Bank Metallinvest

Metallinvestbank appeared on the Russian market in 1993 as a small regional bank serving metallurgy enterprises. Today it is a successful credit organization whose priority vectors of activity are:

- consumer and mortgage lending to private clients;

- car loans;

- credit and debit cards;

- insurance services;

- deposits;

- factoring;

- rental of safe deposit boxes and safes;

- depository services;

- foreign exchange transactions;

- brokerage services;

- trust management;

- IIS;

- Internet banking.

Metallinvestbank is among the TOP 100 largest banks in the Russian Federation and in 2020 ranks 68th in terms of the size of its own assets. The bank ranks 22nd in terms of the size of its mortgage loan portfolio.

Leading rating agencies Expert RA and ACRA assigned Metallinvestbank stable credit ratings (ruBBB and BBB+, respectively).

Key features of the bank’s work:

- restrained and conservative credit policy;

- a major focus on increasing the volume of services offered to the small and medium-sized business sector;

- close connection with OMK (United Metallurgical Company) enterprises;

- more than 40 offices and branches in Moscow, Belgorod, Nizhny Novgorod, Voronezh, Vladimir, Ivanovo, Novosibirsk regions, in the Perm Territory and the Republics of Chuvashia and Tatarstan.

Metallinvestbank mortgage programs: conditions

For private clients who need a solution to their housing issue, Metallinvestbank offers 7 existing programs:

- Loan for the purchase of housing under construction;

- Mortgage for ready-made real estate;

- Refinancing;

- Purchase of country real estate;

- Mortgage for the purchase of apartments;

- Mortgage Dom.rf;

- Loan secured by existing real estate.

Let us consider in detail the lending parameters for each of the listed programs.

Secondary

A mortgage loan for housing with already registered ownership is issued under the following conditions:

For Moscow and the Moscow region, individual mortgage parameters are prescribed, according to which the mortgage amount cannot be less than 500 thousand rubles. and more than 25 million rubles. In the regions you can get 250 thousand - 12 million rubles.

New building

The conditions for purchasing an apartment in an apartment building under construction with a mortgage from Metallinvestbank look like this:

- share of the down payment (% of the price of living space) – not less than 10;

- the amount of credit funds is up to 12 million in the regions and up to 25 million in Moscow and Moscow Region;

- The period for repaying the debt to the bank is no more than 25 years.

The program provides for the purchase of only real estate accredited by the bank.

IMPORTANT! You can clarify the list of objects approved and approved for purchase on the official website of Metallinvestbank, at any authorized service office or by calling the hotline.

For new residential complexes that have just begun to be built, individual approval from the bank is possible based on a thorough analysis of the developer company based on the documentation provided.

country estate

Under such a mortgage program, the borrower can purchase ownership of a house, his own cottage or townhouse with a plot of land.

The parameters for the maximum loan term and minimum/maximum mortgage amount will be standard - up to 25 years and no more than 25 million rubles. The main nuance of the product is the increased mandatory client contribution - it should not be less than 30% of the market price of the purchased property.

The collateral transferred to the bank must meet mandatory requirements regarding its location, the presence of year-round access roads, necessary communications, the absence of serious technical and cosmetic defects, encumbrances in favor of third parties, as well as the year of construction and the absence of registered persons and illegal alterations/extensions.

The land under the building must belong to the category of land of settlements/settlements.

Mortgage refinancing

Metallinvestbank provides all clients who wish to re-issue or refinance an existing mortgage issued with any other bank. Available refinancing terms:

Clients who are overdue for more than 30 calendar days in repaying their current mortgage debt to another bank and have a damaged credit history will be denied refinancing of such a loan. Mortgage loans with previously completed restructurings are also prohibited from being reissued.

Mortgage Dom.rf

Metallinvestbank is a reliable partner of AHML (retail brand - Dom.rf) in the implementation of mortgage programs with state participation. As part of this partnership, 5 mortgage products from Dom.rf are available to borrowers:

- Military mortgage;

- On-lending;

- Ready housing;

- New building;

- Loan secured by an apartment.

As additional options and services, repayment of the down payment with maternity capital (at least 10% of the property price), the “Easy mortgage” option (registration using two documents) and the purchase of apartments are available.

The minimum amount of credit funds is 500 thousand rubles, the maximum is 10 million in the regions and 20 million in Moscow and Moscow Region.

