Mortgage insurance is a mandatory procedure for any borrower applying for the purchase of real estate with the participation of bank funds. This is the only method of protecting obligations and interests in the event of unforeseen circumstances.

When obtaining a mortgage, the concept of financial protection raises the most questions. The client is asked to insure not only the property, but also his life and title (loss of ownership of the loaned property).

We have comprehensive programs that take into account all the risks listed above. It is one of the ten largest and most stable insurers in Russia. How much a mortgage protection policy will cost, how to apply for it and other nuances of insurance at Ingosstrakh, we will discuss in this article.

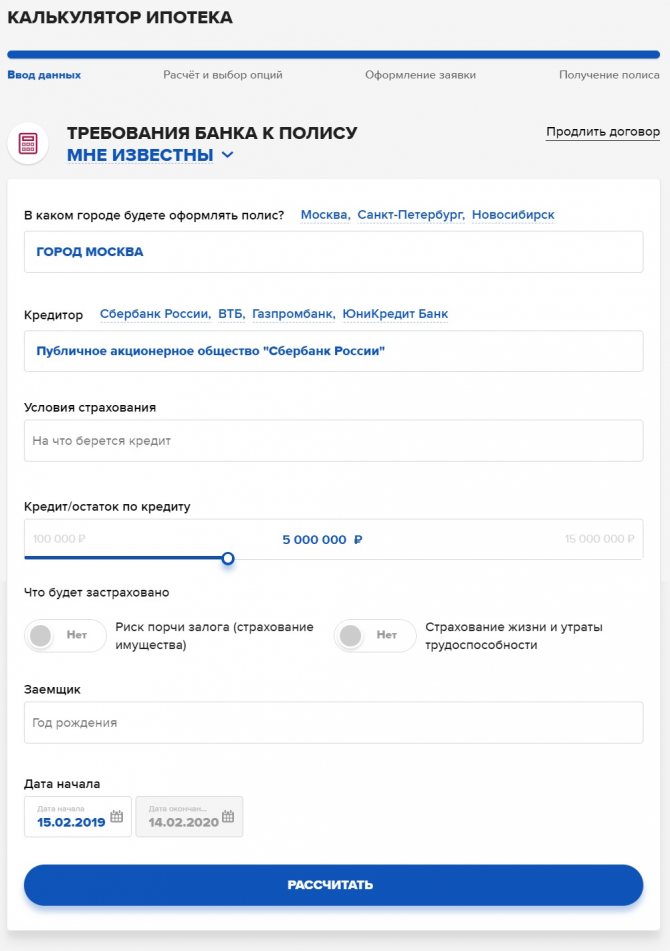

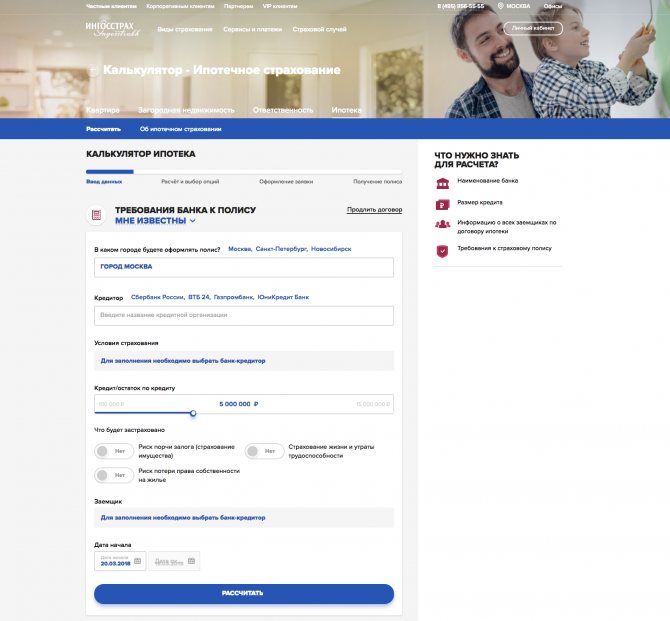

"Ingosstrakh" - Mortgage calculator for life and property insurance

First in importance is the question of the cost of mortgage insurance. The price of the policy can be calculated online on the Ingosstrakh website.

This will allow you to make a purchase decision even before signing a loan agreement with the bank. To use the insurance calculator, go to the company’s official portal and follow the instructions:

1. Go to the Ingosstrakh website using the link: ingos.ru/mortgage/calc .

2. In the window that opens, fill out the calculation form:

- enter the name of the lender;

- type of collateral;

- balance of debt;

- year of birth of the borrower;

- validity period of the policy.

3. Select the type of insurance – against damage to collateral or protection of life and health and click “Calculate”.

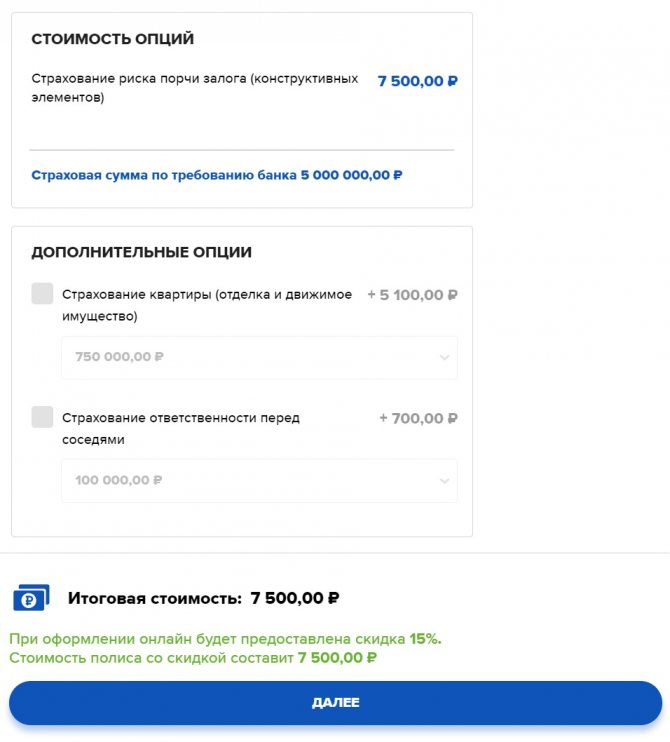

You can make a calculation for both types of insurance at once or separately. The service will offer to sign up for related programs, indicating their cost.

