A bank that clients are willing to trust not only provides pure financial services. Its employees provide clients with qualified advice on all issues arising in connection with the provision of these services.

Sberbank is a financial and credit organization with a reputation as a reliable bank that provides a wide range of mortgage lending programs. Mortgage consultation provided by managers of a financial institution is a service that a potential counterparty of Sberbank should resort to long before signing all documents.

Why is it necessary to consult a manager when applying for a mortgage at Sberbank?

A mortgage is a loan, the processing of which is unthinkable without studying and analyzing a large amount of information, some of which is not yet on the surface.

Often, applicants, having read the phrase about “quick registration of a mortgage using two documents” and “ease of application” for it, remain disappointed: the application is not approved, in reality there are significantly more documents for registration, and additional costs are added to the down payment and the rate , which the applicant was unaware of due to inexperience.

A mortgage, by its specificity, requires solid security in the form of:

- A mortgage on valuable property (usually real estate);

- Joint and several liability of co-borrowers (if several people take out one mortgage);

- Guarantees.

And this also comes as a complete surprise to uninformed clients.

Consultation with Sberbank employees allows the borrower to find an answer to any question he has about applying for and maintaining a loan.

The specialist helps:

- Understand mortgage programs and choose the one you really need;

- Calculate the costs that will arise in connection with the mortgage taken;

- Choose a reliable developer (if the property is purchased in a new building);

- Establish the degree of compliance of housing with the bank’s parameters (if we are talking about a mortgage on housing from the secondary housing stock);

- Prepare a package of documents, fill out an application for a mortgage according to the applicant and a mortgage for housing if the applicant’s application is approved;

- Maintain the mortgage until it is paid in full;

- Document the absence of the client’s obligations to the bank upon completion of the mortgage payment.

The population of the Russian Federation on average remains legally illiterate. Lack of awareness of the rights and responsibilities of mortgage lending can lead to an overly gullible citizen becoming a victim of a criminal scheme. Its direct consequence is the loss of an apartment and a huge credit debt. Consultation received from a Sberbank manager will help the client avoid such situations.

Why was the Sberbank mortgage center created?

It is difficult to create optimal conditions for all clients within one office serving individuals. While there are no difficulties with standard payment transactions and processing regular loans, mortgage clients often encountered problems.

Of course, housing loans can be processed in regular offices, as has been done for many years, but if possible, it is better to contact the Sberbank mortgage center. Its advantages:

- targeted only at mortgage borrowers. There is everything here so that the client can complete all the necessary steps for registration without much time loss and legwork;

- comfortable conditions have been created for making real estate transactions. There are often many owners and buyers, so for convenience, transactions are concluded in spacious offices, and not behind a simple bank counter;

- there are safe deposit boxes with the help of which settlements with sellers are made, the down payment is transferred;

- All employees on staff have been trained specifically in mortgage lending. All Sberbank mortgage centers in Moscow and other cities have a real estate lawyer on staff;

- one-stop service. This applies to consulting, accepting applications, collecting and checking documents, ordering appraiser services, insuring the borrower and real estate, concluding contracts and agreements - everything is done in one place, which is very convenient.

Cash loan Tinkoff Bank

| Max. sum | RUR 2,000,000 |

| Bid | From 8.9% |

| Credit term | Up to 3 years |

| Min. sum | 50,000 rub. |

| Age | From 18 years old |

| Solution | 2 minutes |

Sberbank mortgage lending centers provide more comfortable and faster processing of housing loans. Citizens receive more qualified support from specialists who are trained specifically in mortgages.

Hotline numbers

To obtain more detailed information on a mortgage planned or already taken out at Sberbank, the client can contact employees of the financial and credit organization by calling hotlines. This:

- 900 – short number for subscribers of any mobile operator within the Russian Federation;

- 8 800 555 55 50 – a single number that can be called from landline and mobile phones within Russia;

- +7(495) 500-55-50 – a number that is convenient for making calls to Sberbank for clients located abroad.

Calls to the first two numbers are free, but the cost of the last one depends on the tariff of the telecom operator.

However, for specific advice on mortgages, it is better to contact employees specifically involved in lending. They work in the credit department of Sberbank.

Functions of the credit department of Sberbank

Any relatively large branch of Sberbank has a credit department that works with applicants and borrowers for loans (including mortgages).

