Refinancing a loan to Sovcombank – this is an opportunity to “close” one or more previously taken loans in other financial institutions or banks in Russia.

In 2020, Sovcombank is not implementing a refinancing program. Those wishing to refinance consumer loans or other loans at Sovcombank are offered other options.

At Sovcombank you can get a new consumer loan to repay an existing one at another bank. Rates start from 12%.

AT SOVCOMBANK THE INTEREST RATE FOR REFINANCING LOANS OF OTHER BANKS WILL BE THE SAME AS FOR APPLICATION OF A NEW LOAN.

Refinancing conditions

As such, a service called “refinancing” does not exist at Sovcombank. However, the bank provides consumers with the opportunity to obtain a new loan on favorable terms in order to repay an existing loan.

The interest rate for repaying loans from other banks will be slightly lower, and the term of the loan agreement will be increased. The idea is to provide borrowers with the necessary funds to independently repay their existing debt, rather than transferring debt obligations from one creditor to another.

At the same time, Sovcombank does not control the intended use of money, and therefore it can be used for payments. The disadvantage of this option is that Sovcombank may not approve the issuance of a loan if the individual already has significant obligations or overdue loans.

Thus, the borrower will have one more loan, but he can apply the money received to the old debt, closing it and continue to pay monthly installments to the new lender. Of course, it is important not to have any overdue payments and a positive credit history, since Sovcombank does not cooperate with unreliable clients. Let's consider the bank's offers for individuals, which they can apply for and use to pay off old debts.

Sovcombank also checks the client’s income level. It is compared with existing payments and those planned for the loan to Sovcombank. But if, when submitting an application, it is explained that the loan will be used for payments to other banks, the likelihood of receiving a positive response increases.

Mortgage terms

The final details of loan servicing depend on many factors individual to each client. Here's a short list of them:

- Mortgage servicing period;

- Interest rate;

- The amount of funds paid as an advance payment;

- Characteristics of credit history;

- Client's age.

It is important to note that the client’s age affects the terms of service only in two cases. One is when the user is young enough and has too little work experience, then the interest rates will be higher, and the second is when the client is a pensioner who enjoys special privileges and bonuses.

A mortgage loan is issued for the purpose of acquiring the following forms of property:

- Apartments;

- Office premises;

- Apartments.

The minimum limit for leased credit finance is 500,000, and the maximum is 30 million.

Credit loan servicing periods vary from twelve months to two hundred and forty.

Non-targeted loan

If the debt is small, then it is most profitable to take a non-targeted loan. “Loan for any purpose” program are as follows:

- annual percentage of overpayment – 14.9%;

- loan term – from 1 year to 3 years;

- minimum amount - 40,001 rubles;

- the maximum loan amount is RUB 299,999.

At the same time, quite loyal requirements are presented to the client:

- age from 20 to 85 years (that is, even pensioners can take out a consumer loan to pay off an old one),

- mandatory work experience in one place for at least 4 months,

- permanent registration in a region located no further than 70 km from the nearest company office.

Requirements and conditions

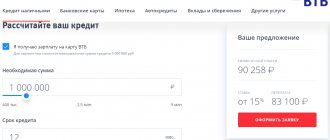

The refinancing instrument is a line of credit projects with the following conditions:

- minimum rate - 20%;

- loan term from 90 days to 7 years;

- maximum approval amount is 1 million rubles;

- if they issue more than 150 thousand, then insurance will be required.

Requirements for refinanced loans

Before visiting the branch, it is recommended to take with you contracts for refinanced amounts, as well as bank statements for current debts. One of the main guarantees of approval will be the absence of claims from previous creditors.

Requirements for the borrower

There are a number of requirements for clients:

- Russian citizenship and permanent registration;

- living in an area where there is a Sovcombank branch within a radius of 70 km;

- official work experience from 1 year, at the last place of work from 4 months;

- availability of mobile and landline phones;

- age - 20-85 years.

Applications are accepted from entrepreneurs who have been operating for at least 1 year, for which there is documentary evidence.

In case of late payment, penalties are automatically charged equal to 20% per annum of the current daily debt. Penalties do not affect the loan rate in the direction of its increase.

