What is a mortgage

A loan for the purchase of a new building is a way to become the owner of an apartment or house. This service is provided by the bank on the terms of the encumbrance of real estate, in legal terms, a mortgage. During the payment period, actions with housing, including sale, redevelopment, rental, require approval from the lender.

List of banks and interest rates

Almost every credit institution offers mortgage loans for the purchase of an apartment in a new building under the DDU. But the conditions of banks differ both in terms of interest rates and other parameters. Let's try to consider the proposals of the largest market players operating in most regions of the country.

At the end of 2020, Sberbank and VTB 24 remained the leaders in the mortgage lending market. This is explained by attractive loan programs, a high level of trust and an extensive regional network of each of them.

Sberbank offers a mortgage for a new building at 9.5% per annum. But this is the base rate that applies to the bank’s salary clients who are ready to take out life and health insurance. For those who are not salary clients, the rate will be 0.5% higher, and if they refuse to take out insurance, the rate will rise by another 1%. The minimum amount of own funds is 15%.

VTB 24 offers a similar rate - 9.5% per annum and it is also relevant under the condition of full life insurance. But this bank also issues loans at 9% interest—teachers and doctors can do this. For salary clients, a rate of 9.2% is offered. The minimum down payment is 10%.

In 2020, Raiffeisenbank became another leader in the mortgage lending industry. His base rate is 9.25% for purchasing an apartment from an accredited developer and 9.5% from any other. Down payment 10%.

DeltaCredit Bank has been offering favorable interest rates for many years. At the beginning of 2020 - from 8.25% per annum. But getting such a rate is not so easy. To do this, you will need to fulfill a number of conditions - make an initial payment of 50%, pay a one-time commission for reducing the interest rate, and take out a full insurance package. As a result, an offer that seems profitable at first glance turns out to be far from so attractive.

Market leaders in terms of mortgage lending are also Bank of Moscow, Alfa-Bank, Uralsib, and Sovcombank.

Who do they give it to?

Only Russian citizens receive a mortgage for a new building from Sberbank. The recipient's age is from 18 to 75 years. The place where the borrower lives does not matter. The loan is issued by the bank branch where the new building is located.

If a client receives wages on a Sberbank card, loan conditions improve:

- reduced rate;

- fewer documents - no income certificate or work book required.

If you are a military man, Sberbank has a special Military Mortgage program

Sberbank calculator for a mortgage in a new building

When performing actual calculations, most borrowers make mistakes because they do not take into account the personal requirements/conditions of the chosen program. Therefore, in order to avoid problems with further payments, and also to understand on the basis of what amounts the monthly payment is formed, we recommend using the online calculator, which is presented in the article. Thanks to it, you can always get accurate information about the interest rate and upcoming payments.

Mortgage

Design methods:

- mortgage center of Sberbank or through consultants in branches;

- through bank representatives at the developer’s office;

- independently through the DomClick online service.

The DomClick website is a specialized resource of Sberbank and combines all procedures for obtaining a mortgage from submitting an application to removing the collateral. All options for obtaining a loan in new buildings at Sberbank go through DomClick.

Mortgage conditions for housing under construction in Sberbank

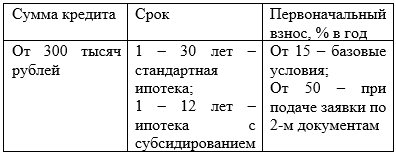

Before submitting a loan application, each potential borrower is recommended to carefully study the basic parameters of obtaining a mortgage for a new building. You can get a mortgage loan for a new apartment under the following conditions:

The parameters indicated in the table are relevant for a standard loan for a new building:

IMPORTANT! The maximum loan amount for a new building, in accordance with Sberbank’s policy, cannot exceed 85% of the value of the contract (equity participation or assignment of rights).

An alternative option for purchasing housing under construction with a mortgage from Sberbank is to apply for a family mortgage, as well as the “Mortgage + Maternity Capital” program:

- As part of the first product with state support, Russian families whose second and/or third child will be born from the beginning of 2020 to the end of 2022 can receive a maximum of 12 million rubles on credit for a new building for up to 30 years, paying at least 20% of the price of the property in the form of a down payment.

- A mortgage with maternal capital is issued on standard terms, except that the client can pay the first installment with available funds from the budget (In this case, the mortgage loan must cover the minimum requirements for the first installment under the program) or pay off the current debt on the mortgage loan.

NOTE! You can buy an apartment in a new building under mortgage lending through Sberbank only from a trusted developer (mortgage partner) in an accredited facility that has all the necessary documents and permits.

Conditions for obtaining a mortgage for a new building in Sberbank

- purchase of housing under construction or housing in a finished new building from the selling company;

- the construction completion date is determined by the developer’s design documentation;

- 90 calendar days from the date of the bank’s decision to issue a loan are given to creditors to transfer the completed documents;

- registration of apartments and commercial premises is allowed;

- payment through a secure payment service, without an additional visit to the bank, by non-cash method;

Terms of agreement

Parties

- full name of the construction organization;

- Full name and power of attorney number of the representative.