Note! The set of risks depends on the requirements of the bank where the loan agreement is drawn up. Full fulfillment of obligations to the bank is ensured by a comprehensive insurance contract.

Online registration of an insurance contract

Immediately after the calculation, you can issue an electronic collateral insurance policy. Click “Next” and go to the insurance registration section.

Insurance is purchased on the website through the online service as follows:

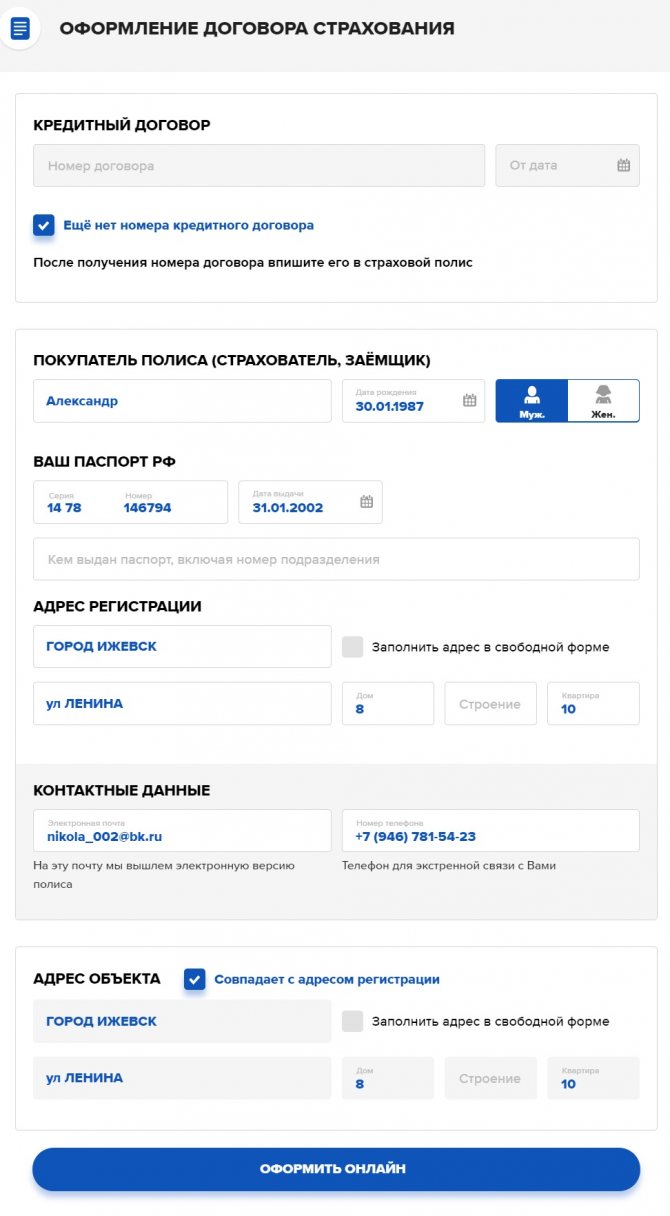

1. Answer the questions on the form to fill out. In particular, indicate the number and date of the loan agreement, borrower data, series and number of passport, registration address and location of the insured object. Click "Apply Online".

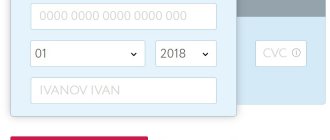

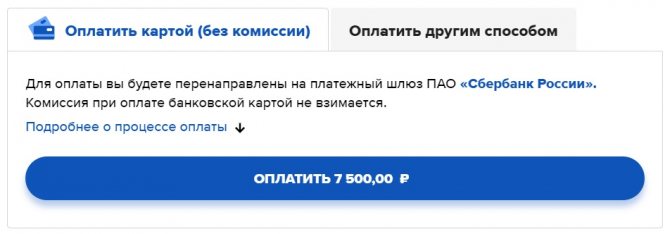

2. Payment is made in the same service using a bank card. Indicate the plastic number, owner's name and the 3-digit code on the back.

After this, an electronic version of collateral property insurance will be sent to your email. It has the same legal force as a policy drawn up on the insurer's letterhead. Financial protection against the risk of loss of ownership of real estate is issued only in conjunction with insurance of the collateral itself.

Property insurance is the main requirement of banks for mortgages. The concluded agreement is provided at the time of issuance of the loan payment. To register, you should contact a specialist at your nearest office. He will take copies of documents and give you a form to fill out an application in the form of a questionnaire.

Based on the documents and information provided, a decision is prepared within 24 hours. Then an insurance contract is prepared, which can be picked up at the nearest office or during the transfer of funds at the bank. Payment is made according to the attached schedule.

Online application for mortgage insurance

The online application is provided only for financial protection of life and health, because it is impossible to purchase this policy on the website.

Answer the questionnaire questions regarding your health. It is necessary to provide only reliable information, because if a deliberate lie is discovered about your health status, the company will refuse insurance payment.

To purchase a policy, you must send a request to a representative of the insurance company, and then go to the office in person. By agreement, you can arrange a meeting with an Ingosstrakh agent in another location.