See this same topic: How to get a mortgage with deferred payment during construction? Sample application

The credit department oversees the processing and issuance of loans and performs a number of functions at each stage associated with their receipt. Department:

- Provides advice to mortgage applicants;

- Handles the application process;

- Checks the information from the package of documents collected by the applicant;

- Approves the application or refuses to issue a loan;

- Draws up a loan agreement;

- Issues money;

- Monitors the debtor's fulfillment of credit obligations;

- Issues to the pledgor a certificate of full payment of the debt.

The credit department also deals with refinancing mortgages (or other loans). In this case, he also performs all his functions - from consulting a potential counterparty to confirming the borrower’s fulfillment of financial obligations.

Mortgage programs implemented by Sberbank

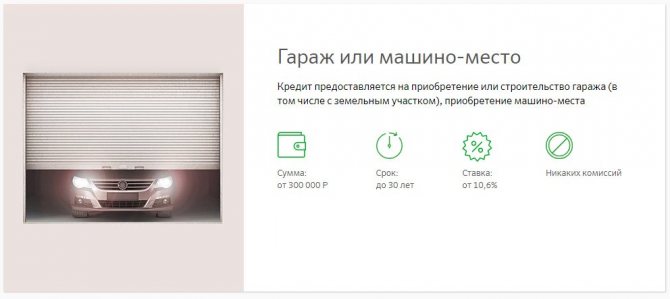

By visiting the Sberbank mortgage center, you can apply for one of the following mortgage programs:

- For properties under construction: at a minimum of 8.2%, up to 30 years for an amount of 85% of the property price.

- For finished residential real estate: at a minimum of 9.6% for periods of no more than 30 years with amounts not exceeding 85% of the cost.

- State support for families with children: from six percent to 12 million for a period of up to 30 years.

- For construction: not less than 11 percent for a maximum of thirty years. The size of the mortgage loan is up to 75% of the estimated or contract price of the housing being financed.

- Non-targeted loan: ten million maximum for terms of no more than twenty years with a rate of 12.4%.

- Military program: at 9.5%, up to 2.5 million for periods no longer than twenty years.

- With the involvement of maternity capital: from 9.6% at rates, up to thirty years for repayment.

In the mortgage department, you will be able to obtain a complete list of loan products available and suitable for you, study their terms and, with the help of an employee, select the best option.

How to get to the credit department

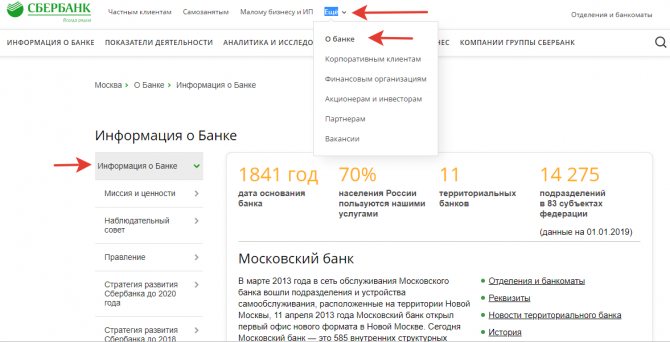

You can find out where the nearest Sberbank branch with a credit department is located on the official website https://sberbank.ru. Having selected your place of residence, you need to open the tabs sequentially: “About the bank”, “Information about the bank”, “Branches and ATMs”. In the window that opens, select the “Branches” tab. After this, all Sberbank branches operating in the given locality will open on the map.

To make your search more specific, you need to click on the “Select services” button and in the list that opens, check the box next to “Mortgage (housing) loans - consultation (accepting applications).”

If a mortgage applicant is concerned about the question of which Sberbank branches can simultaneously get advice and apply for a mortgage, he also marks with a marker the item “Mortgage (housing) loans - registration (issuance).”

In the window that opens, the Sberbank client will see a card with branches located on it that meet the specified parameters.

Methods for sending a question to the Sberbank contact center

Via mobile application

Smartphone owners can contact the operator through a special application for comfortable communication with the support service. You can find it using the links below, depending on your phone model, in the App Store (iPhone), Google Play (Android) or Windows Phone.

After installing the application on your phone, you need to open it and click on the 3 horizontal lines in the left corner at the top. A menu will open in which you need to select “Write to the bank.” A response letter from the service arrives within a couple of minutes, but sometimes you need to wait about an hour.

