What mandatory documents are needed and is it possible to do without an income statement?

- Application form (needed so that the bank can view brief information about the borrower).

- Passport of a citizen of the Russian Federation.

- Insurance certificate of state pension insurance (SNILS).

- A copy of the work book certified by the employer or a certificate/extract from the Work book (needed so that the banking institution can verify that the borrower actually works for a certain time in a particular organization), (military personnel working under a contract provide a certified copy of the latest contract and a certificate about service life).

- For men under 27 years of age - a military ID (a copy of the military ID is provided to determine the possibility of conscription, that is, the bank needs to make sure that after you take out a mortgage loan, you will not be drafted into the army).

- Certificate to confirm the income of an individual (Certificate 2-NDFL or certificate on a bank form) / tax return for the last 12 months.

Read about how long it takes to complete and for what period a 2-NDFL certificate is needed for a mortgage, why the bank needs it, and whether it checks information about income.

Reference! For borrowers who are salary recipients at a banking institution, providing papers to confirm their financial well-being is not required, since the bank has the ability to view payroll accruals on its own.

Video about what is included in the standard list of documents for a mortgage:

Find out which banks give loans without certificates based on 2 documents, and how to get a mortgage without proof of income and employment, here.

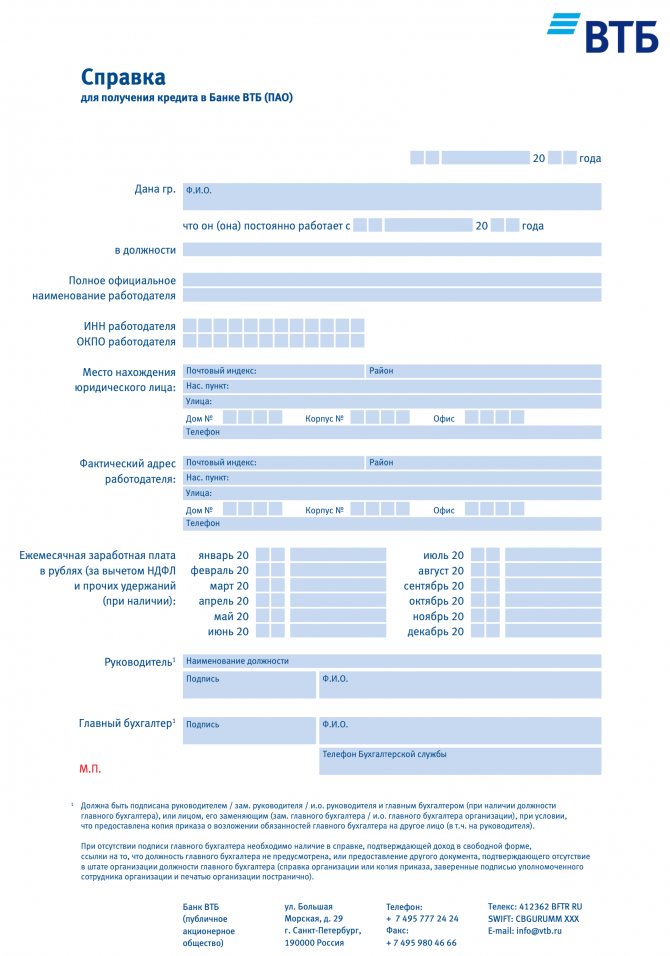

Features of the VTB certificate

Each bank has its own certificate. The form is developed by specialists and contains fields in which the borrower’s salary is indicated. The 2020 form from VTB contains a table. It is necessary to fill in the columns:

- month;

- year;

- the amount of income paid per month (the amount before tax is indicated).

The form must indicate your full name, place of work and period of work.

Filling Features

The borrower must download the certificate in Word format. This can be done on the official VTB website or through another online resource. The document is filled out by the chief accountant of the enterprise or director. It is preferable to enter information via a computer rather than manually. It is important that the data does not contain factual errors. Therefore, it is worth double-checking the information several times. If an error was made, corrective edits must be made marked “Corrected.”

The document must have the signatures of the manager and the chief accountant. If the director holds two positions, then one person signs it. A wet stamp is placed on the completed form.

The VTB certificate is valid for a month. After this period, it must be taken again.

How to convince an employer to fill out a VTB certificate?

As already mentioned, many employers pay two salaries to their employees: one official, and the other “in an envelope”. In this illegal way they reduce the amount of tax deductions. Of course, no one should know about this. Therefore, when an employee asks to fill out a certificate using the VTB Bank form, he receives a sharp and categorical refusal.

The fact is that the director and chief accountant are taking a huge risk. The form must indicate the actual amount of the employee’s salary, certified by the manager’s signature and seal. If it suddenly ends up at the disposal of the tax authorities, then troubles cannot be avoided. According to current legislation, penalties may include a large fine or imprisonment. It all depends on how much damage was caused to the state budget.

