Mortgage refinancing

Refinancing is the re-crediting of a mortgage, that is, obtaining a loan from another financial institution to pay off mortgage debt. The main goal pursued by borrowers is to improve lending conditions and, accordingly, reduce the monthly financial burden. The best conditions mean:

- minimum amount of overpayment;

- reduced annual rate;

- extended lending period;

- cancellation of various commission fees;

- changing the currency in order to protect against a fall in the ruble exchange rate.

Refinancing is also beneficial when the client has several loans from different financial institutions. Refinancing at VTB will allow you to pay off your debts in full, and the borrower will repay only one loan with a smaller overpayment.

Insurance for mortgage refinancing

Transferring a mortgage from VTB to Sberbank becomes possible if the following conditions are met:

- no debts for the last year of payment;

- a mortgage loan will not be refinanced if it has already been refinanced;

- at the time of refinancing, the mortgage servicing period at VTB must be at least 6 months;

- the minimum amount for refinancing should be from 500,000 rubles, the maximum – 5 million;

- the term of the issued mortgage until the loan is fully repaid should not be less than 3 months (the mortgage can be refinanced after six months from the date of its execution).

The funds received from Sberbank for refinancing a VTB housing loan will have to be returned in annuity (uniform) payments. The borrower is allowed to repay the loan ahead of schedule, and no prior notification to the bank is required. You just need to make sure that the account from which the principal debt is written off had the necessary funds.

To apply for refinancing for a housing loan, the borrower must provide bank employees with a portfolio of documents. The following papers are required:

- application form;

- passport of a citizen of the Russian Federation with registration;

- all documentation about the existing mortgage loan;

- documents confirming the borrower's profitability (this paper may not be required if the refinancing amount is equal to the balance of the housing loan that is being refinanced).

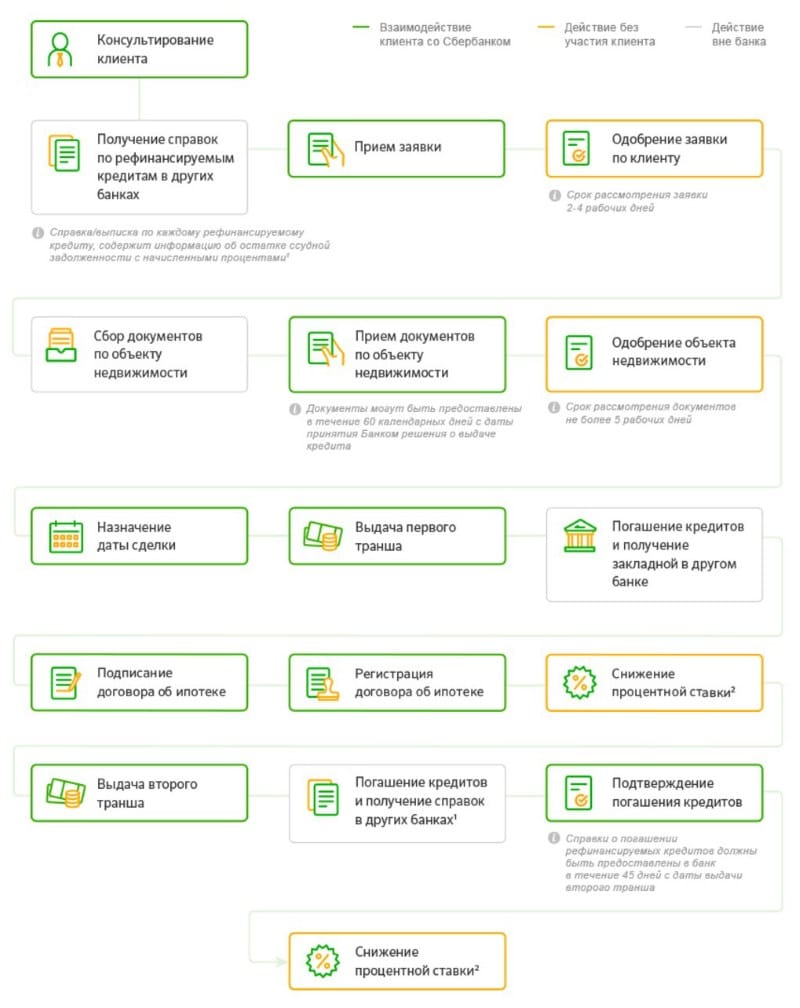

The entire refinancing event consists of the following points:

- Filling out an application form and collecting the required documentation.

