Voluntary or mandatory

There are compulsory and optional insurance programs.

Mandatory, according to Federal Law N 102-FZ, includes insurance of mortgage housing.

Optional items include a guarantee of compensation for damage (for travel or in everyday life), civil liability and title insurance.

You can learn more about the types of policies in this article, and we will move on to the key details.

What risks can you protect yourself from?

The full list of risks includes:

- fire

- bay

- lightning strike

- explosion

- accidents

- falling objects (for example, a tree on a window)

- natural disasters (hurricane, typhoon, earthquake, hail, heavy rain/snow, etc.)

- crimes (robbery, theft, intentional damage to property)

But this list applies only directly to apartment insurance.

Civil liability insurance will allow you to avoid financial expenses if your neighbors were injured due to your fault (for example, pipes burst in your home).

Title insurance is recommended when purchasing a new home to protect against fraud. If the owner's right to real estate is challenged, he will receive appropriate compensation.

note

Not any damage will be classified as an insured event. If a list of such exceptions is posted on the company’s website, read it carefully (for example, Rosgosstrakh provides a similar list). If such a list is not available, check with an employee of the organization in detail which situations are an exception. Reason for disappointment No. 1 is that apartment owners do not take into account natural wear and tear/damage to structures that are not included in insurance. Such points require separate indication in the contract.

How to choose the coverage amount

More compensation means more price for apartment insurance. Cheaper policy means less money for damage. How to choose rationally, without overpaying, but also without being left on the beans?

Calculate the actual amount of possible losses.

- Make a list of property - estimate the approximate cost

- Think about how much you will have to spend on a new renovation (the easiest way to do this is if the renovation was completed recently, the estimate is still available, and the prices for materials are current)

- Look at your neighbors - when insuring civil liability (or refusing this option), you need to understand what you will have to pay for in the same flood: for old, shabby linoleum or for inlaid parquet and solid oak furniture.

Alternative options for structural insurance

However, another point of view seems no less rational. Insurance of an apartment or house is, in essence, insurance of those things that are inside, as well as the interior decoration of the premises (wallpaper, whitewash, windows, etc.). Sometimes civil liability is also added to this list, but this is not an acquired taste. But if an emergency really happens in the place where you live, both the finishing and the property will take the first blow. Therefore, it is obvious that they, as they say, “in any case” must be included in the policy. But as for the constructive one, you still need to think about it; in a difficult financial situation, it is quite possible to abandon it.

On the other hand, there is still a chance of complete destruction of the apartment (for example, in a gas explosion), although it is quite small. Therefore, in order not to wait for favors from the state (and you may not receive them), it is better to purchase a policy.

See also: The insured apartment was flooded

Comparison of 2020 offers

How much does apartment insurance cost? Contrary to promises on websites, it should be borne in mind that the cost of the policy depends not only on the amount of compensation and included options. The area of the home and the condition of the insured “elements” are affected. If there are previously issued policies, the client’s “history”. How many insurance cases were there, and what kind?

Financer.com studied the websites of the largest insurers in Russia and compared how much it costs to insure an apartment on basic terms.

SBERBANK INSURANCE

3 complete offers with different compensation amounts.

The minimum package costs 2250 rubles/year. Includes 250,000 rub. coverage for interior decoration, 200,000 for movable property and 150,000 for civil. responsibility.

The maximum package costs 6,750 rubles/year. Includes 1,000,000 rubles. coverage for interior decoration, 500,000 for movable property and 500,000 for civil. responsibility.

Apartment insurance includes flooding, fire, explosions, robbery, theft, other actions of third parties, damage to furniture, flooding of neighbors and natural disasters.

- 100% online registration

- sending photos and statements online when an insured event occurs

- maximum reliability rating

- a wide range of other insurance products

- there is no possibility of individual program settings - only batch selection

ZETTA

The ZETTA company is an honorary “bronze winner” in the “Better Pay” category. And this is a significant plus. Let’s see what happens to the company with the cost of apartment insurance compared to its “colleagues”.

The minimum package costs 4800 rubles/year. at 750,000 rubles for structural elements, 300,000 for decoration and communications, 300,000 for movable property and 300,000 for damage to neighbors.

The maximum package costs 16,400 rubles/year. at 5,000,000 rub. for structural elements, 1,000,000 rubles for decoration and communications, 600,000 for movable property and 1,000,000 for damage to neighbors.

note

You can only insure the structure. And then it will cost you only 600 rubles/year. This is the lowest price on the home insurance market in Russia.

AGREEMENT

Offers customization of options.

The minimum package costs 4450 rubles/year. when turned on 350,000 rub. coverage for structural elements, 350,000 for interior decoration, 350,000 for movable property and 350,000 rubles for damage to neighbors.

the maximum package - calculations are made only when submitting an individual application.

But it is necessary to offer the maximum amount of compensation for all types of home insurance.

- up to 30 million for structural elements

- up to 10 million for interior decoration/engineering communications

- up to 10 million for movable property

- up to 3 million for damage to neighbors

All types of insured events are specified in detail - flood, fire, natural disasters, illegal actions of third parties (not only theft or robbery, but also arson), damage to property, health or life of neighbors.

