What laws govern mortgage loans?

But federal law 102-FZ is far from the only one that needs to be taken into account when mortgage lending. Yes, it contains the most basic points and everything you need to understand the essence of the issue, but there are also other regulations that also need to be taken into account:

| Law | Short description |

| 188-FZ | On the use and management of residential premises. |

| 122-FZ | The need to register transactions. |

| 51-FZ | General information about loans. |

| 218-FZ | About credit histories. |

| 117 | About military mortgage. |

| 1050 | About the “Young Family” program. |

| 63 | On liability for illegal actions. |

Requirements for drawing up a mortgage agreement

Each bank, when drawing up a mortgage agreement, must be guided by laws and regulations in the field of the civil code and the Federal Law “On Mortgage”. When drawing up a mortgage agreement, the following conditions must be met:

- Correct drafting of a mortgage agreement. The text of the contract must include the subject of the transaction, its estimated value, and the delivery date.

- Mandatory registration of the agreement with Rosreestr. If the parties do not complete the registration procedure, then their mortgage transaction will be considered void.

- Informing the mortgagee about the rights of other persons to the subject of mortgage. If the mortgagor does not inform the mortgagee about the possible rights of third parties to the subject of the mortgage, then the bank has the right to change the terms of the transaction or initiate early fulfillment of the borrower’s obligations.

Look at the same topic: What is a military mortgage and who is entitled to it? Conditions for obtaining a military mortgage in [y] year

What does Federal Law 102 say about mortgages?

Despite the fact that in order to fully understand the essence of a mortgage and all the features associated with it, you need to study all the documents presented above, the main thing you need to know is Law No. 102-FZ

.

Basic provisions

The first chapter of the Mortgage Law is divided into seven articles. In the first one you can learn about the grounds on which a mortgage arises and how it is regulated. Among the main provisions, it is worth highlighting that the collateral, which is security for a mortgage loan, must remain in the use of the owner and is not transferred to the bank. In addition, either the debtor himself or any other person can provide his property as collateral if there is an appropriate agreement to do so.

The second article talks about emerging obligations. Some important features are not indicated here, everything is quite obvious. In the next, third chapter, the law talks about the requirements secured by a mortgage: that after transferring the property as collateral, the borrower must receive the agreed amount for it. It must either correspond to the value of the property or be lower than it.

The fourth article states that if the bank is obliged to bear the costs of maintaining the pledged property instead of its owner, then the costs incurred can be compensated from the property.

Typically, an additional amount is added to the existing debt.

The fifth article lists the property that can act as collateral

:

- Earth.

- Apartments.

- Houses (including garden houses).

- Transport (land, water or air).

The sixth article is devoted to the very right to pledge property. The limitations and features of this operation are indicated. And finally, the seventh chapter talks about exactly how an object should be pledged if it has several owners. In such a situation, the consent of absolutely all owners is mandatory. However, if the object is in common shared ownership and part of it can really be separated and clearly defined, then the consent of all owners is not required.

Banks are extremely reluctant to accept only a share in real estate as collateral

, since it is extremely difficult to sell it later, since it is necessary to take into account the pre-emptive right of other owners of the property. However, such property can be successfully accepted as additional collateral. In this case, the terms of the contract and the financial situation of the borrower are of great importance. For some people, banks make significant relaxations and concessions. The main thing for them is to clearly see that the person is able to repay the loan.

Conclusion of an agreement

The second chapter is entirely devoted to the peculiarities of concluding mortgage agreements. This lists the basic elements of the document and the rules to follow. The annexes and features of their accession to the agreement are separately specified.

Describes the requirement for document registration and the exercise of rights/responsibilities listed in the agreement between the parties.

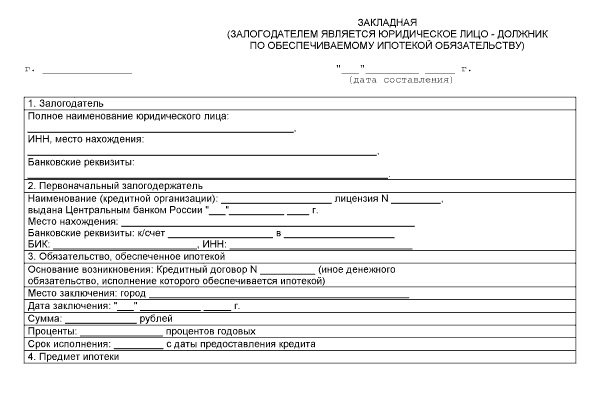

Mortgage

The third chapter describes the features of drawing up a mortgage. In most cases, this is part of the mortgage agreement, but the law distinguishes this concept separately. The articles in this chapter largely copy the information from the previous section.

