Comparison of definitions

The first difference between a pledge agreement and a mortgage agreement is the legal meaning of these concepts.

The definition of bail was given in Part 1 of Art. 334 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). Having analyzed this norm, we can say that a pledge is one of the ways to secure an obligation.

According to Part 1 of Art. 1 of the Federal Law “On Mortgage (Pledge of Real Estate)” (hereinafter referred to as the Federal Law), a mortgage is a pledge of real estate, a way to purchase residential real estate by receiving a loan from a bank for a certain amount. It should be returned within 10-15 or even more years. For some categories of the population (teachers, military, doctors, young professionals), the state provides certain benefits for obtaining a mortgage loan. For many people, a mortgage is the most convenient way to become a property owner without having large funds at their disposal.

The concept of a mortgage is much narrower than the concept of a pledge.

Procedure for obtaining a mortgage

When applying for a mortgage loan, you will need to take the following steps:

- Apply;

- Attach to it your passport, a certificate of your place of residence, salary and a certificate from the Pension Fund;

- Wait until the application is reviewed and your documents are checked;

- Next, the cost of payments is calculated;

- Take certified copies of documents for the apartment from the seller and provide them to the bank;

- After verification, give the seller a letter from the lender;

- Conclusion of purchase and sale agreements and mortgages;

- Making a down payment;

- Receiving a loan and transferring money to the seller.

Mortgages in Kazakhstan are not too different from those in Russia. You can become a borrower even without being a citizen of the Republic of Kazakhstan, the only main thing is that you permanently reside in this country. Any payment method and type of mortgage are available to you. Regarding contributions, to calculate their cost you can use the calculator located directly on the bank’s website.

Subject of the agreement

The subject of the pledge in accordance with Part 1 of Art. 336 of the Civil Code of the Russian Federation can be almost any movable or immovable property, including cars, equipment, jewelry and even property rights to the above objects. Thus, the list of property that can be pledged is enormous.

According to the Federal Law “On Mortgage (Pledge of Real Estate)”, the loan received is secured by the property acquired in this way. If debt arises, the debt is collected by selling the mortgaged property.

Mortgage at 3% per annum for village residents

Mortgages at 3% per annum are provided to rural residents from January 1, 2020 for the purchase of residential premises or residential premises (residential building) with a land plot, construction of a residential building, as well as repayment of a loan taken for these purposes.

Preferential mortgage lending to rural residents is subsidized: the difference between the bank's market rate and the preferential rate is compensated from the federal budget. At the same time, regions can allocate additional funds to subsidize loans for villagers. Thus, with a maximum rate of 3% per annum, subject to regional co-financing, it can be reduced to 0.1% .

More details

Storage of pledged property

Since real estate taken on a mortgage is a way to secure a loan, there is an encumbrance on it. This means that without the written permission of the lender, it will not be possible to donate, sell, or even rent out the purchased apartment.

As for the collateral agreement, if you receive a loan, any valuable property, for example, a car or equipment, can ensure its payment. The property itself, for the purchase of which a loan was issued, may not be subject to encumbrances. The property may be held by the pledgor, pledgee, or deposited with a third party (Article 338 of the Civil Code of the Russian Federation).

The mortgage loan is always guaranteed by the property purchased under this agreement.

Is it profitable to buy apartments with a mortgage?

There are several arguments for and against purchasing commercial real estate. One thing in favor of buying from a bank is the cost - the area is much cheaper than an apartment, on average by 15-25%. A concierge may be included. Apartment housing is often sold in business centers and office buildings, so you can quickly get to work.

On a note! Apartments will cost less than an apartment.

The apartment is suitable for a young couple, creative individuals - designers, photographers, bloggers, artists and even programmers. After purchasing the property, the owners turn the apartments into a place for remote work or permanent residence.

The downside is the status of the premises - residential space only on the condition that the borrower intends to live permanently and register in the house; if not, then the property remains a commercial non-residential premises. Read more about the legal status of apartments in the next section, and about possible difficulties in the block - “how do apartments differ from apartments.”

Requirements for the pledgor

The requirements for a potential mortgagor are minimal. Sometimes all that is required to draw up a contract is a passport and full legal capacity.

The requirements for a mortgagee, when the mortgagor is also the borrower, are much higher. Each bank sets its own framework for those who want to get a mortgage loan, but in any case there are a number of basic requirements:

- age. Mortgages are issued to people over 21 years of age. Each banking organization has its own upper limits, but in any case, the bank calculates so that the loan is fully repaid before retirement age. If the borrower wishes to take advantage of the preferential program, then the age limits are even stricter;

- income level. The potential borrower must have a high enough income to be able to pay the debt on the mortgage loan.