- Contact the Sberbank office. At the same time, you should know that when ordering refinancing, borrowers must contact the Sberbank branch at their place of residence. But salary clients can apply for on-lending at any bank office, regardless of registration.

- Transfer of all prepared documentation to the bank employee.

- Sberbank takes 2-3 banking days to review applications.

- If the refinancing decision is approved, funds are transferred to the borrower's account specified in the application. Sberbank may also (upon prior notice to the client) directly send money to pay off the existing mortgage.

All borrowers are faced with the question of what to do with insurance policies when refinancing a home loan. In this situation, there are two solutions:

- If insurance was taken out by VTB by an insurance company that is one of those accredited by Sberbank, it can prolong the policy (extend it). Under the new lending conditions, a new agreement will be concluded with the borrower. Under a previously existing policy, the insurance company will partially return the funds already paid.

- If the insurance company is not included in the list of those accredited by Sberbank, then a procedure is carried out to return the unused portion of the insurance. And the client enters into a new insurance contract.

When refinancing, the borrower receives quite a lot of advantages. This may include a significant reduction in the overall overpayment on the mortgage and receiving additional money for personal expenses. But you should understand that the loan repayment period will be extended. Could this affect the profitability of this procedure?

To understand whether it is really worth spending time collecting documents, you should first conduct a thorough analysis of the situation, especially in terms of the stated benefits. It is also necessary to take into account the presence of a property tax deduction, according to which the state returns 13% of the cost of housing to each owner when purchasing real estate (provided the property value is over 2 million), and a Russian can use this opportunity only once in his life.

Therefore, refinancing may become unprofitable if the borrower has not yet received this deduction in full. After all, when you apply for a new loan, the housing loan on refinancing is closed completely. The possibility of obtaining a tax deduction is also closed - it is considered extinguished.

Peculiarities

Mortgage refinancing at VTB 24 occurs under the following conditions:

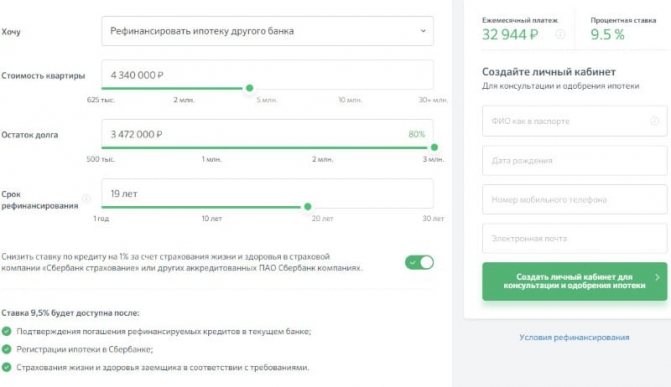

- The interest rate is calculated individually; for an approximate calculation you should use a mortgage calculator

- loan amount up to 90 million rubles

- but just as in the case of refinancing a mortgage at Sberbank, the loan amount should not exceed 80% of the estimated value of the collateral

- Mortgage refinancing period at VTB is 24 to 50 years

- VTB provides for mandatory insurance, not only of the collateral, but also of the life of the borrower, as well as cases of dismissal from work

In order to understand whether refinancing a mortgage at VTB 24 is profitable, you must definitely go to the bank’s office and carry out a detailed loan calculation with any authorized employee. It may also turn out that the full cost of the loan will be higher than the cost of your current loan, and, accordingly, refinancing the mortgage at VTB 24, as well as at Sberbank, will be pointless.