What documents will be needed

The applicant is required to provide the following package of documents:

- copies of passport data, SNILS;

- a certificate from work indicating the date of admission;

- income certificate;

- completed application.

Important! Sometimes they require you to bring additional papers: military ID or deferment certificate, driver’s license, international passport, medical insurance.

Special conditions for pensioners

For pensioners, Sovcombank offers the Pension Plus program. Conditions:

- rate 16.4-26.4%;

- loan term from 3 to 5 years;

- loan size from 40 to 300 thousand.

In this case, the only documents required are a passport and a pension certificate. Officially employed persons are recommended to additionally attach a salary certificate, which will increase the amount of the approved amount. It is advisable that the application indicate the landline telephone number of the place of duty. For non-working people at home.

If you transfer your pension to a bank card, the rate will decrease by 5%.

Who will not be approved for refinancing?

The bank often refuses to receive a loan. The following reasons influence the decision:

- insufficiently high monthly income;

- bad credit history, fines;

- non-compliance with established requirements;

- Incorrect information in the application form or documents.

Loans that can be used for refinancing

As we said above, Sovcombank does not have on-lending programs, but you can take out a loan from them that you can repay on your own, i.e. do a personal refinance .

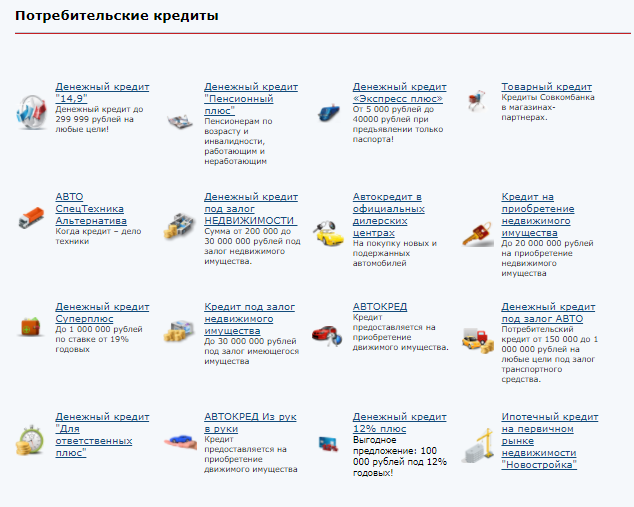

- Cash loan "14.9%". According to the terms of this offer, it is necessary to be a citizen of Russia. In addition, you must have worked for at least 4 months at your last job and have permanent registration.

The length of time for which a consumer loan can be obtained ranges from 12 to 36 months. Amount: from 40,001 to 299,999 rubles.

- "Credit 12% plus." The maximum loan amount for this consumer proposal is 100,000 rubles. The debt must be repaid within 12 months.

You can reduce the interest rate on a consumer loan (up to 5%) at Sovcombank if you apply for a salary card or a card for calculating a pension.

- Standard plus : 40-300 thousand rubles for 1-3 years at 22%.

- Express : 5-40 thousand rubles for 6-18 months at 23%.

- Superplus: 200-1000 thousand rubles for 1-5 years at 18.9% (18.4% upon presentation of personal income tax-2).

- For those in charge (married couples, certified specialists): 40-300 thousand rubles at 19.9%.

- Pension : 40-300 thousand rubles for 12-36 months at 16.4%.

The interest on a loan to Sovcombank will be reduced by 5% if payments from the employer are transferred to the bank. A tariff increase of almost 10 points occurs if an individual does not use the funds transferred to him (at least 80%).

Pros and cons of refinancing

Sovcombank does not refinance loans, according to the Internet, which is a significant disadvantage. To refinance an existing loan, a person needs to contact the bank and take out a new loan, paying off the debt on old obligations on their own.

Interest rates on consumer loans are relatively unfavorable - there are banks offering to refinance loans with a lower overpayment. There is a connection fee, which affects the cost of the loan. Reviews of the organization on the Internet are mostly negative from clients who previously took out loans from it.