The requirements for the mortgagor-borrower to obtain a mortgage are more stringent than for registering a pledge.

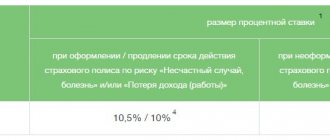

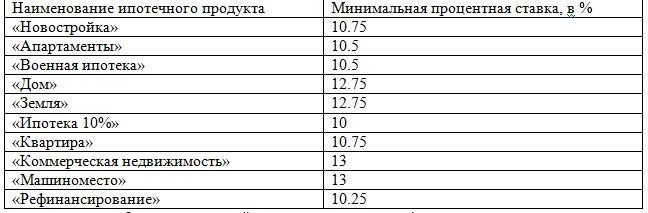

Mortgage interest rate of the Bank of St. Petersburg

The rates indicated in the table are valid subject to the borrower's execution of a comprehensive mortgage insurance agreement.

Important! If the client refuses insurance, the interest rate on the loan will increase by 1% per annum. If he refuses the letter of credit form of payment, the rate will also be increased by 1%.

Clients who have once repaid their mortgage with the bank, or who receive wages into a bank account, or VIP segment clients, are given a discount of 0.25% per annum.

The need for insurance

The need to obtain insurance for purchased real estate is provided for in Article 31 of the Federal Law. Without it, it is impossible to obtain a mortgage loan. In addition, banks often independently establish the requirement to insure the borrower’s life, health, and ability to work. The need to purchase such insurance policies is not provided for at the legislative level, but without them the bank may simply refuse to issue an agreement. Annual insurance payments are usually about 1.5% of the total value of the property.

To obtain a regular pledge, insurance is usually not required.

Insurance of the subject of the mortgage is provided for at the legislative level.

On what conditions can you get a mortgage in Kazakh banks?

You can apply for a housing loan in eleven multi-profile banks in Kazakhstan. The editors of the Nurfin money project have collected information about current interest rates, fees for mortgage lending and other conditions.

Illustrative photo: pixabay.com: UGC

People have long been accustomed to calling a housing loan simply a mortgage. In fact, this is the name of one of the types of collateral in the form of real estate, which remains in the use of the debtor, but if he fails to fulfill the debt obligation, it becomes the possession of the creditor.

Issuing loans secured by purchased real estate is called mortgage lending.

Below we will present to you all the information that we were able to collect about housing loans issued by eleven multi-profile Kazakhstani banks.

Altyn Bank

- Loan amount: from 3 million to 175 million tenge .

- Down payment: 20% of the property value and more.

- For what period of the loan is issued: from 3 to 20 years .

- Interest rates: if you take out a mortgage loan without fees, the annual effective interest rate will start from 18.4% for borrowers who have confirmed their income, and from 20.8% without confirmation. Subject to payment of commissions for arranging the loan and consideration of the application, the annual effective interest rate will start from 15.4% with official confirmation of income and from 18% without confirmation.

- Commissions for applying for mortgage lending: 2.5% of the loan amount for arranging the loan and 10 thousand tenge for processing the application.

ATFBank

- Loan amount: up to 100 million tenge.

- Down payment: 0% , subject to the provision of additional real estate as a total collateral. If the encumbrance is imposed only on the property being purchased, then it is necessary to contribute 20% of its value or more.

- For what period of the loan is issued: up to 15 years.

- Interest rates: GESV from 17.3%.

- Commissions when applying for mortgage lending: no, but it is necessary to insure the property .

Eurasian Bank

This bank can apply for a home loan under various mortgage lending programs.

- Loan amount: up to 65 million tenge under the Horde program and up to 25 million in other cases.

- Down payment: from 30% if income is fully confirmed and from 50% without confirmation under the Horde program. From 20% for other programs.

- For what period of the loan is issued: the maximum period is up to 25 years under the “7-20-25” program, 20 years - “Orda”, 15 years - “Baspana Hit”.

- Interest rates: GESV from 7.2% - under the "7-20-25" program, from 15.1% - under the "Horde" program and higher.

- Commissions for applying for mortgage lending: 1% of the loan amount at a time under the “Orda” program. According to the program “7-20-25” and “Baspana hit” - absent.

Jýsan Bank

This bank also offers several types of mortgage loans.

- Loan amount: up to 40 million tenge under the Horde program and up to 80% of the cost of the purchased housing, but not less than 500,000 tenge, under other programs.

- Down payment: from 30% for the “Horde” program, from 20% of the cost of purchased housing for other programs.

- For what period is the loan issued: up to 25 years under the “7-20-25” program, 20 and 15 years under other programs.