More detailed conditions for mortgage refinancing at VTB 24 can be found in this article.

Refinancing is the re-crediting of a mortgage, that is, obtaining a loan from another financial institution to pay off mortgage debt. The main goal pursued by borrowers is to improve lending conditions and, accordingly, reduce the monthly financial burden. The best conditions mean:

- minimum amount of overpayment;

- reduced annual rate;

- extended lending period;

- cancellation of various commission fees;

- changing the currency in order to protect against a fall in the ruble exchange rate.

Refinancing is also beneficial when the client has several loans from different financial institutions. Refinancing at VTB will allow you to pay off your debts in full, and the borrower will repay only one loan with a smaller overpayment.

Refinancing is a very popular service at VTB Bank. The large influx of clients is due to the following factors:

- low annual loan rate from 13.9%;

- the ability to combine up to 6 loans into a single one, including credit card debt;

- no commission fees;

- transparent transaction procedure;

- quick decision making;

- issuance of reserve funds for other needs.

Of course, like any other loan program, refinancing at VTB also has its drawbacks. Perhaps the most important of them is quite stringent requirements for borrowers and their mortgages. You will also have to collect an impressive package of documents. At the same time, difficulties may arise at the stage of collecting them, since Sberbank is not very willing to give permission to refinance with another bank.

Conditions for refinancing at VTB

Many Sberbank debtors are trying to transfer their mortgage to VTB. Over the years of practice, VTB has developed very favorable conditions for its clients for refinancing mortgages under a program to assist borrowers of other financial organizations.

| Loan amount | From 100 thousand rubles to 3 million rubles |

| Commission amount | From 13.9% to 15% |

| Loan repayment period | From six months to 5 years |

Compared to Sberbank's proposal, refinancing at VTB and lowering the mortgage rate is profitable.

By pledging real estate as collateral, a VTB client who takes out a loan for himself can significantly improve the conditions. A reduced interest rate can also be obtained when insuring the life and health of the borrower.

When is refinancing beneficial?

It is worth noting that refinancing a mortgage is not beneficial in all cases. It may well turn out that the benefit from the procedure is barely noticeable. Below are the parameters that will help you make the only right decision:

- the proposed annual rate must be at least 1% lower than the current one;

- there are no additional fees and commissions, or they are much lower than the current ones;

- VTB is a bank where the borrower is listed as a payroll client;

- There is free time to carry out the refinancing procedure.

You can also use a special refinancing calculator on the official VTB website. It allows you to find out the difference in interest rates between VTB and another bank, taking into account the size of the loan. A similar calculator is available on the official website of Sberbank.

VTB requirements

Not everyone can transfer a mortgage from Sberbank to VTB. The bank puts forward a number of serious requirements for both the borrower and the mortgage.

Client requirements

Persons aged from 21 to 70 years can count on transferring a mortgage to VTB. They must also be Russian citizens and have permanent registration. VTB pays special attention to the client’s wealth and level of income. The borrower must have a permanent source of work and earn at least 10 thousand rubles per month. The work experience must be more than a year, and it is important that the person worked at his last job for at least 3 months. It is important that the client meets all parameters.

Loan requirements

From Sberbank to VTB you can transfer a mortgage loan, a consumer loan, debt on a credit card or debit card with an open credit line, or a car loan. There are special requirements for a mortgage loan, because the loan amount under the agreement is usually several hundred thousand rubles. The terms and conditions for a mortgage loan are as follows:

| Maturity | From 3 months |

| Currency | Rubles |

| Credit history | Timely repayment of the mortgage within six months and complete absence of debt for non-payment of the loan |

| Regularity of repayment | Monthly fee |

Required documents

To transfer a mortgage from Sberbank to VTB, you need to collect a standard set of different documents. The borrower must provide the following documents:

- mortgage refinancing application:

- Russian passport;

- SNILS;

- a document confirming the level of income (certificate of income in form 2-NDFL, personal account statement);

- a copy of the work book;

- military ID for men under 27 years of age.

