With a population of about 10 million people, 10 thousand new residents come to the Czech Republic every year (excluding students). Last year alone, more than 30 thousand apartments were built here. The construction boom allows not only residents of the Czech Republic to purchase modern housing.

Citizens of any state can obtain a mortgage on mutually beneficial terms. Housing prices are constantly rising, foreign borrowers are offered more stringent tariffs, but it is still profitable and convenient to take out a loan for residential or commercial real estate here. To assess your chances, it is worth studying the conditions for its registration. Information is also available on banking websites.

Mortgage conditions for foreigners

Our compatriots can buy an apartment in the Czech Republic at an affordable price, since the conditions for local borrowers and the requirements for foreigners do not differ significantly.

Mortgages in the Czech Republic for Russians are favorably distinguished by:

- Differentiated approach to the borrower;

- Registration of purchased real estate as collateral;

- No penalties for refusing insurance;

- Loyal attitude towards foreign borrowers due to high competition.

A housing loan can be taken out for the purchase of an apartment or any other real estate, including commercial properties. Loan amount (in Czech crowns) – up to 70% of the appraised value of the property. There is a lot of affordable real estate here, which was built back in Soviet times. Banks do not lend to these objects, located mainly in small settlements - they are high risks.

The minimum loan amount is €20 thousand, but the lender also welcomes home purchases up to €50 thousand. They also issue a million euros (in Czech currency), but the terms of such a mortgage are unlikely to be standard.

Advantages and disadvantages

Obtaining a mortgage in the Czech Republic for Russians buying housing is associated with the following advantages:

- significant loan period;

- reasonable lending rates;

- the optionality of insurance for most financial institutions of a given state;

- the opportunity to purchase an apartment without a large one-time investment of your own funds;

- wide age limits and other advantages.

The disadvantages include an increased loan rate for borrowers who have not prepared documents allowing temporary or permanent residence in the country and the impossibility of obtaining a mortgage for the elderly, and the inevitable loss of time for concluding an agreement. However, the disadvantages of Czech mortgage lending do not pose any particular difficulties or problems when purchasing real estate in this way.

As can be seen from the presented material, it is not so difficult for a Russian to take out a mortgage loan to buy a home in the Czech Republic; moreover, this method of purchasing real estate here is characterized by favorable conditions for the borrower. Such a procedure will not last for several months. It is important that this opportunity is provided by the Czech branch of Sberbank.

Who can get a home loan

Bankers have standard requirements for foreigners:

- Age limits – 18-70 years;

- Permission for long-term stay in the Czech Republic;

- Positive account balance in any bank in the Czech Republic;

- Permanent employment and proven solvency;

- The desire to purchase both finished housing and housing under construction.

A normal credit reputation of the borrower is required. The best option for a mortgage applicant is employment in a Czech company with consistently high earnings, which are transferred to a bank account.

A residence permit (EU blue card) and permanent residence status can be an additional argument for the bank, since foreigners with similar privileges have the status of a person with the rights of a Czech citizen, including loyal mortgage conditions.

Housing prices in the Czech Republic are rising, and so are mortgage rates. After innovations that made it easier to obtain a mortgage, banks lost part of their stable income, which is why they raised tariffs. Experts argue that borrowers should be mentally prepared for a further increase in rates, but against the backdrop of Russian or European rates, Czech rates still look attractive.

Mortgage rates for foreigners

Non-residents in the Czech Republic can expect a rate of 4-5%. For Czechs, the conditions for a similar mortgage are 2-3%. As a result, the difference in housing costs is not so significant. Ultimately, the rate will depend on the amount, the duration of the contract and the category assigned to the client. The last parameter is related to the availability of Schengen, temporary residence permit, residence permit, as well as permission for long-term stay in the country. If you have a good relationship with the bank, in some cases it can reduce the rate to 1%.

