All banking operations, which include mortgage lending, are characterized by inflationary, economic, currency, political and tax risks. Their sources are the state of the macroeconomy, the standard of living of the population and the dynamics of changes in the cost parameters of real estate. The applied investment and credit technologies at the level of the state and financial institution, as well as mortgage standards, have an important impact on the stability of relations between both parties to the credit transaction. A prerequisite for the functioning of any credit institution is the minimization of mortgage risks, which is possible by providing appropriate management that determines their analysis, control and management.

Accepted classification

A mortgage issued on real estate in the Russian Federation is a risky operation for the lender and for the borrower for interrelated reasons. The main one is legislative imperfection, instability of the financial position of the parties to the transaction due to sudden changes in currency values and the general economic situation. Possession of information about all the nuances of the transaction, including probable risks causing financial losses, allows participants to assess their own capabilities and make a rational decision on credit cooperation. All risks can be grouped by type:

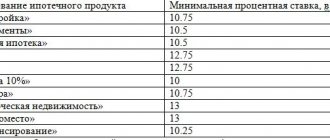

- Changes in mortgage interest rates;

- A decrease in the value of the loan object during the validity of the mortgage agreement due to a decrease in the market price of the acquired real estate and the collateral securing the transaction;

- Changes in the national currency exchange rate;

- Reduced solvency of borrowers;

- Increasing the time limits allocated by law for registration of property rights.

Lenders' risks are associated with a decrease in the profitability of the mortgage operation. Financial losses in this situation are due to a decrease in the expected quantitative cash flow due to inflation and lack of balance between assets and liabilities. A decrease in the market interest rate may cause the borrower to repay the debt early in order to reissue the loan at a lower interest rate, which significantly reduces the financial result of the lender. A separate risk is the sudden insolvency status of the borrower.

Mortgage risk protection for the borrower

Of course, there are ways to protect mortgage risks for the borrower.

You can reduce the likelihood of interest rate risk in the following ways:

- avoid concluding a contract with a variable rate, use only a fixed rate for loan payments;

- choose a short-term loan with a variable rate;

- determine in the contract the minimum and maximum values for the floating credit rate.

In order to minimize the likelihood of a construction risk, you need to check the compliance of the shared participation agreement with special legislation, request from the developer a package of construction permits, an approved project declaration, and verify solvency in other ways.

It might be interesting!

Mortgage rate reduction in 2020: will mortgages become cheaper?

The risk of loss of income, the risk of loss of property rights (title), the risk of a decrease in the value of the collateral, the risk of loss of the collateral, can be reduced by concluding appropriate insurance contracts - life and health insurance, insurance of the property for the full value, and not the value of the loan, loss insurance income and loss of title. In the event of an insured loss of income, the insurance company pays the debt for the borrower for a period of time.

Credit risk can be minimized by restructuring the debt in agreement with the bank - reducing the size of the monthly payment by increasing the insurance period or for a certain period.

Risk Prevention Techniques

Before executing a mortgage transaction, its participants must take all measures to reduce their own credit risks, the consequences of which are financial losses. To do this, before signing the contract, the lender needs to make a correct assessment of the value of the property, as well as determine whether the level of creditworthiness of the borrower corresponds to the size of the loan provided to him. The following help prevent situations unfavorable for participants in a mortgage transaction:

- Mortgage loan insurance;

- Creation of reserve funds aimed at compensating for potential actual losses and lost profits;

- Introduction of a mechanism for collecting funds from borrowers;

- Application of a reliable system for registering property rights;

- Attracting government guarantees for mortgages.

Financial risks are present in any type of credit transaction, but when mortgage lending their social aspect should be taken into account. Since the borrower is an individual, the sale of his collateral may cause him and his family to be deprived of a roof over their heads. To minimize this scenario, it is recommended to critically evaluate all mortgage requests, distribute loans according to risk groups, promptly identify problem loans and take timely measures to repay the debt.

The main risks of mortgage lending for the borrower

In anticipation of concluding a loan agreement secured by a mortgage, the borrower needs to read the signed agreement and all appendices as carefully as possible. Due diligence and care will help to avoid the inclusion of inconsistent terms and interest rate risk in the contract. Interest risk is a condition of a loan agreement under which the loan rate is tied to some constantly changing index. Calculations taking into account a floating interest rate may lead to an unexpected increase in the cost of the loan.

A rational approach to concluding a loan agreement and its thoughtful reading will help to avoid currency risk - an increase in the cost of a foreign currency loan due to an increase in the value of the currency. Despite the low rate of foreign currency loans compared to ruble loans, the loan must be taken in the currency of the borrower’s income.

Management Tools

All types of mortgage risks are associated with financial losses that are relevant to one or both parties to the transaction. To ensure any credit transaction in order to protect the lender and borrower, it is recommended to use mortgage risk management tools before concluding a transaction and after issuing a loan and forming obligations for the borrower. They are aimed at stabilizing a critical situation or minimizing losses. The list of management tools includes:

- Insurance;

- Pledge;

- Surety;

- Fines;

- Penya;

- Debt restructuring;

- Regulation of relations at the legislative level.

