Is it possible to take it?

A mortgage agreement is an agreement on the pledge of real estate (Federal Law No. 102-FZ (as amended on December 31, 2017)). Therefore, the borrower can safely conclude a deal and receive money for repairs, in return providing existing housing as collateral.

If problems arise, the bank has the right to receive money from the debtor based on the value of his property. The amount of approved funds is usually 50-70% of the market price of the collateral property.

Depending on the bank, the program may be called:

- Loan secured by existing housing/real estate;

- Non-target mortgage loan;

- Non-targeted loan secured by real estate.

As an alternative, you can consider loans for any purpose without collateral.

Which banks to contact

There is a fairly wide selection of home renovation programs on the Russian market. The table below provides information on the terms of such lending.

| Bank | The name of the program | Sum | Duration, years | Percent | Note |

| Opening | Mortgage plus | From 500 thousand to 30 million rubles | 5 – 30 | From 12.95 | The loan is issued against the security of existing housing for major repairs and other improvements. Russian citizens aged 18-65 who are ready to confirm their solvency and employment will be able to take out a loan. |

| Alfa Bank | Loan for apartment renovation | Up to 1.5 million rubles | 5 | From 11.99 | Only current salary clients of the bank can apply for a loan for up to 5 years; everyone else will be able to apply for a loan only for a period of up to 3 years. Renovation mortgages are issued in cash to borrowers over 21 years of age with sufficient creditworthiness |

| VTB 24 | Mortgage bonus | From 400 thousand to 5 million rubles | 5 | 13,5 | This loan is issued only to existing mortgage borrowers of VTB24 Bank or other Russian banks. You can use the funds received to renovate your apartment, buy furniture, and household appliances. |

| UniCredit Bank | Target mortgage loan | Up to 15 million rubles | 1 – 30 years | From 12.5 | The loan is issued for any mortgage purpose: purchasing an apartment or house, home renovation or improvement, refinancing an existing mortgage. Confirmation of intended use will be required |

| TransCapitalBank | Loan secured by real estate | From 500 thousand rubles | Up to 15 years | From 15 | Borrowers can be persons from 21 to 75 years old. The loan is targeted |

The table clearly shows the consolidation of some mortgage products. That is, the intended purpose can be simultaneously the purchase of real estate, its repair and improvement. Therefore, mortgage lending has maximum terms - up to 30 years (as, for example, in Otkritie Bank and UniCredit). In practice, if an application is submitted indicating the need for borrowed funds for repairs, the bank can significantly reduce the maximum loan period based on the income the client receives and the loan amount.

NOTE! The maximum mortgage amount for renovation will be determined by the borrower's ability to pay and the appraised value of the property being renovated.

The information presented allows us to draw an obvious conclusion - the best offer can be obtained from Alfa-Bank at 11.99% per annum and UniCreditBank at 12.5% per annum. You should choose the appropriate option taking into account the required amount for repairs, the preferred repayment period of the debt and the requirements for the borrower.

Mortgage+overhaul

Taking out a mortgage greater than the cost of the apartment for renovation is an excellent option. To do this, you need to ask the mortgage manager whether it is possible to add the required amount to the price of the apartment. You can’t just take more and spend less, since the condition for issuing funds implies an assessment of the house or apartment being purchased.

As a result, the loan issued must correspond to the price of the property. One of the banks that considers a mortgage for the purchase and renovation of an apartment by prior agreement is VTB.

Mortgage for apartment renovation

For most citizens, buying an apartment with a mortgage loan is not enough. To solve two pressing issues at once, you have to get a loan for home renovation . There are several important points to consider before signing a loan agreement:

- It is better to apply for a consumer loan or a mortgage type of loan at the same financial institution where the transaction for the purchase of an apartment was concluded.

- To avoid financial difficulties, it is better to sign both agreements for the maximum period. In this case, payments for housing and its repairs will be minimal.

- It is recommended to provide information about monthly family income in natural form.

To have an application approved, the borrower must have a positive credit history in the past and a sufficient level of monthly income. Owners of savings accounts or salary cards often enjoy bank privileges.