You can apply for a loan for up to 30 years with a one-time payment in the form of a down payment of 20%. Interest rates start at 8.75% per annum.

Loan secured by real estate

Metallinvestbank offers 2 options for such mortgage lending: issuing a loan secured by existing real estate for the purchase of housing or issuing a loan for repairs.

A targeted loan for the purchase of a residential property is issued in the amount of 250 thousand to 25 million rubles. In this case, the amount cannot exceed 80% of the estimated value of the mortgaged apartment and 50% of the mortgaged house.

The maximum amount of borrowed funds for a loan for real estate renovation should not exceed 3 million in the regions and 5 million in the Moscow Region and Moscow.

The loan term in accordance with the terms of the program is 1 – 15 years.

Apartment mortgage

Apartments can be purchased through a mortgage from Metallinvestbank on the following conditions:

- debt repayment period – from 1 to 25 years;

- maximum loan amount – up to 5 million rubles. in the constituent entities of the Russian Federation and up to 10 million rubles. in Moscow and the Moscow region;

- share of the first payment (as a % of the cost of housing) – from 10.

The bank allows the purchase of both ready-made real estate properties and those under construction.

A mortgage from Metallinvestbank without a down payment is available only under special programs with developers.

Additional aspects of some programs

Obtaining a loan to purchase a new home is only permissible for properties accredited by the bank. Others require permission, which can be obtained after analyzing the developer's activities.

Country property must have:

- Good location;

- Serviceable access roads;

- Normal state of communications.

The purchased housing cannot be encumbered or illegally redeveloped. The owner must have ownership rights to the house and land.

Metallinvestbank issues loans for the purchase of apartments both for finished properties and those under construction. The bank may exclude the down payment if there is a joint social program with the developer.

The DOM.RF format offers borrowers 5 types of mortgages:

- Military;

- For ready-made housing;

- For new buildings;

- Secured by an apartment;

- Refinancing.

A bonus is that clients have the opportunity to repay the loan with maternity capital. There is an easy mortgage option. It provides for the purchase of real estate by completing only two documents.

Real estate purchased with a mortgage loan becomes the property of the buyer, remaining a bank collateral until the borrowed funds are fully repaid.

Metallinvestbank provides clients with the opportunity to re-issue previously taken out loans on more favorable terms. This does not apply to borrowers:

- Having a bad credit history;

- Payments overdue for more than 30 days;

- Previously completed the refinancing procedure.

Look at the same topic: What is mortgage restructuring at Sberbank for an individual? What is needed for loan restructuring - conditions [y] year

A mortgage loan secured by real estate is issued in an amount not exceeding 80% of the appraised value of the property. Similar rules apply when lending costs for major or current repairs of real estate.

Interest rates may be reduced for employees of Metallinvestbank partner companies.

Knowing all the nuances, you can use a banking program to calculate how much a mortgage will cost.

Considering that there is no visual calculator on the Metallinvestbank website, you can calculate your mortgage by going to the portal of any bank. To do this, fill out a form indicating:

- Timing;

- Loan amount;

- Initial fee;

- Interest rate;

- Date of issue.

The rates of the Moscow Bank and its branches in the Moscow region differ from the lending conditions of other regions.

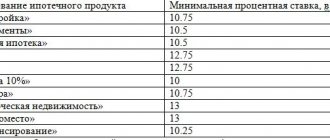

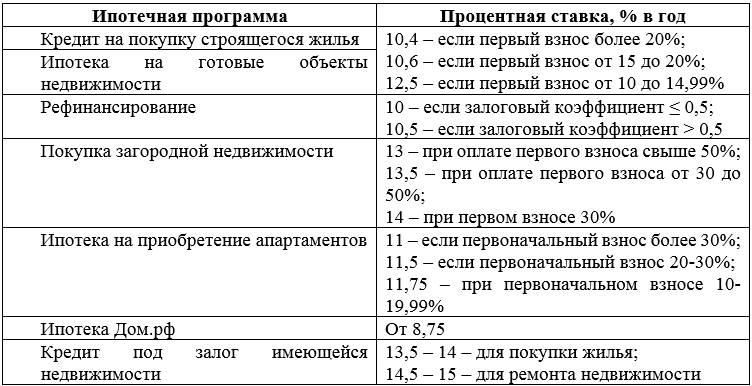

Interest rates of Moscow Metallinvestbank in 2020

The level of interest rates for mortgage products presented by Metallinvestbank is given in the summary table below.