The risk of default by the borrower is associated with the lender not receiving the expected cash flow due to its insolvency. This type of risk is managed at the stage of obtaining a mortgage. Risk minimization is achieved through a competent assessment of the applicant for paid monetary assistance, as well as the selection of cooperation conditions that correspond to his financial situation and social status, including the amount of the loan, the period for which it was issued and the amount of the regular payment. A reliable way to manage the risk of non-repayment of funds is to involve guarantors in the transaction and register valuable property as collateral, the sale of which could fully cover losses and compensate for lost profits.

The main law ensuring a balance of interests between lenders and borrowers is Federal Law No. 102 of July 16, 1998 “On Mortgage”. Its provisions reflect the full protection of the lender for mortgage risks, and also provide for monitoring and control methods that prevent pseudo-insurance and increase the social security of citizens. The regulatory source provides an additional mechanism for reducing risks by providing compensation for part of the losses if the borrower has financial problems.

The risk of early repayment is minimized by penalties in an amount that covers the amount of lost profit. Damage or destruction of the pledged property can be compensated by the insurance company if insurance is issued in a timely manner. Liquidity risk is a lender's problem and is not directly related to the borrower. Low asset liquidity may cause rating downgrades and deterioration of the bank's balance sheet. To regulate this type of risk, standards and restrictions on the activities of mortgage lenders are established in the area of only low-risk transactions.

Banks and insurers have proposed an alternative to the Central Bank's concept of protecting borrowers

The Association of Banks of Russia (ADB) and the All-Russian Union of Insurers (VSU) sent a report to the Central Bank on the market's views on the future of mortgage insurance. The document sharply criticizes the Central Bank’s own concept of shifting the costs of insuring borrowers’ risks to banks. It follows from the text that the Central Bank’s proposals will lead to an increase in mortgage rates by 0.8–1.3 percentage points, increase banks’ costs for changing business processes by tens of billions of rubles, cause the collapse of mortgage insurance and reduce VAT collections to the budget by 4 billion rubles. The business offers its own scenario, according to which the agency commission of banks is exempt from VAT, and citizens will receive a property deduction for mortgage expenses.

The April concept of the Bank of Russia “on the regulation of insurance accompanying the mortgage agreement”—according to it, the bank itself must insure the risks of the borrower—continues to excite the markets. Let us remind you that the concept is the result of the president’s instructions to reduce the cost of a mortgage loan (clause “a”, clause 2 of the list of instructions dated April 2, 2020 No. Pr-612). Two associations - ADB and ARIA - prepared and sent to the Central Bank a report on alternative approaches to mortgage insurance.

How the Central Bank prepared the concept of mortgage regulation

“Kommersant” got acquainted with the document - half of it is devoted to consistent criticism of the concept of the Central Bank. According to it, the bank becomes the sole beneficiary of mortgage insurance, and in the absence of it, bears all associated risks (up to forgiveness of the full amount of the loan debt). In this configuration, “the cost of insurance (for the bank. — “Kommersant”

) can only be compensated by increasing the interest rate on the loan and/or offering the borrower additional products,” ADB and BCC state. They refer to the lack of analogues to the ideas of the Central Bank in foreign practice; the market also does not like the fact that the borrower is deprived of the choice of insurer; mortgage insurance will actually become mandatory and will require state regulation of tariffs. As a result, the increase in mortgage rates could be 0.8–1.3 percentage points, and the loss of commissions by banks from the sale of insurance will lead to “a reduction in tax revenues to the budget system (at least 4 billion rubles annually).” The document estimates banks' expenses for changing business processes at 20 billion rubles, and their maintenance at over 10 billion rubles. in year. And among homeowners, “dependant patterns of behavior will continue to form,” the report’s authors warn.

The alternative presented by market participants in the first paragraph proposes to bring regulation up to the level of EU Directive No. 2014/17/EC on housing loans so that it does not lag behind market practice.

“The goal of the changes should be to fully satisfy the interests of clients ... while simultaneously limiting the risk of abuse, without making it an absolute priority to reduce the cost of a loan by any means,” declare the ADB and the ARIA, while agreeing to “a discussion on the issue of legislative restrictions on the maximum amount of the agency commission” of banks. Also among the market proposals is the exemption of bank commissions from VAT: this “will immediately lead to a reduction in the cost of a mortgage loan by 0.1 percentage point.” The authors are ready to share the benefits with borrowers, securing “the opportunity to receive a property deduction in relation to the paid insurance premium under mortgage insurance contracts, as well as other expenses of the borrower during mortgage lending.” The result of these measures (“Kommersant” did not list all of them) should be a reduction in mortgage rates by 0.2–0.3 percentage points. As ARB Vice President Alexey Voylukov says, the authors “tried to offer options aimed primarily at borrowers—this was the main goal in the president’s guidelines.” According to VSS Vice President Viktor Dubrovin, “the mortgage insurance model has evolved correctly over 20 years,” and insurance rates now do not put much pressure on the cost of the loan - the title rate is 0.15%, the property insurance rate in mortgage and 0.3% costs life insurance.

The Central Bank told Kommersant yesterday that “until today they have not received any tax initiatives”: “The report has just been submitted to the Bank of Russia, after studying it we will form our position.”

Tatyana Grishina