"Nomos Bank"

The banking institution began its work in 1993 under the name “Nomos”. It is part of the largest banking group in Russia. Today Nomos is called Otkritie Financial Corporation. It ranks first among Russian banking groups, and fifth among banking corporations. There are 879 representative offices of this organization and they are located in 57 largest regions of the country. It received its new name in 2014, but back in 2012, the stake in Nomos was purchased by Otkritie Financial Corporation.

All loan portfolios owned by Nomos were transferred to Otkrytie FC; accordingly, previously concluded agreements with clients were also transferred to the financial corporation. But it was decided to leave the interest rates the same, and only change the details for transferring funds.

Nomos deals not only with consumer loans, but also with housing loans. Mortgage loans can be taken out for apartments in the secondary and primary markets, as well as residential buildings, or you can refinance an existing loan in another institution under more favorable conditions.

Nomos Bank mortgage programs: conditions

Nomos Bank offers a number of programs that are suitable for various living conditions and may be of interest to every client. These include:

- "Apartment" program;

- "New building";

- "Apartments";

- military mortgage;

- military mortgage refinancing;

- “Apartment + maternity capital”;

- “New building + maternity capital”;

- mortgage refinancing.

Program "Apartment"

The purpose of the loan is the purchase of secondary market housing or its share. The percentage may be inflated, but this directly depends on the availability of insurance and confirmation of the borrower’s income. For example, if the borrower decides to refuse insurance altogether, the interest rate will increase. The conditions are:

- Issued in Russian currency.

- Down payment from 10% to 80%.

- The rate is 8.9%.

- For up to 30 years.

- The minimum is 500 thousand, and the maximum is 30 million rubles.

New building

This loan is issued for the purchase of an apartment in new apartment buildings, both at the excavation stage and for finished housing with a certificate. The developer must be approved by the bank in order to take out a mortgage for exactly the housing that the construction organization offers. There is a joint program “Nomos Bank” with, under which the first two years of lending have a low rate. The conditions are common to all:

- Currency - rubles.

- Down payment from 10% to 80%.

- Rate – from 8.9%.

- The maximum term is 30 years.

- The minimum amount is 500 thousand, and the maximum is 30 million rubles.

Apartments

Apartments can be purchased on the primary and secondary markets. The most favorable conditions for the down payment and promotional rate are when purchasing from INTECO Group of Companies. Basic conditions:

- Currency - rubles.

- Down payment from 20 to 80%.

- Amount from 500 thousand to 15 million rubles for regions and up to 30 million rubles for Moscow and St. Petersburg.

- The loan term is from 5 to 30 years.

- Rate – from 8.9%.

Mortgage refinancing

It is possible to cover an existing real estate loan under more favorable conditions. You need to contact your bank branch for information about your total debt and then contact Nomos for advice on refinancing.

- Currency - rubles.

- Coverage from 20% to 80%.

- Rate – 9.65%.

- Maximum – 30 years.

- The minimum is 500 thousand, and the maximum is 30 million rubles.

Refinancing refers to the repayment of a mortgage secured by residential real estate, where the mortgagee is a banking organization. It is provided:

- for the purpose of purchasing secondary or primary housing;

- for the purpose of repaying an existing housing loan for secondary and primary real estate;

- for the purpose of repaying a housing loan, the collateral of which is participation in the DDU.

Military mortgage

The opportunity is specifically designed for participants in the savings and mortgage housing system.

- Currency - rubles.

- Down payment of at least 20%.

- The rate is 8.8%.

- Valid for up to 25 years.

- Maximum 2,704,000 rubles.

Note! Full closure of the contract must be made no later than the month in which the borrower reaches his 50th birthday.

Refinancing a military mortgage

Nomos Bank provides the opportunity to repay a housing loan provided by another bank for the purchase of an apartment using funds from a targeted housing loan as part of mortgage lending to NIS participants.

- Currency - rubles.

- Coverage from 20% to 80%. The amount must be no more than the remaining balance on your current mortgage.

- The rate is 8.8%.

- The term is until the borrower reaches 45 years of age.

- Maximum up to 2,704,000 rubles.

Mortgage and maternity capital at Otkritie Bank

Nomos offers its borrowers a loan to purchase an apartment using maternity capital in the primary and secondary markets.

- Currency - rubles.

- Down payment from 10%.

- The rate is 9.3%.

- The grant period is 30 years.

- The minimum is 500 thousand, and the maximum is 30 million rubles.

The loan amount cannot exceed 85% of the cost of the apartment under the contract, excluding maternity capital. If income is confirmed by a bank certificate, then no more than 80% of the cost of housing.