The future shareholder acts as the customer. Preamble:

- Full name of the customer;

- passport details;

- registration address.

What should it contain?

The form is not established by law , therefore its content is established by agreement of the parties:

- The subject (it is an apartment under construction, completed or just planned) and its characteristics.

- Rights and obligations of the parties (this paragraph may also contain terms of payment or the condition of booking without payment for a short period, payment period, deadline for the developer to provide the necessary documentation for study, etc.).

Help: The clause of rights and obligations can be separately divided into clauses on deadlines and payment. - Guarantees of the parties (the developer guarantees to remove the apartment from sale, and the customer - to pay the down payment and conclude the main share participation agreement).

- Responsibility of the parties (fines and penalties, return of funds for failure to fulfill obligations).

What should you pay attention to?

The clause on the subject of the contract must indicate:

- address of the future apartment;

- its characteristics established by the design plan (floor, number, total area, living area);

- full cost.

It is important to record the following conditions:

- the cost of the advance payment;

- payment term;

- the period allotted for concluding the main contract with the developer;

- liability of the parties;

- requisites.

Important! The amount of the down payment is not returned to the customer if he does not enter into a contractual agreement and does not pay the principal amount for the purchase of the apartment.

Interest rate

The base interest rate is 7.6%. With government support, the interest rate is reduced:

| 1-7 years | 7-12 years | 12-30 years |

| Developer subsidy program with a discount for the entire loan term | ||

| 5,4% | 6,1% | 6,6% |

| Developer subsidy program with a discount for 2 years | ||

| 4,1% | 4,5% | 4,6% |

| for the rest of the term 7.6% | ||

The exact interest rate varies depending on the status of the developer, the choice of insurance, the method of conducting the transaction, the set of documents of the borrower and the amount of the down payment.

Mortgage interest rates

If previously it was possible to take out a mortgage loan at 7.4% per annum, in 2020 the mortgage rate for new buildings at Sberbank increased to 8.5%. Moreover, this is the minimum possible indicator, available only to those who have applied for a subsidy program for a period of no more than 7 years. If you take out a mortgage yourself, be prepared to pay the bank annually, in addition to the loan itself, another 10.5% of its amount.

Under certain conditions, the bank may increase the rate. So, if:

- the down payment is 15-20% (excluding the upper limit) of the cost of the apartment, the bank commission will increase by 0.2%;

- the client refuses the proposed insurance, another 1% will be added to the existing rate;

- the client does not have a salary card/account with Sberbank or cannot confirm his income and employment – + 0.3% to the current rate;

- the borrower refused to complete documents through the electronic registration service, + 1% to the interest rate.

As you can see, there are enough nuances. If you don’t want to overpay, before concluding a deal, carefully study the current offers, promotions, and conditions.

Special conditions for some developers

If, when purchasing an apartment in a new building, you are choosing between several options, carefully study the information not only about the premises themselves, but also about their owners. Thus, some developers (subject to obtaining a loan for a period of up to 12 years) offer a reduction in the interest rate down to -2%. Others may contribute to the bank's approval of the application. Still others offer good discounts if the amount of the down payment exceeds a certain percentage of the total cost of the apartment, etc.

What is Electronic Registration Service

- Documents are checked and sent to Rosreestr for state registration of rights.

- Sberbank employees monitor the status of the transaction and remove obstacles to registration.

- Transaction participants receive agreement files with a registration mark to their email.

- Cost – 8-11,000 rubles. In the regions, the cost of the transaction differs and includes state duty.

A mortgage for a new building from Sberbank goes through the DomClick online service. Filling out an application, choosing an apartment and state registration are done remotely; the personal presence of the parties to the transaction occurs only once.

Requirements for the borrower

If you carefully study the terms of a mortgage for a new building from Sberbank, you will notice that they contain quite a lot of restrictions. So, as part of the basic requirements for consideration of an application:

- The borrower has citizenship of the Russian Federation.

- The age at the date of registration of the mortgage is not less than 21 years.

- Age on the date of payment of the last payment - no more than 75 years (if at the time the application is submitted, the borrower does not confirm his income and employment - no more than 65 years).

- If the client does not have a salary card at Sberbank, he must have worked in his last place of official employment for at least six months.

- The number of co-borrowers (if any) is up to 3 individuals. The borrower's spouse automatically becomes a co-borrower, unless he/she does not have Russian citizenship, or a marriage contract has been drawn up between the spouses, including a clause on the regime of separate property.

In addition to the basic requirements, there are additional restrictions within specific mortgage programs. You can clarify them at the bank office or at the electronic customer support service.