The collateral ratio refers to the ratio of the loan amount to the estimated value of the collateral property.

NOTE! The mortgage interest rate can be reduced as part of the loyalty program for employees of reliable companies or partners of Metallinvestbank.

Allowances and additional options

The above lending rates are basic. Both premiums and small discounts can be applied to them. In particular, Metallinvestbank uses the following allowances:

- + 1 p.p. – if the client refused life and health insurance under any mortgage programs, except for the product “Mortgage secured by real estate for home renovation”;

- + 5 p.p. – if the borrower refused personal insurance under the real estate renovation loan program;

- + 3 p.p. – until the actual encumbrance of the collateral in favor of Metallinvestbank when refinancing the mortgage.

Also, when taking out a mortgage loan secured by real estate, borrowers can use the special “Your terms” option, which allows you to reduce the current rate by paying a one-time commission as a percentage of the loan amount.

There are 3 options available:

- S – you can get a discount of 0.5 percentage points. from the rate, while paying 1% of the mortgage amount;

- M – discount of 1 p.p. with a one-time payment of 2.5% of the amount of borrowed funds;

- XL – 1.5 p.p. discount upon payment of 4% of the loan amount.

Lending terms

The loan term for all offered products ranges from one year to 25 years. The minimum loan amount is 500 thousand rubles for Moscow and the Moscow region, 250 thousand for a regional network. The maximum amount is 25 and 12 million rubles, respectively.

An exception is a loan for the purchase of apartments. The minimum loan size for it is similar to all other programs, but the maximum possible loan is set at 10 million for Moscow and the region, 5 million for other branches.

As part of the promotion, Metallinvestbank issues a mortgage at 10.5% per annum. The promotion is carried out by a credit institution together with an established list of developers.

The loan can be issued for residential properties on the primary and secondary market, as well as for real estate that is at the development stage. The promotion is valid until March 31, 2020.

A loan secured by existing property is issued in an amount not exceeding 80% of the cost of the apartment serving as collateral, or 50% of the price of the residential building and plot. The cost is calculated using the services of an independent appraiser. The interest rate for purchasing a home with collateral will be increased by 0.5% if the applicant is an individual entrepreneur, owner or co-owner of a business.

For a mortgage loan for the renovation of a home issued against collateral, all conditions are similar to the previous one, with the exception of the maximum amount. If an apartment serves as collateral, then up to 70% of its market price is issued.

For all programs, with the exception of one, it is necessary to make a down payment of at least 10% of the value of the purchased property. For suburban real estate, a minimum of 30% of the property price is set. However, it is possible to do without an advance payment.

Metallinvestbank mortgage calculator

Loan amount

Payment type

Interest rate, %

Maternal capital

date of issue

Credit term

Early repayments

| date | Type | Amount/rate | |

Schedule

Table

| Term | 0 months |

| Sum | 0 rub. |

| Bid | 0 % |

| Overpayment | 0 rub. |

| Start of payments | 0 |

| End of payments | 0 |

| Required Income | 0 |

| № | date | Payment | Main debt | Interest | Balance owed | Early repayments |

The Metallinvestbank website does not provide a visual calculator for calculations for a housing loan. You can calculate your mortgage using our mortgage calculator, which in a simple and visual form (graphics and tables) will present the information necessary to make a decision on the advisability of applying for a loan.

By filling in the key parameters of a mortgage loan (term, amount, down payment, interest rate and date of issue), the user will be able to estimate the final overpayment for the entire loan term, the amount of the monthly payment and the required level of income.

How to pay off a mortgage

There are several loan repayment options available. This can be done either in cash through the cash register or by transfer using:

- Credit account;

- Transfers from other banks;

- Communication salon “Svyaznoy”;

- Client – banking;

- Deductions from wages;

- ATMs;

- Mail.

See on the same topic: Mortgage insurance at SOGAZ JSC in [y] year

Metallinvestbank allows early repayment of borrowed money. The partial amount must be paid by the date specified in the agreement. The full calculation can be carried out using any number. The only condition for this is advance warning to the creditor of the intention (5 days in advance). After which an application for early repayment is filled out.

The form can be downloaded here application https://drive.google.com/file/d/1rq0eEQo97Xy-A7ZT7hA463cdVhLC_0DM/view.

In case of early partial repayment, the monthly installment is recalculated. Early full repayment of the borrowed amount makes it possible to receive overpaid interest rates and loans.