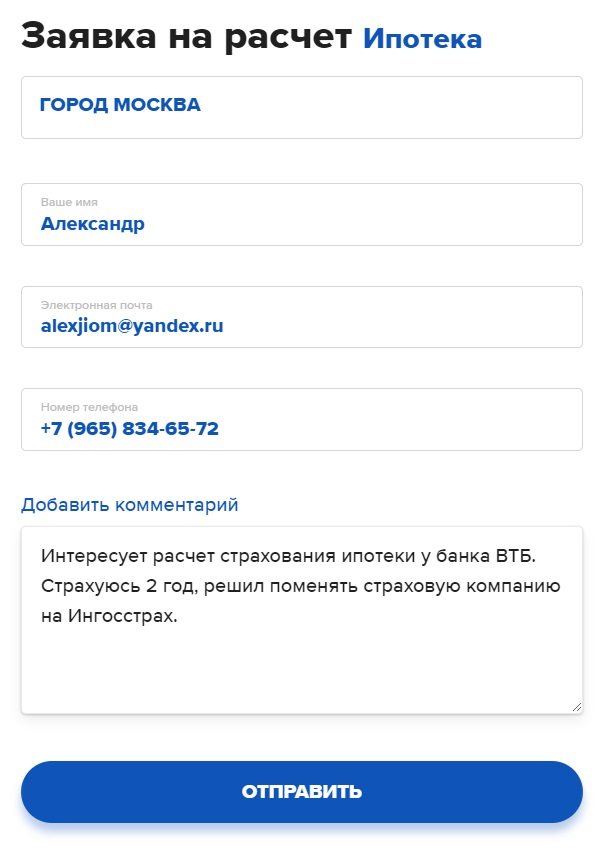

If the borrower does not have time to contact the insurance company in person, an online application can be submitted. To do this, you need to fill out a form on the website, indicating your full name, valid email address and contact phone number. The name of the bank and the amount of the loan provided are indicated.

After submitting the application, a confirmation will be sent by email. An Ingosstrakh employee will contact the borrower to clarify further actions and the list of documents for obtaining insurance.

What affects the cost of mortgage insurance?

The main influence is the size of the mortgage and the bank's requirements for coverage. First of all, the borrower is considered - age, health and gender.

The technical parameters of the property are taken into account - the degree of deterioration of load-bearing structures, materials of walls and ceilings. The status of the property is taken into account - a finished house or not yet put into operation.

The average tariff is at the level of 0.6-1%. To obtain information about the exact cost, you need to send an application to Ingosstrakh or contact the manager personally.

Various coefficients are used to calculate the cost of the policy. The final price depends on the following parameters:

- Requirements of the lender in relation to the content of the policy.

- Amount of credit debt.

- Age and gender of the policyholder.

- Type of property, its condition, year of commissioning - for a collateral financial protection policy.

- The client’s health status, the presence or absence of diseases - for the borrower’s insurance.

- Previous real estate transactions, their number and content - for the financial protection of the title.

The easiest way is to calculate the cost of insuring collateral property under a mortgage. To calculate the price of life insurance, the participation of a representative of the insurance company will be required. If necessary, he may request clarifying documents about the client’s health status.

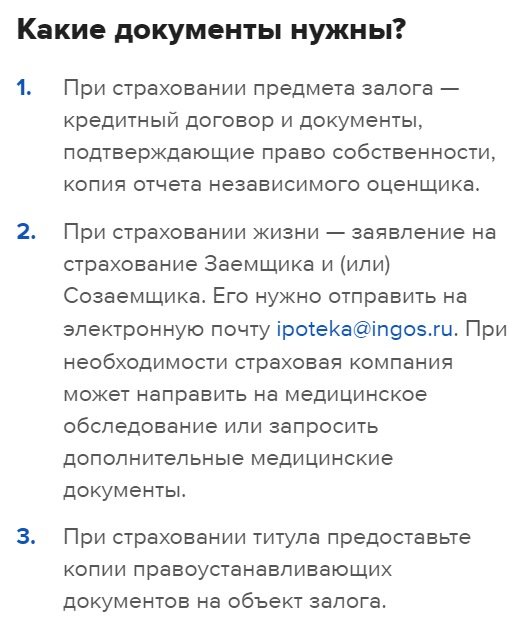

Necessary documents for a mortgage at Ingosstrakh

The list of required documents varies depending on the type of insurance you want to take out.

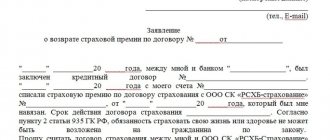

To draw up an insurance contract, you will need personal data, such as full name, address and contact phone number. Provided:

- application from the borrower;

- passport;

- loan agreement;

- extract from the Unified State Register of Real Estate for existing real estate;

- financial personal account;

- certificate from the BTI with a floor plan;

- assessment report if housing is purchased on the secondary market;

- permission from the guardianship authority to register the transaction, if necessary;

- document of title (purchase and sale agreement).

In some cases, the company may request medical records or refer you for examination.

To apply for a financial protection policy, the borrower must prepare an application in which it is necessary to answer questions regarding health in detail and honestly. If necessary, the insurance company has the right to request a medical examination, an extract from the client’s outpatient card and other medical papers.

Insurance of mortgaged real estate and title requires the provision of documents on ownership (extract from the register of rights - USRN, purchase and sale agreement), a copy of the appraisal report to understand the real market value of the property.

"Ingosstrakh" - Questions and Answers on Mortgage

Here is a list of the main questions that insurance clients have:

- Answer

What is mortgage insurance?

These are insurance products that are designed to ensure the return of loan funds to the bank. For this, grounds are determined - such as loss of health or life, damage or loss of property. Banks require compulsory insurance.

- Answer

What is title insurance?