Advantages of choosing programs from this particular bank

- The bank offers a fairly favorable loan rate. FROM 11.5 to 14.5 percent per annum. The total loan size can be 30 million rubles.

- Possibility of repaying the loan after the first year of payments. The maximum loan term is 30 years.

- Preferential military mortgage without guarantors.

- Mortgage programs with state support.

- Prompt review of the package of documents within 3 days.

- There is an opportunity to participate in the refinancing program. The rates are quite loyal, 11 percent.

- When using maternity capital funds, the down payment is 10 percent.

- Loans for a down payment secured by collateral. The amount is half a million rubles, in installments up to 30 years.

- Nomos Bank allows foreign citizens to take out loans, provided that they pay taxes regularly.

- The loan is also available to individuals with the status of “individual entrepreneur”, as well as founders of commercial organizations. True, only if more than two years have passed since the company was registered.

- Possibility of remotely submitting a mortgage application through your personal account.

The bank has a fairly flexible system of working with clients; subtleties and nuances are discussed individually; there are often cases when the bank accommodates clients halfway, even if at the initial stage there were difficulties with approving the application.

An important feature is that the higher the down payment, the lower the interest you will have to pay.

According to the purpose, loans are divided into several boards:

- Buying housing on the secondary market.

- Purchase of housing under construction.

- Mortgage secured by property.

- Loan refinancing program.

- Loan for the purchase of a house on land.

- Issuing a loan for a down payment.

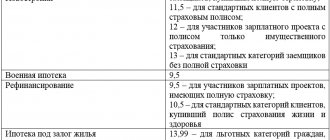

Nomos Bank mortgage interest rates in 2020

As of 2020 updates, mortgage interest rates look like this:

| Program | Bid |

| New building | from 8.9% |

| Apartment | from 8.9% |

| Apartments | from 8.9% |

| Military mortgage | from 8.8% |

| Apartment + maternity capital | from 9.3% |

| New building + maternity capital | from 9.3% |

| Refinancing a military mortgage | from 8.8% |

| Refinancing | from 9.65% |

The rate may be 1-2% higher if you refuse insurance. This applies to almost all mortgage lending programs.

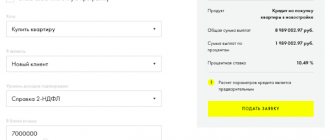

Mortgage calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

You can use the mortgage calculator on our website, which provides an accurate loan calculation.

Basic conditions for obtaining a mortgage

The State Program applies to real estate in new buildings, ready for commissioning or at the construction stage. Main provisions of the project:

- loan amount for Moscow, Moscow region, St. Petersburg and Leningrad region – from 500 thousand to 12 million rubles;

- loan amount for all regions of the Russian Federation – from 500 thousand to 6 million rubles;

- down payment amount is 15-20% (depending on the cost of the apartment and the region);

- mortgage term – from 3 to 30 years, with the possibility of early repayment without penalties;

- the possibility of attracting up to 2 co-borrowers to the mortgage, including those who are not related by blood to the main borrower;

- a preferential interest rate is provided subject to the registration of an insurance policy for the mortgaged property, life, health and ability to work of all official participants in the mortgage.

Important! The client can refuse personal insurance and take out a policy only for real estate. In this case, 1% is added to the interest rate.

Applicants for a mortgage under the State Program will need to provide a standard package of documents to the bank:

- Russian passport with permanent registration;

- documents from the place of work: a copy of the work book (or extract), certificate 2-NDFL, certificate of experience at the current place of employment;

- for individual entrepreneurs – declaration 3-NDFL.

The bank has the right to oblige a potential borrower to submit additional documents if doubts arise about solvency. These can be certificates of income for all working family members and pensioners, certificates from the place of education of children, certificates of ownership of a land plot, a country house (if there is property).

Requirements for the borrower

To obtain a mortgage loan, you must meet certain requirements:

- The borrower must be at least 18 years old and maximum 65 years old. Pensioners can receive a loan under a special program provided by the bank.

- The loan is provided only to citizens of the Russian Federation; therefore, registration in Russia is required.

- At the last place of work, the work experience must be at least 4 months, and the total work experience is 12 months. Confirmation in the form of a photocopy of the work record book will be required.

- For some bank products, it is mandatory to provide collateral.

- Large loans are provided only if there is a guarantor or co-borrower.

A mortgage will be denied:

- Employees of gaming establishments (poker, casinos).

- Restaurant business workers (waiters, bartenders).

- Realtors, property managers.

