Before contacting the bank, you need to find out what terms of the mortgage loan are most beneficial for the borrower. This is necessary in order to calculate how much you will have to overpay later. After all, no one wants to throw away their hard-earned money when it comes to fairly large sums.

A mortgage always confuses its recipient. There is an internal fear that this will last for a long time and whether there will be enough strength and resources to pay the bank in full. However, for most people this is the only way to get decent housing in the shortest possible time.

One axiom applies to all cases. As the loan terms increase, the overpayment increases. Therefore, it is necessary to understand in detail.

Factors influencing the term of a mortgage loan

Mortgage repayment terms are determined individually for each financial institution client. The conditions set by banks for lending periods may be affected by several circumstances.

The term of the mortgage loan set by the financial institution may, for some reasons, be either increased or decreased. Let’s look at what bank requirements the loanee must meet in order:

Depending on the age of the loan recipient

It should be understood that the bank, when issuing a large cash loan, takes a significant risk. Therefore, age differences are determined by which the period of the mortgage loan is determined.

Let’s say for a twenty-year-old borrower, when his working life has just begun, these terms may be the maximum. In this case, the borrower of retirement age can only count on the minimum period for issuing a mortgage.

Most often, banks also set a lending threshold. It usually ranges from 21 to 65 years. However, some financial organizations, like Sberbank, raise this bar to 75 years and, conversely (Otkritie Bank) lower it until adulthood.

Borrower's ability to bear the loan burden

The financial institution must carefully examine the potential borrower’s documents confirming his regular income. Depending on the amount of this income, conditions will be selected for the long-term or, conversely, short-term duration of the mortgage issued.

If the recipient of the loan is married and the spouse also has a regular income, the bank’s confidence in this case increases, which affects the profitability of the loan terms.

Price of purchased property

As you know, a mortgage is repaid monthly in equal or differentiated payments. Accordingly, these contributions directly depend on the price of the property. Based on the calculation of monthly payments, the optimal loan repayment period will be selected.

The fact is that the monthly payment should not exceed a certain percentage of the borrower’s income. Therefore, the compatibility of the lending period with monthly payments should be selected optimally according to the financial strength of the loan recipient.

If the borrowed person falls under the state support program

In this case, based on the category of the program, part of the debt and interest obligations are assumed by the state. This significantly affects the revision of the terms of the mortgage by the bank.

However, other reasons may also influence the increase or decrease in loan terms under state programs. For example, the ratio of federal funds to the personal financial strength of the borrower. And, what is more significant, for some state support programs the boundaries of the time periods for which mortgage loans will be issued have already been determined in advance.

Availability of iron-clad guarantees

One of these guarantees is the presence of a guarantor or co-borrower, the other is a pledge of other real estate. This significantly affects the increase in mortgage terms and the cost of the banking product.

A positive credit history of the borrower is also important. If there are outstanding overdue loans in violation of the agreement with the financial institution, the bank has the right to refuse, citing the unreliability of the person being loaned.

Optimal terms of mortgage lending

The average loan period is 15 years. This period is the most acceptable for the distribution of funds without any special burden for the citizen.

However, depending on a number of conditions, it varies from 1 year to 30 years, and in exceptional cases up to half a century.

There are 3 options for determining a mortgage loan according to its terms:

- short-term (1–10 years);

- medium-term (10–20 years);

- long-term (20 years or more).

Of course, a number of banks are interested in fixed lending periods. Meanwhile, most factors influence the ability to issue a loan within the time frame established by the financial institution.

That is why the time period is so widely stretched both to the upper boundaries and to the lower ones.

Maximum mortgage term

Most banks make it possible to take out a mortgage on an apartment for a maximum period of 30 years. However, many financial institutions seek to protect themselves from all sorts of risks by offering lending terms of up to 25 years and even less than 20 years.

It should also be understood that the longer the mortgage, the higher the overpayment on it will be. But the amount of monthly payments will allow you to repay the loan without much effort, without causing significant blows to the family budget.

Minimum mortgage term

The shortest mortgage period is 1 year. However, some financial institutions have set the lower limit at 3 years or even 5 years, since it is extremely unprofitable for banks to issue loans on a short-term basis.