It insures the risk of loss of real estate due to deprivation of property for reasons beyond the control of the policyholder. It is possible when the seller is a fraudster or relatives appear who have been deprived of their rights to property. The insurance company will pay the remaining debt to the bank.

- Answer

What is the validity period of the insurance?

The real estate insurance contract is concluded for 1 year or for the entire period of the loan. The validity period corresponds to the number of years of the mortgage payment. Insurance is required for the entire payment period.

- Answer

How to defer payment of the next installment?

A deferment is possible if the bank provides written permission. In other cases, payments must be made on time.

- Answer

Is it necessary to visit the office to draw up a contract?

Registration is possible both online and at the insurer’s office or at the bank when concluding a transaction. An Ingosstrakh employee will bring the documents necessary for signing. The document form can be sent by email or in the original through a bank employee or a realtor partner. Collateral insurance is issued on the insurance company’s website.

- Answer

What to do if the policy is lost during the payment period?

Contact the Ingosstrakh office and write a statement. The employee will issue a duplicate, according to which you can continue making payments. You should call in advance and coordinate the production of a duplicate document.

- Answer

Why do you need mortgage insurance?

If an unforeseen event occurs, the insurance company will pay the debt to the bank. To do this, the situation specified in the policy as insurable must occur.

- Answer

Is it necessary to take out insurance for the entire term of the loan agreement?

Only for subsequent years in agreement with the insurance company. When signing the loan agreement, you must pay the annual cost.

- Answer

What if the insured event occurs during the deferred payment period?

The remaining premium must be paid within 10 days, otherwise the insurance contract will be considered terminated.

- Answer

Is it possible to make changes to the terms of the mortgage policy

? Yes, but all amendments must be reported to the bank that issued the loan.

See the entire list of answers to popular questions in the “FAQ” section: ingos.ru/#faq or ask questions by calling the hotline: .

Ingosstrakh - Is it possible to refuse mortgage insurance?

The conditions for refusal of insurance and refund of the cost of the policy should be clarified in the text of the mortgage agreement that the client concluded with Ingosstrakh. The opposite situation also happens when the insurance company refuses to provide financial protection. Most often this is due to the characteristics of the property.

Perhaps it does not suit the policyholder’s conditions and poses an increased risk for him (worn out structural elements, an old date of construction, etc.). Life insurance will also be waived if the client has severe chronic illnesses or has reached retirement age.

Any borrower has the right to refuse insurance. But in most cases, banks stipulate sanctions for refusal in the contract, according to which the interest rate may double. Therefore, it is economically beneficial to pay insurance.

How to complete a deal?

You can enter into a multi-year contract with the company and pay fees through your account on the website. Also pay attention to the banks' conditions. The insurance amount can rise by 10 - 15% of the loan debt. To clarify the bank's coverage claims, send a request for calculation or go through the stages of registering a policy online. Many organizations that issue loans have Ingosstrakh insurance. You collect a package of documents, and a decision is made within 1 day. You can sign and pay for the policy at the office center of the company or our representative, while concluding a transaction at the bank.

Online mortgage insurance calculator on the official Ingosstrakh website www.ingos.ru/mortgage/calc/

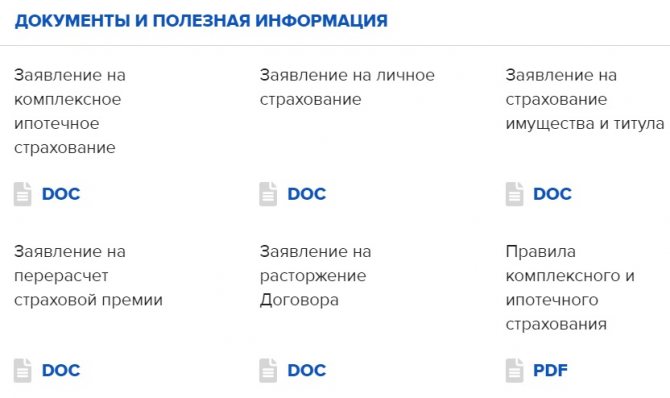

Portfolio of documents

- Documents confirming that you are the owner of the property, copies of the appraiser's conclusions.

- Have you decided to insure your life? Attach an application from the borrower. Medical certificates may be required.

- Title insurance requires title documents.

Algorithm for the Ingosstrakh insurance purchase process

- We go to the corresponding section of the official website of the Ingosstrakh company ingos.ru.

- Let's try to calculate the cost. To do this, click the button with the corresponding inscription and automatically go to the “mortgage calculator” section.

- Do you know the bank's requirements? Select this menu item.

- Choose the city in which you will issue the policy and the lender. Ingosstrakh offers to choose a banking organization (Gazprombank, VTB 24 and others). You can enter the name of your structure yourself. If this bank is not in the company's register, the system will report this.

- We prescribe the terms of insurance: apartment/house. We select the item: is it an object under construction or do you have ownership rights. Then we indicate the annual rate as a percentage.

- We move the “loan balance” scale.

- Selecting structural elements. For example, we insure the risks of damage to collateral or loss of property rights. There is also life insurance for mortgage and disability.

- Fill out information about the borrower, indicating the year of birth, gender and percentage of participation in the loan.

- Enter the dates.

- Click the “calculate” button.

- You are shown the amount of insurance coverage. Also, the insured amount can be increased at the request of the bank.

- If you are satisfied with everything, click the “submit application” button.

- In the form, write your name, email address, city of residence, and contact phone number. Choose a convenient time to call a company specialist. If you have information for an employee, write it in the “add comment” column.

- After all the manipulations, you will receive a confirmation form with the mortgage insurance application number. Check your email. The application number will be duplicated on your mobile phone.

- Ingosstrakh gives gifts. Click on the icon in the form and select a profitable offer. You will be offered good discounts.

- All you have to do is wait for a call from a specialist within the specified time period.