- Bodyguards (great risk to life).

- Those who work for individual entrepreneurs unofficially.

The main reason for refusal for these professions is the inconsistent source of income.

If the borrower is married, then the participation of the spouse in the transaction as a co-borrower will be required, provided that there is no prenuptial agreement. Co-borrowers can also be:

- the borrower's spouse or domestic partner;

- close relatives of the borrower or co-borrower, for example, parents, children, brothers, sisters.

List of required documents

When submitting an application, a potential borrower must provide a certain package of papers for consideration by the lender.

These documents must confirm your social status, income, etc. These include:

- Identification;

- Military ID (for male borrowers over 27 years old);

- Papers that confirm your qualifications and higher education;

- A copy of the employment contract and work book;

- Marriage certificates, birth certificates and marriage contract;

- 2-NDFL certificate to confirm income;

- To confirm the availability of additional income, you can provide relevant agreements, etc.

Mandatory documents for consideration of an application at Nomos Bank, as well as additional conditions for a mortgage

Foreign citizens must additionally provide their visa, permission to work in the Russian Federation, as well as confirm registration and the right to temporary residence in Russia.

For individual entrepreneurs and legal entities, you must bring the following documents:

- Company tax returns;

- Company reporting for 2 years of operation;

- If you hold a management position in a company, you will have to bring an extract from the register stating that you are not the founder of the company.

In addition, at the bank branch you may be asked to bring additional papers. A common request is to provide documents indicating that you have current loan debts. Thus, the employee will be able to calculate for you the optimal monthly payment amount, which will allow you to pay both loans at the same time.

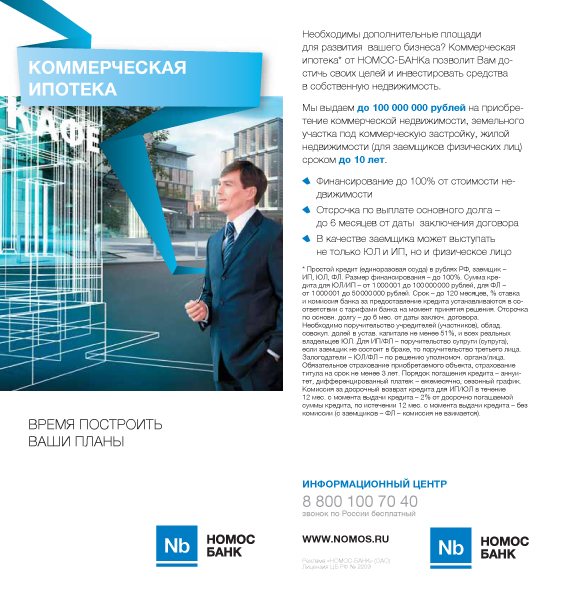

Mortgage for business at Nomos Bank

Package of mortgage documents

To register at Nomos Bank you will need:

- Original and copy of Russian passport.

- Birth certificate.

- SNILS and INN.

- For young parents with a child, the consent of the guardianship authorities may be required. Usually, before purchasing an apartment, the previous apartment was sold.

- Assessment report for the purchased apartment.

- The second document that confirms identity is a foreign passport or driver’s license.

- Certificate of employment in form 2 – personal income tax.

- If you have additional income, you will need a certificate in the form of a bank.

- If property is provided as collateral, then documents for it. For example, a title for a car or a certificate of ownership of an apartment.

Important! The bank has the right to request additional documents from the borrower. For example, this may be the consent of the spouse to the sale of housing if it was purchased during marriage.

It happens that they may ask for consent to provide data from the Credit History Bureau.

Documents for mortgage

This set is not much different from the package of documents for a mortgage in any other bank:

- Statement;

- Passport of a citizen of the Russian Federation (note that the bank will require copies of this and all subsequent documents, it is better to obtain them in advance);

- SNILS and TIN;

- If there are children in the family, you will need to provide a birth certificate for each;

- Certificate 2-NDFL;

- Marriage certificate – if available.

These papers are quite sufficient to submit an application for consideration. But after receiving a positive response from the bank, this package will need to be supplemented with new documents.

How to apply

To apply for a mortgage loan, you must contact the Otkritie FC branch, since Nomos no longer exists. He joined the Otkritie bank.

Submitting an application for a loan is done as follows:

- An application form is filled out at the bank branch. You can also use the official website, where you can also get a preliminary answer.

- Answer questions from the bank employee accepting the application.

- Provide the necessary documents.

- Receive a response on approval or refusal of a mortgage loan.

The application includes the following information about yourself:

- FULL NAME.