Banks in the republic fix interest on housing loans every 3, 5, 7, 10, 15 years. The lock-in period is the time when the client can pay mortgage obligations without fees or penalties. During this period, you can close the debt or change the terms of the contract, as well as the fixation period.

The essence of this term is that the borrower, taking out a mortgage for 5 years, can repay the debt (in whole or in part) during this time. You must notify the bank one month before settlement. Interest for the use of money is recalculated in favor of the client.

An acceptable interest rate allows you to receive additional income from the purchased property. We are talking about renting out an apartment (officially). Rent in the country is such that it compensates for all mortgage costs.

Features of mortgages in the Czech Republic

Most foreign citizens, when purchasing real estate in the Czech Republic (Prague and other cities), want to take out a mortgage loan. This is explained not only by the insufficient amount of funds required for a one-time transfer of the full cost of housing, but also by the reluctance to withdraw money from circulation.

Mortgage lending in Czech is characterized by relatively low interest rates due to high competition between banks. Features of a Czech mortgage loan provide the following opportunities:

- extending the refund period to forty years;

- repayment of previously agreed terms;

- take out a loan without investing additional money from the client (due to the global crisis, this opportunity has been suspended for some time).

The size of the bets depends on the following factors:

- the duration of the payment period under the contract;

- for how long are loan rates fixed?

- level of risks, depending on the foreigner’s solvency and the ratio of the loan size to the collateral amount.

For how long can I apply?

In the Czech Republic they also try to arrange a mortgage for the maximum possible period for the client’s age. The maximum term of the contract can be obtained by the borrower at the age of 36 years, so that after 30 years at the time of the last payment he has not yet turned 67 years old.

Look at the same topic: Foreign currency mortgage borrowers - the latest news for today

Foreign borrowers are provided with a mortgage for 5-20 years, the upper age limit is the same. The period for paying off mortgage obligations will depend on the cost of the purchased home, the size of the down payment, and the financial capabilities of the client. According to statistics, our compatriots take out a housing loan for 10-15 years. During this time, the debt can be repaid without deteriorating the quality of your life.

Is it possible to do without a down payment?

Czech financial companies oblige foreign applicants to make a down payment of at least 30-40% of the value of the property (at market prices). For local residents the requirement is reduced to 10%. Without a down payment, only the most respected client can get a mortgage: with an impeccable financial reputation, known for his many years of successful cooperation with a particular bank.

The need for such a serious prepayment is explained by the tightening measures of banks' mortgage policy. In 2020, the Czech Republic canceled the issuance of 100% mortgages.

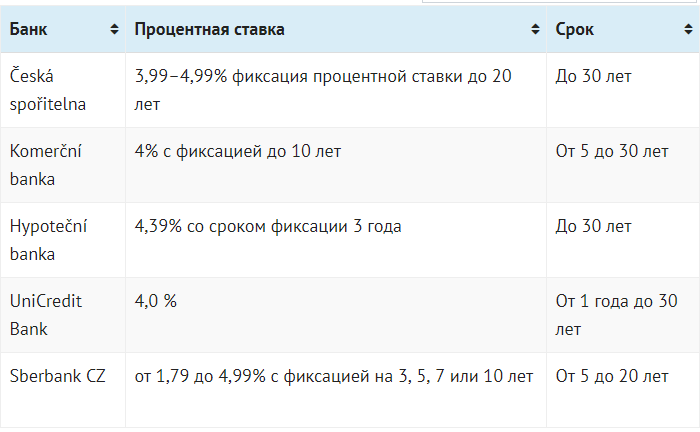

Which bank can I get a mortgage from?

Before submitting an application, applicants monitor offers from Czech banks and representative offices of financial companies from other countries.

Housing loans for foreigners can be obtained from Czech banks in:

- Raiffeisen Bank;

- Hypoteční banka;

- Fio Banka;

- UniCredit Bank;

- LBBW;

- GE Money.