You will have to go through a similar algorithm when registering a “military mortgage” policy. There is one caveat - additional options. You can pay extra for apartment mortgage insurance (movable property and decoration) or liability insurance to neighbors.

Sending an application without calculating the cost Ingosstrakh

Fill out the form, indicate contact information: phone number, name, email address and time to contact a company specialist. Enter data for preliminary calculation. You choose what you will insure: an apartment, a house or something else. Indicate the loan amount and the name of the lender bank. During the filling out process, you check the boxes next to life, title or property insurance. Add a comment and submit your request. A confirmation is sent by email, and you just have to wait for communication with a company employee.

Renew contract

To renew your Ingosstrakh policy, you must fill out the next form. Indicate the series and number of the document. You also enter the last name of the policy owner and click the “renew” button.

Payment of fees

Choose one of the options: payment of the franchise or invoice. Indicate the information: policy number and surname of its owner.

To activate the policy, select an insurance product, indicate its number and activation code.

To check the authenticity of your policy, enter your contact information (Mail.ru email, phone). Click “check”.

Conclusion

Save on mortgage insurance. Use the calculator on the website. Choose the best offer available on the mortgage market. Calculate the cost of the policy in several large companies. Get the product that's right for you. For example, to insure an apartment with a mortgage.

For reference: the tariff on the market, according to average indicators, depends on the lending party, coverage, and varies between 0.6–1%. The total insurance rate is summed up from the cost of the product for each insurance item. If you get a one-year policy, the cost of insurance is paid in a one-time payment. Multi-year policies have annual premiums.

Still have questions? Ask them by filling out the form on the website, calling or writing a question online to a consultant.

See also:

Ingosstrakh - What risks does mortgage insurance cover?

With minimal payments, insurance gives a sense of security, since the responsible organization will assume obligations in the event of an insured event. Ingosstrakh covers a number of insurance risks:

- loss of health or life;

- significant damage to real estate;

- loss of ownership of real estate.

In accordance with the law, insurance of collateral property is mandatory. The insurance program protects against non-payment of debt in the event of difficult circumstances.

Comprehensive mortgage insurance takes into account several risks:

- Death of the borrower. If a person dies, the insurance company pays the loan for him. Otherwise, the debt passes to his heirs.

- Loss of health leading to disability. This refers only to disability of groups 1 and 2, when a person cannot work.

- Destruction of structural elements of the mortgaged property. The collateral is a guarantee that the mortgage debt will be repaid to the bank. If it suffers significant damage or is completely destroyed, the mortgage remains unsecured. Repaying the loan funds will be extremely problematic for the bank; in this case, real estate insurance is provided. Examples of an insured event include a domestic gas explosion, flood or fire.

- Cancellation of the right to own collateral real estate. This type of insurance is provided only in the first three years after purchase. According to the law, it is possible to challenge the client’s property right only during this period. For example, a purchase and sale transaction was carried out in violation - the consent of the seller’s wife was not obtained. Within 3 years, she has the right through the court to declare the sale of the apartment illegal.

Note! The insurance period must be renewed every year. If you decide to refuse financial protection after some time, the bank has the right to increase the rate under the current mortgage agreement.

Of all the types of financial protection listed above, only collateral property insurance is mandatory. Other risks are insured by the borrower at will. The bank does not have the right to force the purchase of a policy, but it can influence the client by increasing the interest rate if they refuse insurance.

Usually the rate increases by 1-2%, but there are lenders who increase the rate by 4-5% at once. It is worth paying special attention to this clause in the loan agreement.

Risks and protection programs

The Group offers clients services in the following categories of mortgage risks:

- insurance of real estate secured by a mortgage;

- life and health insurance of the borrower;

- title insurance of mortgages with secondary housing against loss of ownership.

Important! A mandatory insurance policy for a mortgage is the security of collateral. The remaining types are taken out voluntarily, but if you refuse life and title insurance, you may receive a polite refusal to issue a mortgage or an increase in the loan rate by 1-3%.

Collateral insurance

This is a mandatory type of mortgage insurance and it allows you to obtain protection for a property purchased with the help of borrowed funds from the bank. You cannot refuse this insurance, but it is inexpensive. In this case, only damage to walls, floors and ceilings is insured. You will not be reimbursed for damaged repairs under this program. To do this, you need apartment insurance against fire or flooding.

Risks from destruction of real estate for the following reasons:

- Fall of an aircraft;

- Destruction by transport;

- Natural disasters;

- Man-made accidents;

- Intentional actions of third parties, etc.

Life and health insurance for borrowers

The program includes major contingencies. The borrower guarantees himself financial security in case of insolvency during disability. Also, the insurance company will fully repay the mortgage debt to the bank upon the death of the borrower.

Risks:

- Disability groups 1 and 2.

- Death of the borrower due to accident or illness

Important point! Alcohol or drug intoxication, as well as suicide during the first two years of the contract are not an insured event and payments for such an event will not be made.

Voluntary title insurance

Title is the right to use property and be its owner, based on a specific document (DCP, deed of gift, inheritance). As a result of a series of unforeseen events, the title may be lost. These include, for example, third parties declaring their rights to property or identifying a seizure or encumbrance.

AlfaStrakhovanie offers to issue a policy that provides compensation to the bank in the event of a disaster.

Risks: full or partial encumbrance of property rights.

The insurance company will consider the incident to be covered by warranty when the court decides that the purchase and sale agreement is invalid. We discussed title insurance for mortgages in more detail earlier.

Advantages of obtaining mortgage insurance from Ingosstrakh

Advantages include ample opportunities when contacting an insurer:

- efficiency and flexible tariffs;

- the ability to issue a policy online;

- individual approach to a potential policyholder;

- payment in installments without increasing the amount;

- signing and paying for the contract when preparing documents at the bank;

- favorable conditions even with early repayment of debt.