- Interest rates: from 7% under the “7-20-25” program.

- Commissions for applying for mortgage lending: under the “Baspana Hit” program - 1.5% of the amount for arranging a loan, 10 thousand tenge for reviewing documents. Under the “Horda” program - 1% of the amount for arranging a loan, 5 thousand tenge for reviewing documents. But there are no commissions under the “7-20-25” program.

Nurbank

- Loan amount: up to 50 million tenge.

- Down payment: from 35% of the loan amount.

- For what period of lending is issued: up to 20 years .

- Interest rates: GESV including payment of commissions from 16.5% . GESV without paying commissions from 38.3% .

- Commissions for arranging mortgage lending: for arranging a loan 2% of the loan amount plus 10 thousand tenge .

Bank RBK

In addition to government housing lending programs, this bank has its own mortgage offer.

- Loan amount: up to 75 million tenge .

- Down payment: from 30%.

- For what period of the loan is issued: up to 15 years.

- Interest rates: GESV, taking into account the payment of commissions from 16% . GESV without paying commissions from 28%.

- Commissions for arranging mortgage lending: for arranging a loan 2%, for considering issues of registering property, collateral, etc. 20,000 tenge , but not more than 1% of the loan amount.

Illustrative photo: pixabay.com: UGC

7. Sberbank

- Loan amount: with full confirmation of income 70% of the cost of housing, with partial confirmation of 50% of the cost of housing.

- Down payment: with full confirmation of income 30% of the cost of housing, with partial confirmation of 50% of the cost of housing.

- For what period is the loan issued: with full confirmation of income up to 20 years , with partial confirmation - up to 15 years.

- Interest rates: with full confirmation of income GESV from 15.56% , with partial confirmation - GESV from 17.22% .

Tengri Bank

The bank offers several options for purchasing loans, including the purchase of apartments in a residential complex under construction by the bank’s partners (construction companies) and the purchase of constructed primary or secondary housing.

- Loan amount: up to 65 million tenge.

- Down payment: from 10% for housing under construction, from 20% for commissioned housing.

- For what period of the loan is issued: up to 15 years for housing under construction, up to 20 years for commissioned housing.

- Interest rates: GESV from 6.1% for housing under construction, GESV from 16.5% for commissioned housing.

- Commissions when applying for mortgage lending: no for housing under construction, for commissioned housing from 1% or 0% if the client chooses conditions without commissions.

ForteBank

- Loan amount: up to 50 million tenge.

- Down payment: with confirmation of income from 15% , without confirmation from 50% .

- For what period is the loan issued: with confirmation of income up to 20 years , without confirmation up to 10 years .

- Interest rates: with confirmation of income from 16.4% , without confirmation from 20.5% .

- Commissions for mortgage lending: real estate insurance.

Halyk Bank

Let's consider the terms of this bank's standard mortgage offer.

- Loan amount: depends on the client’s solvency .

- Down payment: from 0% when providing additional collateral, from 20% for participants in the bank’s salary project, from 30% for all clients.

- For how long the loan is issued: up to 20 years.

- Interest rates: GESV from 13.4% for salary earners, from 18.6% for other clients.

- Commissions for arranging mortgage lending: for arranging a loan 1% of the loan amount plus 20 thousand tenge. The commission is charged on the loan amount.

Bank Center Credit

This bank also offers several types of home loans.

- Loan amount: up to 65 million tenge.

- Down payment: from 20%.

- For what period of the loan is issued: up to 25 years.

- Interest rates: from 7.2% under the “7-20-25” program, from 11.3% under the “Baspana Hit” program, from 12% under the “Horde” program.

more about the above mortgage lending programs, such as “Baspana Hit”, “Orda” and “7-20-25” in the near future.

Mortgage conditions for legal entities

Each entrepreneur, before deciding to purchase non-residential real estate under the commercial mortgage program, decides for himself a number of issues regarding lending conditions. Among the most important are:

- Annual rate. Today the average figure is in the range of 11.5 - 13.5%;

- The maximum loan size is up to 200 million rubles.

- The loan term is 7-10 years.

- List of requirements for the borrower and the purchased object.

- Requirements for collateral and additional security.

Is it possible to get a mortgage for a business without a down payment?

Yes, there is such a possibility. Today, only a few banks issue commercial mortgages without a down payment. But instead, they usually require additional collateral or a surety from the business owners. On average, their conditions look like this:

- The maximum loan amount is 150 thousand rubles;

- Interest rate - 9 - 17.5% per year;

- Repayment period - 3 - 10 years;

- Bank commission for registration is up to 1.5%.