Peculiarities

Applying for such a loan is practically no different from that used when issuing consumer loans.

Additionally required documents for property:

- Extract from the Unified State Register (from January 2020, previously – the Unified State Register, before that – a certificate of state registration of rights);

- Valuation report (done by an independent appraisal company accredited by the bank);

- Technical certificate;

- Consent of the spouse to transfer the object as collateral if the premises are his property, etc.

- Example item.

Rates on non-prime mortgages are a cross between rates on consumer loans and standard mortgages. The amounts offered are enough for different types of repairs - economy, standard, luxury - they give out up to several million. Some banks accept as collateral both a house or apartment (new building, resale), as well as a plot of land, a garage, a garage with a plot. No down payment required.

Before issuing money, the client’s housing, solvency and credit history are checked. Open delays/serious violations are the path to refusal. Low commercial attractiveness of property is a way to reduce its value.

The appraiser takes into account not only the technical condition and area, but also the location, distance from key infrastructure, type of building, number of floors, etc.

How to make the right choice?

To choose one or another lending option, the borrower should decide on the following questions.

- Calculate the required amount and acceptable loan term.

- Consider who will do the repairs: individuals or a construction company. The first option is, of course, cheaper, but the bank often itself determines the list of construction companies with which it can deal. Only in this case will the borrower be able to provide the bank with all the necessary financial documentation for repair work.

- If any loan product is suitable for the amount of borrowed funds, you need to analyze the offers of several banks both for loans with and without housing collateral, as well as for regular consumer loans. It is necessary to take into account additional costs for insurance, valuation and bank commissions, i.e. calculate the effective interest rate. It is these rates that need to be compared - sometimes an offer that is more advantageous at first glance may ultimately turn out to be completely inappropriate.

- If you decide to provide the bank with housing as collateral, you should make sure that this property is acceptable to the bank. For example, when mortgaging an apartment, it must meet the requirements for an apartment under a mortgage.

Thus, a mortgage for home renovation is advisable if major work will be carried out (hence, a large amount of money and a long loan term are required). If you plan to simply renovate your apartment, which does not require huge investments, it would be wiser to take out a regular consumer loan and not risk your home. Although the interest rate is higher, you do not have to collect an impressive package of documents, pay for appraisal and insurance, and also report to the bank on the use of loan funds.

Did you like the content?

+17

Mortgage terms

Mortgages for apartment renovation are offered by banks under different conditions, but in general the programs are similar. Some companies require more, others less. To quickly compare options, you can use specialized online services: “Compare”, “Banks”, etc.

Options:

- Rates – from 10%-14% with the possibility of reduction for salary clients;

- Duration – 10-30 years;

- Currency – Russian Federation;

- Amount – up to 10-20 million rubles;

- Percentage of the estimated value of the object – 50%-70%;

- Insurance: property – mandatory, life and health – often optional, but not always. One of the lenders that imposes maximum insurance requirements is Alfa Bank;

- Provision of a loan - at the place of registration of the borrower or accreditation of the employing company;

- Early repayment – without restrictions and commissions.

Separate requirements apply to real estate objects. They must be connected to gas, steam or electric heating systems that provide the necessary conditions for a comfortable stay inside, to the sewer system and water supply (hot water supply and hot water supply).

Look at the same topic: The best new buildings with military mortgages in [y] year

The plumbing equipment installed inside must be in good working order; if not, it can be repaired, like everything else, if the amount is insignificant.

Additionally:

- Roof (top floor or house), windows, doors - in good condition;

- Foundation – brick, stone or reinforced concrete;

- Emergency or dilapidated condition - not considered;

- Major repairs with resettlement/demolition - not planned (not registered);

- Location – within the city limits of the bank’s branch presence.

If the property meets the requirements, it will pass inspection. This is only a small part of the requests; in each specific case everything is decided individually.

As for land plots, they must belong to the category of land in settlements, be used for personal farming or individual housing construction, belong to the borrower on a long-term lease basis (loan term + 1 year) or ownership. The site cannot belong to specially protected areas and to lands on which a special regime of use has been established.