Individuals have the right to refinance a previously taken out mortgage both in this bank and in others.

Requirements for the borrower

Standard requirements for potential clients include:

- Russian citizenship.

- Age – from 18 to 65 years.

- Full legal capacity.

- Registration in the Russian Federation (permanent or temporary).

- Minimum work experience in the current job is at least 4 months. (total experience must be more than 12 months).

- Sufficient solvency.

At its discretion, Metallinvestbank has the right to pursue a loyal policy towards employees of partner companies and mitigate the specified requirements.

Mortgage conditions with state support at Metallinvestbank

State support in this situation is aimed at young families with children. The conditions of a mortgage with state support at Metallinvestbank are fixed at the legislative level, so the bank cannot change them in any way in its favor.

The current program applies to families in which the second, third and all subsequent children were born. Valid from January 1, 2020 until December 31, 2022. At the same time, the possibility of extending the state program is not excluded.

Financing of transactions is carried out at a low interest rate of 4.8%. This is the minimum offer on the market at the moment. At the same time, the minimum down payment is only 20%.

Under such conditions, residents of Moscow, the Moscow region and St. Petersburg can receive from 500 thousand to 12 million rubles. For residents of other regions, the restrictions are different - 250,000 - 6,000,000 rubles. In this case, the size of the maximum loan amount in each case is determined by the selected property - it cannot be more than 80% of the cost of the selected housing.

To complete the transaction, the client is required to register a deposit for the purchased apartment. This must be done within a specially designated period after all documents have been completed. If the choice fell on real estate in a house under construction, then the right of claim of a participant in shared construction acts as collateral at the initial stage.

It is worth noting that when working under this program, the bank considers purchasing an apartment only from legal entities or developers. At the same time, the following persons cannot act as sellers in this situation:

- individual entrepreneurs;

- investment funds;

- investment fund management companies.

When applying for a mortgage loan with state support from Metallinvestbank, the client must take out an insurance policy related to the risk of loss of property. If desired, to increase self-loyalty, he can additionally take out insurance for his own health and ability to work.

To refinance a loan taken from another banking organization, the following conditions must be met:

- the loan is more than six months old;

- there are no overdue payments or debts that are at least six months old;

- No restructuring was carried out for the current loan.

All conditions for this program are transparent and understandable to any client. Metallinvestbank has not been found to engage in fraud or include hidden clauses in contracts that negatively affect the profitability of the loan for clients.

There are also criteria that apply personally to potential borrowers. You can get a mortgage loan under this program only if you meet them.

The list of criteria is as follows:

- the second or any subsequent child should have been born in the family later than January 1, 2020;

- Metallinvestbank considers only citizens of the Russian Federation as borrowers;

- The minimum age of the client is 18 years, and at the end of the contract the borrower must be no more than 70 years old;

- the hired worker must have a total work experience of at least 12 months and at the current place of work for at least 4 months;

- individual entrepreneurs and owners of their own businesses can also count on mortgage lending under this program, but the duration and activity must be at least 2 years;

- a spouse must act as co-borrowers on such a loan; in total, up to 4 people can be involved (must be relatives).

These criteria are standard (except for the birth of a second and subsequent children, this is a mandatory condition for the state program), they are used in all Metallinvestbank mortgage products.

Package of mortgage documents

The basic set of papers required to submit a mortgage application includes:

- questionnaire;

- passport of a Russian citizen;

- copy of the work document;

- certificate 2-NDFL or according to the bank form on income for at least the last six months;

- document on marital status, marriage contract (if any);

- children's birth certificate;

- documents for the pledge (title + assessment report).

Additionally, you may be required to present a pension certificate, employment contract, SNILS, military ID, TIN, documents on education, property owned, etc.

Decor

In order for the mortgage process to proceed as quickly as possible, you should adhere to a certain algorithm of actions:

- Choose a suitable mortgage program.

- Submit the application and all necessary documents to the bank.

- Wait for the decision of the financial institution to issue a loan.

- Find suitable housing.

- Agree on the selected property with the bank.

- Pay the down payment (if applicable).

- Prepare title documents for the living space.

- Sign a loan agreement with the bank and register a deposit.

- Transfer the remaining cost of the home to the seller's account.