As a result, there are extremely few approvals for minimum mortgage terms. Most often, in this case, the interest rate is inflated so that the financial institution receives a decent profit from the transaction.

For what period is it more profitable to take out a mortgage loan?

In 2020, Sberbank occupies a leading position in the mortgage lending market. The minimum mortgage term in Sberbank starts from 1 year, and the maximum mortgage term in Sberbank is 30 years.

At the same time, interest rates and the total amount of overpayments have more advantageous positions than in other financial organizations.

If you are wondering what is the minimum term for which you can take out a mortgage, it is usually 1 year. However, a very small number of citizens, who have their own reasons for this, enjoy this right.

For example, in a year you are expected to receive an inheritance, transfer funds, receive financial assistance from relatives, and pay off a debt. Not everyone will be able to obtain the minimum mortgage term for a large amount .

If the age limits and monthly income do not meet, you will most likely be refused, but may be offered a mortgage for a longer period.

If you are still confident in your capabilities, choose a bank with the possibility of early repayment without paying commissions and agree to the loan term that they offer you. And you will make the decision on when to pay off the debt yourself.

All about overpayment

To have a clear idea of what the expected overpayment will be for long and short loan terms, it is best to give an example of the numbers. They will clearly justify what financial risks the borrower is taking. And how to choose the best option, everyone will decide for themselves.

So, let's divide all possible mortgage terms according to the five-fold system, if the cost of the apartment is 1 million rubles, at an average annual rate of 13%, with annuity payments.

In this case, the initial payment at the rate of 20% will be 200 thousand rubles. Further, the table shows all amounts of overpayments in rubles.

| Loan period | 5 years | 10 years | 15 years | 20 years |

| Monthly payment | 18202,4 | 11944,8 | 10122 | 9372,8 |

| Overpayment amount | 292066 | 633226,4 | 1021649,6 | 1448866,8 |

| Total amount to be repaid | 1092066 | 1433226,4 | 1821649,6 | 2248866,8 |

| Annual budget (payment per year) | 218428,8 | 143337,6 | 121464 | 112473,6 |

From this table it follows that the golden mean is best suited. A mortgage for a period of 10 to 15 years will quickly solve the housing problem, without burdening you with unnecessary financial burden.

However, there are also disadvantages compared to a short-term loan, as well as advantages over a long-term mortgage with its truly huge overpayment.

What is the best term for a mortgage?

So what should you choose, a long or short mortgage? First of all, the buyer of an apartment should think about why he is purchasing this property.

If the goal is to increase capital, when the borrower knows for sure and is confident that after some time the property will be sold, then in this case it is fundamentally important to reduce the overpayment to a minimum.

That is, pay the minimum amount for the period of ownership of this object. In this option, it is advantageous to take a long-term mortgage - for the longest period, with the lowest payments on it.

In a different scenario, if you plan to keep the property for yourself. That is, this option does not imply increasing capital. In this case, the difference between personal income and mortgage costs for a given property is important.

Here you need to do the math for yourself and decide for how long to take out the loan. It all depends on the financial strength of the owner.

Of course, you can pay for a year with a minimum overpayment, but will the owner afford such expenses for monthly payments? The coefficient is calculated according to one’s own capabilities and depending on how many years the bank provides a mortgage for an apartment.

Example of savings with early repayment

Let's find out for what period it is more profitable to take out a mortgage with early repayment using a calculation program. For such calculations, it is convenient to use an online calculator with an early repayment function. Let's enter the same initial parameters (1 million, 10%) and assume that after 5 years the borrower will deposit 300,000 rubles.

Recommended article: Subsequent mortgage - what it is and the terms of the conclusion

Let's compare the results:

- With a ten-year period, the mandatory payment is 13,215 rubles. After 5 years it will decrease to 6,679 rubles. Total savings – 79,729 thousand rubles

- When lending for 15 years – 10,746 rubles. After payment of 300 thousand - 6,747 rubles. Savings – 172,923 rubles.

- For a twenty-year loan, the required contribution is 9,650 rubles. After 5 years it will be reduced to 6,414 rubles. You will be able to save 277,639 rubles.