State registration of a mortgage loan

The fourth chapter of Law 102-FZ talks about exactly how state registration of mortgages should occur. Here you can get information about how exactly the procedure itself should be performed, how you can change or delete data and how much it will cost (state duty). It should be noted that articles 21, 27 and 28 of this chapter have already lost force and cannot be referred to.

Ensuring the safety of property

In the fifth chapter you can find out:

- How the owner can use the collateral

. It must be taken into account that any restrictions present in the contract that relate to the use of property are automatically considered void. Moreover, the owner has the right to use the mortgaged property to generate income (for example, rent out an apartment). - How and at whose expense the repair and maintenance of the facility is carried out

. Unless the mortgage agreement states otherwise, all such costs are borne by the mortgagor. Moreover, neglect of its duties may give rise to the bank's right to demand early repayment of the debt. - On the features and obligations of insurance of pledged property

. The bank client is obliged to insure the property at his own expense for a value not less than the current debt. In some cases, the bank additionally requires life insurance, but this is no longer a mandatory requirement. If the borrower defaults on his obligations, the bank will most likely demand early repayment. - What measures can be taken to protect such property from the actions of third parties, natural disasters or other similar problems.

- That the mortgagee has every right to inspect the mortgaged property.

- What rights does a bank have to ensure its interests?

- About the possible consequences of loss or loss of property.

Transfer of rights to property

This is the name of the sixth chapter of the law, which talks about exactly how the transfer of rights to mortgaged property can be carried out. You can immediately learn about the consequences of such actions, as well as about the forced option of transferring property, which is especially relevant in the case of the subsequent sale of the collateral to pay off the debt.

Subsequent mortgage

The seventh chapter is devoted to the possibility of registering the same object as collateral under several loan agreements. It describes the features and priority of debt collection if such a situation arises, as well as which mortgage options can be declared invalid.

In the latter case, the option is to register as collateral an object that is already collateral, bypassing the existing ban.

Assignment of rights

The bank receives the right and opportunity to assign its rights to the collateral, unless otherwise stated in the agreement concluded with the debtor. In this case, the obligation to pay the debt itself may or may not be transferred. The parties can agree on this separately. You can also transfer the rights to the mortgage. To do this, it is enough to enter the new owner on this document.

Foreclosure of property

If the debtor does not fulfill his obligations or violates the agreements reached, the bank has the right to sue him, take away the collateral and sell it, thereby reimbursing all its expenses and returning the amount of the debt. It should be noted that in such a situation, the amount received is not always enough, and the bank has the right to demand that the borrower pay the balance of the debt.

Sale of pledged property

If the bank decides to sell the debtor’s property, it can do so either with or without the latter’s consent. In the first case, the parties can come to an agreement that suits them and sell the collateral in a way that is convenient for everyone. In the second case, the only possible option is bidding. The bank arranges an auction at which the minimum possible price of the property is indicated. If no one has expressed a desire to purchase the property, then the price is reduced.

Features of land mortgages

Land can be pledged, but only on the condition that there are no restrictions on this. Moreover, it is possible to pledge the rights to lease a plot, but only for the duration of the lease agreement and provided that the lessor agrees with this. Otherwise, the land will not be able to be used to obtain a mortgage loan. It should be noted that when registering a private house as collateral, the land under it is mandatory to be pledged.

Features of enterprise mortgage

If a building (office, industrial complex, workshop, warehouse or other similar objects) belonging to a legal entity is pledged, the land under it must also be pledged. The exception is situations in which a legal entity has not registered ownership of the land and uses it on a lease basis. In the latter case, the lease right is transferred as collateral and, if necessary, the new owner is obliged to obtain the same rights to the land as the previous one.