The mortgage insurance program at Ingosstrakh is acceptable for most banks, as it takes into account all the features of mortgage lending in the Russian Federation.

What makes it stand out from the rest:

- The insurance company's reliability rating is ruAAA. This means that it is stable. The financial forecast for the near future remains the same.

- Most banks that issue mortgage loans cooperate with the insurer. This means that credit institutions have approved Ingosstrakh as their partner and are ready to cooperate with it. It is worth noting that not all insurance companies become official partners of large banks (Sberbank, VTB, Gazprombank and others).

- Financial protection for real estate can be purchased online on the company’s website.

- Other types of insurance are issued at the bank office when receiving a mortgage or through an insurance agent. The purchase of the policy takes place within 1 day; the client will need a small package of documents.

The main point of concern for a mortgage borrower should be the reliability of the insurance company. If an accident occurs, the client must be confident that his loan will be repaid by the insurer.

Ingosstrakh offers the possibility of preliminary calculation of insurance premiums. The calculator takes into account the following parameters:

- the amount of the loan provided;

- characteristics of the property;

- previously completed transactions on the property, including their purity;

- parameters of gender and age, level of health;

- creditor's requirements.

As a result, you can obtain accurate data on the amount of payments that are valid throughout the entire loan period.

Online calculator for the cost of mortgage insurance for an apartment

Mortgage insurance of an apartment, or, as it is called, constructive insurance, provides the bank with repayment of the debt and interest on it in the event of damage to the property. The policy is issued in favor of the lender. It is valid for the entire mortgage period.

It may be difficult to independently calculate the cost of insurance, since the client is not always familiar with all the bank’s requirements. Ignorance of insurance rates can also cause difficulties. Thanks to the online calculator, you can calculate the cost of a policy from different insurance companies in a few minutes.

Mortgage insurance at Ingosstrakh: where is it cheaper to get it?

The client has the opportunity to obtain life, property and title insurance when taking out a mortgage. Many factors are taken into account. Ingosstrakh provides the possibility of insurance in different banks, taking into account the basic parameters of the client, real estate and loan.

Let's consider 2 examples - a 38-year-old man in good health and working in a law enforcement agency, a woman of the same age as an estimating engineer. The object in question is an apartment on the secondary market on the 5th floor and has been owned for more than 5 years. The following payments are established:

- Sberbank. A comprehensive package for a man is 46,718 rubles, for a woman 36,448 with a contract period of 1 year.

- VTB. With a similar period for a man - 72418, for a woman - 46176.

As a result, the insurance premium is largely determined not only by the identity of the borrowers, but also by the conditions of the banks.

When applying for a policy online on the Ingosstrakh website, a 15% discount is provided to Sberbank borrowers. For example, the cost of insuring collateral on a mortgage of 3 million rubles with the same insurance coverage is 5,294 rubles.

When purchasing a policy on the official Ingosstrakh portal, you need to pay 4,500 rubles. The savings will be 794 rubles. Calculations are preliminary and may differ from the cost of insurance in each specific case. Purchasing at the company’s office will cost more, but by agreement a discount can be made for regular policyholders.

Online insurance calculator

Our portal’s online calculator will help you calculate the price of apartment insurance (including title insurance) and life insurance with a mortgage. To do this, you must fill in the following fields:

- Place of registration.

- The name of the lending bank and the cost of the mortgage loan.

- Year of birth and gender of the main borrower, share of participation in the loan.

- Select the necessary options for financial protection of your apartment using a mortgage.

- It is possible to select one or several types of risks and compare the final calculation.

The calculator gives extremely accurate results. The calculation is made based on current tariffs, taking into account age coefficients and the requirements of a specific lender.

"Ingosstrakh" - Types of mortgage insurance: apartments and houses

Ingosstrakh offers ample insurance opportunities if a mortgage is taken out when purchasing real estate. There are two main programs - “Mortgage Insurance” and “Rosvoenipoteka”.

Standard mortgage insurance provides property, life, and title insurance. The amount insured is from 100 thousand to 10 million rubles. The program is accepted by most major banks. Payments start from 150 rubles per year.

Rosvoenipoteka is specially designed for clients who buy real estate under the Military Mortgage program. The amount insured is from 200 thousand to 5 million rubles. Payments start from 180 rubles per year.

Ingosstrakh operates the following mortgage insurance programs:

- Property (collateral) insurance.

- Life and health insurance.

- Title Insurance.

- Rosvoenipoteka. Only the apartment is insured; the Ingosstrakh policy is accepted by all banks participating in the military personnel lending program.

If desired, the client can sign up for a comprehensive financial protection program. Its purchase is more profitable than purchasing individual policies. The cost of each option is calculated individually depending on the terms of the loan agreement.

How not to make a mistake when choosing an insurer?

When choosing an insurance program, it is important to focus on a company that has been operating on the market for a long time. You need to be sure that if an insured event occurs, payment will be made.

As soon as the loan agreement is drawn up, the borrower begins choosing an insurance offer. You must read the terms and conditions. Many people focus on the size of the payment, but this is not always correct.

Choosing the right insurer for financial protection of your mortgage is very important. This determines whether the client will receive an insurance payment if an unforeseen event occurs.

What to look for when choosing:

- Level of reliability in the rating of insurance companies.

- Large payments made recently. Typically, information about them is indicated on the company’s website and other official sources.

- Reviews of those who have used the mortgage insurance service. The opinions of those clients who tried to receive insurance compensation should be taken into account.

An insurance company must first of all be reliable. Even large companies can provide more favorable conditions than new players. For an accurate calculation, fill out an application on the website or contact the manager. He will make calculations and describe the conditions of interaction.

What happens when the insurance is not paid by the borrower?