- Date of Birth.

- Place of Birth.

- City of residence.

- Data about the marriage or its absence (full name of the spouse).

- Place of residence. It doesn't matter whether it's temporary or permanent.

- Contact details. This could be an email address and several phone numbers.

- Work address and work phone number (this is important because a bank employee may call to clarify whether the client works in a particular organization or not).

Note! Some borrowers do not include all the information in the application form, which significantly reduces the possibility of loan approval.

The form specifies the required loan size and approximate repayment period. If the loan amount is large and the income is average or below average, then the mortgage will be denied.

How to get a mortgage from Nomos Bank

There are several ways to submit an application for consideration to the bank:

- You can fill out the form either during a personal visit to the bank or using an online form on the official page of Otkritie Bank. But get ready that you will still have to go to the bank. Since the form of the site does not imply the collection of detailed information about a potential client.

- Prepare thoroughly for your visit to the bank office - take all the necessary papers and documents, this will speed up the process.

- After completing the application, you need to wait for the bank’s decision; without it, nothing will move forward.

- Having received a positive answer, it’s time to start looking for a new living space.

What to do after approval

Once approval has been received from Nomos Bank, the following actions must be taken:

- Order an assessment report for the property being purchased.

- If there is a need to transfer the deposit to the seller of the purchased property, then transfer it.

- Collect the package of documents requested by the bank and provide it to the credit specialist for processing the information, including the assessment report.

- After the documentation package has been collected, you need to wait for a response from the bank regarding approval of the apartment itself. It happens that the apartment is not suitable, for example, if there is redevelopment or the house is quite old.

- If the decision is positive, you need to come to the bank together with the seller, having previously set the day of the transaction. At the bank, transfer the first payment to the seller.

- Sign on the same day all the necessary documents provided by the bank employee.

- Go to the MFC for the transaction, where you need to register the transfer of ownership of the residential property.

- After receiving the property document, provide it to the bank.

- As soon as the documents are provided, the transaction is completed and the bank transfers the remaining amount of money to the seller.

Important! The seller himself prepares the paperwork for the apartment.

The package of documents for the apartment includes:

- certificate of ownership of an apartment or share, or private house (in this case, a certificate of land ownership will be required). Today, instead of a certificate, they issue an extract from the Unified State Register of Real Estate;

- a document on the basis of which the apartment is owned by the seller;

- technical and cadastral documents;

- certificate of family composition;

- certificate of debt on utility bills (electricity, gas, water);

- passports of apartment owners.

Mortgage refinancing

This loan will help those who are already paying off their mortgage, including those from a third-party bank. Here Nomos-Bank is considered one of the most advanced. This is not the first year that specialists have been engaged in this practice, although this area is considered one of the most difficult. The bank has to study competitors' offers as quickly as possible in order to be able to attract as many clients as possible for a lower percentage.

The bank will help you choose a more lenient loan rate and change the amount of mandatory payments. Moreover, the amount of the refinancing agreement may not always be equal to the balance of the loan from a third-party bank. The client, at his discretion, can increase the loan amount, for example, spend the excess on repairs. By the way, the percentage here is very democratic - 11.75.

Insurance

At Nomos Bank, like any other, the insurance service is issued on a voluntary basis. In other words, you can refuse it, but there are a lot of disadvantages.

For example, the interest rate increases if you cancel your insurance. In addition, in the event of an unforeseen situation with the borrower, the mortgage will have to be paid by one of the relatives. If you have insurance, the entire debt is paid off by the insurance company.

Example two. If the client has lost his job and there is no insurance for this case, then there will clearly be a delay, since now there is nothing to pay with. And if there was insurance, then the payments would be paid by the insurance company, and only then, when the job appears, the client again.

Nomos Bank employs a partner, LLC IC RGS-Life. Those. It is this company that handles the insurance, not the bank itself.

The amount of the insurance premium is set individually and depends on the term and size of the loan. The client independently chooses for which life situations he will need insurance.

Note! You can refuse insurance before signing the loan agreement and after that. Refunds for unused insurance are also possible.

According to the law, it is possible to return the money for insurance in full at any time. According to the new law, which came into force on June 1, 2016, the insurance premium is refunded within 5 working days.

Required documents

To apply for a mortgage, the following set of documents is provided to the bank:

- The borrower's Russian passport - original and photocopies of pages with registration, personal information about the citizen, marital status, military duty.

- SNILS or INN.

- If a mortgage is purchased by young parents who have a child, a certificate from the Guardianship and Trusteeship Authority may be required, especially if the family sells one home and buys another.