The subject of the pledge should not be encumbered by the rights of third parties or be prohibited.

Specifics of obtaining a loan

According to the bank's requirements, the housing for the renovation of which funds are taken must be pledged to this financial institution. If we compare the terms of service, there are significant differences from conventional mortgage lending. To receive money, you will need to provide a minimum package of documents to the financial institution.

Among the bank’s mandatory requirements for the credited person, the following should be highlighted:

- Registration of property under renovation as collateral.

- Providing funds in the amount of 70% of the total value of the property.

- The maximum loan period is no more than 10 years.

- Loan rates range from 14 to 20% per annum.

- Using the services of an appraiser to carry out the procedure for assessing the value of real estate for the purpose of registration as collateral. The loan recipient will have to pay for the service.

- Carrying out repairs with the help of a contractor with drawing up an estimate for costs and a contract for the provision of services.

The main advantage of obtaining a mortgage for home renovation is the ability of the financial institution to provide a larger cash loan than when applying for a standard consumer loan.

The disadvantages include considerable interest on this type of loan and additional costs at the borrower’s expense for insurance, notary and appraiser services.

Requirements for the borrower

Those who can pay the bills get the money. The bank is interested in hassle-free refunds. The main thing for the borrower is a stable income and work in a company with a good reputation in the labor market. The required work experience over the past 5 years is 1 year, at the current place of work - six months, less often - 3 or 4 months.

For salary clients, the values are divided in half. Seniority does not apply to pensioners and sometimes to persons aged 18-20 years. Those who run a personal household must do so for at least a year at the time of application (as evidenced by entries in the household book).

Place of work: Russian organizations or branches of transnational companies. Age at the time of application: 18-21/65-70-75 years. Citizenship - Russian Federation, in some places also Ukraine and the Republic of Belarus (example - Alfa Bank). Registration - on the territory of the Russian Federation at the place of residence or stay. But the same Alfa Bank does not require registration in the locality where the object is purchased.

Advantages and disadvantages compared to a consumer loan

When you receive a refusal from various banks, and you need money to renovate an apartment in your favorite new building/resale or in a house, you can act differently - offer the lender more favorable conditions for him - real estate collateral, incl. the only one and with children registered in it. This option solved the problems of lack of money for many borrowers and this is its advantage.

But this method also has a big drawback - the danger of being left without housing. The bank does not set itself the goal of taking away property; selling such property is a troublesome business, therefore, as soon as problems arise, inform an employee of the organization, do not wait for the next payment. Answer all calls and messages, take active steps to solve the problem.

The only thing you don’t need to do is take a passive position, be rude to specialists, and hide from fulfilling obligations.

There are 2 more advantages - the rates are closer to mortgage rates, and the loan size is higher (you can buy higher quality materials, purchase goods in bulk at discounts). The disadvantage is a longer registration process. In addition to your own, you need to collect documents for real estate, which must also meet the requirements.

Advantages and disadvantages

A renovation mortgage loan has pros and cons. Let's start with the advantages:

- With borrowed funds, you can carry out expensive repairs and furnish your apartment.

- A mortgage involves the issuance of large sums. Consumer loans are smaller.

- Rates are lower than with standard lending.

- The terms are longer, which reduces the monthly payments.

- In most cases, insurance will not be required.

Flaws:

- A real estate pledge places an encumbrance on the apartment and prohibits transactions with it.

- Additional costs arise: assessment, payment of duties.

- Risks of losing collateral if debt is not paid. The mortgaged apartment is sold by the lender when the client stops fulfilling his debt obligations.

- It will not be possible to get more than 75-90% of the apartment price.

A mortgage for apartment renovation is possible. Knowing the nuances of such loans, you can find the best offer and get money for repair work.

How to apply step by step?

At the first stage, you need to carefully read the requirements of the selected credit institution and make sure you comply with them. It is advisable to check your credit history, taking advantage of the free right to do this through specialized services (Government Services and others), read reviews of clients who were denied loans, try to find out the reasons, find out the internal mechanisms of the company (through friends or on the Internet).