In your personal account

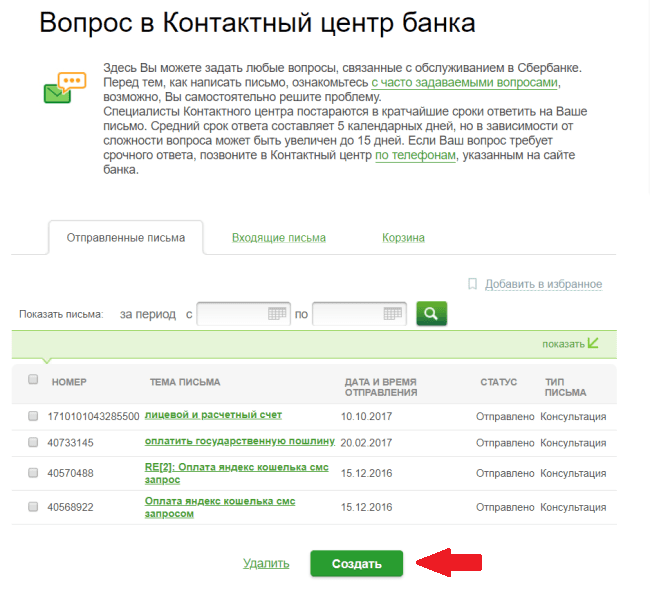

Step-by-step algorithm for interaction through your personal account:

- Log into your personal account on the page online.sberbank.ru, select the “Letter” icon at the top right.

- Select the “Create” item.

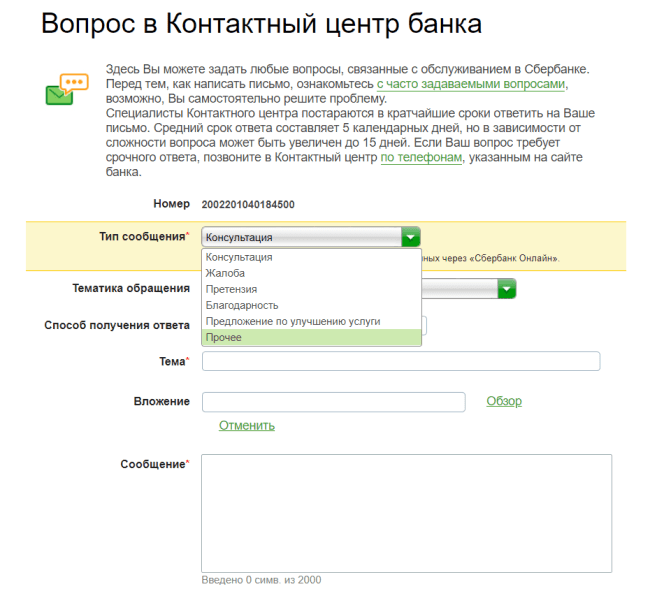

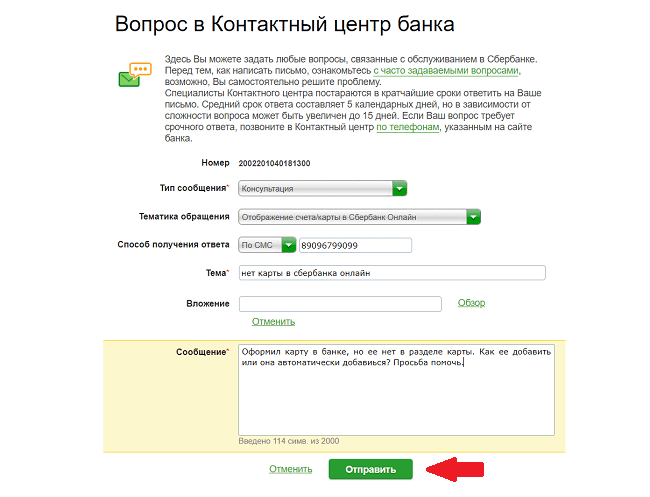

- Determine the purpose of the appeal - consultation, claim or complaint, offer, gratitude or services, etc.

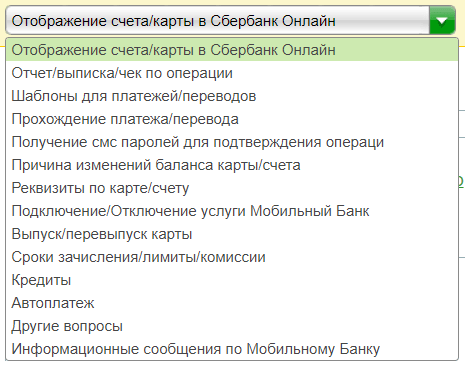

- Indicate the topic of the appeal.

- Choose the appropriate response method (in writing, by phone).