Sberbank of Russia also has a Czech representative office - a subsidiary bank of Sberbank CZ; it is especially popular among compatriots, since the terms of mortgage and consumer loans here are more favorable than those of competitors. Persons who do not have permission to stay in the country for a long time can also apply for a loan. No other financial institution offers such privileges.

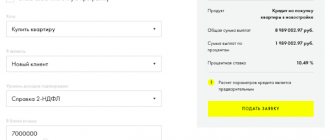

The credit limit for Russians in the Czech branches of Sberbank ranges from 100 thousand to 27 million crowns. The contract can be concluded for 5-30 years. The interest rate is fixed (4.99%).

In any of the listed banks, you can use the services of a financial consultant to clarify the terms of the loan and the necessary documentation.

Terms of a real estate loan in the Czech Republic

Czech banks are increasing the volume of mortgage lending every year.

And they are increasingly giving out loans to foreigners. In the first half of 2017, the country issued €4.6 billion in funds for the purchase of real estate, which is €727 million more than last year, which was also a record year. About 2 million people received loans. (The population of the entire Czech Republic is only 10 million.) To find out how a Russian can get a mortgage in the Czech Republic, you can read the current conditions that banks publish on their websites (many have English-language versions).

Pay attention to Hypoteční banka, GE Money, Fio Banka, UniCredit Bank, Raiffeisen Bank, LBBW. There is also a branch of the Russian Sberbank in the Czech Republic.

Banks provide local residents with more favorable conditions - lower interest rates, softer requirements for the borrower.

The ideal foreign applicant for the bank has permanent residence or a residence permit in the Czech Republic, is employed in a local company and receives a stable, high salary into an account in a Czech bank. But even if this is not the case (for example, you live and work in Russia and are not going to receive any residence permit in the Czech Republic), you can still buy an apartment in Prague with a mortgage.

Typical terms and conditions of real estate loans for foreigners

| Loan currency | Czech crown |

| Loan amount | Up to 70% of the assessed value |

| Mortgage term | 5-30 years |

| Borrower's age | 18-70 years |

| Loan repayment | Monthly, annuity or differentiated payments. Many products allow early repayment without penalty. |

What documents to prepare

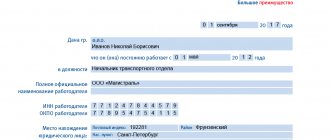

The better you can prove your financial solvency, the more favorable conditions they will be able to offer you. To do this, you need to prepare the documentation correctly and on time. The standard set of documents for a mortgage includes:

- Russian and foreign passports;

- Confirmation of your residence status in the state;

- Certificate 2-NDFL (at least six months) - for clients working in an enterprise, tax return - for individual entrepreneurs, bank account statement - if there is passive income;

- An extract from the Credit History Bureau about the state of your credit history;

- Documentation for housing (independent assessment, excerpt from the cadastre, purchase and sale agreement (preliminary is also possible);

- Application form.

Banks reserve the right to require other documents. Sometimes you are asked to provide an employment contract with the employer indicating its validity period. Ideally, this should be an indefinite period or at least the period until the end of the mortgage agreement.

The income of the borrower’s family is also taken into account, regardless of the country where it was received. The main thing is that the sources are confirmed. If you receive a stable income from renting out an apartment, you must provide an agreement registered with the Ministry of Justice of the Russian Federation.

A notarized translation of all loan documentation is required. The processing time depends on the complexity: an application for the purchase of a typical home will be considered faster than a metropolitan shopping complex.

Stages of obtaining a mortgage

The process of obtaining a housing loan in the Czech Republic consists of several stages:

- Selection of suitable housing. When choosing real estate, you can contact realtors, other intermediaries, and view advertisements on special resources. Czech banks finance the acquisition of both residential and commercial properties.

- Preparation of documentation. They begin collecting documents during the period of analyzing real estate market offers, since this process can significantly slow down the processing of a mortgage.