Despite the existing shortcomings, the bank has some advantages - the client can take advantage of the advantageous offer as part of the “We are crazy” promotion and receive a loan on relatively attractive terms. The difference between the institution is the minimum age limit for borrowing money - you can get a loan up to 85 years old inclusive. There are special lending rates for pensioners, there are quite a lot of loan offers, including a car loan and mortgage program.

Before formalizing the obligation, it is recommended to carefully study the contract, determine the actual overpayment, taking into account commissions, and, if necessary, consult with an employee of the organization. This measure may help avoid problems with payments in the future.

Penalties

If the loan debt is not repaid on time, most banks impose sanctions on the client. The longer the payment is not made, the more you will have to overpay later.

For late payment of an existing loan, the bank charges penalties at the rate of 20% per annum. If the borrower violates the purpose and methods of using the funds received under the loan, the interest rate for using the loan is set in the amount specified in the agreement.

Reasons for refusing a loan

The organization does not approve loans to all clients. If a person cannot confirm income or has a bad credit history, there is a chance that the bank will refuse cooperation or offer the least favorable conditions for issuing a loan. If the person does not meet the bank’s parameters, the loan will be denied.

The institution primarily works with clients who are solvent, have no debt, have extensive work experience and a good credit rating.

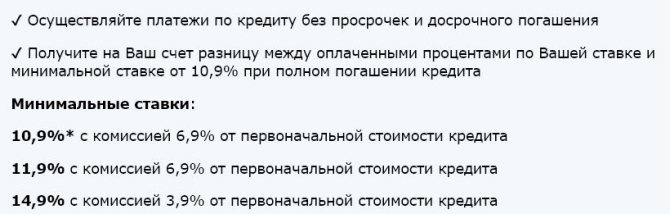

Interest rate reduction

For all types of loans, it is possible to activate the Minimum Rate service. If you avoid delays, then at the end of the loan period, Sovcombank will recalculate at a lower rate and return the difference to the client.

The cost of the service in 2020 is:

- to convert to 11.9%, you need to pay 6.9% of the loan amount;

- 14.9% - 3.9%.

To activate the option, you must present personal income tax-2, as well as connect to the insurance program. The cost of insurance depends on the duration and size of the loan: 5-22%.

If the borrower transfers the receipt of a salary or pension to a Sovcombank card or activates an automatic payment to repay current contributions from any card through the Best2pay system, the overpayment percentage can be reduced by 5 points.

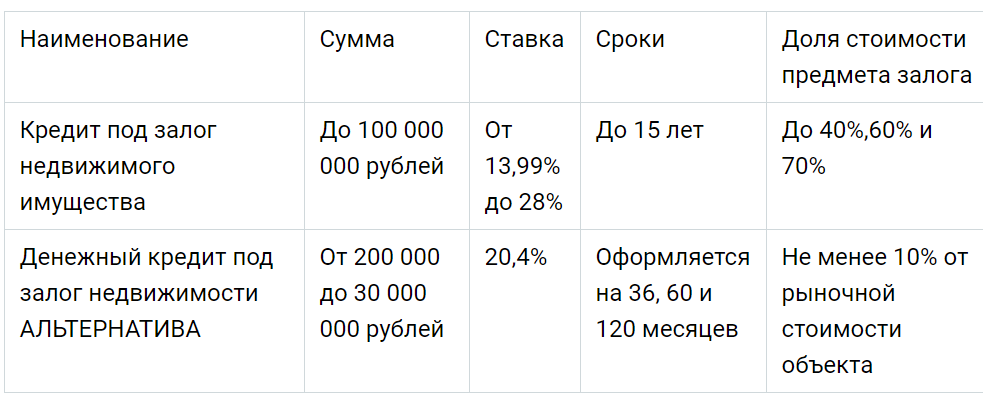

Mortgage refinancing at Sovcombank

There is no service called “mortgage refinancing” at Sovcombank . But the client can take advantage of a favorable mortgage offer to repay the existing loan. In this case, the rate for a new mortgage at Sovcombank will depend on which bank product you choose and on the size of the down payment made and the fact of state registration of real estate:

- Mortgage loan on the primary market “New building” - provided at an annual interest rate of 12% according to the standard program.