- Specify the subject of the message (main question).

- Formulate a question in a special field, keeping it within 2000 characters.

- Click the “Submit” button.

After these steps, information about the sent letter will appear. The response arrives within 5 days, sometimes you have to wait 15 days.

by email

Citizens can submit questions by email by selecting the appropriate email address:

- [email protected] – individuals and legal entities;

- [email protected] – investors;

- [email protected] – to media representatives.

Each letter is processed individually, personal data is protected.

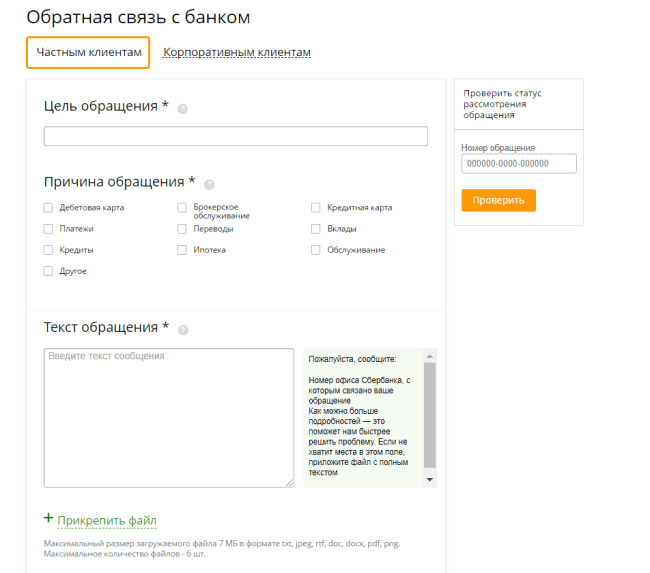

Using the feedback form

A form for feedback from consultants is available on the official website at this link. You need to fill out the required fields of the form and contact the management of Sberbank or wait for a call from a specialist. The form is simple to fill out: the purpose and reason for the request, the essence of the problem, personal and contact information.

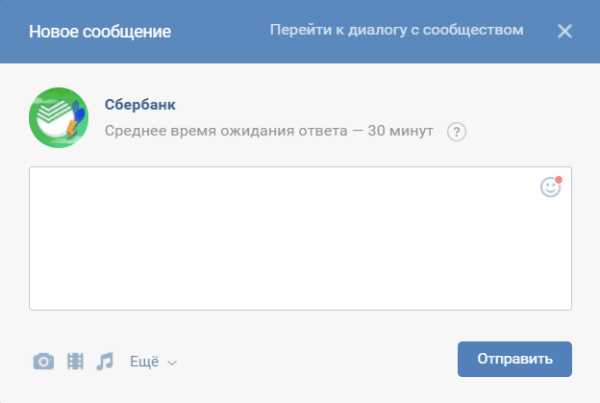

Via chat in Sberbank groups on VKontakte and Odnoklassniki

Another convenient way to get an answer to a question is to contact support chat specialists on social media. networks. To do this, you need to follow the link to the Sberbank group on VKontakte or Odnoklassniki. All that remains is to write a message and promptly receive information support.

Consultation with Sberbank employees: frequently asked questions

Below are answers to the questions that credit department employees are most often asked. Applicants are interested in issues of processing and repaying a loan, the rules for calculating its amount and interest rate, and providing the bank with collateral as security for the loan.

The client will receive detailed answers in consultation with a credit department employee. The review provides general answers to these questions.

How is the loan repaid?

Loans (including mortgages) issued by Sberbank are repaid in annuity payments, that is, in equal amounts over the entire loan term. Sberbank does not use a differentiated payment scheme, when the contribution amount decreases from month to month, when issuing mortgages.

With differentiated payments, the client pays the principal amount of the loan (the body of the loan) in equal installments, and the bank charges interest every month on the portion remaining after the next installment.

In the first few months the client pays large sums, but in the last few months the client pays relatively small sums.

Annuity payments are based on the fact that first the client pays most of the interest, and then the body of the loan. An annuity is beneficial to the bank, but it is also quite convenient for the client, as it makes it easy to plan monthly expenses.

What is the commission amount?

The legislation of the Russian Federation prohibits any commissions - for consideration of an application, hidden or monthly. In compliance with the laws, Sberbank does not charge commissions from debtors. Providing advice to an applicant on a mortgage also does not imply any monetary reward.

Is it possible to register a mortgaged apartment as shared ownership?