Thus, the sooner you deposit the extra money, the greater the savings will be. It should also be taken into account that money can be directed through two channels: to reduce the mandatory payment and to reduce the term. The total savings in both cases will be approximately the same. But reducing the monthly payment will relieve the family budget.

Important! Experts say that paying off a mortgage loan early is beneficial in the first half. When mostly interest is paid. In recent years of payments, there is no longer any need to worry about early repayment.

Thus, if you ask an expert for how long it is better to take out a mortgage with early repayment, the answer will be as follows. If, as a result of early repayment, the payment is reduced, then for a short time. After all, short-term loans have a high mandatory contribution, and the debt load is huge. For a long-term loan, it is more profitable to shorten the loan period.

Important to know: When is it better to pay off your mortgage early?

Early repayment of a mortgage: is it more profitable to shorten the term or payment?

Return of mortgage interest upon early repayment

Types of mortgage programs

With the advent of government mortgage projects, the state has a significant influence on the terms of lending. If, of course, the mortgage itself falls within the framework of social programs for partial financing of the transaction.

Government support programs for the purchase of housing can be classified in several areas for certain categories of persons. Let's consider the main ones:

For contract military personnel

In this type of state program, a mortgage accumulation system for the military is clearly developed, regulated by 117-FZ of August 20, 2004. Financial resources are accumulated every year in the personal account of the contractor, who subsequently has the right to use them to buy an apartment with a military mortgage.

The maximum age allowed for obtaining a loan should not exceed 45 years. This is due to the fact that military service poses a threat to the life of the borrower, as well as early retirement. The minimum age limit is 22 years, but subject to at least 3 years of service. Loan terms can be up to 23 years - no more.

For newlyweds and families with children

For young spouses who do not yet have children, as well as for families with one child, the state has developed several mortgage lending programs in order to expand and improve the welfare of these social groups of citizens. Budget funds are allocated annually for the implementation of these programs.

According to the provided housing certificate, persons receiving loans under these programs have the right to pay both the initial mortgage payment and use the funds for partial repayment of interest and the amount (body) of the loan.

However, there are certain age restrictions. Only citizens aged 21 to 35 have the right to use state support.

The loan period depends on the program and conditions of the bank, as well as on the borrower’s decision for how long it is more profitable for him to take out a mortgage. In addition, the harmfulness of the work of the person being credited will be taken into account.

For current pensioners

At many enterprises, retirement varies according to age criteria. This depends not only on the climatic difficulties of the regions of the Russian Federation (for residents of the Far North), but also on the type of production (harmfulness).

If a real estate loan does not fall under state programs for young families and military personnel, then for pensioners the mortgage term should not exceed the age limit when the borrower turns 75 years old on the date of the last payment. And yet, in the terms of the contract there may be exceptions to a greater or lesser extent.

Early repayment of a mortgage loan

Of course, every borrower strives to quickly relieve himself of the burden of obligations to the bank. The fastest way out of the situation, if financially possible, is to close the mortgage early. However, you should still take a closer look at the features of this operation and find out if there are any disadvantages to it.

Find out in advance from the bank whether the borrower will be able to make early payments in the future and under what conditions. After all, some financial organizations do not agree to this type of operation, as initially stated in the contract.

If the agreement with the bank nevertheless stipulates this option, and on what principles it is carried out, then you need to verify the calculations by asking the credit manager to calculate the amounts due for repayment at different lending periods.

As a result, the benefits will be discussed with the bank and made very clear to the borrower.

For annuity payments

If the agreement provides for annuity payments, it is recommended to pay the bank in the first five years of using the mortgage loan. In this case, the bank undertakes to recalculate the amount, since the loan amount is reduced.

This will significantly reduce overpayments. The decision to repay the loan early after five years of using the mortgage no longer provides an advantage to the person receiving the loan, but rather the opposite. After all, the financial organization receives its main profit precisely in this first five-year period.

The question often arises when closing a mortgage loan early: is recalculation carried out, that is, the amount is used to close the principal amount of the loan or to pay interest?

Interest is always calculated from the balance of the loan. The lower it is, the lower the amount of interest. Although the interest rate itself does not change during the entire loan period according to the terms of the agreement.