Required documents

In order for Metallinvestbank specialists to consider an application for a housing loan, the following documents are required from borrowers:

- client application form;

- a statement indicating the borrower’s consent to the bank receiving information about him from the credit history bureau;

- passport;

- in the absence of permanent registration - a temporary registration document;

- a copy of the work record book and/or employment contract certified by the employer;

- income certificate;

- on attitude to military service - for persons subject to conscription;

- about marital status;

- marriage contract (if available).

In addition to the above documents, to confirm the appropriate level of solvency, the client can submit to the financial institution certificates confirming the availability of liquid assets and additional sources of income.

After the bank approves the mortgage application, the client should prepare the documents necessary to agree with the financial institution on the real estate that will be the subject of collateral:

- independent appraiser's report;

- extract from the Unified State Register of Real Estate;

- title documents for housing;

- technical passport, etc.

How to apply

Submitting an application for a mortgage at Metallinvestbank is carried out through the website or at a bank branch engaged in mortgage lending.

To submit an online application you must fill out:

- purpose of lending;

- real estate price;

- the amount of the down payment;

- debt repayment period;

- social status;

- Family status;

- monthly earnings;

- the amount of payments for all existing obligations;

- FULL NAME.;

- contacts;

- Convenient bank branch.

After filling out this form, a Metallinvestbank employee will contact the borrower to clarify the conditions for obtaining a mortgage and an invitation to the selected service office to sign the application and submit a set of papers.

In order to apply for a mortgage online at Metallinvestbank and other banks, it is enough.

Current conditions

The mortgage product market has been quite loyal to borrowers in recent years. There is no exception to the mortgage at Metallinvestbank, the terms of which are presented in the table.

| The name of the program | An initial fee, % | Loan term, years | Loan amount, thousand rubles. |

| "Mortgage loan" (promotion) | From 10 | Up to 25 | Moscow and region: 500-25000 |

| Regions: 250-12000 | |||

| "No down payment" | From 0 to 9.99 | Up to 25 | Moscow and region: 1500-8000 |

| Regions: 1000-3000 | |||

| “For the purchase of finished housing” | From 10 | Up to 25 | Moscow and region: 500-25000 |

| Regions: 250-12000 | |||

| “For the purchase of housing under construction” | From 10 | Up to 25 | Moscow and region: 500-25000 |

| Regions: 250-12000 | |||

| “For the purchase of country real estate” | From 30 | Up to 25 | Moscow and region: 500-25000 |

| Regions: 250-12000 | |||

| "Secured by real estate": | From 20 | Up to 15 | Moscow and region: 500-25000 |

| for the purchase of residential real estate | Regions:250-10000 | ||

| for repair | From 30 | Up to 15 | Moscow and region:500-10000 |

| Regions: 250-3000 | |||

| "For the purchase of apartments" | From 10 | Up to 25 | Moscow and region: 500-10000 |

| Regions: 250-5000 |

"No down payment"

This lending program is aimed at purchasing apartments both in new buildings and on the secondary market. Its terms allow clients who do not have sufficient savings to make a down payment to take advantage of the mortgage. A long loan term allows you to develop a convenient debt repayment schedule without significantly burdening the borrower’s budget.

Review period

A standard application that does not involve receiving assistance from the state, refinancing or obtaining a Dom.rf mortgage is considered by Metallinvestbank within 4-7 business days.

Employees of the bank's partner companies can count on the minimum time to make a decision on a mortgage application due to a reduced package of papers and a loyal attitude towards this category of borrowers.

When applying for a loan from Metallinvestbank with the participation of Matkapital, the transaction may take 3-5 weeks, since the Pension Fund allocates a calendar month for approval and transfer of funds.

Advantages of a mortgage with state support at Metallinvestbank

All borrowers already cooperating with the company note the individual approach of the organization’s specialists. This allows us to come to an optimal mortgage solution, tailored to all the characteristics and capabilities of the borrower.

Efficiency of work also comes first. Typically, office managers review the initial application within a few hours. This speed allows a potential client to quickly begin collecting the necessary documents to obtain a mortgage loan.

Even if a person has no experience in economic issues, the company specialist assigned to him will help solve all difficulties. The duties of the employees include prompt consultation of borrowers and assistance in selecting the optimal product.

The main advantages of working with the organization include:

- low interest rate on mortgages with state support at Metallinvestbank;

- the down payment starts from 20% of the cost of the selected object;

- the company cooperates with a large number of large developers, which opens up a large selection of real estate for the client;

- it is possible to refinance the current loan under the terms of the program with state support (if the basic requirements are met).