If a late payment is detected within 1 month, the borrower receives a notification about the need to pay. As a rule, banks do not go to court over unpaid insurance payments.

They are worried about the safety of their property, since if loan payments are not received, the property is confiscated. It must remain in its original form and not be damaged. An insurance company can save you from this by compensating your investment when an insured event occurs.

If the policyholder has not contacted the insurance company to renew the mortgage insurance, Ingosstrakh transmits the relevant information to the bank. Further actions take place on the part of the lender in accordance with the terms of the mortgage agreement.

You can renew the contract online on the Ingosstrakh website:

The consequences for the borrower will vary depending on the type of policy:

- Collateral insurance. Due to the fact that the availability of a policy is a mandatory condition of the loan agreement, the bank has the right to impose penalties. The worst-case scenario would be a one-time demand to repay the entire amount of the debt and a trial.

- Life, health and title insurance. The policy is issued voluntarily, but the bank has leverage over the borrower for an uninsured loan. Most likely, the terms of the loan agreement stipulate an increase in the interest rate. This is exactly what the lender will do after being notified of non-renewal of the mortgage policy.

If you decide to switch to another insurance company, be sure to notify the bank that issued the mortgage. Or make sure the new insurer passes on the information to your lender.

"Ingosstrakh" - Insured event on mortgage property, what to do?

If an unexpected incident occurs with the insured property, many clients do not know where to go and what to do. Ingosstrakh has developed detailed instructions for the following situations:

Property

In the event of damage to the insured mortgage property, perform the following actions:

1. Contact the competent authorities - the police, the Ministry of Emergency Situations, the fire department, depending on the circumstances.

2. Within 3 days, report the incident to the insurance company. In the event of significant harm to health or death, the client must notify the insurer within a month (if there is a life insurance policy).

3. Obtain supporting documents from government agencies and provide them to Ingosstrakh.

4. Until the insurance company’s employees inspect the property, it should be kept unchanged. An exception is the situation when there is a threat to the lives of family members of the borrower or other persons, for example, the risk of collapse of structures.

For all telephone numbers and a list of documents, see the section “ Insured Event ” (ingos.ru/incident/mortgage).

It is advisable to coordinate the procedure with representatives of Ingosstrakh. This can be done by calling the hotline number, which is listed on the official website. For regions of Russia the following number applies: 8-800-100-77-55.

It is important to provide complete information about the amount of damage, its causes and consequences, as well as its nature. It is required to describe the events that occurred and express complaints.

Life and health

If damage occurs to the borrower's health, the following actions are taken:

- seeking medical help;

- notifying the insurer of the incident 3 days or 1 month in advance if the borrower died or became disabled.

Loss of ownership rights (Title)

If the damage occurs due to loss of title, the policyholder notifies the insurance company by calling the hotline.

Insurance compensation is paid in the following amounts:

- Complete loss of property. The remaining debt to the bank is fully repaid.

- Partial loss of property. Payment is made in the amount of expenses necessary for restoration.

- If a death occurs or the policyholder receives a non-working disability group, a payment is made in the amount of the insurance premium.

- When temporary disability occurs, 1/30 of the monthly premium is paid for each day of the period of inability to work. In this case, the amount cannot be more than 0.2% of the insurance payment.

If there is a restriction or termination of ownership, a share of the insurance payment is indemnified, which proportionally corresponds to the insured property.

Mortgage insurance claim forms: .

