Loan calculator with early repayment

The loan calculator will help you calculate the amounts for early repayment of the loan. To do this, you need to know your interest rate, the date the loan was issued, the loan amount and the amount for which you want to make an early repayment of the bank loan. Read below on how to make early repayment correctly.

Apply for a deferment on a Sberbank loan for 6 months - online

Loan calculator with early repayment provided by calcus.ru

About early repayment in Sberbank

Some borrowers seek to redeem their home from the loan collateral as early as possible - this is due to the unstable economic situation in the country and the constant fear of breaking the mortgage payment schedule.

Conditions for partial early repayment of a mortgage

Today, Sberbank has no restrictions on making partial payments, and there is also no specific minimum payment amount. When making a payment ahead of schedule, it is required that the borrower have a sufficient amount of funds in the account. The required amount must first be transferred to the card or deposited through the terminal. Then write an application to Sberbank to repay the debt ahead of schedule, or write off the required amount through a bank terminal.

When depositing money at a bank branch, it is best to ask in your application that this amount be included in the monthly payment schedule. Then they will calculate the early repayment for you, and this payment will be written off, and the reduced payment will be recorded on the next date.

Early repayment of a mortgage at Sberbank can be done without contacting the bank in your Sberbank online account. For this function to be available, you must contact the bank branch and activate it through the administrator.

Partial early repayment from Sberbank is available only with the possibility of reducing the monthly payment. It is not possible to shorten the term of the existing mortgage after early repayment. Our early repayment mortgage calculator allows you to make two types of calculations:

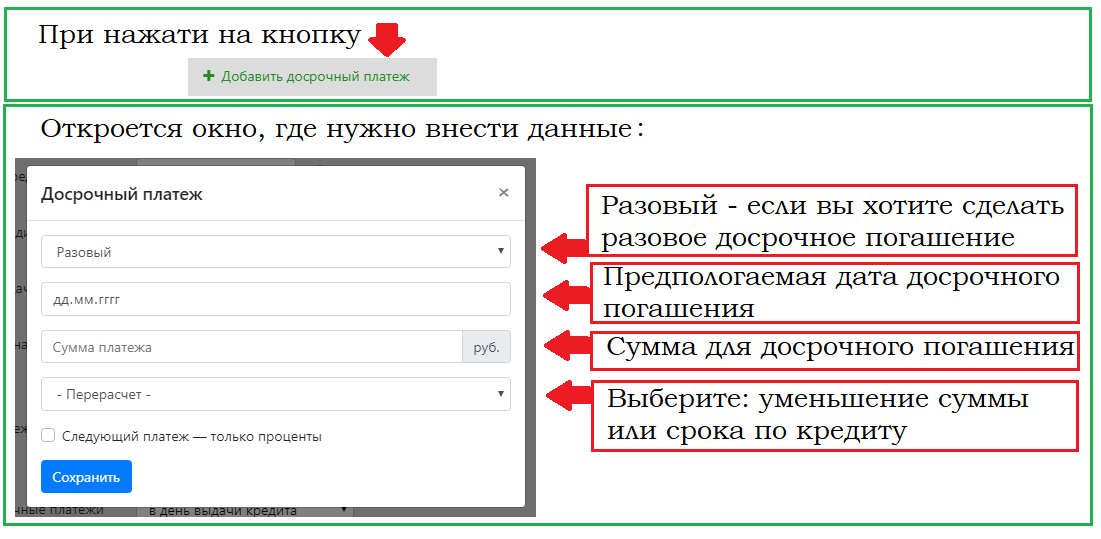

- One-time repayment or on a specific date will create a payment schedule taking into account one-time early mortgage payments on the required dates.

- Monthly for a certain amount. Allows you to build a schedule taking into account the monthly transfer of a certain additional amount for payment according to the schedule.

Full repayment of the mortgage

This type of debt repayment relieves the borrower of mortgage obligations, and all restrictions are also removed from his home, and it becomes the property of the borrower. To repay the loan in full before the due date:

- Call the bank or come to the branch in person to clarify the remaining amount on the loan.

- The required amount is transferred to the specified account. It is better to make payments not through online services, but in person at Sberbank - this speeds up the process of crediting the borrower’s money.

- Obtain from bank employees a certificate confirming that loan obligations have been fulfilled and that they have no claims regarding credit debt.