Features of mortgages of residential buildings and apartments

Households or apartments can become the subject of collateral if there are no restrictions. For example, if the apartment is the property of a disabled person or a minor, then you must first obtain permission from the guardianship authorities to transfer the property as collateral. Part of the residential premises may be pledged if they are allocated in kind, but premises owned by the municipality or the state (non-privatized) cannot be pledged.

Final provisions of the law

Law No. 102-FZ has been in force since its adoption. The same applies to all changes made to the document. It should be borne in mind that all clauses of the law apply only to those contracts that were concluded after its adoption. This also applies to all changes made. That is, if the mortgage agreement was concluded according to the rules that were relevant as of 2020, it does not need to be redone to comply with all emerging innovations.

Subsequent mortgage process

First of all, you need to obtain consent from both banks for a subsequent mortgage, taking into account the selected loan program. If the procedure for refinancing loans has already been established, then other types of loans may not require subsequent collateral at all (). This issue should be clarified with the bank where you want to apply for a new loan.

Recommended article: Mortgage with friends – nuances, pros and cons

How is a transaction followed by a real estate mortgage carried out:

- Choose a bank and a lending program that allows you to re-register the collateral.

- Obtain the new lender's approval and the mortgagee's consent to the subsequent mortgage.

- Collect a package of documents for real estate and submit it to the bank for verification.

- If the result of the review is positive, sign the loan documentation and submit it for registration to Rosreestr. Some banking institutions allow you to do this right in your own office, but for a fee.

- At the same time, loan funds are issued. If you take out a loan to refinance, you must immediately use the money to pay off the original loan. A consumer loan does not require closing the existing mortgage; the funds received can be spent at your own discretion.

- When refinancing, after a couple of days you should check that the current debt has been closed. When the mortgage is repaid, order a certificate of fulfilled obligations to the bank and the original mortgage note (if it was previously issued).

- Submit an application for removal of the encumbrance. You will likely need to have a representative of the bank - the primary mortgagee - present. The right of subsequent mortgage must already be registered with Rosreestr, so the subsequent mortgage is imposed automatically.

- Upon expiration of the registration period, the borrower receives an extract from the register of real estate rights. It should already contain an encumbrance in favor of the new creditor.

If the borrower is married, the consent of the spouse will be additionally required to apply for a mortgage. The fact is that not only their property, but also their debts are joint.

Please note that a certificate of consent for a subsequent mortgage from the first bank is a mandatory document. It is attached to the package of papers and confirms the legality of the transaction. A sample consent for a subsequent mortgage should be taken from the organization where you are applying for a new loan. According to the terms of the loan, the document may contain various information. Usually it is required to indicate the details of the mortgage agreement, the characteristics of the collateral, the amount of debt at the moment, the presence of overdue debt and the quality of repayment.

Recommended article: Mortgage under an equity participation agreement secured by rights

If the text of the loan documentation for the primary mortgage does not contain any restrictions regarding subsequent collateral, you should go to a bank branch and order permission for the transaction. At the same time, the mortgagee has every right to refuse to issue you such a certificate. As a rule, it is drawn up by the legal department, which may see certain risks in the subsequent mortgage.

In this case, you must be given a written response justifying the decision. There are likely certain legal restrictions that allow the primary lender to refuse. But banks usually do not prevent debt refinancing with another organization.

Changes in the mortgage law 2017-2018

During 2017-2018, several changes were made to Law No. 102-FZ. Let's look at their main features:

Changes within the framework of the adopted law No. 141-FZ of July 1, 2017 affected the registration of a mortgage simultaneously with the execution of a purchase and sale agreement, which facilitated the lending option in which the same real estate that would be pledged was provided as collateral. A separate article also appeared related to the renovation program in Moscow.

On November 25, 2017, another law No. 328-FZ was adopted, according to which the parties were able to enter into pledge agreements even if the fact of the pledge itself arose on the basis of other documents. Other changes

:

- Article 4 of the law specifies who exactly bears the costs and for whom.

- It is no longer possible to pledge space objects.

- Art.6. It is clarified what kind of property can be pledged.

- Art.9. Minor changes have been made to improve understanding of the text.