- , which is ordered at the expense of the borrower from the appraisal company.

- The second document confirming your identity must be with a photo: driver’s license, international passport.

- A certificate from the place of employment confirming official employment and a document in form 2NDFL.

- If a citizen does not work officially, another document is provided confirming the availability of additional income.

- When providing the bank with property as collateral—a car or an apartment—you also need a document confirming ownership of the pledged object.

If for some reason the original document is missing or cannot be presented, photocopies are allowed, but they must be certified by a notary. In some cases, a bank employee requests additional documents in order for the mortgage to be approved, they must be presented.

Advantages of a mortgage at Otkritie Bank

The advantages of Nomos Bank include:

- Large selection of mortgage programs.

- Possibility of using a maternal certificate.

- Possibility of using a military certificate.

- The package of papers is minimal.

- If the income is below the established level or the work experience is minimal, then existing property can be provided as collateral.

- The housing loan is closed with annuity payments. The payment schedule is agreed upon with the client in advance, according to the client’s preferences.

Advantages and disadvantages

Each type of loan has its own pros and cons. In general, despite the opportunity to purchase their own home, people are afraid to take out mortgage loans because of their size - the minimum amount of 500,000 rubles can be repaid over 5 to 10 years.

However, most citizens have no other option to purchase their home other than taking out a mortgage, so they still have to take out a mortgage. In order not to feel severe disappointment, you should familiarize yourself in advance with the main pros and cons of this type of lending.

Advantages:

- A large number of different mortgage lending programs, the possibility of obtaining a loan using maternity capital funds, a military mortgage or with government support.

- A minimum, standard package of documents required to receive money.

- By providing collateral, you can get a loan, even if your income is below the minimum established by the bank, or you are missing several months of experience.

- Repayment is carried out in equal, annuity payments, the schedule is negotiated with the client in advance and is drawn up taking into account his preferences.

Flaws:

- Despite the fact that the annual interest rate is relatively low and amounts to about 14%, when receiving a large loan amount the overpayment is significant.

- Penalties will be assessed for delays.

- Not every client can get a “credit holiday,” therefore, when applying for a mortgage, you need to assess your strengths in advance.

Compared to other banks, the conditions offered by Nomos Bank and the Otkritie financial group are very loyal and profitable. A significant advantage is that even those citizens who were refused by Sberbank, VTB 24 and other organizations can get a mortgage.

Find out where you can get a mortgage for a new building in the article: mortgage for a new building. The features of SKB Bank's mortgage are discussed here.

Read about the features of mortgage refinancing at B&N Bank here.

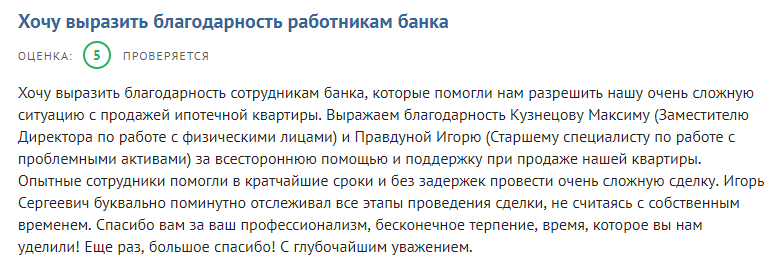

Customer Reviews

According to the Banki.ru source, Otkritie FC occupies 19th place in the national rating.

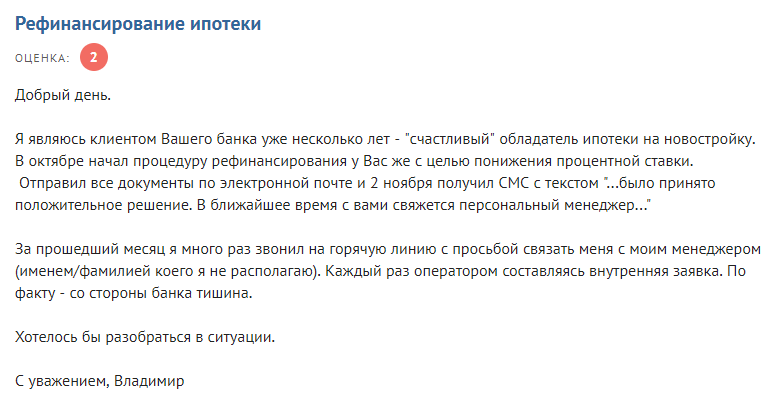

According to the majority, it is not recommended to refinance a home loan at Nomos Bank, since a lot of difficulties arise in solving this issue.

But there are also satisfied clients