- After this, the borrower should terminate contractual obligations with Sberbank.

- Then you need to close the mortgage account so that you are not charged for its maintenance and documentation.

- Remove restrictions from your home and close the insurance drawn up when drawing up the insurance contract.

Sberbank mortgages are discussed in more detail in a separate post. To find out what documents are needed for a mortgage at Sberbank, go to another post.

We are waiting for your questions about the operation of the calculator. We would be grateful for your assessment of his work and repost on social networks.

How to make payments for early repayment

The loan calculator will help you make an approximate calculation of early repayment. Since interest in banks can be calculated in different ways, there may be a small error of 1-3% in the calculations. It is worth considering that different banks may have different commissions, insurance, paid services, which can also be included in monthly payments. Bank specialists will tell you the exact calculations when you visit the office or call the hotline.

When depositing an amount for early partial or full repayment of the loan, do not forget to write an application for early repayment . Otherwise, your amount will not be written off; only the monthly payment will be written off.

When using our early repayment loan calculator, calculate in different ways. Choose the calculation that suits you best.

If you want to reduce the loan term, choose to recalculate the loan term. If you are not comfortable paying (large monthly payment amount), reduce the loan amount - choose recalculation of the monthly payment.

If the term is reduced, the total loan payment will be less than if the monthly payment amount is reduced.

VTB 24 mortgage calculator with early repayment (reducing the loan term)

Rating: 5.0 /5. From 7 votes.

Please wait…

Voting is currently disabled, data maintenance in progress.

The VTB 24 mortgage calculator on the website allows you to calculate your mortgage payment online, as well as take into account early repayment of your mortgage at VTB-24 while saving the results in Excel.

The calculator is used both for mortgage calculations on the primary market and for housing on the secondary market. It is possible to specify maternity capital as a down payment on a mortgage.

Next, the calculator itself and the rules for early repayment at the bank.

Calculator:

It is possible to use Excel calculation directly on the website or. Substitution of parameters is carried out in yellow fields (editable cells) . The schedule is calculated using the annuity payment method based on instructions from the Central Bank of Russia. The model allows you to plan early repayment of your mortgage with a shorter repayment period.

Mortgage early repayment calculator VTB 24

You can download the calculation model in MS Excel format by clicking on

The model allows you to plan early repayment of your mortgage while maintaining the same monthly payment amount (annuity), but reducing the loan term. This repayment method is now used in VTB 24 and some other banks at the request of the client. An alternative method of calculation with early repayment involves reducing the monthly payment - the mortgage repayment model of Sberbank of Russia.

This repayment method is also available to clients of VTB 24 Bank - here the choice is up to the clients (unlike Sberbank, where there is only one scheme). The Sberbank model can be used for calculations, because it is based on the Bank of Russia methodology.

When making full early repayment, read a review of the practice about the possibility of returning part of the interest paid on the loan.

Can a bank charge a fee for early repayment of a mortgage?

The entry into force of the Federal Law “On Mortgage (Pledge of Real Estate)” dated July 16, 1998 N 102-FZ has made the mortgage lending market more client-oriented.

If previously the bank that provided the borrower with a mortgage loan had the right to refuse the possibility of early repayment (or even impose penalties for such), then after the adoption of the law, all that is required of the borrower who wants to repay the entire loan (or part of it) ahead of schedule is to warn bank 30 days before the planned transfer of funds.

If you want to find out which collateral and life insurance contracts are required for a mortgage, read our article

The law also sets the maximum period within which it is necessary to write an application - 30 days. Moreover, the bank can change this period downwards. Obviously, the banks were not happy with what was happening, because early repayment of even part of the debt leads to a discrepancy between the planned and actual profit on the loan.

Some of the banks, having lost part of their income, resorted to a last resort - the introduction of additional fees for early repayment. The accrual of such commissions is unlawful, but borrowers in some cases have to resort to the help of professional lawyers to return personal funds illegally obtained by the bank. It should be immediately emphasized that this practice does not apply to VTB 24.

What are the mortgage payment plans?

Today, banks offer two payment schemes for mortgage loans - differentiated and annuity.