In addition, the client must provide VTB with a certificate of the mortgage taken out from Sberbank. This certificate contains the following information:

- the balance of the loan amount, both principal and interest;

- information about the borrower's credit history;

- information about loan repayment.

Sometimes the bank may require other documents. For example, this could be a certificate of marriage registration, birth of a child and other papers.

Pros and cons of refinancing

Refinancing is a very popular service at VTB Bank. The large influx of clients is due to the following factors:

- low annual loan rate from 13.9%;

- the ability to combine up to 6 loans into a single one, including credit card debt;

- no commission fees;

- transparent transaction procedure;

- quick decision making;

- issuance of reserve funds for other needs.

Of course, like any other loan program, refinancing at VTB also has its drawbacks. Perhaps the most important of them is quite stringent requirements for borrowers and their mortgages. You will also have to collect an impressive package of documents. At the same time, difficulties may arise at the stage of collecting them, since Sberbank is not very willing to give permission to refinance with another bank.

The essence of the refinancing program carried out at Sberbank

Refinancing (or refinancing) at Sberbank is based on full repayment of the existing debt on an existing housing loan. Moreover, under current conditions, Sber allows the consolidation of debt existing in several banks at once (up to five). For these purposes, the borrower issues a new consumer loan.

Registration of refinancing at Sberbank helps borrowers solve several problems at once. Including:

- Reduces the total amount of regular payments on existing loans.

- Receive additional funds for personal use.

- Combine existing loans into a single one issued at Sberbank. This greatly simplifies the client’s actions to repay numerous loans.

Order of conduct

Many people do not know how to transfer a mortgage to VTB. The refinancing procedure takes place in several subsequent stages:

- Initially, you need to contact the VTB branch at your place of registration and get advice on the issue of mortgage refinancing. In particular, read the requirements and conditions.

- If the borrower meets the requirements put forward by VTB, then you can proceed to collecting documents. After which they need to be submitted to the VTB branch and a corresponding application must be written.

- The bank reviews the application within 3 days, and then notifies the borrower of its decision by telephone. If the latter has a positive credit history, then the application will be approved.

- After approval from VTB, you need to get approval from Sberbank. It is worth noting that Sberbank is extremely reluctant to accommodate clients who want to refinance their mortgage.

- Then the loan agreement is signed between the borrower and VTB and the funds are transferred to the bank where the loan is valid. Thus, VTB fully repays the borrower’s mortgage. The bank also takes on other related issues.

Today you can apply for refinancing online without worry or wasting time. This can be done on the official VTB website or through the VTB mobile application. The last option is convenient because the answer can be received on the day you took out the loan. The mobile application also allows the bank client to promptly learn information about new promotions, changes in bank tariffs and much more. You can also carry out various financial transactions through the application, for example, pay for housing and communal services, check coins and bonuses in your account, transfer money to charity, and much more.

If a mortgage in Sberbank for an apartment or house has become an unbearable burden, since you took it out at a high interest rate, then it is possible to improve the current conditions and reduce the interest rate by refinancing with another bank. On-lending at VTB is currently one of the most profitable. The bank offers attractive lending conditions and low rates. In addition, he is very loyal to his clients. Therefore, if the borrower has a positive credit history, then it is highly likely that his application for a loan transfer will be approved.

How to apply

- On the official website you can fill out an online application for advice from a bank employee. He will tell you what set of documents needs to be prepared (most often it is standard - passport, income certificate, work book, valid loan agreement and documentation for real estate purchased on credit).

- Having collected the necessary package of papers, you take them to the nearest branch of VTB 24 Bank and submit an application. It will be reviewed within 3-5 business days.

- Within a few days, a bank specialist will contact you and announce a decision. If it turns out to be positive, the terms offered to you will be dictated to you, and if you are satisfied with them, you will need to come to the office again in order to sign the agreement and receive the necessary funds.

- After this, you pay off the existing debt and obtain a certificate confirming its absence. With this statement, come to the office again, hand it over and start paying off the loan under the new conditions.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

Credit card refinancing ⇒