Each refusal negatively affects further attempts to obtain the required amount in other places.

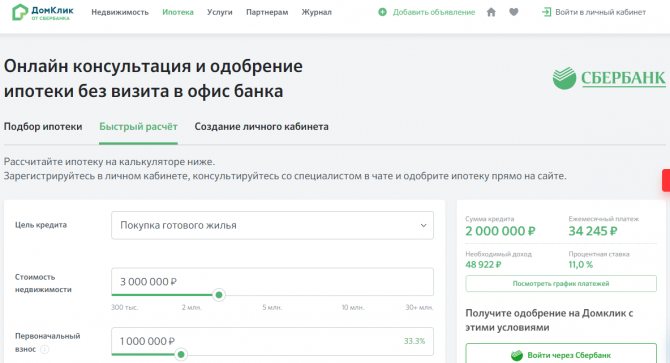

At the second stage, you can start forming an application on the official website - go to the required section, fill out the form, entering your personal data and information about the employer (up-to-date and truthful), and send it for consideration. After some time, a response (preliminary decision) will be received from the bank. After this, you need to take the necessary documents and come to the branch to apply for a loan.

Look at the same topic: Military mortgage at VTB 24 bank - conditions, maximum amount and interest rate in [y] year

A preliminary decision does not mean that funds will be issued without fail. This only means that the client’s personal data has been verified and he can potentially count on the requested amount.

The third stage is submitting a repeated application to the bank and providing a package of documents. The employee will fill out the form again, send it for review, and advise on any questions of interest.

After reconciliation of data and full verification, the bank will receive a final decision. Afterwards, the money can be spent on your needs (purchase of building materials, payment for work, etc.).

Documentation

You need to come to the department with your passport and write an application there. You need to take with you SNILS, 2-NDFL (not needed by the lender’s clients), a certified copy of your work record or an extract from it, a military ID (for men under 27 years old).

Documents on the property pledged as collateral:

- Agreement of purchase and sale or equity participation (confirmation of the basis for the emergence of ownership rights);

- Unified housing document/extract from the house register;

- The appraisal report and all copies of documents used by the appraiser, including the registration certificate;

- Extract from the Unified State Register of Real Estate;

- The owner’s consent to transfer the object as collateral.

During the review process, the bank has the right to request other documentation.

Is it possible to get money to repair a mortgaged apartment?

Is it possible to take money to renovate an apartment if it is on a mortgage? The lender provides a loan, to repay which the citizen spends a certain part of his profit (payment/income ratio). Usually it is 50%.

If there is enough money to service the parallel loan, the bank will issue a new one. The main thing is that the citizen must have at least 20-30% of available funds after all deductions.

The calculation method is as follows:

- Take the cost of living in the region;

- Monthly payments are added to it;

- Subtract the resulting figure from the salary indicated in the application form.

As a result, 20-30% of free funds should remain. Other values can be used in the formula - each bank uses its own methods.

Pay attention to such a clause as “Penalty for late repayment.” It must correspond to the key rate of the Bank of Russia in effect on the date of conclusion of the agreement.

Reviews about mortgages for renovation

in the field of repair there is little demand. Loans are usually issued without collateral. All nuances and problems that may arise due to non-fulfillment of conditions are reflected in the contract.

Pay close attention to the text written in small font. If there is no money for repairs, taking out a loan secured by property is not the best option. It is easier to eliminate the reasons that led to the refusal or use consumer lending.

Fortunately, the rates for the products offered do not vary much. And under no circumstances contact microfinance organizations by sponsoring their activities.

Features of a loan for apartment renovation

Having considered all the proposed loan programs, it can be noted that there is no direction specifically for issuing a loan for repairs. Therefore, in this situation, you can take advantage of offers for obtaining other non-targeted loans . In particular:

| Loan name | Annual (in%) | Loan term (in months) | Amount (in rubles) |

| consumer without security | from 12.90 | up to 60 | up to 3 million |

| with the involvement of guarantors (individuals) | up to 5 million | ||

| secured by real estate | from 12.00 | up to 240 | up to 10 million |