- Differentiated scheme , as its name suggests, assumes that the amount of payments varies, decreasing from month to month. Payment under a differentiated scheme consists of two parts - the part that goes to repay the main body of the debt and the part that goes to cover the interest accrued on the loan. At the same time, repayment of the principal debt is carried out evenly - every month an equal part of the loan body is repaid, which ultimately leads to a high burden on the borrower in the first half of the term, when interest payments are high.

- An annuity scheme is an artificial calculation of the repayment amount in such a way that the borrower deposits the same amount every month, up to the full repayment of the debt with interest. At the same time, at the very beginning of the term, to compensate for the payment of high interest payments on the amount of the debt, the client repays the loan body itself very minimally, and only at the end of the term does he begin to repay the principal debt more actively.

Obviously , partial early repayment of a mortgage loan leads to a recalculation of the previously fixed monthly payment amount or an adjustment of the term.

Early repayment of a mortgage at VTB 24 Bank

VTB 24 Bank strictly fulfills the requirements for banks prescribed in the Federal Law “On Mortgage”. The borrower may exercise the legal right to repay the mortgage loan early, either in full or in part.

Important: the period within which you must notify the bank of your intention to repay the debt early is 15 days. In this case, the bank sets a minimum payment of 15 thousand rubles.

You can make early repayment of your VTB 24 mortgage in the following ways:

- Personally deposit funds through a bank cash desk.

- Send money via Telebank online banking.

- Use a VTB 24 ATM equipped with a cash acceptance function.

- Take advantage.

- Through an ATM, using a bank card, from which funds will be debited.

How to submit an application for early repayment of a mortgage loan

Different banks have different requirements for the format of the notice of intent to make early repayment. Some banks, including Sberbank, offer to draw up and send an application via Internet banking.

Until recently, VTB 24 Bank accepted such statements exclusively in writing. Some time ago, the bank announced the possibility of notification by telephone. According to the data provided on the bank’s official website, the application-obligation for full or partial early repayment must, among other things, include information on the amount of early payment (excluding accrued interest), in addition, it must be submitted no later than one day in advance before the next payment period.

You can read about mortgage refinancing at VTB Bank in our article

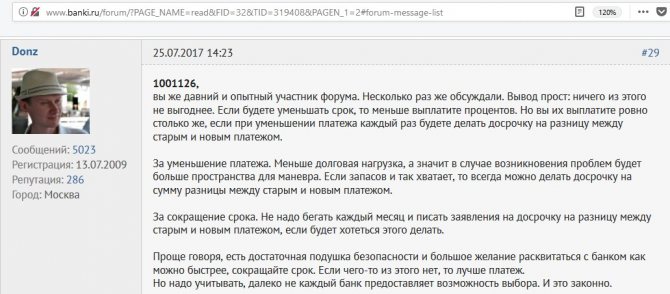

Partial early repayment - reduce the term or amount of the loan?

In the application for partial early repayment, the borrower may indicate how he wishes to change the loan repayment scheme.

Banks provide two options.

- Reducing the loan term.

- Reducing the monthly payment amount.

Both options have both advantages and disadvantages. The VTB 24 mortgage calculator, offered by the bank on the official website, does not provide for the possibility of recalculating payments for partial early repayment.

If the annuity method of repaying the loan is chosen, then, obviously, the benefit is directly related to the amount of funds already spent on repaying the loan.

- If you decide to resort to early repayment after, say, 10 years after taking out a mortgage, then almost all the interest has already been paid. And in this case, it will be more profitable to reduce the size of the monthly payment, thereby reducing the financial burden.

- If the bank has not yet managed to “take its toll” on the accrued interest, then reducing the payment period in all cases will be more profitable, since you are reducing the lending period.

But you can’t give universal advice - it’s worth considering how significant the mortgage payment is for you and how stable your job is.

For example, if you are currently earning well, but you have doubts that the situation will not change, it is wiser to first reduce the monthly payment to a comfortable level, and then resort to recalculating the loan term.

We recommend calculating the VTB 24 mortgage, initially taking into account that the mortgage payment should not hit the family budget too significantly.

Some nuances of early repayment of a mortgage at VTB 24

Changing the date of monthly mortgage payment at VTB 24

To change the calendar date of a monthly payment, you must write a written application at a bank branch. But we draw your attention to the fact that clients of VTB 24 Bank periodically become dissatisfied with the time this procedure may take. Therefore, we recommend that you arrange for a change in the payment date in advance and obtain a new payment schedule agreed upon by the parties.