To ensure the high quality of Metallinvestbank’s service, just read the reviews on the Internet. They are on all major sites and are mostly positive in nature.

What to do after approval

After the application is approved:

- the client selects a property to purchase;

- concludes an agreement with the seller, which should specify the procedure and terms of payment;

- purchases an insurance policy;

- signs a loan agreement with a payment schedule;

- pays the down payment amount specified in the contract.

After this, the transaction is formalized in the Registration Chamber or the MFC (an encumbrance is placed on the housing) and the bank transfers the remaining money to the seller’s bank account.

Actions of the applicant after approval by the bank

When a positive verdict is reached, the borrower can:

- Select a property;

- Conclude a purchase agreement;

- Sign a loan agreement with the bank;

- Make a down payment;

- Register an encumbrance for the purchase at the Registration Chamber or the multifunctional center for state and municipal services (MFC).

When obtaining a mortgage, one of the main conditions is insurance of the purchased property. This procedure minimizes the risks of the parties to the transaction in the event of loss or damage to the collateral.

If desired, the borrower can insure his health and life, which will have a positive effect when determining the interest rate.

Insurance is valid only in companies accredited by the bank.

Insurance

The obligatory type of insurance when applying for a mortgage at Metallinvestbank is only property insurance, which is designed to minimize the risks of the parties in the event of loss or damage to the collateral.

The client's health and life insurance, as well as title insurance, are purchased solely at the request of the borrower or in order to avoid premiums on the base interest rate.

An insurance contract can only be concluded with an insurance company accredited by Metallinvestbank.

Metallinvestbank – mortgage refinancing

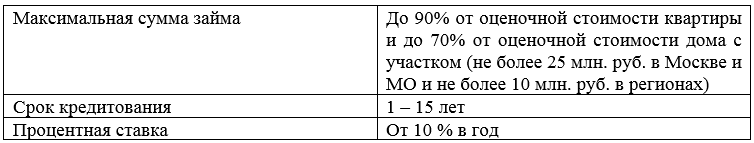

Clients are invited not only to take out a mortgage from Metallinvestbank, but also to refinance their existing loan. In this case, the following conditions should be taken into account:

- the maximum amount for the capital is 25 million, for the regions – 10 million;

- the loan amount cannot exceed 90% of the cost of the apartment and 70% of the price of the country house;

- debt repayment period is limited to 30 years;

- when receiving a loan in the amount of more than half the value of the property, and up to 80% of the value - the rate will be 10.5%;

- if a client needs to take out a loan for an amount less than half the cost of housing, the interest rate is 10%.

The remaining requirements and conditions are standard. People who have not been in arrears and who have been regularly paying off their debt for at least a year can apply for refinancing and receive funds. In addition, they must be Russian citizens living in the region where the bank (branches) are present.

Pros and cons of a mortgage at Metallinvestbank

The key advantages of a mortgage at Metallinvestbank are:

- many mortgage programs;

- serious loan amount (up to 25 million rubles);

- the possibility of obtaining a loan for renovation of real estate;

- implementation of programs from Dom.rf;

- Credit cards less than 50,000 rubles are not taken into account;

- loyal attitude towards small delays;

- loyal attitude towards employees of partner banks.

Minuses:

- limited loan period (only 25 years);

- interest rates are slightly higher than the market average;

- refinancing only for a period of up to 15 years.

Rates

A mortgage from Metallinvest is characterized by an affordable fee for the use of borrowed funds. The rate depends on the size of the down payment. For convenience, the established interest rates are presented in tabular format.

| Program name | Down payment amount, % | Bid, % |

| Mortgage loan 10.5% | from 10 5-99.9 | 10 10,5 |

| For the purchase of finished housing | 10-9,99 | 11.75 |

| 20-30 | 1.5 | |

| from 30 | 11 | |

| For the purchase of real estate under construction | 10-19,99 | 11.75 |

| 20-30 | 11.5 | |

| from 30 | 11 | |

| For the purchase of housing outside the city | from 30 | 14.0 |

| 30-50 | 13,5 | |

| from 50 | 13 | |

| Mortgage secured by real estate for the purchase of housing | up to 50 | 13.5 |

| from 50 | 14 | |

| Mortgage loan for renovation secured by property | up to 50 | 14.5 |

| from 50 | 14,5 | |

| For the purchase of apartments | 10-19,99 | 11.75 |

| 20-30 | 11.5 | |

| from 30 | 11 |