70% of Russians want to improve their living conditions. But, unfortunately, not all citizens have enough money to buy a new home. Then the dilemma arises: which organization to contact? Housing cooperative or mortgage: pros and cons of both options. Mortgage housing is not available to everyone. Need money for a down payment. An alternative is housing savings cooperatives. This option is used if there are no large savings. Both methods of purchasing an apartment are different from each other.

How to buy an apartment through a housing cooperative?

First you need to become a member of this voluntary structure. Collective activity has one focus - obtaining housing. The organization has a charter. It reflects all contractual aspects.

Attention!!! To join housing cooperatives in Russia, you must be 16 years old.

You can obtain ownership of the living space only after paying off the dues. The activities of the cooperative are prescribed in the Housing Code (Chapter 11). Community members may redevelop, purchase, and maintain a multifamily property. This is where the formula comes from. At least 5 citizens can participate in the project. The maximum composition of the association should not exceed the number of apartments in a residential building. A certain category of citizens has the primary right to enroll in a cooperative:

- low-income groups of the population;

- persons recognized as needing housing.

How to join a cooperative?

- You submit an application, which is reviewed within a month;

- pay the entrance fee;

- a protocol is drawn up indicating the procedure for making voluntary contributions.

Recommended article: How much mortgage can you expect with a salary from 15,000 to 100,000

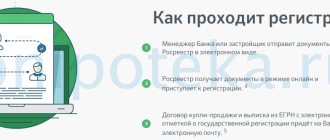

Rules for registering ownership of an apartment

- The right is registered in the register;

- a document is submitted indicating that you have paid all fees;

- the list of documents to be submitted includes the charter;

- the final information is reflected in the protocol.

Housing cooperative or mortgage?

Let's assess the risks of participating in the cooperative program:

- Responsibility for the house, reconstruction and maintenance falls on the shoulders of the association. For example, an incorrect calculation may lead to the fact that the share contributions will not be enough to construct the facility. The result is that additional funds will be required, which means membership fees.

- Late payment of contributions. Accordingly, the construction period will be delayed. A dubious alternative to a mortgage. This will also affect the situation with contractors. These are additional expenses.

- Mass exit of participants from the cooperative. The organizers will have to return the funds. And this reduces the financial opportunity for further construction. Housing will have to wait a long time until the cooperative is replenished with new faces.

A housing cooperative is an alternative to a mortgage; you use the housing by paying contributions.

What is a housing cooperative (LC)?

A housing cooperative is a voluntary association of citizens (and in some cases, legal entities) based on their membership, created for the purpose of obtaining housing for citizens, as well as for the purpose of managing an apartment building. The legal status of housing cooperatives is established by Chapter. 11 of the Housing Code of the Russian Federation (LC RF). Members of the association participate in the acquisition, reconstruction, and maintenance of an apartment building, which is the purpose of creating such a cooperative.

At least five citizens can take part in the creation of a cooperative , but no more than the number of apartments that exist in the purchased building.

The decision to create a residential complex is made by a meeting of its founders . The specified body approves the charter, after which state registration occurs.

A distinctive feature of a housing cooperative, by which it could be distinguished from other types of such associations, is the opportunity established by law to purchase a house (with possible further reconstruction and management). That is, such an association is prohibited from constructing a new facility. For this purpose, another form of cooperative is being created - housing and construction.

Constituent documents

The founding document of the Housing Code is the charter , approved by the meeting of founders. Approval of the charter, like any other decision of the meeting, must be documented in the form of minutes .

By virtue of the direct instructions of Art. 113 of the Housing Code of the Russian Federation, the charter must contain :

- the name of the cooperative, as well as its location;

- subject and goals of activity;

- procedure for joining and leaving the cooperative;

- the procedure for issuing a share contribution and (or) other payments upon exit;

- the amount of share and entrance fees, as well as the procedure for making them;

- provision on liability for breach of obligations;

- the competence and composition of both the management bodies of the association and the bodies monitoring the activities of the cooperative;

- the procedure for making decisions by management bodies;

- the procedure for covering losses incurred by members of the cooperative;

- regulations on liquidation and reorganization of the cooperative.

The charter may include other provisions not included in the above list, but they must not contradict the law .

Types of housing cooperatives

The Housing Code of the Russian Federation directly provides for only two types of cooperatives:

- housing;

- housing construction.

The difference between the above types is that when creating the first, it is implied the acquisition of a house and its subsequent management (with the possibility of reconstruction), while the purpose of creating the second is not the purchase of a house, but its construction .

However, there are a number of other cooperatives:

- housing-savings;

- consumer mortgage;

- consumer credit.