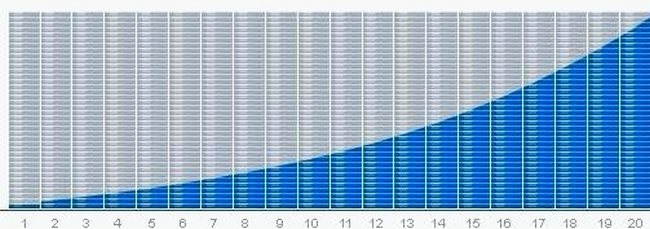

Equal monthly payments by the borrower go towards partial repayment of the loan amount and interest on it. Gradually, the principal amount of the loan decreases and, according to the calculated coefficient, from the initial lending period to the last, the ratio between the loan body and the interest on it fluctuates from less to more.

As an example of a settlement with a bank, a scheme for the full period of mortgage lending is proposed.

Columns - annuity payments: Gray - interest Blue - principal amount of the mortgage

In case of partial early repayment, the balance of the loan body is taken as the basis, on which interest is charged and the amounts are divided into annuity payments until the end of the remaining mortgage period.

However, most financial institutions do not want to quickly lose their client and can provide options such as reducing monthly payments.

For many, this is a tempting offer, since amounts, often exceeding 50% of the family budget barrier, used to pay the mortgage, in this case are significantly reduced and allow partial relief from the imposed burden of loan obligations.

For differentiated payments

Early closure of a mortgage loan in this case is also cost-effective for the borrower at the first stage of time.

In most cases, based on the amount that needs to be paid to close the loan in full, and not many people can afford it, it is best to go for incomplete early repayment of the loan.

The entire overpayment during differentiated payments goes towards repaying the principal amount of the mortgage, and accordingly, the interest on it is reduced. Further payments will also be significantly lower after automatic recalculation.

Reducing the lending period is also one of the solutions for both differentiated payments and annuity payments. It is still worth resorting to a special calculator, which are usually provided on the portals of financial organizations where mortgages are taken out.

By counting and visually familiarizing yourself with the proposed figures, you can decide which conditions are best to accept.

Beware of pitfalls

There are cases when a borrower applies to a bank for early repayment of a loan agreement, the operator makes a calculation, verbally or documented the amount, as a result of which the payment is made.

However, here is the mistake! It would seem that the loan has been repaid and the obligation to the bank has been lifted, but no. After some time, the borrower is informed from the bank that he still has to pay some amount.

His money, deposited earlier, was simply kept in his personal account and was not used for early payment of the debt. Further, according to the schedule and agreement, monthly loan payments continued to be written off.

Moreover, most financial organizations operate this way. Apparently, employees are instructed not to inform clients in advance that they need to do certain things in order for the invested funds to go as intended.

Namely, you will need to write an application for early repayment of the mortgage. Based on this act, a recalculation will be made, which the borrower will repay in the appropriate form provided for in the loan agreement.

For how long should I take out a mortgage with annuity and differentiated payments?

Today, a limited number of banks (Rosselkhozbank and Gazprom) are ready to accept repayment in uneven payments. If the borrower is lucky and repays the loan differentially, then his debt decreases proportionally. Therefore, the period does not matter much, because interest is still calculated on the actual balance.

In the case of level payments, the first years of payments are mainly interest payments. The longer the loan, the greater the overpayment. Therefore, it is better not to delay annuity payments over time and keep them within a ten-year period.

Recommended article: What to do after paying off your mortgage to the bank

Bank offers on mortgage terms

Top Russian banks offer their mortgage products according to terms set by themselves.