New features of registration of a mortgage agreement in Law 102-FZ

In order for a document to have legal force, it is prepared in a single copy and registered in the state Rosreestr , which checks all points of this document for compliance with the laws of the Russian Federation.

The loan agreement must be registered with Rosreestr.

In order to avoid controversial issues, when drawing up an agreement and signing it, it is necessary to indicate only truthful information about the pledge.

If it suddenly turns out that there are other applicants for the mortgaged living space, the lender, according to the law, has every right to demand payment of all loan funds ahead of schedule.

The application and agreement are supplemented with a mortgage on the mortgaged property and other documents appearing as appendices. When applying for a mortgage, the mortgage is a security that must be submitted to the registration chamber.

Sample note when applying for a mortgage.

Typically, participants in the registration procedure use the services of a notary to obtain certified copies of the transaction agreement, which may be needed when resolving controversial situations.

The registration procedure is as follows:

- Submitting an application from one of the parties or the notary who certified the mortgage agreement (no state fee is charged for this process).

- The state body registering the agreement enters into the database information about the mortgagee , which is presented in the agreement.

When the mortgagee changes, data about the new participant is entered into Rosreestr based on the application submitted by him.

Useful video:

Process deadlines specified in the mortgage law

Depending on the type of real estate that acts as collateral, the registration procedure has different processing times:

- Residential property – 5 days.

- Non-residential stock : land plots, buildings, commercial and industrial real estate - 15 days.

- Other objects – up to 1 month.

If the pledge agreement is notarized, the entire procedure can be reduced to 5 days, but no more.

What can interfere with the deal and how to make adjustments?

In fact, there are many reasons for the failure of an operation. But the decision to suspend the deal must come from all participants in the process.

According to Article 20 of Federal Law No. 122-FZ, the registration chamber may refuse to enter data into the state register, but this requires a good reason. If there is one, then the parties to the transaction must be properly notified about it.

You can find all the necessary information on the Rosreestr website.

All adjustments for obtaining a mortgage are made only at this stage. Along with this, if a mortgage was issued at the time of the transaction, then making any changes is unacceptable.

The registration process is suspended for up to one month to eliminate all shortcomings and comments. After all issues have been resolved and the necessary amendments have been made, you can send a new request for registration of the contract.

Record of registration of pledge

After completing the registration procedure in Rosreestr, a special mark indicating the completion of registration is affixed to all documents (agreement, mortgage note, certificate of ownership).

After registration, Rosreestr puts a similar mark and seal on each document.

In the register itself, an entry is made that includes information about the holder of the pledge, the object of the mortgage, the cash equivalent of the obligations on the loan secured by the pledge and a note about the execution of the mortgage.

The process of removing mortgage encumbrances

A registration entry on the existence of obligations confirmed by a pledge can be redeemed only when the following cases occur:

- Providing a statement and a mortgage note from the mortgagee with a visa stating that the obligations under the mortgage loan have been fully fulfilled by the borrower .

- A court decision to terminate a mortgage.

- In the case of a military mortgage - provision of an application from the executive authority that controls the functionality of the savings-mortgage system.

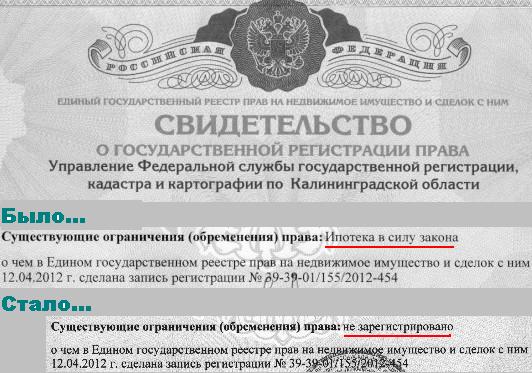

A sample Rosreestr entry in the Certificate of Property after paying off the mortgage.

New mortgage law

At the moment, the government does not yet plan to repeal the current law and create a new one, because the existing system works quite effectively and fulfills its functions. However, quite significant changes will be made to Law No. 102-FZ. In particular, from July 1, 2018, many new articles on electronic mortgages will come into force. The new system will make the process of processing documents somewhat easier, since a significant part of the actions will be transferred to the State Services website.