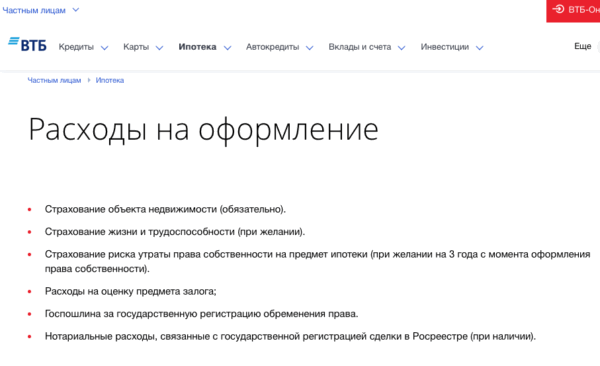

VTB 24

The VTB website has a convenient system that allows you to arbitrarily combine the amount of coverage within various options and customize your policy individually (based on the cost or volume of compensation coverage).

The minimum package costs 700 rubles/year. but only includes coverage for movable property in the amount of RUB 100,000.

The maximum package costs 33.335 rubles/year. when including 1,400,000 coverage for interior decoration, 800,000 for household property, 10,000,000 for structural elements, 1,000,000 for civil. liability + 6,000,000 for the health of residents (if they were injured in a domestic accident, fire or other disaster in the house).

Apartment insurance compared to Ingosstrakh is almost identical - against explosions, fires, flooding, illegal actions of third parties, damage caused to neighbors.

note

First, on the VTB Insurance website, you select the desired amount of coverage for decoration, movable property and structural elements. And only after clicking the “Buy” button will it be possible to further configure civil liability and compensation in case of an accident. After registration, the policy can be sent to your phone or to a special application on IOS or Android.

How is the cost of mortgage insurance calculated?

The mortgage loan user usually pays the insurance premium (policy cost) once a year until the debt is paid off, so it is beneficial for the borrower to close the contract as soon as possible. You can calculate the cost of an insurance policy under a mortgage agreement yourself, using the calculator on the website of a bank or insurance company. Information is also provided by the loan officer or insurance broker offering the policy to the client. The cost of insurance is calculated taking into account the following indicators.

The amount of total debt to the bank as of the date of signing the insurance contract. The insurance agreement is signed annually before the mortgage is paid off, so the cost of the policy is recalculated depending on the outstanding balance. The amount of the obligation includes the principal debt, as well as interest payments, fines and penalties (if the client is in arrears). For example, a client took out a mortgage in the amount of 18 million rubles, so insurance payments in the first year amounted to 36 thousand rubles. A year later, due to early repayments and the sale of liquid real estate, the client’s debt decreased to 10 million rubles, so insurance payments amounted to 12 thousand rubles per year. Specific values depend on the insurance company chosen by the borrower.

The interest rate at which a mortgage is issued (or the insurance company's ratio). Most insurance companies calculate the cost of the policy taking into account the interest rate provided by the bank. For example, a client took out a preferential military mortgage at a rate of 8% per annum - in this case the coefficient is 0.08. From the insurance company's point of view, the higher the mortgage interest rate, the greater the risk of loan default and the more expensive the insurance program. The ratios calculated by the insurance company are usually approximately equal to the interest rate.

The cost of each insurance program (or the insurance company's tariff). This figure is a percentage of the amount remaining on the mortgage loan. For example, a property insurance policy at VTB Bank costs about 0.33% of the remaining debt amount. As a rule, collateral insurance is paid at the highest rate, followed by programs to protect the life and health of the borrower (about 0.2% of the debt amount on average) and title insurance (no more than 0.18% of the debt amount). Rates are set individually by each insurance company and depend on the age and health of the borrower (for life insurance), his profession and employer status (for financial insurance), the technical condition and number of real estate transactions (for title and collateral insurance).

The cost of an insurance policy for a client consists of the following indicators:

- Sum insured (or coverage amount). This value reflects the amount of possible payments upon the occurrence of insured events specified in the policy. For example, the insured amount under the title protection program is 800 thousand rubles. If a real estate transaction is declared invalid due to the incapacity of the seller (an insured event according to the policy), the client will receive compensation in the amount of 800 thousand rubles. The amount of the insured amount is usually specified in the loan agreement and is the balance of the debt multiplied by a specified percentage (for example, the mortgage rate). For example, a borrower took out a mortgage in the amount of 8 million rubles, the insured amount exceeds this value by 10%. The amount of coverage in this case is (8,000,000*1.1) = 8,800,000 rubles - this is the amount of funds the client will receive upon the occurrence of an insured event.

- Insurance premium (or mandatory payment from the client). This value reflects the cost of insurance paid annually by the borrower until the closing of the mortgage debt. For example, a client took out life insurance with VSK with coverage of 10 million rubles, the insurance premium is 36,690 rubles per year. The insurance premium is usually specified in the contract with the insurance company, equal to the product of the amount of coverage and the insurance rate of this company. For example, a borrower took out a mortgage loan in the amount of 6 million rubles, signed a collateral insurance agreement at a rate of 0.33% and a coverage amount of 6,600,000 rubles. In this case, the annual insurance premium (or cost of insurance) is (6,600,000*0.0033) = 21,780 rubles.

Russian legislation allows clients to renew (extend) an insurance contract with the current organization or every year contact a new insurance company accredited by the bank. The second option allows the payer to save on paying for the insurance policy and reduce the final costs of the mortgage.