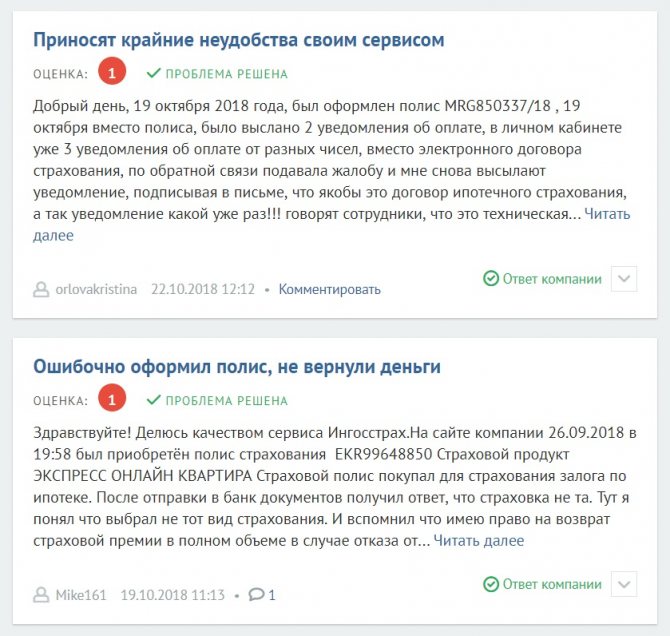

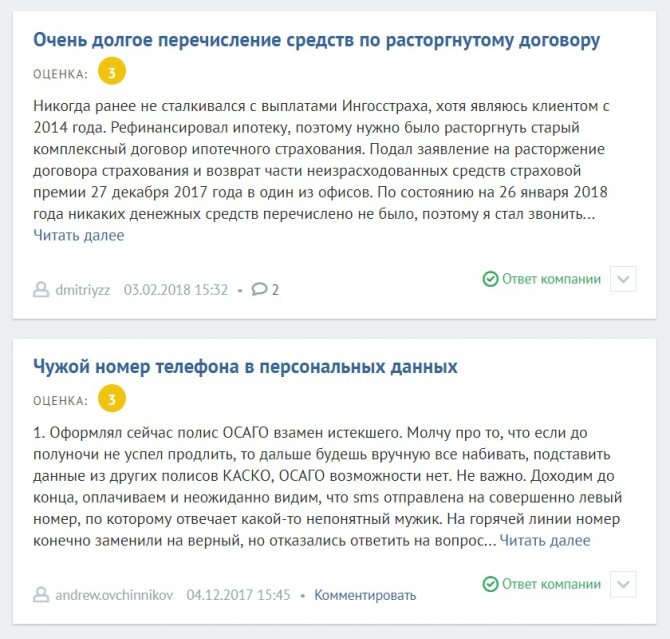

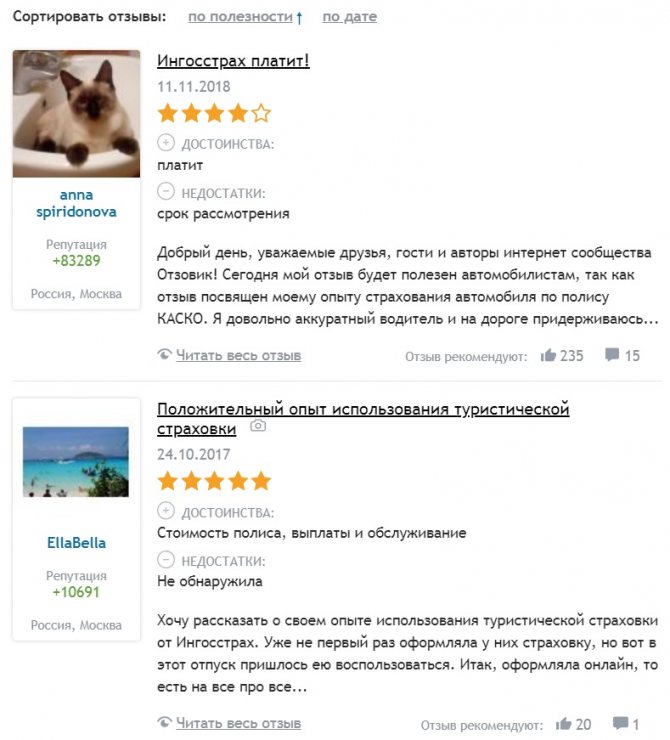

Customer reviews about mortgage insurance at Ingosstrakh

Reviews from Ingosstrakh clients posted on independent portals are not nearly as encouraging as those on the insurer’s website.

The company is recommended for cooperation by only half of all those who left their opinion on the Internet.

The main problems faced by mortgage borrowers:

- Unprofessional service.

- Imposition of additional products.

- Long time for reviewing documents related to an insured event.

- Violation of payment terms.

It is noteworthy that there are few complaints about the lack of mortgage insurance payments.

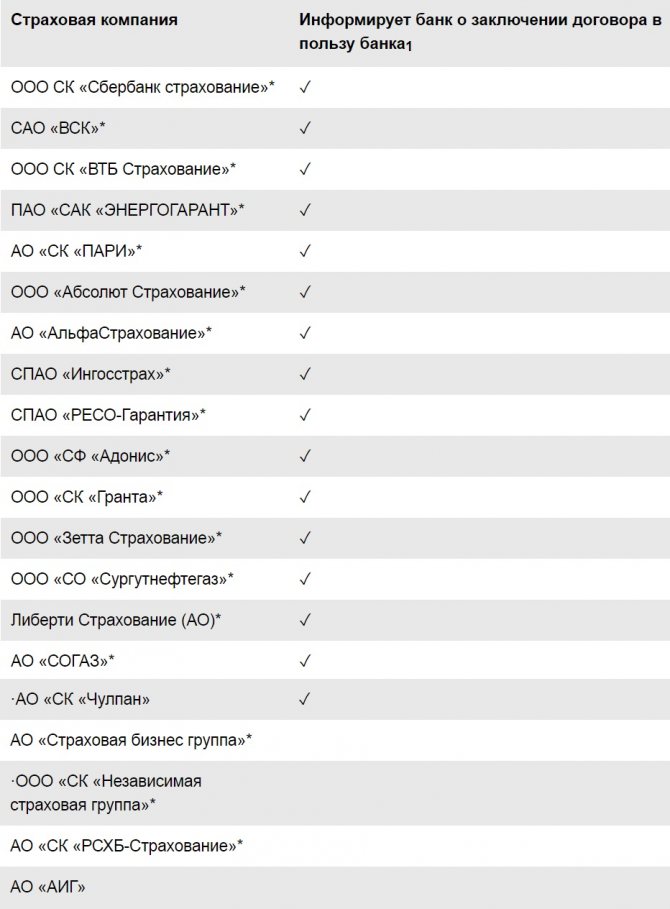

"Ingosstrakh" - Accredited mortgage insurance companies

Ingosstrakh is accredited by almost all banks that issue mortgage loans. Among the company's regular partners are: Sberbank, VTB, Gazprombank, Rosselkhozbank, AHML and others.

Each bank has its own accredited companies. You can find out which ones are included on the credit institution’s website:

- Sberbank - sberbank.ru/credit_org/ins_comp_prop.pdf;

- Rosselkhozbank - rshb.ru/download-file/300241/1.pdf;

- Moscow Credit Bank - mkb.ru/about/insurance-company;

- Promsvyazbank - psbank.ru/Insurance;

- Raiffeisen - raiffeisen.ru/retail/insurers/;

- VTB - docviewer.yandex.ru/auto_accredited_companies.pdf.

In addition, Ingosstrakh mortgage policies are accepted by lenders working on military mortgages. This means that the company has long-term relationships not only with major representatives of the financial market, but also with government agencies.

Ingosstrakh is one of the best Russian insurers, which is one of the systemically important companies of the state. The organization has an extensive network of conveniently located offices. They are intended to serve citizens and legal entities. Offers a line of unique products.

The company takes its reputation and the products it offers seriously, which is why it is accredited by many Russian banks to provide mortgage insurance. Any major bank will offer to take out insurance from Ingosstrakh, as it is a reliable partner.