In this regard, it is very difficult to obtain a certificate in the bank form from the employer. The only argument that can be appealed to is that VTB undertakes not to disclose information received from the client without his knowledge, and the document is of an internal nature.

Auxiliary papers that a bank employee may require

Additional documents:

- For individual entrepreneurs.

- An extract from the register confirming registration as an individual entrepreneur or founder of an enterprise.

- Tax registration certificate.

In some cases, bank employees can inspect the enterprise and draw an appropriate conclusion about the business being conducted by the borrower and its level of profitability. This document can play a decisive role when applying for a loan.

- For individuals and legal entities.

- If the borrower is married, the bank has the right to request a copy of the marriage certificate.

- Financial and business documents (for legal entities).

- Marriage contract (Such a contract may contain certain provisions that regulate the repayment of the mortgage that was issued before the marriage, and the rights of the two parties to real estate).

- Certificates confirming other sources of income (alimony, rent) - in some cases, the bank may request additional certificates of income.

The purpose of these documents is to create a complete picture of the client’s solvency and employment confirmed by the employer!

Mortgage under two documents in VTB 24

The least amount of documents is required to obtain a mortgage for an apartment or house using 2 documents. Have an original and a copy of your Russian passport with you, as well as another document that will prove your identity (driver’s license, etc.).

Spouses need to have a copy of their wife/husband's passport with them. On the official website, you need to fill out the fields of the questionnaire and send it to the bank for review. Keep track of the documents for the selected property. But with a small number of securities, in return you will receive an increased discount rate and a large down payment.

Contents of the application according to the form

The bank especially carefully checks the application, which must contain:

- last name, first name and patronymic;

- Date of Birth;

- your mobile phone;

- email;

- all information about the job, that is, this is the employer’s TIN;

- average monthly income after tax 13%;

- general and current experience;

- purpose of the loan;

- the city in which you would like to purchase;

- the city where the mortgage loan itself was obtained;

- type and cost of the real estate;

- down payment, loan size and term;

- number, series and date of issue of the passport.

Advice! It is very important for a banking institution that the borrower can confirm his employment in the organization, therefore the bank is very picky about length of service and salary.

The marriage contract is another important point , because after the borrower takes out a mortgage, all formalities can pass to his spouse. Such an agreement will avoid courts after a divorce, since all the rules must be spelled out in it.

Why do you need a certificate?

This document is required to obtain a large loan, for example, a mortgage or to buy a car. Before disbursing money, the bank must make sure that the borrower can repay the amount received.

The official document that confirms the income of an individual is a certificate in form 2-NDFL. Often, such a document does not display a person’s entire income, since many enterprises use “black” or “gray” income schemes, which allows them to reduce the amount of tax payments.

Part of the income does not appear anywhere. The official salary is significantly lower than the real one. This often becomes the reason for refusal to receive a large loan.

Sometimes a person, even having a high income and the ability to pay a loan on time, cannot buy an apartment with a mortgage or make another large purchase. To prevent unpleasant situations, VTB introduced and approved its own document.

It has a simplified form and fully reflects a person’s real income. The information indicated in the certificate remains available only to VTB and is confidential. Third parties do not receive this data.

A certificate must be provided in the following cases:

- mortgage registration;

- obtaining a large consumer loan or other type of loan;

- issuing a VTB credit card;

- taking out a large loan to repay a loan that was taken out from another financial institution;

- refinancing a loan at VTB.

If a client, having applied for a loan from VTB, for certain reasons does not have the opportunity to make a certificate in Form 2-NDFL, he can use the document established by the financial institution itself.

Not all employers agree to issue a VTB Bank certificate, since this is a document that confirms tax evasion.

Where can I get the necessary documentation?

Let's look at everything in order:

- his passport and SNILS with him.

- the application form from the bank itself or print out an electronic version from the main VTB 24 website and fill it out yourself at home, and then take it to the bank. Or leave an online request so that the bank specialist will call you back and write down all the information about you.

- The work book is usually kept by the employer in the personnel department; you need to make a copy of the pages where there is a record of how long the borrower has been working at this place of work and a copy of the records from previous jobs in order to calculate the total length of service. Such copies must be certified by the signature and seal of the boss. If, instead of copies from the employment record, the HR department offers to make an extract, then the HR specialist himself will write down all the places of work and the terms at which the borrower worked, and will put the necessary stamp and signature.

- A military ID is required in order to take out a mortgage loan, but if the borrower does not have one, then most likely he will be asked to take someone as a guarantor.

- a certificate of income from the HR department, but be careful, it takes about 10 days to complete, so plan your time well. If a declaration is needed, it is obtained from the tax service.