The housing savings cooperative is regulated by Federal Law dated December 30, 2004 No. 215-FZ “On Housing Savings Cooperatives.” Such an association is created for the same purpose as a housing construction cooperative, however, the construction of apartments can be carried out in different buildings . Another distinctive feature is the “cumulative” nature. In practice, a member of the association pays a certain percentage, after which an apartment is purchased and transferred to him for use. Transfer of ownership is carried out only after payment of all fees .

Unlike a housing and savings cooperative, in a consumer mortgage the apartment is registered immediately, after which a mortgage is issued on the apartment - a mortgage . The activities of a credit consumer cooperative are regulated by the Federal Law “On Credit Cooperation” dated July 18, 2009 No. 190-FZ. The operating principle of such an association is to form a fund from the entrance fees of its members and further provide loans to the members of the association for the purpose of purchasing housing.

Thus, there are quite a lot of types of such citizen associations. There are several options for purchasing housing using this form of association of individuals and legal entities.

Buying an apartment through a housing cooperative or mortgage.

Let's compare the pros and cons.

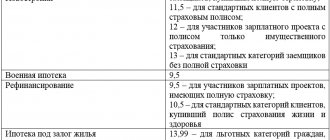

- The annual percentage is lower in a cooperative. If we take average data, then from 1 to 4%. At the bank the rate is at 11 - 13% per annum.

- A mortgage loan includes a large list of documentation. You must provide certificates of salary and family composition. You must have registration in the city, guarantors, papers for other real estate. At the cooperative you show your passport and employment ID.

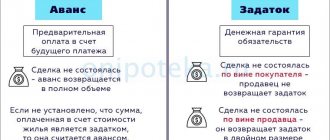

- The contribution to the cooperative is calculated at 3 - 6%. But in addition to this, you pay a share (2 - 3% of the loan amount) and a membership fee. In the case of a mortgage, a one-time payment is made - 20 - 30% of the cost of housing. The frequency of payments is set by the bank. In the cooperative, the issue is discussed at a meeting of the Housing Committee.

- The buyer cannot move into the property without paying 50% of the cost of the apartment. In the case of a mortgage, this can be done immediately after the transaction is completed. The apartment immediately becomes property. In a co-op you will have to wait until you pay the full price.

- Payment in both cases is made by monthly contributions to the credit institution.

Conclusion: Citizens go to cooperatives for low interest rates and convenient lending programs. You agree on the contribution amount and repayment schedule based on your capabilities. In this option, the initial payment is lower and there is no huge portfolio of documents. The first installment, by the way, can also be paid with maternity capital, using subsidies.

Housing construction cooperative: advantages and disadvantages

A housing construction cooperative is a consumer cooperative. Its goal is to provide housing for all members of the cooperative, according to the size of the share participation. The cooperative exists until the housing facility is put into operation, or it can continue its activities in the form of partnerships that control and carry out all housing and communal activities.

Housing cooperatives have a number of advantages:

- No authorized capital required.

- A participant in a housing cooperative is not obliged to directly work for a housing cooperative, building a house on his own (although this method of “people’s” construction existed quite recently).

- The size of the share contribution is determined based on the real needs of the cooperative, which includes estimates for building materials, construction labor and other expenses.

- Due to the lack of borrowed interest, overpayments for housing are minimal: they only relate to ensuring the activities of housing cooperatives during construction.

- The minimum number of participants in a housing cooperative is not specified, which means that a relatively small group of people can form a cooperative by choosing a development project: it can be a two- or three-story cottage-type house, or several multi-story buildings.

In the current environment of increased risks, not everything is so rosy. Housing cooperatives also have difficulties:

- You need to enter into an agreement with construction companies, or be developers yourself:

- contact architect-developers;

- purchase building materials;

- hire builders and pay them salaries;

- maintain an annual balance of funds required for construction.

- Coherence of action and quick resolution of controversial situations are necessary:

- if some participants do not deposit funds in a timely manner, then the deficiency is divided among the remaining members of the housing cooperative.

- Just as with any shared construction, bankruptcy may not escape building cooperatives.

- Privatization of a cooperative apartment is possible after full payment of the cost of the property.

How to register a housing cooperative

State registration of housing cooperatives occurs without long bureaucratic red tape.

The constituent document – the Charter of the cooperative contains:

- name and type of activity of the legal entity - housing cooperative;

- address and contact telephone number of the housing cooperative management;

- required amount of share contribution;

- obligations of cooperative members to take care of common property and cover possible losses (subsidiary liability).