- Loan secured by real estate - at 18.9% per annum.

- Cash loan “12 plus” - at 12% (the loan volume is 100,000 rubles).

Sovcombank cannot refinance a mortgage from another bank, but it offers to issue a new home loan in the amount of 300,000 to 30,000,000 rubles. The mortgage term ranges from 1 year to 30 years. The rate ranges from 10.4% to 11.9% per annum.

A mortgage for a new building is issued only in domestic currency (rubles). The subject of the agreement may be apartments, commercial real estate located in a building under construction. If a loan is taken out against real estate, the collateral must be owned by the borrower.

The “Superplus” option with a limit of up to 1,000,000 rubles is also suitable. There are several other mortgage refinancing options that were not included in the table:

Requirements for the subject of collateral:

- apartment;

- non-residential premises;

- apartments;

- room;

- residential building with land.

For the ALTERNATIVE program, additionally:

- Non-residential premises or premises (without land).

- Non-residential building or structure with land.

- Objects in the format of low-rise buildings.

An assessment of the object itself is mandatory. In addition, you need to prepare all mortgage documents. In this case, the assignment of collateral between banks is not carried out; the encumbrance is imposed after the primary mortgage is repaid.

A Russian citizen applying for a loan to purchase a home must meet the following conditions:

- A mortgage will not be given if the applicant does not have Russian citizenship.

- Registration at the place of residence is required.

- The future borrower must be at least 21 years old. The maximum age must be at least 85 years at the time of loan repayment.

- The person applying for the loan must have a total work experience of at least 1 year, as well as 3 months in one place. Individual entrepreneurs must be engaged in business in Russia for at least 1 year.

Requirements, conditions, documents

To become a bank client, you must provide not only a corresponding application, but also:

- Personal data. The form is issued by a bank representative; you must fill out all fields, indicating the most accurate information.

- Passport of a citizen of the Russian Federation indicating the place of registration, TIN. Copies of documents will be required.

- A certificate from your place of employment indicating your monthly income. If there is additional income, this fact must be documented. The certificate will not be required only for clients who receive wages through the bank.

At its discretion, the bank may request from the client additional data and copies, original documents . Among these may be a copy of the work book indicating the place of current work.

If you are refinancing a mortgage - documents for housing, car loans - for a vehicle.

How to apply online for refinancing?

To apply for a loan or mortgage (new, since Sovcombank does not offer a service for refinancing loans from other banks) via the Internet, just follow these simple steps:

- Open the official page of Sovcombank;

- In the top menu, click on the “Credits” tab;

- Next, indicate your region of residence;

- Then, from a large selection of services presented, select the desired type of loan;

- Read its terms and conditions and click the green “Apply for a loan” button located on the left;

- Fill out the form provided and send it to the bank for review.

After completing the above steps, expect a call from the bank's contact center.

Advantages and disadvantages of refinancing

At Sovcombank, loan refinancing is becoming an increasingly popular service.

The operation has unique advantages:

- Wide range of options and conditions;

- Possibility to refinance with a minimum number of documents;

- Affordable interest rates;

- Promptness of application consideration.

There are far fewer disadvantages to refinancing. First of all, there is a high probability of getting rejected. Another disadvantage is the possibility of obtaining a loan at favorable interest rates only for programs above 100 thousand rubles. Large sums are received only by legal entities.

What's the easiest way to get approval?

To increase your chances of transferring a loan to Sovcombank, we recommend that you do not submit an application through the website of this organization, but contact its branch directly. Before your visit, you should prepare documents about the loans you want to refinance. At a minimum, loan agreements under them and statements of current debt will not be superfluous.

Explain to the loan manager why you want to take out a new loan. Show that your income is sufficient to pay off the existing debt and that old creditors have no claims against you. If you have already dealt with Sovcombank before, or receive a pension/salary from it, it is quite possible that an explanation of the situation will help you find a solution that will suit both you and the bank.

If an ordinary manager cannot help, you should make an appointment with the head of the credit department. He has more knowledge and authority, and, therefore, more opportunities to resolve the situation in your favor.

- Deposit extension and other issues

- Halva “Halal”