- Monitoring of offers from credit institutions. To choose the best option, experts recommend comparing offers from at least 5-7 banks. The rating of the financial company also matters.

- Signing the purchase and sale agreement. Before concluding a preliminary agreement, the client is obliged to inform the seller that he plans to pay for the housing using borrowed funds. Without his consent to this calculation option, it makes no sense to continue the process.

- Submitting an application to the bank. Credit institutions in the Czech Republic accept for consideration only a questionnaire filled out in person. A complete package of documents is attached to the application.

- Approval of the application and assessment of the selected housing. It takes 5-14 business days from submitting documents to making a decision by the bank. If the result is positive, the terms of cooperation and the parameters of a home loan are discussed.

- Conclusion of a loan agreement. If the parties have reached a consensus and the client meets the bank’s requirements, a date and time are set for concluding the transaction.

- Payment of the first installment. The borrower transfers the agreed amount to a special bank account. Cash is not used in such transactions.

- Registration of the agreement in the state cadastre. They submit a set of documents for registration and make a record of the encumbrance of the property.

- Final settlement. Even when concluding a preliminary purchase and sale agreement, a deadline is specified for the seller to receive the full amount for the property. If the specified deadlines are violated, the buyer will face fines.

Look at the same topic: New Federal Law “On Mortgage (Pledge of Real Estate)” - current edition [y]

Czech Republic: mortgage from Sberbank for foreigners

The number of foreigners who purchase real estate in the Czech Republic is growing every year. For example, last year more than a third of new apartments in the capital of the country were bought by citizens of other countries, while every fourth buyer used a loan. This is largely due to the fact that Czech banks currently offer the cheapest mortgages in history. In March 2013, the average rate on mortgage loans in the Czech Republic decreased once again and reached 2.93% (some banks give citizens of the Czech Republic or persons with permanent residence mortgages at 2.5%).

Low cost is an important advantage, but you still need to get a loan. From this point of view, Sberbank CZ is the only bank in the Czech Republic that provides Russian citizens who do not have permission for long-term stay in the Czech Republic with mortgage loans in the amount of up to 50% of the value of real estate for a period of 5 to 25 years. This article covers the conditions for obtaining and applying for a mortgage in the Czech Sberbank and explains who can get a loan to purchase real estate.

How to get a mortgage from Sberbank CZ

Any individual who is a resident of the Russian Federation between the ages of 18 and 70 has the right to apply for a mortgage loan from Sberbank CZ. Those who decide to take out a housing loan from Sberbank should keep in mind that a prerequisite for obtaining it is that the client has an official salary confirmed by documents, as well as at least a Czech tourist visa. Other conditions include:

- minimum wage or income in the Russian Federation: if you have a tourist visa - 150,000 rubles (estimated by the bank as 50% of the salary);

- if you have a residence permit/permanent residence permit – 100,000 rubles (estimated by the bank as 75% of the salary).

- no more than 4 applicants;

- minimum/maximum loan size – 1 million/7 million CZK;

- minimum/maximum term – 5/25 years from the date of signing the loan agreement;

- interest rate: + 0.5% to the standard rate of SBERBANK CZ for residence permit/permanent residence

- + 1.5% to the standard SBERBANK CZ rate for tours. visa

- fixation period – from 3 to 5 years.

It should be noted that Sberbank CZ provides loans to the following real estate objects: unfinished construction, private houses, cottages, ready for use and habitation, as well as land plots and other buildings for consumer use. For these purposes, the client is invited to use the product “Mortgage for a private House / Loan for the construction of a private House.”

To do this, the borrower must provide the bank with a land permit, building permit, urban planning information, and a house design. At the same time, the conditions for obtaining a mortgage remain the same as in the case of an apartment, that is, an applicant with a residence permit or permanent residence can receive a loan for real estate with an interest rate of + 0.5% of the standard rate of Sberbank CZ.