Receiving a payment schedule after partial early repayment

After the bank receives additional funds for partial early repayment of the mortgage, a recalculation is made, based on the results of which the bank manager offers possible options for further payments. Once agreed, the new payment schedule comes into force.

Preferential mortgage lending programs VTB 24

VTB 24 Bank participates in all government housing programs and accepts any certificates (for maternity capital, for military mortgages) for the purchase of real estate.

It is important to take into account that a number of borrowers expressed dissatisfaction with the fact that maternity capital cannot be used to reduce the loan term. But the mortgage rate for a young family will be only 11%, the maximum amount is limited to 8 million rubles.

Read about using maternity capital as a down payment on a mortgage

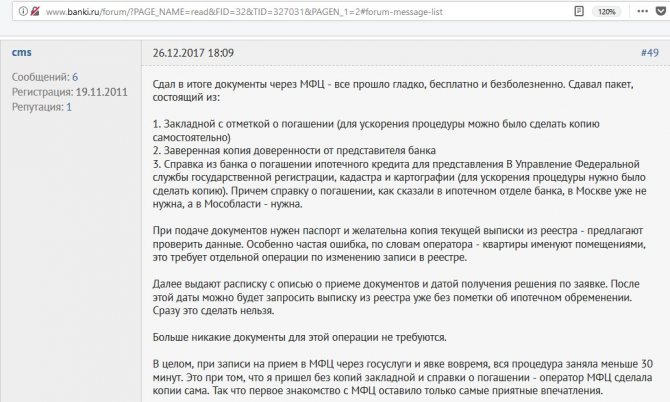

The procedure for removing encumbrances from an apartment

After paying off the entire mortgage loan, a number of procedures will need to be carried out, which will result in the release of the property from the encumbrance. For this you will need:

- Certificate of full repayment of the loan.

- Originals and copies of owners' passports.

- An application for lifting restrictions certified by bank employees.

- Loan agreement.

- A mortgage note with a maturity note.

- Certificate of ownership (now not required, as it has been replaced by an extract).

- Confirmation of payment of state duty

- Contract of sale.

The collected documents must be submitted to Rosreestr (via the MFC), and after five days you must pick up a document confirming the fact that the encumbrance has been removed from the apartment.

By the way , you can also submit an application through the Rosreestr website, if you have an electronic digital signature, which is purchased at the MFC

Congratulations, you are now the full owner of the purchased home!

This may be useful:

- Sberbank has reduced mortgage rates. News of Sberbank mortgage programs in 2017-2018

- The procedure for collecting penalties from the developer under 214-FZ in 2018

- Sale of a share in an apartment: participation of a notary according to the rules of 2018

- VTB Bank of Moscow mortgage calculator with early repayment

- Is it possible to sell an apartment purchased with a mortgage or 8 ways to get out of mortgage slavery

Amounts of interest and principal

After completing the calculation, a preliminary payment schedule will be displayed on the screen. Where you can see all the calculations:

- How much has been paid on the loan ? This is the total amount of all your loan payments, which includes the amount of accrued interest and the amount of principal owed.

- The amount of the debt paid is the amount for which the loan was issued.

- The amount of interest paid is the sum of all accrued interest on the loan, paid and forthcoming, taking into account early repayment.

After early partial repayment of a loan (any: consumer, mortgage, car loan), ask the bank for a new payment schedule. You will know for sure whether a write-off occurred for early repayment.

If you have repaid the loan in full ahead of schedule, it would be a good idea to take a certificate confirming the closure of the loan (certifying that there is no debt on the loan)

How the bank will write off amounts for early repayment

When repaying early, it is worth considering that not the entire amount will be written off towards early repayment. Let me give you an example.

Example. Reducing the term for early repayment.

The loan amount is 100,000 rubles. The monthly payment amount is 2380 rubles. Term 5 years. You want to repay 30,000 rubles ahead of schedule, but this amount only covers part of the loan; the loan will not be repaid in full.

From 30,000 rubles, you need to subtract the amount of the monthly payment (if early repayment is made on the day the monthly payments are written off). So, 30,000-2380=27,620 rubles will be used to repay the interest.