- An extract on registration as an individual entrepreneur must be taken to the Unified State Register of Individual Entrepreneurs.

- The tax registration certificate is obtained from the tax service accordingly.

- The marriage contract and marriage certificate are kept by the borrower himself.

- Financial and documents confirming business activities are kept by the individual entrepreneur or in the human resources department.

Important! Confirmation of the borrower's income and other documents except for a passport and a dream (the option of obtaining a mortgage using two documents) is possible, but the rates on such a mortgage loan will be much higher, and the amount of the down payment will also increase!

A version of such a program exists in the banking organization VTB 24, called “Victory over formalities”; consideration of an application for a mortgage is carried out using only two documents (passport, SNILS), but this option has some disadvantages:

- the rate is higher, if on a regular mortgage the rate is from 10.7%, then such a program implies an interest rate of 11.5%;

- down payment from 30%, whereas in a regular program with a full list of all documents the down payment is from 10%, and in the presence of maternity (family) capital from 5%;

- The loan term is up to 20 years, in other programs up to 30 years.

Not only VTB-24 issues loans based on certificates. In our articles you can find out what certificates are needed on the bank form for a mortgage at Sberbank.

Certificate form according to VTB form in 2020

Download the certificate using the VTB form

income certificates in the VTB form can be:

- From the official VTB website: .

- From the InfaProNet website: right-click on the image, select "Save Image As".

Take your time to print out the form; it is better to fill it out in printed form.

Find out which bank will approve a loan Take a short test and find out which banks are ready to approve a loan for you. Select a suitable bank from the list, submit an online application and receive money today.

Step-by-step filling out the document

So that the borrower does not make mistakes and does not make mistakes, for his attention, instructions on how to fill out the document step by step.

- Indicate the name of the company where the borrower works:

- for enterprises - the full name of the company assigned to the legal entity;

- for individual entrepreneurs - last name, first name and patronymic of the employer.

- Specify data for verification:

- OKPO (if the employer is a legal entity);

- Taxpayer identification number (if the employer is a private individual).

- Employer contact details and address:

- landline telephone number of the boss (his secretary);

- landline number of the accounting department or human resources department;

- the actual address of the company's location (if it does not coincide with the legal address);

- legal address at which the company is registered (in cases where it coincides with the actual address, then it is necessary to duplicate the information).

This is where all the required information about the employer ends. But there are still fields to fill out; now you should enter data about the borrower himself.

- The name of the position held in the company;

- Date, month and year of employment (the data must match the entries in the work book, since VTB Bank may also require it);

- The amount of monthly salary (the amount must be indicated minus all possible taxes, that is, you only need to enter the amount of “net” income).

Sample certificate on the bank form for obtaining a loan from VTB Bank

Perhaps you were looking for:

- expiration date of personal income tax certificate 2 for obtaining a loan from VTB;

- how many days is the personal income tax certificate 2 valid for VTB Bank;

- how long is certificate 2 personal income tax valid for a mortgage in VTB;

- for a loan from VTB, a salary certificate for what period;

- how long is certificate 2 personal income tax valid for a VTB loan;

- VTB certificate for obtaining a consumer loan;

- How long is certificate 2 personal income tax valid for a mortgage in VTB?

Features of filling out the certificate

A document confirming the level of solvency of the borrower will be required by a bank employee. In this context, before the step-by-step instructions, it would be useful to outline a number of features that the process of filling out the certificate includes.

- This document must be filled out not by the borrower, but by third parties, those who can responsibly and competently declare the financial situation of the citizen:

- the head of the human resources department of the company in which the potential debtor works;

- the chief accountant of the enterprise where the citizen who wants to get a loan works.

- After filling out the certificate, at the end (at the bottom) of the form there must be two signatures confirming the veracity of the data presented in the document:

- immediate supervisor: director of the company, owner of the enterprise;

- chief accountant of the employing company.

- It is worth focusing the attention of readers on the fact that all information specified in the certificate on the bank form must be relevant and truthful at the time of its provision. The data can be checked and, if it turns out that the information is slightly distorted, the credit department of VTB Bank will not approve the loan application.

Step-by-step process for filling out a certificate for obtaining a loan at VTB PJSC

There are a lot of details that, in fact, play a very significant role in the procedure for applying for a loan. So, it would seem that it is quite simple to obtain a certificate in the form of personal income tax-2 if the borrower is an officially employed citizen. But, there are cases when the employer is an individual entrepreneur or, for example, a potential client works for a legal entity under a contract. In such situations, a citizen will be able to confirm his income only by providing a certificate in the form of a bank. Fortunately, there is an option to provide such a certificate to obtain a loan at VTB PJSC; the certificate form can be obtained from an employee of the department for working with individuals.