How to get a mortgage at Sberbank CZ

Before applying for a mortgage loan, you need to familiarize yourself with the various options for mortgage programs offered by Sberbank CZ. You can consult our agency about this, and only then, based on the program you have already chosen, you need to start collecting documentation.

The bank is provided with a full package of documents regarding the loaned property, as well as confirmation of income.

After checking the provided documents and receiving a positive response from the bank, an assessment of the acquired real estate is carried out. Then the client’s application is reviewed by the risk department, after which a purchase and sale agreement and a property insurance agreement are drawn up. The interest rate averages 4.5%.

For any questions, please contact our agency. This offer is valid for specific objects in new projects, for the purchase of which you do not pay us a commission.

If your dream is to buy real estate in the Czech Republic, then a mortgage from Sberbank CZ will be an excellent option even when you do not have a residence permit in the Czech Republic and the full amount to pay for it.

New buildings in Prague and Karlovy Vary here

Don't want to search? Take advantage - we will do everything for you online. The service is free. Just describe your application to us.

Timur Kashapov

How to pay off your mortgage

Mortgage obligations must be repaid monthly, according to an annuity or differentiated scheme; many banks also provide for early repayment of debt without additional fees.

Until 2020, early repayment of a mortgage was not encouraged in the Czech Republic: if such a procedure was necessary, the client was fined in the amount of 7-10% of all borrowed money. The possibility of early repayment was not even indicated in the contract.

In 2020, serious changes took place in the financial sector, according to which the client has the right to repay up to 25% of the debt amount once a year without penalties. In case of early repayment of the entire loan amount, the penalty is CZK 51.5 thousand.

Experts emphasize that in case of any financial difficulties it is impossible to “disappear from the radar”, since the creditor is forced to use the Notarial Protocol. With Czech bankers you can always agree on a deferment of up to 6 months or a certain period of time to pay only interest. The bank issues permission to the borrower to independently sell the collateralized housing.

Mortgage lending in Czech

The Western world is very different from Russia.

In our country, mortgage lending is in its infancy; the percentage of people turning to credit banks to purchase housing is only 10%. But in Europe, at least 40-50% of the population have taken out a loan secured by real estate at least once. Europeans are accustomed to living on credit. For them, a loan is not a debt pit, as it is for us, but a way to properly invest their funds and receive the benefits of civilization right now. Since the product is in demand, there is considerable competition among banks. To attract customers, credit institutions offer favorable conditions and low interest rates.

In the Czech Republic, there are rarely transactions where real estate is purchased for cash. It is easier and more profitable to take out a mortgage than to withdraw funds from circulation, so mortgage lending here will not surprise anyone.

Photo: https://pixabay.com/photos/city-sky-clouds-prague-1979892/

Features of Czech mortgage:

- low interest rate due to high competition among banks (2% -6% per annum);

- every 3, 5, 7, 10 and 15 years, interest is fixed, that is, the borrower repays debts without fees and fines, can pay off the debt in full or change the terms of the contract;

- Usually the loan term is 30 years, but sometimes it can be extended to forty years;

- early repayment is possible without commissions and additional conditions;

- the down payment is 20-30% (depending on the bank) and higher, since foreigners are included in the risk category;

- an individual approach is applied to each borrower;

- There is no compulsory insurance for mortgage real estate, but life and disability insurance will have to be provided;

- The bank will take a decision on a foreigner for at least two months;

- the minimum loan amount is from CZK 300,000, the maximum is without restrictions, but here the bank will carefully check the client’s solvency;

- Living space purchased with a mortgage can be officially rented out (the rent is quite high, so all debt obligations are repaid much faster);

- mortgages are not issued to those who hide their income;

- Having property in the Czech Republic does not give you the right to a residence permit.

As the demand for purchasing real estate in the Czech Republic grows, analysts assume that interest rates will increase and credit institutions will no longer take into account income received outside the country.