Below is a table for visual reference so that everyone can choose the appropriate bank, taking into account the minimum and maximum lending periods determined for themselves.

| Financial organizations | Minimum term (years) | Maximum term (years) |

| Sberbank | 1 | 30 |

| VTB 24 | 1 | 30 |

| Raiffeisenbank | 1 | 25 |

| VTB Bank of Moscow | 1 | 30 |

| Gazprombank | 1 | 30 |

| DeltaCredit Bank | 3 | 25 |

| Rosselkhozbank | 1 | 30 |

| Bank "Saint-Petersburg | 1 | 25 |

| Bank "Revival | 1 | 30 |

| Absolut Bank | 1 | 30 |

| Promsvyazbank | 3 | 25 |

| Bank Uralsib | 3 | 25 |

| Bank Russian Capital | 1 | 25 |

| Bank AK BARS | 1 | 25 |

| Bank Center-Invest | 1 | 20 |

| Transcapitalbank | 1 | 25 |

| Bank FC Otkritie | 5 | 30 |

| Zapsibcombank | 3 | 30 |

| Svyaz-Bank | 3 | 30 |

| Bank Zhilfinance | 1 | 20 |

In truth, judging by the table, there are no special differences in the terms of mortgage lending for the choice to fall on a specific bank.

Those purchasing living space for long-term personal use are in most cases satisfied with a medium-term loan. However, this is not at all true for people who intend to subsequently sell their home or pay off their mortgage early.

What mortgage repayment term to choose - let's do the math

To get your bearings using real numbers, let’s download a mortgage calculator. Let's say an apartment costs 2 million rubles. You make 1 million as a down payment and take out a million as a loan at 10% per annum.

- with a five-year loan, the monthly payment will be 21 thousand (total overpayment - 275 thousand rubles);

- for a ten-year term – 13 thousand (total overpayment – 586 thousand rubles);

- over 15 years, paying 10.8 thousand monthly, you will overpay the bank 935 thousand rubles;

- with a twenty-year term, you will have to pay 9.6 thousand, and the overpayment will be 1 million 300 thousand rubles.

Important! The maximum loan period is 30 years. But issuing such a loan is an exceptional case.

As can be seen from the example, when the period increases beyond 10 years, the monthly payment decreases slightly. But the total overpayment is growing exponentially. Hence the conclusion: the optimal lending period for purchasing a home is 5–10 years.

Recommended article: At what age can you take out a mortgage?

But this situation does not suit the banks. Or the salary does not allow you to repay a large amount every 30 days (especially for young couples). But for late payment, fines are assessed and the living space can be taken away if payment is not made.

In this case, let’s pose the question this way: is it profitable to take out a mortgage for a long period and repay it early? Yes, this option is beneficial for low-income families. If the financial situation improves, you can repay the loan early. If it doesn’t improve, it means payments will remain at the same level.

To sum it up - for how many years is it better to take out a mortgage?

So, this article provides a detailed analysis of the time periods for lending and mortgage repayment. And also in the table above the approximate overpayment on a housing loan is calculated.

From which follow several tips and recommendations that are worth taking into account as a reminder.

- Determine the terms of the loan based on personal benefits and subsequent overpayment.

- Based on why the property is purchased – for sale or for long-term personal use – determine the optimal loan terms.

- Know under what conditions by age category, based on the price of housing, the client’s solvency, eligibility for government support programs and what guarantees the time period of the mortgage is determined.

- It is recommended to recalculate in advance the overpayments and monthly payments using the calculator provided on the bank’s website and compare them with your financial strength.

- You should always choose the golden mean.

- Once again, ask the bank about the terms of the loan and how the early repayment operation is carried out in order to avoid pitfalls.

- When closing a mortgage early, it is best to pay the bank in the first five years of lending. You should also examine the conditions for partial early repayment.

Unfortunately, not all banks follow a conscientious policy. There is nothing to be done, everyone is looking for their own benefit. The main thing is that this benefit fits within the legal framework. Therefore, be careful with your money. And remember: knowledge is power!

What to do before taking out a mortgage

- Once again, think carefully about whether this is worth doing in principle or not. A mortgage is a very responsible and time-consuming matter that imposes many obligations. In some life circumstances, it is worth giving up a mortgage and limiting yourself, for example, to rented housing.

- Assess the stability of your life. Everyone has long known that absolute stability does not exist and life is very changeable, that everything cannot be foreseen, but relative stability still exists. It is worth taking out a mortgage only if you have a permanent job and a regular source of income, as well as outside support in case of emergency. Without all this, a mortgage is not the best solution.

- If a person nevertheless decides to take out a mortgage, then he should carefully calculate everything: which bank is most profitable to take it from, at what percentage, for what period, on what terms, etc.