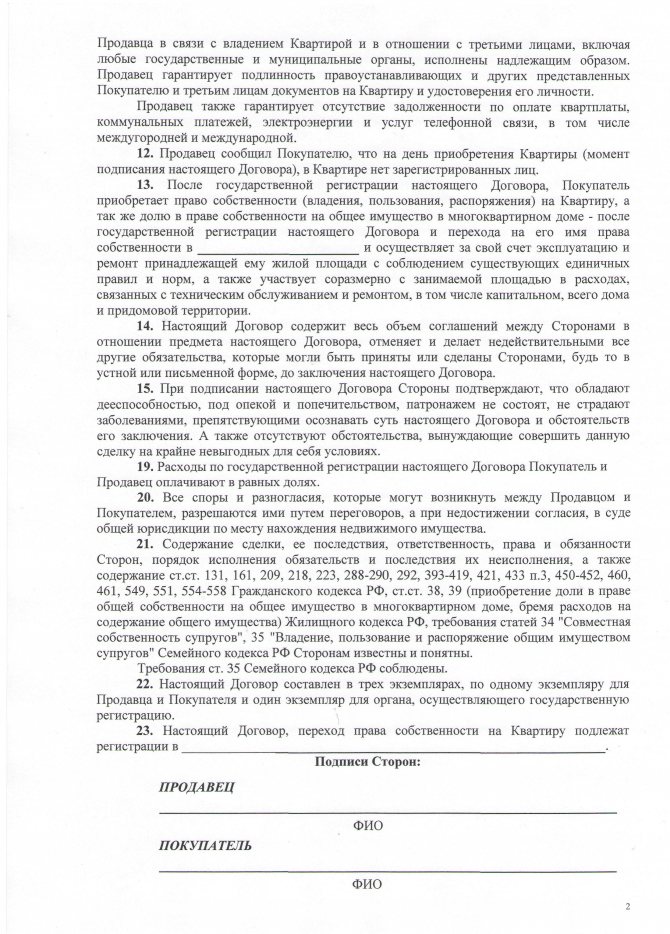

- title documentation – purchase and sale agreement, gift, certificate of inheritance, privatization, etc.;

- certificate of ownership in the name of the land owner;

- a report from an independent appraiser in the original indicating the market value of the plot;

- a certificate from the BTI confirming the absence of unauthorized buildings on the land plot based on the results of the inspection;

- a preliminary purchase and sale agreement between the land owner and the borrower, a receipt for the transfer of collateral.

Required documents

A “Large” loan can be provided to the client after the latter submits a list of necessary documentation:

- general passport;

- 2-NDFL for 6 months, certified at the place of employment;

- SNILS;

- if the loan amount exceeds 500,000 rubles, you are additionally required to provide a photocopy of your work record book or employment contract, certified at the place of work.

Persons who receive salaries on a VTB 24 Bank plastic card can submit a simplified package of documentation:

- general passport;

- SNILS.

To receive a loan for building a house from VTB 24 Bank, using the funds received under the “Loan against existing housing” program, you must submit the following documents to the bank for the client:

- statement;

- passport;

- SNILS;

- 2-NDFL for the last year (providing this document will not be required if the individual is a payroll client);

- a photocopy of the work book certified by the employer;

- military ID - for males who have not reached 27 years of age.

You will also need the following documents regarding the mortgaged real estate:

- certificate of state registration of property rights to the property;

- a document that serves as the basis for the emergence of a property right to a given object - this could be, for example, a purchase and sale agreement;

- other title documentation, which is indicated in the certificate of ownership or in an extract from the Unified State Register;

- a single housing document or an extract from the house register.

VTB 24 may require the client to provide other documentation not specified in the above list. Before collecting and preparing documents, we recommend that you consult with mortgage experts by phone on this issue.

How to apply for a mortgage on a plot of land in VTB 24

Obtaining a credit service is carried out in several stages:

- submitting an application online on the VTB24 website to receive a preliminary decision, indicating personal data in the application form, including place of employment and monthly income;

- upon approval of the application, contact the bank branch to check the data and provide official documents to an employee of the institution;

- ordering a land assessment from an independent licensed agency, providing an opinion to the bank;

- obtaining complete information on a loan product regarding a specific property with characteristics and assessment;

- signing a purchase and sale agreement and a mortgage agreement with the registration of collateral, drawing up an act of acceptance and transfer of the property in fact from the owner to the borrower, registering the transaction in the local branch of Rosreestr.

What documents will be required?

Purchasing a plot of land on credit has its own specific features. First, we recommend determining which banks provide land mortgages in your area. Then choose the most suitable offer for you. And already contact the department to transfer a package of documents. This set may include:

- Cadastral passport, which indicates the boundaries and size of the land.

- If the seller has a wife, then it is necessary to formalize the wife’s consent to the sale, but if there are minors among the land owners, then permission from the guardianship authorities. Such documents must be notarized.

- A certificate from the technical inventory bureau stating that there are no additional structures on the site.

- Extract according to the Unified State Register form.

- Certificate of ownership from the owner of the land.

- Appraiser's report.

Nuances

The main requirement when drawing up a mortgage agreement on land at VTB 24 is the bank’s requirement that the borrower construct an individual construction project or other real estate on the received land using his own funds.

For this purpose, specific deadlines are established that must be strictly observed, or it will be regarded as a violation of the terms of the contract, and the funds are considered to be not used for the intended purpose, which entails termination of the agreement and the imposition of sanctions on the borrower with significant losses and putting the collateral up for public auction in order to sale and receipt of funds to cover mortgage debt.

Their availability is checked at the stage of approval of the application and conclusion of the contract.

Typically, a down payment of 20% is required. Payment of at least part of the debt is not provided through maternity capital funds, the Affordable Housing program and other government subsidies. For comparison, Sberbank of Russia offers a rate of 13% per annum when making a 50% contribution.

When purchasing a plot of land for joint ownership of spouses, it is necessary to provide a notarized consent; without this, the transaction is impossible. If the legal regime is changed, then you will need to provide a marriage contract or an agreement on the allocation of shares, approved by a notary office.

The maximum repayment period is 50 years, while the minimum is only 3 years.

During the execution of the transaction, an insurance contract for the collateral object must be concluded after the assessment has been carried out. The life and health of the borrower, the risks of loss of ability to work due to unforeseen events, are protected on a voluntary basis.

There is no commission for concluding a mortgage agreement at VTB, however, additional costs arise in connection with the inclusion of a package of insurance services and carrying out appraisal activities, for the state fee for transferring ownership in the amount of 400 rubles. for citizens and 22,000 rubles. on organizations.

Reviews about the Svyaz Bank mortgage can be found in the article: Svyaz Bank mortgage. Check out the mortgage terms for pensioners at Sberbank here.

Features of Transcapitalbank mortgage are discussed here.

Features of consumer credit

Compared to mortgages, consumer lending has some advantages. For example, there is no requirement to use your future home as collateral or make a down payment. The bank provides the opportunity to obtain a “Large” loan. The client has the right to count on a loan in the amount of 400,000 rubles to 5,000,000 rubles if he receives a salary on a VTB card. The debt repayment period ranges from 6 months to 5 years. Regardless of the size of the debt and the time of its payment, a single interest rate of 16.5% applies (for salary card holders).

Article on the topic: 3 lending programs for salary card holders from VTB

In this case, the bank independently makes a decision on the amount of the borrowed amount, based on the credit history of the applicant and his level of income. In some cases, it may be too small to carry out construction work and purchase materials.