When registering, it is required to provide documents and information about all founders of the cooperative, as well as persons acting without a power of attorney on behalf of the legal entity (director, board members, etc.).

Several small cooperatives can merge into one large one under a single management.

What do reviews say about housing savings cooperatives?

Opinions differ, since buyers entering into agreements for participation in shared construction of housing under Federal Law - 214-FZ have priority with regard to lawsuits. Even if you terminate the deal and appeal to a higher authority, it is not a fact that you will get your money back. Because they are not in the cooperative fund. The law on the protection of consumer rights does not apply if objects are built by a housing savings cooperative in accordance with 215-FZ. The agreement with the cooperative does not appear in the Russian State Register, that is, it is not registered in Rosreestr, therefore, fraud and double sales occur. People complain about the small selection of apartments, and that at the end of construction there are unsightly options left.

Recommended article: What to do after paying off your mortgage to the bank

Consumer mortgage cooperative - pros and cons

03.07.2012

As experts say, mortgages are experiencing a rebirth. The volume of mortgage loans has reached pre-crisis levels. Also, experts emphasize that, along with traditional banking programs, various other mortgage lending offers have begun to operate. Alexander Mamaev and Andrey Kramarov (director and chairman of the board of the consumer cooperative Housing Construction and Mortgage Corporation) expressed their opinion on the mortgage market and the advantages of consumer mortgage cooperatives.

When asked about the state of the mortgage market today, experts said that the so-called second wave of demand for mortgages has been observed since the end of 2010, when the cost per square meter decreased noticeably and Russians had the opportunity to purchase housing. Based on the results of last year, we can say that the market has stabilized. This year there has been an increase in mortgage issuance volumes; in general, the mortgage market has approached pre-crisis levels.

Also, experts noted that the company is ready to compete with banks that have been involved in mortgage programs for a long time. The corporation has existed for 10 years, and during this time it has opened many branches throughout Russia. At the beginning of this year, branches were opened in Shakhty and Taganrog, which are already bringing good results. Such dynamic development of the consumer mortgage cooperative Housing Construction and Mortgage Corporation best demonstrates the possibility of competing with banking programs.

When asked what the advantages of a consumer mortgage cooperative are so that the borrower is guaranteed to turn to this company, the experts answered that today the buyer has become more literate and has a good understanding of the market. And that’s why he needs arguments and specific numbers; he won’t fall for promises.

The interest rate on a bank mortgage is calculated from the refinancing rate, which today is 8%. Plus the bank's increase is 3-5%, and the result is at least 11% per annum. And the corporation offers mortgage loans at 5-7% per annum, says Mamaev. In a bank you have to overpay several times (on average 250-300% overpayment), but in a cooperative the cost of housing is fixed, and installments are paid based on this price. In general, the overpayment is no more than 22% of the total cost of housing.

To join the cooperative, the following documents are required:

- A document confirming the borrower’s employment (not necessarily personal income tax certificate 2);

- Passport;

- TIN.

In addition, Mamaev noted that the corporation is currently considering the option of cooperation with citizens who are currently unemployed. Also, the consumer cooperative is ready to cooperate with pensioners and other categories of citizens who, due to circumstances, cannot obtain a loan from the bank. In such a situation, it would seem that the risks increase, but the director of the board noted that work with each client is carried out individually, to find out how ready the potential borrower is to agree to the requirements of the consumer cooperative. In case of delay. The cooperative also does not panic; the main thing is to report temporary difficulties in a timely manner and write a corresponding statement. One of the most important points in the company is the mandatory contributions of cooperative members to the Reserve Fund of the PC, which is a kind of guarantee of the stability of the cooperative’s work, subject to any nuances. Everything certainly looks very attractive, but as they say, there is a fly in the ointment in every barrel. To which Mamaev replied that, of course, there are some drawbacks, the initial payment in a consumer cooperative, for example, is 30%, or 15 - with subsequent accumulation of up to 30%.

When asked whether the consumer cooperative issues mortgages only for housing, Kramarov said that funds are allocated for a garage, land, and housing in both the primary and secondary markets. The purchased property is immediately transferred to the ownership of the owner. However, in modern society, cooperatives are often associated with pyramids. According to the chairman of the board, there is a law “On consumer cooperation (consumer societies and their unions) in the Russian Federation,” which specifically spells out all the actions and responsibilities of the cooperative.

Everything in the corporation’s activities is transparent; absolutely all shareholders can see how and where the funds are directed. Also, Kramarov added that for greater openness and transparency of the cooperative, work is underway to develop a website where any shareholder can obtain fresh and reliable information.

For more information, please call 240-28-56.