The mortgage provides for this possibility. Thus, a housing loan is often issued not by one person, but by co-borrowers. One of them, the title one, takes on the main steps of processing and maintaining a loan. According to Federal Law No. 102 “On Mortgage,” the borrower’s spouse is registered as his co-borrower.

The co-borrower has the right to an interest in the property being purchased, in exchange for which he is financially responsible for repaying the loan on an equal basis with the title co-borrower.

Does the bank check the creditworthiness of potential counterparties?

Yes, financial solvency is one of the main requirements for the applicant. In the mortgage application, the applicant must provide detailed information about his official income and assets.

Since the mortgage is taken out for a long period and involves a loan for a large amount (up to several million rubles), the credit department of Sberbank carefully checks the solvency of the potential counterparty, including its credit history. If the latter is not clean enough, Sberbank will refuse to issue a mortgage.

How does Sberbank set the loan amount for a borrower?

It is appointed by Sberbank based on the results of an analysis of the applicant’s financial viability and the value of the collateral real estate. The minimum mortgage amount is 300,000 rubles, and the maximum as of the current year is 15 million rubles. The loan term also depends on the listed factors.

Look at the same topic: How much does it cost to check the legal purity of an apartment before buying it? Is it possible to check the apartment yourself before buying?

Is it possible to reduce the overpayment on a loan?

Yes, such opportunities exist.

- Providing the maximum number of documents necessary to obtain a loan: a mortgage with two documents implies an increased rate.

- Use of preferential mortgage lending and maternity capital programs.

- Early repayment of mortgage.

When calculating the overpayment on a mortgage, Sberbank provides a discount to its salary clients and users of the service for buying and selling real estate DomClick.

How is the mortgage interest rate calculated?

The calculation of the rate is related to a number of factors:

- The specifics of the mortgage product (preferential programs involve lower expenses);

- The cost of collateral housing;

- Using maternity capital;

- Client's income level;

- Availability of a Sberbank salary card.

A potential borrower gets an approximate idea of the rate by reading the information on the Sberbank website.

More specific information is provided by an online calculator, into which you enter the required amount of a home loan and its repayment period. However, to specify the information, consultation with the bank manager is necessary.

What kind of living space do you buy with borrowed funds?

Sberbank's mortgage programs are varied. Having chosen the one that meets the requirements, the client can buy:

- An apartment or residential building on the primary real estate market;

- An apartment or house from the secondary housing stock;

- Wooden house (in the Moscow and Lipetsk regions);

- Garden house (dachas);

- Garage or parking space.

Sberbank participates in all preferential mortgage programs:

- With maternity capital;

- Military;

- Preferential 6% at the birth of the second or next child;

- "Young Family" program.

It is also possible to issue a non-targeted loan secured by real estate.

Real estate under construction or purchased with mortgage funds must meet the requirements set for it by Sberbank. If housing under construction is purchased, the bank checks the reliability of the construction company.

If the object of the mortgage is housing from the secondary market, it is checked for liquidity and general condition. It must not be in disrepair and/or built earlier than a certain year (as of the current year, the property must not be “older” than 1950).

Compliance with the requirements for the purchased property is due to the fact that, in addition to the object of purchase, it is also collateral that guarantees the return of money to the bank.

There should be no encumbrance placed on the collateral housing other than the current mortgage. Otherwise, it will not be able to secure the loan, and the loan will not be issued.

What functions are assigned to mortgage departments?

The center for full support of housing transactions operates in almost all cities of Russia (both large and small). Clients visiting this establishment come into contact with managers who have undergone certain training. Moreover, each employee has his own functional areas:

Mortgage Lending Manager . The duties of this employee include the following services:

- consulting clients on housing and credit programs offered by Sber;

- assistance in choosing a given product according to specific client requests;

- searching for suitable real estate that meets the parameters of the loan being processed;

- clarification and assistance in collecting a portfolio of documentation necessary for concluding a housing loan;

- direct conclusion of credit transactions with individuals (drawing and signing relevant documentation and issuing a loan).

Housing Loan Service Manager . Mortgage centers also manage/support already completed housing loan agreements and provide full support for Sberbank mortgages. The duties of the employee include:

- acceptance and execution of papers for restructuring/refinancing;

- replacement (if necessary) of co-borrowers, as well as guarantors (removal of these persons from the transaction);

- assistance in obtaining benefits for housing loans and mortgage holidays;

- resolving all emerging issues regarding the replacement of pledged property;

- concluding contractual obligations with borrowers for the rental of safe deposit boxes.